November 30, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

November 30, 2020

PO Box 16391 San Diego, CA 92176 www.ktpg.org Special Public Meeting Minutes November 30, 2020 I. PARLIAMENTARY ITEMS o Via a virtual meeting held via the Zoom software application, the Special Public Meeting was called to order by Chair, David Moty, hosting the meeting. The meeting began at 6:33 pm. o Board members present – Brian Helmich, Ari Isaak, Daniele Laman, Fred Lindahl, David Moty, Carolyn Satter, Deborah Sharpe, Ralph Teyssier, Kelly Waggonner, Lisa Sinclair o Board members not present: Don Taylor; Joan Fitzsimons; Daniel Heller; Ken Horsley; Norma Clark o Audience members signed in: Gary Rosoff; Don Rosencrantz. City Officials signed in: Sonna Loando (of Councilmember Gomez’ office) and Jayme Anderson (of Nathan Fletcher’s office.) o Approval of Agenda: Having received no objections to the agenda, the agenda was accepted as presented by unanimous consent. o Approval of Minutes: The minutes of the regular November 2020 Board meeting shall be presented for approval at the January 2021 meeting. o Treasurer’s report: given by Lisa Sinclair, no changes from prior November meeting. II. COMMUNITY FORUM & NON-AGENDA COMMENT o Sanna Loando, representing District 9 Councilmember Georgette Gomez: . Reported on rental assistance program and current depleted funding with City of SD, but likely to be replenished and motion to be heard 12/8/20 by City Council. Reported on CIP issues and funding removal of palm trees from Fairmount to Collwood along south side of Montezuma, and permit fee waivers extending to 2021. (See attached 10-16-20 CIP Memo.) Jayme Anderson, representing SD County Board of Supervisor Nathan Fletcher’s Office . -

City Manager's Bi-Weekly Report November 30, 2018 David Biggs, City Manager

City Manager’s Bi-Weekly Report November 30, 2018 David Biggs, City Manager CITY MANAGER’S OFFICE Holiday Tree Lighting Santa is coming! It’s time for the City of Hercules annual Holiday Tree Lighting event this Sunday, December 2, from 5-7pm at the Community Swim Center. Help us welcome Santa and Mrs. Claus at 5:15pm as they light the tree. As usual, there will be activities, photo opportunities, light refreshments and entertainment for the entire family. We will also collect food, toys and gently used coats to help out those in need. This event is FREE to the community! We look forward to seeing you all on Sunday evening. City Council Reorganization On Tuesday, December 11th, the City Council will take action to certify the results of the November municipal election. Council Member Chris Kelley will be sworn in for a second term, and Dion Bailey will be seated for his first term on the City Council. Council Member Myrna de Vera will be recognized for her eight years of service on the City Council and prior service on the Planning Commission. The City Council will also select a new Mayor and Vice Mayor for the upcoming year. The City Council meeting will start at 7 PM with the reorganization matters being first on the agenda, followed by a break and reception to welcome those joining the Council and to say thank you to those departing and whose roles are changing. Energy Efficiency Kits Four hundred (400) households in the Bayside, Baywood, and Promenade neighborhoods took advantage of free energy efficiency kits which were made available to them by the City as former Hercules Municipal Utility (HMU) customers. -

Monday, November 30 Good Morning, I Hope Everyone Enjoyed a Wonderful Happy Thanksgiving Holiday. in These Challenging Times, We

Monday, November 30 Good morning, I hope everyone enjoyed a wonderful Happy Thanksgiving holiday. In these challenging times, we continue to see dedicated people go above and beyond to support their neighbors and communities. Thank you to everyone that is making a difference in our school community and beyond. Can you believe we only have three weeks of school before winter break? Time is flying! This week’s newsletter is a little lighter than normal. I’ve posted the Monday Message video for this week which includes some fun student challenges. Check it out if you have time. This week’s schedule: • Monday & Tuesday - Normal class schedule • Wednesday - Community Connection and Advisory meetings. • Thursday & Friday - Normal class schedule High school club rush - Next Wednesday, December 9th we will be holding a “club rush” immediately following our Advisory meetings. This is a great opportunity for our students to explore the new clubs. I’ll share additional information next week. Middle school electives - If your middle school student has not yet signed up for an elective, please ask them to complete the form as quickly as possible (even if they are not going to take an elective). Electives that are hosted by our Virtual Online Program staff will begin on this Wednesday, December 2. (UPDATED) Winter Blitz - This is a wonderful community service project I was involved in while I was at Clackamas High School. In 1997 two staff members at Clackamas High School created a community service project to support one family during the holidays. The idea was to do a one day scavenger hunt for a tree, food, gifts, clothes and household items. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

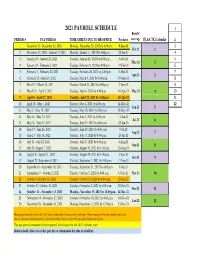

Payroll Calendar 2021

2021 PAYROLL SCHEDULE 1 Benefit PERIOD # PAY PERIOD TIME SHEETS DUE TO HR OFFICE Paydates coverage FLSA 7K Calendar 2 1 December 13- December 26, 2020 Monday, December 28, 2020 by 4:00 p.m. 8-Jan-21 3 Feb-21 1 2 December 27, 2020 - Janurary 9, 2021 Monday, January 11, 2021 by 4:00 p.m. 22-Jan-21 4 3 January 10 - January 23, 2021 Tuesday, January 26, 2021 by 4:00 p.m. 5-Feb-21 5 Mar-21 2 4 January 24 - February 6, 2021 Tuesday, February 9, 2021 by 4:00 p.m. 19-Feb-21 6 5 February 7 - February 20, 2021 Tuesday, February 26, 2021 by 4:00 p.m. 5-Mar-21 7 Apr-21 3 6 February 21 - March 6, 2021 Tuesday, March 9, 2021 by 4:00 p.m. 19-Mar-21 8 7 March 7 - March 20, 2021 Tuesday, March 23, 2021 by 4:00 p.m. 2-Apr-21 9 8 March 21 - April 3, 2021 Tuesday, April 6, 2021 by 4:00 p.m. 16-Apr-21 May-21 4 10 9 April 4 - April 17, 2021 Tuesday, April 20, 2021 by 4:00 p.m. 30-Apr-21 11 10 April 18 - May 1, 2021 Tuesday, May 4, 2021 by 4:00 p.m. 14-May-21 12 Jun-21 5 11 May 2 - May 15, 2021 Tuesday, May 18, 2021 by 4:00 p.m. 28-May-21 12 May 16 - May 29, 2021 Tuesday, June 1, 2021 by 4:00 p.m. 11-Jun-21 Jul-21 6 13 May 30 - June 12, 2021 Tuesday, June 15, 2021 by 4:00 p.m. -

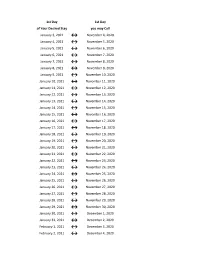

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

COVID-19 in Ontario: January 15, 2020 to November 30, 2020

Daily Epidemiologic Summary COVID-19 in Ontario: January 15, 2020 to November 30, 2020 This report includes the most current information available from CCM and other case management systems (CCM plus) as of November 30, 2020. Please visit the interactive Ontario COVID-19 Data Tool to explore recent COVID-19 data by public health unit, age group, sex, and trends over time. A weekly summary report is available with additional information to complement the daily report. This daily report provides an epidemiologic summary of recent COVID-19 activity in Ontario. The change in cases is determined by taking the cumulative difference between the current day and the previous day. Highlights There are a total of 118,199 confirmed cases of COVID-19 in Ontario reported to date. Compared to the previous day, this represents: An increase of 1,707 confirmed cases (percent change of -2.2%) An increase of 7 deaths (percent change of -12.5%) An increase of 1,373 resolved cases (percent change of +4.0%) In this document, the term ‘change in cases’ refers to cases publicly reported by the province for a given day. Data corrections or updates can result in case records being removed and or updated from past reports and may result in subset totals for updated case counts (i.e., age group, gender) differing from the overall updated case counts. The term public health unit reported date in this document refers to the date local public health units were first notified of the case. COVID-19 in Ontario: January 15, 2020 to November 30, 2020 1 Case Characteristics Table 1a. -

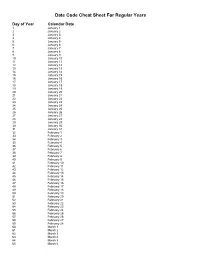

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

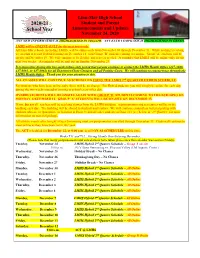

2020-21 School Year Announcements and Updates November 24, 2020

Linn-Mar High School Student and Parent 2020-21 School Year Announcements and Updates November 24, 2020 ANY NEW INFORMATION IS HIGHLIGHTED IN YELLOW . ANY EXTRA EMPHASIS IS HIGHLIGHTED IN GREEN. LMHS will be ONLINE-ONLY for the next two weeks: All Linn-Mar schools, including LMHS, will be online-only from November 30 through December 11. While nothing is certain, we do plan to restart Hybrid learning on December 14, with Group ‘B’ students coming to campus. Group ‘A’ students will be on-site on December 15. We will continue to be flexible and react as needed. A reminder that LMHS will be online-only for the next two weeks. A reminder will be sent out on Sunday, November 29. It is imperative during this two-week online-only period that parents continue to contact the LMHS Health Office (447-3080, 447-3081, or 447-3082) for all Exposures/Close Contacts and all Positive Cases. We will continue to contact trace through the LMHS Health Office. Thank you for your attention to this. ALL CLASSES WILL CONTINUE AS SCHEDULED USING THE LMHS 2nd QUARTER HYBRID SCHEDULE. For students who have been online-only, there will be no change. For Hybrid students, you will simply be online for each day during the two weeks instead of coming to school every other day. HYBRID STUDENTS WILL BE ONSITE AGAIN WITH GROUP ‘B’ STUDENTS COMING TO THE BUILDING ON MONDAY, DECEMBER 14. GROUP ‘A’ STUDENTS WILL BE ON-SITE ON DECEMBER 15. Many, but not all, teachers will be teaching classes from the LMHS building. -

Elementary Schedule for November 30 – Dec. 18Th

Elementary Schedule for November 30 – Dec. 18th Elementary Monday Tuesday Wednesday Thursday Friday Schools November 30 December 1 December 2 December 3 December 4 In-Person All Grades All Grades All Grades All Grades All Grades Learning Distance Learning Elementary Monday Tuesday Wednesday Thursday Friday Schools December 7 December 8 December 9 December 10 December 11 In-Person All Grades All Grades All Grades All Grades All Grades Learning Distance Learning Elementary Monday Tuesday Wednesday Thursday Friday Schools December 14 December 15 December 16 December 17 December 18 In-Person All Grades All Grades All Grades All Grades All Grades Learning Distance Learning CCMS Schedule for November 30 – December 18 Middle Monday Tuesday Wednesday Thursday Friday School November 30 December 1 December 2 December 3 December 4 In-Person All Grades All Grades All Grades All Grades Learning All Students All Students All Students All Students Distance All Grades Learning All Students Middle Monday Tuesday Wednesday Thursday Friday School December 7 December 8 December 9 December 10 December 11 In-Person All Grades All Grades All Grades All Grades Learning All Students All Students All Students All Students Distance All Grades Learning All Students Middle Monday Tuesday Wednesday Thursday Friday School December 14 December 15 December 16 December 17 December 18 In-Person All Grades All Grades All Grades All Grades Learning All Students All Students All Students All Students Distance All Grades Learning All Students CCHS Schedule for November 30 – December 18 High School Monday Tuesday Wednesday Thursday Friday November 30 December 1 December 2 December 3 December 4 In-Person 9th and 10th 11th and 12th 9th and 10th 11th and 12th 9th and 10th Learning grades grades grades grades grades Distance 11th and 12th 9th and 10th 11th and 12th 9th and 10th 11th and 12th Learning grades grades grades grades grades High School Monday Tuesday Wednesday Thursday Friday TESTING December 7 December 8 December 9 December 10 December 11 WEEK In-Person ENG. -

2021 Rezoning Review Schedule

City of Waukee | 2021 ZONING AMENDMENT REVIEW SCHEDULE APPLICATION STAFF APPLICANT PUBLIC P & Z P & Z COUNCIL COUNCIL COUNCIL COUNCIL DUE COMMENTS REVISIONS by HEARING SUBMITTAL MEETING SUBMITTAL MEETING MEETING MEETING by 5:00 p.m. SENT 5:00 p.m. DATE SET by 5:00 p.m. 6:00 p.m. by 5:00 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. [1st Consider.] [2nd Consider.] [3rd Consider.] (TUES.) (TUES.) (TUES.) (MON.) (THUR.) (TUES.) (WED.) (MON.) (MON.) (MON.) November 17 November 24 December 1 December 7 December 17 December 22 December 30 January 4 January 18 February 1 December 8 December 15 December 22 December 21 January 7 January 12 January 13 January 18 February 1 *February 16* December 22 December 29 January 5 January 4 January 21 January 26 January 27 February 1 *February 16* March 1 January 5 January 12 January 19 January 18 February 4 February 9 February 10 *February 16* March 1 March 15 January 19 January 26 February 2 February 1 February 18 February 23 February 24 March 1 March 15 April 5 February 2 February 9 February 16 *February 16* March 4 March 9 March 10 March 15 April 5 April 19 February 16 February 23 March 2 March 1 March 18 March 23 March 31 April 5 April 19 May 3 March 2 March 9 March 16 March 15 April 8 April 13 April 14 April 19 May 3 May 17 March 16 March 23 March 30 April 5 April 22 April 27 April 28 May 3 May 17 June 7 March 30 April 6 April 13 April 19 May 6 May 11 May 12 May 17 June 7 June 21 April 13 April 20 April 27 May 3 May 20 May 25 June 2 June 7 June 21 *July 6* April 27 May 4 May 11 May 17 June 3 June 8 June