Mine Infrastructure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LEGISLATIVE COUNCIL Question on Notice

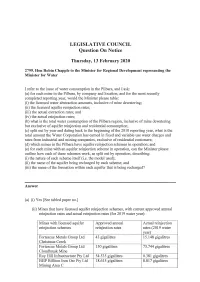

LEGISLATIVE COUNCIL Question On Notice Thursday, 13 February 2020 2799. Hon Robin Chappie to the Minister for Re ional Development representing the Minister for Water I refer to the issue of water consumption in the Pilbara, and I ask: (a) for each mine in the Pilbara, by company and location, and for the most recently completed reporting year, would the Minister please table: (i) the licensed water abstraction amounts, inclusive of mine dewatering; (ii) the licensed aquifer reinjection rates; (iii) the actual e traction rates; and (i ) the actual reinjection rates; (b) what is the total water consumption of the Pilbara region, inclusive of mine dewatering but exclusive of aquifer reinjection and residential consumption; (c) split out by year and dating back to the beginning of the 2010 reporting year, what is the total amount the Water Corporation has earned in fixed and variable use water charges and rates from industrial and mining companies, exclusi e of residential customers; (d) which mines in the Pilbara have aquifer reinjection schemes in operation; and (e) for each ine with an aquifer reinjection scheme in operation, can the Minister please outline how each of these schemes work, as split out by operation, describing: (i) the nature of each scheme itself (i.e. the model used); (ii) the name of the aquifer being recharged by each scheme; and (iii) the name of the formation within each aquifer that is being recharged? Answer (a) (i) Yes [See tabled paper no.] (ii) Mines that have licensed aquifer reinjection schemes, with current -

Welcome to Cloudbreak

Welcome to Cloudbreak This booklet provides you with the information needed to help make your stay at Cloudbreak more pleasant. Please take the time to read through the information before arriving on site. FEBRUARY 2009 Table of Contents Welcome Message ........................................................................................... 1 Foreword ..................................................................................................... 1 PART ONE: Before you depart ......................................................................... 2 The Pilbara ....................................................................................................... 3 Fortescue Metals Group Limited ...................................................................... 3 Cloudbreak....................................................................................................... 3 Packed and ready to go .................................................................................... 4 At the departure lounge ............................................................................... 4 Parking at Perth Airport ............................................................................... 5 Staying in touch ............................................................................................... 5 On Arrival ......................................................................................................... 5 At the Airstrip .............................................................................................. -

Australian Government Takeovers Panel Index of Reasons By

Australian Government Takeovers Panel Index of Reasons By Legislation 2000 – 30 June 2019 Takeovers Panel Index of published reasons - By legislation - 2000 to 30 June 2019 The information in this index is current as at 30 June 2019. This index is provided by the Panel for the general assistance of parties and the public. It makes no representation or warranty as to the accuracy of the information contained in the index. The Panel will update the index from time to time. If you have any suggestions in terms of improving the index, please email [email protected] Corporations Act s9 'Panel Proceedings' GoldLink IncomePlus Limited 04R [2009] ATP 3, [11] s9 'Relevant Agreement' Isis Communications Limited [2002] ATP 10 Winepros Limited [2002] ATP 18, [26] World Oil Resources Limited [2013] ATP 1, [52] Touch Holdings Limited [2013] ATP 3 Merlin Diamonds Limited [2016] ATP 18, [34] Molopo Energy Limited 01 & 02 [2017] ATP 10, [49 Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12, [53] s9 'Voting Share' The President's Club Limited [2012] ATP 10, [77] Condor Blanco Mines Limited [2016] ATP 8, [34] s9 'Remedial Order' Molopo Energy Limited 03R, 04R & 05R [2017] ATP 12, [280], footnote 80 s11 Molopo Energy Limited 01 & 02 [2017] ATP 10, [53(a)] s12 Taipan Resources NL 03 [2000] ATP 17, [72]-[79] (Corp Law 12) Winepros Limited [2002] ATP 18 Anzoil NL 01 [2002] ATP 19, [52]-[60] Aztec Resources Limited [2006] ATP 28, [37]-[41] BigAir Group Limited [2008] ATP 12 Mesa Minerals Limited [2010] ATP 4, [41] CMI Limited [2011] ATP 4 CMI Limited -

Atlas Iron Limited 67

David Flanagan Atlas Iron Limited 67 ASX Small to Mid Caps Conference Hong Kong 2008 Disclaimer This presentation has been prepared by Atlas Iron Limited (“Atlas” or the “Company”). It should not be considered as an offer or invitation to subscribe for or purchase any securities in the Company or as an inducement to make an offer or invitation with respect to those securities. No agreement to subscribe for securities in the Company will be entered into on the basis of this presentation. This presentation contains forecasts and forward looking information. Such forecasts, projections and information are not a guarantee of future performance, involve unknown risks and uncertainties. Actual results and developments will almost certainly differ materially from those expressed or implied. There are a number of risks, both specific to Atlas and of a general nature which may affect the future operating and financial performance of Atlas and the value of an investment in Atlas including and not limited to economic conditions, stock market fluctuations, iron ore demand and price movements, timing of access to infrastructure, timing of environmental approvals, regulatory risks, operational risks, reliance on key personnel, reserve and resource estimations, native title and title risks, foreign currency fluctuations, and mining development, construction and commissioning risk. You should not act or refrain from acting in reliance on this presentation material. This overview of Atlas does not purport to be all inclusive or to contain all information which its recipients may require in order to make an informed assessment of the Company’s prospects. You should conduct your own investigation and perform your own analysis in order to satisfy yourself as to the accuracy and completeness of the information, statements and opinions contained in this presentation before making any investment decision. -

Australian Mining League Table –

Australian Mining League table – Q1 2014 Australian Mining League table – Q1 2014 Position Market Capitalisation Differe Differenc Q1 2014 Q4 2013 nce e Moving into the Company Q1 Q4 Moveme ($A ($A ($A 2014 2013 nt million) million) (%) million) top 25: BHP Billiton Limited (ASX:BHP) 1 1 194,149.9 202,204.3 -4.0% (8,054.4) • Western Areas in at 22 up from 32 Rio Tinto Ltd. (ASX:RIO) 2 2 117,516.2 126,029.9 -6.8% (8,513.7) Fortescue Metals Group Limited 3 3 16,347.4 18,122.3 -9.8% (1,774.9) • OceanaGold in at (ASX:FMG) 25 up from 30 Alcoa Inc. (NYSE:AA) 4 4 14,963.6 12,713.2 17.7% 2,250.4 Newcrest Mining Limited (ASX:NCM) 5 5 7,575.6 5,971.7 26.9% 1,603.9 AngloGold Ashanti Ltd. (JSE:ANG) 6 6 7,547.4 5,270.4 43.2% 2,277.0 Iluka Resources Ltd. (ASX:ILU) 7 7 4,140.0 3,599.3 15.0% 540.7 Washington H. Soul Pattinson and 8 8 3,717.8 3,497.6 6.3% 220.2 Company Limited (ASX:SOL) Alumina Ltd. (ASX:AWC) 9 9 3,353.4 3,128.9 7.2% 224.5 New Hope Corporation Limited 10 10 2,484.5 2,766.5 -10.2% (282.0) (ASX:NHC) Arrium Limited (ASX:ARI) 11 11 1,831.3 2,371.6 -22.8% (540.3) Whitehaven Coal Limited 12 12 1,697.5 1,959.1 -13.4% (261.6) (ASX:WHC) Regis Resources Limited (ASX:RRL) 13 13 1,134.4 1,454.1 -22.0% (319.7) Moving out of the OZ Minerals Limited (ASX:OZL) 14 18 1,080.3 954.7 13.2% 125.6 top 25: Mount Gibson Iron Limited 15 14 992.4 1,106.9 -10.3% (114.5) (ASX:MGX) • Yancoal at 36 Aquila Resources Limited 16 19 963.0 947.1 1.7% 15.9 down from 24 (ASX:AQA) PanAust Limited (ASX:PNA) 17 15 961.7 1,075.7 -10.6% (114.0) • BC Iron in at 30 down from 25 Independence Group NL (ASX:IGO) 18 22 912.3 725.6 25.7% 186.7 Sandfire Resources NL (ASX:SFR) 19 17 908.9 1,005.4 -9.6% (96.5) Atlas Iron Limited (ASX:AGO) 20 16 892.6 1,052.8 -15.2% (160.2) Alacer Gold Corp. -

20130627 D107351

Ref: O10_0347 Submission to the Economic Regulation Authority – Floor and ceiling costs proposed by The Pilbara Infrastructure (TPI) 11 June 2013 FLOOR AND CEILING COSTS PROPOSED BY THE PILBARA INFRASTRUCTURE (TPI) TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ....................................................................................................................... 2 2. CONTEXT AND PURPOSE ................................................................................................................... 2 1. Context .......................................................................................................................................... 2 2. Purpose........................................................................................................................................... 3 3. REQUIREMENTS OF THE CODE ........................................................................................................... 4 4. COMMENTS ON COSTS PROPOSED BY TPI ....................................................................................... 5 1. TPI failure to provide costs for proposed access ................................................................... 5 2. TPI failure to provide Costing Model or supporting information ......................................... 5 3. Factors to be considered in an assessment of costs ............................................................. 6 5. BROCKMAN’S ASSESSMENT OF COSTS FOR THE ROUTE .................................................................. 7 6. COMPARISON -

12 December 2010

14 November 2012 96 Ewing Street, Welshpool WA 6106 PO Box 625 Welshpool DC WA 6986 P: (08) 9351 8488 | F: (08) 9351 8477 | E: [email protected] ____________________________________________________________________________________________________ Notices of Award Atlas Iron – Abydos DSO Project ____________________________________________________________________________________________________ MACA Limited (‘MACA’) (ASX: MLD) is pleased to announce that it has received two Notices of Award from Atlas Iron Limited (‘Atlas’) (ASX: AGO) in relation to its Abydos DSO (Direct Shipping Ore) Hematite Iron Ore project in the Pilbara region of Western Australia. Mining Services MACA will provide civil infrastructure works and open pit mining services including drilling and blasting, and loading and hauling. Mobilisation to site is due to commence later this month with operations to commence in early December 2012. Crushing Services The Crushing services to be carried out by MACA involve crushing and screening of an ‘all in’ product. MACA anticipates crushing will commence in June 2013. The two proposed contracts, in aggregate, are expected to generate revenues of circa $200 million over a period of approximately 36 months commencing December 2012 (Mining) and June 2013 (Crushing). MACA is currently providing mining services and crushing services to Atlas at its Pardoo mine and has also recently mobilised to Atlas’ Mt Dove mine where it is providing similar services. MACA Civil is also in the process of completing civil works at Mt Dove. Operations Director, Geoff Baker said “We are delighted to have been awarded a further two contracts with Atlas, building on the existing relationship with Atlas at its Pardoo and Mt Dove operations. We look forward to continuing to support Atlas with their growth objectives. -

Atlas Iron Limited September 2011

QUARTERLY REPORT ATLAS IRON LIMITED SEPTEMBER 2011 25 October 2011 HIGHLIGHTSFOR THE SEPTEMBER 2011 QUARTER . 1.465 Mt (WMT) shipped during the September 2011 quarter, consistent with the June 2011 quarter. Maiden dividend of 3 cents per share paid post quarter end following maiden annual profit announced during the quarter . Atlas achieved an average price per tonne for its product of ~ USD 152/t CFR (DMT) . Unaudited notional cash operating costs (FOB, excluding royalties) remain consistent with guidance of $42-45/t range for the 2012 financial year . $373 million cash on hand at 30 September 2011. $390 million cash on hand at 21 October 2011 after payment of $26.6 million in dividends post quarter end . Atlas’ successful off-market takeover offer of FerrAus Limited closed on 5 October 2011 with Atlas moving to compulsory acquisition on 6 October 2011 . DSO Resources at the end of the September 2011 quarter stand at 1.035Bt at 56.3%Fe . Atlas is on target to continue to ship at a rate of approximately 1.5Mt in the December 2011 quarter (6Mtpa) . Wodgina expansion commenced and initial payments of $23.1 million made to Global Advanced Metals, as part Wodgina infrastructure access agreement announced in May 2011 . $18.7 million strategic investment in Brazilian iron ore explorer and developer, Centaurus Metals (ASX Code: CTM) completed . Horizon 1 Strategy feasibility studies (inclusive of rail analysis) is expected to completed by 31 March 2012 “This has been a massive period for Atlas. The team have delivered on production targets within cost guidance, announced our first profit, paid a maiden dividend, achieved the takeover of FerrAus, completed 45,000 metres of drilling, advanced delivery of our growth projects and grew DSO resources to over 1 billion tonnes,” commented Atlas Managing Director, David Flanagan. -

Atlas Iron Limited June 2010

JUNE 2010 QUARTERLY REPORT 28 JULY 2010 HIGHLIGHTS FOR THE JUNE 2010 QUARTER Mining commences at Wodgina. Atlas is on track to more than quadruple Pilbara iron ore exports to a 6Mtpa rate by December 2010. 173,557 WMT shipped. 322,686 ore tonnes processed. 283,114 ore tonnes mined. Improved costs at Pardoo as production ramps up. Hercules prospect discovered at Wodgina. Maiden Inferred resource on the Wishbone deposit at the Warrawanda Project, south east Pilbara. $63.5 million fund raising completed in May 2010 to fast track ramp up of DSO production to benefit from strong market demand. $155.2 million of cash on hand at 30 June 2010. Subsequent to the end of the quarter: commissioning of the Wodgina crushing and screening facility was completed, with ore production expected to commence in mid- August. JUNE 2010 QUARTERLY REPORT Page 1 of 9 QUARTERLY REPORT ATLAS IRON LIMITED JUNE 2010 OPERATIONS PRODUCTION Table 1: Mine Production 12 June March Variance Variance Months to Quarter Quarter Quarter Quarter June 30 10 (t) 10 (t) (t) (%) (t) Ore Tonnes Mined 283,114 389,703 -106,589 -27% 1,239,813 Ore Tonnes Processed 322,686 335,155 -12,469 -4% 1,258,683 Ore Tonnes Shipped (Dry) 164,706 326,521 -161,815 -50% 1,109,159 Table 2: Inventory June March Variance Variance Quarter 10 (t) Quarter 10 (t) Quarter (t) Quarter (%) Run of Mine Ore Stocks 42,647 71,936 -29,289 -41% Final Product Stocks - Site 34,691 63,782 -29,091 -46% Final Product Stocks - Port 242,152 101,766 140,386 138% Mining during the quarter at Pardoo focussed on pit development and waste mining at the South Limb and Alice East as the site prepares for expanded production leading up to the end of the calendar year. -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

The Mineral Industry of Australia in 2007

2007 Minerals Yearbook AUSTRALIA U.S. Department of the Interior December 2009 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing Constitution belong to the States and Territories. All powers that countries and ranked among the top 10 countries in the world in relate to mineral resources and their production belong to the the production of bauxite, coal, cobalt, copper, gem and near- States and Territories. Except for the Australian Capital Territory gem diamond, gold, iron ore, lithium, manganese ore, tantalum, (that is, the capital city Canberra and its environs), all Australian and uranium. Reflecting an increase in world demand for States and Territories have identified mineral resources and mineral commodities, the Australian economy grew at a rate of established mineral industries. 3.9% during 2007. Owing to anticipated higher prices of mineral The Mineral Council of Australia (MCA) urged the Federal commodities in the world markets, the Australian economy Government to establish a nationwide project approval process continued expanding and, as a result, surplus productive that would be consistent across all jurisdictions to reduce capacity was expected in the future. Owing to an increase in regulatory burdens that were affecting the mineral sector. In domestic demand and a tightening in the labor market, the addition, 10 principal statutes govern occupational health and consumer price index increased by 4.2% in 2007. safety in Australia, and, according to the MCA, this multilayer Australia’s total mineral exploration spending, excluding regulatory regime imposes a significant administrative burden petroleum, was $1,751.9 million (A$2,061.1 million) in 2007. -

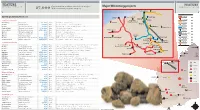

Feature Feature Major Wa Mining Projects

FEATURE FEATURE MINING OUTLOOK Construction workers needed for major Major WA mining projects MINING OUTLOOK 27,000 WA resources projects 2014-15 Source: Pitcrew Port Hedland Pardoo Rio Tinto rail MAJOR WA MINING PROJECTS Dampier Cape Lambert Iron Bridge Mt Dove Rio Tinto mine Completed in past year Balla Balla Abydos (Forge Resources) BHP rail Karara Mining Karara project $2.6bn Mid West Production ramp-up proceeding Sino Iron Wodgina Rio Tinto Hope Downs 4 mine $2.1bn Pilbara First production in H1 2013, ramping up to 15mtpa BHP mine Rio Tinto Marandoo mine expansion $1.1bn Pilbara Production will be sustained at 15mtpa for 16 further years Mt Webber McPhee Creek FMG rail Fortescue Metals Christmas Creek 2 expansion $US1.0bn Pilbara Completed in June 2013 quarter Fortescue Metals Port Hedland port expansion $US2.4bn Pilbara Fourth berth and support infrastructure opened in Aug 2013 Pannawonica FMG mine Atlas Iron Mt Dove mine development n/a Pilbara Production commenced in Dec 2012 Hancock proposed rail Atlas Iron Abydos mine development n/a Pilbara First haulage in Aug 2013, ramping up to 2-3mtpa Solomon Atlas Iron Utah Point 2 stockyard n/a Pilbara Largely complete and now ready to receive ore Hancock mine Hub Christmas Creek Rio Tinto Argyle Diamonds underground mine $US2.2bn Kimberley Production commenced in H1 2013 and is ramping up Buckland (Iron Ore Holdings) Cloudbreak Mineral Resources Sandfire Resources DeGrussa copper mine $US384m Mid West Ramp-up to nameplate production nearing completion Koodaideri Roy Hill Atlas Iron Construction