For Personal Use Only Use Personal for Local Isps Such As Iinet, Gotalk, Internode, Transact and Bigair

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Letter from the Chairman of Bigair 7 Letter from the Chairman of Superloop 9

The Australian St ock Ex change Limit ed Level 4, 20 Bridge Stre et SYDNEY NSW 2000 Attention: C ompany Announc ement Ofc er 28 Oct ober 2016 First Court Hearing and Scheme Booklet BigAir Group Limited (ASX:BGL) (“BigAir” or “Company”) is pleased to advise that the Federal Court of Australia (“Court”) has approved orders to convene meetings of the Company’s shareholders to consider and vote on the Scheme of Arrangement (“Scheme”) under which Superloop Limited will acquire all BigAir shares which it does not already own. A full copy of the Scheme Booklet is attached, as approved by the Court for dispatch to shareholders. The Scheme Booklet includes an Independent Expert Report prepared by Lonergan Edwards & Associates Limited. The Independent Expert has opined that the Scheme is fair and reasonable and in the best interests of BigAir shareholders, in the absence of a superior proposal. Indicative timetable The timetable steps for completion of the Scheme are: Scheme Meeting 11.00am on Wednesday, 7 December 2016 Second Court Date for approval of the Scheme Friday, 9 December 2016 Effective Date Friday, 9 December 2016 Court order lodged with ASIC BigAir Shares suspended from trading on ASX New Superloop shares commence trading on ASX on a deferred Monday, 12 December 2016 settlement basis Record Date for determining entitlement to the Scheme Wednesday, 14 December 2016 Consideration Implementation Date Wednesday, 21 December 2016 Payment of cash consideration and issue of New Superloop Shares Trading of New Superloop Shares commence on ASX on a normal By Thursday, 22 December 2016 settlement basis This timetable is indicative only and, among other things, is subject to the satisfaction of or, where applicable, waiver of the conditions precedent to the Scheme, and to all necessary shareholder and Court approvals. -

Annual Report 2005 5

Telecommunications Industry Ombudsman Telecommunications Industry Ombudsman 2005 Annual Report Providing free, independent, just, informal and speedy Annual Report resolution of complaints 2005 Telecommunications Industry Ombudsman Limited ACN 057 634 787 Telephone 03 8600 8700 Facsimile 03 8600 8797 Freecall TH 1800 062 058 Freefax TH 1800 630 614 TTY 1800 675 692 Translator & Interpreter Service 131 450 Website www.tio.com.au Postal Address PO Box 276 Collins Street West Melbourne Victoria 8007 Australia Street Address Level 15, 114 William Street Melbourne Victoria 3000 Australia PROVIDING FREE, INDEPENDENT, JUST, INFORMAL AND SPEEDY RESOLUTION OF COMPLAINTS ABOUT TELECOMMUNICATIONS SERVICES. Established in 1993, the Telecommunications Industry Ombudsman Limited (TIO) is a free and independent dispute resolution service for residential and small business consumers who have been unable to resolve a complaint with their telephone or internet service provider. The TIO is wholly funded by telephone and internet service providers, who are required by law to be How to make a complaint part of, and pay for, the TIO Scheme. Before lodging a complaint with the TIO you should: • try to solve the problem with your telephone company The TIO’s Annual Report includes a comprehensive or Internet service provider review of complaint statistics for the 2004/05 • try to get the name of the person you spoke to at financial year. These statistics are published for the company • gather any papers relevant to the complaint, such as the information of consumers, and to help service contracts, bills or copies of correspondence (please do not providers identify areas where they can improve send original documents to the TIO). -

Superloop FY18 Financial Reportopens in New Window

Superloop Limited ABN 96 169 263 094 Appendix 4E Preliminary Final Report Results for announcement to the market For the year 1 July 2017 to 30 June 2018 (previous corresponding period to 30 June 2017) SUMMARY OF FINANCIAL INFORMATION 30 June 2018 30 June 2017 Change Change $ $ $ % Revenue from ordinary activities $125,171,014 $59,805,182 +$65,365,832 +109.3% Profit / (loss) from ordinary activities after income tax for the year attributable to $7,123,028 ($1,239,792) +$8,362,820 n/a members Profit / (loss) after income tax attributable $7,123,028 ($1,239,792) +$8,362,820 n/a to members Explanation of profit/(loss) from ordinary activities after tax The Group achieved its first positive full year Net Profit after Tax, with a $7.1 million after-tax profit generated in FY18 (compared to a loss of $1.2 million in FY17). During the year, the Group recognised tax credits for temporary timing differences associated with acquisitions which had not been previously recognised. Net profit before tax was positive $4.2 million (compared to a loss of $5.7 million in FY17). Also included in the result was non-cash amortisation for acquired customer relationships and brand names of $5.5 million and non-cash share-based payments of $0.4 million. Revenue and earnings in FY18 include contributions from NuSkope (acquired in October 2017) and GX2 Technology (acquired in November 2017). Revenue and earnings for FY18 also reflect the full year contribution from BigAir Group acquired in the previous corresponding period in December 2016 and SubPartners acquired in April 2017. -

1. the Proposed Transaction

EFTEL LIMITED ACN 073 238 178 NOTICE OF GENERAL MEETING, EXPLANATORY STATEMENT AND INDEPENDENT EXPERT’S REPORT TIME : 10.00am (WST) DATE : 29 June 2011 PLACE : Citigate Hotel 707 Wellington St PERTH WESTERN AUSTRALIA This Notice of Meeti ng , Explanatory Statement and Independent Expert’s Report should be read in its entirety. If Shareholders are in doubt as to how they should vote, they should seek advice from their professional advisors prior to voting. For personal use only Should you wish to discuss the matters in this Notice of Meeting, Explanatory Statement or Independent Expert’s Report please do not hesitate to contact the Company Secretary, Mr John Raftis on (+61 8) 9420 9999. 26 May 2011 Dear Fellow Shareholder Re: Major Transaction On 8 April, your company Eftel Limited ( ASX: EFT ) announced an in principle agreement to purchase ClubTelco Pty Ltd, a national ISP with offices in Queensland, Victoria and the Philippines. A formal transaction agreement was entered into on 18 April 2011. ClubTelco is a very similar business to Eftel. It delivers around 60,000 services, including ADSL, fixed line telephony, VoIP, mobile broadband and mobile telephony, and generates approximately $28M annual turnover. ClubTelco was formed by the founders and directors of Dodo, Australia’s largest privately held telecommunications company, who have been an Eftel partner since 2008. The transaction, which is subject to Eftel shareholder approval, will see your company double in size to 120,000 active services and in excess of $55M annual turnover. The combined entity will employ more than 300 people located across offices in Manila, Kuala Lumpur, Melbourne, the Gold Coast and Perth. -

2019 ANNUAL REPORT SUPERLOOP LIMITED | ABN 96 169 263 094 Superloop.Com 2019 ANNUAL REPORT _____

2019 ANNUAL REPORT SUPERLOOP LIMITED | ABN 96 169 263 094 superloop.com 2019 ANNUAL REPORT _____ Table of Contents Chairman & CEO Report 4 FY19 Business Overview 10 Directors’ Report 13 Remuneration Report 26 Auditor’s Independence Declaration 38 Financial Report 39 Notes to the Consolidated Financial Report 44 Directors’ Declaration 81 Independent Auditor’s Report 82 ASX Additional Information 87 2 SUPERLOOP LIMITED AND CONTROLLED ENTITIES ANNUAL REPORT FY19 3 Chairman & CEO Report On behalf of the Board of Directors of Superloop Limited, it is our FY20 Operational Highlights pleasure to present the Annual Report for the 12 months ended 30 June 2019 (FY19). Superloop was founded to change the way that Asia Pacific connects, identifying in 2014 that legacy incumbent networks around the region were designed before the advent of the cloud, therefore creating an opportunity for a brand new purpose- built network and organisation to meet the growing demand Completed Asia Pacific On-Net Buildings Award-winning network for high capacity, low latency, connectivity across the region. core network loop Best Telco Innovation 392 Best Fixed Wireless Provider This was your Company’s fourth full financial year since listing, INDIGO & AU backbone +26% YoY Best Virtual Network Operator and arguably its most momentous and eventful year so far. 2019 saw the completion of the two final pieces of our pan-Asia Pacific core network ‘loop’. This was also a year of significant corporate activity including a capital raise, a debt facility extension, due diligence from a non-binding indicative offer, as well as restructuring and refocusing the company on our core assets. -

My Net Fone Limited ACN 118 699 853

My Net Fone Limited ACN 118 699 853 Notice of Extraordinary General Meeting and Explanatory Memorandum Date: 22 February 2012 Time: 10.30am (AEDT) Location: Level 2, 12-14 Waterloo Street, Surry Hills, NSW 2010 This is an important document and requires your attention This Notice of Extraordinary General Meeting and Explanatory Memorandum should be read in its entirety. If you are in doubt how to deal with it, please consult your financial or other professional adviser. My Net Fone Limited My Net Fone Limited ACN 118 699 853 29th December 2011 Dear Shareholder Please fi nd enclosed the following documents in relation to an extraordinary general meeting of shareholders (Shareholders) of My Net Fone Limited (Company) to be held at the Company offi ce, Level 2, 10-14 Waterloo Street, Surry Hills, NSW 2010 at 10.30am (AEDT) on 22 February 2012 (Meeting): (a) Notice of Meeting (together with an Explanatory Memorandum); and (b) Proxy Form (together with proxy instructions). The Meeting is being convened for the purpose of seeking shareholder approval of a resolution which, if ap- proved, will permit the Company to proceed with its acquisition of the Symbio group of companies (Proposed Acquisition), which consists of Symbio Wholesale Pty Limited ACN 136 972 355, Symbio Wholesale (Singapore) Pte Ltd BRN 200913528D and Symbio Networks Pty Limited ACN 102 756 123 (together Symbio). The My Net Fone group of companies consists of the Company, My Net Fone Australia Pty Limited ACN 109 671 285 and MNF Leasing Pty Limited ACN 136 966 955 (together MNF). MNF is a provider of VoIP and broadband Internet services to residential and enterprise customers in Australia. -

Sophisticated Broadband Services

Final Report for the Department of Trade and Industry (DTI) Sophisticated broadband services 28 November 2005 Our ref.: 307-445 Analysys Consulting Limited St Giles Court, 24 Castle Street Cambridge, CB3 0AJ, UK Tel: +44 (0)1223 460600 Fax: +44 (0)1223 460866 [email protected] www.analysys.com Sophisticated broadband services Final Report for the Department of Trade and Industry (DTI) Contents 0 Executive summary i 0.1 Fixed coverage i 0.2 Mobile coverage iii 0.3 Initial coverage conclusions v 0.4 Initial usage conclusions vi 1 Introduction 1 2 Coverage of sophisticated broadband services – methodology 3 2.1 Technical limitations of DSL technologies 4 2.2 Distribution of line lengths 5 2.3 UK-specific analysis 7 3 Coverage of sophisticated broadband services – results 8 3.1 Interpretation of the results 9 3.2 United Kingdom 10 3.3 Australia 15 3.4 Canada 17 3.5 France 19 3.6 Germany 22 3.7 Ireland 24 3.8 Italy 26 3.9 Japan 29 3.10 South Korea 30 3.11 Sweden 32 3.12 US 34 Sophisticated broadband services 4 Usage of sophisticated broadband services – results 37 4.1 Methodology for business indicators 38 4.2 Methodology for residential indicators 40 4.3 Results for business indicators 42 4.4 Results for residential indicators 50 4.5 Trends analysis articles 57 0 Executive summary This document is the second report of the study commissioned to Analysys by the Department of Trade and Industry (DTI) to examine the market for sophisticated broadband services across the G7,1 Australia, Ireland, South Korea and Sweden. -

ASX200 Telecommunications -6% Performance S&P/ASX200 Information Technology 20%

IT and Telecommunications Sector Profile Jun-10 Mkt Cap $62b No. of companies 138 12 month index S&P/ASX200 Telecommunications -6% performance S&P/ASX200 Information Technology 20% Overview Top 100 stocks^ The listed Telecommunications and Information Technology sector consists of a small number ASX Code Company Name Market Cap Brief Description of large corporates and numerous small to medium sized businesses. The sector heavyweight, TLS Telstra $40,440 m Telecommunications Carrier CPU Computershare $5,896 m Share Registries Telstra, has become the most widely held stock by Australian investors since the privatisation of TEL Telecom Of New Zealand $2,939 m Telecommunications Carrier the national carrier. New Zealand's and Singapore's national carriers are also listed on the ASX. TPM TPG Telecom $1,472 m ISP Operating Under TPG, Soul Brands Large cap technology companies include service providers to the financial sector in HTA Hutchison Telecommunications (Aus) $1,222 m Operator of 3G Network Under "3" Brand Computershare and Iress Market Technology. SMEs make up the majority of the sector and SGT Singapore Telecommunications $1,199 m Telecommunications Carrier CRZ carsales.com $1,107 m Online Automotive Advertising consist of telecommunications distributors and resellers, IT consultancies and software IRE Iress Market Technology $1,095 m Trading Technology & Market Information developers and vendors. SLX Silex Systems $686 m Laser Isotope Separation Technology CSV CSG $445 m Application, Printing, Document Management S&P/ASX200 vs S&P/ASX200 -

2012 Annual Report

Telecommunications Industry Ombudsman TELECOMMUNICATIONS INDUSTRY OMBUDSMAN 2012 ANNUAL REPORT PREPARING FOR THE FUTURE CONTENTS ABOUT US 1 COMPLAINT STATISTICS 16 ENGAGEMENT 32 About the TIO 1 Dashboard 16 Awareness of TIO services 32 Ombudsman’s message 2 New Complaints by quarter 16 Resilient Consumers 32 New Complaints v. concilations TIO Talks 32 Board Chairman’s message 3 and investigations 16 First online annual report 32 Council Chairman’s message 4 New complaints by consumer type 16 Accessibility 32 New complaints by service type 17 A new website 32 Board and Council in 2011-12 5 Conciliations and Investigations Community engagement 33 Board members in 2011-12 5 by service type 17 Council members in 2011-12 8 Top 7 issues in new complaints 17 Industry engagement 34 Trends overview 18 Account management model 34 Ombudsman roadshow 34 PERFORMANCE 11 Complaints about the “big three” service providers 18 MNews 34 Conciliation 11 Complaints about mobile phone Our membership 34 services 18 Live transfers 11 Government and regulation 34 Small business complaints 19 Conciliation snapshot 11 Highlights 34 Increase in enquiries 19 List of submissions 35 Timeliness 12 Geographical trends 20 Consumer satisfaction Australia wide 20 ORGANISATION 36 with TIO services 12 Victoria 21 Feedback about the TIO 12 South Australia 21 Staff overview 36 Amendments to the Australian Capital Territory 22 New teams 36 TIO Constitution 13 New South Wales 22 TIO organisational structure 36 Queensland 23 Wellness program 36 Monetary limits 13 Western Australia -

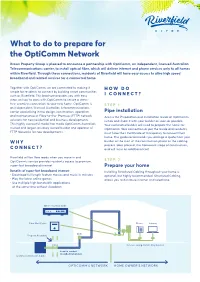

Opticomm Network

What to do to prepare for the OptiComm Network Brown Property Group is pleased to announce a partnership with OptiComm, an independent, licensed Australian Telecommunications carrier, to install optical fibre, which will deliver internet and phone services only to all homes within Riverfield. Through these connections, residents of Riverfield will have easy access to ultra high speed broadband and related services for a connected home. Together with OptiComm, we are committed to making it HOW DO simple for residents to connect by building smart communities such as Riverfield. This brochure provides you with easy I CONNECT? steps on how to work with OptiComm to secure a stress- free, seamless connection to your new home. OptiComm is STEP 1: an independent, licensed Australian Telecommunications carrier specialising in the design, construction, operation Pipe installation and maintenance of Fibre-to-the- Premises (FTTP) network Access the Preparation and Installation Guide at OptiComm. solutions for new residential and business developments. net.au and share it with your builder as soon as possible. This highly successful model has made OptiComm Australia’s Your nominated builder will need to prepare the home for trusted and largest privately owned builder and operator of OptiComm fibre connection as per the Guide and residents FTTP Networks for new developments. must have their Certificate of Occupancy to connect their home. The guide recommends you arrange a quote from your WHY builder at the start of the construction phase as the cabling process takes place at the framework stage of construction, CONNECT? and will incur an additional cost. Riverfield will be fibre ready when you move in and OptiComm’s service provides residents access to premium, STEP 2: super-fast broadband internet. -

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2017 GTLAW.COM.AU 1 TAKEOVERS + SCHEMES REVIEW 2017 GILBERT + TOBIN PRESENTS THE 2017 TAKEOVERS AND SCHEMES REVIEW 2016 was a solid but unspectacular year for Australian public company mergers and acquisitions. Some key themes were: + Number and value of transactions down from 2015 but aggregate transaction values were still higher than 2014. + 2016 saw a record number of all-cash transactions. There was a shift away from creative consideration structures. In general, target boards and shareholders seemed to value certainty in uncertain political and economic times. + Schemes of arrangement were increasingly the transaction structure of choice. + Despite negativity in respect of the Government/FIRB’s approach to the Ausgrid and Kidman transactions, foreigners continued to bid for Australian companies and were generally successful. + ASIC and the ACCC were highly active in their transaction reviews. This Review examines 2016’s public company transactions valued over $50 million and provides our perspective on the trends for Australian M&A in 2016 and what that might mean for 2017. We trust you will find this Review to be an interesting read and a useful resource for 2017. 2 CONTENTS KEY HIGHLIGHTS 4 1 MARKET ACTIVITY 6 2 SECTOR ANALYSIS 9 3 TRANSACTION STRUCTURES 13 4 FOREIGN BIDDERS 15 5 CONSIDERATION STRUCTURES 19 6 SUCCESS FACTORS 22 7 TRANSACTION TIMING 27 8 IMPLEMENTATION AGREEMENTS 29 AND BID CONDITIONS 9 THE REGULATORS 32 2016 PUBLIC M&A TRANSACTIONS 36 OUR APPROACH 38 ABOUT GILBERT + TOBIN 40 RECENT TRANSACTIONS -

Fibre Optic Brochure

UPS mounted inside Structured Wiring dwelling and plugged Cabinet (optional) into 240V AC GPO NTD – Mounted inside Fibre Wall Outlet Internet High speed broadband TV Compare these speeds to Phone download 900Mb movie Optical Fibre 56K Modem 36.7 hours Property Boundary PCD 24Mb ADSL2+ 19.5 minutes 1m 25Mb Fibre 4.9 minutes Communications Lead-in conduit In-house wiring 50Mb Fibre 3 minutes pit and pipe (installed by builder) (installed by builder) 100Mb Fibre 75 seconds OPTICOMM’S NETWORK HOME OWNER’S NETWORK 250Mb Fibre 30 seconds RETAIL SERVICE CONTACT SERVICES PROVIDER NUMBER WEBSITE INTERNET TELEPHONE FOXTEL BUSINESS Activ8me 13 22 88 activ8me.net.au BigAir N/A bigair.com.au Clear Networks 1300 855 215 clearnetworks.com.au Commander 1300 293 067 commander.com Exetel 1300 393 835 exetel.com.au Foxtel 1300 785 622 foxtel.com.au Fuzenet 1300 881 917 fuzenet.com.au iiNet 1300 455 806 iinet.net.au Internode 13 66 33 internode.on.net iPrimus 13 17 89 iprimus.com.au Telesurf 1300 795 528 telesurf.com.au Harbour ISP 1300 366 169 harbourisp.com.au DCSI 1300 665 575 dcsi.net.au Please check the OptiComm website for latest RSP information via http://opticomm.net.au/index.php/communities/retail-partners Ask your builder about installing a lead-in communication conduit and about wiring your home for optical fibre. Further information on getting connected to Australia’s fastest broadband is available at the Surrounds Sales Office. Visit our Land Sales Centre Open 10am – 5pm, 7 days Country Club Drive, Helensvale, Selling agent 4212, Queensland, 1300 235 476 [email protected] thesurrounds.com.au Disclaimer: Every precaution has been taken to establish the accuracy of the material herein.