Week 4: Ending January 29, 2021 S&P/TSX Composite Index Recap by the Sunday Investor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Management's Discussion and Analysis

Management’s Discussion and Analysis Table of Contents 4 At a Glance The following Management’s Discussion and Analysis (“MD&A”) for George Weston 5 Our Business Limited (“GWL” or the “Company”) should be read in conjunction with the audited annual consolidated financial statements and the accompanying notes on pages 89 8 Key Performance Indicators to 171 of this Annual Report. The Company’s audited annual consolidated financial Operating Segments statements and the accompanying notes for the year ended December 31, 2019 have 12 Loblaw been prepared in accordance with International Financial Reporting Standards (“IFRS” or “GAAP”) as issued by the International Accounting Standards Board (“IASB”). 14 Choice Properties The audited annual consolidated financial statements include the accounts of 16 Weston Foods the Company and other entities that the Company controls and are reported in 19 Financial Results Canadian dollars, except where otherwise noted. 76 Outlook Under GAAP, certain expenses and income must be recognized that are not necessarily reflective of the Company’s underlying operating performance. Non-GAAP financial 77 Non-GAAP Financial Measures measures exclude the impact of certain items and are used internally when analyzing 87 Forward-Looking Statements consolidated and segment underlying operating performance. These non-GAAP 88 Additional Information financial measures are also helpful in assessing underlying operating performance on a consistent basis. See Section 14, “Non-GAAP Financial Measures”, of this MD&A for more information on the Company’s non-GAAP financial measures. The Company operates through its three reportable operating segments, Loblaw Companies Limited (“Loblaw”), Choice Properties Real Estate Investment Trust (“Choice Properties”) and Weston Foods. -

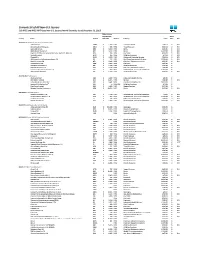

BMO Low Volatility Canadian Equity ETF (ZLB) Summary of Investment Portfolio • As at September 30, 2016

Quarterly portfolio disclosure BMO Low Volatility Canadian Equity ETF (ZLB) summary of investment portfolio • as at september 30, 2016 % of Net Asset % of Net Asset Portfolio Allocation Value Top 25 Holdings Value Financials ......................................................................25.4 Fairfax Financial Holdings Limited ............................................ 5.0 Consumer Staples .............................................................15.4 Dollarama Inc. ................................................................. 4.1 Real Estate ....................................................................12.0 Waste Connection, Inc. ........................................................ 3.7 Utilities ........................................................................11.7 Intact Financial Corporation ................................................... 3.6 Consumer Discretionary ......................................................10.3 Canadian REIT .................................................................. 3.6 Telecommunication Services .................................................. 8.1 BCE Inc. ......................................................................... 3.0 Information Technology ....................................................... 6.9 RioCan REIT ..................................................................... 2.9 Industrials ...................................................................... 3.7 Empire Company Limited, Class A ........................................... -

Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

Growth Potential of Stocks: Security of a GIC

BMO Financial Group BMO Growth GIC Growth potential of Stocks: Security of a GIC This medium term GIC allows you to participate in the growth of Canadian stocks with no risk to your principal investment. It offers the potential to generate returns based on the performance of a basket of 15 large Canadian companies. Is this GIC right for you? Product Features This GIC may be right for you if you: Term • are looking to diversify your portfolio with a medium term investment Minimum Investment • would like principal protection Maximum Rate of Return • are willing to forego a guaranteed return for the potential for the Term to earn higher market linked returns • can keep your money invested until the end of the term 100 % Principal protected Reference Portfolio Key Benefits This GIC is an excellent way for you to gain access to the Company (equally weighted) returns on a portfolio of 15 large Canadian companies with • Toronto-Dominion Bank (The) (TD) • Royal Bank of Canada (RY) the security of principal protection. • Canadian Imperial Bank of • George Weston Limited (WN) Commerce (CM) • Principal protection 100% of your original investment is • Nutrien Ltd. (NTR) returned to you at maturity • Bank of Nova Scotia (The) (BNS) • Canadian Tire Corp Ltd (CTC.A) • BCE Inc. (BCE) • Higher return potential based on the performance of a • Suncor Energy Inc. (SU) portfolio of Canadian stocks • Saputo Inc. (SAP) • Enbridge Inc. (ENB) • Designed in partnership with BMO Capital Markets®, a • National Bank of Canada (NA) • TransCanada Corporation (TRP) market -

Blg.Com Mergers & Acquisitions Mining United States United Kingdom Agribusiness

Steve Suarez Partner T 416.367.6702 Business Tax F 416.367.6749 International Tax Toronto Tax Disputes & Litigation [email protected] Mergers & Acquisitions Mining United States United Kingdom Agribusiness Steve works exclusively on income tax matters, focusing on mergers and acquisitions, inbound and outbound investment, corporate restructurings and audit management, and tax dispute resolution. He is the founder of Mining Tax Canada website, a website devoted to mining-related taxation issues. Experience Sterling Capital Brokers in its merger with Luedey Consultants Inc. to become one of the largest independent employee-owned benefit consulting firms in Canada. Epiroc Canada Holding Inc., a subsidiary of Epiroc Rock Drills AB, in its acquisition of 100% of MineRP Holdings Inc. from Dundee Precious Metals Inc. (TSX: DPM). BNY Mellon Wealth Management, Advisory Services, Inc. in its sale to Guardian Capital Group (TSX: GCG). SterlingCapitalBrokers Ltd. acquired all of the issued and outstanding shares of Riverview Insurance Solutions Inc. Virtu Financial (NASDAQ: VIRT), a leading provider of financial services and products that leverages cutting-edge technology, in its sale of MATCHNow marketplace to Cboe Global Markets. Canadian Premier Life Insurance Company in its acquisition of Gerber Life Insurance Company's Canadian insurance business from U.S.-based Western & Southern Financial Group. Berkshire Hathaway Energy Company ("BHE"), in its indirect share purchase acquisition of the Montana Alberta Tie-Line from Enbridge Inc. for an approximate purchase price of $200M. Atlas Copco AB on its divisive reorganization and spin-out of Epiroc AB. HollyFrontier Corporation in connection with its acquisition of Petro-Canada Lubricants Inc. from Suncor Energy. -

2018 Annual Report

2018 Annual Report George Weston Limited Footnote Legend (1) See Section 18, “Non-GAAP Financial Measures”, of the Company’s 2018 Management’s Discussion and Analysis. (2) For financial definitions and ratios refer to the Glossary beginning on page 174. (3) To be read in conjunction with “Forward-Looking Statements” beginning on page 4. (4) Certain current and comparative figures have been restated to present Continuing Operations at Loblaw as a result of Loblaw’s spin-out of Choice Properties. See note 5 in the Company’s 2018 annual consolidated financial statements. (5) Certain figures have been restated as a result of IFRS 15, “Revenue from Contracts with Customers” and a change in accounting policy. See note 2 in the Company’s 2018 annual consolidated financial statements. Financial Highlights 1 / Report to Shareholders 2 / Management’s Discussion and Analysis 3 / Financial Results 79 / Three Year Summary 172 / Glossary 174 / Corporate Directory 176 / Shareholder and Corporate Information 177 Financial Highlights(2) As at or for the years ended December 31 ($ millions except where otherwise indicated) 2018 2017(5) Consolidated Operating Results Sales $ 48,568 $ 48,289 Operating income 2,585 2,561 Adjusted EBITDA(i) 4,528 4,337 Depreciation and amortization(ii) 1,746 1,685 Net interest expense and other financing charges 948 523 Adjusted net interest expense and other financing charges(i) 762 555 Income taxes 639 449 Adjusted income taxes(i) 680 712 Net earnings 998 1,589 Net earnings attributable to shareholders of the Company(iii) -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Odgers Berndtson CFO Talent Report 2021

CFO Talent Report 2021 WHAT’S NEXT FOR FINANCE LEADERSHIP ODGERS BERNDTSON CFO PRACTICE THE CFO REPORT Over the past 16 years, Odgers Berndtson tracked CFO TALENT movements in CFO leadership and analyzed trends in demographics, tenure, education and other aspects of professional development to better understand how the REPORT 2021 composition of top CFOs is evolving. We also interviewed leaders from Canada’s top organizations, including WHAT’S NEXT Shopify, Celestica and George Weston Limited, in order to gain insight into how public companies are recruiting, FOR FINANCE managing succession planning and developing their LEADERSHIP finance talent for the future. What we continue to see is that the growing demand The CFO role has never been more critical or more in for strategic acumen, transformational capabilities and demand — and yet the gap continues to grow between balanced oversight of an ever-expanding portfolio has what companies want in their CFOs and their ability to made the CFO role one of the most demanding and critical recruit and develop these top finance leaders. roles in the C-suite, and also increasingly harder to fill. Canada is in the midst of a CFO talent crunch and our new Chief Financial Officers have been thrust into the spotlight report explores what organizations can do about it. to help their companies adjust to market conditions, reinvent outdated business models or simply ensure enough liquidity to survive. To be successful, today’s finance leaders must quickly move beyond the numbers Succession planning is and understand the key levers to creating value across the more important than ever business and driving growth. -

Loblaw President Vicente Trius to Speak at the Scotiabank Back to School Conference

Loblaw President Vicente Trius to speak at the Scotiabank Back to School Conference BRAMPTON, Ontario (September 9, 2013) - Loblaw Companies Limited (TSX: L) will be participating in the Scotiabank Global Banking and Markets Back to School Conference: Focus on the Consumer on Tuesday, September 17, 2013. The conference will be held at The Ritz-Carlton hotel in Toronto. Vicente Trius, President of Loblaw Companies Limited will be presenting at 11:40 a.m. (ET). The audiocast can be accessed on the day of the conference through the following link: http://event.on24.com/r.htm?e=673812&s=1&k=BC2008AA60683863913983786159908E. This link will be available for three months following the conference. The presentation slides and link to the webcast will also be available on loblaw.ca in the Investor Centre. About Loblaw Companies Limited Loblaw Companies Limited, a subsidiary of George Weston Limited, is Canada's largest food retailer and a leading provider of drugstore, general merchandise and financial products and services. Loblaw is one of the largest private sector employers in Canada. With more than 1,000 corporate and franchised stores from coast to coast, Loblaw and its franchisees employ approximately 134,000 full-time and part-time employees. Through its portfolio of store formats, Loblaw is committed to providing Canadians with a wide, growing and successful range of products and services to meet the everyday household demands of Canadian consumers. Loblaw is known for the quality, innovation and value of its food offering. It offers Canada's strongest control (private) label program, including the unique President's Choice®, no name® and Joe Fresh® brands. -

Alphabetical Listing by Company Name

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2015 Alphabetical Listing by Company Name COMPANY COUNTRY MARKET 21 Vianet Group Inc. Cayman Islands Global Market 37 Capital Inc. Canada OTC 500.com Ltd. Cayman Islands NYSE 51Job, Inc. Cayman Islands Global Market 58.com Inc. Cayman Islands NYSE ABB Ltd. Switzerland NYSE Abbey National Treasury Services plc United Kingdom NYSE - Debt Abengoa S.A. Spain Global Market Abengoa Yield Ltd. United Kingdom Global Market Acasti Pharma Inc. Canada Capital Market Acorn International, Inc. Cayman Islands NYSE Actions Semiconductor Co. Ltd. Cayman Islands Global Market Adaptimmune Ltd. United Kingdom Global Market Adecoagro S.A. Luxembourg NYSE Adira Energy Ltd. Canada OTC Advanced Accelerator Applications SA France Global Market Advanced Semiconductor Engineering, Inc. Taiwan NYSE Advantage Oil & Gas Ltd. Canada NYSE Advantest Corp. Japan NYSE Aegean Marine Petroleum Network Inc. Marshall Islands NYSE AEGON N.V. Netherlands NYSE AerCap Holdings N.V. Netherlands NYSE Aeterna Zentaris Inc. Canada Capital Market Affimed N.V. Netherlands Global Market Agave Silver Corp. Canada OTC Agnico Eagle Mines Ltd. Canada NYSE Agria Corp. Cayman Islands NYSE Agrium Inc. Canada NYSE AirMedia Group Inc. Cayman Islands Global Market Aixtron SE Germany Global Market Alamos Gold Inc. Canada NYSE Alcatel-Lucent France NYSE Alcobra Ltd. Israel Global Market Alexandra Capital Corp. Canada OTC Alexco Resource Corp. Canada NYSE MKT Algae Dynamics Corp. Canada OTC Algonquin Power & Utilities Corp. Canada OTC Alianza Minerals Ltd. Canada OTC Alibaba Group Holding Ltd. Cayman Islands NYSE Allot Communications Ltd. Israel Global Market Almaden Minerals Ltd. -

Speaker Biographies

Speaker Biographies Catherine Anderson Bringing her business acumen and nearly a Jill Krop as a veteran Canadian journalist has a wealth of decade of retail experience overseeing operations and strategy, experience to draw on as the host of Unfiltered, Global BC’s Catherine Anderson’s track record of evaluating and capitalizing evening talk show on BC1. Over the course of her 27 year career, upon growth opportunities through sound, scalable operations Jill has covered major breaking events, including anchoring the positions her as a well-regarded retail leader whose perspective live evening coverage of 9/11 and the 2011 Stanley Cup riot. She is in demand for retailers looking to grow. She utilized this has interviewed politicians, actors, athletes, rock stars and reputation to develop the role of Principal at Stalwart Advisors, "everyday" people. After being interviewed by Jill in his where she counseled retailers with growth aspirations. Catherine Saltspring Island home, renowned Canadian artist Robert previously held a variety of leadership roles at Aritzia, including Bateman said, “That didn’t feel like an interview – it felt like a Director of Business Development and VP of Store Development. conversation.” She was a driving force for the company’s growth, a women’s fashion apparel retailer based in Vancouver, which grew from a Jeff Lucas is a true strategist at marketing and advertising, Jeff national player to a highly profitable international success story. leads, develops and implements marketing programs for Catherine has recently taken on a new role overseeing real celebrated clients like Hyundai Canada, COBS Bread, Newcap estate and construction for Starbucks as Director of Store Radio (various stations), BC Government’s Ministry of Health, Development, Western Canada. -

Current List of All Non-U.S. Issuers 515 NYSE and NYSE MKT-Listed Non-U.S

Current List of All Non-U.S. Issuers 515 NYSE and NYSE MKT-listed non-U.S. Issuers from 46 Countries (as of December 31, 2015) Global Market Capitalization Share Country Issuer † Symbol ($M USD) Market Industry Listed Type IPO #N/A 12/31/2015 ARGENTINA (10 ADR Issuers and 4 non-ADR Issuers ) Adecoagro S.A. AGRO $ 1,487 NYSE Consumer Goods 1/28/11 O IPO Arcos Dorados Holdings Inc. ARCO $ 655 NYSE Travel & Leisure 4/14/11 O IPO Banco Marco S.A. BMA $ 3,339 NYSE Banks 3/24/06 A IPO BBVA Banco Francés S.A. BFR $ 3,414 NYSE Banks 11/24/93 A IPO Empresa Distribuidora y Comercializadora Norte S.A. (Edenor) EDN $ 795 NYSE Electricity 4/26/07 A IPO GeoPark Limited GPRK $ 155 NYSE Oil & Gas Producers 2/7/14 O IPO Globant S.A. GLOB $ 1,276 NYSE Software & Computer Services 7/18/14 O IPO IRSA-Inversiones y Representaciones, S.A. IRS $ 712 NYSE Real Estate Investment & Services 12/20/94 A IPO Nortel Inversora S.A. NTL $ 2,032 NYSE Fixed Line Telecommunications 6/17/97 A IPO Pampa Energia S.A. PAM $ 1,394 NYSE Electricity 10/9/09 A Petrobras Argentina S.A. PZE $ 1,119 NYSE Oil & Gas Producers 1/26/00 A Telecom Argentina S.A. TEO $ 3,115 NYSE Fixed Line Telecommunications 12/9/94 A Transportadora de Gas del Sur, S.A. TGS $ 968 NYSE Oil Equipment, Services & Distribution 11/17/94 A YPF Sociedad Anónima YPF $ 6,183 NYSE Oil & Gas Producers 6/29/93 A IPO AUSTRALIA (6 ADR Issuers ) Alumina Limited AWC $ 2,420 NYSE Industrial Metals & Mining 1/2/90 A BHP Billiton Limited BHP $ 65,005 NYSE Mining 5/28/87 A IPO James Hardie Industries N.V.