Vimpelcom Publishes Pro Forma Financial Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Claimant's Memorial on Merits and Damages

Public Version INTERNATIONAL CENTRE FOR ICSID Case No. ARB/16/16 SETTLEMENT OF INVESTMENT DISPUTES BETWEEN GLOBAL TELECOM HOLDING S.A.E. Claimant and GOVERNMENT OF CANADA Respondent CLAIMANT’S MEMORIAL ON THE MERITS AND DAMAGES 29 September 2017 GIBSON, DUNN & CRUTCHER LLP Telephone House 2-4 Temple Avenue London EC4Y 0HB United Kingdom GIBSON, DUNN & CRUTCHER LLP 200 Park Avenue New York, NY 10166 United States of America Public Version TABLE OF CONTENTS I. Introduction ............................................................................................................................ 1 II. Executive Summary ............................................................................................................... 3 III. Canada’s Wireless Telecommunications Market And Framework For The 2008 AWS Auction................................................................................................................................. 17 A. Overview Of Canada’s Wireless Telecommunications Market Leading Up To The 2008 AWS Auction.............................................................................................. 17 1. Introduction to Wireless Telecommunications .................................................. 17 2. Canada’s Wireless Telecommunications Market At The Time Of The 2008 AWS Auction ............................................................................................ 20 B. The 2008 AWS Auction Framework And Its Key Conditions ................................... 23 1. The Terms Of The AWS Auction Consultation -

Italian Guidelines About Wind Turbine Sound: How to Improve Them And

Italian guidelines about wind turbine sound: PO. ID How to improve them and make them work better C001 Martina Repossi Alerion Clean Power S.p.A. – Milan (Italy) Abstract Critical topics about Italian landscape Wind turbines can produce unwanted sound (referred to as noise) during operation. The nature of sound As a matter of facts, Italian population density, at 197 inhabitants per square kilometre (ISTAT Report, 2013), depends on wind turbine design. Propagation of the sound is primarily a function of distance, but it can also be is higher than that of most Western European countries. However, the distribution of the population is widely affected by turbine placement, surrounding terrain, and atmospheric conditions. uneven. The most densely populated areas are the Po Valley (that accounts for almost a half of the national In Italy, unlike other European countries, we don’t have specific legislation about windmills sound population) and the metropolitan areas of Rome and Naples, while vast regions such as the Alps and measurement and noise limits from Law no.447 are not functional for noise verifical for wind farms. Public Apenins highlands, the island of Sardinia and the plateaus of Basilicata are very sparsely populated. health is an essential Constitutional right (art.32 from Italian Constitution: "la Repubblica tutela la salute come Besides that, Italian landscape is full of protected areas in order to guarantee environmental conservation. The fondamentale diritto dell'individuo e interesse della collettività”) and disagreements related to wind farms noise consequence is that designers need to adapt wind farms layouts to these constraints, also because most are actually recurring. -

Telenor East Holding II AS V. Altimo &

Neutral Citation Number: [2011] EWHC 735 (Comm) Case No: 2011 Folio 139 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 1st March 2011 Before : MRS JUSTICE GLOSTER, DBE - - - - - - - - - - - - - - - - - - - - - Between : Telenor East Holding II AS Applicant - and - (1 Altimo Holdings & Investments Ltd Respondents (2 Altimo Cooperatief UA (3 VimpelCom Ltd - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Joe Smouha Esq, QC, Vernon Flynn Esq, QC, Paul McGrath Esq and James Willan Esq (instructed by Orrick, Herrington & Sutcliffe (Europe) LLP) for the Applicant Huw Davies Esq, QC, Stephen Houseman Esq and Anton Dudnikov Esq (instructed by Skadden, Arps, Slate, Meagher & Flom LLP) for the First & Second Respondents Mark Howard Esq, QC and Oliver Jones Esq (instructed by Akin Gump LLP) for the Third Respondents Hearing dates: 25th February 2011 - - - - - - - - - - - - - - - - - - - - - Judgment Mrs Justice Gloster, DBE: 1. This is an application for an interim injunction pursuant to section 44 of the Arbitration Act 1996 which is made by the claimant, Telenor East Holdings II AS (“Telenor”), for an injunction restraining the third respondent, VimpelCom Limited (“VimpelCom”), and the first and second respondents, Altimo Holdings & Investments Limited ad Altimo Cooperatief UA, the latter as a shareholder in VimpelCom, from taking any action to convene, or proceed with, or vote at, a Special General Meeting of VimpelCom’s shareholders -

Operational Performance 5

GIVING THE WORLD A VOICE ORASCOM TELECOM HOLDING Full Year 2010 Orascom Telecom Holding YE – 2009 Page | 1 GIVING THE WORLD A VOICE CONTENT Highlights 3 CEO’s Comment 4 Operational Performance 5 Main Financial Events 9 Financial Review 14 Financial Statements 20 Operational Overview 25 Orascom Telecom Holding YE – 2009 Page | 2 GIVING THE WORLD A VOICE Orascom Telecom Holding Full Year 2010 Results Cairo, April 18th, 2011: Orascom Telecom Holding (OTH) (Ticker: ORTE.CA, ORTEq.L, ORAT EY, OTLD LI), announces its year end 2010 consolidated results. Highlights • On 4 January 2011, OTH sold its entire shareholding in Orascom Tunisia Holding and Carthage Consortium through which OTH owned 50% of Orascom Telecom Tunisia (“OTT”). As a result the proportionate consolidation of OTT during Q4 is no longer applicable under IFRS as it renders the entity an investment held for sale, and consequently a discontinued operation under IFRS rules. Figures for 2009 and 9M 2010 have been restated to reflect the accounting treatment of OTT. • Total subscribers exceeded 101 million, an increase of 16% over the same period last year. • Net Income before minority interest showed a sharp increase of 106% compared to the same period last year, reaching US$ 781 million1 for the period ending December 31st, 2010, mainly due to the gain recognized on the Mobinil transaction by comparing the carrying amount of the investments in Mobinil and ECMS to the relevant fair value, taking into consideration the net proceeds from the transaction for the global settlement fee amounting to US$300 million. • Revenues reached US$ 3,825 million1, increasing by 2% over the previous year as a result of strong growth in all GSM operations, with the exception of Algeria. -

Financial Information at September 30, 2020

FINANCIAL INFORMATION AT SEPTEMBER 30, 2020 This document has been translated into English for the convenience of the readers. In the event of discrepancy, the Italian language version prevails. CONTENTS HIGHLIGHTS __________________________________________________________________________________ 3 INTRODUCTION _______________________________________________________________________________ 7 MAIN CHANGES IN THE SCOPE OF CONSOLIDATION OF THE TIM GROUP _____________________________ 8 RESULTS OF THE TIM GROUP FOR THE FIRST NINE MONTHS OF 2020 ________________________________ 9 RESULTS OF THE BUSINESS UNITS _____________________________________________________________ 14 AFTER LEASE INDICATORS _____________________________________________________________________ 18 BUSINESS OUTLOOK FOR THE YEAR 2020 _______________________________________________________ 19 EVENTS SUBSEQUENT TO SEPTEMBER 30, 2020 __________________________________________________ 19 MAIN RISKS AND UNCERTAINTIES ______________________________________________________________ 19 ATTACHMENTS ______________________________________________________________________________ 21 TIM GROUP – FINANCIAL HIGHLIGHTS ___________________________________________________________ 21 TIM GROUP – RECLASSIFIED STATEMENTS _______________________________________________________ 22 SEPARATE CONSOLIDATED INCOME STATEMENTS OF THE TIM GROUP _____________________________ 22 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME OF THE TIM GROUP ____________________ 23 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION -

Operátor Stát MTN Afghanistan Afghanistan Afghan Wireless

Operátor Stát MTN Afghanistan Afghanistan Afghan Wireless Communications Company Afghanistan Etisalat Afghanistan Telecom Development Company Limited Afghanistan Telekom Albania Sh.A Albania ALBtelecom sh.a. Albania Vodafone Albania Sh.A. Albania ATM Mobilis Algeria OPTIMUM TELECOM ALGERIE Spa Algeria Wataniya Algeria s.p.a. Algeria Andorra Telecom, S.A.U. Andorra Unitel Angola Angola Cable & Wireless Anguilla Anguilla APUA imobile (former APUA PCS Ltd.) Antigua and Barbuda Cable & Wireless Antigua Antigua and Barbuda TELECOM ARGENTINA S.A Argentina AMX Argentina S.A. Argentina NII Holdings, Inc. (Nextel Argentina S.R.L.) Argentina Telefonica Moviles Argentina S.A. Argentina VEON Armenia CJSC Armenia MTS Armenia CJSC Armenia Karabakh Telecom Armenia New Millennium Telecom Services NV Aruba Servicio di Telecomunicacion di Aruba (SETAR) N.V. Aruba Telstra Corporation Limited Australia Yes Optus Australia Vodafone Hutchison Australia Pty Limited Australia Hutchison Drei Austria GmbH Austria Hutchison Drei Austria GmbH Austria A1 Telekom Austria AG Austria T-Mobile Austria GmbH Austria A1 Telekom Austria AG Austria A1 Telekom Austria AG Austria T-Mobile Austria GmbH Austria Azercell Telekom B.M. Azerbaijan Azerfon LLC Azerbaijan Bakcell LLC Azerbaijan BTC Bahamas Bahamas Bahrain Telecommunication Company Bahrain Zain Bahrain B.S.C Bahrain Viva Bahrain Robi Axiata Limited Bangladesh Banglalink Digital Communications Ltd. Bangladesh GrameenPhone Limited Bangladesh Teletalk Bangladesh Limited Bangladesh Cable & Wireless Barbados Barbados Mobile TeleSystems Belarus Belarusian Telecommunications Network CJSC Belarus FE VELCOM Belarus Telenet Group BVBA/SPRL Belgium Telenet Group BVBA/SPRL Belgium Orange Belgium SA/NV Belgium Proximus PLC (former Belgacom SA/NV) Belgium Belize Telemedia Limited Belize Etisalat Benin Benin Spacetel-Benin S.A. -

Bot U10522 001.00.00.00 3

ACE BOWNE OF TORONTO 01/30/2011 18:12 NO MARKS NEXT PCN: 002.00.00.00 -- Page is valid, no graphics BOT U10522 001.00.00.00 3 IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) QIBS THAT ARE QPS (EACH AS DEFINED BELOW) OR (2) NON-U.S. PERSONS OR ADDRESSEES OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the prospectus supplement following this page (the “Prospectus Supplement”), and you are therefore advised to read this carefully before reading, accessing or making any other use of the Prospectus Supplement. In accessing the Prospectus Supplement, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE ISSUER HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “INVESTMENT COMPANY ACT”) AND THE SECURITIES HAVE NOT BEEN, AND WILL NOT, BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS AND WHICH DOES NOT REQUIRE THE ISSUER TO REGISTER UNDER THE INVESTMENT COMPANY ACT. -

![History Sheba Telecom(PVT Ltd)-After Talking Lots- Finally Was Granted License in 1989[6] to Operate in the Rural Areas of 199 Upazilas](https://docslib.b-cdn.net/cover/0479/history-sheba-telecom-pvt-ltd-after-talking-lots-finally-was-granted-license-in-1989-6-to-operate-in-the-rural-areas-of-199-upazilas-1760479.webp)

History Sheba Telecom(PVT Ltd)-After Talking Lots- Finally Was Granted License in 1989[6] to Operate in the Rural Areas of 199 Upazilas

Banglalink (Bengali: বাংলািলংক), is the second largest cellular service provider inBangladesh after Grameenphone. As of April 2012, Banglalink has a subscriber base of 25 million.[3] It is a wholly owned subsidiary of Orascom Telecom. Banglalink had 1.03 million connections until December, 2005. The number of Banglalink users increased by 257 per cent[4] and stood at 3.64 million at the end of 2006, making it the fastest growing operator in the world of that year. In August, 2006, Banglalink became the first company to provide free incoming calls from BTTB for both postpaid and prepaid connections. On August 20, 2008, Banglalink got past the landmark of 10 million subscriber base.[5] History Sheba Telecom(PVT Ltd)-after talking lots- finally was granted license in 1989[6] to operate in the rural areas of 199 upazilas. Later it obtained GSM license in 1996 to extend its business to cellular mobile, radio telephone services. It launched operation in the last quarter of 1997 as a Bangladesh-Malaysia joint venture. Tigers' Den (banglalink's headquarters) atGulshan. In July, 2004, it was reported that Egypt based Orascom Telecom is set to purchase the Malaysian stakes in Sheba Telecom through a hush-hush deal, as Sheba had failed to tap the business potentials in Bangladesh mainly due to a chronic feud between its Malaysian and Bangladeshi partners. An agreement was reached with Orascom worth US$25 million was finalized in secret. The pact has been kept secret for legal reasons, considering financial fallout and because of the feud. The main reason for the undercover dealing was the joint venture agreement between the Bangladeshi and the Malaysian partners, which dictates that if any party sells its Sheba shares, the other party will enjoy the first right to buy that. -

Wind Park Extension Becomes Vestas' First Merchant Project in Italy

Page 1 of 2 News release from Vestas Mediterranean Madrid, 24 June 2019 Wind park extension becomes Vestas’ first merchant project in Italy Vestas has signed an 18 MW contract with VRG Wind 060 for the extension of the Mazara del Vallo wind park in Sicily, Italy. Utilising Vestas’ industry-leading technology and the operation data from the site’s existing wind turbines to boost energy production and mitigate production uncertainties, Vestas and the customer have developed a solution and business case that will be commercially viable without any direct financial support, selling electricity on merchant market terms. The order includes the supply and installation of six V126-3.45 MW turbines delivered in 3.0 MW Load Optimised Mode, adding to the customer’s 48 MW of Senvion turbines already installed at the site. Alberto Musso, CEO of VRG Wind 060, says: “Our merchant project, one of the first ones in the Italian wind sector, leverages on the following positive drivers: a wind farm in operation since 2008 mitigates energy production uncertainties, a new financing scheme which foresees such extension and Vestas’ state-of-the-art technology, which will allow us to better harness wind resources with larger rotors and modern wind turbines. We appreciated Vestas’ team for their competences and effort to finalise the agreements in a very short timeframe”. “This merchant project underlines how a tailored technical solution and leveraging our market experience and project finance expertise enable a highly competitive business case for our customer. As one of Italy’s first merchant projects, it confirms wind energy’s increasing competitiveness and represents a great step on the country’s transition towards renewable energy that we are very proud to be part of”, says Rainer Karan, Vestas Vice President of Sales for Southern Europe and Turkey. -

Weather Investments S

Orascom Telecom Holding renamed to Global Telecom Holding Cairo/London, September 22, 2013: The company is pleased to announce that it has changed its name to “Global Telecom Holding S.A.E.”. The Egyptian Stock Exchange (“EGX”) and the London Stock Exchange (“LSE”) will amend the new name of the company, “Global Telecom Holding S.A.E.”, and amend the ticker symbol on the trading screens to “GTHE.CA” on the EGX and “GLTD:LI” on the LSE with effect from September 23, 2013. This gives effect to the decision of the shareholders at the Extraordinary General Assembly Meeting held on November 12, 2012. All references to the previous company name shall be substituted by the new name. The company was obliged to change its name as part of the WIND Telecom S.p.A. and VimpelCom Ltd. merger, under which the company and its subsidiaries were required to cease the use of the “Orascom” name, designs and logos. Ahmed Abou Doma, Group CEO of Global Telecom Holding S.A.E. commented: “Our new name and corporate identity are intended to provide a modern look and feel, and emphasize our specific strengths as an international telecom group. The Global Telecom Holding S.A.E. new corporate identity allows our group to leverage on the goodwill, the strong growth and outstanding performance of our parent company VimpelCom Ltd. and will provide our organization with a solid platform to build upon in our upcoming endeavors and growth potential in the telecom sector.” -END- About Global Telecom Holding: Global Telecom (“GTH”) is a leading international telecommunications company operating GSM networks in high growth markets in the Middle East, Africa and Asia, having a total population under license of approximately 459 million with an average mobile telephony penetration of approximately 53% as of June 30, 2013. -

Profile Maximo Ibarra

Profile Maximo Ibarra Maximo Ibarra is renowned for his experience in digitalization, marketing and customer centricity. Ibarra previously worked for the Italian company Wind Telecommunications where he served as CEO from 2012 onwards. From 2016, as CEO of Wind Tre, he was responsible for the integration of the 50/50 joint venture between the Italian telecommunications activities of VEON (Wind Telecommunications) and CK Hutchison (3 Italia). Wind Tre, with approximately € 6.5 billion in revenues, serves more than 30 million mobile customers and 2.8 million fixed line customers. Ibarra joined Wind Telecommunications in 2004, and served in a number of leadership roles until his appointment as CEO in 2012. Prior to joining Wind Telecommunications, Ibarra held several leadership and commercial positions at a number of companies including Benetton, FIAT and DHL. In the early days of his career he held several marketing‐related roles at Vodafone Italy and Telecom Italia. Ibarra has studied politics and economics at the University of Rome 'La Sapienza', Italy. He also attended various postgraduate courses at leading academic institutions (London Business School, INSEAD, Singularity University, STOA’ Business School). In addition, he is Professor of Marketing and Digital Marketing at the Luiss University & Business School in Rome. Ibarra (48) has the Colombian and Italian nationality, and is fluent in English, Italian and Spanish. He is married and has a daughter. CV: 2016 – 2017 CEO of Wind Tre 2012 – 2016 CEO & Managing Director of Wind Telecommunications -

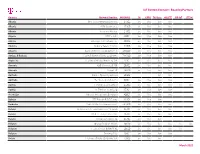

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd.