Q4 2020 Form 10-K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Playstation 4

PLAYSTATION 4 7 DAYS TO DIE DRAGONBALL XENOVERSE 2 LEGO DC SUPERVILLAINS A WAY OUT DRAGONS DAWN OF NEW RID LEGO MARVEL AVENGERS AC EZIO COLLECTION DYNASTY WARRIORS 8 XTRE LEGO MARVEL SUPERHERO 2 AC ODYSSEY DYNASTY WARRIORS 9 LEGO MOVIE 2 ACCEL WORLD VS SWORD AR EARTH DEFENSE FORCE 4.1 LEGO THE INCREDIBLES ACE COMBAT 7 EARTHFALL DE LOST SPHEAR AIR CONFLICTS SECRET ELEX MEGADIMENSION NEPTU VII AKIBAS TRIP UNDEAD & UN ELITE DANGEROUS METRO EXODUS ALL STAR FRUIT RACING F1 18 MONSTER ENERGY SUPERC 2 AMAZING SPIDERMAN 2 FAIRY FENCER F ADF MONSTER ENERGY SUPERCRO ANTHEM FAR CRY NEW DAWN MONSTER HUNTER WORLD AO INTERNATIONAL TENNIS FATE EXTELLA LINK MORTAL KOMBAT XL ARK SURVIVAL EVOLVED FIFA 19 MOTO GP 18 ASSASSINS CREED 3 REMAS FINAL FANTASY X/X MX VS ATV ALL OUT ASSETTO CORSA UE FIRE PRO WRESTLING WORL MXGP PRO ASTROBOT RESCUE MISSION VR FISHING SIM WORLD MY HERO ONES JUSTICE ATELIER SOPHIE ALCHEMIS FIST OF THE NORTH STAR NARUTO SUNS TRILOGY ATTACK ON TITAN 2 FLAT OUT 4 TI NARUTO TO BORUTO SHIN S ATTACK ON TITAN GALGUN 2 NBA LIVE 18 BATTLEFIELD 5 GENERATION ZERO NELKE & THE LEG ALCHEM BLAZBLUE CROSS TAG BATT GENERATION ZERO XB1 NHL 19 BLOODBORNE GOTY GENESIS ALPHA ONE NIER AUTOMATA CALL OF CTHULHU GHOSTBUSTERS NIOH CARS 3 DRIVEN GOAT SIMULATOR NO HEROES ALLOWED VR COD BLACK OPS 4 GOD EATER 3 ODIN SPHERE LEIFTH COD MW REMASTERED GOD OF WAR OMEGA LABYRINTH Z CONSTRUCTOR HD GOD WARS FUTURE PAST ONE PIECE BURNING CRASH BANDICO NSANE TRI GRAND AGES MEDIEVAL ONE PIECE WORLD SEEKER CYBERDIMENSION NEPTUN 4 GRIP OUTLAST TRINITY DAKAR 18 GUILTY GEAR -

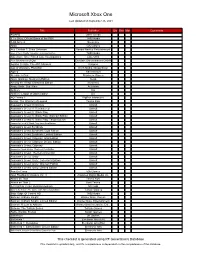

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

19 May 2020 Team17 Group Plc ("Team17", the "Group" Or the "Company")

RNS Number : 3721N Team17 Group PLC 19 May 2020 19 May 2020 Team17 Group plc ("Team17", the "Group" or the "Company") Result of AGM Team17, a global games entertainment label, creative partner and developer of independent ("indie") premium video games, is pleased to announce that all resolutions proposed at the Annual General Meeting of the Company held earlier today were duly passed on a show of hands. The full text of the resolutions can be found in the Notice of Annual General Meeting, which is available on the Company's website at https://www.team17group.com/. The full proxy results can also be found on the Company's website at https://www.team17group.com/. Enquiries: Team17 Group plc Debbie Bestwick MBE, Chief Executive Officer via Vigo Communications Mark Crawford, Chief Financial Officer +44 (0)20 7390 0238 GCA Altium (Nominated Adviser) Phil Adams / Adrian Reed / Paul Lines +44 (0)845 505 4343 Berenberg (Broker) Chris Bowman / Marie Moy / Alix Mecklenburg-Solodkoff +44 (0)20 3207 7800 Vigo Communications (Financial Public Relations) Jeremy Garcia / Charlie Neish +44 (0)20 7390 0233 [email protected] About Team17 Team17 is a leading games entertainment label and creative partner for independent ("indie") developers, focused on the premium, rather than free to play market, and creating games for the PC home computer market, the video games console market and the mobile and tablet gaming markets. Alongside developing the Company's own games in house ("first party IP"), Team17 also partners with independent developers across the globe to add value to their games in all areas of development and production alongside bringing them to market across multiple platforms for fixed percentage royalties ("third-party IP"). -

Silver Lake Announces Strategic Investment in Unity Technologies Joins Current Investors Including Sequoia Capital in the World

Silver Lake Announces Strategic Investment in Unity Technologies Joins Current Investors Including Sequoia Capital in the World’s Leading Game Development Platform Company Poised for Continued Rapid Growth in Core Game Engine and Virtual and Augmented Reality Technology SAN FRANCISCO, Calif. — Unity Technologies, the largest global development platform for creating 2D, 3D, virtual and augmented reality games and experiences, announced today an investment by Silver Lake, the global leader in technology investing, of up to $400 million in the company. The primary use of new capital will be driving growth in Unity’s augmented and virtual reality capabilities and in its core engine. Silver Lake Managing Partner Egon Durban will join Unity’s board of directors. “Our mission to help game developers bring their disparate creative visions to life has enabled us to create a rapidly expanding global platform with enormous growth potential both within and beyond gaming,” said John Riccitiello, CEO of Unity. “We look forward to partnering with Silver Lake, with its proven technology industry expertise, to enhance Unity’s next stage of growth, allowing us to accelerate the advance of augmented and virtual reality in both gaming and non-gaming markets and continue to democratize development.” Unity is the leading provider of mission-critical infrastructure for gaming. Every month, developers using the Unity platform create more than 90,000 unique applications, which are downloaded over 1.7 billion times per month. Over the past two years, the company has leveraged its long history as a game engine provider to expand into new offerings, including a market-leading in-game mobile ad network and a widely deployed analytics tool using machine learning and data science. -

Game Developer Magazine

>> INSIDE: 2007 AUSTIN GDC SHOW PROGRAM SEPTEMBER 2007 THE LEADING GAME INDUSTRY MAGAZINE >>SAVE EARLY, SAVE OFTEN >>THE WILL TO FIGHT >>EXCLUSIVE INTERVIEW MAKING SAVE SYSTEMS FOR CHANGING GAME STATES HARVEY SMITH ON PLAYERS, NOT DESIGNERS IN PANDEMIC’S SABOTEUR POLITICS IN GAMES POSTMORTEM: PUZZLEINFINITE INTERACTIVE’S QUEST DISPLAY UNTIL OCTOBER 11, 2007 Using Autodeskodesk® HumanIK® middle-middle- Autodesk® ware, Ubisoftoft MotionBuilder™ grounded ththee software enabled assassin inn his In Assassin’s Creed, th the assassin to 12 centuryy boots Ubisoft used and his run-time-time ® ® fl uidly jump Autodesk 3ds Max environment.nt. software to create from rooftops to a hero character so cobblestone real you can almost streets with ease. feel the coarseness of his tunic. HOW UBISOFT GAVE AN ASSASSIN HIS SOUL. autodesk.com/Games IImmagge cocouru tteesyy of Ubiisofft Autodesk, MotionBuilder, HumanIK and 3ds Max are registered trademarks of Autodesk, Inc., in the USA and/or other countries. All other brand names, product names, or trademarks belong to their respective holders. © 2007 Autodesk, Inc. All rights reserved. []CONTENTS SEPTEMBER 2007 VOLUME 14, NUMBER 8 FEATURES 7 SAVING THE DAY: SAVE SYSTEMS IN GAMES Games are designed by designers, naturally, but they’re not designed for designers. Save systems that intentionally limit the pick up and drop enjoyment of a game unnecessarily mar the player’s experience. This case study of save systems sheds some light on what could be done better. By David Sirlin 13 SABOTEUR: THE WILL TO FIGHT 7 Pandemic’s upcoming title SABOTEUR uses dynamic color changes—from vibrant and full, to black and white film noir—to indicate the state of allied resistance in-game. -

January 2010

SPECIAL FEATURE: 2009 FRONT LINE AWARDS VOL17NO1JANUARY2010 THE LEADING GAME INDUSTRY MAGAZINE 1001gd_cover_vIjf.indd 1 12/17/09 9:18:09 PM CONTENTS.0110 VOLUME 17 NUMBER 1 POSTMORTEM DEPARTMENTS 20 NCSOFT'S AION 2 GAME PLAN By Brandon Sheffield [EDITORIAL] AION is NCsoft's next big subscription MMORPG, originating from Going Through the Motions the company's home base in South Korea. In our first-ever Korean postmortem, the team discusses how AION survived worker 4 HEADS UP DISPLAY [NEWS] fatigue, stock drops, and real money traders, providing budget and Open Source Space Games, new NES music engine, and demographics information along the way. Gamma IV contest announcement. By NCsoft South Korean team 34 TOOL BOX By Chris DeLeon [REVIEW] FEATURES Unity Technologies' Unity 2.6 7 2009 FRONT LINE AWARDS 38 THE INNER PRODUCT By Jake Cannell [PROGRAMMING] We're happy to present our 12th annual tools awards, representing Brick by Brick the best in game industry software, across engines, middleware, production tools, audio tools, and beyond, as voted by the Game 42 PIXEL PUSHER By Steve Theodore [ART] Developer audience. Tilin'? Stylin'! By Eric Arnold, Alex Bethke, Rachel Cordone, Sjoerd De Jong, Richard Jacques, Rodrigue Pralier, and Brian Thomas. 46 DESIGN OF THE TIMES By Damion Schubert [DESIGN] Get Real 15 RETHINKING USER INTERFACE Thinking of making a game for multitouch-based platforms? This 48 AURAL FIXATION By Jesse Harlin [SOUND] article offers a look at the UI considerations when moving to this sort of Dethroned interface, including specific advice for touch offset, and more. By Brian Robbins 50 GOOD JOB! [CAREER] Konami sound team mass exodus, Kim Swift interview, 27 CENTER OF MASS and who went where. -

10 Minimum Towards Pokemon & Star Wars

$10 MINIMUM TOWARDS POKEMON & STAR WARS Games Eligible for this Promotion - Last Updated 11/13/19 Game .HACK G.U. LAST RECODE PS4 3D BILLARDS & SNOOKER PS4 3D MINI GOLF PS4 7 DAYS TO DIE PS4 7 DAYS TO DIE XB1 7th DRAGON III CODE VFD 3DS 8 TO GLORY PS4 8 TO GLORY XB1 8-BIT ARMIES COLLECTOR ED P 8-BIT ARMIES COLLECTORS XB1 8-BIT HORDES PS4 8-BIT INVADERS PS4 A WAY OUT PS4 A WAY OUT XB1 ABZU PS4 ABZU XB1 AC EZIO COLLECTION PS4 AC EZIO COLLECTION XB1 AC ROGUE ONE PS4 ACE COMBAT 3DS ACES OF LUFTWAFFE NSW ACES OF LUFTWAFFE PS4 ACES OF LUFTWAFFE XB1 ADR1FT PS4 ADR1FT XB1 ADV TM PRTS OF ENCHIRIDION ADV TM PRTS OF ENCHIRIDION ADV TM PRTS OF ENCHIRIDION ADVENTURE TIME 3 3DS ADVENTURE TIME 3DS ADVENTURE TIME EXP TD 3DS ADVENTURE TIME FJ INVT 3DS ADVENTURE TIME FJ INVT PS4 ADVENTURE TIME INVESTIG XB1 AEGIS OF EARTH PRO ASSAULT AEGIS OF EARTH: PROTO PS4 AEREA COLLECTORS PS4 AGATHA CHRISTIE ABC MUR XB1 AGATHA CHRSTIE: ABC MRD PS4 AGONY PS4 AGONY XB1 Some Restrictions Apply. This is only a guide. Trade values are constantly changing. Please consult your local EB Games for the most updated trade values. $10 MINIMUM TOWARDS POKEMON & STAR WARS Games Eligible for this Promotion - Last Updated 11/13/19 Game AIR CONFLICTS 2-PACK PS4 AIR CONFLICTS PACFC CRS PS4 AIR CONFLICTS SECRT WAR PS4 AIR CONFLICTS VIETNAM PS4 AIRPORT SIMULATOR NSW AKIBAS BEAT PS4 AKIBAS BEAT PSV ALEKHINES GUN PS4 ALEKHINE'S GUN XB1 ALIEN ISOLATION PS4 ALIEN ISOLATION XB1 AMAZING SPIDERMAN 2 3DS AMAZING SPIDERMAN 2 PS4 AMAZING SPIDERMAN 2 XB1 AMAZING SPIDERMAN 3DS AMAZING SPIDERMAN PSV -

Over 570 Eligible Titles!

Over 570 eligible titles! Games Eligible for this Promotion - Last Updated 7/22/21 GAME NSW PS4 PS5 XB1 XBX 1-2-SWITCH 13 SENTIELS: AEGIS RIM 30 IN 1 GAME COLLECTION A HAT IN TIME NSW ADAMS VENTURE ORIGIN ADDAMS FAMILY MAN MAY AGE OF WONDERS PLANETFALL AI SOMNIUM FILES NIR IN AIR CONFLICTS DBL PK AIR MISSIONS HIND AKIBAS TRIP & HELLBOUND ALEX KIDD IN MIRACLE WD ALIENS FIRETEAM ELITE AMULET OF CHAOS DONJON ADV ANCESTORS LEGACY ANGRY BRDS 2 UNDR PRSR ANIMA: GATE OF MEMORIES ANIMAL CROSSING NEW HOR AO TENNIS 2 ARAGAMI 2 ARC OF ALCHEMIST ARMS ARY AND SECRET OF SEASONS ASSASSINS CREED VALHAL ASSETTO CORSA ASSETTO CORSA COMPETIZIONE ASTRAL CHAIN ATELIER LULUA SCION ARLND ATELIER RYZA 2 LOST LEGNDS ATELIER SECRET HIDEOUT ATELIER SOPHIE: ALCHMST ATTACK ON TITAN ATTACK ON TITAN2 FINAL BTL AVICII INVECTOR ENCORE ED AXIOM VERGE MULTIVERSE ED AZUR LANE CROSSWAVE BAKUGAN CHAMPN VEST DLX ED BALAN WONDERWORLD BALDURS GATE 1&2 ENH ED BASS PRO SHOP BAYONETTA & VANQ ANV REG Some Restrictions Apply. This is only a guide. Trade values are constantly changing. Please consult your local EB Games for the most updated trade values. Over 570 eligible titles! Games Eligible for this Promotion - Last Updated 7/22/21 GAME NSW PS4 PS5 XB1 XBX BAYONETTA & VNQUISH 10 ANV BAYONETTA 2 BEAST QUEST LE BEE SIMULATOR BIG RUMBLE BOXING CREED BIOMUTANT BLACKSAD UNDER THE SKIN LE BLADED FURY BLASPHEMOUS DEL ED BLASPHEMOUS DEL ED HG BLAZE & MONSTER MACH XCR BLOODSTAINED BLOODSTAINED COM BLUE FIRE BOUNTY BATTLE BRAVELY DEFAULT 2 BUGSNAX BUILDINGS HAVE FEELINGS BURGER TIME PARTY NSW BURNOUT REMASTERED CABELA HUNT CADENCE OF HYRULE NECRO CAFE ENCHANTE CALL OF CTHULHU NSW CANT DRIVE THIS HG CAPTAIN TOAD TT CATHERINE FULL BODY CHILDREN OF MORTA CHIVALRY 2 CLASSIC RACER ELITE CLOUDPUNK CLUBHOUSE GAMES COBRA KAI COD BLACK OPS COLD WAR COD MODERN WARFARE COD MW PRECISION ED CODE REALIZE FTR BLSSNG D1 CODE REALIZE FUTRE BLSSNGS CODE REALIZE GUARDN RBRTH CODE REALIZE WINTERTIDE COLLAR X MALICE Some Restrictions Apply. -

Sumo Digital Hires New Art Director and Marketing Manager

Feb 16, 2021 14:30 GMT Sumo Digital Hires New Art Director and Marketing Manager 16th February 2021, Sheffield UK – Sumo Digital has today announced two major new hires. Chris Black joins Sumo’s Sheffield studio as an Art Director with more than 20 years' experience in the industry. Chris has worked on more than 50 titles from PlayStation’s TOCA series to Worms Rumble and Overcooked 2. Chris joins the team following several years at Team 17 and will be bringing a wealth of experience to an as yet unannounced project at Sumo Sheffield. Hollie Pattison joins the Sumo Digital team as Marketing Manager. Since joining the industry over 10 years ago, Hollie has been responsible for the strategic planning and implementation of numerous marketing campaigns. This includes more than 20 SKUs for independent video game publisher Ripstone. “Despite the challenges of 2020, we continue to look forward by growing our team and welcoming exceptional industry talent to our studio,” said Sheffield Studio Director Jim Woods. “We are excited to have Chris join the Sumo family and look forward to seeing what his valuable experience brings to our projects in 2021 and beyond.” “Sumo’s growth as a developer and a brand is driven by our people,” added Richard Iggo, Sumo Digital Director of Marketing. “Hollie’s leadership in marketing will help define our strategy as we promote our status as an award-winning developer and employment destination.” Sumo Digital is currently hiring for more than 120 roles across its network of studios including roles in programming, design, QA, audio, and art direction. -

Comparison of Unity and Unreal Engine

Bachelor Project Czech Technical University in Prague Faculty of Electrical Engineering F3 Department of Computer Graphics and Interaction Comparison of Unity and Unreal Engine Antonín Šmíd Supervisor: doc. Ing. Jiří Bittner, Ph.D. Field of study: STM, Web and Multimedia May 2017 ii iv Acknowledgements Declaration I am grateful to Jiri Bittner, associate I hereby declare that I have completed professor, in the Department of Computer this thesis independently and that I have Graphics and Interaction. I am thankful listed all the literature and publications to him for sharing expertise, and sincere used. I have no objection to usage of guidance and encouragement extended to this work in compliance with the act §60 me. Zákon c. 121/2000Sb. (copyright law), and with the rights connected with the Copyright Act including the amendments to the act. In Prague, 25. May 2017 v Abstract Abstrakt Contemporary game engines are invalu- Současné herní engine jsou důležitými ná- able tools for game development. There stroji pro vývoj her. Na trhu je množ- are numerous engines available, each ství enginů a každý z nich vyniká v urči- of which excels in certain features. To tých vlastnostech. Abych srovnal výkon compare them I have developed a simple dvou z nich, vyvinul jsem jednoduchý ben- game engine benchmark using a scalable chmark za použití škálovatelné 3D reim- 3D reimplementation of the classical Pac- plementace klasické hry Pac-Man. Man game. Benchmark je navržený tak, aby The benchmark is designed to em- využil všechny důležité komponenty her- ploy all important game engine compo- ního enginu, jako je hledání cest, fyzika, nents such as path finding, physics, ani- animace, scriptování a různé zobrazovací mation, scripting, and various rendering funkce. -

Game-Tech-Whitepaper

Type & Color October, 2020 INSIGHTS Game Tech How Technology is Transforming Gaming, Esports and Online Gambling Elena Marcus, Partner Sean Tucker, Partner Jonathan Weibrecht,AGC Partners Partner TableType of& ContentsColor 1 Game Tech Defined & Market Overview 2 Game Development Tools Landscape & Segment Overview 3 Online Gambling & Esports Landscape & Segment Overview 4 Public Comps & Investment Trends 5 Appendix a) Game Tech M&A Activity 2015 to 2020 YTD b) Game Tech Private Placement Activity 2015 to 2020 YTD c) AGC Update AGCAGC Partners Partners 2 ExecutiveType & Color Summary During the COVID-19 pandemic, as people are self-isolating and socially distancing, online and mobile entertainment is booming: gaming, esports, and online gambling . According to Newzoo, the global games market is expected to reach $159B in revenue in 2020, up 9.3% versus 5.3% growth in 2019, a substantial acceleration for a market this large. Mobile gaming continues to grow at an even faster pace and is expected to reach $77B in 2020, up 13.3% YoY . According to Research and Markets, the global online gambling market is expected to grow to $66 billion in 2020, an increase of 13.2% vs. 2019 spurred by the COVID-19 crisis . Esports is projected to generate $974M of revenue globally in 2020 according to Newzoo. This represents an increase of 2.5% vs. 2019. Growth was muted by the cancellation of live events; however, the explosion in online engagement bodes well for the future Tectonic shifts in technology and continued innovation have enabled access to personalized digital content anywhere . Gaming and entertainment technologies has experienced amazing advances in the past few years with billions of dollars invested in virtual and augmented reality, 3D computer graphics, GPU and CPU processing power, and real time immersive experiences Numerous disruptors are shaking up the market .