NIFTY Metal Index Is Designed to Reflect the Behaviour and Performance of the Metals Sector (Including Mining)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

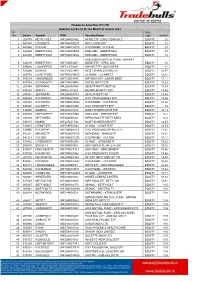

(P) LTD Approve Scrip List for the Month of August 2021 Sr

Tradebulls Securities (P) LTD Approve Scrip List for the Month of August 2021 Sr. Sub No. Series Symbol ISIN Security Name Type Haircut 1 205775 NETFLTGILT INF204KB1882 NI IND ETF LONG TERM GILT EQUITY 12 2 541097 LIQUIDETF INF740KA1EU7 DSP LIQUID ETF EQUITY 12 3 541946 ICICILIQ INF109KC1KT9 ICICIPRAMC - ICICILIQ EQUITY 12 4 542908 EBBETF0423 INF754K01KN4 EDELAMC - EBBETF0423 EQUITY 12 5 542909 EBBETF0430 INF754K01KO2 EDELAMC - EBBETF0430 EQUITY 12 EDELWEISS MUTUAL FUND - BHARAT 6 543216 EBBETF0431 INF754K01LE1 BOND ETF - APRIL 2031 EQUITY 12 7 590096 LIQUIDBEES INF732E01037 NIP IND ETF LIQUID BEES EQUITY 12 8 533385 MON100 INF247L01AP3 MOST SHARES N100 ETF EQUITY 12.57 9 205772 LICNETFGSC INF767K01MV5 LICNAMC - LICNMFET EQUITY 12.91 10 590104 JUNIORBEES INF732E01045 NIP INDIA ETF JUNIOR BEES EQUITY 13.11 11 537708 KOTAKNIFTY INF174K014P6 KOTAK NIFTY ETF EQUITY 13.29 12 203358 SETFNN50 INF200KA1598 SBI-ETF NIFTY NEXT 50 EQUITY 13.33 13 590110 QNIFTY INF082J01028 QUANTUM NIFTY ETF EQUITY 13.45 14 204361 SETFNIF50 INF200KA1FS1 SBI-ETF NIFTY 50 EQUITY 13.48 15 555555 ICICISENSX INF346A01034 ICICI PRUD SENSEX ETF EQUITY 13.53 16 541809 ICICINXT50 INF109KC1NS5 ICICIPRAMC - ICICINXT50 EQUITY 13.96 17 537007 ICICINIFTY INF109K012R6 ICICI PRUD NIFTY ETF EQUITY 14 18 536960 MOM100 INF247L01023 MOST SHARES M100 ETF EQUITY 14.13 19 539516 HDFCNIFETF INF179KC1965 HDFCAMC - HDFCNIFETF EQUITY 14.2 20 590103 NIFTYBEES INF204KB14I2 NIPPO IND ETF NIFTY BEES EQUITY 14.2 21 590115 MOM50 INF247L01536 MOST SHARES M50 ETF EQUITY 14.45 22 539313 UTINIFTETF -

Motilal Oswal Nifty Smallcap 250 Index Fund (MOFSMALLCAP) (An Open Ended Scheme Replicating / Tracking Nifty Smallcap 250 Index)

FACT SHEETth As on 30 April 2021 BUY RIGHT : SIT TIGHT Buying quality companies and riding their growth cycle Motilal Oswal Focused 25 Fund (MOF25) (An open ended equity scheme investing in maximum 25 stocks intending to focus on Large Cap stocks) Investment Objective Performance (As on 30-April-2021) The investment objective of the Scheme is to achieve long term capital appreciation by 1 Year 3 Year 5 Year Since Inception investing in up to 25 companies with long term Current Value Current Value Current Value Current Value sustainable competitive advantage and CAGR of Investment CAGR of Investment CAGR of Investment CAGR of Investment growth potential. However, there can be no (%) of ` 10,000 (%) of ` 10,000 (%) of ` 10,000 (%) of ` 10,000 assurance or guarantee that the investment 38.7 13,865 10.4 13,465 13.9 19,225 14.5 29,354 objective of the Scheme would be achieved. Scheme Nifty 50 TRI (Benchmark) Benchmark 49.9 14,989 12.2 14,135 14.7 19,869 13.3 27,015 Nifty 50 TRI S&P BSE Sensex TRI (Additional Benchmark) 46.3 14,626 12.9 14,377 15.1 20,260 13.6 27,579 Continuous Offer NAV (`) Per Unit 21.1712 21.8001 15.2688 10.0000 Minimum Application Amount : ` 500/- and in (29.3541 : as on 30-Apr-2021) multiples of `1 /- thereafter. Date of inception: 13-May-13. = Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for Additional Application Amount : ` 500/- and in computation of returns. -

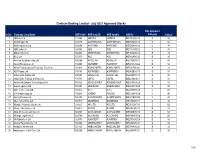

Working July 2021.Xlsx

Centrum Broking Limited - July 2021 Approved Stocks CBL Approved Sr.No Company Long Name BSE Code BSE Scrip ID NSE Symbol ISIN No Category Haircut 1 3M India Ltd 523395 3MINDIA 3MINDIA INE470A01017 D 50 2 Aarti Drugs Ltd 524348 AARTIDRUGS AARTIDRUGS INE767A01016 D 50 3 Aarti Industries Ltd 524208 AARTIIND AARTIIND INE769A01020 C 40 4 ABB India Ltd 500002 ABB ABB INE117A01022 C 40 5 Abbott India Ltd 500488 ABBOTINDIA ABBOTINDIA INE358A01014 B 25 6 ACC Ltd 500410 ACC ACC INE012A01025 B 25 7 Accelya Solutions India Ltd 532268 ACCELYA ACCELYA INE793A01012 E 60 8 Adani Enterprises Ltd 512599 ADANIENT ADANIENT INE423A01024 D 50 9 Adani Ports & Special Economic Zone Ltd 532921 ADANIPORTS ADANIPORTS INE742F01042 A 20 10 ADF Foods Ltd 519183 ADFFOODS ADFFOODS INE982B01019 D 50 11 Aditya Birla Capital Ltd 540691 ABCAPITAL ABCAPITAL INE674K01013 D 50 12 Aditya Birla Fashion & Retail Ltd 535755 ABFRL ABFRL INE647O01011 D 50 13 Advanced Enzyme Technologies Ltd 540025 ADVENZYMES ADVENZYMES INE837H01020 D 50 14 Aegis Logistics Ltd 500003 AEGISLOG AEGISCHEM INE208C01025 D 50 15 Agro Tech Foods Ltd 500215 ATFL ATFL INE209A01019 E 60 16 AIA Engineering Ltd 532683 AIAENG AIAENG INE212H01026 C 40 17 Ajanta Pharma Ltd 532331 AJANTPHARM AJANTPHARM INE031B01049 C 40 18 Akzo Nobel India Ltd 500710 AKZOINDIA AKZOINDIA INE133A01011 C 40 19 Alembic Pharmaceuticals Ltd 533573 APLLTD APLLTD INE901L01018 E 60 20 Alkem Laboratories Ltd 539523 ALKEM ALKEM INE540L01014 B 25 21 Alkyl Amines Chemicals Ltd 506767 ALKYLAMINE ALKYLAMINE INE150B01039 D 50 22 Allcargo Logistics -

NIFTY Bank Index Comprises of the Most Liquid and Large Indian Banking Stocks

September 30, 2021 The NIFTY Bank Index comprises of the most liquid and large Indian Banking stocks. It provides investors and market intermediaries a benchmark that captures the capital market performance of the Indian banks. The Index comprises of maximum 12 companies listed on National Stock Exchange of India (NSE). NIFTY Bank Index is computed using free float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Bank Total Returns Index. Portfolio Characteristics Index Since Methodology Periodic Capped Free Float QTD YTD 1 Year 5 Years Returns (%) Inception No. of Constituents 12 Price Return 7.63 19.71 74.46 14.18 18.11 Launch Date September 15, 2003 Total Return 7.76 20.13 75.09 14.60 19.75 Base Date January 01, 2000 Since Statistics ## 1 Year 5 Years Base Value 1000 Inception Calculation Frequency Real-Time Std. Deviation * 24.94 25.19 29.89 Index Rebalancing Semi-Annually Beta (NIFTY 50) 1.40 1.24 1.09 Correlation (NIFTY 50) 0.86 0.90 0.83 1 Year Performance Comparison of Sector Indices Fundamentals P/E P/B Dividend Yield 24.32 2.81 0.33 Top constituents by weightage Company’s Name Weight(%) HDFC Bank Ltd. 28.02 ICICI Bank Ltd. 20.92 State Bank of India 13.03 Kotak Mahindra Bank Ltd. 12.67 Axis Bank Ltd. 12.36 IndusInd Bank Ltd. 5.30 AU Small Finance Bank Ltd. 2.01 Bandhan Bank Ltd. -

20200331001 NIFTY 100 Fund

Get the Top 100 on your side. AXIS NIFTY 100 INDEX FUND An open-ended index fund tracking the NIFTY 100 Index December 2020 About the Fund • Nifty 50 is typically used as a large Performance (NAV Movement) 31st December 2020 cap substitute consisting of large bluechip companies. Axis Nifty 100 Index Fund - Regular Plan - Growth Option ` 11,920 • However, Nifty Next 50 Index also NIFTY 100 Index TRI offers attractive opportunities as there are many well-established and mature companies. 18th October 2019 • Nifty 100 essentially captures the entire large cap universe in the `12,074 market. ` 10,000 Achieving Investor Objectives with an Index Fund 1 Year 3 Years@ 5 Years@@ Since Inception Index Funds have relatively Current Current Current Current lower expenses than actively Value of Value of Value of Value of Lower Expenses CAGR CAGR CAGR CAGR managed funds. (%) Investment (%) Investment (%) Investment (%) Investment of of of of ` 10,000/- ` 10,000/- ` 10,000/- ` 10,000/- Axis Nifty 100 Index Fund - NIFTY 100 represents top 100 14.90% 11,495 NA NA NA NA 15.68% 11,920 Consistent Style Regular Plan - Growth Option companies based on full market capitalisation from NIFTY 500. NIFTY 100 Index TRI (Benchmark) 16.03% 11,608 NA NA NA NA 16.92% 12,074 Nifty 100 Index consist of Nifty 50 TRI (Additional Benchmark) 16.09% 11,614 NA NA NA NA 17.37% 12,130 Diversification 100 companies spread across 16 Industries. Past performance may or may not be sustained in future. Since inception ( 18th October 2019).The performance data for 3 & 5 years period has not been provided, since scheme is in existence for less than 3 years. -

Mirae Asset Nifty Next 50 Etf

MIRAE ASSET NIFTY NEXT 50 ETF Mirae Asset Investment Managers MIRAE ASSET NIFTY NEXT 50 ETF (An open ended scheme replicating/tracking Nifty Next 50 Index) NIFTY Next 50: Profile Parameter NIFTY 50 NIFTY Next 50 NIFTY Midcap 150 Segment Large Cap Mid Cap Companies ranked from 101 Criteria Top 50 stocks by M-Cap Remaining 50 Stocks to 250 based on full MCap Constituents 50 50 150 Avg. MCap 1,84,085 46,234 15,498 Avg. MCap (Top 25) 2,99,812 54,824 22,544 Avg. MCap (Next 25) 68,357 37,643 18,164 Reliance (13.24) Adani Green (4.41) Apollo Hospital (2.18) HDFC Bank (10.25) Avenue Supermart (4.39) PI Industries (1.89) Top 5 Stocks Infosys (7.74) Tata Consumer (3.89) Zee Entertainment (1.84) (% Weight) HDFC (6.87) Dabur India(3.81) Jubilant Foodworks (1.78) ICICI General Insurance (3 TCS (5.58) Voltas (1.75) .55) NIFTY Next 50 portfolio aims to captures the essence of large caps and midcaps Source: NSE, Oct 30, 2020. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same. 2 Mirae Asset Mutual Fund NIFTY Next 50: Sector distribution 36% 29% OTHER FINANCIAL 5.4% SERVICES 19% 17% 15% 14% 6.8% 12% NBFC 10% 2.4% 6% 6% 7% 4% 5% 6% 4% 3% 2.4% 2% 2% 3% INSURANCE 1% 1.5% PHARMA IT Others AUTOMOBILE CONSUMER GOODS CONSUMER FINANCIAL SERVICES FINANCIAL SERVICES POWER CEMENT & CEMENT & CEMENT CEMENT OIL & GAS & OIL HOUSING PRODUCTS FINANCE 6.9% FINANCIAL 1.3% INSTITUTION 3.2% NIFTY 50 NIFTY Next 50 BANKS 24.7% 0.0% 10.0% 20.0% 30.0% NIFTY Next 50 portfolio is more diversified as compared to NIFTY 50 Source: NSE, as on Oct 30, 2020. -

Approved Securities List July 2021

Approved Securities List July 2021 Scrip Name ISIN Mindspace Business Parks REIT INE0CCU25019 Max Healthcare Institute Limited INE027H01010 Happiest Minds Technologies Limited INE419U01012 Route Mobile Limited INE450U01017 Computer Age Management Services Limited INE596I01012 Chemcon Speciality Chemicals Limited INE03YM01018 Kotak Mahindra MF - Kotak NV 20 ETF - DP INF174K01Z71 DSP BlackRock Liquid ETF (Daily Dividend INF740KA1EU7 ICICI Prudential Bank ETF INF109KC1E27 Sundaram Finance Holdings Limited INE202Z01029 ABB India Ltd INE117A01022 Amara Raja Batteries Ltd INE885A01032 Hdfc Ltd INE001A01036 Bombay Dyeing & Manu. Company Ltd INE032A01023 Atul Ltd INE100A01010 Force Motors Ltd INE451A01017 Bajaj Finance Ltd INE296A01024 Banco Products India Ltd INE213C01025 Century Textiles & Industries Ltd INE055A01016 Bannari Amman Sugars Ltd INE459A01010 BASF India Ltd INE373A01013 Bata India Ltd INE176A01028 BEML Limited INE258A01016 Bharat Electronics Ltd INE263A01024 Blue Star Ltd INE472A01039 CESC Ltd INE486A01013 Exide Industries Ltd INE302A01020 Cipla Ltd INE059A01026 DIC INDIA LTD INE303A01010 Dabur India Ltd INE016A01026 Bharat Heavy Electricals Ltd INE257A01026 Hindustan Petroleum Corporation Ltd INE094A01015 IFCI Ltd INE039A01010 Mahanagar Telephone Nigam Ltd INE153A01019 Mangalore Refinery & Petrochemicals Ltd INE103A01014 Chennai Petroleum Corporation Ltd INE178A01016 State Bank of India INE062A01020 Steel Authority of India Limited INE114A01011 Titan Company Ltd INE280A01028 IDBI Bank Limited INE008A01015 Dr Reddys Laboratories -

Sensex, Nifty at Lifetime Highs, Rally to Continue

TUESDAY • AUGUST 31, 2021 CHENNAI ₹10 • Pages 10 • Volume 28 • Number 242 DATA FOCUS ONE DISTRICT ONE PRODUCT SCHEME 5G ROLLOUT Venture capital, debt funding surpass Dedicated team set up to identify products Airtel intends to roll out 5G network 2019 levels as pentup economic from 739 districts and devise plan for in key cities at the earliest, says activity and recovery chip in p2 export promotion p3 Chairman Sunil Bharti Mittal p7 Bengaluru Chennai Coimbatore Hubballi Hyderabad Kochi Kolkata Madurai Malappuram Mangaluru Mumbai Noida Thiruvananthapuram Tiruchirapalli Tirupati Vijayawada Visakhapatnam Regd. TN/ARD/14/2012-2014, RNI No. 55320/94 Powell effect: Sensex, Nifty at Malaysia lockdown may dent upcoming festival auto sales lifetime highs, rally to continue tain parts. We are also trying to Adds to the woes find out availability from the Sensex nears 57k, rupee gains 40 paise cent trading takes place in it. of OEMs that are stockists and directly purchas So, when it falls, it simply ing them at a higher price,” on Fed’s dovish stance; midcaps revive means that investors are buy already facing severe Chandra said. ing assets and hence pushing chip shortage According to Shashank OUR BUREAU prices and stock prices. Mar up its price. In India, the trend Srivastava, Senior Executive Dir Mumbai, August 30 kets are likely to remain posit has been that IT stocks rise S RONENDRA SINGH ector (Marketing & Sales), Amid the perception that ive and rising for the next one when the dollar rises since New Delhi, August 30 Maruti Suzuki India (MSIL), the stock market valuations were year at least. -

NIFTY Next 50 Stocks That ‘Aspire’ to Be a Part of the Coveted League of NIFTY 50 Stocks

Indices WHITE PAPER SERIES #16 Next 50 Capturing the performance of ‘Next 50’ blue-chip companies in large cap universe February 2019 Introduction The world of sports is full of inspirational stories. Sportsmen across the globe have consistently broken records, set seemingly unattainable benchmarks and become idols for the next generation of youngsters only to see records being broken by the aspiring stars. The game of Cricket had its own set of idols: Sachin Tendulkar had father figures of Sunil Gavaskar and Sir Vivian Richards to look up- to. The cricketers he idolized, tried to match and eventually outperform. As Sachin reached the twilight of his career, we had Virat Kohlis, Steve Smiths, Joe Roots who aspired to be the best batsmen of their times just like Tendulkars, Laras and Pontings. Every generation of aspiring youngsters has a benchmark set by former greats to aim for. The benchmarks are a matter of pride and prestige, a goal that keeps driving them towards achieving greater milestones. Similar to the game of cricket, in stock market, we have the pool of NIFTY Next 50 stocks that ‘aspire’ to be a part of the coveted league of NIFTY 50 stocks. NIFTY Next 50 is an index that represents the performance of 50 large cap stocks which come after the top 50 (NIFTY 50) in order of free float market capitalization in NIFTY 100. NIFTY Next 50 thus represents companies which are presently below the NIFTY 50 index constituents in terms of free float market cap and may be potential candidates for inclusion in NIFTY 50 in future, subject to index criteria. -

Kotak Nifty Next 50 Index Fund an Open Ended Scheme Replicating/Tracking Nifty Next 50 Index

Kotak Nifty Next 50 Index Fund An open ended scheme replicating/tracking Nifty Next 50 Index NFO Opens: 17th February 2021 NFO Closes: 24th February 2021 1 FROM GULLY CRICKET TEAM INDIA NIFTY 50 FROM MICROCAP TO TEAM INDIA Leaders with STOCKS TO NIFTY 50 steady growth U-19 + BENCH On fast track to success NIFTY NEXT 50 – potential superstars RANJI TROPHY First step to success – many compete, MIDCAP STOCKS few would leave a mark MICRO AND SMALL GULLY CRICKET A lot of competition- few survivors CAP STOCKS The cricket analogy is used as a paradigm for selection process. Nifty Next 50: Captures potential blue chips of tomorrow Stocks in the current NIFTY 50 that moved from NIFTY Next 50 in the last decade Name Moved in Name Moved in Kotak Mahindra Bank Ltd. 2010 Indian Oil Corporation Ltd. 2017 Bajaj Auto Ltd. 2010 Bajaj Finance Ltd. 2017 Dr. Reddy's Laboratories Ltd. 2010 UPL Ltd. 2017 Grasim Industries Ltd. 2010 Titan Company Ltd. 2018 Grasim Industries Ltd. 2011 Bajaj Finserv Ltd. 2018 Coal India Ltd. 2011 JSW Steel Ltd. 2018 Asian Paints Ltd. 2012 Britannia Industries Ltd. 2019 UltraTech Cement Ltd. 2012 Shree Cement Ltd. 2020 IndusInd Bank Ltd. 2013 HDFC Life Insurance Company Ltd. 2020 Tech Mahindra Ltd. 2014 Divi's Laboratories Ltd. 2020 Adani Ports and Special Economic Zone Ltd. 2015 SBI Life Insurance Company Ltd. 2020 Eicher Motors Ltd. 2016 Source: NSE, as on Jan 31, 2021 3 Nifty Next 50 portfolio is more diversified as compared to Nifty 50 Sector Distribution – Financial Services Nifty 50 Nifty Next 50 38.1 Nifty 50 2%2%2% 29.14 2% HDFC Bank Ltd. -

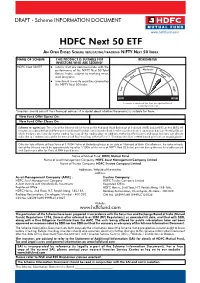

HDFC Next 50 ETF SID V2.Indd

DRAFT - Scheme INFORMATION DOCUMENT HDFC Next 50 ETF AN O PEN E NDED S CHEME REPLICATING/TRACKING NIFTY NEXT 50 INDEX NAME OF SCHEME THIS PRODUCT IS SUITABLE FOR RISKOMETER INVESTORS WHO ARE SEEKING* HDFC Next 50 ETF l returns that are commensurate with the performance of the NIFTY Next 50 Total Moderate Moderately Return Index, subject to tracking error, High over long term ModeratelyLow l investment in equity securities covered by the NIFTY Next 50 Index High Low LOW HIGH Investors understand that their principal will be at moderately high risk *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. New Fund Offer Opens On: New Fund Offer Closes On: Scheme re-opens on: The units of the Scheme will be listed on the National Stock Exchange of India Ltd. (NSE) and/or BSE Limited (BSE). All investors including Authorised Participants and Large Investors can subscribe (buy) / redeem (sell) units on a continuous basis on the NSE/BSE on which the Units are listed during the trading hours on all the trading days. In addition, Authorised Participants and Large Investors can directly subscribe to / redeem units of the Scheme on all Business Days with the Fund in ‘Creation Unit Size’ at NAV based prices on an ongoing basis. Offer for Sale of Units of Face Value of 1/100th Value of Underlying Index as on date of Allotment of Units (On allotment, the value of each unit of the Scheme would be approximately equal to 1/100th of the value of NIFTY Next 50 Index) per unit during the new fund offer period and Continuous offer for Units at NAV based prices. -

Front Cover Page

SCHEME INFORMATION DOCUMENT Product Labeling This product is suitable for investors who are seeking*: • Long term Capital appreciation. • Investment in securities covered by Nifty Next 50 Index *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Offer of Units of Rs. 10 each during the New Fund Offer and NAV related prices on ongoing basis New Fund Offer New Fund Offer Scheme re-opens on Opens on Closes on Within 5 business days from the April 28, 2021 May 11, 2021 date of allotment Mutual Fund Trustee Company Asset Management Company SBI Mutual Fund SBI Mutual Fund Trustee SBI Funds Management Private Company Private Limited Limited ('AMC') ('Trustee Company') (A joint venture between SBI and CIN: AMUNDI) U65991MH2003PTC138496 CIN: U65990MH1992PTC065289 Corporate Office Registered Office: Registered Office: 9th Floor, Crescenzo, C– 9th Floor, Crescenzo, C– 38 9th Floor, Crescenzo, C– 38 & 39, 38 & 39, G Block, & 39, G Block, Bandra-Kurla, G Block, Bandra-Kurla, Complex, Bandra-Kurla, Complex, Complex, Bandra (East), Bandra (East), Mumbai- 400 051 Bandra (East), Mumbai- Mumbai- 400 051 400 051 Website : www.sbimf.com The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document.