December 15, 2020 Chairman Jay

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Role of Regulation in Shaping Equity Market Structure and Electronic Trading

S. HRG. 113–478 THE ROLE OF REGULATION IN SHAPING EQUITY MARKET STRUCTURE AND ELECTRONIC TRADING HEARING BEFORE THE COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS UNITED STATES SENATE ONE HUNDRED THIRTEENTH CONGRESS SECOND SESSION ON EXAMINING THE INFLUENCE OF REGULATION ON THE GROWTH OF MARKET STRUCTURE, THE SYSTEMS AND OPERATION OF MARKET PARTICIPANTS AND THE DEVELOPMENT OF BUSINESS PRACTICES RE- LATED TO HIGH-FREQUENCY TRADING, ELECTRONIC MARKETS AND AUTOMATED TRADING JULY 8, 2014 Printed for the use of the Committee on Banking, Housing, and Urban Affairs ( Available at: http://www.fdsys.gov/ U.S. GOVERNMENT PUBLISHING OFFICE 91–300 PDF WASHINGTON : 2015 For sale by the Superintendent of Documents, U.S. Government Publishing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate 0ct 09 2002 11:05 Mar 18, 2015 Jkt 000000 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 S:\DOCS\91300.TXT SHERYL BANKI-41578DSA with DISTILLER COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS TIM JOHNSON, South Dakota, Chairman JACK REED, Rhode Island MIKE CRAPO, Idaho CHARLES E. SCHUMER, New York RICHARD C. SHELBY, Alabama ROBERT MENENDEZ, New Jersey BOB CORKER, Tennessee SHERROD BROWN, Ohio DAVID VITTER, Louisiana JON TESTER, Montana MIKE JOHANNS, Nebraska MARK R. WARNER, Virginia PATRICK J. TOOMEY, Pennsylvania JEFF MERKLEY, Oregon MARK KIRK, Illinois KAY HAGAN, North Carolina JERRY MORAN, Kansas JOE MANCHIN III, West Virginia TOM COBURN, Oklahoma ELIZABETH -

Chair Mary Jo White, April 10, 2013 to December 31, 2013

Chair Mary Jo White Public Calendar April 10, 2013 to December 31, 2013 Wednesday, April 10 2013 9:00 am Oath of Office 10:00 am Open Commission Meeting 11:30 am Meeting with staff 12:30 pm Meeting with job applicant 1:30 pm Meeting with staff 2:30 pm Meeting with staff 3:30 pm Meeting with staff 4:00 pm Meeting with staff 4:30 pm Meeting with staff Thursday, April 11 2013 9:00 am Meeting with staff 9:30 am Meeting with staff 10:00 am Meeting with staff 11:30 am Meeting with Commissioner Parades 12:30 pm Meeting with Commissioner Gallagher 1:40 pm Meeting with staff 2:00 pm Closed Commission Meeting 3:30 pm Meeting with staff 4:00 pm Meeting with staff Friday, April 12 2013 9:00 am Meeting with staff 10:00 am Meeting with Commissioner Walter and staff 10:30 am Swearing‐in Ceremony 12:00 pm Meeting with Russell Golden, Chair, Financial Accounting Standards Board (FASB) 1:00 pm Meeting with staff Monday, April 15 2013 9:30 am Meeting with staff 10:30 am Meeting with staff 11:00 am Meeting with staff 1 11:15 am Phone call with staff 11:30 am Meeting with staff 12:00 pm Phone call with Jim Doty, Chairman, Public Company Accounting Oversight Board (PCAOB) 12:45 pm Phone call with staff 1:00 pm Meeting with staff 2:00 pm Meeting with staff 3:00 pm Meeting with staff 4:00 pm Meeting with staff 4:30 pm Meeting with staff 5:00 pm Meeting with staff 5:05 pm Phone call with Gary Gensler, Chairman, Commodity Futures Trading Commission (CFTC) 5:45 pm Phone call with Congressman Scott Garrett Tuesday, April 16 2013 9:00 am Meeting with staff 10:00 -

The Role of Market Speculation in Rising Oil and Gas Prices: a Need to Put the Cop Back on the Beat

1 109th Congress S. PRT. " ! 2nd Session SENATE 109–65 THE ROLE OF MARKET SPECULATION IN RISING OIL AND GAS PRICES: A NEED TO PUT THE COP BACK ON THE BEAT STAFF REPORT PREPARED BY THE PERMANENT SUBCOMMITTEE ON INVESTIGATIONS OF THE COMMITTEE ON HOMELAND SECURITY AND GOVERNMENTAL AFFAIRS UNITED STATES SENATE JUNE 27, 2006 U.S. GOVERNMENT PRINTING OFFICE 28–640 WASHINGTON : 2006 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 0ct 09 2002 09:54 Aug 01, 2006 Jkt 028640 PO 00000 Frm 00001 Fmt 5012 Sfmt 5012 C:\DOCS\28640.TXT SAFFAIRS PsN: PAT congress.#13 COMMITTEE ON HOMELAND SECURITY AND GOVERNMENTAL AFFAIRS SUSAN M. COLLINS, Maine, Chairman TED STEVENS, Alaska JOSEPH I. LIEBERMAN, Connecticut GEORGE V. VOINOVICH, Ohio CARL LEVIN, Michigan NORM COLEMAN, Minnesota DANIEL K. AKAKA, Hawaii TOM COBURN, Oklahoma THOMAS R. CARPER, Delaware LINCOLN D. CHAFEE, Rhode Island MARK DAYTON, Minnesota ROBERT F. BENNETT, Utah FRANK LAUTENBERG, New Jersey PETE V. DOMENICI, New Mexico MARK PRYOR, Arkansas JOHN W. WARNER, Virginia MICHAEL D. BOPP, Staff Director and Chief Counsel JOYCE A. RECHTSCHAFFEN, Minority Staff Director and Chief Counsel TRINA DRIESSNACK TYRER, Chief Clerk PERMANENT SUBCOMMITTEE ON INVESTIGATIONS NORM COLEMAN, Minnesota, Chairman TED STEVENS, Alaska CARL LEVIN, Michigan TOM COBURN, Oklahoma DANIEL K. AKAKA, Hawaii LINCOLN D. CHAFEE, Rhode Island THOMAS R. CARPER, Delaware ROBERT F. BENNETT, Utah MARK DAYTON, Minnesota PETE V. DOMENICI, New Mexico FRANK LAUTENBERG, New Jersey JOHN W. -

O'brien Financial Advisors

Del Principe | O’Brien Financial Advisors LLC Vol. VI No. III: X.MMXX October 2020 Dear Fellow Investors, “Just keep in mind: the more we value things outside our control, the less control we have.” –Epictetus In times like these, it’s easy to let volatility and uncertainty get the best of us. It’s tempting to look for ways to make short-term gains in order to take the sting out of previous losses. But this kind of thinking pulls us away from our value investing fundamentals and distracts us with shiny objects. What kind of shiny objects? How about the top 5 largest stocks in the S&P 500. The top 5 – Apple, Microsoft, Amazon.com, Alphabet (Google), and Facebook – account for approximately 23% of the index’s market value. That leaves 495 or so other companies in the index, many of which are worthy of investment based not on their index position but on other analyzable criteria. Let’s not forget that the S&P is weighted by float-adjusted market capitalization, which is why the top 5 stocks affect the index so profoundly and are watched and talked about like they are the only players in the game. We value investors shouldn’t fall for the trap of index funds. We know to avoid the pitfall of correlating the weighted index position of a stock with the quality of the business behind it. We know that largest does not always mean strongest or best value. In this letter, you can read about companies in our portfolio that are demonstrating their strength and intrinsic value. -

Rebellionat Themercby MATTHEW LEISING and JOHN

By MATTHEW LEISING REBELLION at the MERCand JOHN LIPPERT 76 BLOOMBERG MARKETS AUGUST 2008 CME floor traders moved to the Board of Trade building after the merger. CHICAGO HEDGE FUNDS AND NEW YORK BANKS HAVE FOUNDED A NEW EXCHANGE TO BREAK CME’S MONOPOLY ON FINANCIAL FUTURES. THEY’RE UP AGAINST AN INSTITUTION THAT HAS SPENT 160 YEARS STRENGTHENING ITS POSITION. Photograph by Michael Abramson Rubio, center, with Citadel’s Faraz Javaid, left, and Misha Malyshev, want ELX to keep CME in check. HICAGO HEDGE FUND MANAGER TOM RUBIO NEVER considered himself a rebel. He used to stay out of the limelight, quietly developing software to buy and sell interest-rate derivatives and building his 100-person firm, Breakwater Trading LLC. Infatuated with trading technology for 20 years, he once Creprogrammed a scientific calculator to figure out options prices. Rubio, 44, dates his emergence as leader of a revolt to October 2006, when the ON S Chicago Mercantile Exchange, known as the Merc, agreed to buy the Chicago Board of Trade. By combining two rivals that competed for more than a century, the acquisition would put 98 percent of exchange-traded U.S. interest-rate MICHAEL ABRAM 78 BLOOMBERG MARKETS AUGUST 2008 contracts—and 87 percent of all futures— to wrest away from CME are growing fast- from less than 10 cents to more than $1 a under one roof. Rubio’s Breakwater and er than ordinary stock trading. Invest- trade, added up to $1.8 billion, and the funds like it rely on the Merc and CBOT for ment banks and hedge funds are finding company isn’t finished growing. -

2015 Year-End Issue

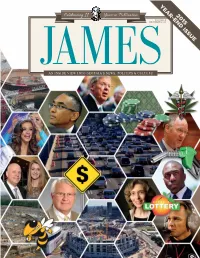

YEAR-END ISSUE 2015 NOVEMBER DECEMBER2015 JAMESAN INSIDE VIEW INTO GEORGIA’S NEWS, POLITICS & CULTURE ON THE COVER Along with photos of the new Atlanta Braves and Falcons stadiums under construction are pictures of prominent 2015 Georgia newsmakers. From bottom left (by the Georgia Tech yellow jacket) are state House Majority Leader John Burns; ICE executives Jeff Sprecher and his wife Kelly Loeffler (the James “Influential Georgians” of the Year); Miss America Betty Cantrell of Warner Robins; former DeKalb County CEO Burrell Ellis, jailed for corruption; U.S. Senator Johnny Isakson, running for re-election; state Rep. Allen Peake, DEPARTMENTS author of a medical cannabis oil law; DeKalb CEO Lee May, who replaced Ellis; Atlanta attorney Linda Klein, president- Publisher’s Message 4 elect of the American Bar Association; and University of Georgia head football coach Mark Richt. Floating Boats 6 FEATURES JAMES Staggering Figures Show Wall Street P.O. BOX 724787 “Knew” Attacks Were Coming ATLANTA, GEORGIA 31139 by Matt Towery 404 • 233 • 3710 8 A Look Back at 2015 PUBLISHED BY INTERNET NEWS AGENCY LLC by Phil Kent 19 Interviewing U.S. Senator Johnny Isakson by Jim Kingston 21 CHAIRMAN MATTHEW TOWERY CEO & PUBLISHER PHIL KENT [email protected] COLUMNS CHIEF OPERATING OFFICER LOUIE HUNTER Gubernatorial Candidates Waiting in the Wings ASSOCIATE EDITOR GARY REESE by Randy Evans 11 ADVERTISING OPPORTUNITIES PATTI PEACH [email protected] “True Blue” Alumna Keeps Georgia in the Black MARKETING REPRESENTATIVE MELANIE DOBBINS by -

Capitalmarkets | PLS Inc | 43 Characters Or Less

January 10, 2013 • Volume 06, No. 02 CAPITALMARKETS Serving the marketplace with news, analysis and business opportunities Williams & Access raising $4.2 billion for Chesapeake deal Even after cliff deal, loss of Williams and Access Midstream Partners LP have gone on a capital raising tax breaks a real possibility flurry that will gross a combined $4.2 billion or more when all is said and done. Wells Fargo analysts noted in a recent Williams plans to use proceeds to fund a portion of its $2.17-2.40 billion purchase report that talks with their contacts in of a 25% stake (via 34.5 million LP units) in Access and a 50% interest Washington lead them to believe industry in its general partner Access Williams paying up to $2.4 billion for tax incentive reform “could potentially Midstream Partners. quarter stake in Access’ LP. be a part of a broader corporate The combined Access businesses tax reform” in late 2013. Cuts comprised a big chunk of Chesapeake’s midstream portfolio, which was acquired to benefits such as expensing in June by PE firm Global Infrastructure Partners for $4.0 billion under the assets’ of intangible drilling costs, percent of previous monikers Chesapeake Midstream Partners and Chesapeake Midstream depletion deductions and other incentives Development. Global will receive $1.82 billion cash from Williams and retain a 43% have been raised by President Obama and stake in Access LP. Also, both Global and Williams agreed to jointly purchase $350- 580 million worth of Access paid-in-kind equity as part of the deal. -

President William C. Dudley Daily Schedules January 2009

President William C. Dudley Daily Schedules January 2009 – September 2010 William Dudley January 29, 2009 Calendar Thursday, January 29, 2009 06:15 AM Bank car pick up from home 07:30 AM - 07:45 AM Daily meeting with Bill and Mike 08:45 AM - 09:00 AM Morning Briefing - you are to lead today's meeting 09:00 AM - 09:30 AM Martin Feldstein, NBER 09:15 AM - 09:45 AM Morning Calls / Dial-in 09:30 AM - 10:00 AM Hold for Markets Group, 9th floor 10:00 AM - 10:30 AM Special Management Conference, 12FCC 10:30 AM - 10:45 AM Ed/Bill D. 11:00 AM - 11:30 AM Planning for the next FOMC cycle (with Simon Potter) 11:30 AM - 12:30 PM Lunch with Tudor Investments Corp., Lincoln Room 01:30 PM - 02:30 PM Discussion re: Morgan Stanley with Rutledge 03:00 PM - 04:00 PM Discussion re: Citigroup 04:00 PM - 04:30 PM Market Conditions Briefing 04:30 PM - 05:00 PM Directors' Telephone Conference call (Chris will be in Phila.) 05:00 PM - 05:30 PM Meet with Brian Peters Mr. Dudley's departure from the Bank on January 30 is to be determined. William Dudley January 30, 2009 Calendar Friday, January 30, 2009 06:15 AM Bank car pick up from home 07:30 AM - 07:45 AM Daily meeting with Bill and Mike Schetzel 08:45 AM - 09:00 AM Morning Briefing - You are to lead today's meeting. 09:15 AM - 09:45 AM Morning Calls / Dial-in 10:00 AM - 11:00 AM Meeting with Derryck Maughan, Managing Director, Kohlberg Kravis Roberts & Co (Marianne 02:30 PM - 03:00 PM AIG Update Meeting with Mr. -

Jamesan Inside View Into Georgia’S News, Politics & Culture

MARCH/APRIL2015 JAMESAN INSIDE VIEW INTO GEORGIA’S NEWS, POLITICS & CULTURE 2015 JAMES’ MOST INFLUENTIAL COLUMNS BY JOSH BELINFANTE // RANDY EVANS // MAC McGREW // WAYNE OLIVER // DR. DANA RICKMAN JAVIER RODRIGUEZ // MATT TOWERY // LARRY WALKER Y E A R S OF 100championing & job ECONOMIC GROWTH creation, increasing the quality of life for all Georgians, supporting tax, regulatory and legal policies to help your business grow, RAISING EDUCATION STANDARDS because those kids are going to be running our companies, promoting a career-ready, GLOBALLY COMPETITIVE WORKFORCE, advocating for policies that enhance our BUSINESS CLIMATE from the mountains to the coast, building the ENSURING INFRASTRUCTURE, to health care, and transportation system we need, ACCESS partnering with ELECTED OFFICIALS, local and regional chambers and business leaders and WORKING TOGETHER. CELEBRATING A CENTURY OF LEADERSHIP With the support of thousands of members and investors statewide, the Georgia Chamber is proud of what we’ve accomplished over the past 100 years to create a better state of business. Join and lead today at gachamber.com. DEPARTMENTS ON THE COVER 4 James’ 2015 “Georgians of the Year” PUBLISHER’S MESSAGE Jeffrey Sprecher and Kelly Loeffler FLOATING BOATS of Intercontinental Exchange. 6 FEATURES JAMES 2015JAMES’ MOST INFLUENTIAL 18 P.O. BOX 724787 ATLANTA, GEORGIA 31139 404 • 233 • 3710 33 PUBLISHED BY INTERNET NEWS AGENCY LLC 35 CHAIRMAN MATTHEW TOWERY COLUMNS CEO & PUBLISHER PHIL KENT [email protected] WHEN LOYALTY WINS OUT CHIEF OPERATING OFFICER LOUIE HUNTER by Matt Towery ASSOCIATE EDITOR GARY REESE 8 ADVERTISING OPPORTUNITIES SCOTT BARD A Good Political Name is Rather to be Had [email protected] by Larry Walker CIRCULATION PATRICK HICKEY 11 [email protected] INTERN WILLIAM STOWERS Transportation Legislation: Fix it Plus by Randy Evans 12 CONTRIBUTING WRITERS JOSH BELINFANTE RANDY EVANS On the midnight train to Sine Die MAC McGREW by Josh Belinfante WAYNE OLIVER 15 DR. -

The Impact of Oil Price Volatility to Oil and Gas Company Stock Returns and Emerging Economies

International Journal of Energy Economics and Policy ISSN: 2146-4553 available at http: www.econjournals.com International Journal of Energy Economics and Policy, 2018, 8(1), 144-158. The Impact of Oil Price Volatility to Oil and Gas Company Stock Returns and Emerging Economies Veysel Ulusoy1, Caner Özdurak2* 1Department of International Finance, Yeditepe University, Istanbul, Turkey, 2Department of Financial Economics, Yeditepe University, Istanbul, Turkey. *Email: [email protected] ABSTRACT In this paper, we examine the impact of oil price shocks on both selected companies and emerging markets. The novelties of this study can be described as: (i) It also includes the recent oil price crisis compared to previous articles in this field, (ii) our study considers in details the oil and gas company business acumen to explain the results of the econometric models which is not the case in previous studies, (iii) we also include the impact of oil price volatility on emerging markets since oil prices have an importance as explanatory variable of exchange rate movements which makes out study a very comprehensive one. As mostly preferred in many previous studies in this literature, we employed the exponential GARCH (EGARCH) estimation methodology, we concluded that the volatility effect of a given shock to the oil prices and oil and gas company stock price returns are highly persistent and the successive forecasts of the conditional variance converge to the steady state slowly. In addition, we also present the news impact curves which indicate that the behavior of commodity prices and company stock prices react differently to bad and good news. -

2016 Corporate Responsibility Report Message from Chairman and Ceo Jeffrey C

2016 CORPORATE RESPONSIBILITY REPORT MESSAGE FROM CHAIRMAN AND CEO JEFFREY C. SPRECHER Dear Stakeholder, I am pleased to present Intercontinental Exchange’s (NYSE:ICE) inaugural Corporate Responsibility report. Since our founding in 2000, ICE’s culture has been one of a conscientious, ethically driven company – and one that contributes to the development of our employees, community and shareholder value. As you may know, 2015 was a pivotal year for Intercontinental Exchange. It marked our tenth year as a public company, with 10 years of consecutive record revenue and adjusted earnings, which is an unmatched achievement in our sector. These achievements were driven by a focus on our customers and the commitment of our teams around the world to innovate and grow. The result of our efforts is that we have continued to drive outperformance in returns for our shareholders. We are one of the premier architects and advocates of the world’s markets and clearing houses. We take the responsibility to heart and advocate for a market structure that is secure, transparent and resilient. Our global ecosystem of markets, clearing houses, data services, and technology provides secure, reliable access to investment and risk management. Our business spans established global benchmarks across energy, agriculture, interest rates, currencies, equities, equity options, and equity indices. As a result, we are uniquely positioned to provide end-to-end risk management solutions to our customers. As we look ahead, we see many new opportunities to serve our customers and our other stakeholders, which include sharing more information about how we operate. ICE’s business continues to evolve and, consequently, how we view and implement our governance policies will change with the needs of our business as well. -

Euronext Prospectus

DO NOT FORWARD IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) PERSONS OUTSIDE OF THE UNITED STATES MEETING APPLICABLE RESTRICTIONS OR (2) QIBS (AS DEFINED BELOW) Attached is a copy of the prospectus dated 10 June 2014 approved by the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) (the “Prospectus”) for the proposed global offer of ordinary shares of Euronext N.V. (the “Shares”). IMPORTANT: You must read the following before continuing. The following applies to the Prospectus following this page whether received by email or otherwise received as a result of electronic communication. You must read this disclaimer carefully before reading, accessing or making any other use of the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions including any modifications to them from time to time, each time you receive any information from us as a result of such access. THIS COMMUNICATION AND THE ATTACHED DOCUMENT ARE BEING FURNISHED TO YOU ONLY AND MAY NOT BE REPRODUCED, REDISTRIBUTED, FORWARDED OR PASSED ON (ELECTRONICALLY OR OTHERWISE) IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, TO ANYONE OTHER THAN THE PERSON TO WHOM THIS COMMUNICATION IS ADDRESSED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. THIS COMMUNICATION IS INTENDED ONLY FOR (I) PERSONS LOCATED OUTSIDE THE UNITED STATES MEETING APPLICABLE RESTRICTIONS AND (II) QUALIFIED INSTITUTIONAL BUYERS (“QIBS”) AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT.