CMC Markets PLC (CMCX:LN)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Capital Analytics UK Registrars Benchmarking Survey 2009

Capital Analytics UK Registrars Benchmarking Survey 2009 CAPITAL ANALYTICS UK REGISTRARS BENCHMARKING SURVEY 2009 September 2009 © Copyright, 2009 Capital Analytics Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission from Capital Analytics Limited. No advertising or other promotional use can be made of the information in this report without the express prior written consent of Capital Analytics Limited. Capital Analytics UK Registrars Benchmarking Survey 2009 CONTENTS SURVEY PURPOSE AND METHODOLOGY ................................................................................... 4 Purpose ................................................................................................................................................ 4 Methodology ........................................................................................................................................ 4 COMPANY SATISFACTION INDEX 2009 ........................................................................................ 6 INDUSTRY ANNUAL OVERALL COMPARISON 2005 - 2009 ...................................................... 7 OVERALL SATISFACTION WITH SERVICES .............................................................................. 8 Comments on Overall Satisfaction with Services ................................................................................ 8 Overall Satisfaction with Registrar .................................................................................................. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

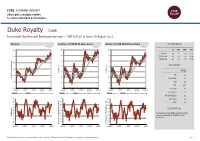

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Morningstar Report

Report as of 25 Sep 2021 Aberdeen Standard Equity Inc Trust plc , (GB0006039597) Morningstar Rating™ Peer Group Classification Last Close Last Actual NAV (23 Sep 2021) Discount Estimated Nav QQ Morningstar IT UK Equity 345.00 379.95 -9.20 379.95 Income Investment Objective Performance The fund aims to provide shareholders with an above 169 average income while also providing real growth in 146 capital and income. It will invest in a diversified 123 portfolio consisting mainly of quoted UK equities 100 which will normally comprise between 50 and 70 77 individual equity holdings. 54 2016 2017 2018 2019 2020 2021-08 -10.88 23.83 -12.55 9.46 -19.70 19.51 Fund 16.75 13.10 -9.47 19.17 -9.82 14.66 Benchmark 8.76 10.73 -10.56 18.95 -12.56 15.52 Category Management Fee Summary Management fee of 0.65% p.a. of NA on the first GBP 175m and 0.55% thereafter. No performance fee. Contract terminable on notice period of 6 months. Portfolio 31/08/2021 Asset Allocation % Long Short Net Equity Style Box™ Mkt Cap % Fund America Europe Asia Large Size Stocks 113.11 0.00 113.11 Giant 17.55 Bonds 0.00 0.00 0.00 Mid Large 18.27 Cash 0.00 13.11 -13.11 Medium 22.91 Other 0.00 0.00 0.00 Small Small 24.92 Value Blend Growth Micro 16.35 Style Average Mkt Fund Cap (Mil) Ave Mkt Cap GBP 4,115.7 <25 25-50 50-75 >75 7 Top Holdings Stock Sector Weightings % Fund World Regions % Fund Name Sector % hCyclical 66.41 Americas 2.36 BHP Group PLC r 4.54 rBasic Materials 13.25 United States 2.36 Rio Tinto PLC r 4.30 tConsumer Cyclical 14.81 Canada 0.00 CMC Markets PLC y 3.99 -

Annual Report 2016 Contents at a Glance

IG GROUP HOLDINGS PLC ANNUAL REPORT 2016 CONTENTS AT A GLANCE COMPANY OVERVIEW ’2016 was another At a Glance 2 record year for IG, CHAIRMAN’S STATEMENT 4 with revenue up 14% STRATEGIC REPORT Chief Executive Officer’s Review 6 to £456.3 million. Our Business 10 Our investments in Our Product Suite 12 Our Clients and Business Model 14 improving online Our People 16 marketing, developing Our Strategic Objectives 20 new offices and Our Operational Strategy in Action 22 Key Performance Indicators (KPIs) 28 extending our product Business Conduct and Sustainability 30 set are beginning to Operating and Financial Review 36 Managing Our Risks 44 pay off.’ CORPORATE GOVERNANCE REPORT Chairman’s Introduction to Corporate Governance 56 Peter Hetherington Corporate Governance Statement 57 Chief Executive Officer The Board 58 19 July 2016 Nomination Committee 68 Directors’ Remuneration Report 70 Audit Committee 90 Board Risk Committee 95 Directors’ Report 98 Statement of Directors’ Responsibilities 101 Independent Auditors’ Report 102 FINANCIAL STATEMENTS Group Income Statement 108 Statements of Financial Position 109 Cash Flow Statements 112 Notes to the Financial Statements 113 INVESTOR RESOURCES Five-Year Summary 166 Examples 168 Glossary 174 Global Offices 177 Shareholder and Company Information 178 This report is fully accessible online at: iggroup.com/ar2016 FOUR-YEAR COMPOUND ANNUAL GROWTH RATES 5.6% 2.9% REVENUE(1) PROFIT BEFORE TAX 4.4% 8.7% 8.9% DILUTED TOTAL OWN FUNDS EARNINGS DIVIDEND GENERATED FROM PER SHARE PER SHARE OPERATIONS REVENUE(1) PROFIT BEFORE TAX OWN FUNDS GENERATED FROM OPERATIONS £456.3m £207.9m £197.9m £193.2m £400.2m £159.2m £366.8m £361.9m £370.4m £388.4m £185.7m £192.2m £194.9m £169.5m £140.7m £154.3m £160.6m £136.8m FY12 FY13 FY14 FY15 FY16 FY12 FY13 FY14 FY15 FY16 FY12 FY13 FY14 FY15 FY16 DILUTED EARNINGS TOTAL DIVIDEND PER SHARE PER SHARE 44.58p 31.40p 41.07p 28.15p (1) Throughout this report Revenue refers to net trading revenue (ie excluding interest on segregated client funds and after taking account of introducing partner commissions). -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Fintech Monthly Market Update | July 2021

Fintech Monthly Market Update JULY 2021 EDITION Leading Independent Advisory Firm Houlihan Lokey is the trusted advisor to more top decision-makers than any other independent global investment bank. Corporate Finance Financial Restructuring Financial and Valuation Advisory 2020 M&A Advisory Rankings 2020 Global Distressed Debt & Bankruptcy 2001 to 2020 Global M&A Fairness All U.S. Transactions Restructuring Rankings Advisory Rankings Advisor Deals Advisor Deals Advisor Deals 1,500+ 1 Houlihan Lokey 210 1 Houlihan Lokey 106 1 Houlihan Lokey 956 2 JP Morgan 876 Employees 2 Goldman Sachs & Co 172 2 PJT Partners Inc 63 3 JP Morgan 132 3 Lazard 50 3 Duff & Phelps 802 4 Evercore Partners 126 4 Rothschild & Co 46 4 Morgan Stanley 599 23 5 Morgan Stanley 123 5 Moelis & Co 39 5 BofA Securities Inc 542 Refinitiv (formerly known as Thomson Reuters). Announced Locations Source: Refinitiv (formerly known as Thomson Reuters) Source: Refinitiv (formerly known as Thomson Reuters) or completed transactions. No. 1 U.S. M&A Advisor No. 1 Global Restructuring Advisor No. 1 Global M&A Fairness Opinion Advisor Over the Past 20 Years ~25% Top 5 Global M&A Advisor 1,400+ Transactions Completed Valued Employee-Owned at More Than $3.0 Trillion Collectively 1,000+ Annual Valuation Engagements Leading Capital Markets Advisor >$6 Billion Market Cap North America Europe and Middle East Asia-Pacific Atlanta Miami Amsterdam Madrid Beijing Sydney >$1 Billion Boston Minneapolis Dubai Milan Hong Kong Tokyo Annual Revenue Chicago New York Frankfurt Paris Singapore Dallas -

Weekend News Summary

Weekend News Summary THE SUNDAY TIMES INDICES THIS MORNING Current (%) 1W% Change Sirius seeks light at end of the tunnel: Work continued at Sirius Value Change* Minerals’ Woodsmith mine in North Yorkshire, even as shares in the FTSE 100 7,415.0 -0.2% 1.1% company fell to new lows amid fears over its future. The company so DAX 30 12,383.8 0.02% -0.7% far has completed just over a mile of a planned 23-mile tunnel to take CAC 40 5,647.2 0.1% -0.9% polyhalite deposits from its site near Whitby to Teesside for export as DJIA** 26,820.3 - -0.4% fertiliser. S&P 500** 2,961.8 - -1.0% Clipper Logistics delivers warning with higher profit: A logistics NASDAQ Comp.** 7,939.6 - -2.2% company that processes online orders for retailers including John Nikkei 225 21,755.8 -0.6% -0.9% Lewis and Boohoo.com has posted a strong increase in annual Hang Seng 40 26,092.3 0.5% -1.8% earnings but warned of potential trading turbulence in the year Shanghai Comp 2,905.2 -0.9% -2.5% ahead. Kospi 2,063.1 0.6% -2.0% Fosun ‘discussing bid’ for Thomas Cook brand name: The Chinese BSE Sensex 38,642.5 -0.5% 2.1% company that was working on a rescue deal for Thomas Cook before S&P/ASX 200 6,688.3 -0.4% -0.2% it collapsed is interested in buying the brand name of the 178-year- Current Values as at 10:15 BST, *%Chg from Friday Close, ** As on Friday Close old tour operator. -

FTF Franklin UK Equity Income Fund August 31, 2021

FTF - FTF Franklin UK Equity Income Fund August 31, 2021 FTF - FTF Franklin UK Equity August 31, 2021 Income Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 0673123 ASSOCIATED BRITISH FOODS PLC 795,000 £15,741,000 1.75% N/A N/A 0989529 ASTRAZENECA PLC 526,000 £44,783,640 4.98% N/A N/A 0263494 BAE SYSTEMS PLC 2,560,000 £14,551,040 1.62% N/A N/A BH0P3Z9 BHP GROUP PLC 927,000 £20,927,025 2.33% N/A N/A B3FLWH9 BODYCOTE PLC 1,340,000 £12,924,300 1.44% N/A N/A 0798059 BP PLC 10,175,000 £30,214,662 3.36% N/A N/A 0176581 BREWIN DOLPHIN HOLDINGS PLC 3,442,000