Insights Newsletter – Corporate Credit Q3 2018 Jul 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 LTA Annual Report

ANNUAL Report 2018 01 Annual Review 2018 Welcome 02 WELCOME It is my pleasure to welcome you to the LTA’s Annual Report for 2018. We made significant progress in our work to grow tennis in Britain last year, the highlights of which are outlined in this report. As you will read in my introduction to the Finance and Governance Report, it was a year of transition for the LTA, where we laid down the foundations for our new long-term strategy published earlier this year. I am proud to have been able to contribute to this work since commencing my role as Chairman in September. My appointment followed that of Scott Lloyd as our new CEO at the start of the year, forming a new leadership team for a new era for our sport. Since taking up his position, Scott has led the We won’t achieve this overnight, and we can’t do organisation in developing and launching our new it on our own. Only by working with counties, vision – tennis opened up. It’s just three words, clubs, and a whole range of individuals and but it is now at the heart of everything we do organisations have we been able to make the and will set the direction for our work in 2019 progress highlighted in this document. and beyond. I hope you enjoy reading about what we achieved They aren’t just words either. We are truly in 2018, and what we plan to in the future. Our passionate about turning our vision into reality, thanks go to everyone who has contributed in and are committed to achieving our long-term any capacity, however big or small, and we look ambition of making tennis a sport that is for forward to that continuing as we work together anyone – all ages, all backgrounds, and all abilities. -

![[Click Here and Type in Recipient's Full Name]](https://docslib.b-cdn.net/cover/0661/click-here-and-type-in-recipients-full-name-1930661.webp)

[Click Here and Type in Recipient's Full Name]

MEDIA NOTES City ATP Tour PR Tennis Australia PR Sydney Brendan Gilson: [email protected] Harriet Rendle: [email protected] Brisbane Richard Evans: [email protected] Kirsten Lonsdale: [email protected] Perth Mark Epps: [email protected] Victoria Bush: [email protected] ATPCup.com, @ATPCup / ATPTour.com, @ATPTour / TennisTV.com, @TennisTV ATP CUP TALKING POINTS - SATURDAY 4 JANUARY 2020 • World No. 1 Rafael Nadal (ESP), No. 2 Novak Djokovic (SRB) and No. 4 Dominic Thiem (AUT) make their ATP Cup debuts Saturday as the second match of the night session in Perth, Brisbane and Sydney respectively. • Thiem takes on Borna Coric (CRO) at Ken Rosewall Arena in Sydney. Though Thiem has yet to break into the Top 3 of the FedEx ATP Rankings, he has at least four wins over Nadal, Djokovic and No. 3 Roger Federer. o 4-9 vs Nadal Wins at 2016 Buenos Aires, 2017 Rome, 2018 Madrid and 2019 Barcelona o 4-6 vs Djokovic Wins at 2017 & 2019 Roland Garros, 2018 Monte-Carlo and 2019 Nitto ATP Finals o 5-2 vs Federer Wins at Rome & Stuttgart in 2016 and Indian Wells, Madrid & ATP Finals in 2019 • Only three other players have at least four wins over each member of the Big Three -- 34-year-old Jo-Wilfried Tsonga, 32-year-old Andy Murray and 31-year-old Juan Martin del Potro. Thiem is 26 years old and his .433- win percentage against the Big Three is better than Murray’s (.341), Tsonga’s (.291) and Del Potro’s (.274). -

BULLETIN the Master Point Press IBPA Book of the Year Shortlist

THE INTERNATIONAL BRIDGE PRESS ASSOCIATION Editor: John Carruthers This Bulletin is published monthly and circulated to members of the International Bridge Press Association, comprising the world’s leading journalists, authors and editors of news, books and articles about contract bridge, with an estimated readership of some BULLETIN 200 million people who enjoy the most widely-played of all card games. www.ibpa.com Bulletin No. 642 July 10, 2018 President Barry Rigal (USA) +1 212 366 4799 [email protected] Chairman Per Jannersten (Sweden) [email protected] The Master Point Press IBPA Executive Vice-President Book of the Year Shortlist David Stern (Australia) We have five terrific candidates for Book of the Year. As usual, the hopefuls are [email protected] a varied bunch, with teaching experts and intermediates the main theme. Only Organizational one of the five could be considered pure entertainment. Here they are: Vice-President & Augie Boehm, Expert Hand Evaluation, 2017, 142 pp, Bulletin Production paperback, $14.95 Manager If bidding were as simple as counting high-card points, most of us would have Dilip Gidwani (India) lost interest in bridge a long time ago. Appreciating the life-long challenge of a +91 98214 53817 game immune to mastery, experts are always trying to hone their bidding [email protected] judgment. This book’s aim is to help you develop good bidding judgment by Secretary refining and improving your hand evaluation, which is the bedrock of good Elisabeth van Ettinger bidding. Learning the requirements for everyday sequences suffices to solve a (Netherlands) great many situations – but often not when a borderline hand falls into the +31 655 680 120 gray zone. -

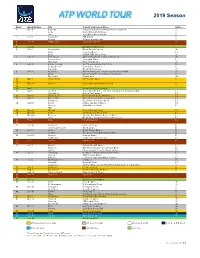

2018 ATP Calendar As of 19

2019 Season Week Week Starting City Current Tournament Name Surface 1 Dec 31 Brisbane Brisbane International presented by Suncorp H Doha Qatar ExxonMobil Open H Pune Tata Open Maharashtra H 2 Jan 7 Auckland ASB Classic H Sydney Sydney International H 3Jan 14 Melbourne Australian Open* H 4 5 Jan 28 Davis Cup First Round* 6 Feb 4 Montpellier Open Sud de France IH Quito Ecuador Open CL Sofia DIEMA XTRA Sofia Open IH 7 Feb 11 Rotterdam ABN AMRO World Tennis Tournament IH Buenos Aires Argentina Open CL New York New York Open IH 8 Feb 18 Rio de Janeiro Rio Open presented by Claro CL Delray Beach Delray Beach Open H Marseille Open 13 Provence IH 9 Feb 25 Acapulco Abierto Mexicano Telcel presentado por HSBC H Dubai Dubai Duty Free Tennis Championships H São Paulo Brasil Open ICL 10 Mar 4 Indian Wells BNP Paribas Open H 11 12 Mar 18 Miami Miami Open presented by Itaú H 13 14 Apr 1 Davis Cup Quarter-finals* 15 Apr 8 Houston Fayez Sarofim & Co. U.S. Men’s Clay Court Championship CL Marrakech Grand Prix Hassan II CL 16 Apr 15 Monte-Carlo Rolex Monte-Carlo Masters CL 17 Apr 22 Barcelona Barcelona Open Banc Sabadell CL Budapest Gazprom Hungarian Open CL 18 Apr 29 Estoril Millennium Estoril Open CL Munich BMW Open by FWU CL TBD 19 May 6 Madrid Mutua Madrid Open CL 20 May 13 Rome Internazionali BNL d’Italia CL 21 May 20 Geneva Banque Eric Sturdza Geneva Open CL Lyon Open Parc Auvergne-Rhône-Alpes Lyon CL 22May 27 Paris Roland Garros* CL 23 24 Jun 10 Stuttgart MercedesCup G ’s-Hertogenbosch Ricoh Open G 25 Jun 17 Halle Gerry Weber Open G London The Queen’s Club Championships G 26 Jun 24 Antalya Antalya Open G Eastbourne Eastbourne International G 27Jul 1 London Wimbledon* G 28 29 Jul 15 Båstad SkiStar Swedish Open CL Newport Dell Technologies Hall of Fame Open G Umag Plava Laguna Croatia Open Umag CL 30 Jul 22 Hamburg German Tennis Championships 2019 CL Atlanta BB&T Atlanta Open H Gstaad J. -

Good Research Practice in Non-Clinical Pharmacology and Biomedicine Handbook of Experimental Pharmacology

Handbook of Experimental Pharmacology 257 Anton Bespalov Martin C. Michel Thomas Steckler Editors Good Research Practice in Non-Clinical Pharmacology and Biomedicine Handbook of Experimental Pharmacology Volume 257 Editor-in-Chief James E. Barrett, Philadelphia Editorial Board Veit Flockerzi, Homburg Michael A. Frohman, Stony Brook Pierangelo Geppetti, Florence Franz B. Hofmann, München Martin C. Michel, Mainz Clive P. Page, London Walter Rosenthal, Jena KeWei Wang, Qingdao The Handbook of Experimental Pharmacology is one of the most authoritative and influential book series in pharmacology. It provides critical and comprehensive discussions of the most significant areas of pharmacological research, written by leading international authorities. Each volume in the series represents the most informative and contemporary account of its subject available, making it an unri- valled reference source. HEP is indexed in PubMed and Scopus. More information about this series at http://www.springer.com/series/164 Anton Bespalov • Martin C. Michel • Thomas Steckler Editors Good Research Practice in Non-Clinical Pharmacology and Biomedicine Editors Anton Bespalov Martin C. Michel Partnership for Assessment & Department of Pharmacology Accreditation of Scientific Practice Johannes Gutenberg University Heidelberg, Baden-Württemberg, Germany Mainz, Rheinland-Pfalz, Germany Thomas Steckler Janssen Pharmaceutica N.V. Beerse, Belgium ISSN 0171-2004 ISSN 1865-0325 (electronic) Handbook of Experimental Pharmacology ISBN 978-3-030-33655-4 ISBN 978-3-030-33656-1 -

Clinical Trials in Radiology and Data Sharing: Results from a Survey of the European Society of Radiology (ESR) Research Committee

European Radiology (2019) 29:4794–4802 https://doi.org/10.1007/s00330-019-06105-y IMAGING INFORMATICS AND ARTIFICIAL INTELLIGENCE Clinical trials in radiology and data sharing: results from a survey of the European Society of Radiology (ESR) research committee Maria Bosserdt1 & Bernd Hamm1 & Marc Dewey1 Received: 23 November 2018 /Revised: 5 January 2019 /Accepted: 12 February 2019 /Published online: 27 February 2019 # European Society of Radiology 2019 Abstract Objectives To determine the current situation and future directions of clinical trials and data sharing in radiology. Methods This survey was conducted between July and September 2018 among European heads of imaging departments and speakers at the Clinical Trials in Radiology sessions at ECR 2015–2018. The survey was approved by the ESR research committee, was administered online, and chi-square tests were used. Results The overall response rate was 29% (132/460). Responses were received from institutions in 29 countries. These insti- tutions reported having conducted 429 trials, leading to 332 publications, of which 43% were first and 44% were last authorships by those institutions. For future trials, 98% of respondents (93/95) said they would be interested in sharing data, although only 34% had shared data already (23/68, p < 0.001). The major barriers to data sharing were data protection (78%, 74/95), ethical issues (49%, 47/95), and the lack of a data sharing platform (49%, 47/95). Of the respondents, 89% believed a platform would facilitate data sharing (85/95 vs. 10/95 did not, p < 0.001) and should offer easy data uploading (74%, 70/95), data safety (66%, 63/95), easy communication between providers and re-users (62%, 59/95), and data access policies (56%, 53/95). -

The-Traveling-Tennis-Players.Pdf

● ● • • • • • • • • • • o o o • o o o • o o o • o o o The Women’s Tennis Association (WTA) The WTA is the global leader in women’s professional sport with more than 2,500 players representing nearly 100 nations competing for a record $146 million in prize money. The 2018 WTA competitive season includes 54 events and four Grand Slams in 30 countries. In 2017, televised matches showing the WTA Tour were watched around the world by a total TV audience of 500 million. The 2018 WTA competitive season concludes with the BNP Paribas WTA Finals Singapore presented by SC Global from October 21-28, 2018 and the WTA Elite Trophy in Zhuhai, China from October 30-November 4, 2018. The Association for Tennis Professionals (ATP) The ATP is the governing body of the men's professional tennis circuits - the ATP World Tour, the ATP Challenger Tour and the ATP Champions Tour. With 64 tournaments in 31 countries, the ATP World Tour showcases the finest male athletes competing in the world’s most exciting venues. From Australia to Europe and the Americas to Asia, the stars of the 2018 ATP World Tour will battle for prestigious titles and ATP Rankings points at ATP World Tour Masters 1000, 500 and 250 events, as well as Grand Slams (non ATP events). At the end of the season only the world’s top 8 qualified singles players and doubles teams will qualify to compete for the last title of the season at the Nitto ATP Finals. Held at The O2 in London, the event will officially crown the 2018 ATP World Tour No. -

Tournament Directory Grand Slams Nitto Atp Finals Atp World Tour Masters 1000 Atp World Tour 500 Atp World Tour 250 Next Gen Atp Finals

TOURNAMENT DIRECTORY GRAND SLAMS NITTO ATP FINALS ATP WORLD TOUR MASTERS 1000 ATP WORLD TOUR 500 ATP WORLD TOUR 250 NEXT GEN ATP FINALS 13 ATP Store Ad.indd 1 11/28/17 1:40 PM ATP WORLD TOUR 2018 SEASON As of 6 December 2017 START TOTAL FINANCIAL WEEK DATE CITY TOURNAMENT NAME SURFACE DRAW PRIZE MONEY COMMITMENT** 1 Dec 31 Brisbane 1 Brisbane International presented by Suncorp H 28 $ 468,910 $ 528,910 Jan 1 Doha 7 Qatar ExxonMobil Open H 32 $ 1,286,675 $ 1,386,665 Jan 1 Pune 7 Tata Open Maharashtra H 28 $ 501,345 $ 561,345 2 Jan 7 Sydney 1,7 Sydney International H 28 $ 468,910 $ 528,910 Jan 8 Auckland 7 ASB Classic H 28 $ 501,345 $ 561,345 3 Jan 15 Melbourne Australian Open* H 128 4 5 Feb 2 Davis Cup First Round* 6 Feb 5 Montpellier Open Sud de France IH 28 € 501,345 € 561,345 Feb 5 Sofia Sofia Open IH 28 € 501,345 € 561,345 Feb 5 Quito Ecuador Open CL 28 $ 501,345 $ 561,345 CALENDAR 2018 CALENDAR 7 Feb 12 Rotterdam ABN AMRO World Tennis Tournament IH 32 € 1,862,925 € 1,996,245 Feb 12 New York New York Open IH 28 $ 668,460 $ 748,450 Feb 12 Buenos Aires Argentina Open CL 28 $ 568,190 $ 648,180 8 Feb 19 Rio de Janeiro Rio Open presented by Claro CL 32 $ 1,695,825 $ 1,842,475 Feb 19 Marseille Open 13 Provence IH 28 € 645,485 € 718,810 Feb 19 Delray Beach Delray Beach Open H 32 $ 556,010 $ 622,675 9 Feb 26 Acapulco 7 Abierto Mexicano Telcel presentado por HSBC H 32 $ 1,642,795 $ 1,789,445 Feb 26 Dubai 7 Dubai Duty Free Tennis Championships H 32 $ 2,623,485 $ 3,057,135 Feb 26 Sao Paulo Brasil Open ICL 28 $ 516,205 $ 582,870 10 Mar 8 Indian Wells 5 BNP Paribas Open H 96 $ 7,972,535 $ 8,909,960 11 12 Mar 21 Miami 4 Miami Open presented by Itau H 96 $ 7,972,535 $ 8,909,960 13 14 Apr 6 Davis Cup Quarter-finals* 15 Apr 9 Marrakech Grand Prix Hassan II CL 32 € 501,345 € 561,345 Apr 9 Houston Fayez Sarofim & Co. -

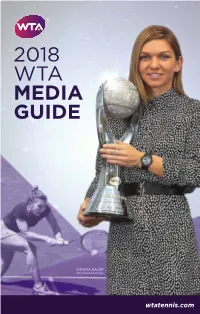

2018 Wta Media Guide

2018 WTA MEDIA GUIDE SIMONA HALEP WTA World No.1 Player wtatennis.com CATCH EVERY POINT! Experience the new wtatennis.com Photo Credit Getty Images 2018 SEASON JANUARY FEBRUARY DOHA DUBAI MARCH APRIL MAY JUNE JULY AUGUST MONTREAL SEPTEMBER OCTOBER SINGAPORE ZHUHAI WTA FINALS WTA ELITE TROPHY CALENDAR AS OF SEPTEMBER 2017 *GRAND SLAMS ARE NOT WTA EVENTS wtatennis.com Photo Credit Getty Images 2018 Women’s Tennis Association Media Guide © Copyright WTA 2018 All Rights Reserved. No portion of this book may be reproduced —electronically, mechanically or by any other means, including photocopying— without the written permission of the Women’s Tennis Association (WTA). Compiled by the Women’s Tennis Association (WTA) Communications Department WTA CEO: Steve Simon Editor-in-Chief: Kevin Fischer Assistant Editors: Chase Altieri, Amy Binder, Heather Bowler, Estelle LaPorte, Adam Lincoln, Alex Prior, Catherine Sneddon, Bryan Shapiro, Chris Whitmore, Yanyan Xu Cover Design: Jack Anton, Henrique Ruiz, Tim Smith, Michael Taylor Graphic Design: Provations Group, Nicholasville, KY, USA Contributors: Mike Anders, Evan Charles, Crystal Christian, Sophia Eden, Kelly Frey, Anne Hartman, Jill Hausler, Pete Holtermann, David Kane, Ashley Keber, Peachy Kellmeyer, Cindy Lupkey, Courtney McBride, Courtney Nguyen, Sean O’Malley, Joan Pennello, Neil Robinson, Kathleen Stroia, Eloise Tyson, Jeff Watson, June Mak Wei Photography: Getty Images (AFP, Bongarts), Action Images, GEPA Pictures, Ron Angle, Michael Baz, Matt May, Pascal Ratthe, Art Seitz, Chris Smith, Red -

2018 ATP Calendar As of 19

2018 Season Week Start Date City Current Tournament Name Surface Draw Prize Money Total Financial Commitment** 1 Dec 31 Brisbane ¹ Brisbane International presented by Suncorp H 28$468,910 $528,910 Jan 1 Doha ⁷ Qatar ExxonMobil Open H 32$1,286,675 $1,386,665 Jan 1 Pune ⁷ Tata Open Maharashtra H 28$501,345 $561,345 2 Jan 7 Sydney ¹ ˒ ⁷ Sydney International H 28$468,910 $528,910 Jan 8 Auckland ⁷ ASB Classic H 28$501,345 $561,345 3Jan 15 Melbourne Australian Open* H 128 4 5 Feb 2 Davis Cup First Round* 6 Feb 5 Montpellier Open Sud de France IH 28 € 501,345 € 561,345 Feb 5 Sofia DIEMA XTRA Sofia Open IH 28€ 501,345 € 561,345 Feb 5 Quito Ecuador Open CL 28$501,345 $561,345 7 Feb 12 Rotterdam ABN AMRO World Tennis Tournament IH 32€ 1,862,925 € 1,996,245 Feb 12 New York New York Open IH 28$668,460 $748,450 Feb 12 Buenos Aires Argentina Open CL 28$568,190 $648,180 8 Feb 19 Rio de Janeiro Rio Open presented by Claro CL 32$1,695,825 $1,842,475 Feb 19 Marseille Open 13 Provence IH 28€ 645,485 € 718,810 Feb 19 Delray Beach Delray Beach Open H 32$556,010 $622,675 9 Feb 26 Acapulco ⁷ Abierto Mexicano Telcel presentado por HSBC H 32$1,642,795 $1,789,445 Feb 26 Dubai ⁷ Dubai Duty Free Tennis Championships H 32$2,623,485 $3,057,135 Feb 26 São Paulo Brasil Open ICL 28$516,205 $582,870 10 Mar 8 Indian Wells ⁵ BNP Paribas Open H 96 $7,972,535 $8,909,960 11 12 Mar 21 Miami ⁴ Miami Open presented by Itaú H 96 $7,972,535 $8,909,960 13 14 Apr 6 Davis Cup Quarter-finals* 15 Apr 9 Marrakech Grand Prix Hassan II CL 32€ 501,345 € 561,345 Apr 9 Houston Fayez Sarofim & Co. -

2019 Year-End Prize Money Leaders

2019 YEAR-END PRIZE MONEY LEADERS As of 25 November 2019 1 Rafael Nadal........................................$16,349,586 35 Nick Kyrgios ........................................$1,384,572 69 Marcel Granollers ...............................$870,663 2 Novak Djokovic....................................$13,372,355 36 Frances Tiafoe.....................................$1,375,737 70 Casper Ruud ........................................$848,872 3 Roger Federer ......................................$8,716,975 37 Marin Cilic ...........................................$1,359,590 71 Horacio Zeballos .................................$848,157 4 Dominic Thiem ....................................$8,000,223 38 Nicolas Mahut .....................................$1,355,053 72 Lorenzo Sonego ...................................$810,416 5 Daniil Medvedev ..................................$7,902,912 39 Fernando Verdasco .............................$1,293,590 73 Yoshihito Nishioka ..............................$810,305 6 Stefanos Tsitsipas ..............................$7,488,927 40 Milos Raonic........................................$1,291,082 74 Ugo Humbert .......................................$807,920 7 Alexander Zverev .................................$4,280,635 41 Feliciano Lopez ...................................$1,283,705 75 Andreas Seppi .....................................$807,276 8 Matteo Berrettini ................................$3,439,783 42 Taylor Fritz ..........................................$1,275,240 76 Nicolas Jarry .......................................$798,800 -

2019 USTA Pro Circuit Program

A T S U y b s o t o h P Welcome to the USTA Pro Circuit n behalf of the United States Tennis Association, it is my pleasure to welcome you to this 2019 USTA Pro OCircuit event. This year, the USTA Pro Circuit celebrates its 40th anniversary, and since its inception in 1979, the Pro Circuit has been bringing the excitement of world-class professional tennis to dozens of local communities such as this one. In that time, the USTA Pro Circuit has grown from a handful of regional events and is now the largest professional developmental tennis circuit in the world, with more than 100 events held annually, offering some $4 million in prize money. These events not only provide a great stage for some of our sport’s top talents, but also provide a one-of-a-kind experience for thousands of tennis fans who otherwise might not have a chance to experience the pro sport firsthand. All of the players competing here this week are incredibly talented and eager to prove that they’ve got what it takes to take their games to the next level of the sport. Many do. In fact, Pro Circuit alumni have accounted for more than 50 Grand Slam singles titles, and 17 Pro Circuit veterans have risen to No. 1 in the world. For young players, the Pro Circuit is the ultimate proving ground, and for fans, it provides the opportunity to get a glimpse today at the stars of tomorrow. The USTA Pro Circuit showcases the very best of our sport, and that goes beyond the world-class tennis.