World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

'Trans-European Retail Banking'

AEI-BROOKINGS G E M JOINT CENTER www.aei-brookings.org http://gem.sciences-po.fr ‘Trans-European Retail Banking’ Challenges to new entrants and integration in European retail banking An instructive case study of mobile banking June 2006 Ivan Mortimer-Schutts Groupe d’Economie Mondiale The author would like to thank Paul Atkinson and Was Rahman and Francesco Mauro for helpful comments and critique. While every effort has been made to ensure the accuracy of this article, no factual material or statements presented here are guaranteed correct 1 EXECUTIVE SUMMARY Policy makers are increasingly concerned by the relative lack of retail banking integration in Europe. For many, the long term success of the “Single Market” depends on bringing the benefits of economic liberalisation in a tangible form to consumers and the public at large. But there has been little if any development of cross border competition in retail banking. The emergence of pan-European retail banking is hindered not least by a lack of demand. The persistence of national structures is hence not surprising. But as a niche market, pan-European retail banking could be developed by innovative new entrants to the sector. Removing undue barriers that new entrants might face should be the first priority for European authorities, particularly if the pronounced preference for market led integration is to be respected. Market led integration requires focus on removing barriers to new, innovative entrants. In highly concentrated markets such as retail banking, incumbents have little interest in initiating aggressive strategies to capture new market share. They may face decreasing returns as price competition lowers profits for all. -

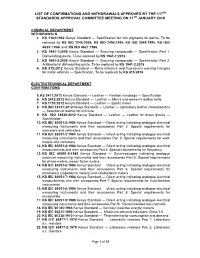

Approved List of Confirmation and Witdrawals January 2018

LIST OF CONFIRMATIONS AND WITHDRAWALS APPROVED BY THE 117TH STANDARDS APPROVAL COMMITTEE MEETING ON 11TH JANUARY 2018 CHEMICAL DEPARTMENT WITHDRAWALS 1. KS 1104:1992 Kenya Standard — Specification for iron pigments for paints, To be replaced by KS ISO 1248:2006, KS ISO 2495:1995, KS ISO 3549:1995, KS ISO 4620:1986 and KS ISO 4621:1986 2. KS 1941-1:2005 Kenya Standard — Scouring compounds — Specification Part 1: Dishwashing paste, To be replaced by KS 1941-1:2018 3. KS 1941-2:2005 Kenya Standard — Scouring compounds — Specification Part 2: Antibacterial dishwashing paste, To be replaced by KS 1941-2:2018 4. KS 815:2012 Kenya Standard — Retro-reflective and fluorescent warning triangles for motor vehicles — Specification, To be replaced by KS 815:2018 ELECTROTECHNICAL DEPARTMENT CONFIRMATIONS 5. KS 2411:2012 Kenya Standard — Leather — Fashion handbags — Specification 6. KS 2412:2012 Kenya Standard — Leather — Men’s and women’s leather belts 7. KS 1730:2012 Kenya Standard — Leather — Sports shoes 8. KS ISO 16131:2012 Kenya Standard — Leather — Upholstery leather characteristics — Selection of leather for furniture 9. KS ISO 14930:2012 Kenya Standard — Leather — Leather for dress gloves — Specification 10. KS IEC 60051-2:1984 Kenya Standard — Direct acting indicating analogue electrical measuring instruments and their accessories Part 2: Special requirements for ammeters and voltmeters 11. KS IEC 60051-3:1984 Kenya Standard — Direct acting indicating analogue electrical measuring instruments and their accessories Part 3: Special requirements for watt- meters and varmeters 12. KS IEC 60051-4:1984 Kenya Standard — Direct acting indicating analogue electrical measurements and their accessories Part 4: Special requirements for frequency 13. -

Réussissez Votre Migration S€PA Les Bonnes Pratiques Pour Un Projet À Valeur Ajoutée

LES GUIDES SAGE POUR LA GESTION DE VOTRE ENTREPRISE Réussissez votre migration SEPA Les bonnes pratiques pour un projet à valeur ajoutée Sommaire Introduction . 4 Le SEPA Qu’est-ce que le SEPA ? ......................................................6 La zone SEPA ................................................................. 7 Les grandes dates à retenir .................................................. 8 Quelles sont les mesures issues du SEPA ? . 9 Quels sont les impacts du SEPA sur votre entreprise ? .................. 12 Témoignage AFTE ........................................................... 13 Quels sont les impacts du SEPA sur les instruments de paiement ? ..... 14 La fin programmée du protocole ETEBAC . 16 Quelles sont les actions engagées en France ? ........................... 17 Témoignage BNP Paribas . 18 Quelle est la démarche adoptée par Sage ? . 19 Réussir sa migration dans les délais . 20 Témoignage Société Générale .............................................. 25 Témoignage Client Tel and Com . 26 Lexique . 28 L’offre Sage . 30 Les bonnes pratiques pour un projet à valeur ajoutée 3 e SEPA (Single Euro Payment Area) est un espace européen représentant près de 480 millions d’habitants, 9000 banques et 25 Lmillions d’entreprises, à l’intérieur duquel les paiements vont être harmonisés en remplaçant progressivement les outils dématérialisés de transferts de fonds actuellement utilisés. Le but : que chaque entreprise et chaque particulier puisse effectuer des paiements en euro aussi facilement dans ces 32 pays que sur leur territoire national. Dans ce guide, nous vous donnons toutes les clés pour comprendre cette réglementation, analyser ses impacts au sein de votre entreprise et préparer de manière efficace votre entrée dans le SEPA. La naissance de l’Europe des paiements Si le SEPA est important, c’est qu’il marque l’avènement de l’Europe des paiements. -

Devicelock® DLP 8.3 User Manual

DeviceLock® DLP 8.3 User Manual © 1996-2020 DeviceLock, Inc. All Rights Reserved. Information in this document is subject to change without notice. No part of this document may be reproduced or transmitted in any form or by any means for any purpose other than the purchaser’s personal use without the prior written permission of DeviceLock, Inc. Trademarks DeviceLock and the DeviceLock logo are registered trademarks of DeviceLock, Inc. All other product names, service marks, and trademarks mentioned herein are trademarks of their respective owners. DeviceLock DLP - User Manual Software version: 8.3 Updated: March 2020 Contents About This Manual . .8 Conventions . 8 DeviceLock Overview . .9 General Information . 9 Managed Access Control . 13 DeviceLock Service for Mac . 17 DeviceLock Content Security Server . 18 How Search Server Works . 18 ContentLock and NetworkLock . 20 ContentLock and NetworkLock Licensing . 24 Basic Security Rules . 25 Installing DeviceLock . .26 System Requirements . 26 Deploying DeviceLock Service for Windows . 30 Interactive Installation . 30 Unattended Installation . 35 Installation via Microsoft Systems Management Server . 36 Installation via DeviceLock Management Console . 36 Installation via DeviceLock Enterprise Manager . 37 Installation via Group Policy . 38 Installation via DeviceLock Enterprise Server . 44 Deploying DeviceLock Service for Mac . 45 Interactive Installation . 45 Command Line Utility . 47 Unattended Installation . 48 Installing Management Consoles . 49 Installing DeviceLock Enterprise Server . 52 Installation Steps . 52 Installing and Accessing DeviceLock WebConsole . 65 Prepare for Installation . 65 Install the DeviceLock WebConsole . 66 Access the DeviceLock WebConsole . 67 Installing DeviceLock Content Security Server . 68 Prepare to Install . 68 Start Installation . 70 Perform Configuration and Complete Installation . 71 DeviceLock Consoles and Tools . -

Success Codes

a Volume 2, No. 4, April 2011, ISSN 1729-8709 Success codes • NTUC FairPrice CEO : “ International Standards are very important to us.” • Fujitsu innovates with ISO standards a Contents Comment Karla McKenna, Chair of ISO/TC 68 Code-pendant – Flourishing financial services ........................................................ 1 ISO Focus+ is published 10 times a year World Scene (single issues : July-August, November-December) International events and international standardization ............................................ 2 It is available in English and French. Bonus articles : www.iso.org/isofocus+ Guest Interview ISO Update : www.iso.org/isoupdate Seah Kian Peng – Chief Executive Officer of NTUC FairPrice .............................. 3 Annual subscription – 98 Swiss Francs Special Report Individual copies – 16 Swiss Francs A coded world – Saving time, space and energy.. ..................................................... 8 Publisher ISO Central Secretariat From Dickens to Dante – ISBN propels book trade to billions ................................. 10 (International Organization for Uncovering systemic risk – Regulators push for global Legal Entity Identifiers ..... 13 Standardization) No doubt – Quick, efficient and secure payment transactions. ................................. 16 1, chemin de la Voie-Creuse CH – 1211 Genève 20 Vehicle ID – ISO coding system paves the way for a smooth ride ........................... 17 Switzerland Keeping track – Container transport security and safety.. ....................................... -

The New Normal: Market Cooperation in the Mobile Payments Ecosystem ⇑ Jonas Hedman , Stefan Henningsson

Electronic Commerce Research and Applications 14 (2015) 305–318 Contents lists available at ScienceDirect Electronic Commerce Research and Applications journal homepage: www.elsevier.com/locate/ecra The new normal: Market cooperation in the mobile payments ecosystem ⇑ Jonas Hedman , Stefan Henningsson Department of IT Management, Copenhagen Business School, Howitzvej 60, 2000 Frederiksberg, Denmark article info abstract Article history: The introduction of mobile payments is one of many innovations that are changing the payment market. Received 26 November 2014 This change involves new payment service providers entering this lucrative market, and meanwhile, the Received in revised form 19 March 2015 existing stakeholders are trying to defend their oligopolistic positions. The mobile payment market Accepted 19 March 2015 cooperation (MPMC) framework in this article shows how the digitalization of payments, as a technology Available online 26 March 2015 innovation, affects the competition and collaboration among traditional and new stakeholders in the payment ecosystem at three levels of analysis. We do this by integrating theories of market cooperation Keywords: with the literatures on business and technology ecosystems. The MPMC framework depicts technology- Case study based market cooperation strategies in the context of recent battles in the mobile payments ecosystem. iZettle Market cooperation In these battles, the competitors can use technology either in defensive build-and-defend strategies to Mobile payment protect market position, or in offensive battering-ram strategies for ecosystem entry or position improve- Payment ecosystem ment. Successful strategies can lead to: (1) Ricardian rents, based on operational efficiency advantages Payment markets traceable to the firm’s position relative to suppliers and monopoly power; and (2) Bainian rents, resulting PayPal from the extent the firm is able to resist price competition in the market. -

Le SEPA Quest-Ce Que Le SEPA ?

LES GUIDES SAGE POUR LA GESTION DE VOTRE ENTREPRISE SEPA N’attendez plus pour réussir votre migration Sommaire Introduction ................................................................. 4 Le SEPA Quest-ce que le SEPA ? . 6 Qui est concerné par le SEPA ? ............................................. 7 Les grandes dates à retenir .................................................. 8 Quelles sont les mesures issues du SEPA ? . 9 Quels sont les impacts du SEPA sur votre entreprise ? .................. 12 Témoignage AFTE ........................................................... 13 Quels sont les impacts du SEPA sur les instruments de paiement ? ..... 14 Que deviennent les protocoles ETEBAC ? . 16 Quelles sont les actions engagées en France ? ........................... 17 Témoignage BNP Paribas . 18 Quelle est la démarche adoptée par Sage ? . 19 Comment se préparer pour réussir ? . 20 Témoignage Société Générale .............................................. 25 Témoignage Client Tel and Com . 26 Lexique ...................................................................... 28 L’offre Sage ................................................................ 30 N’attendez plus pour réussir votre migration ! 3 e SEPA (Single Euro Payments Area) est un espace européen représentant près de 480 millions d’habitants, 9000 banques et 25 Lmillions d’entreprises, à l’intérieur duquel les paiements vont être harmonisés en remplaçant progressivement les outils dématérialisés de transferts de fonds actuellement utilisés. Le but : que chaque entreprise -

Schnittstellenspezifikation DFÜ-Abkommen

Z ENTRALER K REDITAUSSCHUSS MITGLIEDER: BUNDESVERBAND DER DEUTSCHEN VOLKSBANKEN UND RAIFFEISENBANKEN E.V. BERLIN · BUNDESVERBAND DEUTSCHER BANKEN E. V. BERLIN · BUNDESVERBAND ÖFFENTLICHER BANKEN DEUTSCHLANDS E. V. BERLIN · DEUTSCHER SPARKASSEN- UND GIROVERBAND E. V. BERLIN-BONN · VERBAND DEUTSCHER HYPOTHEKENBANKEN E. V. BERLIN Anlage 3 der Schnittstellenspezifikation für die Datenfernübertragung zwischen Kunde und Kreditinstitut gemäß DFÜ-Abkommen „Spezifikation der Datenformate“ Version 2.3 vom 05.11.2008 gültig ab 15. November 2008 Final Version Änderungsverfolgung (gegenüber Version 2.2 vom 29.10.2007) Be- Kapitel schluss- Art* Beschreibung Inkrafttreten Datum 1 E/L Aufnahme von 2 neuen Textschlüsseln für Netzbetrei- ber 2 F/K Korrektur bzw. Klarstellung von 2 Beispielen Klarstellung zum Feld MessageID 5 Ä/F Anpassungen der Akkreditivnachrichten an den SWIFT SRG 2008 Kleinere Korrekturen 6 L/E Verschiedene SEPA-spezifische Anpassungen * F = Fehler; Ä = Änderung; K = Klarstellung; E = Erweiterung; L = Löschung DFÜ – Abkommen Anlage 3: Spezifikation der Datenformate Inhaltsverzeichnis 1 Inlandszahlungsverkehr.................................................................................4 1.1 DTAUS0: Zahlungsverkehrssammelauftrag Diskettenformat..........................4 1.2 DTAUS: Zahlungsverkehrssammelauftrag Magnetbandformat.....................15 2 SEPA-Zahlungsverkehr ................................................................................25 2.1 Festlegungen zu allen Datenformaten ..........................................................26 -

Openfunds Fields (Sorted by OF-ID)

Openfunds Fields (sorted by OF-ID) Status: DRAFT Version: Version 1.27 (Including fields of this and all preceding versions.) Date: 2021-06-11 Notice: IMPORTANT NOTICE: --------------------------------------------------- With this list (version 1.26.3) a new field set has been added to cover information generally contained in Fund Factsheets. This field set, openfunds Fund Ratios and Exposures, has been assigned the new openfunds field prefix OFRE. To receive more information about the initiative openfunds, visit https://www.openfunds.org. --------------------------------------------------- In general, openfunds uses lower case for values, i.e. “yes” / “no”. However, implementations of interfaces based on the openfunds standard should not be case sensitive as many existing systems use a different diction. --------------------------------------------------- Please note, that as a general rule an empty field means "unknown" within openfunds. To avoid any deletion of a value in the receiving database, openfunds recommends using the command "[IGNORE]" instead of a value. (Without quotation marks but including square brackets. All capital letters). --------------------------------------------------- Excel knows different ways of formatting percentage figures. As some of them might not convert properly into decimal figures, openfunds strongly recommends using decimal figures only. --------------------------------------------------- Please note that fields that are no longer supported are now marked at the top of the field description and no -

Sepa Credit Transfer Scheme Customer-To-Bank Implementation Guidelines

EPC132-08 2019 Version 1.0 Approved 22 November 2018 EPC [X] Public – [ ] Internal Use – [ ] Confidential – [ ] Strictest Confidence Distribution: Publicly available SEPA CREDIT TRANSFER SCHEME CUSTOMER-TO-BANK IMPLEMENTATION GUIDELINES Abstract This document sets out the rules for implementing Version 1.0 of the 2019 SEPA Credit Transfer Scheme Rulebook based on relevant ISO 20022 XML message standards. Document Reference EPC132-08 Issue 2019 Version 1.0 Approved Date of Issue 22 November 2018 Reason for Issue Approval for publication by the October 2018 Scheme Management Board (SMB) Circulation Publicly available Effective Date 17 November 2019 Note The Originator Bank is obliged to accept customer-to- bank credit transfer instructions which are based on the ISO 20022 XML message standards that are described in this document. Conseil Européen des Paiements AISBL Cours Saint-Michel 30, B 1040 Brussels ∙ Tel: +32 2 733 35 33 Fax: +32 2 736 49 88 Enterprise N° 0873.268.927 ∙ www.epc-cep.eu ∙ [email protected] © 2018 Copyright European Payments Council (EPC) AISBL: Reproduction for non-commercial purposes is authorised, with acknowledgement of the source TABLE OF CONTENTS 0 DOCUMENT INFORMATION ................................................................................ 2 0.1 REFERENCES ..................................................................................................... 2 0.2 CHANGE HISTORY ............................................................................................... 2 0.3 PURPOSE OF DOCUMENT ...................................................................................... -

UBS Implementation Guidelines

UBS Implementation Guidelines Swiss Payment Standards for credit transfers pain.001.001.03.ch.02 - SPS Version 1.7.2 UBS Version 1.0 January 2018 UBS Implementation Guidelines – Swiss Payment Standards for credit transfers Table of Contents 1. Credit Transfer message 3 1.1 Scope of application of this document 3 1.2 Flow of messages in accordance with Swiss Payment Standards 3 2. Technical specifications 4 2.1 UBS Implementation 4 2.2 Structure of pain.001 message 4 2.3 Explanation of statuses used in this chapter 4 2.4 Supported Header 5 3. Interbank limitation 46 2 UBS Implementation Guidelines – Swiss Payment Standards for credit transfers 1. Credit Transfer message 1.1 Scope of application of this document 1.2 Flow of messages in accordance with Swiss This brochure is designed to inform you about technical Payment Standards aspects of using the credit transfer message pain.001 at The message standard recommended by Swiss financial UBS. The document is valid within the following scope of institutions, the Swiss Payment Standards is based on the application: ISO 20022 Payments Standard. The chart below provides an overview of the flow of messages currently supported Characteristics Scope of application by UBS and shows the use of pain.001 in the context of Use of message Swiss Payment Standards for the end-to-end message flow: credit transfers for domestic and international transfers Product Credit Transfer Service Payment order Message type Debtor available to Recommendation Swiss Payment Standards Schema pain.001.001.03.ch.02 Implementation 1.7.2 – 22.09.2017 Guide Version Replaces old DTA TA 826, TA 827, TA messages 830, TA 832, TA 836 messages (Switzerland), , EDIFACT (PAYMUL) MT100, MT101 Available through For clients of UBS UBS electronic Switzerland interfaces • UBS KeyPort • UBS E-Banking XML upload 3 UBS Implementation Guidelines – Swiss Payment Standards for credit transfers 2. -

Npc Instant Credit Transfer Scheme Customer-To-Bank Recommended Implementation Guidelines

NPC INSTANT CREDIT TRANSFER C2B IG Reference: NPC013-01 2021 Version 1.0 NPC INSTANT CREDIT TRANSFER SCHEME CUSTOMER-TO-BANK RECOMMENDED IMPLEMENTATION GUIDELINES Abstract This document sets out the recommended rules for implementing Version 1.0 of the 2021 NPC Instant Credit Transfer Scheme Rulebook based on version 2009 of the cus- tomer-to-bank credit transfer ISO 20022 XML message standards. Document Reference NPC013-01 Issue 2020 Version 1.0 Date of Issue 27 March 2020 Reason for Issue NPC Open Consultation Circulation Publicly available Effective Date 19 February 2021 Nordic Payments Council – Box 7306 – SE 103 94 Stockholm Company Registration Number 802524-8645 © 2020 Copyright Nordic Payments Council (NPC) Based on EPC121-16 SEPA Instant Credit Transfer Scheme Customer-to-Bank Implementation Guidelines 2019 v. 1.0 with the authorisation from Conseil Européen des Paiements AISBL– Cours Saint-Michel 30 – B 1040 Brussels Enterprise N° 0873.268.927 © 2018 Copyright European Payments Council (EPC) AISBL Reproduction for non-commercial purposes is authorised, with acknowledgement of the source NPC INSTANT CREDIT TRANSFER C2B IG Reference: NPC013-01 2021 Version 1.0 TABLE OF CONTENTS 0. Document Information ................................................................................................................................. 3 0.1 References ................................................................................................................................................... 3 0.2 Change History ............................................................................................................................................