PGDBM XL BROCHURE in A4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Submitted By

A report on MEDIA SPACE (Selling & Distribution) Part B In partial fulfillment of the SDM course Submitted by: Group 10 Bhavik Leuva – 2016PGP093 Bijoy Roy Chowdhury – 2013IPM031 Kalaivani G – 2016PGP163 Keerthi Naidani – 2016PGP171 Sadhana P – 2016PGP329 Sanapala Venkata Sri Harsha – 2016PGP332 Suryansh Singal – 2013IPM099 Tanya Shah – 2013IPM101 INTRODUCTION: In order to understand and evaluate the sales and distribution of the industry “Media Space”, the media conglomerate TIMES group has been chosen. The Times Group also called Bennett Coleman & Co. Ltd (BCCL) established in 1838 is India’s largest media conglomerate with a dominant presence across all media platforms and a footprint spanning the whole of Indian sub-continent. The flagship daily of the group - The Times of India – is today the largest English newspaper in the world with its sister publication – The Economic Times being world’s second-largest English business daily. TIMES group offers wide variety of products such as Publishing, Broadcasting, Radio, Entertainment, TIMES OOH and web portals, App. A primary research was made on how the Media AD spaces were sold and distributed for the Times group across all its product categories. This primarily involves Advertisement agencies acting between the Media house and the clients. The ads are classified across various verticals such as Education, services, CIS, Premium, Contact, Obituary and Personal, Business, Shopping, Matrimonial, Packages, Property, Automobile, Travel, Computers, Tender and Public notices and appointmnets. PUBLISHING: Publishing refers to the print media, which includes Times of India, Economic Times, Financial Times, Maharashtra Times and Navbharat Times. Typically a newspaper is sold at Rs.3 - Rs.6. -

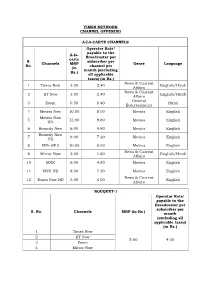

Times Network Channel Rate Card A-La-Carte

TIMES NETWORK CHANNEL RATE CARD A-LA-CARTE CHANNELS Operator Rate* payable to the Broadcaster A-la- per carte S. subscriber Tick / Channels MRP Genre Language No. per channel Cross (in per month Rs.) (excluding all applicable taxes) (in Rs.) News & Current 1 Times Now 3.00 2.40 English/Hindi Affairs News & Current 2 ET Now 3.00 2.40 English/Hindi Affairs General 3 Zoom 0.50 0.40 Hindi Entertainment 4 Movies Now 10.00 8.00 Movies English Movies Now 5 12.00 9.60 Movies English HD 6 Romedy Now 6.00 4.80 Movies English Romedy Now 7 9.00 7.20 Movies English HD 8 MN+ (HD) 10.00 8.00 Movies English News & Current 9 Mirror Now 2.00 1.60 English/Hindi Affairs 10 MNX 6.00 4.80 Movies English 11 MNX HD 9.00 7.20 Movies English Times Now News & Current 12 5.00 4.00 English World (HD) Affairs BOUQUET-1 Operator Rate* Tick/Cross payable to the Broadcaster per S. Channels MRP (in Rs.) subscriber per month No. (excluding all applicable taxes) (in Rs.) 1 Times Now 2 ET Now 5.00 4.00 3 Zoom 4 Mirror Now BOUQUET-2 Operator Rate* payable to the Broadcaster per S. subscriber per month Tick/Cross Channels MRP (in Rs.) No. (excluding all applicable taxes) (in Rs.) 1 Times Now 2 Mirror Now 3 ET Now 4 Zoom 13.00 10.40 5 Movies Now 6 MNX 7 Romedy Now BOUQUET-3 Operator Rate* payable to the Broadcaster per S. -

Galgotias University, India Mr

The Researcher International Journal of Management Humanities and Social Sciences January-June, 2019 Issue 01 Volume 04 Chief Patron Mr. Suneel Galgotia, Chancellor, Galgotias University, India Mr. Dhruv Galgotia, CEO, Galgotias University, India Patron Prof.(Dr.) Renu Luthra Vice Chancellor, Galgotias University, India GALGOTIASEditor-in -UNIVERSITYChief Dr. Adarsh Garg Galgotias University Publication SCIENCE IN THE CONTEXT OF SOCIETY THROUGH QR CODE IN PROBLEM BASED LEARNING Science in the Context of Society through QR Code in Problem Based Learning David Devraj Kumar1 Susanne I. Lapp2 Abstract Science education in the context of societal applications through QR code in problem-based learning (PBL) is addressed in this paper. An example from an elementary classroom where the students received mentoring by their high school peers to develop QR codes involving the Florida Everglades is presented. Through meaningful guidance it is possible to enhance elementary students knowledge of science in society and awaken their curiosity of science using QR code embedded problem-based learning. Key Words: QR Code, Problem Based Learning, Science in Society, Mentor 1. Introduction How to connect classroom science to societal applications in problem-based learning (PBL) through QR code is explored in this paper. We live in a world highly influenced and impacted by science and its technological applications. Science and its application in technology are an integral part of society. One of the goals of science education is preparing students to be critical thinkers and problem solvers who understand the role of science and technology in society [1]. Currently, the US focus has followed a standards-driven model for educating students. -

Channels Language Genre Broadcaster Drp/Rate* Hd

CHANNELS LANGUAGE GENRE BROADCASTER DRP/RATE* HD/SD ASIANET MALAYALAM GEC STAR 19 SD SURYA MALAYALAM GEC SUN 12 SD ASIANET PLUS MALAYALAM GEC STAR 5 SD ASIANET HD MALAYALAM GEC STAR 19 HD SURYA TV HD MALAYALAM GEC SUN 19 HD JAYA TV TAMIL GEC JAYA 3.78 SD SUN TV TAMIL GEC SUN 19 SD COLORS TAMIL TAMIL GEC TV18 3 SD STAR VIJAY TAMIL GEC STAR 17 SD ZEE TAMIL TAMIL GEC ZEE 12 SD AADITHYA TAMIL GEC SUN 9 SD VIJAY HD TAMIL GEC STAR 19 HD SUN TV HD TAMIL GEC SUN 19 HD ZEE TAMIL HD TAMIL GEC ZEE 19 HD JEET DISCOVERY HINDI GEC DISCOVERY 1 SD STAR PLUS HINDI GEC STAR 19 SD SONY HINDI GEC SONY 19 SD COLORS HINDI GEC TV18 19 SD ZEE TV HINDI GEC ZEE 19 SD SONY SAB HINDI GEC SONY 19 SD RISHTEY HINDI GEC TV18 1 SD & TV HINDI GEC ZEE 12 SD UTV BINDASS HINDI GEC DISNEY 1 SD STAR ULTSAV HINDI GEC STAR 1 SD ZOOM HINDI GEC TIMES 0.5 SD SONY HD HINDI GEC SONY 19 HD COLORS HD HINDI GEC TV18 19 HD ZEE TV HD HINDI GEC ZEE 19 HD SONY SAB HD HINDI GEC SONY 19 HD AXN ENGLISH GEC SONY 5 SD COMEDY CENTRAL ENGLISH GEC TV18 7 SD ZEE CAFÉ ENGLISH GEC ZEE 15 SD STAR WORLD ENGLISH GEC STAR 8 SD COLORS INFINITY ENGLISH GEC TV18 7 SD AXN HD ENGLISH GEC SONY 7 HD COMEDY CENTRAL HD ENGLISH GEC TV18 9 HD COLORS INFINITY HD ENGLISH GEC TV18 9 HD UDAYA TV KANNADA GEC SUN 17 SD COLORS KANNADA KANNADA GEC TV18 19 SD ZEE KANNADA KANNADA GEC ZEE 19 SD SUVARNA KANNADA GEC STAR 19 SD COLORS SUPER KANNADA GEC TV18 3 SD UDAYA HD KANNADA GEC SUN 19 HD SUVARNA HD KANNADA GEC STAR 19 HD GEMINI TELUGU GEC SUN 19 SD JAYA PLUS TAMIL NEWS JAYA 1.68 SD SUN NEWS TAMIL NEWS SUN 1 SD NEWS 18 TAMIL -

Times Network Channel Offering A-La

TIMES NETWORK CHANNEL OFFERING A-LA-CARTE CHANNELS Operator Rate* payable to the A-la- Broadcaster per carte S. subscriber per Channels MRP Genre Language No. channel per (in month (excluding Rs.) all applicable taxes) (in Rs.) News & Current 1 Times Now 3.00 2.40 English/Hindi Affairs News & Current 2 ET Now 3.00 2.40 English/Hindi Affairs General 3 Zoom 0.50 0.40 Hindi Entertainment 4 Movies Now 10.00 8.00 Movies English Movies Now 5 12.00 9.60 Movies English HD 6 Romedy Now 6.00 4.80 Movies English Romedy Now 7 9.00 7.20 Movies English HD 8 MN+ (HD) 10.00 8.00 Movies English News & Current 9 Mirror Now 2.00 1.60 English/Hindi Affairs 10 MNX 6.00 4.80 Movies English 11 MNX HD 9.00 7.20 Movies English News & Current 12 Times Now HD 5.00 4.00 English Affairs BOUQUET-1 Operator Rate* payable to the Broadcaster per subscriber per S. No. Channels MRP (in Rs.) month (excluding all applicable taxes) (in Rs.) 1 Times Now 2 ET Now 5.00 4.00 3 Zoom 4 Mirror Now BOUQUET-2 Operator Rate* payable to the Broadcaster per S. Channels MRP (in Rs.) subscriber per No. month (excluding all applicable taxes) (in Rs.) 1 Times Now 2 Mirror Now 3 ET Now 4 Zoom 13.00 10.40 5 Movies Now 6 MNX 7 Romedy Now BOUQUET-3 Operator Rate* payable to the Broadcaster per S. No. Channels MRP (in Rs.) subscriber per month (excluding all applicable taxes) (in Rs.) 1 Movies Now HD 2 MN+ (HD) 3 Romedy Now HD 4 MNX HD 20.00 16.00 5 Times Now HD 6 Mirror Now 7 ET Now 8 Zoom BOUQUET-4 Operator Rate* payable to the Broadcaster per S. -

List of Pay Channels

List of Pay Channels SL# CHANNEL NAMES SD/HD LANGUAGE GENRE BROADCASTER NAME DRP 1 & FLIX SD ENGLISH MOVIES ZEE 15.00 2 & FLIX HD HD ENGLISH MOVIES ZEE 19.00 3 & PICTURES SD HINDI MOVIES ZEE 10.00 4 & PRIVE HD HD ENGLISH MOVIES ZEE 19.00 5 & TV SD HINDI GEC ZEE 12.00 6 24 GHANTA SD BENGALI GEC ZEE 0.10 7 AAJ TAK SD HINDI NEWS TV TODAY 0.75 8 ADITHYA TV SD TAMIL MOVIES SUN 9.00 9 ANIMAL PLANET SD ENGLISH INFO & LIFESTYLE DISCOVERY 2.00 10 ANIMAL PLANET HD HD ENGLISH INFO & LIFESTYLE DISCOVERY 3.00 11 ASIANET SD MALAYALAM GEC STAR 19.00 12 ASIANET HD HD MALAYALAM GEC STAR 19.00 13 ASIANET MOVIES SD MALAYALAM MOVIES STAR 15.00 14 ASIANET PLUS SD MALAYALAM GEC STAR 5.00 15 AXN SD ENGLISH GEC SONY 5.00 16 AXN HD HD ENGLISH GEC SONY 7.00 17 BBC WORLD SD ENGLISH NEWS BBC 1.00 18 BINDASS SD HINDI GEC DISNEY 1.00 19 CARTOON NETWORK SD ENGLISH KIDS TURNER 4.25 20 CHINTU TV SD KANNADA KIDS SUN 6.00 21 CHUTTI TV SD TAMIL KIDS SUN 6.00 22 CNBC AWAAZ SD HINDI NEWS TV18 1.00 23 CNBC TV18 SD ENGLISH NEWS TV18 4.00 24 CNBC TV18 HD HD ENGLISH NEWS TV18 1.00 25 CNN SD ENGLISH NEWS TURNER 0.50 26 CNN NEWS18 SD ENGLISH NEWS TV18 0.50 27 COLORS SD HINDI GEC TV18 19.00 28 COLORS BANGLA SD BENGALI GEC TV18 7.00 29 COLORS BANGLA HD HD BENGALI GEC TV18 14.00 30 COLORS GUJRATHI SD GUJARATI GEC TV18 5.00 31 COLORS INFINITY SD ENGLISH GEC TV18 7.00 32 COLORS INFINITY HD HD ENGLISH GEC TV18 9.00 33 COLORS KANNADA SD KANNADA GEC TV18 19.00 34 COLORS KANNADA CINEMA SD KANNADA MOVIES TV18 2.00 35 COLORS KANNADA HD HD KANNADA GEC TV18 19.00 36 COLORS MARATHI SD MARATHI -

Asianet Recommended Packs

ASIANET RECOMMENDED PACKS KERALA ECONOMY Rs 32.10 ( Network Capacity Fee & taxes extra) Target Market :Kerala 9 Pay channels Genre Channels Surya TV Zee Keralam GEC ACV Mega TV Rosebowl Surya Movies Movies Surya Comedy Music Surya Music Kochu TV Kids KERALA VALUE Rs 92.10 ( Network Capacity Fee & taxes extra) Target Market :Kerala 35 Pay channels Genre Channels Asianet Asianet Plus Surya TV GEC Zee Keralam ACV Rosebowl Zoom Movies Now MNX Romedy Now Movies Asianet Movies Surya Movies Surya Comedy Music Surya Music Star Sports 1 Sports Star Sports 2 Star Sports 3 Star Sports First Dsport Times Now Mirror Now ET NOW News Aaj Tak Aaj Tak Tez India Today National Geographic Channel (NGC) Nat Geo Wild Discovery Channel Animal Planet Infotainment TLC Discovery ID Discovery Science Discovery Turbo Kochu TV Kids Discovery Kids Channel KERALA BUDGET Rs.103.70 ( Network Capacity Fee & taxes extra) Target Market :Kerala 34 Pay channels Genre Channels Asianet Asianet Plus Surya TV Zee Keralam GEC ACV Rosebowl ÁDN Gold Zoom Movies Now MNX Romedy Now Asianet Movies Movies Surya Movies ACV Movies Comex Surya Comedy Surya Music Music ACV Juke Box ACV Medley Star Sports 1 Star Sports 2 Sports Star Sports 3 Star Sports First News Times Now Mirror Now News18 Kerala CNN News18 ET NOW Aaj Tak Aaj Tak Tez India Today National Geographic Channel (NGC) Infotainment Nat Geo Wild Kids Kochu TV KERALA CLASSIC Rs.111.20 ( Network Capacity Fee & taxes extra) Target Market :Kerala 45 Pay channels Genre Channels Asianet Asianet Plus Surya TV Zee Keralam GEC ACV Rosebowl -

~"'A Bennett, Coleman & Co

~"'a Bennett, Coleman & Co. Ltd. 7,Bahadurshah Zafar Marg, New Delhi 110103 T:9111 23302000 ,'NiE~,-TIMES Registered Office: The Times of India Building, Or. D.N Road, Mumbai 400001 GROUP Corporate Identity No: U22120MH1913PLCO00391 The Registering Officer 14th Feb,2018 Contract Labour ( R & A ) Act - 1970 Govt. of NCT of Delhi Central District, Pusa New Delhi Ref : Certificate of Registration No. CLA / PE / 1376 / 2000 / LC dated 24.4.2000 Sub: Annual Return of the Principal Employer for year endfng 31st December 2017 Dear Sir, Please find enclosed the annual return (in duplicate) in Form XXV under Contract Labour ( Regulation & Abolition) Act & Rules for the year ending sr' December 2017. Please acknowledge receipt of the same. Thanking You, Yours truly, For Bennett I Coleman & Co. Ltd. ( Rakesh Chaturvedi ) Chief Manager - Personnel Encls : a/a The Times of India The Economic Times Mumbai Mirror Bombay Times Speaking Tree Times Now NavBharat Times Nav Gujarat Samay Maharashtra Times Ei Samay Vijay Karnataka Filmfare Femina Hello RadioMirchi ET Now Zoom Romedy Now Movies Now Indiatimes Magicbricks Timesjobs Gaana FORM XXV ~'.. , ~ '. i~..' ( See rule 82 ( 2 ) ) ANNUAL RETURNS OF PRINCIPAL EMPLOYER TO BE SENT TO THE REGISTERING OFFICER Year ending 31st December 2017 1. Full name and address of the Principal Employer Bennett , Coleman & CO. Ltd. 7, Bahadur Shah Zafar Marg New Delhi - 2 2. Name of Establishment Bennett ,Coleman & Co. Ltd ( a) District Central ( b) Postal Address 7, Bahadur Shah Zafar.Marq New Delhi - 2 ( c) Nature of operations I industry I work carried on Publication of Newspapejs.. etc. , ""'" 3. Full name of the Manager or person responsible for Sh.Ashok Srivastava,GM ( Personnel') Personnel supervision and control of the establishment 4. -

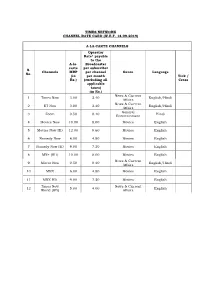

Times Network Channel Rate Card (W.E.F

TIMES NETWORK CHANNEL RATE CARD (W.E.F. 14.09.2019) A-LA-CARTE CHANNELS Operator Rate* payable to the A-la- Broadcaster carte per subscriber S. Channels MRP per channel Genre Language No. (in per month Tick / Rs.) (excluding all Cross applicable taxes) (in Rs.) News & Current 1 Times Now 3.00 2.40 English/Hindi Affairs News & Current 2 ET Now 3.00 2.40 English/Hindi Affairs General 3 Zoom 0.50 0.40 Hindi Entertainment 4 Movies Now 10.00 8.00 Movies English 5 Movies Now HD 12.00 9.60 Movies English 6 Romedy Now 6.00 4.80 Movies English 7 Romedy Now HD 9.00 7.20 Movies English 8 MN+ (HD) 10.00 8.00 Movies English News & Current 9 Mirror Now 0.50 0.40 English/Hindi Affairs 10 MNX 6.00 4.80 Movies English 11 MNX HD 9.00 7.20 Movies English Times Now News & Current 12 5.00 4.00 English World (HD) Affairs BOUQUET-1 Operator Rate* payable Tick/Cross to the Broadcaster per S. subscriber per month Channels MRP (in Rs.) No. (excluding all applicable taxes) (in Rs.) 1 Times Now 2 ET Now 5.00 4.00 3 Zoom 4 Mirror Now BOUQUET-2 Operator Rate* payable to the Broadcaster per S. subscriber per month Tick/Cross Channels MRP (in Rs.) No. (excluding all applicable taxes) (in Rs.) 1 Times Now 2 Mirror Now 3 ET Now 4 Zoom 13.00 10.40 5 Movies Now 6 MNX 7 Romedy Now BOUQUET-3 Operator Rate* payable to the Broadcaster per S. -

Gala Night... Behind the Scenes

January, 2021 GALA NIGHT... BEHIND THE SCENES From (L-R) Priyamani, Tripti Dimri, Jaideep Ahlawat, THE MAGIC AND GLORY OF THE Nawazuddin Siddiqui and FLYX FILMFARE OTT AWARDS Manoj Bajpayee Volume 70 # January 2021 / ISSN NUMBER 0971-7277 January, 2021 GALA NIGHT... BEHIND THE SCENES From (L-R) Priyamani, Tripti Dimri, Jaideep Ahlawat, THE MAGIC AND GLORY OF THE Nawazuddin Siddiqui and FLYX FILMFARE OTT AWARDS Manoj Bajpayee PHOTOGRAPH: MEETESH TANEJA Editor’s Choice 19 27 The FLYX Filmfare OTT 04 Awards were a resounding success Looking back at the 82 eventful 2020 Masala fix Akshay Kumar to do a 08 double role in a sci-fi film, Aamir Khan’s son Junaid to be launched by YRF, Katrina Kaif’s superhero film gets a title and other grist from the rumour mill 62 72 68 Awards fashion Newsmakers 2020: 62 The stars who created All the glamour and the maximum buzz 12 glitz from the FLYX Filmfare last year OTT Awards function Sunny Leone talks about 68 her LA sojourn Exclusives Anupam Kher feels every Awards Show Report: 72 day is your best day 20 Encapsulating all that happened at the FLYX Your say Filmfare OTT Awards Award Winners: Readers send in 26 Profiling the winners from 78 their rants the FLYX Filmfare OTT Shatrughan Sinha’s Awards 80 wacky witticisms 12 17 12 olivesatyourtable.in Olives at your table INDIA @olivesatyourtable.in Olives at your table INDIA The content of this promotion campaign publication represents the views of the author only and is his/her sole responsibility. The European Commission and the Consumers, Health, Agriculture and Food Executive Agency (CHAFEA) do not accept any responsibility for any use that may be made of the information it contains. -

![Here Are the Indian States That Drink, Smoke and Smoke up More Than Others. [Surprises Ahead]](https://docslib.b-cdn.net/cover/0510/here-are-the-indian-states-that-drink-smoke-and-smoke-up-more-than-others-surprises-ahead-6060510.webp)

Here Are the Indian States That Drink, Smoke and Smoke up More Than Others. [Surprises Ahead]

News Lifestyle Entertainment Health Videos Trending India Here Are The Indian States That Drink, Smoke And Smoke Up More Than Others. [Surprises Ahead] Kunal Anand 2.2k December 24, 2015 Shares A small pre-election raid in September this year saw 83,067 litres of illicit liquor seized in Bihar – and that was just the final phase of election polling. Considering that Nitish Kumar, part of the Bihar’s ruling faction had ambitiously declared the state to be dry one, there’s a crackdown on what will become a parallel alcohol economy once the 100% alcohol ban goes live. open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com But you can’t take the high out of India’s third largest state, which is India’s second biggest spender on ganja, according to the government’s National Sample Survey (July 2011 and June 2012) Here are India’s leaders when it comes to Alcohol (toddy, country liquor, foreign liquor, and beer), smoking (cigarettes), and getting high (ganja) Despite its reputation as a hyper educated state, Kerala finds prominent presence in the 'All Alcohol', 'Cigarettes' and 'Ganja' categories. open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com It may be surprising that urban metros like Delhi and Mumbai are not India's leaders when it comes to cigarette consumption. More surprisingly, Mizoram smokes a LOT - over a 100 Rupees per person every month on smoking! open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com reuters The North East, represented by Arunachal Pradesh and Sikkim, leads the 'All Alcohol' category, which is not surprising considering their fondness for locally brewed liquor. -

Hd Package Current Rates

HD PACKAGE CURRENT RATES FIRST TV @ ` 352.17 PM SUBSEQUENT 3 TV@ ` 282.61 P.M SR. NO. CHANNEL NAME CATEGORIES CURRENT AVAILABLITY 1 STAR PLUS HINDI ENTERTAINMENT YES 2 LIFE OK HINDI ENTERTAINMENT YES 3 SONY HINDI ENTERTAINMENT YES 4 COLORS HINDI ENTERTAINMENT YES 5 ZEE TV HINDI ENTERTAINMENT YES 6 SAB TV HINDI ENTERTAINMENT YES 7 RISHTEY HINDI ENTERTAINMENT YES 8 CHANNEL V HINDI ENTERTAINMENT YES 9 SONY PAL HINDI ENTERTAINMENT YES 10 BIG MAGIC HINDI ENTERTAINMENT YES 11 BINDASS HINDI ENTERTAINMENT YES 12 EPIC HINDI ENTERTAINMENT YES 13 BEST DEAL HINDI ENTERTAINMENT YES 14 STAR UTSAV HINDI ENTERTAINMENT YES 15 INVESTIGATION DISCOVERY HINDI ENTERTAINMENT YES 16 ZOOM HINDI ENTERTAINMENT YES 17 FOOD FOOD HINDI ENTERTAINMENT YES 18 ROMEDY NOW HINDI ENTERTAINMENT YES 19 SHOP CJ SHOPPING CHANNELS YES 20 HOMESHOPE 18 SHOPPING CHANNELS YES 21 NAAPTOL SHOPPING CHANNELS YES 22 HBN SHOPPING CHANNELS YES 23 PTC PUNJABI PUNJABI ENTERTAINMENT YES 24 A-PLUS PUNJABI ENTERTAINMENT YES 25 PTC CHAKDE PUNJABI ENTERTAINMENT YES 26 STAR WORLD ENGLISH ENTERTAINMENT YES 27 AXN ENGLISH ENTERTAINMENT YES 28 COLORS INFINITY ENGLISH ENTERTAINMENT YES 29 FX INDIA ENGLISH ENTERTAINMENT YES 30 COMEDY CENTRAL ENGLISH ENTERTAINMENT YES 31 NDTV GOOD TIMES ENGLISH ENTERTAINMENT YES 32 PUNJABI HITS PUNJABI MUSIC CHANNEL YES 33 MH 1 PUNJABI MUSIC CHANNEL YES 34 TADKA PUNJABI MUSIC CHANNEL YES 35 JOSH PUNJABI MUSIC CHANNEL YES 36 HULCHUL PUNJABI MUSIC CHANNEL YES 37 9X TASHAN PUNJABI MUSIC CHANNEL YES 38 LUDHIANA KHABARNAMA LOCAL KHABARNAMA YES 39 AMRITSAR KHABARNAMA LOCAL