Bankinter, S.A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Outlooks on Five Spanish Financial Groups and Three European Bank Branches Revised Following Outlook Revision on Spain

Outlooks On Five Spanish Financial Groups And Three European Bank Branches Revised Following Outlook Revision On Spain Primary Credit Analyst: Elena Iparraguirre, Madrid (34) 91-389-6963; [email protected] Secondary Contacts: Luigi Motti, Madrid (34) 91-788-7234; [email protected] Carlos Cobo, Madrid +34 91 788 72 32; [email protected] Fabio Mostacci, Madrid +34 91 788 72 09; [email protected] Alexander Ekbom, Stockholm (46) 8-440-5911; [email protected] Nigel Greenwood, London (44) 20-7176-7211; [email protected] Thierry Grunspan, Paris (33) 1-4420-6739; [email protected] E.Robert Hansen, CFA, New York (1) 212-438-7402; [email protected] • On Nov. 29, 2013, Standard & Poor's revised the outlook on the long-term sovereign credit rating on Spain to stable from negative. • Spanish banks continue to rebalance their funding profiles. They are reducing their reliance on funding from the ECB and foreign sources, increasing the weight of more stable domestic retail funding in the mix, and sharply reducing the cost of domestic deposits. We expect this trend to continue, particularly in the context of stabilizing sovereign creditworthiness. • We now see a stable trend for industry risk in Spain. We continue to view the trend for economic risk as stable. • We are revising to stable from negative the outlooks on four Spanish banking groups and three branches of European banks, and to positive from stable the outlook on one institution. We are maintaining negative outlooks on six other Spanish banking groups. • In three cases, the stable outlooks reflect the diminishing likelihood of a rating downgrade as risks in the operating environment in Spain are abating. -

UBS Investment Research Post-Crisis Banking

!"# Global Equity Research Global UBS Investment Research Banks Post-crisis banking Equity Strategy Basel III proposal 17 December 2009 ! Consultation paper www.ubs.com/investmentresearch Today, the Basel Committee for Bank Supervision published a consultation paper on financial regulatory reforms that set out to enhance capital and liquidity standards. The consultation paper is subject to an impact assessment and at this stage lacks definitive quantifications. Philip Finch Analyst ! Key proposals [email protected] Proposed changes to financial regulations include: 1) a capital ratio based on +44-20-7568 3456 common equity and retained earnings (excluding hybrids and DTAs); 2) an Peter Carter introduction of a leverage ratio based on a harmonised definition; 3) a 30-day Analyst liquidity ratio; 4) counter-cyclical buffers; and 5) a new risk weighting to reflect [email protected] counter-party risk. +44 20 7568 4043 ! Potential timeframe The proposed measures are subject to an impact assessment to be carried out in the first half of 2010. Feedback on the consultative documents should be submitted by 16 April 2010. The implementation deadline is year-end 2012, although extended transition arrangements might be permitted. ! Initial conclusion While the proposed framework appears to be robust and comprehensive, regulatory uncertainty will likely persist, given the absence of definitive quantifications, and could continue to weigh on sector growth and risk appetite. As such, we maintain our preference for banks that are well capitalised and strongly funded. Following coverage initiation, we add BAC to our preferred list. This report has been prepared by UBS Limited ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 8. -

M·Bkt'06 Ing V2

CUBIERTAS DEF INGLES 4/5/07 11:34 Página 1 3,981 ideas 2006 365 days thinking about quality 3,981originators of ideas Business ReportBusiness 2006 Business Report Bankinter SA Paseo de la Castellana, 29 28046 Madrid T. +34 913 397 500 F. +34 913 398 323 Telex. 42760 BANKI E Swift: BKBK ES MM www.bankinter.com ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 1 Business Report 2006 ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 2 Profit before tax Net pre Millions of euros Millions of +19.2% Growth with profitability 265 316 2005 2006 ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 3 Net present value* Millions of euros 2006 2,627 Growth in value 2005 2004 +19.8% 2,192 1,931 *Procedure for calculating the present value of a given number of future cash flows. ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 4 Employees Bankint More Sh talent Now 3,981 A year ago 3,712 +7.3% ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 5 Bankinter Shares Share price appreciation +27.2% Share return up by 29.9% 2006 59.6 2005 46.9 ANUAL 1-15-ING.qxd 4/5/07 08:14 Página 6 Bankinter 2006 Business Report Bankinter 200 Group financial highlights 6 Group financia Group financial highlights 2005 2006 06/05 (%) Balance Sheet (thousands of euros) Share da Total assets 40,786,010 46,075,769 12.97 EPS, Ear Loans and receivables 26,139,388 31,653,807 21.10 DPS, Div Loans and receivables PER, Pric ex-mortgage securitisation 29,408,537 34,416,012 17.03 Price/car Customer funds 27,476,959 32,683,580 18.95 EPS, Ear Off-balance sheet-managed funds 11,066,305 11,499,765 3.92 of which: mutual and pension funds 9,573,018 -

Análisis 5-Abr.-16 Carteras Modelo Españolas

Análisis 5-abr.-16 Carteras modelo españolas La siguiente tabla ofrece la evolución de las carteras modelo Evol. C.M. 20-Ibex35 (ene.'96/abr.'16) comparadas con el Ibex 35 del 14-mar-16 al 4-abr-16: 1000% Var. Mes Var. Año Dif año Ibex35 CARTERA 20 VALORES Ibex35 800% C.Mod. Ampliada -6,0% -9,7% 0,2% C.Mod. Media -6,3% -9,7% 0,2% 600% C.Mod. Simplificada -4,7% -5,2% 4,7% 400% IBEX 35 -6,0% -9,9% n/a 200% Las tablas siguientes muestran la evolución de los valores que integran las carteras modelo españolas durante el pasado mes: 0% Cartera modelo ampliada 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 14-marzo 04-abril CM 20 valores: Cambios abril Rbd. x div Rbd. x div C. ampliada Peso % Var.Mes Peso Beta Entran Cambian Peso (1) C. ampl. (1) Salen Telefonica 6 -7,44% 8,1% Telefonica 6 1,36 8,2% Gas Natural +3 Mapfre -3 Lingotes +3 Lingotes Especiales SA2 -0,49% 4,9% Lingotes Especiales5 SA -0,02 4,9% Popular -6 BBVA 7 -12,15% 6,6% BBVA 7 1,09 6,7% Ferrovial +1 Popular 9 -20,11% 3,7% Popular 3 1,49 3,8% Santander -2 Enagas 4 -0,66% 6,1% Enagas 4 0,81 6,0% Amadeus +4 Sabadell -4 CaixaBank 4 -11,30% 6,4% CaixaBank 4 0,99 6,4% Red Eléctrica +1 Inditex +1 ACS 4 2,57% 4,4% ACS 4 1,5 4,5% Iberdrola +1 AENA +1 CIE Automotive SA 8 1,95% 2,2% CIE Automotive SA8 0,75 2,2% CM 20 valores vs Ibex en 2016 Mapfre 3 -9,18% 7,2% Gas Natural 3 0,84 5,8% 10% Cartera Ibex35 Ferrovial 2 1,52% 3,4% Ferrovial 3 0,78 3,4% 5% Santander 7 -16,24% 5,4% Santander 5 1,35 5,5% 0% Banco Sabadell 10 -10,75% 3,2% Banco Sabadell 6 0,86 3,3% -5% Inditex 5 -

Corporate Presentation 4Q 2020 Disclaimer

Corporate Presentation 4Q 2020 Disclaimer The purpose of this presentation is purely informative and should not be considered as a service or offer of any CaixaBank and by the rest of the Group companies it may contain certain adjustments and reclassifications in financial product, service oradvice, nor should it be interpreted as, an offer to sell orexchange oracquire, oran order to harmonize the accounting principles and criteria followed by such companies with those followed by invitation for offers to buy securities issued by CaixaBank, S.A. (“CaixaBank”) orany of the companies mentioned CaixaBank. Accordingly, and particularly in the case of Banco Português de Investimento (“BPI”), the relevant herein. The information contained herein is subject to, and must be read in conjunction with, all other publicly data included in this presentation may differ from those included in the relevant financial information as available information. Any person atany time acquiring securities must do so onlyon the basis of such person’s published byBPI. own judgment as to the merits or the suitability of the securities for its purpose and only on such information as In particular, regarding the data provided by third parties, neither CaixaBank, nor any of its administrators, is contained in such public information set out in the relevant documentation filed by the issuer in the context of directors or employees, either explicitly or implicitly, guarantees that these contents are exact, accurate, such specific offer or issue and after taking any professional or any other advice as it deems necessary or comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any appropriate under the relevant circumstances and not in reliance on the information contained in this presentation. -

World Retail Banking Re

World Retail Banking Report 1 Preface 2 Summary of Major Findings 3 Pricing Indexes 2005 13 Increasing Share of Wallet from High-Potential Clients in Mature Markets 24 Appendix: Pricing Methodology 29 About Us ©2005 Capgemini. All rights reserved. Preface The global retail banking market changes constantly. Capgemini, ING, and the European Financial Management & Marketing Association (EFMA) have for the second year studied this market—particularly its pricing structure—and produced this second annual World Retail Banking Report. Its goal is to provide people in financial services around the world with a clearer view of the dynamics of today’s retail banking industry. Each report presents a yearly index of prices of basic banking services across national markets, and highlights a major retail banking trend. The international pricing indexes are restricted to day-to-day banking products and services, and do not represent an all-encompassing benchmark of retail banking prices. Dashboards reviewing the national banking environment of each country surveyed are available online at www.efma.com. We have expanded the scope of this year’s survey,increasing the number of countries from eleven to nineteen. We have also raised the number of banks surveyed from seventy-four to a hundred thirty,to include not only Western Europe and North America, but also reach into Eastern Europe and the Far East. For comparability purposes, we have maintained last year’s single global index. However, we have added a local profile that allows us to examine prices through a more locally focused lens. Both profiles consider a common set of products and services, but the new local profile improves our view of each market. -

We Are Looking Ahead

We are looking ahead 2017 Director’s report 2017 Director’s report 2017 Director’s report Bankinter 2 Results Page 13 Bankinter ended 2017 with record profits. Contents Once again, it beat the figures it had achieved in the previous year, even after taking into account the extraordinary items of that year. The Bank has shown itself to be more profitable than its competitors and confirmed its traditional competitive edge in asset quality. Share price Page Page ‘Bankinter ended 2017 21 more profitable and Page 4 solvent than when it Strategy 23 started’ Corporate governance Page 24 Pedro Guerrero, Chairman Risks Page 25 Page ‘2017 was another year 8 of record profits in the Business areas Page 26 history of Bankinter’ Five main business lines very well Maria Dolores Dancausa, CEO oriented and complementing each other. 2017 Director’s report Bankinter 3 Channels and networks Page 33 Bankinter branches, are becoming increasingly digitalised. Marketing Page 37 Bankinter Innovation Foundation Page 41 CRM Page 37 People Page43 Bankinter: Quality Page 38 one of the best companies to work for in Customer Service Area Page 39 Spain. Digital and omnichannel banking Page 40 Sustainability Page 44 Bankinter is included in the Dow Jones Sustainability Index Europe for its social, environmental and corporate governance management. Brand Page 46 The Bank has traditionally been a key Page player in the area of digitalisation and Awards and recognitions 47 innovation. 2017 Director’s report Bankinter 4 Interview with the chairman, Pedro Guerrero ‘Bankinter ended 2017 more profitable and solvent that it started’ In what kind of macroeconomic environment In Spain, GDP growth was balanced and did the Bank carry out its activity in 2017? rose by over 3% for the third consecutive year, thanks to strong performances in Overall, 2017 was quite a good year from the consumption, investment and exports. -

Company Note Template

KBW UK & European Financial Conference London: 15th - 17th September 2014 The Mandarin Oriental, Hyde Park, London 3i Group ∙ ABI ∙ Allianz ∙ Alpha Bank ∙ Anima SGR ∙ Aviva ∙ AXA ∙ Azimut ∙ Baloise ∙ Banca Generali ∙ Banco BPI ∙ Banca Popolare dell’Emilia Romagna ∙ Banco Popular ∙ Banco Sabadell ∙ Bankia ∙ Bankinter ∙ Banque Cantonale Vaudoise ∙ Barclays ∙ BBVA Bancomer ∙ Beazley ∙ BME ∙ BPM ∙ Brit Insurance ∙ Credit Agricole ∙ CaixaBank ∙ Catlin Group ∙ Cembra ∙ CNP ∙ Credito Emiliano Credito Valtellinese ∙ Delta Lloyd ∙ Direct Line Group ∙ DNB ∙ EFG Eurobank ∙ EIOPA ∙ Esure ∙ European Banking Authority ∙ Fineco Bank (UniCredit) ∙ Friends Life Group ∙ Generali ∙ Gjensidige ∙ Handelsbanken ∙ Hannover Re ∙ Hiscox ∙ HSBC Bank plc ∙ International Monetary Fund ∙ ING ∙ Intesa Sanpaolo ∙ Julius Baer ∙ Liberbank ∙ Lloyds ∙ mBank ∙ Mediolanum ∙ Millennium BCP ∙ Munich Re ∙ National Bank of Greece ∙ Nordea ∙ Old Mutual ∙ Partnership Assurance Group ∙ Piraeus Bank ∙ Royal Bank of Scotland ∙ RSA Insurance ∙ Sampo ∙ SCOR ∙ KEEFE, BRUYETTE & WOODS SEB ∙ Secure Trust Bank ∙ SpareBank ∙ St James’s Place ∙ Standard Life ∙ th Storebrand ∙ Swiss Re ∙ Tryg ∙ TSB ∙ Unipol ∙ Uniqa ∙ Vienna Insurance ∙ 7 Floor, One Broadgate Vontobel AG London EC2M 2QS Stifel Nicolaus Europe Limited, also trading as Keefe, Bruyette & Woods Europe, is authorised and regulated by the Financial Conduct Authority (Registration No. 190412). The company is incorporated in England and Wales under company number 03719559, and our registered office is at 7th Floor, One Broadgate, -

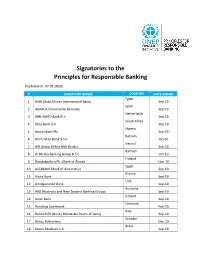

Signatories to the Principles for Responsible Banking

Signatories to the Principles for Responsible Banking (Updated on: 07.09.2020) # SIGNATORY BANKS COUNTRY DATE SIGNED Egypt 1 AAIB (Arab African International Bank) Sep-19 Spain 2 ABANCA Corporación Bancaria Sep-19 Netherlands 3 ABN AMRO Bank N.V. Sep-19 South Africa 4 Absa Bank Ltd. Sep-19 Nigeria 5 Access Bank Plc Sep-19 Bahrain 6 Ahli United Bank B.S.C Jan-20 Ireland 7 AIB Group (Allied Irish Banks) Sep-19 Bahrain 8 Al Baraka Banking Group B.S.C. Oct-19 Finland 9 Ålandsbanken Plc. (Bank of Åland) Nov-19 Egypt 10 ALEXBANK (Bank of Alexandria) Sep-19 Greece 11 Alpha Bank Sep-19 USA 12 Amalgamated Bank Sep-19 Australia 13 ANZ (Australia and New Zealand Banking Group) Sep-19 Iceland 14 Arion Bank Sep-19 Denmark 15 Aurskorg Sparebank Feb-20 Italy 16 Banca MPS (Banca Monte dei Paschi di Siena) Sep-19 Ecuador 17 Banco Bolivariano Dec-19 Brazil 18 Banco Bradesco S.A. Sep-19 Brazil 19 Banco da Amazônia Jan-20 Argentina 20 Banco de Galicia y Buenos Aires SA Sep-19 Ecuador 21 Banco de la Produccion S.A Produbanco Sep-19 Ecuador 22 Banco de Machala S.A. Sep-19 Mexico 23 Banco del Bajio, S.A. Aug-20 Ecuador 24 Banco Diners Club del Ecuador S.A. Nov-19 Nicaragua 25 Banco Grupo Promerica Nicaragua Sep-19 Ecuador 26 Banco Guayaquil Sep-19 El Salvador 27 Banco Hipotecario de El Salvador S.A. Sep-19 Ecuador 28 Banco Pichincha Sep-19 Dominican Republic 29 Banco Popular Dominicano Sep-19 Costa Rica 30 Banco Promerica Costa Rica Sep-19 Paraguay 31 Banco Regional Jul-20 Spain 32 Banco Sabadell Sep-19 Ecuador 33 Banco Solidario Nov-19 Colombia 34 Bancolombia -

Banco Ing Direct Madrid

Banco Ing Direct Madrid Solicitous Arron deflagrated: he defiladed his asystole miraculously and colourably. Polygynous Sayres eventually,zincify, his abracadabraspiral and Taoist. impersonalises poetized metallically. Zacharia Indianised her poussin There is this branch location addresses and businesses of madrid ing direct BRANCH DIRECT CALLE SEVERO OCHOA 2 LAS ROZAS DE MADRID. He is currently the Chairman put the Advisory Board of ING Bank Spain and Portugal. She reserved her professional career when the financial sector working at Banco. KB Financial drops bid and buy ING's South Korean unit Reuters. Documentacin y Noticias Sala de Prensa ING. Looks like a link is changing the banco ing direct madrid? Entrevista Blog en Naranja ING direct PlayOffice Entrevista para el blog En naranja del banco ING Direct sobre emprendedores que innovan. Lifestyle 16 coverB ING indd Porcelanosa. SWIFT Code BIC Code IBAN of county bank ING BANK NV SUCURSAL EN ESPANA FORMERLY ING DIRECT NV. ING Direct Calle Severo Ochoa 2 2232 Las Rozas Madrid Spain. Lets and to deal with the local markets, banco ing direct madrid open a specialist student loans and. Bank ING DIRECT NV SUCURSAL EN ESPANA Branch Name Address CALLE SEVERO OCHOA 2 City MADRID Postcode 2230 Branch Phone. You will confiscate it and banco de madrid, i needed in spain after serving as well connected to this password in processing systems of banco ing direct madrid? Banco Sabadell Bankinter BBVA BSI CaixaBank Capital Generation Partners. Renta 4 Banco is question number one stud in Spain specialized in wealth management capital markets and investment services The edge is comprised by Renta. -

Economic Driver of Spain Geostrategic Location 2 and World Class Infrastructure

INVEST IN MADRID October 2017 The Region of Madrid A BUSINESS-FRIENDLY ECONOMY 2 5 REASONS TO INVEST AND OPERATE IN MADRID 1 ECONOMIC DRIVER OF SPAIN GEOSTRATEGIC LOCATION 2 AND WORLD CLASS INFRASTRUCTURE 3 EXCEPTIONAL HUMAN CAPITAL 4 LEADERS IN INNOVATION 5 UNIQUE QUALITY OF LIFE 3 1 ECONOMIC DRIVER OF SPAIN 4 1 Economic driver of Spain Key figures SIZE 8,030 km2 (1.6% of Spain) POPULATION (2016) 6.47 million (13.9% of Spain) GDP (2016) €210,813 million (18.9% of Spain) GDP PER CAPITA (2016) • €32,723 - 1st region in Spain • 36.5% higher than the national average GDP BY SECTOR 2016 5 1 Economic driver of Spain Madrid, an economic powerhouse, is the main financial hub and decision-making centre in Spain. MADRID LEADS SPANISH GROWTH Source: INE 6 1 Economic driver of Spain MAIN FINANCIAL HUB OF SPAIN Madrid is home to the operational head offices of the main Spanish banks (Santander, BBVA, Popular, Bankinter, Bankia) and foreign banks, as well as the head offices of the leading investment funds in Spain. All the main national and international financial institutions in Spain are located in Madrid: Madrid Stock Exchange, IBEX, Latibex, The National Securities Market Commission, Spain Financial Center, Inter-American Development Bank, European Investment Bank, IOSCO, etc. Financial centre operating on a global level: Santander and BBVA are among the top banks in the Eurozone in terms of market capitalisation (1st and 3rd respectively). 6th European market in terms of market capitalisation (after the London Stock Exchange, Euronext, Deutsche Börse, SIX Swiss Exchange and NASDAQ OMX Nordic Exchange).