2021 DRAFT Budget

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Middlesex County and the Municipality of Middlesex Centre

Middlesex County and the Municipality of Middlesex Centre have completed a Schedule ‘C’ Municipal Class Environmental Assessment (Class EA) to identify potential streetscape improvements to Glendon Drive, County Road 14. The study area extends from the Thames River Bridge through the communities of Kilworth and Komoka to the Highway 402 interchange. The Class EA has been undertaken in accordance with the planning process outlined in the Municipal Engineers Association, Municipal Class EA (2000, as amended in 2007, 2011, & 2015). Study recommendations include a range of intersection and corridor improvements including: • Road widening along the length of the • Signalized intersections at Tunks Lane, corridor; Crestview Drive, and Springfield Way • Roundabouts at the intersections of (when warranted); Glendon Drive with Komoka Road, and • Improvements to reduce through traffic Jefferies Road; along Old River Road and improve safety • A realignment of Coldstream Road to meet conditions at its intersection with Glendon Glendon Drive at Springfield Way; Drive, along with bank stability improvements. Public Information Centre (PIC) No. 1 was held on November 26, 2015, PIC No. 2 was held on June 27, 2016, and PIC No. 3 was held on November 30, 2017. The study also included consultation with review agencies, Indigenous communities, and other stakeholders. The Environmental Study Report (ESR) documenting the decision-making process and environmental impacts and mitigation measures has been compiled and by this notice will be placed on public record for the statutory 30-day public review period from Thursday June 28 – Friday August 3, 2018. The ESR will be available at the following locations: Online: Middlesex Wellness and Middlesex Centre Clerk’s www.glendondrive.mindmixer.com Recreation Centre, Office www.middlesexcentre.on.ca 1 Tunks Ln, Komoka 10227 Ilderton Road www.middlesex.ca Mon to Thurs: 6 a.m-10:30 p.m. -

Ec Dev Update Council Presentation

November 10, 2020 Page 1 of 21 A 1 - CW MIDDLESEX COUNTY ECONOMIC DEVELOPMENT & TOURISM Department Update Middlesex County Council Tuesday, November 10, 2020 November 10, 2020 Page 2 of 21 A 1 - CW Economic Development Leadership Chair/Co - Chair - London Chamber of Commerce Agri - Business Committee, Middlesex Workforce Development Partnership, Middlesex Economic Resiliency Task Force, Middlesex Economic Development Strategic Planning Committee, Ontario Food Cluster Member – SWOTC; SCOR; Middlesex London Food Policy Council; Middlesex Community Safety & Well Being Committee; TIAO; EMOLTB Workforce Projects November 10, 2020 Page 3 of 21 A 1 - CW CIP Development Strathroy- Middlesex Southwest North Lucan Caradoc Centre Middlesex Middlesex Biddulph Expanding plan both Expanding plan both New CIP being New CIP being New CIP being geographically as geographically as developed. developed. developed. well as incentive well as incentive offerings. offerings. November 10, 2020 Page 4 of 21 A 1 - CW Grants Secured - 2020 FedDev Ontario, Middlesex London OMAFRA RED Health Unit, Middlesex London Funding to double all Workforce Food Policy Council and Middlesex Development initiatives in 2020 Federation of Agriculture Funding for new Middlesex County Culinary Guide Global Affairs Canada FedDev Ontario Funding to complete Foreign Direct Funding through Tourism Industry Investment Strategy as part of the Association of Ontario for Tourism Relief Economic Development Strategy refresh in and Recovery 2020 November 10, 2020 Page 5 of 21 A 1 - CW Local -

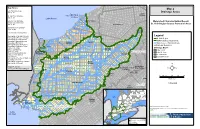

Legend Lower Thames Valley Source Protection Area Assessment Report

CENTRE WELLINGTON CENTRAL HURON NORTH PERTH Map 1-1 HURON EAST Thames-Sydenham & Region WOOLWICH WELLESLEY Source Protection Region WATERLOO PERTH EAST WEST PERTH WATERLOO Lake BLUEWATER PERTH Lower Thames Valley HURON KITCHENER CAMBRIDGE Huron WILMOT Source Protection Area STRATFORD Assessment Report SOUTH HURON NORTH DUMFRIES PERTH SOUTH ST. MARYS BLANDFORD-BLENHEIM Legend CHIPPEWAS OF KETTLE & ZORRA-TAVISTOCK MICHIGAN STONY POINT LUCAN-BIDDULPH FIRST NATION Source Protection Region LAMBTON SHORES NORTH MIDDLESEX ZORRA WOODSTOCK BRANT County Boundaries OXFORD Municipal Boundaries MIDDLESEX MIDDLESEX CENTRE INGERSOLL PLYMPTON-WYOMING First Nation Reserves POINT EDWARD WARWICK ADELAIDE-METCALFE NORWICH SARNIA THAMES CENTRE SOUTH-WEST OXFORD LONDON Source Protection Areas AAMJIWNAANG FIRST NATION STRATHROY-CARADOC Lower Thames Valley PETROLIA r ENNISKILLEN BROOKE-ALVINSTON TILLSONBURG e St. Clair Region CHIPPEWAS OF THE v LAMBTON ONEIDA NATION i THAMES FIRST OF THE THAMES NATION R OIL SPRINGS MUNSEE-DELAWARE MALAHIDE NORFOLK Upper Thames River r ST. CLAIR ST. THOMAS i FIRST NATION AYLMER SOUTHWEST MIDDLESEX a SOUTHWOLD l BAYHAM C ELGIN . DAWN-EUPHEMIA t NEWBURY S DUTTON/DUNWICH NORFOLK WEST ELGIN 0 5 10 20 30 40 BKEJWANONG TERRITORY DELAWARE NATION (WALPOLE ISLAND km FIRST NATION) Lake St. Clair CHATHAM-KENT Lake Map created by UTRCA, December 2, 2009 Erie Base mapping produced under license with the WINDSOR Ontario Ministry of Natural Resources. © 2009.. Source Water Protection Region boundary defined LAKESHORE TECHUMSEH by Ontario Ministry of the Environment, 2006. ESSEX Thames-Sydenham and Region ESSEX KINGSVILLE LEAMINGTON Komoka Wyoming Watford Strathroy SARNIA PLYMPTON-WYOMING WARWICK Map 1-2 Mount Brydges LONDON Lower Thames Valley PETROLIA STRATHROY-CARADOC ADELAIDE-METCALFE MIDDLESEX CENTRE Source Protection Area MICHIGAN BROOKE-ALVINSTON r e ENNISKILLEN MIDDLESEX v Alvinston CHIPPEWAS OF THE i ONEIDA NATION THAMES FIRST R OF THE THAMES NATION r LAMBTON MUNSEE-DELAWARE Lower Thames Valley i OIL SPRINGS a ST. -

Middlesex Community Safety and Well-Being Plan, 2021-2026 Table of Contents

Middlesex Community Safety and Well-Being Plan, 2021-2026 Table of Contents Introduction .................................................................................................................................... 2 The Middlesex Context ................................................................................................................... 3 Community Safety and Well-Being Planning In Ontario: An Overview .......................................... 4 Our Approach .................................................................................................................................. 7 Middlesex Community Safety and Well-Being Plan 2021-2026 ................................................... 11 Health ............................................................................................................................................ 12 Physical Health .......................................................................................................................... 13 Mental Health ........................................................................................................................... 14 Substance Use and Addiction .................................................................................................... 15 Housing and Homelessness .......................................................................................................... 16 Housing and Homelessness ...................................................................................................... -

A.1 CONTACT LIST Municipality of Middlesex Centre Stormwater Management Master Plan Municipal Class Environmental Assessment

A.1 CONTACT LIST Municipality of Middlesex Centre Stormwater Management Master Plan Municipal Class Environmental Assessment Stakeholder Contact List Interest Agency Title First Name Last Name Department Title Address City Pr Postal Phone Email Provincial Contacts Provincial Ministry of Natural Resources and Forestry Ms. Kathryn Markham Aylmer District District Planner 615 John Street North Aylmer ON N5H 2S8 [email protected] Provincial Ministry of the Environment and Climate Change Mr. Craig Newton Southwestern Region Regional Environmental Assessment Coordinator 733 Exeter Road London ON N6E 1L3 Provincial Ministry of the Environment and Climate Change Environmental Assessment & Approvals Branch Director 135 St. Clair Avenue West, 1st Floor Toronto ON M4V 1P5 Email only completion notice Provincial Ministry of Tourism, Culture and Sport Ms. Rosi Zirger Culture Services Unit Heritage Planner 401 Bay Street, Suite 1700 Toronto ON M7A 0A7 [email protected] Local Government (EMAIL ONLY) Mayor Municipality of Middlesex Centre Mayor Aina Deviet 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Dept. Mayor John Brennan 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Counc. Debbie Heffernan 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Counc. Wayne Shipley 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Counc. Derek Silva 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Counc. Brad Scott 10227 Ilderton Road ColdstreamON N0M 2A0 Council Municipality of Middlesex Centre Counc. Hugh Aerts 10227 Ilderton Road ColdstreamON N0M 2A0 Local Contacts Local City of London Mr. Scott Mathers Environmental and Engineering Services Director, Water and Wastewater 300 Dufferin Avenue, 3rd Floor London ON N6A 4L9 [email protected] Local City of London Mr. -

Knowledge Dissemination and Private Well Water Testing in Middlesex County, Ontario Amanda Pellecchia Western University

Western Public Health Casebooks Volume 2015 2015 Article 17 2015 Case 11 : Knowledge Dissemination and Private Well Water Testing in Middlesex County, Ontario Amanda Pellecchia Western University Fatih Sekercioglu Middlesex-London Health Unit Amanda Terry Western University Follow this and additional works at: https://ir.lib.uwo.ca/westernpublichealthcases Recommended Citation Pellecchia, A., Sekercioglu, F., Terry, A. (2015).Knowledge Dissemination and Private Well Water Testing in Middlesex County, Ontario. in: Speechley, M., & Terry, A.L. [eds] Western Public Health Casebook 2015. London, ON: Public Health Casebook Publishing. This Case is brought to you for free and open access by Scholarship@Western. It has been accepted for inclusion in Western Public Health Casebooks by an authorized editor of Scholarship@Western. For more information, please contact [email protected], [email protected]. Schulich Interfaculty Program in Public Health CASE 11 Knowledge Dissemination and Private Well Water Testing in Middlesex County, Ontario1 Amanda Pellecchia, BHSc, MPH (MPH Class of 2014) Fatih Sekercioglu, MSc, MBA (Manager, Environmental Health Safe Water & Rabies Prevention and Control, Middlesex-London Health Unit) Amanda Terry, PhD (Assistant Professor, Western University) INTRODUCTION David Killarney, Manager of the Safe Water and Rabies Team of the Environmental Health Department at the Middlesex-London Health Unit (MLHU), stood in the office kitchen filling his tea kettle with tap water. He took a moment to reflect and appreciate the comfort and safety associated with municipal drinking water, readily available at the touch of a tap. While most Canadians receive drinking water from municipal sources, it is estimated that over four million Canadians receive drinking water from private wells, the responsibility and maintenance of which reside with their respective owners (Jones et. -

A.4 Comments and Correspondence With

A.4 Comments and Correspondence with Agencies UTRCA Comments on Executive Summary – Middlesex Centre Stormwater Master Plan Settlement Area UTRCA Comment Stantec Response Report Section Arva • Alternative #3 would be best from a LID perspective. Alternative #3 would eliminate • Acknowledged UTRCA prefers Alternative #3 for this SA; however, it is noted that Section 4.2.1 implementing LID may prove challenging due to tight till. Following consultation with the proposed culvert under Medway Road (culvert means increased maintenance and Section 6.1 eventual replacement). It would also be better to control SWM on a catchment basis landowner and UTRCA, preferred alternative revised to #3. and would be easier to maintain the dry pond. Ballymote • Realignment of the Highbury-Armitage Drain would require site-specific approval from • All points noted Section 6.2 the UTRCA • Lots do not appear large enough for private septic • UTRCA must be consulted on any watercourse realignment Ilderton Drain No. 2 No specific comments - N/A South Ilderton Development Area No specific comments - N/A Komoka Drain No.1 • It is doubtful if there is enough capacity in any of the ponds. We are concerned that if • Stantec performed a hydraulic analysis for the preferred alternative and identified that pond Section 6.5 development here continues the way it has then in the near future this area may just levels would only increase by 6 inches in a 1:250-year storm event. Flooding can be be one giant pond avoided by controlling pond levels via outlet. • UTRCA suggests site specific SWM should be utilized here rather than regional SWM • Noted preference for site-specific SWM controls or a lined forebay, OGS and/or swale ponds should a regional SWM ponds be carried forward as the preferred alternative. -

Public Notice of Pesticide Use

PUBLIC NOTICE OF PESTICIDE USE COUNTY OF MIDDLESEX MUNICIPALITY OF STRATHROY-CARADOC, MUNICIPALITY OF ADELAIDE METCALFE, and MUNICIPALITY OF MIDDLESEX CENTRE Notice is hereby given that the above Municipal Road Departments will be spraying for weed control and intend to apply CLEARVIEW Herbicide with active ingredients: Aminopyralid, present as potassium salt (52.5%) and Metsulfuron-Methyl (9.45%) – Registration #29752. GATEWAY Adjuvant with active ingredients: Paraffinic Oil (586 g/L) and Alkoxylated alcohol non-ionic surfactant (242 g/L) – Registration #31470, under the Pest Control Products Act (Canada). Middlesex roadside weed spray is exempt under section 7.1 (2) .4. Uses related to the promotion of public health or safety. During the period from May 10, 2021 to June 30, 2021 the following locations will be sprayed (weather permitting): (A) COUNTY OF MIDDLESEX - THE RURAL COUNTY ROAD ROADSIDES IN ALL OF OR PORTIONS OF THE FOLLOWING MUNICIPALITIES: - North Middlesex - Middlesex Centre - Strathroy-Caradoc - Lucan Biddulph - Adelaide Metcalfe - Thames Centre (B) RURAL ROADSIDES IN THE MUNICIPALITY OF STRATHROY-CARADOC: - Various Township rural roadsides. For more details call collect 519-245-1070. (C) RURAL ROADSIDES IN THE MUNICIPALITY OF MIDDLESEX CENTRE: - Various Township rural roadsides. For more details call collect 519-666-0190. (D) RURAL ROADSIDES IN THE MUNICIPALITY OF ADELAIDE METCALFE: - Various Township rural roadsides. For more details call collect 519-247-3687. Anyone not wishing to have the roadway sprayed in front of their property, please construct and properly place a “NO SPRAY” sign at the start of your property, and a “Start Spraying” Sign at the end of your property. -

2018 Approved Budget

2018 Approved Budget 1. Quick Facts (pg. 2-3) 2. 2018 Budget Highlights (pg. 3) 3. 2018 Budget (pg. 4-5) 4. 2018 Levy Assessment (CVA) - Schedule “A” (pg. 6-7) 5. 2018 Municipal Funding Summary - Schedule “B” (pg.8-9) 6. **NEW** 2018 Municipal Budget Impact - Schedule “C” (pg.10-11) 7. 2018 Conservation Areas Maintenance and Operation Budget - Schedule “D” (pg.11-12) 8. **NEW** 2018 Water Erosion Control Infrastructure – Schedule “E” (pg 13) 9. 2018 Conservation Area’s Capital Projects (pg. 14-15) St. Clair Region Conservation Authority Quick Facts General: • 17 member municipalities from Lambton and Middlesex Counties and the cities of Sarnia and Chatham-Kent (see member directory for full listing) • 20 members on the Board of Directors appointed by municipalities (see directory) • 14 watersheds - Sydenham River with its East and North branches, 13 smaller named watersheds entering Lake Huron, St. Clair River and Lake St. Clair. • of the 36 Conservation Authorities in the province, the St. Clair Region ranks: • 9th largest in area (4,100 km2) • 16th in population (151,420 within the watershed) • 35th in general levy ($3.22 per capita)in 2013, excluding Capital projects • 6th in receipt of provincial grant from the Ministry of Natural Resources Land: • owns 4,200 acres of property • manages another 1,340 acres for the County of Lambton • manages 16 properties (1,100 acres) for our Conservation Foundation • has 16 Conservation Areas including 3 regional campgrounds - 522 serviced campsites • campgrounds are self-sufficient, profits generated from their operations are used to offset capital development • over 200,000 visitors to Conservation Areas in 2017 Water Management: • has the largest flood control dam and diversion in the province (McKeough Floodway) • 11 recreation dams at 8 Conservation Areas • assisting Chatham-Kent with maintenance of nearly 20 km of dykes • assisting Sarnia, Point Edward, St. -

Township of Strathroy-Caradoc” Are Replaced with the “Municipality of Strathroy-Caradoc”

THE CORPORATION OF THE MUNICIPALITY OF STRATHROY-CARADOC BY-LAW NO. 8-15 A BY-LAW TO ADOPT AMENDMENT NO. 5 TO THE OFFICIAL PLAN OF THE MUNICIPALITY OF STRATHROY-CARADOC WHEREAS under Section 17 of the Planning Act, R.S.O. 1990, c.P. 13, authorizes municipalities to adopt official plans and amendments thereto; WHEREAS under Section 22 of the Planning Act, R.S.O. 1990, c.P. 13, permits persons or public bodies to request council to amend its official plan; AND WHEREAS the requirements for the giving notice and the holding of a public meeting of this amendment have been met; AND WHEREAS the Council of the Corporation of the Municipality of Strathroy-Caradoc deems it advisable to amend the Official Plan of the Municipality of Strathroy-Caradoc; NOW THEREFORE BE IT ENACTED BY THE COUNCIL OF THE CORPORATION OF THE MUNICIPALITY OF STRATHROY-CARADOC AS FOLLOWS: 1. THAT: Amendment No. 5 to the Official Plan of the Municipality of Strathroy- Caradoc consisting of the attached text and schedules is hereby adopted. 2. THAT: the Clerk is hereby authorized to make application to the County of Middlesex for approval of Amendment No. 5 to the Official Plan of the Municipality of Strathroy-Caradoc. 3. THAT: this By-law shall come into force and take effect on the day of the final passing thereof. Read a FIRST, SECOND AND THIRD TIME AND FINALLY PASSED IN OPEN COUNCIL this 2nd day of February 2015. Mayor Clerk AMENDMENT NO. 5 TO THE OFFICIAL PLAN OF THE MUNICIPALITY STRATHROY-CARADOC SUBJECT: GENERAL AMENDMENT JANUARY 2015 PART A - THE PREAMBLE 1.0 PURPOSE AND EFFECT The purpose of this Amendment is to implement a number of changes to the Official Plan to ensure consistency with the 2014 Provincial Policy Statement (PPS), conformity with the County of Middlesex Official Plan and to reflect changing circumstances since the adoption of the current Official Plan on April 18, 2006 and its subsequent approval on July 17, 2007. -

Agricultural Food Economic Impact Report

1 COUNTY OF MIDDLESEX 1 AGRI-FOOD ECONOMIC IMPACT REPORT COUNTY OF MIDDLESEX Agri-Food Economic Impact Report March 2015 STRATEGY. ACTION. RESULTS. STRATEGY. ACTION. RESULTS. STRATEGY. ACTION. RESULTS. COUNTY OF MIDDLESEX 2 AGRI-FOOD ECONOMIC IMPACT REPORT Report commissioned by: County of Middlesex 399 Ridout Street North London, ON N6A 2P1 Contributors Project Team Rob Hannam, C.B.S. Mark Ferguson, Hon. B.A., Ag. Bus. Dip., MSc. (PLAN) Harry Stoddart, B.Sc. in Agriculture, M.Sc. of Science in Agricultural Economics Al Mussel, PhD, Agricultural and Applied Economics Synthesis Agri-Food Network 100 Stone Road West, Suite 109 Guelph, ON N1G 5L3 www.synthesis-network.com County of Middlesex Agriculture Sector Strategy Steering Committee Aileen Murray – Middlesex County, Economic Development Durk Vanderwerff – Middlesex County, Planning Department Valerie Clark – Ontario Ministry of Agriculture and Food Butch Siebenmorgen – Bonduelle North America Marsha Paley – Municipality of North Middlesex Ernie Muzylowsky – Apple Land Station Paul Ward – Middlesex Federation of Agriculture Karl Soetemans – Lambton Middlesex Federation of Agriculture Rose Keunen – Henro Dairy Farms Pauline Sleger – Slegers Greens Inc. Clare Bloomfield – Middlesex County, Councilor STRATEGY. ACTION. RESULTS. 2 COUNTY OF MIDDLESEX 3 AGRI-FOOD ECONOMIC IMPACT REPORT Table of Contents Executive Summary 4 Introduction 6 Land Base 8 Crop Production 8 Vegetable and Fruit Production 14 Livestock Production 16 Farm Cash Receipts 20 Farm Size and Number 22 Production Summary 23 Economic Overview 24 Middlesex Agri-food Industry in the Context 31 of Neighbouring Counties Complementarity of the County of 34 Middlesex’s and London’s Agri-food Sectors Agriculture Support Services 37 Total Economic Impact of the 39 Agri-food Industry Conclusion 41 Appendices 42 NAIC Definitions – included in definition 42 of Agri-food industry NAIC Definitions – Agriculture Support Services 44 (not included in definition of Agri-food industry) Data Source Descriptions 45 STRATEGY. -

Map 2: Drainage Areas

Map Notes: Map 2 Lake Huron Drainage: 635 sq. km Drainage Areas Chippewas of Lucan- St. Clair River Drainage: Kettle & Stony Point Biddulph 262 sq. km First Nation Lake Huron Shashawandah Creek Lake St. Clair Drainage: Lambton Shores Watershed Characterization Report (includes St. Clair Delta) 484 sq. km North Middlesex St. Clair Region Source Protection Area Sydenham River Drainage: Hickory Creek 2,751 sq. km Middlesex Centre List of member municipalities: Bonnie Doon Creek Municipality of Adelaide-Metcalfe Legend Municipality of Brooke-Alvinston Point St. Clair Region Municipality of Chatham-Kent Edward Lake Huron Township of Dawn-Euphemia SCRCA Drainage Basin Divide Cow Creek Plympton- Warwick Township of Enniskillen Wyoming Watercourses / Municipal Drains Municipality of Lambton Shores Perch Creek Municipal Boundaries Township of Middlesex Centre Sarnia Village of Newbury Bear Creek Adelaide- Drainage Basin Village of Oil Springs Metcalfe Lake Huron Town of Petrolia Aamjiwnaang M I D D L E S E X Lake St. Clair Town of Plympton-Wyoming First Nation Strathroy- Village of Point Edward Talford Creek Caradoc St. Clair River City of Sarnia Brown Creek Sydenham River Petrolia Municipality of Southwest Middlesex eek Durham Creek East Sydenham River Township of St. Clair Cr Municipality of Strathroy-Caradoc Baby Brooke- Municipality of Warwick Enniskillen Alvinston Report Reference St. Clair L A M B T O N Oneida Nation Sydenham River Chippewas of the Thames of the Thames 2.1 Source Protection Region River St. Clair First Nation Munsee-Delaware Black Creek Oil Springs First Nation ² Southwest Middlesex 02.5 5 10 15 20 Clay Creek Southwold Kilometres McKeough Floodway Dawn-Euphemia Newbury 1:385,000 North Sydenham River E L G I N St.