Presidential Politics & Private Equity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Leadership Newsletter Winter 2020 / 2021

T���������, M���� ��� T����������������� Leadership Newsletter Winter 2020 / 2021 GTCR Firm Update Since the firm’s inception in 1980, GTCR has Technology, Media and Tele- partnered with management teams in more communications than 200 investments to build and transform growth businesses. Over the last twenty years alone, GTCR has invested over $16 billion in approximately 100 platform acquisitions, 30+ 95+ PLATFORMS ADD-ONS including more than 65 companies that have been sold for aggregate enterprise value of over $ $50 billion and another 14 companies that have 25B+ been taken public with aggregate enterprise value PURCHASE of more than $34 billion. In November 2020, PRICE we closed GTCR Fund XIII, the firm’s largest fund to date, with $7.5 billion of limited partner capital commitments. This fund follows GTCR Fund Acquisition Activity Since 2000 XII, which we raised in 2017, with $5.25 billion As of January 15, 2021* of limited partner capital commitments. GTCR currently has 25 active portfolio companies; ten of these companies are within the Technology, Media and Telecommunications (“TMT”) industry. Page 1 / Continues on next page Technology, Media and Telecommunications Group Update Since 2000, GTCR has completed over 30 new platform investments and over 95 add-on acquisitions within the TMT industry, for a total of over 125 transactions with a combined purchase price of over $25 billion. During just the past year, we have realized several of these investments, selling three businesses and completing the partial sale of two additional companies, for a combined enterprise value of over $9 billion. Our TMT franchise includes ten active portfolio companies and one management start-up, which together have completed nearly 30 add-on acquisitions under our ownership, representing approximately $3 billion of GTCR invested capital. -

Not Mitt Romney's Bain Capital: Boston Investment Firm Home To

Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe Interested in documentaries? Click here to view our latest free screening. TEXT SIZE MANAGE ACCOUNT LOG OUT NEWS BusinessMETRO MARKETS TECHNOLOGY ARTS BUSINESS BETABOSTON SPORTS OPINION Red Sox Live 3 8 POLITICS LIFESTYLE Final MAGAZINE INSIDERS AtTODAY'S Bain, PAPER a broad range of viewpoints is the new reality E-MAIL FACEBOOK TWITTER GOOGLE+ LINKEDIN 57 http://www.bostonglobe.com/...romney-bain-capital-boston-investment-firm-home-diverse-political-views/gAGQyqkSROIoVubvsCXJxM/story.html[5/23/2015 10:37:45 PM] Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe SUZANNE KREITER/GLOBE STAFF Former Governor Deval Patrick, a Democrat, is joining Bain Capital — an investment firm founded by his predecessor on Beacon Hill, Republican Mitt Romney. By Beth Healy and Matt Rocheleau GLOBE STAFF APRIL 16, 2015 There are two chestnuts that drive Bain Capital partners crazy: First, the notion that they are ruthless capitalists who enjoy firing people. Second, that they are all card-carrying Republicans. Fifteen long years since Mitt Romney left the Boston investment firm he founded, those old impressions still rankle. Enter Deval Patrick, former Massachusetts governor and a Democrat closely aligned with President Obama, named this week a Bain managing director who will focus on “social impact” investing. The newest Bain employee — and the public spirit implied by his new job — would seem to contradict the firm’s old image. But current and former partners, and close observers of the firm say Bain Capital is more of a big tent than many might think. -

Private Equity and Value Creation in Frontier Markets: the Need for an Operational Approach

WhatResearch a CAIA Member Review Should Know Investment Strategies CAIAInvestmentCAIA Member Member Strategies Contribution Contribution Private Equity and Value Creation in Frontier Markets: The Need for an Operational Approach Stephen J. Mezias Afzal Amijee Professor of Entrepreneurship and Family Enterprise Founder and CEO of Vimodi, a novel visual discussion with INSEAD, based at the Abu Dhabi campus application and Entrepreneur in Residence at INSEAD 42 Alternative Investment Analyst Review Private Equity and Value Creation in Frontier Markets Private Equity and Value Creation in Frontier Markets What a CAIA Member Should Know Investment Strategies 1. Introduction ership stakes, earning returns for themselves and the Nowhere else is the operational value creation approach LPs who invested with them. While this clarifies that more in demand than in the Middle East North Africa capturing premiums through ownership transactions is (MENA) region. Advocating and building operational a primary goal for GPs, it does not completely address capabilities requires active investment in business pro- the question of what GPs need to do to make the stakes cesses, human capital, and a long-term horizon. Devel- more valuable before selling the companies in question. oping the capabilities of managers to deliver value from There are many ways that the GPs can manage their in- operations will not only result in building capacity for vestments to increase value, ranging from bringing in great companies, but will also raise the bar for human functional expertise, e.g., sound financial management, talent and organizational capability in the region. In the to bringing in specific sector operational expertise, e.g., long term, direct support and nurturing of the new gen- superior logistics capabilities. -

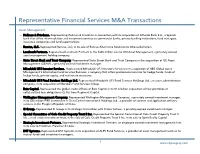

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

How Will Financial Services Private Equity Investments Fare in the Next Recession?

How Will Financial Services Private Equity Investments Fare in the Next Recession? Leading funds are shifting to balance-sheet-light and countercyclical investments. By Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith are partners with Bain & Company’s Financial Services and Private Equity practices. They are based, respectively, in London, New York, Boston and London. Copyright © 2019 Bain & Company, Inc. All rights reserved. How Will Financial Services Private Equity Investments Fare in the Next Recession? At a Glance Financial services deals in private equity have grown on the back of strong returns, including a pooled multiple on invested capital of 2.2x in recent years, higher than all but healthcare and technology deals. With a recession increasingly likely during the next holding period, PE funds need to develop plans to weather any storm and potentially improve their competitive position during and after the downturn. Many leading funds are investing in balance-sheet-light assets enabled by technology and regulatory change. Diligences now should test target companies under stressful economic scenarios and lay out a detailed value-creation plan, including how to mobilize quickly after acquisition. Financial services deals by private equity funds have had a strong run over the past few years, with deal value increasing significantly in Europe and the US(see Figure 1). Returns have been strong as well. Global financial services deals realized a pooled multiple on invested capital of 2.2x from 2009 through 2015, higher than all but healthcare and technology deals (see Figure 2). -

2017 Mid-Market Private Equity Transactions

2017 MID-MARKET PRIVATE EQUITY TRANSACTIONS Sale of Key Acquisition of Minority investment Retirement Group to Buyout of Future Investment in Media Buyout of Reapit by Syslink by Synova in Radius Payment Partners Group by Investment in Industrial Services iQ by ECI Partners Accel-KKR Capital Solutions by Phoenix Equity ChargePoint by NorthEdge Inflexion Partners Technology by LDC Capital Advised ECI Advised Accel-KKR Advised Synova Advised Inflexion Advised Phoenix Advised LDC Advised NorthEdge Sale of Fine Acquisition of Investment in Make Investment in Sale of The Creative Industries by Acquisition of AllClear Insurance It Cheaper by ECI Rayner Surgical Acquisition of Engagement Group NorthEdge Capital Thornbridge Services by Synova Partners Group by Phoenix Fastflow Group by by LDC to Sawmills by Capital Equity Partners Elysian Capital Huntsworth plc Advised NorthEdge Cairngorm Capital and other Advised Synova Advised ECI Advised Phoenix Advised Elysian Advised LDC shareholders Advised Cairngorm Sale of MKM Investment in Sale of Admiral Building Supplies to Law Firm of the Year Sygnature Discovery Buyout of Cawood Buyout of Fishawack Taverns to Proprium UK Legal Adviser of Bain Capital by 3i (Deal Structuring) by Phoenix Equity Scientific by Communications by by Cerberus and the Year and LDC Partners Inflexion LDC management 2017 2017 Advised 3i and Advised Phoenix Advised Inflexion Advised Admiral LDC Advised LDC 2017 GROWTH AND DEVELOPMENT CAPITAL TRANSACTIONS Minority investment in Sale of JCRA to Shaw Healthcare by Investment in -

Federal Register/Vol. 84, No. 78/Tuesday, April 23

16854 Federal Register / Vol. 84, No. 78 / Tuesday, April 23, 2019 / Notices EARLY TERMINATIONS GRANTED MARCH 1, 2019 THRU MARCH 31, 2019—Continued 20191014 ...... G Novacap Industries IV, L.P.; GHP Group, Inc.; Novacap Industries IV, L.P. 03/25/2019 20191004 ...... G Blackbird HoldCo, Inc.; Irving Place Capital Partners III SPV, L.P.; Blackbird HoldCo, Inc. 20191008 ...... G AP Drive, L.P.; EQT Infrastructure II Limited Partnership; AP Drive, L.P. 03/26/2019 20191019 ...... G Concrete Pumping Holdings, Inc.; A. Keith Crawford and Melinda Crawford; Concrete Pumping Holdings, Inc. 03/29/2019 20190912 ...... G George J. Pedersen; Kforce Inc.; George J. Pedersen. FOR FURTHER INFORMATION CONTACT: FEDERAL TRADE COMMISSION waiting period prior to its expiration Theresa Kingsberry, Program Support and requires that notice of this action be Specialist, Federal Trade Commission Granting of Requests for Early published in the Federal Register. Termination of the Waiting Period Premerger Notification Office, Bureau of The following transactions were Under the Premerger Notification Competition, Room CC–5301, granted early termination—on the dates Rules Washington, DC 20024, (202) 326–3100. indicated—of the waiting period By direction of the Commission. Section 7A of the Clayton Act, 15 provided by law and the premerger notification rules. The listing for each April J. Tabor, U.S.C. 18a, as added by Title II of the Hart-Scott-Rodino Antitrust transaction includes the transaction Acting Secretary. Improvements Act of 1976, requires number and the parties to the [FR Doc. 2019–08081 Filed 4–22–19; 8:45 am] persons contemplating certain mergers transaction. The grants were made by BILLING CODE 6750–01–P or acquisitions to give the Federal Trade the Federal Trade Commission and the Commission and the Assistant Attorney Assistant Attorney General for the General advance notice and to wait Antitrust Division of the Department of designated periods before Justice. -

So What Does Bain Say to Its Clients?

So what does Bain say to its clients? Leads | By Remapping Debate | Economy, Politics Jan 18, 2012 — Does it really make sense to take at face value the statements made by and on be- half of Mitt Romney as he and his campaign try to place a positive spin on his tenure at Bain Capital? Wouldn’t it be better to look at how the firm articulates its mission for current and prospective business clients? So far, that has not been happening. Gov. Romney and his lieu- The suggestions that Bain tenants have engaged in a two-track operation. One element was or is somehow in the — which may very well work — is to try to frighten the press into business of job creation or submission with the 2012 version of the Red Scare (“you’re giv- ing aid and comfort to the enemies of capitalism”). sought to create jobs are fundamentally deceitful. The other element is to turn his vulnerability on profiting from American job losses to the kind of “he said, she said” story that many like to serve up as evidence of evenhandedness. As has been reported, “Mr. Romney as of late has defended his record at the firm. He has touted the success of some businesses, including Staples, and said job losses at others were unfortunate.” If there are two sides to the story, they certainly do not seem balanced: companies did shed jobs on the advice or at the direction of Bain, and job gains at some companies in which B ain invested did not necessarily mean a net gain for the economy (company A gaining jobs and market share at the expense of company B does not increase overall job numbers). -

Bi-Weekly Finanial Technology Sector Report

Financial Technology Sector Summary Week of May 22, 2017 1 DEAL DASHBOARD Financial Technology (3) (1) (3) $11.9 Bn | 1,188 Deals Industry Stock Market Performance $75.9 Bn | 852 Deals LTM Financing Volume Last Twelve Months LTM M&A Volume 160 Select Recent Financing Transactions Select Recent M&A Transactions Company Amount ($MM) 150 Target Acquirer EV ($MM) 140 $130.0 $3,720.0 130 $120.0 NA 120 Z enith $63.0 110 M erchant NA Services 100 Wacai $42.0 NA 90 $42.0 NA 80 5/19/16 7/4/16 8/17/16 9/30/16 11/15/16 12/29/16 2/13/17 3/29/17 5/12/17 $37.0 NA Payments Exchanges Payments Financial Data, Content, Information Processors / $37.0 & Analytics Credit Bureaus NA Banking & Lending Online Broker Dealers Technology $25.0 NA Investment Services, Healthcare / Insurance Software, & Technology Technology S&P 500 (3) (3) Quarterly Financing Volume Quarterly M&A Volume $10 500 $30 219 250 205 196 188 $8 $8.9 400 $25 200 $24.9 299 298 316 $24.5 276 $20 $6 300 $20.8 $20.4 150 $15 $4 200 100 $10 $3.0 $2 $2.6 $2.6 100 $5 50 $0 0 $0 0 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Financing Volume ($Bn) Financing Deal Count M&A Volume ($Bn) M&A Deal Count Notes: Source: Capital IQ, CB Insights and GCA FinTech Database. Market Data as of 5/19/17. 1) Refer to footnotes on page 5 for index composition. -

Private Equityspotlight

Spotlight Private Equity www.preqin.com May 2010 / Volume 6 - Issue 5 Welcome to the latest edition of Private Equity Spotlight, the monthly newsletter from Preqin providing insights into private equity performance, investors and fundraising. Private Equity Spotlight combines information from our online products Performance Analyst, Investor Intelligence, Fund Manager Profi les, Funds in Market, Secondary Market Monitor and Deals Analyst. Secondaries in 2010 Feature Spotlight Fundraising Spotlight page 3 page 13 Secondaries in 2010 This month’s Fundraising Spotlight looks at buyout, venture and cleantech fundraising. There was expectation across the industry that there would be heightened activity on the secondary market in 2009. This month’s Feature Article examines why this never materialized Secondaries Spotlight page 16 and looks at what 2010 has in store for the secondary market. We look at statistics from Preqin’s industry-leading product, Secondary Market Monitor, and uncover the latest secondaries news. Performance Spotlight page 6 Secondaries Funds of Funds Investor Spotlight page 17 This month’s Performance Spotlight looks at private equity secondaries funds. This month’s Investor Spotlight examines investors’ attitudes towards the secondary market. Fund Manager Spotlight page 8 Conferences Spotlight page 19 This month’s Fund Manager Spotlight reveals which US states This month’s Conferences Spotlight includes details of upcoming have the most private equity fi rms and capital. events in the private equity world. Deals Spotlight Investor News page 10 page 21 This month’s Deals Spotlight looks at the latest buyout deals and Preqin’s latest product - Deals Analyst. All the latest news on private equity investors including • Abu Dhabi Investment Authority What would you like to see in Private Equity Spotlight? Email us at: [email protected]. -

Private Equity Investors

Private Equity Investors Press Release Guernsey, Channel Islands, October 2, 2006 KKR Private Equity Investors Makes $282.3 Million Investment in Philips Semiconductors Business KKR Private Equity Investors, L.P. (Euronext Amsterdam: KPE) announced that it has invested approximately $282.3 million in connection with the publicly announced transaction to acquire, by an investor group that includes Kohlberg Kravis Roberts & Co. (KKR), a controlling stake in the semiconductors business of Royal Philips Electronics, formerly known as Philips Semiconductors International B.V. The semiconductors business has been renamed NXP B.V. Royal Philips Electronics recently announced the closing of this transaction, pursuant to which a consortium that includes KKR, Silver Lake Partners, Bain Capital, Apax Partners and AlpInvest Partners NV acquired an 80.1% stake in NXP B.V. and Royal Philips Electronics retained a 19.9% stake in NXP B.V. The $282.3 million total investment was comprised of a $250.0 million co-investment and $32.3 million of capital contributions to KKR-sponsored private equity funds. The amount invested by KPE in NXP B.V. represents approximately 6.0% of KPE’s net asset value as of August 30, 2006. About KPE KKR Private Equity Investors, L.P. (KPE) is a Guernsey-based limited partnership that seeks to create long-term value primarily by participating in private equity investments sponsored by KKR. Formed in April 2006 to provide complementary capital for KKR-sponsored private equity funds, KPE enables certain non-U.S. public market investors and certain other qualified investors to invest in select KKR- sponsored investments. -

Bain Capital Specialty Finance, Inc

SUBJECT TO COMPLETION, DATED NOVEMBER 7, 2018 PRELIMINARY PROSPECTUS 7,500,000 SHARES BAIN CAPITAL SPECIALTY FINANCE, INC. Common Stock We are an externally managed specialty finance company focused on lending to middle market companies that has elected to be regulated as a business development company (‘‘BDC’’), under the Investment Company Act of 1940, as amended (together with the rules and regulations promulgated thereunder, the ‘‘1940 Act’’). Our primary focus is capitalizing on opportunities within our Senior Direct Lending strategy, which seeks to provide risk-adjusted returns and current income to our stockholders by investing primarily in middle market companies with between $10.0 million and $150.0 million in annual earnings before interest, taxes, depreciation and amortization. We focus on senior investments with a first or second lien on collateral and strong structures and documentation intended to protect the lender. We may also invest in mezzanine debt and other junior securities, including common and preferred equity, on an opportunistic basis, and in secondary purchases of assets or portfolios, but such investments are not the principal focus of our investment strategy. We are managed by our investment adviser, BCSF Advisors, LP, a subsidiary of Bain Capital Credit, LP. This is an initial public offering of shares of our common stock. All of the shares of common stock offered by this prospectus are being sold by us. Shares of our common stock have no history of public trading. We currently expect that the initial public offering price per share of our common stock will be between $20.25 and $21.25.