2015 Championship Problem

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Working Planetologist Speculative Worlds and the Practice of Climate Science

Chapter 2: The Working Planetologist Speculative Worlds and the Practice of Climate Science Katherine Buse In a 2010 editorial in the journal Nature, the climate scientist and Executive Direc- tor of the International Geosphere–Biosphere Programme, Sybil Seitzinger, ar- gues that scientists ought to be more centrally involved in international policy dis- cussions about sustainable development. “In Frank Herbert’s 1965 science-fiction classic Dune,” she writes, “the number-one position on the planet is held not by a politician, but by a planetary ecologist” (Seitzinger 2010: 601). Seitzinger invokes Herbert’s novel here to make a pointed comparison. In Dune, the inhabitants of the planet Arrakis are engaging in a long-term terraforming project that neces- sitates the oversight of a planetary ecologist. But here on Earth, we too have been making such changes, “altering, in profound and uncontrolled ways, key biologi- cal, physical and chemical processes of ecosystems.” For Seitzinger, grappling re- sponsibly with these processes requires a global, far-sighted perspective that she finds lacking in most Earth politicians. She advises that, while the governments of Earth have not yet considered appointing a planetary ecologist, “perhaps it is time to take the idea seriously.” And she is dead serious, both as a worried scientist and policy analyst, and also as a reader of Dune. Although she discusses the novel explicitly only in the first and last sentences of her editorial, Seitzinger does not invoke Dune merely to provide a bit of ‘science communication’ flavor to entertain Nature’s interdisciplinary read- ership. After all, the perspective she takes in the editorial is profoundly similar to Frank Herbert’s vision in Dune: both pragmatic and theoretical, it subsumes socio-political concerns as components of a planetary ecological model. -

Atreides Bene Gesserit Emperor Harkonnen Spacing Guild Fremen

QUICK START GUIDE Frank Herbert’s classic science fiction novelDune will live for generations as a masterpiece of creative imagination. In this game, you can bring to life the alien planet and the swirling intrigues of all the book’s major characters. Atreides Harkonnen The Atreides led by the The Harkonnens, led youthful Paul Atreides by the decadent Baron (Muad’Dib) — rightful Vladimir Harkonnen — heir to the planet, gifted master of treachery and with valiant lieutenants. cruel deeds. Bene Spacing Gesserit Guild The Bene Gesserit The Spacing Guild Sisterhood, represented represented by by Reverend Mother steersman Edric (in Gaius Helen Mohiam — league with smuggler ancient and inscrutable. bands) — monopolist of transport, yet addicted to ever increasing spice flows. Emperor Fremen The Emperor, his The Fremen majesty the Padishah represented by the Emperor Shaddam IV planetary ecologist Liet- — keen and efficient, Kynes — commanding yet easily lulled into fierce hordes of natives, complacency by his own adept at life and travel trappings of power. on the planet. SETUP: SPICE BANK SETUP: TREACHERY & SPICE DECKS, STORM MARKER I’m Lady Jessica of the House Atreides. Prepare to become immersed in the world of Dune. Here’s Feyd-Rautha of House Harkonnen here. how to set everything up. We are masters of treachery and cruel deeds! Next, shuffle the Treachery & Spice Decks and set them next to the board. I am Stilgar of the Fremen. We are adept Staban Tuek, at life and travel on of the Spacing the planet Dune. Guild coalition. First set out the We control all game board map. shipments on and off Dune. -

Frank Herbert's Dune

D U N E Part One by John Harrison Based on the novel by Frank Herbert Revisions 11/15/99 © 1999 New Amsterdam Entertainment, Inc. Converted by duneinfo.com 1. A1 FADE IN: A black void where... A PLANET slowly emerges. Forming in orange/gold mists. Desolate, monochromatic contours. No clouds. Just a thin cover of cirrus vapor. And somewhere... A mechanical voice...lecturing with monotonous precision. VOICE ....Arrakis...Dune...wasteland of the Empire. Wilderness of hostile deserts and cataclysmic storms. Home to the monstrous sandworm that haunts the vast desolation. The only planet in the universe where can be found...the SPICE. Guardian of health and longevity, source of wisdom, gateway to enhanced awareness. Rare and coveted by noble and commoner alike. The spice! Greatest treasure in the Empire... And now...ANOTHER VOICE. Not mechanical. BARON HARKONNEN And so it begins. The trap is set. The prey approaches... Suddenly the planet becomes transparent. It's a HOLOGRAM! And there behind it... The face of BARON VLADIMIR HARKONNEN. Staggeringly obese. Staring with intimidating intensity at the 3D globe suspended in front of him. The calm of his voice is frightening. BARON HARKONNEN A glorious winter is about to descend on House Atreides and all its heirs. The centuries of humiliation visited upon my family will finally be avenged. Behind him... MALE VOICE (RABBAN) BUT ARRAKIS WAS MINE. ANOTHER VOICE (FEYD) Shut up, Rabban! The Baron turns. REVEALING... 2. 1 EXT. BARON'S SUITE...HARKONNEN PALACE - NIGHT ...his NEPHEWS...GLOSSU RABBAN...AKA "the Beast"...his fat sweaty face twisted with rage. -

Hijos De Dune Dune - 3

Leto Atreides, el hijo de Paul —el mesías de una religión que arrasó el universo, el mártir que, ciego, se adentró en el desierto para morir—, tiene ahora nueve años. Pero es mucho más que un niño, porque dentro de él laten miles de vidas que lo arrastran a un implacable destino. Él y su hermana gemela, bajo la regencia de su tía Alia, gobiernan un planeta que se ha convertido en el eje de todo el universo: Arrakis, más conocido como Dune. Y en este planeta, centro de las intrigas de una corrupta clase política y sometido a una sofocante burocracia religiosa, aparece de pronto un predicador ciego, procedente del desierto. ¿Es realmente Paul Atreides, que regresa de entre los muertos para advertir a la humanidad del peligro más abominable? Frank Herbert Hijos de Dune Dune - 3 ePub r2.0 Titivillus 16.11.2020 Título original: Children of Dune Frank Herbert, 1976 Traducción: Domingo Santos Diseño de portada: Lightniir Editor digital: Titivillus ePub base r2.1 Índice de contenido Capítulo 1 Capítulo 2 Capítulo 3 Capítulo 4 Capítulo 5 Capítulo 6 Capítulo 7 Capítulo 8 Capítulo 9 Capítulo 10 Capítulo 11 Capítulo 12 Capítulo 13 Capítulo 14 Capítulo 15 Capítulo 16 Capítulo 17 Capítulo 18 Capítulo 19 Capítulo 20 Capítulo 21 Capítulo 22 Capítulo 23 Capítulo 24 Capítulo 25 Capítulo 26 Capítulo 27 Capítulo 28 Capítulo 29 Capítulo 30 Capítulo 31 Capítulo 32 Capítulo 33 Capítulo 34 Capítulo 35 Capítulo 36 Capítulo 37 Capítulo 38 Capítulo 39 Capítulo 40 Capítulo 41 Capítulo 42 Capítulo 43 Capítulo 44 Capítulo 45 Capítulo 46 Capítulo 47 Capítulo 48 Capítulo 49 Capítulo 50 Capítulo 51 Capítulo 52 Capítulo 53 Capítulo 54 Capítulo 55 Capítulo 56 Capítulo 57 Capítulo 58 Capítulo 59 Capítulo 60 Capítulo 61 Capítulo 62 Capítulo 63 Capítulo 64 Sobre el autor PARA BEV: Por el maravilloso lazo de nuestro amor, y por aportar su belleza y su sabiduría hasta el punto de ser realmente ella quien inspiró este libro. -

Terror Ecology: Secrets from the Arrakeen Underground

Terra‐&‐Terror Ecology: Secrets from the Arrakeen Underground Nandita Biswas Mellamphy Western University, Canada It is […] vital to an understanding of Muad'Dib’s religious impact that you never lose sight of one fact: the Fremen were a desert people whose entire ancestry was accustomed to hostile landscapes. Mysticism isn’t difficult when you survive each second by surmounting open hostility […]. With such a tradition, suffering is accepted […]. And it is well to note that Fremen ritual gives almost complete freedom from guilt‐feelings. This isn’t necessarily because their law and religion were identical, making disobedience a sin. It is likely closer to the mark to say they cleansed themselves of guilt easily because their everyday existence required brutal (often deadly) judgments which in a softer land would burden men with unbearable guilt. Dune I (576‐77) This world, which is the same for all, no one of gods or men has made. But it always is, was, and will be an ever‐living Fire, igniting and extinguishing in equal measure. Heraclitus Fragments (DK B30) [F]orm is nothing but holes and cracks […] with a nature that has no hardness or solidity. Ancient Buddhist saying. Frank Herbert’s science‐fiction classic Dune1 is a literary work about political, religious, military and ecological design: a design in which Dune’s desert‐planet is, like fire, a perpetually self‐consuming political, religious, military and ecological topos and in which human beings— among other things like water, sand‐worms and religious doctrines—are the fodder that fuels what could be called the ‘Great Ecology’ of planetary regeneration and desertification. -

The Blackness of Liet-Kynes: Reading Frank Herbert's Dune Through

religions Article The Blackness of Liet-Kynes: Reading Frank Herbert’s Dune Through James Cone Peter Herman Theology & Religious Studies, Marymount University, Arlington, VA 22207, USA; [email protected] Received: 1 August 2018; Accepted: 17 September 2018; Published: 18 September 2018 Abstract: Frank Herbert’s landmark science fiction novel Dune has received numerous sequels, prequels, and film treatments. Detailing the saga of humanity’s far future beyond our present solar system, the work plays successfully with religious, political, and ecological themes. This essay deals with the social/theological implications of two figures within the story-world of Dune: Its protagonist and visible hero, Paul Atreides/Muad’Dib and the lesser figure of the “Imperial Planetologist” Dr. Kynes, also known to the Fremen as “Liet”. By reading these two figures through the theology of James Cone, we discover that the obvious hero is not a messianic figure but a demonic one. Further, it is the lesser character of Liet-Kynes who actually fulfills the messianic role in Cone’s theological system. This essay is preceded by and makes use of Jeremy Ian Kirk’s work with the film Avatar that provides similar analysis. Where Kirk’s principal concern is with the ethical considerations of Avatar, this essay will more closely bear on Cone’s dynamic of redemption and conversion, specifically his notion of dying to white identity to be reborn in blackness. Keywords: theology; whiteness; black liberation; liberation theology; soteriology; salvation 1. Introduction Frank Herbert’s six Dune novels provide an amazing and detailed view of a possible future for the human race among the stars.1 The world-building in which he engaged spans thousands of years and billions of miles in his speculative future version of our known universe.2 Religion, specifically the often cynical manipulations of the Bene Geserit Sisterhood, plays a role in the narrative. -

Foundation and Dune

Mythmoot III: Ever On Proceedings of the 3rd Mythgard Institute Mythmoot BWI Marriott, Linthicum, Maryland January 10-11, 2015 Foundation and Dune or, Hari Seldon and the Golden Path Neil A. Ottenstein and Phillip Menzies Introduction The idea of there being a similarity between the Dune novels by Frank Herbert and Foundation series by Isaac Asimov became apparent during one of the Mythgard Academy classes on Dune led by Corey Olsen. During this class we examined in great detail what Paul Atreides was experiencing when his ability to see the future started to surface in his consciousness. In describing the mechanics of Paul’s view of the future it became clear that Paul was not “seeing” the future in any kind of mystical way. This view of seeing the future reminded some participants in the class of Psychohistory as put forward by Hari Seldon in the Foundation series. In this series Psychohistory was entirely based upon science and mathematics once again totally unrelated to mysticism or magic in any way. This paper will look at these two methods of foretelling or predicting the future by describing and comparing what was experienced by Paul and the Psychohistorians. It will also examine the mechanics of “seeing” the future. We are able to do this because these abilities were rational based on science, mathematics, observation and extrapolation and totally explainable unlike magic or metaphysical forces. Both novels also described limitations to seeing the future by showing that some things were not able to be seen and anticipated. We will examine this by venturing into the sequel Foundation and Empire. -

DUNE Ccg Rules

DUNE: Thunder At Twilight TABLE OF CONTENTS 1 INTRODUCTION................................................................................................................................................................................................................................................................................................................................2 2 GAME OVERVIEW.........................................................................................................................................................................................................................................................................................................................2 2.1 GAME OBJECTIVES...........................................................................................................................................................................................................................................................................................................2 2.2 CHOAM...........................................................................................................................................................................................................................................................................................................................................3 2.3 LANDSRAAD.............................................................................................................................................................................................................................................................................................................................3 -

The Bene Gesserit in Frank Herbert's Dune

T. Meza 1 Hugvísindasvið The Bene Gesserit in Frank Herbert’s Dune An analysis. Ritgerð til B.A.-prófs Luis Felipe Torres Meza December 2010 T. Meza 2 Háskóli Íslands Hugvísindasvið Enska The Bene Gesserit in Frank Herbert’s Dune An Analysis. Ritgerð til B.A.-prófs. Luis Felipe Torres Meza Kt.: 250786-3959 Leiðbeinendur: Matthew Whelpton og Valgerður Guðrún Bjarkadóttir December 2010 T. Meza 3 Abstract. The following is a work of literary analysis involving Frank Herbert’s Dune, which is the first published tome of what later became known as the Dune Chronicles. The Chronicles comprise six books authored by Frank Herbert many of which are referred to here, but this work centres only on Dune. This literary analysis focuses on the Bene Gesserit, an organization of women which plays a large part in the development of Herbert’s novel. The main objective of the discussion is to describe this conglomerate of characters and analyse it as one single collective character with its own story and its own characteristics in order to expand the understanding of Dune. Although much work about this science fiction novel exists today, the implications of the Bene Gesserit have not been adequately discussed. There are critics who condemn Herbert’s depiction of women in his universe based on the comparison of power between the novel’s protagonist hero, Paul Atreides and his Bene Gesserit counterparts. Another important tendency in Dune criticism is the inaccurate view that limits the understanding of the Bene Gesserit as a religious organization, although Dune itself provides readers with evidence to the contrary. -

University of Pardubice Faculty of Arts and Philosophy Social Critique in Sci-Fi Novels Dune by Frank Herbert and the Left Hand

University of Pardubice Faculty of Arts and Philosophy Social Critique in Sci-Fi Novels Dune by Frank Herbert and The Left Hand of Darkness by Ursula K. Le Guin Jan Kroupa Master Thesis 2019 Prohlašuji: Tuto práci jsem vypracoval samostatně. Veškeré literární prameny a informace, které jsem v práci využil, jsou uvedeny v seznamu použité literatury. Byl jsem seznámen s tím, že se na moji práci vztahují práva a povinnosti vyplývající ze zákona č. 121/2000 Sb., autorský zákon, zejména se skutečností, že Univerzita Pardubice má právo na uzavření licenční smlouvy o užití této práce jako školního díla podle § 60 odst. 1 autorského zákona, a s tím, že pokud dojde k užití této práce mnou nebo bude poskytnuta licence o užití jinému subjektu, je Univerzita Pardubice oprávněna ode mne požadovat přiměřený příspěvek na úhradu nákladů, které na vytvoření díla vynaložila, a to podle okolností až do jejich skutečné výše. Beru na vědomí, že v souladu s § 47b zákona č. 111/1998 Sb., o vysokých školách a o změně a doplnění dalších zákonů (zákon o vysokých školách), ve znění pozdějších předpisů, a směrnicí Univerzity Pardubice č. 9/2012, bude práce zveřejněna v Univerzitní knihovně a prostřednictvím Digitální knihovny Univerzity Pardubice. V Pardubicích dne 1.4.2019 Jan Kroupa Acknowledgment I would like to express my sincere gratitude to my supervisor Doc. Mgr. Šárka Bubíková, Ph.D. for her valuable advice and guidance throughout the process of writing this thesis and for offering this topic, as the reading re-ignited my passion for this genre. I would also like to thank my family, girlfriend, classmates, friends, and colleagues for their support and understanding of my behavior and diet during the last week prior to the deadline. -

Math 1303 - Math in the Liberal Arts Exam 1

Math 1303 - Math in the Liberal Arts Exam 1 Assigned: 2020.09.09, 12:01 AM Due: 2020.09.09 at 11:59 PM Instructions: Work on this by yourself, if you feel you need to ask a question for clarification purposes, you may email the instructor. For each problem be sure to show all of your work and write every step down in a clear and concise manner. When finished, upload this front sheet and all of your work, as a pdf or jpg to Blackboard. Agreement: Please read the following statement and then write it at the bottom of the page before the signature line: \I hereby swear that all the work that appears on this exam is completely my own, and I have not discussed any portion of this exam with any one else besides the instructor." Printed Name: Signature: Date: 1 1. Construct truth tables for the following statements: (a) [(p ! q) ^ (p ! r)] $ [ p ! (q ^ r)] (b) (p _ q _ r) $ [(∼ p ^ ∼ q) ! r] For problems 2{5, let p, q, r, and s be the following sentences: p: There is no open water on the planet Arrakis. q: Arrakis is a desert planet. r: Sandworms live in the desert. s: Arrakis is the only planet on which sandworms thrive. 2. Use p, q, r, and s as above to write each of the following symbolic statements in words. (a) q ! p (b) r ^ s (c) (r ^ s) ! q (d) s $ (p ^ q) 3. State the negation of the following sentence without using a conditional sentence form: If spice melange can be found in the desert, then sandworms also live in the desert. -

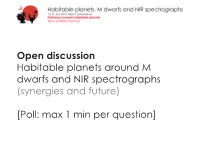

Open Discussion Habitable Planets Around M Dwarfs and NIR Spectrographs (Synergies and Future)

Open discussion Habitable planets around M dwarfs and NIR spectrographs (synergies and future) [Poll: max 1 min per question] Q1: do M dwarfs have planets? a) Yes, from microlensing (e.g. OGLE) b) Yes, from radial velocity (e.g. HARPS) c) Yes, from transits (e.g. Kepler) d) Yes, from protoplanetary disc observations e) All of the above f) No Q2: spectral type of inactive dwarfs for which NIR “>” VIS? a) M3V or earlier b) M4V c) M5V or later Q3: impact of tidal locking on habitability? a) 0% (i.e. 100% of planet surface is habitable) b) 100% (i.e. 0% of planet surface is habitable) c) 1-99% (i.e. only certain areas are habitable) Q4: spectral type of active dwarfs for which NIR “>” VIS? a) K7V or earlier b) M0V c) M1V or later Q5: impact of stellar activity on habitability? a) 0% (i.e. 100% of planet surface is habitable) b) 100% (i.e. 0% of planet surface is habitable) c) 1-99% (i.e. only certain areas are habitable) Q6: best passband for RV monitoring ~M4V? a) V, R, I b) Z c) Y d) J e) H f) K g) >3.5 μm Q7: most important parameter for HZ in M dwarfs? (but tidal locking and stellar activity) a) Ocean/initial water content b) Atmospheric composition c) Atmospheric pressure/scale height d) Stellar spectral type e) Planet magnetosphere f) Planet Bond albedo g) Other (e.g. Multiplanet system, continent distribution, migration, asteroid belt, tectonics, carbonate-silicate cycle…) Q8: best NIR spectral resolution? a) R=60,000 or less b) R=70,000-90,000 c) R=100,000 or more Q9: most probable habitable planet example? a) Tatooine (Mars, Arrakis):