Legislative Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Health Services Committee

19.5163.01000 June 25, 2018 MEETING NOTICE Senator Judy Lee, Chairman, has called a meeting of the HEALTH SERVICES COMMITTEE. Date: Thursday, July 26, 2018 Time: 9:00 a.m. Place: Roughrider Room, State Capitol, Bismarck Agenda: Presentations and committee discussion regarding the committee's studies, including presentations by representatives of the Department of Human Services and other organizations and interested persons regarding the study of the early intervention system for individuals with developmental disabilities, information on federal requirements affecting Medicaid eligibility for early intervention services, and information on recipient liability under Medicaid for early intervention services; by representatives of the Department of Human Services, Insurance Department, and other organizations and interested persons regarding the study of developmental disabilities and behavioral health needs, including information on mental health parity, status of clients at the Life Skills and Transition Center, number of children served at the center, updates regarding behavioral health and developmental disabilities initiatives, and potential changes needed to continue to be in compliance with state and federal laws; and other presentations, including presentations relating to the children's prevention and early intervention behavioral health services pilot project, the Task Force on Children's Behavioral Health, information on services for individuals on the autism spectrum, potential bill drafts to amend the definition of brain injury and to increase tax rates on tobacco products, and results of the independent review of the tobacco prevention and control plan's effectiveness and implementation Special Note: Anyone who plans to attend the meeting and needs assistance because of a disability should contact the Legislative Council staff as soon as possible. -

Budget Section

15.5082.03000 NORTH DAKOTA LEGISLATIVE MANAGEMENT Minutes of the BUDGET SECTION Wednesday, March 12, 2014 Senate Chamber, State Capitol Bismarck, North Dakota Representative Chet Pollert, Chairman, called the meeting to order at 10:00 a.m. Members present: Representatives Chet Pollert, Larry Bellew, Tracy Boe, Mike D. Brandenburg, Al Carlson, Jeff Delzer, Bill Devlin, Mark A. Dosch, Bette Grande, Ron Guggisberg, Rick Holman, Keith Kempenich, Gary Kreidt, Bob Martinson, Corey Mock, David Monson, Jon Nelson, Kenton Onstad, Blair Thoreson, Don Vigesaa, Alon Wieland; Senators Bill L. Bowman, Ron Carlisle, Robert Erbele, Joan Heckaman, Ray Holmberg, Ralph Kilzer, Jerry Klein, Karen K. Krebsbach, Gary A. Lee, Tim Mathern, David O'Connell, Larry J. Robinson, Mac Schneider, Terry M. Wanzek, Rich Wardner, John M. Warner Members absent: Representatives Eliot Glassheim, Kathy Hawken, Mark Sanford, Bob J. Skarphol, Roscoe Streyle, Clark Williams; Senator Tony Grindberg Others present: Donald Schaible, State Senator, Mott Representative Jim Schmidt, member of the Legislative Management, was also in attendance. See Appendix A for additional persons present. It was moved by Senator Robinson, seconded by Senator O'Connell, and carried on a voice vote that the minutes of the December 11, 2013, meeting be approved as distributed. STATUS OF THE GENERAL FUND Ms. Pam Sharp, Director, Office of Management and Budget, presented a report (Appendix B) on the status of the general fund. Ms. Sharp presented the following information on the status of the general -

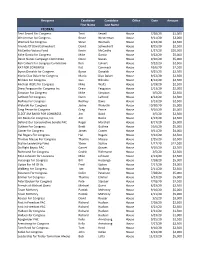

MCF CONTRIBUTIONS JULY 1 - DECEMBER 31, 2016 Name State Candidate Amount U.S

MCF CONTRIBUTIONS JULY 1 - DECEMBER 31, 2016 Name State Candidate Amount U.S. House Robert Aderholt for Congress AL Rep. Robert Aderholt $2,000 ALABAMA TOTAL U.S. House Crawford for Congress AR Rep. Rick Crawford $1,500 Womack for Cogress Committee AR Rep. Stephen Womack $500 ARKANSAS TOTAL U.S. House Kyrsten Sinema for Congress AZ Rep. Kyrtsen Sinema $500 ARIZONA TOTAL U.S. House Denham for Congress CA Rep. Jeff Denham $1,500 Garamendi for Congress CA Rep. John Garamendi $500 Kevin McCarthy for Congress CA Rep. Kevin McCarthy $1,000 Valadao for Congress CA Rep. David Valadao $1,500 U.S. House Leadership Majority Committee PAC--Mc PAC CA Rep. Kevin McCarthy $5,000 State Assembly Adam Gray for Assembly 2016 CA Assm. Adam Gray $1,500 Catharine Baker for Assembly 2016 CA Assm. Catharine Baker $2,500 Cecilia Aguiar-Curry for Assembly 2016 CA Assm. Cecilia Aguiar-Curry $2,000 Chad Mayes for Assembly 2016 CA Assm. Chad Mayes $2,000 James Gallagher for Assembly 2016 CA Assm. James Gallagher $1,500 Patterson for Assembly 2016 CA Assm. James Patterson $2,000 Jay Obernolte for Assembly 2016 CA Assm. Jay Obernolte $1,500 Jim Cooper for Assembly 2016 CA Assm. Jim Cooper $1,500 Jimmy Gomez for Assembly 2016 CA Assm. Jimmy Gomez $1,500 Dr. Joaquin Arambola for Assembly 2016 CA Assm. Joaquin Arambula $1,500 Ken Cooley for Assembly 2016 CA Assm. Ken Cooley $1,500 Miguel Santiago for Assembly 2016 CA Assm. Miguel Santiago $1,500 Rudy Salas for Assembly 2016 CA Assm. -

Date: March 7, 2011 To: Systems Who Have Benefited from The

Date: March 7, 2011 To: Systems who have benefited from the Operator Reimbursement Program From: Eric Volk, Executive Director Re: Call to Action‐House Bill 1004‐ND Department of Health Budget Originally funded by a grant from the Environmental Protection Agency (EPA), the North Dakota Water Operator Reimbursement Program provides funding for certification and training expenses for operators of small public drinking water systems. This was a one‐time grant, administered by the ND Department of Health. Unfortunately, this grant is coming to an end and will run out during the summer of 2011. The ND Department of Health (NDDOH) requested supplemental funding to be included in the Governor’s Budget to continue the Operator Reimbursement Program. This request also addressed small wastewater systems. These funds were not included in the Executive Budget. $200,000 for Drinking Water and $180,000 for Wastewater were requested. No additional Full‐ Time Equivalents would be required. Drinking water and wastewater operator certification and training is critical for the protection of public health and the maintenance of safe, optimal and reliable operations of water and wastewater facilities. It is crucial that funding is available to help operators become and remain certified without placing a financial hardship on the small system. House Bill 1004 (NDDOH Budget) is currently assigned to the Senate Appropriations Committee. The first hearing was March 3. On short notice, I was lucky enough to provide testimony in support of the Operator Reimbursement Program to the full committee. We were able to get our foot in the door, but we now need your help to open it fully. -

Ieps and SECTION 504 - WHAT's the DIFFERENCE?

February 2017 - In This Issue: IEPs AND SECTION 504 - WHAT'S THE DIFFERENCE? SUPPORT PATHFINDER FUNDING US DEPARTMENT ED NEWS TRAINING OPPORTUNITIES NEWS FROM NDDPI RAISING PRE-SCHOOLERS RAISING ELEMENTARY STUDENTS LIFE WITH TEENS RESOURCES SPOTLIGHT AGENCY/ORGANIZATION SPOTLIGHT IEPs and Section 504 - What's the Difference? To be eligible for individualized assistance under Section 504, a student The staff at Pathfinder is frequently asked must have a disability that "substantially limits" one or more "major life to explain the differences between an IEP activities" (very broadly defined). The major difference between a 504 (Individualized Education Program) and a plan and an IEP is that, for a 504 plan, the student does NOT need Section 504 accommodation plan. We specialized instruction to make effective progress. Instead, the student agree that it can be confusing, so here is a may need only accommodations (such as additional time, special short primer on some key points: seating, or sensory breaks) and/or related services (such as a reading program, speech and language services, or occupational therapy) in Legal Framework order to access the general curriculum. It is important to note a child who is on an IEP is automatically protected under Section 504. In most An Individualized Education Program (IEP) is a written statement of cases, there is no need for two plans, as any needed accommodations a student's educational program designed to meet a child's and related services are typically included in the IEP. individual needs. Every child who receives special education services must have an IEP. The Individuals with Disabilities Placement Education Act of 2004 (IDEA) at the federal level outline the process for how to develop an IEP. -

Senate Daily Journal

Page 885 47th DAY THURSDAY, MARCH 18, 2021 885 JOURNAL OF THE SENATE Sixty-seventh Legislative Assembly * * * * * Bismarck, March 18, 2021 The Senate convened at 1:00 p.m., with President Sanford presiding. The prayer was offered by Pastor Alan L. Hathaway, Riverdale Community Church, Riverdale. The roll was called and all members were present. A quorum was declared by the President. THE SENATE RECOGNIZED THE PRESENCE OF: former Lieutenant Governor Wayne Sanstead. ANNOUNCEMENT PRESIDENT SANFORD ANNOUNCED that the Senate would stand at ease. THE SENATE RECONVENED pursuant to recess taken, with President Sanford presiding. MOTION SEN. KLEIN MOVED that the Senate resolve itself into a Memorial Service, which motion prevailed on a voice vote. PRESIDENT SANFORD ANNOUNCED that the Memorial Committee will escort Secretary- of-State Al Jaeger, former Senator Tim Flakoll and former Senator Carolyn Nelson to the podium. PRESIDENT SANFORD ANNOUNCED that the Memorial Committee will escort the family and friends of each Senator to the seating in the front of the Chamber. SENATE MEMORIAL SERVICE Memorial Service Committee Senator Robert Erbele, Chairman Senator Kathy Hogan Senator Dave Oehlke Senator Nicole Poolman Moderator Lt. Governor Brent Sanford Introduction of Guests LT. Governor Brent Sanford Escorted by Lyle Lauf, Sergeant-At-Arms And the Memorial Service Committee Invocation Carolyn Nelson, Former Senator from District 21 Musical Selection "The Lord's Prayer" Senator Robert Erbele, District 28 Accompanied by Levi Andrist First and Second Reading -

The 62Nd ND Legislative Assembly Top Issues – Health Care Reform

North Dakota Medical Association Checkup ontents J u n e 2011 The mission of the North Dakota Medical C Association is to promote the health and well- being of the citizens of North Dakota and to President’s Message ........................ 3 provide leadership to the medical community. The NDMA Checkup is published quarterly by The 62nd North Dakota the North Dakota Medical Association, 1622 E. Interstate Avenue, P.O. Box 1198, Bismarck, ND Legislative Assembly ....................... 4 58502-1198, (701) 223-9475, Fax (701) 223-9476, e-mail: [email protected] NDMA Briefings ...............................10 Kimberly T Krohn MD, President A Michael Booth MD, Vice President Health Information Steven P Strinden MD, Secretary Treasurer Debra A Geier, MD, Speaker of the House Exchange Update ...........................12 Gaylord J Kavlie MD, AMA Delegate Robert W Beattie MD, AMA Alternate Delegate NDMA Alliance News .......................13 Councillors: Joseph E Adducci MD Debra A Geier MD MMIC Risk Management ..................14 Yvonne L Gomez MD Catherine E Houle MD Timothy J Luithle MD Steven R Mattson MD Rupkumar Nagala MD Fadel Nammour MD Mark W Rodacker MD Shelly A Seifert MD Rory D Trottier MD Harjinder K Virdee MD Derek C Wayman MD Dennis E Wolf MD alendar of Upcoming events Staff C Courtney Koebele, Director of Advocacy September 9-10 Leann Tschider, Chief Operating Officer ND Society of Obstetrics and Annette Weigel, Administrative Assistant Gynecology Annual Meeting Shelly Duppong, Designer & Production Manager Ramkota Inn, Bismarck with Clearwater Communications For more information contact Dennis Lutz, MD at 701-852-1555 SUBMISSIONS: The NDMA Checkup welcomes manuscript, photography and art submissions. -

2020 PAC Contributions.Xlsx

Recipient Candidate Candidate Office Date Amount First Name Last Name FEDERAL Terri Sewell For Congress Terri Sewell House 7/28/20 $1,000 Westerman for Congress Bruce Westerman House 9/11/20 $3,000 Womack for Congress Steve Womack House 9/22/20 $2,500 Friends Of David Schweikert David Schweikert House 8/25/20 $2,500 McCarthy Victory Fund Kevin McCarthy House 1/27/20 $20,000 Mike Garcia for Congress Mike Garcia House 9/22/20 $5,000 Devin Nunes Campaign Committee Devin Nunes House 9/10/20 $5,000 Ken Calvert For Congress Committee Ken Calvert House 9/22/20 $2,500 KAT FOR CONGRESS Kat Cammack House 10/6/20 $2,500 Byron Donalds for Congress Byron Donalds House 9/25/20 $2,500 Mario Diaz‐Balart for Congress Mario Diaz‐Balart House 9/22/20 $2,500 Bilirakis For Congress Gus Bilirakis House 8/14/20 $2,500 Michael Waltz for Congress Mike Waltz House 3/19/20 $2,500 Drew Ferguson for Congress Inc. Drew Ferguson House 2/13/20 $2,000 Simpson For Congress Mike Simpson House 3/5/20 $2,500 LaHood For Congress Darin LaHood House 8/14/20 $2,500 Rodney For Congress Rodney Davis House 3/13/20 $2,500 Walorski For Congress Jackie Walorski House 10/30/20 $5,000 Greg Pence for Congress Greg Pence House 9/10/20 $5,000 ELECT JIM BAIRD FOR CONGRESS Jim Baird House 3/5/20 $2,500 Jim Banks for Congress, Inc. Jim Banks House 2/13/20 $2,500 Defend Our Conservative Senate PAC Roger Marshall House 8/17/20 $5,000 Guthrie For Congress Brett Guthrie House 10/6/20 $5,000 Comer for Congress James Comer House 9/11/20 $4,000 Hal Rogers For Congress Hal Rogers House 9/22/20 $2,500 -

MIDWESTERN LEGISLATIVE CONFERENCE Annual Meeting | July 12–15, 2015 GENERAL INFORMATION

MIDWESTERN LEGISLATIVE CONFERENCE Annual Meeting | July 12–15, 2015 GENERAL INFORMATION ON-SITE HELP, INFORMATION AT BISMARCK EVENT CENTER CSG Midwest/MLC Office: Cottonwood Room, Lower Level Host State Office: Show Manager’s Office, Lower Level Presenters Room: Hall D Ticket Office, Lower Level Conference Registration, Information and CSG-Sponsored Internet Access: » Saturday: 11:30 a.m. to 6 p.m. | Lower Lobby » Sunday: 8 a.m. to 6 p.m. | Lower Lobby » Monday and Tuesday: 7:30 a.m. to 5:30 p.m. | Lower Lobby » Wednesday: 8:30 a.m. to 12 p.m. | Lower Lobby All of these rooms are located at the Bismarck Event Center (formerly Bismarck Civic Center), 315 S. Fifth Street. All of the conference’s sessions will be held at the center. TRANSPORTATION BETWEEN HOTELS, EVENT CENTER Transportation will be provided between the Bismarck Event Center and five hotels: the Radisson, Fairfield Inn & Suites South, Expressway Suites, Expressway Inn and Ramkota. Buses will depart from the Radisson hotel’s main entrance (on Broadway Avenue) and travel directly to the Event Center. Buses also will depart from the Fairfield Inn & Suites South; continue to the Expressway Suites, Expressway Inn and Ramkota; and then arrive at the Bismarck Event Center. The buses will make continuous loops on each day of the meeting during the times listed below. » Saturday, 11:15 a.m. to 6:15 p.m.: First bus leaves hotels at 11:15 a.m. and last bus leaves Event Center at 6:15 p.m. » Sunday, 7:45 a.m. to 6:15 p.m.: First bus leaves hotels at 7:45 a.m. -

ND Legislative Assembly Enacts Health Information Technology Bill

North Dakota Medical Association CONTENTS J UNE 2009 Checkup The mission of the North Dakota Medical Association is to promote the health and well- feature articles being of the citizens of North Dakota and to provide leadership to the medical community. 61st ND Legislative Assembly 5 The NDMA Checkup is published quarterly by Medicaid Rebase a Reality the North Dakota Medical Association, 1622 E. Interstate Avenue, P.O. Box 1198, Bismarck, ND 58502-1198, (701) 223-9475, Fax (701) 223-9476, Just What the Doctor Didn’t Order: e-mail: [email protected] 11 Why Wills Alone Won’t Work For Most Physicians Robert A Thompson MD, President Kimberly T Krohn MD, Vice President A. Michael Booth MD, Secretary Treasurer ND Legislative Assembly Enacts Steven P Strinden MD, Speaker of the House 16 Shari L Orser MD, Immediate Past President Health Information Technology Bill Gaylord J Kavlie MD, AMA Delegate Robert W Beattie MD, AMA Alternate Delegate Understanding the Health Care Councillors: 17 Provisions of the Stimulus Joseph E Adducci MD Thomas F Arnold MD Package Steven D Berndt MD William D Canham MD Debra A Geier MD Will You Be Ready For Linda L Getz Kleiman MD 19 Yvonne L Gomez MD HITECH Health Care? Catherine E Houle MD Steven R Mattson MD Rupkumar Nagala MD Minor Consent for Prenatal Care Fadel Nammour MD 27 and SB 2394 Jeremiah J Penn MD Shelly A Seifert MD Rory D Trottier MD The Recovery Audit Contractor Derek C Wayman MD 29 (RAC) is Here Rosemarie Kuntz, MBA, CMPE, NDMGMA President Staff MMIC Risk Management Bruce Levi, Executive Director 34 Managing Medication Risks Dean Haas, General Counsel Leann Tschider, Director of Membership & Office Manager Annette Weigel, Secretary Shelly Duppong, Designer & Production Manager departments with Clearwater Communications SUBMISSIONS: The NDMA Checkup welcomes manuscript, photog- President’s Message 3 raphy and art submissions. -

Vol. 41, No. 4: Holiday 2016 School of Medicine & Health Sciences

University of North Dakota UND Scholarly Commons North Dakota Medicine Archive School of Medicine & Health Sciences 2016 Vol. 41, No. 4: Holiday 2016 School of Medicine & Health Sciences Follow this and additional works at: https://commons.und.edu/ndm-archive Recommended Citation School of Medicine & Health Sciences, "Vol. 41, No. 4: Holiday 2016" (2016). North Dakota Medicine Archive. 13. https://commons.und.edu/ndm-archive/13 This Book is brought to you for free and open access by the School of Medicine & Health Sciences at UND Scholarly Commons. It has been accepted for inclusion in North Dakota Medicine Archive by an authorized administrator of UND Scholarly Commons. For more information, please contact [email protected]. Holiday 2016 VOLUME 41, NUMBER 4 NORTH DAKOTA MEDICINE Holiday 2016 1 www.ndmedicine.org 2 NORTH DAKOTA MEDICINE FallHoliday 2016 2016 FEATURES Triple Threat Research 10 The unique work of three scientists has one goal: 10 healthier North Dakotans. Cradle of Knowledge 14 Researcher seeks evidence-based interventions to save babies. 14 From Volume to Value 20 Shift in focus enables rural healthcare organizations to provide high-quality care. 20 DEPARTMENTS Dean’s Letter 4 News Briefs 6 UNIVERSITY OF NORTH DAKOTA Student Writing & Art 16 SCHOOL OF MEDICINE AND HEALTH SCIENCES - Champions Summer Floor Hockey League MARK KENNEDY, President, University of North Dakota - Epistemology - Physicians for Human Rights JOSHUA WYNNE, Vice President for Health Affairs and Workforce 18 Dean, School of Medicine and Health -

In the Supreme Court State of North Dakota

20200298 FILED IN THE OFFICE OF THE CLERK OF SUPREME COURT In the Supreme Court NOVEMBER 19, 2020 STATE OF NORTH DAKOTA State of North Dakota November 19, 2020 Supreme Court No. 20200298 Doug Burgum, in his capacity as North Dakota’s Governor, Petitioner, vs. Alvin Jaeger, in his capacity as North Dakota’s Secretary of State; the North Dakota Legislative Assembly, Chet Pollert, Chairman of Legislative Management; and the District 8 Republican Committee, Loren DeWitz, District Chairperson, Respondents. APPENDIX OF INTERVENOR DEMOCRATIC NON-PARTISAN LEAGUE (DEM-NPL) DISTRICT 8 HOUSE OF REPRESENTATIVES CANDIDATE KATHRIN VOLOCHENKO IN RESPONSE TO THE PETITION BY NORTH DAKOTA GOVERNOR DOUG BURGUM FOR “PRELIMINARY INJUNCTIVE RELIEF, DECLARATORY JUDGMENT, WRIT OF INJUNCTION, AND WRIT OF MANDAMUS” Duane A. Lillehaug (03232) David C. Thompson (09321) MARING WILLIAMS LAW OFFICE, P.C. DAVID C. THOMPSON, P.C. 1220 Main Avenue, Suite 105 321 Kittson Avenue Fargo, North Dakota 58103 Grand Forks, ND, 58201 (701) 241-4141 (701) 775-7012 [email protected] [email protected] COUNSEL FOR INTERVENOR KATHRIN VOLOCHENKO TABLE OF CONTENTS 1. Summary with web links for general interest media articles and social media posts relating to the District 8 House of Representatives race and the November 3, 2020 North Dakota General Election…………………………………………………………………………page 001 2. Media articles relating to the District 8 House of Representatives race and the November 3, 2020 North Dakota General Election…………………………………………………………………………page 006 Statewide Oct. 5 / https://kfgo.com/2020/10/05/north-dakota-legislative-candidate-dies-following-brief-illness/ Oct. 6 https://www.thedickinsonpress.com/opinion/6704488-Port-Andahls-death-in-District-8-creates tense-political-situation Oct.