Infigen Energy Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

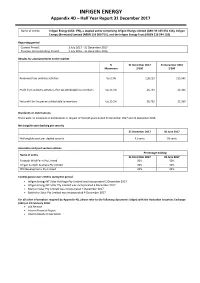

INFIGEN ENERGY Appendix 4D – Half Year Report 31 December 2017

INFIGEN ENERGY Appendix 4D – Half Year Report 31 December 2017 Name of entity: Infigen Energy (ASX: IFN), a stapled entity comprising Infigen Energy Limited (ABN 39 105 051 616), Infigen Energy (Bermuda) Limited (ARBN 116 360 715), and the Infigen Energy Trust (ARSN 116 244 118) Reporting period Current Period: 1 July 2017 ‐ 31 December 2017 Previous Corresponding Period: 1 July 2016 ‐ 31 December 2016 Results for announcement to the market % 31 December 2017 31 December 2016 Movement $’000 $’000 Revenues from ordinary activities Up 2.5% 118,213 115,365 Profit from ordinary activities after tax attributable to members Up 25.1% 26,733 21,366 Net profit for the period attributable to members Up 25.1% 26,733 21,366 Dividends or distributions There were no dividends or distributions in respect of the half‐years ended 31 December 2017 and 31 December 2016. Net tangible asset backing per security 31 December 2017 30 June 2017 Net tangible asset per stapled security 41 cents 38 cents Associates and joint venture entities Percentage holding Name of entity 31 December 2017 30 June 2017 Forsayth Wind Farm Pty Limited 50% 50% Infigen Suntech Australia Pty Limited 50% 50% RPV Developments Pty Limited 32% 32% Control gained over entities during the period Infigen Energy NT Solar Holdings Pty Limited was incorporated 1 December 2017 Infigen Energy NT Solar Pty Limited was incorporated 4 December 2017 Manton Solar Pty Limited was incorporated 4 December 2017 Batchelor Solar Pty Limited was incorporated 4 December 2017 For all other information required -

Emergency Response Plan Capital & Woodlawn Wind Farms

Emergency Response Plan Capital & Woodlawn Wind Farms Document Version: 1.1 Document Date: 23 January 2018 If an incident has occurred, evacuate if required and immediately refer to Section 2 - Emergency Response Flowchart on page 7. Call 000 (triple zero) or radio Site Supervisor for assistance. All staff members should familiarise themselves with this document. Contents 1 - Plan Summary .................................................................................................................................................................. 5 2 - Emergency Response Flowchart .......................................................................................................................................... 7 3 - Site Details ...................................................................................................................................................................... 8 Location ............................................................................................................................................................................... 8 Site Office (O&M Building) ......................................................................................................................................................... 8 Site Muster Location ................................................................................................................................................................ 8 Site Layout ........................................................................................................................................................................ -

Renewable Energy Industry Overview

RENEWABLE ENERGY INDUSTRY OVERVIEW Aaron Bonanno and Chris Martell Training • Consulting • Engineering • Publications creating sustainable change through education, communication and leadership © 2014 GSES P/L COMPANY PROFILE Established in 1998, GSES® leads Australia in renewable energy engineering, training and consultancy. - Official Australian - System testing and - Grid Connected PV, - Grid Connected PV Registered Training commissioning Stand-Alone PV and Systems Design and Organisation (RTO) hybrid system design Installation - Tender specification and - Face to face practical evaluation - Feasibility studies - Stand Alone Power and online training Systems Design and - System compliance - DNSP liaison for Grid Installation - Grid Connect PV (GCPV), inspections for the Clean Connected systems Stand-Alone, GC with Energy Regulator and - News releases, Technical Batteries, Solar private business Articles and much more. Fundamentals, etc. creating sustainable change through education, communication and leadership © 2014 GSES P/L CONTENTS • Status of the Renewable Energy Sector • Australia • Global • Current Industry Direction • Policy • Economic Drivers • Disruptive Technology • What is the Future of the Industry • New Technology • New Energy Markets creating sustainable change through education, communication and leadership © 2014 GSES P/L INTRODUCTION United Nations World Human Population Estimated Global Energy Consumption Per Capita Current Consumption In Relatable Terms: 80Gj/person/year ~= 60kWh/person/day ~= 390TWh Globally/day -

Infigen Energy 2012 Annual Report and Agm Notice of Meeting

12 October 2012 INFIGEN ENERGY 2012 ANNUAL REPORT AND AGM NOTICE OF MEETING Infigen Energy (ASX: IFN) advises that the attached 2012 Annual Report and the Notice of Meeting relating to the Annual General Meetings of Infigen Energy to be held on Thursday, 15 November 2012, are being despatched to securityholders today. The 2012 Annual Report and AGM Notice of Meeting are also available at Infigen’s website (www.infigenenergy.com). ENDS For further information please contact: Richard Farrell, Investor Relations Manager Tel +61 2 8031 9900 About Infigen Energy Infigen Energy is a specialist renewable energy business. We have interests in 24 wind farms across Australia and the United States. With a total installed capacity in excess of 1,600MW (on an equity interest basis), we currently generate enough renewable energy per year to power over half a million households. As a fully integrated renewable energy business in Australia, we develop, build, own and operate energy generation assets and directly manage the sale of the electricity that we produce to a range of customers in the wholesale market. Infigen Energy trades on the Australian Securities Exchange under the code IFN. For further information please visit our website: www.infigenenergy.com INFIGEN ENERGY OUR GENERATION, YOUR FUTURE Annual Report 2012 INFIGEN ENERGY ANNUAL REPORT 2012 OUR GENERATION CONTINUES TO CONTRIBUTE TO THE TRANSITION TO LOW CARBON EMISSION ELECTRICITY, for yoUR FUTURE AND FUTURE GENERATIONS MIKE HUTCHINSON Chairman 1 INFIGEN ENERGY We strive to be recognised as the leading provider of renewable energy. We want to make a positive difference. Our focus is on customer needs. -

Wind Energy in NSW: Myths and Facts

Wind Energy in NSW: Myths and Facts 1 INTRODUCTION Wind farms produce clean energy, generate jobs and income in regional areas and have minimal environmental impacts if appropriately located. Wind farms are now increasingly commonplace and accepted by communities in many parts of the world, but they are quite new to NSW. To increase community understanding and involvement in renewable energy, the NSW Government has established six Renewable Energy Precincts in areas of NSW with the best known wind resources. As part of the Renewable Energy Precincts initiative, the NSW Department of Environment, Climate Change and Water (DECCW) has compiled the following information to increase community understanding about wind energy. The technical information has been reviewed by the Centre for Environmental and Energy Markets, University of NSW. The Wind Energy Fact Sheet is a shorter and less technical brochure based on the Wind Energy in NSW: Myths and Facts. The brochure is available for download at www.environment.nsw.gov.au/resources/climatechange/10923windfacts.pdf. For further renewable energy information resources, please visit the Renewable Energy Precincts Resources webpage at http://www.environment.nsw.gov.au/climatechange/reprecinctresources.htm. 2 CONTENTS CONTENTS ...............................................................................................................3 WIND FARM NOISE ..................................................................................................4 WIND TURBINES AND SHADOW FLICKER...........................................................11 -

Clean Energy Fact Sheet We All Want Affordable, Reliable and Clean Energy So We Can Enjoy a Good Quality of Life

Clean Energy fact sheet We all want affordable, reliable and clean energy so we can enjoy a good quality of life. This fact sheet sets out how we’re leading a transition from fossil fuels to cleaner forms of energy. Background Minimising or, where we can, avoiding financial EnergyAustralia is one of the country’s biggest hardship is part of the challenge as we transition generators of power from fossil fuels. Each to cleaner generation. We need to do this while preserving the reliability of supply. +800 MW year we produce around 20 million tonnes Rights to of greenhouse gases, mostly carbon dioxide Our approach involves supporting the renewable energy or CO₂, from burning coal and gas to supply development of clean energy while helping our electricity to our 2.4 million accounts across customers manage their own consumption so eastern Australia. they use less energy. Because when they do For around a century, coal-fired power plants that, they generate fewer emissions and they ~$3B have provided Australians with reliable and save money. Long term affordable power and supported jobs and renewable Supporting renewable energy agreements economic development. The world is changing with fossil fuel generation being replaced by Right now, EnergyAustralia has the rights to lower emissions technologies. more than 800 MW worth of renewable energy, combining solar and wind farm power purchase The way we generate, deliver and use energy agreements, and we half-own the Cathedral 7.5% has to change. As a big emitter of carbon, it’s Rocks wind farm. Of large-scale up to us to lead the transition to cleaner energy wind and solar in a way that maintains that same reliable and project in the NEM affordable access to energy for everyone. -

Infigen Energy Annual Report 2018

Annual Report 2019. Infigen Energy Image: Capital Wind Farm, NSW Front page: Run With The Wind, Woodlawn Wind Farm, NSW Contents. 4 About Infigen Energy 7 2019 Highlights 9 Safety 11 Chairman & Managing Director’s Report Directors’ Report 16 Operating & Financial Review 31 Sustainability Highlights 34 Corporate Structure 35 Directors 38 Executive Directors & Management Team 40 Remuneration Report 54 Other Disclosures 56 Auditor’s Independence Declaration 57 Financial Report 91 Directors’ Declaration 92 Auditor’s Report Additional Information 9 Investor Information 8 10 Glossary 1 10 4 Corporate Directory Infigen Energy Limited ACN 105 051 616 Infigen Energy Trust ARSN 116 244 118 Registered office Level 17, 56 Pitt Street Sydney NSW 2000 Australia +61 2 8031 9900 www.infigenenergy.com 2 Our Strategy. We generate and source renewable energy. We add value by firming. We provide customers with reliable clean energy. 3 About Infigen Energy. Infigen is leading Australia’s transition to a clean energy future. Infigen generates and sources renewable energy, increases the value of intermittent renewables by firming, and provides customers with clean, reliable and competitively priced energy solutions. Infigen generates renewable energy from its owned wind farms in New South Wales (NSW), South Australia (SA) and Western Australia (WA). Infigen also sources renewable energy from third party renewable projects under its ‘Capital Lite’ strategy. Infigen increases the value of intermittent renewables by firming them from the Smithfield Open Cycle Gas Turbine facility in Western Sydney, NSW, and its 25MW/52MWh Battery at Lake Bonney, SA, where commercial operations are expected to commence in H1FY20. Infigen’s energy retailing licences are held in the National Electricity Market (NEM) regions of Queensland, New South Wales (including the Australian Capital Territory), Victoria and South Australia. -

Draft Minutes of Meeting 8

Yass Valley Wind Farm & Conroys Gap Wind Farm Level 11, 75 Miller St NORTH SYDNEY, NSW 2060 Phone 02 8456 7400 Draft Minutes of Meeting 8 Yass Valley Wind Farm & Conroys Gap Wind Farm Community Consultation Committee Present: Nic Carmody Chairperson NC Paul Regan Non-involved landowner PR John McGrath Non-involved landowner JM Rowena Weir Non-involved landowner RW Tony Reeves Involved landowner TR Chris Shannon Bookham Ag Bureau CS Peter Crisp Observer PC Barbara Folkard Observer BF Brian Bingley Observer BB Wilma Bingley Observer LB Noeleen Hazell Observer NH Bruce Hazell Observer BH Alan Cole Observer AC Andrew Bray Observer AB Mark Fleming NSW OEH (Observer) MF Andrew Wilson Epuron AW Donna Bolton Epuron DB Julian Kasby Epuron JK Apologies: Sam Weir Bookham Ag Bureau Wendy Tuckerman Administrator Hilltops Council Neil Reid Hilltops Council Stan Waldren Involved landowner YASS VALLEY & CONROYS GAP WIND FARM PTY LTD COMMUNITY CONSULTATION COMMITTEE Page 2 of 7 Absent: Councillor Ann Daniel Yass Valley Council Date: Thursday 23rd June 2016 Venue: Memorial Hall Annex, Comur Street, Yass Purpose: CCC Meeting No 8 Minutes: Item Agenda / Comment / Discussion Action 1 NC opened the Community Consultation Committee (CCC) meeting at 2:00 pm. - Apologies were noted as above. 2 Pecuniary or other interests - No declarations were made. 3 Minutes of Previous meeting No comments were received on the draft minutes of meeting number 7, which had been emailed to committee members. The draft minutes were accepted without changes and the finalised minutes will be posted on the project website. AW 4 Matters arising from the Previous Minutes JM raised that the planned quarterly meetings had not been occurring and that the previous meeting was in March 2014. -

Automate CP.Xlsm

FCAS Causer Pays Settlement Factors Issued: 10/12/2020 Period of Application: 27/12/2020 to 23/01/2021 Sample Period: 12:05AM, 8/11/2020 to 12:00AM, 6/12/2020 Queensland, New South Wales, Victoria, South Australia and Tasmania Region Causer Pays Factors Scheduled and Semi-Scheduled Aggregations Factor AETV Pty Ltd 0.013562453 AGL Hydro Partnership 4.012190653 AGL Loy Yang Marketing Pty Ltd 0 AGL Macquarie Pty Limited 0 AGL PARF NSW Pty Ltd 2.310470219 AGL PARF QLD Pty Limited 0.46800389 AGL SA Generation Pty Limited 1.849553623 Alinta Energy Retail Sales Pty Ltd 0.449145117 Ararat Wind Farm Pty Ltd 0.875407241 Arrow Southern Generation Pty Ltd And Arrow Braemar 2 Pty Ltd 0.042579354 Boco Rock Wind Farm Pty Ltd 0.433630577 Bodangora Wind Farm Pty Limited 0.382480317 Bomen Solar Farm Pty Ltd As Trustee For Bomen SF Trust 0.556490672 Braemar Power Project Pty Ltd 0.706700821 Bulgana Wind Farm Pty Ltd 0.837111039 Callide Power Trading Pty Limited 0 Cherry Tree Wind Farm Pty Ltd As Trustee For The Cherry Tree Project Trust 0.156136526 Childers Solar Pty Ltd ATF The Childers Solar Trust 0.080755682 Clare Solar Farm Pty Ltd 0.651235137 CleanCo Queensland Limited 1.758098911 Clermont Asset Co Pty Ltd ATF Clermont Solar Unit Trust 0 Coleambally Solar Pty Ltd 1.111648664 Collector Wind Farm Pty Ltd 0.185651799 Crookwell Development Pty Ltd 0.401146682 CRWF Nominees Pty Ltd As Trustee For The CRWF Trust 0 CS Energy Limited 0 Darling Downs Solar Farm Pty Ltd 0.875202842 Darlington Point Solar Farm Pty Ltd 0.660040796 Daydream Solar Farm Pty Ltd As -

Cash Flow 84 $ M 62

29 September 2014 INFIGEN ENERGY – FY14 ANNUAL FINANCIAL REPORT Infigen Energy (ASX: IFN) advises that the attached Annual Financial Report for the Infigen Energy Group for the year ended 30 June 2014, which includes the Annual Financial Report for Infigen Energy Trust, was despatched to securityholders today. The report is also available on Infigen’s website: www.infigenenergy.com ENDS For further information please contact: Richard Farrell, Investor Relations Manager Tel +61 2 8031 9900 About Infigen Energy Infigen Energy is a specialist renewable energy business. We have interests in 24 wind farms across Australia and the United States. With a total installed capacity in excess of 1,600MW (on an equity interest basis), we currently generate enough renewable energy per year to power over half a million households. For personal use only As a fully integrated renewable energy business, we develop, build, own and operate energy generation assets and directly manage the sale of the electricity that we produce to a range of customers in the wholesale market. Infigen Energy trades on the Australian Securities Exchange under the code IFN. For further information please visit our website: www.infigenenergy.com INFIGEN ENERGY INFIGEN | ANNUAL REPORT 2014 INFIGEN ENERGY ANNUAL REPORT 2014 For personal use only For personal use only A LEADING SPECIALIST RENEWABLE ENERGY BUSINESS CONTENTS 02 Business Highlights 51 Directors’ Report 04 About Us 56 Remuneration Report 06 Chairman’s Report 68 Auditor’s Independence Declaration 08 Managing Director’s Report 69 Financial Statements 12 Management Discussion and Analysis 75 Notes to Financial Statements 33 Safety and Sustainability 137 Directors’ Declaration 38 Infigen Board 138 Independent Auditor’s Report 40 Infigen Management 140 Additional Investor Information For personal use only 42 Corporate Governance Statement 143 Glossary 43 Corporate Structure 145 Corporate Directory All references to $ is a reference to Australian dollars and all years refer to financial year ended 30 June unless specifically marked otherwise. -

Final Report

The Senate Select Committee on Wind Turbines Final report August 2015 Commonwealth of Australia 2015 ISBN 978-1-76010-260-9 Secretariat Ms Jeanette Radcliffe (Committee Secretary) Ms Jackie Morris (Acting Secretary) Dr Richard Grant (Principal Research Officer) Ms Kate Gauthier (Principal Research Officer) Ms Trish Carling (Senior Research Officer) Mr Tasman Larnach (Senior Research Officer) Dr Joshua Forkert (Senior Research Officer) Ms Carol Stewart (Administrative Officer) Ms Kimberley Balaga (Administrative Officer) Ms Sarah Batts (Administrative Officer) PO Box 6100 Parliament House Canberra ACT 2600 Phone: 02 6277 3241 Fax: 02 6277 5829 E-mail: [email protected] Internet: www.aph.gov.au/select_windturbines This document was produced by the Senate Select Wind Turbines Committee Secretariat and printed by the Senate Printing Unit, Parliament House, Canberra. This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License. The details of this licence are available on the Creative Commons website: http://creativecommons.org/licenses/by-nc-nd/3.0/au/ ii MEMBERSHIP OF THE COMMITTEE 44th Parliament Members Senator John Madigan, Chair Victoria, IND Senator Bob Day AO, Deputy Chair South Australia, FFP Senator Chris Back Western Australia, LP Senator Matthew Canavan Queensland, NATS Senator David Leyonhjelm New South Wales, LDP Senator Anne Urquhart Tasmania, ALP Substitute members Senator Gavin Marshall Victoria, ALP for Senator Anne Urquhart (from 18 May to 18 May 2015) Participating members for this inquiry Senator Nick Xenophon South Australia, IND Senator the Hon Doug Cameron New South Wales, ALP iii iv TABLE OF CONTENTS Membership of the Committee ........................................................................ iii Tables and Figures ............................................................................................ -

SEQ Retail Electricity Market Monitoring: 2017–18

Updated Market Monitoring Report SEQ retail electricity market monitoring: 2017–18 March 2019 We wish to acknowledge the contribution of the following staff to this report: Jennie Cooper, Karan Bhogale, Shannon Murphy, Thomas Gardiner & Thomas Höppli © Queensland Competition Authority 2019 The Queensland Competition Authority supports and encourages the dissemination and exchange of information. However, copyright protects this document. The Queensland Competition Authority has no objection to this material being reproduced, made available online or electronically but only if it is recognised as the owner of the copyright2 and this material remains unaltered. Queensland Competition Authority Contents Contents EXECUTIVE SUMMARY III THE ROLE OF THE QCA – TASK AND CONTACTS V 1 INTRODUCTION 1 1.1 Retail electricity market monitoring in south east Queensland 1 1.2 This report 1 1.3 Retailers operating in SEQ 1 2 PRICE MONITORING 3 2.1 Background 3 2.2 Minister's Direction 4 2.3 QCA methodology 4 2.4 QCA monitoring 6 2.5 Distribution non-network charges 45 2.6 Conclusion 47 3 DISCOUNTS, SAVINGS AND BENEFITS 48 3.1 Background 48 3.2 Minister's Direction 48 3.3 QCA methodology 48 3.4 QCA monitoring 49 3.5 Conclusion 96 4 RETAIL FEES 98 4.1 Background 98 4.2 Minister's Direction 98 4.3 QCA methodology 98 4.4 QCA monitoring 98 4.5 GST on fees 104 4.6 Fees that 'may' have applied 105 4.7 Additional fee information on Energy Made Easy 105 4.8 Conclusion 105 5 PRICE TRENDS 107 5.1 Minister's Direction 107 5.2 Data availability 107 5.3 QCA methodology