Guinea Africa Unitary Country

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code List 11 Invoice Currency

Code list 11 Invoice currency Alphabetical order Code Code Alfa Alfa Country / region Country / region A BTN Bhutan ngultrum BOB Bolivian boliviano AFN Afghan new afghani BAM Bosnian mark ALL Albanian lek BWP Botswanan pula DZD Algerian dinar BRL Brazilian real USD American dollar BND Bruneian dollar AOA Angolan kwanza BGN Bulgarian lev ARS Argentinian peso BIF Burundi franc AMD Armenian dram AWG Aruban guilder AUD Australian dollar C AZN Azerbaijani new manat KHR Cambodian riel CAD Canadian dollar B CVE Cape Verdean KYD Caymanian dollar BSD Bahamian dollar XAF CFA franc of Central-African countries BHD Bahraini dinar XOF CFA franc of West-African countries BBD Barbadian dollar XPF CFP franc of Oceania BZD Belizian dollar CLP Chilean peso BYR Belorussian rouble CNY Chinese yuan renminbi BDT Bengali taka COP Colombian peso BMD Bermuda dollar KMF Comoran franc Code Code Alfa Alfa Country / region Country / region CDF Congolian franc CRC Costa Rican colon FKP Falkland Islands pound HRK Croatian kuna FJD Fijian dollar CUC Cuban peso CZK Czech crown G D GMD Gambian dalasi GEL Georgian lari DKK Danish crown GHS Ghanaian cedi DJF Djiboutian franc GIP Gibraltar pound DOP Dominican peso GTQ Guatemalan quetzal GNF Guinean franc GYD Guyanese dollar E XCD East-Caribbean dollar H EGP Egyptian pound GBP English pound HTG Haitian gourde ERN Eritrean nafka HNL Honduran lempira ETB Ethiopian birr HKD Hong Kong dollar EUR Euro HUF Hungarian forint F I Code Code Alfa Alfa Country / region Country / region ISK Icelandic crown LAK Laotian kip INR Indian rupiah -

Monthly Economic Review Monthly Economic Review

MONTHLY ECONOMIC REVIEW MONTHLY ECONOMIC REVIEW CENTRAL BANK OF LIBERIA (CBL) MONTHLY ECONOMIC REVIEW OCT. 2017 VOLUME 3 No. 10 MONTHLY ECONOMIC REVIEW MONTHLY ECONOMIC REVIEW The Monthly Economic Review is produced by the Table 2: Performances of End-of-Period WAMZ Bank’s Research, Policy & Planning Department. Exchange Rates against the US Dollar Inquiries concerning this publication should be Appr (-)/Depr (+) addressed to: Currency Oct-16 Sep-17 Oct-17 MoM YoY GHC 3.96 4.40 4.37 -0.61 10.36 The Director GMD 49.86 46.40 47.61 2.60 -4.52 Research, Policy & Planning Department GNF 9,048.48 8,976.34 8,998.22 0.24 -0.56 Central Bank of Liberia LRD 98.50 117.67 119.14 1.25 20.95 P. O. Box 2048 NGN 305.00 305.30 305.25 -0.02 0.08 Ashmun & Lynch Streets, Monrovia, Liberia SLL 7,037.65 7,521.01 7,539.54 0.25 7.13 Contacts: +231-880-649103/886-246587/555-960556 Sources: Central Banks of Liberia and WAMA: www.amao-wama.org/ LRD—Liberian Dollar Fax: 00(231)77059642 GHC—Ghanaian Cedi GMD—Gambian Dalasi GNF—Guinean Franc NGN—Nigerian Naira SLL—Sierra Leonean Leone USD—US Dollar 9 MONTHLY ECONOMIC REVIEW MONTHLY ECONOMIC REVIEW REAL SECTOR & PRICE DEVELOPMENTS Jul-17 Aug-17 Sep-17 Oct-17 External Trade (Volume) – cont’d (Metric Tons) Production of Key Commodities - Petroleum Products 4,759 4,731 4,507 3,962 Movements in production data for the month of October, 2017 were mixed. -

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities September 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

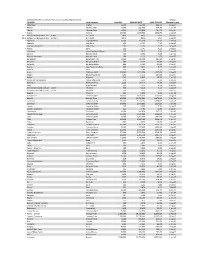

Maximum Monthly Stipend Rates For

MAXIMUM MONTHLY STIPEND RATES FOR FELLOWS AND SCHOLARS Jul 2020 COUNTRY Local Currency Local DSA MAX RES RATE MAX TRV RATE Effective % date * Afghanistan Afghani 12,600 132,300 198,450 1-Aug-07 * Albania Albania Lek(e) 14,000 220,500 330,750 1-Jan-05 Algeria Algerian Dinar 31,600 331,800 497,700 1-Aug-07 * Angola Kwanza 133,000 1,396,500 2,094,750 1-Aug-07 #N/A Antigua and Barbuda (1 Apr. - 30 Nov.) E.C. Dollar #N/A #N/A #N/A 1-Aug-07 #N/A Antigua and Barbuda (1 Dec. - 31 Mar.) E.C. Dollar #N/A #N/A #N/A 1-Aug-07 * Argentina Argentine Peso 18,600 153,450 230,175 1-Jan-05 Australia AUL Dollar 453 4,757 7,135 1-Aug-07 Australia - Academic AUL Dollar 453 1,200 7,135 1-Aug-07 * Austria Euro 261 2,741 4,111 1-Aug-07 * Azerbaijan (new)Azerbaijan Manat 239 1,613 2,420 1-Jan-05 Bahrain Bahraini Dinar 106 2,226 3,180 1-Jan-05 Bahrain - Academic Bahraini Dinar 106 1,113 1,670 1-Aug-07 Bangladesh Bangladesh Taka 12,400 130,200 195,300 1-Aug-07 Barbados Barbados Dollar 880 9,240 13,860 1-Aug-07 Barbados Barbados Dollar 880 9,240 13,860 1-Aug-07 * Belarus New Belarusian Ruble 600 5,850 8,775 1-Jan-06 Belgium Euro 338 3,549 5,324 1-Aug-07 Benin CFA Franc(XOF) 123,000 1,291,500 1,937,250 1-Aug-07 Bhutan Bhutan Ngultrum 7,290 76,545 114,818 1-Aug-07 * Bolivia Boliviano 1,200 10,800 16,200 1-Jan-07 * Bosnia and Herzegovina Convertible Mark 279 3,557 5,336 1-Jan-05 Botswana Botswana Pula 2,220 23,310 34,965 1-Aug-07 Brazil Brazilian Real 530 4,373 6,559 1-Jan-05 British Virgin Islands (16 Apr. -

![Demonyms: Names of Nationalities [Demonym Is a Name Given to a People Or Inhabitants of a Place.] Country Demonym* Country Demonym*](https://docslib.b-cdn.net/cover/7054/demonyms-names-of-nationalities-demonym-is-a-name-given-to-a-people-or-inhabitants-of-a-place-country-demonym-country-demonym-887054.webp)

Demonyms: Names of Nationalities [Demonym Is a Name Given to a People Or Inhabitants of a Place.] Country Demonym* Country Demonym*

17. Useful Tables Th is chapter contains useful tables presented in GPO style. Th e tables display various design features most frequently used in Government publications and can be considered examples of GPO style. U.S. Presidents and Vice Presidents President Years Vice President Years George Washington ....................................... (1789–1797) John Adams .................................................... (1789–1797) John Adams ..................................................... (1797–1801) Th omas Jeff erson ........................................... (1797–1801) Th omas Jeff erson ............................................ (1801–1809) Aaron Burr...................................................... (1801–1805) George Clinton .............................................. (1805–1809) James Madison ................................................ (1809–1817) George Clinton .............................................. (1809–1812) Vacant .............................................................. (1812–1813) Elbridge Gerry ............................................... (1813–1814) Vacant .............................................................. (1814–1817) James Monroe.................................................. (1817–1825) Daniel D. Tompkins ..................................... (1817–1825) John Quincy Adams ...................................... (1825–1829) John C. Calhoun ............................................ (1825–1829) Andrew Jackson .............................................. (1829–1837) -

I. the Economic Environment

Guinea WT/TPR/S/54 Page 1 I. THE ECONOMIC ENVIRONMENT (1) MAJOR FEATURES OF THE ECONOMY 1. The Republic of Guinea is a coastal country of West Africa with an area of 245,857 km2 and a population of 7.1 million inhabitants at the beginning of 1997. Except for the capital, Conakry, which has over one million inhabitants, the other main cities, including Kankan, Kindia and N'Zérékoré, have fewer than 100,000 inhabitants. Life expectancy at birth was below 50 years in 1995, with high rates of infant mortality and illiteracy (Table I.1). Table I.1 Basic social data, 1990 and 1995 Indicators 1990 1995 Population (millions) 5.8 6.6 Urban population (percentage) 26 30 Rate of population growth (percentage) 3 3 Infant mortality rate (per '000 live births) 138 128 Life expectancy 44 49 Public spending on health (percentage of GDP) 0.5 0.5 Public spending on education (percentage of GDP) 1.5 1.7 Illiteracy (percentage of population) 76 64 - Men 65 50 - Women 87 78 Human development indication (HDI ranking/total number of countries) 173/173 167/175 Source: World Bank, various publications; United Nations Development Programme, Human Development Report, several issues. 2. With a Gross National Product (GNP) of US$570 per capita in 1997,1 Guinea is a least developed country. Formal activities are dominated by exploitation of the numerous mining resources with which the Guinean subsoil abounds (Chapter IV (3)(i)). Bauxite (the main mineral resource), gold and diamonds are currently mined on an industrial scale. These resources undergo little local processing but still account for over 90 per cent of goods-export revenue. -

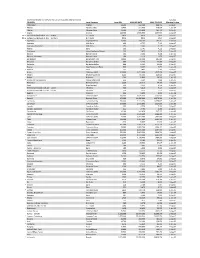

Maximum Monthly Stipend Rates For

MAXIMUM MONTHLY STIPEND RATES FOR FELLOWS AND SCHOLARS Mar 2021 COUNTRY Local Currency Local DSA MAX RES RATE MAX TRV RATE Effective % date Afghanistan Afghani 12,600 132,300 198,450 1-Aug-07 * Albania Albania Lek(e) 13,400 211,050 316,575 1-Jan-05 Algeria Algerian Dinar 31,600 331,800 497,700 1-Aug-07 * Angola Kwanza 146,000 1,533,000 2,299,500 1-Aug-07 #N/A Antigua and Barbuda (1 Apr. - 30 Nov.) E.C. Dollar #N/A #N/A #N/A 1-Aug-07 #N/A Antigua and Barbuda (1 Dec. - 31 Mar.) E.C. Dollar #N/A #N/A #N/A 1-Aug-07 * Argentina Argentine Peso 23,900 197,175 295,763 1-Jan-05 Australia AUL Dollar 453 4,757 7,135 1-Aug-07 Australia - Academic AUL Dollar 453 1,200 7,135 1-Aug-07 Austria Euro 261 2,741 4,111 1-Aug-07 * Azerbaijan (new)Azerbaijan Manat 240 1,620 2,430 1-Jan-05 Bahrain Bahraini Dinar 106 2,226 3,180 1-Jan-05 Bahrain - Academic Bahraini Dinar 106 1,113 1,670 1-Aug-07 Bangladesh Bangladesh Taka 12,400 130,200 195,300 1-Aug-07 Barbados Barbados Dollar 880 9,240 13,860 1-Aug-07 Barbados Barbados Dollar 880 9,240 13,860 1-Aug-07 Belarus New Belarusian Ruble 660 6,435 9,653 1-Jan-06 * Belgium Euro 333 3,497 5,245 1-Aug-07 Benin CFA Franc(XOF) 123,000 1,291,500 1,937,250 1-Aug-07 * Bhutan Bhutan Ngultrum 8,200 86,100 129,150 1-Aug-07 * Bolivia Boliviano 1,200 10,800 16,200 1-Jan-07 * Bosnia and Herzegovina Convertible Mark 256 3,264 4,896 1-Jan-05 Botswana Botswana Pula 2,220 23,310 34,965 1-Aug-07 Brazil Brazilian Real 530 4,373 6,559 1-Jan-05 British Virgin Islands (16 Apr. -

Republic of Guinea: Overcoming Growth Stagnation to Reduce Poverty

Report No. 123649-GN Public Disclosure Authorized REPUBLIC OF GUINEA OVERCOMING GROWTH STAGNATION TO REDUCE POVERTY Public Disclosure Authorized SYSTEMATIC COUNTRY DIAGNOSTIC March 16, 2018 International Development Association Country Department AFCF2 Public Disclosure Authorized Africa Region International Finance Corporation Sub-Saharan Africa Department Multilateral Investment Guarantee Agency Sub-Saharan Africa Department Public Disclosure Authorized WORLD BANK GROUP IBRD IFC Regional Vice President: Makhtar Diop : Vice President: Dimitris Tsitsiragos Country Director: Soukeyna Kane Director: Vera Songwe : Country Manager: Rachidi Radji Country Manager: Cassandra Colbert Task Manager: Ali Zafar : Resident Representative: Olivier Buyoya Co-Task Manager: Yele Batana ii LIST OF ACRONYMS AGCP Guinean Central Procurement Agency ANASA Agence Nationale des Statistiques Agricoles (National Agricultural Statistics Agency) Agence de Promotion des Investissements et des Grands Travaux (National Agency for APIX Promotion of Investment and Major Works) BCRG Banque Centrale de la République de Guinée (Central Bank of Guinea) CEQ Commitment to Equity CGE Computable General Equilibrium Conseil National pour la Démocratie et le Développement (National Council for CNDD Democracy and Development) Confédération Nationale des Travailleurs de Guinée (National Confederation of CNTG Workers of Guinea) CPF Country Partnership Framework CPIA Country Policy and Institutional Assessment CRG Crédit Rural de Guinée (Rural Credit of Guinea) CWE China Water and -

Currency List

Americas & Caribbean | Tradeable Currency Breakdown Currency Currency Name New currency/ Buy Spot Sell Spot Deliverable Non-Deliverable Special requirements/ Symbol Capability Forward Forward Restrictions ANG Netherland Antillean Guilder ARS Argentine Peso BBD Barbados Dollar BMD Bermudian Dollar BOB Bolivian Boliviano BRL Brazilian Real BSD Bahamian Dollar CAD Canadian Dollar CLP Chilean Peso CRC Costa Rica Colon DOP Dominican Peso GTQ Guatemalan Quetzal GYD Guyana Dollar HNL Honduran Lempira J MD J amaican Dollar KYD Cayman Islands MXN Mexican Peso NIO Nicaraguan Cordoba PEN Peruvian New Sol PYG Paraguay Guarani SRD Surinamese Dollar TTD Trinidad/Tobago Dollar USD US Dollar UYU Uruguay Peso XCD East Caribbean Dollar 130 Old Street, EC1V 9BD, London | t. +44 (0) 203 475 5301 | [email protected] sugarcanecapital.com Europe | Tradeable Currency Breakdown Currency Currency Name New currency/ Buy Spot Sell Spot Deliverable Non-Deliverable Special requirements/ Symbol Capability Forward Forward Restrictions ALL Albanian Lek BGN Bulgarian Lev CHF Swiss Franc CZK Czech Koruna DKK Danish Krone EUR Euro GBP Sterling Pound HRK Croatian Kuna HUF Hungarian Forint MDL Moldovan Leu NOK Norwegian Krone PLN Polish Zloty RON Romanian Leu RSD Serbian Dinar SEK Swedish Krona TRY Turkish Lira UAH Ukrainian Hryvnia 130 Old Street, EC1V 9BD, London | t. +44 (0) 203 475 5301 | [email protected] sugarcanecapital.com Middle East | Tradeable Currency Breakdown Currency Currency Name New currency/ Buy Spot Sell Spot Deliverabl Non-Deliverabl Special Symbol Capability e Forward e Forward requirements/ Restrictions AED Utd. Arab Emir. Dirham BHD Bahraini Dinar ILS Israeli New Shekel J OD J ordanian Dinar KWD Kuwaiti Dinar OMR Omani Rial QAR Qatar Rial SAR Saudi Riyal 130 Old Street, EC1V 9BD, London | t. -

List of Currencies of All Countries

The CSS Point List Of Currencies Of All Countries Country Currency ISO-4217 A Afghanistan Afghan afghani AFN Albania Albanian lek ALL Algeria Algerian dinar DZD Andorra European euro EUR Angola Angolan kwanza AOA Anguilla East Caribbean dollar XCD Antigua and Barbuda East Caribbean dollar XCD Argentina Argentine peso ARS Armenia Armenian dram AMD Aruba Aruban florin AWG Australia Australian dollar AUD Austria European euro EUR Azerbaijan Azerbaijani manat AZN B Bahamas Bahamian dollar BSD Bahrain Bahraini dinar BHD Bangladesh Bangladeshi taka BDT Barbados Barbadian dollar BBD Belarus Belarusian ruble BYR Belgium European euro EUR Belize Belize dollar BZD Benin West African CFA franc XOF Bhutan Bhutanese ngultrum BTN Bolivia Bolivian boliviano BOB Bosnia-Herzegovina Bosnia and Herzegovina konvertibilna marka BAM Botswana Botswana pula BWP 1 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Brazil Brazilian real BRL Brunei Brunei dollar BND Bulgaria Bulgarian lev BGN Burkina Faso West African CFA franc XOF Burundi Burundi franc BIF C Cambodia Cambodian riel KHR Cameroon Central African CFA franc XAF Canada Canadian dollar CAD Cape Verde Cape Verdean escudo CVE Cayman Islands Cayman Islands dollar KYD Central African Republic Central African CFA franc XAF Chad Central African CFA franc XAF Chile Chilean peso CLP China Chinese renminbi CNY Colombia Colombian peso COP Comoros Comorian franc KMF Congo Central African CFA franc XAF Congo, Democratic Republic Congolese franc CDF Costa Rica Costa Rican colon CRC Côte d'Ivoire West African CFA franc XOF Croatia Croatian kuna HRK Cuba Cuban peso CUC Cyprus European euro EUR Czech Republic Czech koruna CZK D Denmark Danish krone DKK Djibouti Djiboutian franc DJF Dominica East Caribbean dollar XCD 2 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Dominican Republic Dominican peso DOP E East Timor uses the U.S. -

List of Currencies That Are Not on KB´S Exchange Rate

LIST OF CURRENCIES THAT ARE NOT ON KB'S EXCHANGE RATE , BUT INTERNATIONAL PAYMENTS IN THESE CURRENCIES CAN BE MADE UNDER SPECIFIC CONDITIONS ISO code Currency Country in which the currency is used AED United Arab Emirates Dirham United Arab Emirates ALL Albanian Lek Albania AMD Armenian Dram Armenia, Nagorno-Karabakh ANG Netherlands Antillean Guilder Curacao, Sint Maarten AOA Angolan Kwanza Angola ARS Argentine Peso Argentine BAM Bosnia and Herzegovina Convertible Mark Bosnia and Herzegovina BBD Barbados Dollar Barbados BDT Bangladeshi Taka Bangladesh BHD Bahraini Dinar Bahrain BIF Burundian Franc Burundi BOB Boliviano Bolivia BRL Brazilian Real Brazil BSD Bahamian Dollar Bahamas BWP Botswana Pula Botswana BYR Belarusian Ruble Belarus BZD Belize Dollar Belize CDF Congolese Franc Democratic Republic of the Congo CLP Chilean Peso Chile COP Colombian Peso Columbia CRC Costa Rican Colon Costa Rica CVE Cape Verde Escudo Cape Verde DJF Djiboutian Franc Djibouti DOP Dominican Peso Dominican Republic DZD Algerian Dinar Algeria EGP Egyptian Pound Egypt ERN Eritrean Nakfa Eritrea ETB Ethiopian Birr Ethiopia FJD Fiji Dollar Fiji GEL Georgian Lari Georgia GHS Ghanaian Cedi Ghana GIP Gibraltar Pound Gibraltar GMD Gambian Dalasi Gambia GNF Guinean Franc Guinea GTQ Guatemalan Quetzal Guatemala GYD Guyanese Dollar Guyana HKD Hong Kong Dollar Hong Kong HNL Honduran Lempira Honduras HTG Haitian Gourde Haiti IDR Indonesian Rupiah Indonesia ILS Israeli New Shekel Israel INR Indian Rupee India, Bhutan IQD Iraqi Dinar Iraq ISK Icelandic Króna Iceland JMD Jamaican -

BIS Locational Banking Statistics: Notes to Explain the Data Structure

Version DSD_LBS_V201712 December 2017 BIS locational banking statistics: explanation of the data structure definitions Contents 1. DSD for reporting: BIS_LBP ........................................................................................... 2 2. Code lists for selected dimensions.................................................................................. 4 2.1. Currency denomination: L_DENOM ...................................................................... 4 2.2. Currency type of reporting country: L_CURR_TYPE ............................................. 6 2.3. Parent country: L_PARENT_CTY .......................................................................... 7 2.4. Reporting country: L_REP_CTY ............................................................................ 9 2.5 Counterparty country dimension: L_CP_COUNTRY ........................................... 11 3. Consistency in reporting ............................................................................................... 18 3.1 Aggregates vs unallocated members .................................................................. 18 3.2 Instrument breakdown ......................................................................................... 18 3.3 Debt securities liabilities ...................................................................................... 18 3.4 Related offices and central banks ........................................................................ 19 3.5 Unrelated banks ..................................................................................................