Remuneration Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agenda20 21 Annual General Meeting of Shareholders

Agenda20 21 Annual General Meeting of Shareholders Agenda Agenda for the Virtual Annual General Meeting of Shareholders of Wolters Kluwer N.V., to be held on Thursday, April 22, 2021, at 3.00 PM CET. Formally the meeting will be held at the Corporate Office of Wolters Kluwer, Zuidpoolsingel 2, 2408 ZE in Alphen aan den Rijn, the Netherlands. In accordance with the Temporary Act COVID-19 Justice and Safety, shareholders can only attend the meeting virtually and if desired vote real-time via www.abnamro.com/evoting. 1 Opening 2 2020 Annual Report a Report of the Executive Board for 2020 b Report of the Supervisory Board for 2020 c Advisory vote on the remuneration report as included in the 2020 Annual Report * 3 2020 Financial Statements and dividend a Proposal to adopt the Financial Statements for 2020 as included in the 2020 Annual Report * b Explanation of dividend policy c Proposal to distribute a total dividend of €1.36 per ordinary share, resulting in a final dividend of €0.89 per ordinary share * 4 Release of the members of the Executive Board and the Supervisory Board from liability for the exercise of their respective duties a Proposal to release the members of the Executive Board for the exercise of their duties * b Proposal to release the members of the Supervisory Board for the exercise of their duties * 5 Composition Supervisory Board a Proposal to reappoint Mr. Frans Cremers as member of the Supervisory Board * b Proposal to reappoint Ms. Ann Ziegler as member of the Supervisory Board * 6 Proposal to reappoint Mr. -

Wolters Kluwer Governance Roadshow

Wolters Kluwer Governance Roadshow Selection & Remuneration Committee of the Supervisory Board of Wolters Kluwer November 2020 Governance Roadshow, November 2020 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. Governance Roadshow, November 2020 2 Agenda Wolters Kluwer NV - Selection & Remuneration Committee Current remuneration policy and how it links to strategy Remuneration consultation Proposed changes Proposed ESG measures in STIP Current policy versus proposed changes Next steps Appendix Governance Roadshow, November 2020 3 Selection & Remuneration Committee The Selection & Remuneration Committee is responsible for Executive Board succession planning and remuneration policy Frans Cremers Jeanette Horan Ann Ziegler . -

Wolters Kluwer Governance Roadshow

Wolters Kluwer Governance Roadshow Selection & Remuneration Committee of the Supervisory Board of Wolters Kluwer September, 2020 Governance Roadshow, September 2020 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. -

CONCEPT Kort Verslag

Short Report of the General Meeting of Shareholders of Wolters Kluwer N.V., held on Wednesday, April 22, 2015 at 11.00 a.m. in Amsterdam, The Netherlands. Chairman: Mr. P.N. Wakkie Secretary: Mr. M.C. Thompson According to the attendance record, 692 shareholders are present or represented, who could jointly cast 162,475,498 votes, representing 54.79% of the issued share capital. Furthermore, Ms. McKinstry and Mr. Entricken are present on behalf of the Executive Board and Messrs. Wakkie, Angelici, Forman, and Hooft Graafland, and Ms. Dalibard and Ms. Qureshi are present on behalf of the Supervisory Board. The meeting is also attended by a number of guests and representatives of the press. 1. OPENING The Chairman opens the meeting and welcomes those present, including the external auditor and the notary, and he explains that Mr. James was not able to attend the meeting. The Chairman observes that all stipulations of the Articles of Association as regards convening the meeting have been complied with, as a notice has been published on the corporate website of the company on March 11, 2015, which has been made public by means of a press release. Shareholders recorded in the shareholders register have been called by letter to attend the meeting. As the requirements of the Articles of Association have been fulfilled, the present meeting can pass legally valid resolutions. 2. 2014 ANNUAL REPORT a. Report of the Executive Board for 2014 b. Report of the Supervisory Board for 2014 c. Execution of the remuneration policy in 2014 3. 2014 FINANCIAL STATEMENTS AND DIVIDEND a. -

Stoxx® Europe Low Risk Weighted 100 Index

STOXX® EUROPE LOW RISK WEIGHTED 100 INDEX Components1 Company Supersector Country Weight (%) BARRY CALLEBAUT Food, Beverage & Tobacco CH 1.40 KUEHNE + NAGEL Industrial Goods & Services CH 1.35 ALLREAL HLDG Real Estate CH 1.35 NESTLE Food, Beverage & Tobacco CH 1.33 SCHINDLER P Industrial Goods & Services CH 1.31 BANQUE CANTONALE VAUDOISE Banks CH 1.20 EMS-CHEMIE HLDG Chemicals CH 1.16 NOVO NORDISK B Health Care DK 1.16 GALENICA SANTE AG Personal Care, Drug & Grocery Stores CH 1.16 SWISSCOM Telecommunications CH 1.15 AHOLD DELHAIZE Personal Care, Drug & Grocery Stores NL 1.14 KONE B Industrial Goods & Services FI 1.14 DANONE Food, Beverage & Tobacco FR 1.13 HERMES INTERNATIONAL Consumer Products & Services FR 1.12 NOVOZYMES Health Care DK 1.11 GEBERIT Construction & Materials CH 1.11 SWISS PRIME SITE Real Estate CH 1.11 NOVARTIS Health Care CH 1.10 SGS Industrial Goods & Services CH 1.10 AXFOOD Personal Care, Drug & Grocery Stores SE 1.09 STADLER RAIL AG Industrial Goods & Services CH 1.08 WOLTERS KLUWER Media NL 1.08 SANOFI Health Care FR 1.07 KONINKLIJKE DSM Chemicals NL 1.07 DEUTSCHE TELEKOM Telecommunications DE 1.06 GIVAUDAN Chemicals CH 1.05 PERNOD RICARD Food, Beverage & Tobacco FR 1.05 ACKERMANS & VAN HAAREN Financial Services BE 1.05 UNIPER Utilities DE 1.05 SAINSBURY (J) Personal Care, Drug & Grocery Stores GB 1.04 ELISA CORPORATION Telecommunications FI 1.04 ADMIRAL GRP Insurance GB 1.04 HENKEL PREF Consumer Products & Services DE 1.04 IMCD Chemicals NL 1.04 JDE PEET S Food, Beverage & Tobacco NL 1.04 VOPAK Industrial Goods -

Wolters Kluwer HY2020 Results Presentation

Wolters Kluwer 2020 Half-Year Results Nancy McKinstry – CEO Kevin Entricken – CFO August 5, 2020 2020 Half-Year Results 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. 2020 Half-Year Results 2 Agenda Introduction Financial Review Operating and Strategic Review Outlook 2020 Appendices 2020 Half-Year Results 3 COVID-19 Since mid-March, we have been focused on protecting our employees and supporting our customers in extraordinary circumstances Employees: ensuring health and safety Customers: providing access and tools . -

Entire Wolter Kluwers 2012 Annual Report

THE SEER Julie Peck General Manager, TyMetrix, Wolters Kluwer Corporate Legal Services THE VISIONARY Ian Rhind CEO of Wolters Kluwer Audit, Risk & Compliance THE GO-TO PERSON Robinson deJesus Latin America Director, Wolters Kluwer Audit, Risk & Compliance THE SIMPLIFIER Brian Levy Chief Medical Officer at Health Language THE SEER Julie Peck General Manager, TyMetrix, Wolters Kluwer THE ANALYst Corporate Legal Services Craig Raeburn Managing Director, TyMetrix Legal Analytics THE COUNSELOR Claudine Weyn Business Unit Director, Wolters Kluwer provides Kluwer, Belgium professionals the essen- tial information, soft- THE VISIONARY ware, and services they need to make decisions Ian Rhind with confidence. We CEO of Wolters Kluwer Audit, constantly evaluate and Risk & Compliance adapt how we deliver and apply our expertise through new service models, new technolo- gies, and new workflow THE MAstERMIND solutions. We pride our- Arvind Subramanian selves in working as a President and CEO, team of professionals Wolters Kluwer Health, with deep experience in the industries we serve. Clinical Solutions THE INITIATOR Robert Lemmond Vice President, Legal THE GO-TO PERSON Markets Group, Wolters Robinson DeJesus Kluwer Law & Business Latin America Director, Wolters Kluwer Audit, Risk & Compliance THE SIMPLIFIER Brian Levy Chief Medical Officer at Health Language THE AUGMENTER Shasha Chang CEO of Wolters Kluwer China THE FAMILY DOCTOR Linda Peitzman Chief Medical Officer, Wolters Kluwer Health CONTENT OVERVIEW SUPPORTING DECISIONS 42 44 48 50 Editorial Supporting Supporting Supporting Work Insight Anytime Technological change affects how profession- als make decisions. They can tap into massive volumes of data As businesses become more The real value of data analytics is Five years ago, a big shift took that, combined with the global, their operations become in uncovering relationships place that put pressure on more distributed, both domesti- between every facet of the data lawyers to compete with their right decision support cally and internationally. -

2019 Annual Report Wolters Kluwer 2019 Annual Report 5 Table of Contents | Consolidated Financial Statements | Company Financial Statements

2018 Annual Report 2019Annual Report Table of Contents | Consolidated Financial Statements | Company Financial Statements Table of Contents 2019 Financial Statements 6 8 82 89 Message from Wolters Kluwer Consolidated Notes to the the CEO at a Glance in 2019 Financial Statements Consolidated Financial Statements 10 12 178 180 Value Creation Report of the Company Notes to the Company Model Executive Board Financial Statements Financial Statements 12 Improving Lives Today and for the Future 20 Transformative Innovations 23 Embracing People and Society 30 Our Organization 187 195 32 Key Figures Other Information Other Information 34 Operational and Financial Review 45 2020 Full-Year Outlook on the Financial 195 Report of the Wolters Kluwer Statements Preference Shares Foundation 196 Wolters Kluwer Shares and Bonds 46 64 187 Independent Auditor’s Report 204 Five-Year Key Figures 194 Articles of Association Provisions 206 Glossary Corporate Report of the Governing Profit Appropriation 207 Contact Information Governance and Supervisory Board Risk Management 64 Supervisory Board Report 68 Remuneration Report 46 Corporate Governance 51 Risk Management 61 Statements by the Executive Board 62 Executive Board and Supervisory Board 4 Wolters Kluwer 2019 Annual Report Wolters Kluwer 2019 Annual Report 5 Table of Contents | Consolidated Financial Statements | Company Financial Statements Digital & services Recurring revenues of total revenues, 89% up 6% organically 78% of total revenues, up 5% organically approach to capital allocation, enabling the right levels Commitment to society at large Message from the CEO of investment to keep our current products healthy, while We are guided by the principles of the United Nations working hard to innovate and launch new products and Global Compact and acknowledge the importance of the services. -

Euronext Amsterdam During the Last Quarter of 2004

Contents Table 1 - Liquid Shares Table 2 - Liquidity classes Table 3 - Block size (pre-trade) Table 4 - Publication delays (post-trade) Table 5 - Internalization Notes 1. Statistics computed in this file relate to trades including applications recorded in the central order book of Euronext Amsterdam during the last quarter of 2004. 2. Table 1 - Company shares included in table 1 meet at least 1 out of the following 3 criteria: - Market Value > EUR 1 bn - Average Daily Volume > EUR 2 mn - Average Daily Number of Trades > 500 3. Table 2 - Block size : a column "average trade size" was added to his table. Free-Float Market Average Daily Number Average Daily Num Isin Code Name Value (m €) of Trades Volume (ADV) 1 NL0000009470 ROYAL DUTCH PETROL 88 161 6 252 323 880 692 2 NL0000303600 ING GROEP 48 371 5 464 181 794 086 3 NL0000009538 KON PHILIPS ELECTR 25 677 5 199 163 499 955 4 NL0000009348 UNILEVER 28 196 3 256 150 043 380 5 NL0000301109 ABN AMRO HOLDING 33 189 3 999 127 020 158 6 NL0000334365 ASML HOLDING 5 712 3 718 105 545 963 7 NL0000301760 AEGON 15 573 3 679 92 012 564 8 BE0003801181 FORTIS 26 444 2 706 74 780 401 9 NL0000009082 KONINKLIJKE KPN 16 848 2 148 72 382 602 10 NL0000331817 KONINKLIJKE AHOLD 8 855 2 616 56 419 518 11 NL0000009132 AKZO NOBEL 8 979 1 522 32 017 342 12 NL0000349488 REED ELSEVIER 7 423 1 478 30 172 790 13 NL0000009058 TPG 9 596 1 428 28 596 177 14 NL0000009165 HEINEKEN 6 010 1 422 28 312 747 15 NL0000389872 V N U 5 514 1 404 27 379 316 16 NL0000009769 DSM 4 809 1 053 20 454 320 17 NL0000395887 WOLTERS KLUWER 4 -

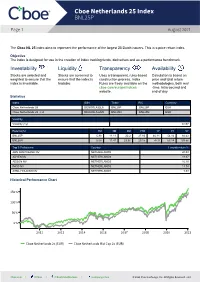

Cboe Netherlands 25 Index BNL25P

Cboe Netherlands 25 Index BNL25P Page 1 August 2021 Cboe Exchange The Cboe NL 25 index aims to represent the performance of the largest 25 Dutch issuers. This is a price return index. Objective The index is designed for use in the creation of index tracking funds, derivatives and as a performance benchmark. Investability Liquidity Transparency Availability Stocks are selected and Stocks are screened to Uses a transparent, rules-based Calculation is based on weighted to ensure that the ensure that the index is construction process. Index price and total return index is investable. tradable. Rules are freely available on the methodologies, both real cboe.com/europe/indices -time, intra-second and website. end of day. Statistics Index ISIN Ticker RIC Currency Cboe Netherlands 25 DE000SLA22L5 BNL25P .BNL25P EUR Cboe Netherlands 25 - net DE000SLA22M3 BNL25N .BNL25N EUR Volatility Volatility (1y) 0.157 Returns(%) 1M 3M 6M YTD 1Y 3Y 5Y BNL25P 5.88 11.11 22.2 27.83 46.11 54.82 84.42 BNL25N 6.08 11.41 23.36 29.15 47.9 63.14 103.66 Top 5 Performers Country 1 month return % ABN AMRO BANK NV NETHERLANDS 20.03 ADYEN NV NETHERLANDS 19.37 AEGON NV NETHERLANDS 16.10 IMCD NV NETHERLANDS 13.74 ASML HOLDING NV NETHERLANDS 9.63 Historical Performance Chart 150% 100% 50% 0% 2011 2013 2014 2016 2017 2018 2020 2021 Cboe Netherlands 25 (EUR) Cboe Netherlands Mid Cap 25 (EUR) Cboe.com | ©Cboe | /CboeGlobalMarkets | /company/cboe © 2021 Cboe Exchange, Inc. All Rights Reserved. v1.0 Cboe Netherlands 25 Index BNL25P Page 2 August 2021 Cboe Exchange Industry Classification Benchmark Index constituents are classified by the FactSet Revere Business Industry Classification (RBICS) consisting of 12 anchor industries. -

2018 Annual Report

2018 Annual Report 2019Annual Report When you have to be right 2019 Annual Report Table of Contents 6 8 Message from Wolters Kluwer the CEO at a Glance in 2019 10 12 Value Creation Report of the Model Executive Board 12 Improving Lives Today and for the Future 20 Transformative Innovations 23 Embracing People and Society 30 Our Organization 32 Key Figures 34 Operational and Financial Review 45 2020 Full-Year Outlook 46 64 Corporate Report of the Governance and Supervisory Board Risk Management 64 Supervisory Board Report 68 Remuneration Report 46 Corporate Governance 51 Risk Management 61 Statements by the Executive Board 62 Executive Board and Supervisory Board 4 Wolters Kluwer 2019 Annual Report 2019 Financial Statements 82 89 Consolidated Notes to the Financial Statements Consolidated Financial Statements 178 180 Company Notes to the Company Financial Statements Financial Statements 187 195 Other Information Other Information on the Financial 195 Report of the Wolters Kluwer Statements Preference Shares Foundation 196 Wolters Kluwer Shares and Bonds 187 Independent Auditor’s Report 204 Five-Year Key Figures 194 Articles of Association Provisions 206 Glossary Governing Profit Appropriation 207 Contact Information Wolters Kluwer 2019 Annual Report 5 Message from the CEO I am pleased to report that we It was a year in which we made significant progress on improving systems and infrastructure to support sustained 4% organic revenue growth operational agility. Scaling our expert solutions and adding in 2019. We delivered an improvement value to our information products will provide a strong foundation for 2020. We are committed to creating value in adjusted operating profit margin, for our customers, employees, investors, and society, as overcoming a challenging reflected in our 2019 performance. -

Nomura Europe Media Field Trip to New York

Nomura Europe Media Field Trip to New York Kevin Entricken CFO, Wolters Kluwer Health & Pharma Solutions Arvind Subramanian President and CEO, Wolters Kluwer Health, Clinical Solutions Denise Basow President, Editor in Chief of UpToDate Forward-looking Statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties, that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward- looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.