Guide to Reading Your Financial Aid Award

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FAFSA 2021-22 Web

Paying for a College Education Understanding the various sources of financial aid can help make college more affordable for you and your family! Personal Grants Savings Here are the five basic financial resources: grants, scholarships, loans, work-study, and personal savings. Scholarships GRANTS: Money that you don’t have to repay; based on financial need. Many Loans grants come from the federal government. • Pell Grant: The largest source of free federal money for students with financial Work-Study need. Awards range from $600 to approximately $6495 per year. • Other Federal Grants: Find out about other federal grants at studentaid.ed.gov. SCHOLARSHIPS: Money you don’t have to repay; usually based on SCHOLARSHIP WEBSITES student talents or interests. University of Hawai‘i Scholarships: • Examples include athletic, musical, or other special talents; community hawaii.edu/tuition/scholarships/ service; good grades; or academic achievements. uhfoundation.org/scholarships • Scholarships are available through religious and community organizations foundations, businesses, schools, and labor unions. Talk Scholarships for Hawai‘i Residents: to your school counselor for more information. hawaiicommunityfoundation • Beware of scholarship scams! Be alert if a company makes scholarship .org/scholarships promises, charges a fee, or asks for your credit card information to hold a scholarship. Scholarships for Native Hawaiians: oha.org/scholarships WORK-STUDY: Students with financial need can earn money through pauahi.org/apply-for-a-scholarship part-time jobs. • Colleges assist students in finding job placements. Asian & Pacific Islander Scholarships: • Non, need-based employment opportunities are also available apiasf.org through colleges. • Jobs often have flexible hours that will fit a student’s schedule. -

Types of Federal Student Aid 2021-2022

FAFSA Is Used to Determine Eligibility For These Programs Grants Program and Type of Aid Eligibility and Program Information Annual Award Amounts (subject to change) For undergraduates with financial need who have not earned bachelor's or professional degrees. Federal Pell Grant Amounts change annually Does not have to be repaid Visit studentaid.ed.gov/pell‐grant for more information A student can receive Pell for no more than 12 semesters or the equivalent. Federal Supplemental Educational Opportunity Grant Up to $4000, but varies with the school. For undergradates with exceptional financial need. Pell Grant recipients take priority. Schools may have limited funds. (FSEOG) Visit studentaid.gov/fseog for more information Does not have to be repaid For students who are not Pell‐eligible due to expected family contribution calculations whose parent or guardian died as a result of Amount can be up to the annual Pell Grant amount, but Iraq and Afghanistan Service military service in Iraq or Afghanistan after the events of 9/11. cannot exceeds the school's cost of attendance. Grant Visit studentaid.gov/iraq‐afghanistan for more Does not have to be repaid A student can receive this grant for nore more than 12 semesters or the equivalent information Teacher Education Assistance for College and Higher Education (TEACH) Grant For undergraduate, postbaccalaureate, and graduate students who are completing or plan to complete course work needed to begin a Does not have to be repaid career in teaching. As a condition of this grant, a student must sign a TEACH Grant Agreement to Serve. Up to $4000 unless converted to a Direct Visit studentaid.gov/teach for more information Unsubsidized Loan for failure to Check with school to determine what educational levels can apply. -

FAFSA Simplification

U.S. Department of Education – Report to Congress on Efforts to Simplify the Free Application for Federal Student Aid (FAFSA) January 16, 2009 BACKGROUND On August 14, 2008, President Bush signed the Higher Education Opportunity Act (HEOA) (Pub. L. No. 110-315) into law, amending the Higher Education Act of 1965 (HEA). Section 483(f)(2) of the HEA, as amended by the HEOA, requires the Secretary of Education (Secretary) to submit to Congress a report on some of the Secretary’s efforts to simplify the Free Application for Federal Student Aid (FAFSA). Specifically, the report must provide the following information: • How the expected family contribution of a student can be calculated using substantially less income and asset information than was used on March 31, 2008; • The extent to which the reduced income and asset information will result in a redistribution of Federal grants and subsidized loans under Title IV of the HEA, State aid, or institutional aid, or in a change in the composition of the group of recipients of such aid and the amount of such redistribution; • How the alternative approaches for calculating the expected family contribution will rely mainly, in the case of students and parents who file income tax returns, on information available on the 1040, 1040EZ and 1040A tax forms, and include formulas for adjusting income or asset information to produce similar results to the existing approach with less data; • How the Internal Revenue Service (IRS) can provide to the Secretary income and other data needed to compute an expected -

Revisiting FAFSA Simplification: Expanding Access to the IRS Data Retrieval Tool

Revisiting FAFSA Simplification: Expanding Access to the IRS Data Retrieval Tool We describe how the complexity in the FAFSA hinders students’ ability to meet financial aid deadlines and examine the feasibility of using a simplified formula to determine aid eligibility. Authors Key Findings Susan Dynarski is a 1 Applying for federal aid for college is complex and slow. Information professor of public about aid eligibility arrives well after students have made crucial policy, education, decisions about preparation for college. Complexity in the aid process and economics at the undermines the intent of aid, which is to get more students into college. University of Michigan. 2 Efforts to simplify the aid process have fallen short of intent. Mark Wiederspan is 3 Students would benefit from a simplified process that automatically a doctoral candidate determines aid eligibility using tax information. This would allow in higher education students to receive information about aid eligibility early, when they are administration at the making key decisions about college. University of Michigan. 4 We show that a simplified process could closely replicate the current distribution of aid, with a much lower paperwork burden on families and colleges. EPI Policy Brief #1 | May 2015 page 1 A simplified aid application shows promise in determining students’ financial aid eligibility. In June 2014 Senators Lamar Alexander (R-TN) and Michael Bennet (D-CO) co- authored a bill that simplifies applying for financial aid. Based on research by EPI Co-Director Susan Dynarski and Judith Scott-Clayton of Columbia University,1 the bill would reduce the 100-question aid application to a postcard with two questions. -

Your Federal Student Loans: Learn the Basics and Manage Your Debt, Washington, D.C., 2010

Your Federal Student Loans Learn the Basics and Manage Your Debt Websites and Contact Information Student Aid on the Web www.studentaid.ed.gov Your source for in-depth information on preparing for and funding education beyond high school. FAFSA on the WebSM www.fafsa.gov Apply online for federal student aid. National Student Loan Data SystemSM (NSLDSSM) www.nslds.ed.gov Use your Federal Student Aid PIN to access your federal student loan records. Military www.studentaid.ed.gov/military If you are in the armed forces or have a family member in the service, visit this site to find out more about grants, repayment, and forgiveness options. MyMoney.gov www.mymoney.gov Several general government agencies offer advice on how to manage your money. Office of Inspector General Hotline To report student aid fraud (including identity theft), waste, or abuse of U.S. Department of Education funds. 1-800-MIS-USED (1-800-647-8733) E-mail: [email protected] Website: www.ed.gov/misused Federal Student Aid Information Center (FSAIC) To call or write if you have questions on federal student aid. 1-800-4-FED-AID (1-800-433-3243) TTY users can call 1-800-730-8913. Callers in locations without access to 1-800 numbers may call 319-337-5665. E-mail: [email protected] P.O. Box 84 Washington, DC 20044-0084 Cover photos: U.S. Department of Education U.S. Department of Education Federal Student Aid U.S. Department of Education Arne Duncan Secretary Federal Student Aid William J. Taggart Chief Operating Officer Student Experience Group Michele Y. -

January 17, 2011 Ms. Monica Jackson Office of the Executive Secretary

January 17, 2011 Ms. Monica Jackson Office of the Executive Secretary Consumer Financial Protection Bureau 1500 Pennsylvania Ave., NW (Attn: 1801 L Street) Washington, DC 20220 (sent via email to: [email protected]) Dear Ms. Jackson: These comments are in response to the “Request for Information Regarding Private Education Loans and Private Educational Lenders” (FR Doc. 2011–29737, Docket No. CFPB–2011–0037). We appreciate the opportunity to comment as the Consumer Financial Protection Bureau (Bureau) prepares its report on these topics, as required by Section 1077 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Institute for College Access & Success (TICAS) is an independent, nonpartisan, nonprofit research and policy organization working to improve both educational opportunity and outcomes so that more underrepresented students complete meaningful post-secondary credentials and do so without incurring burdensome debt. Our Project on Student Debt, launched in 2005, focuses on increasing public understanding of rising student debt – including private student loan debt – and the implications for individuals, families, the economy and society. Publicly available data provide a troubling, but incomplete, picture of the private education lending market in the United States and its impact on students and families. The Bureau’s study represents an important opportunity to improve public understanding of what is at stake for consumers at all stages of the private loan process. We believe the information gathered and analyzed by this study will underscore the need for the Bureau to work with the Department of Education, Congress, colleges and others to strengthen consumer protections and provide consumers with the information they need to make sound decisions about how to pay for college. -

The MPN and the Stafford/PLUS Loan Process

VOLUME 4 Processing Aid & Managing FSA Funds Chapter 1: The MPN & the Stafford/PLUS Loan Process...... 4-1 STUDENT APPLIES FOR AID & COMPLETES THE MPN ................................................................................. 4-1 Required borrower information on MPN, Multiyear use of the MPN & when a new MPN is required PLUS MPN ................................................................................................................................................................. 4-6 PLUS certification specifying amount to be borrowed, Adverse credit history & use of endorser SCHOOL CERTIFIES/ORIGINATES LOAN ........................................................................................................... 4-7 Certifying eligibility, Submission of award & disbursement data (Direct Loans), Scheduling disbursements with an FFEL lender, Lender/guarantor approval (FFEL only), Review of the Stafford MPN process Chapter 2: Disbursing FSA Funds........................................... 4-13 NOTIFICATION OF DISBURSEMENT ................................................................................................................ 4-13 REQUIRED STUDENT/PARENT AUTHORIZATION ....................................................................................... 4-15 USING ELECTRONIC PROCESSES FOR AUTHORIZATIONS & NOTIFICATIONS .................................... 4-17 The E-Sign Act METHOD OF DISBURSEMENT ......................................................................................................................... -

Funding Your College Education: Financial Aid 101

FUNDING YOUR COLLEGE EDUCATION: FINANCIAL AID 101 PRESENTER: MARY LYNN DIXON ADVISOR AGENDA • What is Financial Aid? • How do colleges award Financial Aid? • What is the Financial Aid application process? • What to do if the family’s financial situation has changed? • What types of aid can be included on the award letter? • What are the best ways to find scholarships? WHAT IS FINANCIAL AID? • Any funds provided to students and families to help pay for college expenses • Sources of Financial Aid: • Federal Government • State Government • Institutional • Private Sources LOANS ARE CONSIDERED FINANCIAL AID! TWO TYPES OF FINANCIAL AID… Gift Aid Self-Help Aid • Funds which do not • Funds which must be need to be repaid repaid or earned Example: Example: • Federal or State Grants • Loans • Scholarships • Work Study HOW DO COLLEGES AWARD AID? COLLEGES AWARD AID BASED ON… Merit • Often notified after accepted for admission • Based on GPA and/or ACT/SAT test scores, special talents, athletic abilities, leadership/service Financial Need • Notified between December and April from the FA office • Cost of Attendance - EFC = Financial Need Tuition and Fees Room and Board Books and Supplies Transportation Miscellaneous Expenses EXPECTED FAMILY CONTRIBUTION (EFC) EFC is an index number calculated when the Free Application for Federal Student Aid (FAFSA) is submitted by the student. The EFC is NOT what a student will pay for a year of college. EFC Factors: • Parental Income • Family Size • Parental Assets (excluding retirement • Number in College account -

Fiscal Year 2022 Budget Request

Department of Education P. STUDENT FINANCIAL ASSISTANCE Fiscal Year 2022 Budget Request CONTENTS Page Appropriations Language .......................................................................................................... P-1 Analysis of Language Provisions and Changes ........................................................................ P-2 Appropriation, Adjustments and Transfers ................................................................................ P-3 Summary of Changes ............................................................................................................... P-4 Authorizing Legislation .............................................................................................................. P-5 Appropriations History ............................................................................................................... P-6 Significant Items in FY 2021 Appropriations Reports ............................................................... P-7 Summary of Request ................................................................................................................ P-8 Activities: Federal Pell Grants ............................................................................................................. P-10 Federal Supplemental Educational Opportunity Grants ..................................................... P-23 Federal Work-study ............................................................................................................ P-28 Iraq and Afghanistan -

HB Chapter 3

a a a a a a a a a a a a aaa a a aaa a aa aa a a a The Case Study Worksheets WITHDRAWAL RECORD (WR) Completed properly when a student withdraws, this document provides all the data needed to calculated refunds and repayments REFUND CALCULATION and organizes it so that it's easy to use. WORKSHEET WITHDRAWAL RECORD Completed using the figures from the a a a a a a a a a 1. Studenta a Informationa aaa a a aaa a aa aa a a a WR, this Worksheet calculates unpaid Name Start Date Withdrawal Date/LDA Social Security Number Length of Enrollment Period Date of WD/LDA Determination charges and refunds, and can be used a a a a a a a a a a a a USE TOTALS FOR PERIOD aaa a a aaa a aa aa a a a 2. Program Costs CHARGED* for nonpro rata refund policies (except non- non- inst. inst. inst. inst. TOTAL Tuition/Fees Personal/Living Inst. Costs: the Federal Refund Calculation. Administrative Fee Dependent Care A Room & Board Disability Costs TOTAL Noninst. Costs: Books & Supplies Miscellaneous REFUND CALCULATION WORKSHEET a a a a a a a a a a a a a a a B a aa a a a a a a a a a a a a a aa aa a a a Transportation Miscellaneous a aa aa a a a aaaa a a a a a aa a a a a a aaa a a a a a a a a a a a a TOTAL Aid Paid Total Institutional Costs a a a a a a a aa a a a a aa aa a a a a a 3. -

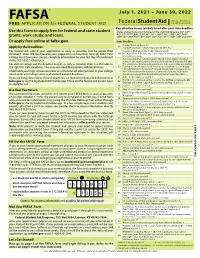

2021-2022 Free Application for Federal Student Aid (FAFSA)

FAFSA July 1, 2021 – June 30, 2022 FREE APPLICATION for FEDERAL STUDENT AID Pay attention to any symbols listed after your state deadline. Use this form to apply free for federal and state student States and territories not included in the main listing below: AL, AS*, AZ, CO, FM*, GA, GU*, HI*, KY^$, MH*, NC^$, ND^$, NE, NH*, grants, work-study, and loans. NM, OK^$, PR, PW*, RI*, SD*, VA*, VI*, VT^$*, WA^, WI and WY*. Or apply free online at fafsa.gov. State Deadline Alaska Education Grant ^ $ AK Apply by the Deadlines Alaska Performance Scholarship: June 30, 2021 # $ For federal aid, submit your application as early as possible, but no earlier than Academic Challenge: July 1, 2021 (date received) October 1, 2020. We must receive your application no later than June 30, 2022. Your AR ArFuture Grant: Fall term, July 1, 2021 (date received); spring term, Jan. 10, college must have your correct, complete information by your last day of enrollment 2022 (date received) For many state financial aid programs: March 2, 2021 (date postmarked). in the 2021-2022 school year. Cal Grant also requires submission of a school-certified GPA by March 2, 2021. For state or college aid, the deadline may be as early as October 2020. See the table to For additional community college Cal Grants: Sept. 2, 2021 (date postmarked). the right for state deadlines. You may also need to complete additional forms. CA For noncitizens without a Social Security card or with one issued through the federal Deferred Action for Childhood Arrivals (DACA) program, fill out Check with your high school counselor or a financial aid administrator at your college the California Dream Act Application. -

Stafford/PLUS Loan Periods and Amounts

CHAPTER Stafford/PLUS Loan 5 Periods and Amounts The rules for awarding Stafford and PLUS Loans are different than for Pell Grants and other FSA programs. Annual loan limits vary by grade level, and there are aggregate limits on the total amount that may be borrowed at one time. Also, the loan period, payment period, and the disbursements within that period may not always correspond to the payment periods that you’re using for Pell Grants. Finally, the requirement to prorate Stafford loan limits is different than the requirements for calculating Pell Grants. CHAPTER 5 HIGHLIGHTS: To request Stafford or PLUS Loan funds for a student, a school must n Measurements of academic and loan certify that the borrower is eligible for the loan award, and must provide periods specific amounts and dates for each disbursement of the loan award. ➔ Loan periods, academic terms, & program length A borrower’s eligibility for a Stafford or PLUS Loan is calculated ➔ Scheduled Academic Year (SAY) may differently than for a Pell Grant. There are no fixed tables such as the Pell be used for credit-hour programs with standard terms and certain nonstandard Grant Payment and Disbursement Schedules that determine award amounts. term programs Stafford Loans have annual and aggregate limits that are the same for all ➔ Borrower-Based Academic Year (BBAY) students at a given grade level and dependency status. In general, you may may be used as an alternative to an SAY for not originate a loan for more than the: programs also offered in an SAY ➔ BBAY must be used for clock-hour, nonterm, and nonstandard-term programs, • amount the borrower requests, and for standard-term credit-hour programs • borrower’s cost of attendance (see Chapter 2), without an SAY • borrower’s maximum borrowing limit as described in this ➔ “SE9W” (a program with terms substantially equal in length, with each chapter), or term comprised of 9 or more weeks of • borrower’s unmet financial need (as determined using the rules instructional time) in Chapter 7 of this volume).