The 2% Tax for Eritreans in the Diaspora

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ERI-NEWS Cohesion and the Kemey Zeykewn!) Defence of Sovereignty Bi-Weekly Newsletter Permanent Mission of the State of Eritrea to AU and UNECA Press Section

Eritrea: Land of National Service: A tool Can-Do People! for Economic Development, National (Yikealo! kikewn eyu ERI-NEWS Cohesion and the kemey zeykewn!) Defence of Sovereignty Bi-Weekly Newsletter Permanent Mission of the State of Eritrea to AU and UNECA Press Section President Isaias Received Message from the President of Volume 1, Issue 8 Mauritania 15 April 2014 On 02 April 2014, Mr. Camara President Isaias, on his part, assured the Amedi, Minister of Environment of Minister of Eritrea’s readiness to boost Mauritania delivered a message from its efforts for the realization of the goals President Mohamed Ould Abdelaziz of the Initiative. The GGWI comprises Inside this issue: to President Isaias Afwerki, and gave 13 African states including Eritrea, and the President a briefing on the Great has the objective of combating desertifi- Green Wall Initiative (GGWI). cation. (shabait.com) Eritrean Ambassador to Kenya Held Talks 2 Advisor Delivered President Isaias’ Message to President Beshir with the Vice Pres- ident of Kenya On 7 April 2014, Presidential Advisor Eritrea and Sudan, and key regional Mr Yemane Ghebreab delivered Pres- developments. Ethiopia Must Withdraw 2 ident Isaias Afwerki’s message to from Sovereign Eri- H.E. Omar Hassan Al-Beshir, Presi- During his stay in Khartoum, Mr. trean Territories for dent of Sudan. Yemane also held discussions with the Peace to Prevail in President Isaias’ message focused on Sudanese First Vice President and the the Horn of Africa fostering bilateral relations between Minister of Foreign Affairs. Intervention by Ambassador Araya Desta Handed-Over His Credentials to the Ambassador Chairperson of AUC Araya Desta at 3 the AUPSC Ambassador Araya Desta presented the best wishes of President Isaias Meeting on South his credentials to Dr. -

Addis Ababa Univers Ity School of Graduate Studies

ADDIS ABABA UNIVERS ITY SCHOOL OF GRADUATE STUDIES DEPARTME NT OF POLITICAL SCIENCE AND INTERNATIONAL RELAT IONS THE CURRENT INTERNAL POLITICAL DYNAMICS OF ETHIOPIA AND ITS ECONOMIC IMPACT IN THE HORN OF AFRICA BY NATNA EL TADE SSE AYE LE ADVIS OR: PROF. MERERA .G ADDIS ABABA, ETHIO PIA JUNE, 2019 THE CURREN T INTERNAL POLIT ICAL DYNAMICS OF ETHIOPIA AND ITS ECONOMIC IMPACT IN THE HORN OF AFRICA BY NATNAEL TADESSE AYELE A THESIS SUBMITTED TO THE SCHOOL OF GRADUATE STUDIES OF AAU IN PARTIA L FULFIL LME NTS OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTERS OF ARTS IN INTER NAT ION AL RELAT IONS AND DIPLO MAC Y ADVIS OR: PROF. MERERA. G. ADDIS ABABA UNIVERS ITY COLLE GE OF SOCIAL SCIENC ES SCHOO L OF GRADUAT E STUDIES DEPAR TME NT OF POLITIC AL SCIENC E AND INTERNA TIO NAL RELAT ION ADDIS ABABA UNIVERS ITY SCHOOL OF GRADUAT E STUDIE S DEPAR TME NT OF POLITICAL SCIENC E AND INTERNA TIO NAL RELAT ION S THE CURREN T INTERN AL POLIT ICAL DYNAMIC S OF ETHIOPIA AND ITS ECONOMIC IMPACT IN THE HORN OF AFRICA BY NATNA EL TADE SSE AYE LE Approved by the Board of Examiners Advisor Signature Date External Examiner Signature Date Internal Examiner Signature Date DECLARATION I, the undersigned, declare that this thesis is my original work and has not been presented for a degree in any other university and that sources of materials used for the thesis have been duly acknowledged. Natnael Tadesse June 2019 iv Acknowledgments First, above all, let be Glory to God Almighty for always being with me in all my life. -

The Role of the African Diaspora in Conflict Processes

B ONN INTERNATIONAL CENTER FOR CONVERSION • INTERNATIONALES KONVERSIONSZENTRUM BONN Agents of Peace or Agents of War? The Role of the African Diaspora in Confl ict Processes CONCEPT PAPER The Role of the African Diaspora in Conflict Processes Concept Paper (abridged English version) Of the Workshop Agents of Peace or Agents of War? The Role of the African Diaspora in Conflict Processes organized by the Ministry for Intergenerational Affairs, Family, Women and Integration of the Land of North Rhine-Westphalia in cooperation with the Bonn International Center for Conversion (BICC) INTERNATIONALES KONVERSIONSZENTRUM BONN - An der Elisabethkirche 25 BONN INTERNATIONAL CENTER FOR CONVERSION (BICC) GMBH 53113 Bonn, GERMANY Phone: +49-228-911 96-0 Director: Peter J. Croll Fax: +49-228-24 12 15 Chairman of the Board: Deputy Minister Dr. Michael Stückradt E-Mail: [email protected] Register of Companies: Bonn HRB 6717 Internet: www.bicc.de Authors: Andrea Warnecke Julie Brethfeld Volker Franke BICC, April 2007 2 ANDREA WARNECKE is Junior Researcher at BICC JULIE BRETHFELD is Research Associate at BICC VOLKER FRANKE is Research Director at BICC This study was conducted by BICC with the support of the Ministry for Intergenerational Affairs, Family, Women and Integration of the Land of North Rhine-Westphalia. The authors are solely responsible for the content and for the opinions expressed therein. 3 1. INTRODUCTION 5 2. THE TERMS ‘CONFLICT PROCESS’ AND ‘DIASPORA’ 7 2.1. Conflict process 7 2.2. Diaspora 7 3. THE AFRICAN DIASPORA IN GERMANY (FOCUS NORTH RHINE-WESTPHALIA) 9 3.1. Heterogeneity and networking 10 3.2. Organizations of the African Diaspora in NRW 11 4. -

The Africa Union Handbook

African Union Handbook African THE YEAR OF REFUGEES, RETURNEES AND INTERNALLY DISPLACED PERSONS: Towards Durable Solutions to Forced Displacement in Africa The logo for the 2019 Theme of the Year has been built around the crisis facing refugees in Africa. New Zealand is proud to once again partner with the African Union “Whereas migration is a common Commission to produce the latest version of the African Union Handbook. phenomenon as people have always relocated for various reasons, in the With new and updated information about the Union, its organs and related case of Africa, the continent is painted as a miserable place bodies, the Handbook serves as a factual and concise reference guide to all because migration is as a result of aspects of the African Union and its Commission, and remains an invaluable civil strife, poverty and a myriad of tool for anyone working with, and within, the AU system. other factors, thereby promoting the narrative that Africa cannot care for Through its ambitious integration agenda, African Union members have its people. Africa knows how to take care of its own in each regard no committed themselves to aspire to a world where international connections matter what, and many African between peoples and nations are the most powerful tools for creating countries continue to welcome and prosperous societies based on inclusive growth and sustainable development. host refugees while working to resolve the issues that caused them At a time when the need for collective global action and multilateralism has to flee their homes. never been clearer, New Zealand expresses its profound respect to the African For the 2019 Theme, an identity has Union for its commitments made under Agenda 2063 towards achieving an been developed of a mother with integrated, inclusive and united Africa. -

Eritrean Diaspora in Germany: the Case of the Eritrean Refugees in Baden-Württemberg

Eritrean Diaspora in Germany: The case of the Eritrean refugees in Baden-Württemberg Beatris de Oliveira Santos Dissertação de Mestrado em Migrações, Inter-Etnicidades e Transnacionalismo September, 2019 Dissertação apresentada para cumprimento dos requisites necessários à obtenção do grau de Mestre em Migrações, Inter-Etnicidades e Transnacionalismo, realizada sob orientação científica da Prof. Dr. Alexandra Magnólia Dias - NOVA/FCSH e Prof. Dr. Karin Sauer - Duale Hochschule Baden-Württemberg. This dissertation is presented as a final requirement for obtaining the Master's degree in Migration, Inter-Ethnicity and Transnationalism, under the scientific guidance of Prof. Dr. Alexandra Magnólia Dias of NOVA/FCSH, and co-orientation of Prof. Dr. Karin Sauer of DHBW. Financial Support of Baden-Württemberg Stiftung ACKNOWLEDGMENTS First of all, I would like to thank my thesis advisors Prof. Dr. Alexandra Magnólia Dias of the New University of Lisbon and Prof. Dr. Karin Sauer of the Duale Hochschule Villingen-Schwenningen. The access to both advisors was always open whenever I ran into trouble or had a question about my research or writing. I would also like to thank the experts who were involved in the validation survey for this research project: Jasmina Brancazio, Felicia Afryie, Karin Voigt, Orland Esser, Uwe Teztel, Werner Heinz, Volker Geisler, Abraham Haile, Tekeste Baire, Semainesh Gebrey, Inge Begger, Isaac, Natnael, Maximillian Begger, Alexsander Siyum, Robel, Dawit Woldu, Herr Kreuz, Hadassa and Teclu Lebasse. Without their passionate participation and inputs, this research could not have been successfully conducted. For all refugees who shared me their experiences with generosity, trust, knowledge and time, my sincerely thank you all. -

Ethiopian Jews in Canada: a Process of Constructing an Identity

Ethiopian Jews in Canada: A Process of Constructing an Identity Esther Grunau Department of Anthropology McGill University, Montreal c November, 1995 A thesis submitted to the Faculty of Graduate Studies and Research in partial fulfilment of the requirements of the degree of Master of Arts, Anthropology. © Esther Grunau, 1995 Table of Contents Acknowledgments ll Abstract IV Chapter 1 : Introduction 1 Chapter 2: Historical Background 17 Chapter 3: Emigration out ofEthiopia 32 Chapter 4: The Construction of Group Identity in Israel 46 Chapter 5: The Canadian Experience 70 Conclusion Ill Appendix A: Maps 113 Appendix B: Ethiopian Jewish Informants 115 Appendix C: Glossary 118 Appendix D: Abbreviations 120 References Cited 121 11 Acknowledgments This thesis could not have been completed without the support and assistance of several individuals and organizations. My supervisor, Professor Allan Young, encouraged me throughout the M.A. program and my thesis to push myself intellectually and creatively. I thank him for his gu~dance, constructive comments and support through my progression in the program and the evolution of my thesis. Professor Ell en Corin carefully supervised a readings course on Ethiopian Jews and identity which served as the background for this thesis. Throughout my progression in the course and in the M. A. program she was always available to discuss ideas with me, and her invaluable comments and support helped me to gain focus and direction in my work. Dr. Laurence Kirmayer provided me with a forum to explore the direction of my thesis through my involvement in the Culture and Mental Health Team. His insightful comments on how to link cultural anthropology with mental health challenged me to think more clearly about my graduate work and my career. -

Ethiopian Jews in Israel

Ethiopian Jews in Israel by STEVEN KAPLAN and CHAIM ROSEN KJF THE MANY DIASPORA JEWISH communities, none has under- gone more dramatic change in recent years than the Beta Israel (Falashas).1 Prior to 1977 all but a handful of Beta Israel lived in Ethiopia. During the 1980s, almost half the community emigrated to Israel, and the center of Beta Israel life shifted from Ethiopia to Israel. In 1991, "Operation Sol- omon" put an end to the Beta Israel as an active and living Diaspora community, and by the end of 1993 virtually all Beta Israel were in Israel. This article describes and analyzes the process of their immigration (aliyah) to, and absorption (klitah) in, Israel. Although every attempt has been made to provide as much quantitative statistical data as possible, significant gaps remain. Most of the research undertaken on the Ethiopians in Israel has been qualitative in nature. Even in those cases where attempts have been made to carry out precise surveys of immigrants, the results have not always been satisfactory.2 Since Ethiopian immigrants usually arrived in Israel with few official documents, basic "facts" such as age and family status were often unverifiable, and immigrants were registered on the basis of their own or family members' testimony. Once they were settled in the country, the multiplicity of agencies dealing with the immigrants further complicated the process of compiling comprehensive and authoritative information.3 'In Ethiopia, the members of the group usually referred to themselves as Beta Israel (the House of Israel) or simply Israel. They were more widely known as "Falashas." Today, they prefer to be called Ethiopian Jews. -

Modes and Potential of Diaspora Engagement in Eritrea

Working Paper No.3 Modes and Potential of Diaspora Engagement in Eritrea Clara Schmitz‐Pranghe1 July 2010 1 The author would like to thank her colleagues Andrea Warnecke and Elvan Isikozlu, the external reviewers Tricia Redeker Hepner and Markus Treiber as well as Johannes Kidane for providing very helpful comments and suggestions on an earlier draft of this paper. She is also very grateful for being able to rely on valuable data on Eritreans in Germany gathered by Bettina Conrad in the framework of the DIASPEACE project. Moreover, she would like to thank Heike Webb for both language and copy-editing of this paper. Last but not least, the support of the European Commission who generously funds the DIASPEACE project is gratefully appreciated. DIASPEACE Working Papers are published by the research project Diasporas for Peace: Patterns, Trends and Potential of Long-distance Diaspora Involvement in Conflict Settings. Case Studies from the Horn of Africa (DIASPEACE), which is a three-year research project funded by the European Commission under the 7th Framework Programme. The project seeks to generate policy-relevant, evidence-based knowledge on how exiled populations from conflict regions play into the dynamics of conflict and peace in their countries of origin. It has an empirical focus on diaspora networks operating in Europe, which extend their transnational activities to the Horn of Africa. The project is coordinated by the University of Jyväskylä and it involves six partners from Europe and two from the Horn of Africa and will conduct field research in both Europe and Africa. All published papers have been refereed by at least two experts in the field. -

In Search of Italianness: an Ethnography of the Second-Generation Condition

SCUOLA DI DOTTORATO UNIVERSITÀ DEGLI STUDI DI MILANO-BICOCCA Department of Scienze umane per la formazione Riccardo Massa PhD program: DACS antropologia culturale e sociale Cycle XXX In search of Italianness: an ethnography of the second-generation condition in a mobility perspective Surname: Grimaldi Name: Giuseppe Registration number: 744185 Tutor: Prof. Bruno Riccio Co-Supervisor: Prof. Timothy Raeymaekers Coordinator: prof. Alice Bellagamba ACADEMIC YEAR 2016/2017 Contents Introduction ........................................................................................................................................... 1 The second-generation condition ................................................................................................................. 5 Habesha in immobility: ancestral identification as a site of incorporating difference ................................. 8 Habesha as a source of mobility. Practicing the difference to navigate a second-generation condition in the social space of the diaspora .................................................................................................................. 11 Milano as an interconnected space. Siting the exploration of a second-generation condition ................. 13 Between methodology and epistemology. The “clue paradigm” and the second-generation condition .. 15 Structure of the work .................................................................................................................................. 19 Chapter 1: Italianness and Habesha. -

Secretariat Distr.: Limited

UNITED NATIONS ST /SG/SER.C/L.615 _____________________________________________________________________________________________ Secretariat Distr.: Limited 6 October 2006 PROTOCOL AND LIAISON LIST OF DELEGATIONS TO THE SIXTY-FIRST SESSION OF THE GENERAL ASSEMBLY I. MEMBER STATES Page Page Afghanistan.........................................................................5 Cyprus.............................................................................. 32 Albania ...............................................................................5 Czech Republic ................................................................ 33 Algeria ...............................................................................6 Democratic People’s Republic of Korea .......................... 34 Andorra...............................................................................7 Denmark........................................................................... 35 Angola ................................................................................7 Djibouti ............................................................................ 36 Antigua and Barbuda ..........................................................8 Dominica.......................................................................... 36 Argentina............................................................................8 Dominican Republic......................................................... 37 Armenia..............................................................................9 -

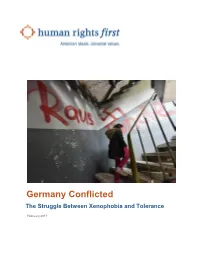

Germany Conflicted the Struggle Between Xenophobia and Tolerance

Germany Conflicted The Struggle Between Xenophobia and Tolerance February 2017 ON HUMAN RIGHTS, the United States must be a beacon. ACKNOWLEDGEMENTS Activists fighting for freedom around the globe continue to Research for this report was conducted by Susan Corke look to us for inspiration and count on us for support. and Erika Asgeirsson at Human Rights First and a team from Upholding human rights is not only a moral obligation; it’s a the University of Munich: Heather Painter, Britta vital national interest. America is strongest when our policies Schellenberg, and Klaus Wahl. Much of the research and actions match our values. consisted of interviews and consultations with human rights Human Rights First is an independent advocacy and action activists, government officials, national and international organization that challenges America to live up to its ideals. NGOs, multinational bodies, faith and interfaith groups, We believe American leadership is essential in the struggle scholars, and attorneys. We greatly appreciate their for human rights so we press the U.S. government and assistance and expertise. Rebecca Sheff, the former legal private companies to respect human rights and the rule of fellow with the antisemitism and extremism team, also law. When they don’t, we step in to demand reform, contributed to the research for this report during her time at accountability, and justice. Around the world, we work where Human Rights First. We are grateful for the team at Dechert we can best harness American influence to secure core LLP for their pro bono research on German law. At Human freedoms. Rights First, thanks to Sarah Graham for graphics and design; Meredith Kucherov and David Mizner for editorial We know that it is not enough to expose and protest injustice, assistance; Dora Illei for her research assistance; and so we create the political environment and policy solutions the communications team for their work on this report. -

L'érythrée: Rejetée Et Rejeton De La Corne De L'afrique

L’Érythrée : Rejetée et rejeton de la Corne de l’Afrique Jean-Nicolas Bach, Patrick Ferras, Berouk Mesfin To cite this version: Jean-Nicolas Bach, Patrick Ferras, Berouk Mesfin. L’Érythrée : Rejetée et rejeton de la Cornede l’Afrique. Patrick Ferras. La Corne de l’Afrique. Évolutions politiques et sécuritaires, I, Observatoire de la Corne de l’Afrique, pp.157-202, 2015, 978-2-9553919-0-7. halshs-02384564 HAL Id: halshs-02384564 https://halshs.archives-ouvertes.fr/halshs-02384564 Submitted on 28 Nov 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. L’ÉRYTHRÉE, REJETÉE ET REJETON DE LA CORNE DE L’AFRIQUE JEAN-NICOLAS BACH, PATRICK FERRAS, BEROUK MESFIN L’Érythrée reste un État difficile d’accès où l’information est peu disponible et extrêmement filtrée. La situation de « ni paix, ni guerre » avec l’Éthiopie reste un élément majeur dans le comportement des deux anciens protagonistes du conflit de 1998-2000 et détermine l’avenir de la paix et de la sécurité dans la Corne de l’Afrique toute entière. Les conséquences de ce conflit se répercutent en effet sur l’ensemble d’une région déjà instable qui offre à l’Érythrée de nombreuses opportunités d’agir afin de nuire à l’Éthiopie et ses alliés : conflits en Somalie, sur la côte kényane, au Soudan du Sud, ou encore rébellions armées en Éthiopie.