Private Equity Investors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Leadership Newsletter Winter 2020 / 2021

T���������, M���� ��� T����������������� Leadership Newsletter Winter 2020 / 2021 GTCR Firm Update Since the firm’s inception in 1980, GTCR has Technology, Media and Tele- partnered with management teams in more communications than 200 investments to build and transform growth businesses. Over the last twenty years alone, GTCR has invested over $16 billion in approximately 100 platform acquisitions, 30+ 95+ PLATFORMS ADD-ONS including more than 65 companies that have been sold for aggregate enterprise value of over $ $50 billion and another 14 companies that have 25B+ been taken public with aggregate enterprise value PURCHASE of more than $34 billion. In November 2020, PRICE we closed GTCR Fund XIII, the firm’s largest fund to date, with $7.5 billion of limited partner capital commitments. This fund follows GTCR Fund Acquisition Activity Since 2000 XII, which we raised in 2017, with $5.25 billion As of January 15, 2021* of limited partner capital commitments. GTCR currently has 25 active portfolio companies; ten of these companies are within the Technology, Media and Telecommunications (“TMT”) industry. Page 1 / Continues on next page Technology, Media and Telecommunications Group Update Since 2000, GTCR has completed over 30 new platform investments and over 95 add-on acquisitions within the TMT industry, for a total of over 125 transactions with a combined purchase price of over $25 billion. During just the past year, we have realized several of these investments, selling three businesses and completing the partial sale of two additional companies, for a combined enterprise value of over $9 billion. Our TMT franchise includes ten active portfolio companies and one management start-up, which together have completed nearly 30 add-on acquisitions under our ownership, representing approximately $3 billion of GTCR invested capital. -

Not Mitt Romney's Bain Capital: Boston Investment Firm Home To

Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe Interested in documentaries? Click here to view our latest free screening. TEXT SIZE MANAGE ACCOUNT LOG OUT NEWS BusinessMETRO MARKETS TECHNOLOGY ARTS BUSINESS BETABOSTON SPORTS OPINION Red Sox Live 3 8 POLITICS LIFESTYLE Final MAGAZINE INSIDERS AtTODAY'S Bain, PAPER a broad range of viewpoints is the new reality E-MAIL FACEBOOK TWITTER GOOGLE+ LINKEDIN 57 http://www.bostonglobe.com/...romney-bain-capital-boston-investment-firm-home-diverse-political-views/gAGQyqkSROIoVubvsCXJxM/story.html[5/23/2015 10:37:45 PM] Not Mitt Romney’s Bain Capital: Boston investment firm home to diverse political views - Business - The Boston Globe SUZANNE KREITER/GLOBE STAFF Former Governor Deval Patrick, a Democrat, is joining Bain Capital — an investment firm founded by his predecessor on Beacon Hill, Republican Mitt Romney. By Beth Healy and Matt Rocheleau GLOBE STAFF APRIL 16, 2015 There are two chestnuts that drive Bain Capital partners crazy: First, the notion that they are ruthless capitalists who enjoy firing people. Second, that they are all card-carrying Republicans. Fifteen long years since Mitt Romney left the Boston investment firm he founded, those old impressions still rankle. Enter Deval Patrick, former Massachusetts governor and a Democrat closely aligned with President Obama, named this week a Bain managing director who will focus on “social impact” investing. The newest Bain employee — and the public spirit implied by his new job — would seem to contradict the firm’s old image. But current and former partners, and close observers of the firm say Bain Capital is more of a big tent than many might think. -

Private Equity and Value Creation in Frontier Markets: the Need for an Operational Approach

WhatResearch a CAIA Member Review Should Know Investment Strategies CAIAInvestmentCAIA Member Member Strategies Contribution Contribution Private Equity and Value Creation in Frontier Markets: The Need for an Operational Approach Stephen J. Mezias Afzal Amijee Professor of Entrepreneurship and Family Enterprise Founder and CEO of Vimodi, a novel visual discussion with INSEAD, based at the Abu Dhabi campus application and Entrepreneur in Residence at INSEAD 42 Alternative Investment Analyst Review Private Equity and Value Creation in Frontier Markets Private Equity and Value Creation in Frontier Markets What a CAIA Member Should Know Investment Strategies 1. Introduction ership stakes, earning returns for themselves and the Nowhere else is the operational value creation approach LPs who invested with them. While this clarifies that more in demand than in the Middle East North Africa capturing premiums through ownership transactions is (MENA) region. Advocating and building operational a primary goal for GPs, it does not completely address capabilities requires active investment in business pro- the question of what GPs need to do to make the stakes cesses, human capital, and a long-term horizon. Devel- more valuable before selling the companies in question. oping the capabilities of managers to deliver value from There are many ways that the GPs can manage their in- operations will not only result in building capacity for vestments to increase value, ranging from bringing in great companies, but will also raise the bar for human functional expertise, e.g., sound financial management, talent and organizational capability in the region. In the to bringing in specific sector operational expertise, e.g., long term, direct support and nurturing of the new gen- superior logistics capabilities. -

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

How Will Financial Services Private Equity Investments Fare in the Next Recession?

How Will Financial Services Private Equity Investments Fare in the Next Recession? Leading funds are shifting to balance-sheet-light and countercyclical investments. By Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith are partners with Bain & Company’s Financial Services and Private Equity practices. They are based, respectively, in London, New York, Boston and London. Copyright © 2019 Bain & Company, Inc. All rights reserved. How Will Financial Services Private Equity Investments Fare in the Next Recession? At a Glance Financial services deals in private equity have grown on the back of strong returns, including a pooled multiple on invested capital of 2.2x in recent years, higher than all but healthcare and technology deals. With a recession increasingly likely during the next holding period, PE funds need to develop plans to weather any storm and potentially improve their competitive position during and after the downturn. Many leading funds are investing in balance-sheet-light assets enabled by technology and regulatory change. Diligences now should test target companies under stressful economic scenarios and lay out a detailed value-creation plan, including how to mobilize quickly after acquisition. Financial services deals by private equity funds have had a strong run over the past few years, with deal value increasing significantly in Europe and the US(see Figure 1). Returns have been strong as well. Global financial services deals realized a pooled multiple on invested capital of 2.2x from 2009 through 2015, higher than all but healthcare and technology deals (see Figure 2). -

Inprs Cafr Fy20 Working Version

COMPREHENSIVE ANNUAL FINANCIAL REPORREPORTT 2020 For the FiscalFiscal YearYear EndedEnded JuneJune 30,30, 20202019 INPRS is a component unit and a pension trust fund of the State of Indiana. The Indiana Public Retirement System is a component Prepared through the joint efforts of INPRS’s team members. unit and a pension trust fund of the State of Indiana. Available online at www.in.gov/inprs COMPREHENSIVE ANNUAL FINANCIAL REPORT 2020 For the Fiscal Year Ended June 30, 2020 INPRS is a component unit and a pension trust fund of the State of Indiana. INPRS is a trust and an independent body corporate and politic. The system is not a department or agency of the state, but is an independent instrumentality exercising essential governmental functions (IC 5-10.5-2-3). FUNDS MANAGED BY INPRS ABBREVIATIONS USED Defined Benefit DB Fund 1. Public Employees’ Defined Benefit Account PERF DB 2. Teachers’ Pre-1996 Defined Benefit Account TRF Pre-’96 DB 3. Teachers’ 1996 Defined Benefit Account TRF ’96 DB 4. 1977 Police Officers’ and Firefighters’ Retirement Fund ’77 Fund 5. Judges’ Retirement System JRS 6. Excise, Gaming and Conservation Officers’ Retirement Fund EG&C 7. Prosecuting Attorneys’ Retirement Fund PARF 8. Legislators’ Defined Benefit Fund LE DB Defined Contribution DC Fund 9. Public Employees’ Defined Contribution Account PERF DC 10. My Choice: Retirement Savings Plan for Public Employees PERF MC DC 11. Teachers’ Defined Contribution Account TRF DC 12. My Choice: Retirement Savings Plan for Teachers TRF MC DC 13. Legislators’ Defined Contribution Fund LE DC Other Postemployement Benefit OPEB Fund 14. -

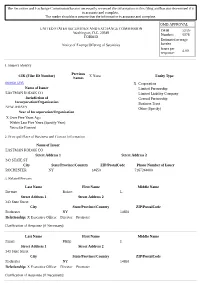

Form 3 FORM 3 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

SEC Form 3 FORM 3 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 OMB APPROVAL INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF OMB Number: 3235-0104 Estimated average burden SECURITIES hours per response: 0.5 Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940 1. Name and Address of Reporting Person* 2. Date of Event 3. Issuer Name and Ticker or Trading Symbol Requiring Statement EASTMAN KODAK CO [ EK ] Chen Herald Y (Month/Day/Year) 09/29/2009 (Last) (First) (Middle) 4. Relationship of Reporting Person(s) to Issuer 5. If Amendment, Date of Original Filed C/O KOHLBERG KRAVIS ROBERTS & (Check all applicable) (Month/Day/Year) CO. L.P. X Director 10% Owner Officer (give title Other (specify 2800 SAND HILL ROAD, SUITE 200 below) below) 6. Individual or Joint/Group Filing (Check Applicable Line) X Form filed by One Reporting Person (Street) MENLO Form filed by More than One CA 94025 Reporting Person PARK (City) (State) (Zip) Table I - Non-Derivative Securities Beneficially Owned 1. Title of Security (Instr. 4) 2. Amount of Securities 3. Ownership 4. Nature of Indirect Beneficial Ownership Beneficially Owned (Instr. 4) Form: Direct (D) (Instr. 5) or Indirect (I) (Instr. 5) Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities) 1. Title of Derivative Security (Instr. 4) 2. Date Exercisable and 3. Title and Amount of Securities 4. 5. 6. Nature of Indirect Expiration Date Underlying Derivative Security (Instr. 4) Conversion Ownership Beneficial Ownership (Month/Day/Year) or Exercise Form: (Instr. -

Knowledgenow Conference Pressure Points October 2017 What’S Inside?

KnowledgeNow Conference Pressure Points October 2017 What’s inside? THE INSIDE-OUT VIEW Tackling today’s biggest threats to business 02 Time, talent and energy Driving Sales Effectiveness Digital transformation At Boats Group Amazon The elephant in every room Invent Farma A smooth transition Unilabs A transformation story THE OUTSIDE-IN VIEW Global leaders provide perspective 10 Disjointed environments The rising tide of populism Globalization under attack Addressing the challenge 16 Who’s who? 18 The Operational Excellence team 20 References Introduction Pressure Points The theme of our seventh annual KnowledgeNow Conference, “Pressure Points”, explored the th complex combination annual of internal and external KnowledgeNow 7 forces that executives must navigate to evolve and grow their enterprise. The event combines the open sharing of knowledge between the Apax Funds’ portfolio companies in attendance with the tools and experience of the Operational Excellence Practice (OEP) to generate actionable insights. Apax Partners 01 Driving growth through operational excellence “Benign economic conditions, a plentiful supply of financing and record stock-markets have driven corporate valuations on both sides of the Atlantic to unsurpassed levels. Against this backdrop, the ability to materially accelerate portfolio growth is a crucial factor in driving returns.” Andrew Sillitoe Co-CEO, Apax Partners Operational improvements have accounted for circa The fact that the OEP has been our % fastest-growing team in recent years is real proof of the -

Annual Report 2019 Annual Report

Annual Report 2019 Annual report 01 Report of the Managing Board 08 Consolidated financial statements 09 Consolidated balance sheet 10 Consolidated income statement 11 Consolidated cash flow statement 12 Notes to the consolidated financial statements 13 1. Accounting policies for the consolidated balance sheet 15 2. Accounting policies for the consolidated income statement 16 3. Financial instruments and risk management 17 4. Notes to the consolidated balance sheet 22 5. Notes to the consolidated income statement 25 6. Employees 26 Company financial statements 27 Company balance sheet 28 Company income statement 29 7. Notes to the company balance sheet 42 8. Supplementary information company financial statements 45 Other information 46 Independent auditor’s report B AlpInvest Annual Report 2019 Report of the Managing Board Market and economic tensions, 10-year yields ended the year at 1.92%, developments 2019 34bps above the yield on 2-year Treasuries. Slower Global Growth Amid Trade Tensions Substantial valuation gains in risk markets Global economic growth continued to lose steam Despite the slowdown in global economic growth, in 2019 as trade tensions undermined business equity markets around the world enjoyed sub- confidence. This slowdown was particularly visible stantial gains in 2019. While the S&P 500 index in the manufacturing sector. By contrast, services, rose 28.9% during the year, the Euro Stoxx 50 which are less exposed to external factors, index gained 24.8% (in euro terms). Although the remained comparatively robust. At the same time, FTSE 100 index increased comparatively more high levels of employment and moderate wage moderately, at the end of 2019 it was still 12.1% gains in major economies supported consump- higher than a year earlier. -

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB 3235- Washington, D.C. 20549 Number: 0076 FORM D Estimated average Notice of Exempt Offering of Securities burden hours per 4.00 response: 1. Issuer's Identity Previous CIK (Filer ID Number) X None Entity Type Names 0000031235 X Corporation Name of Issuer Limited Partnership EASTMAN KODAK CO Limited Liability Company Jurisdiction of General Partnership Incorporation/Organization Business Trust NEW JERSEY Other (Specify) Year of Incorporation/Organization X Over Five Years Ago Within Last Five Years (Specify Year) Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer EASTMAN KODAK CO Street Address 1 Street Address 2 343 STATE ST City State/Province/Country ZIP/PostalCode Phone Number of Issuer ROCHESTER NY 14650 7167244000 3. Related Persons Last Name First Name Middle Name Berman Robert L. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Faraci Philip J. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Haag Joyce P. Street Address 1 Street Address 2 343 State Street City State/Province/Country ZIP/PostalCode Rochester NY 14650 Relationship: X Executive Officer Director Promoter Clarification of Response (if Necessary): Last Name First Name Middle Name Kruchten Brad W. -

HELLAS TELECOMMUNICATIONS (LUXEMBOURG) II SCA Case No

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: Chapter 15 HELLAS TELECOMMUNICATIONS (LUXEMBOURG) II SCA Case No. 12-10631 (MG) Debtor in a Foreign Proceeding. ANDREW LAWRENCE HOSKING and BRUCE MACKAY, in Adv. Pro. No. 14-01848 (MG) their capacity as joint compulsory liquidators and duly authorized foreign representatives of HELLAS TELECOMMUNICATIONS (LUXEMBOURG) II SCA, Plaintiffs, -against- TPG CAPITAL MANAGEMENT, L.P., f/k/a TPG CAPITAL, L.P., and APAX PARTNERS, L.P., on behalf of themselves, -and- DAVID BONDERMAN, JAMES COULTER, WILLIAM S. PRICE III, TPG ADVISORS IV, INC., TPG GENPAR IV, L.P., TPG PARTNERS IV, L.P., T3 ADVISORS II, INC., T3 GENPAR II, L.P., T3 PARTNERS II, L.P., T3 PARALLEL II, L.P., TPG FOF IV, L.P., TPG FOF IV-QP, L.P., TPG EQUITY IV-A, L.P., f/k/a FIRST AMENDED COMPLAINT TPG EQUITY IV, L.P., TPG MANAGEMENT IV-B, L.P., TPG COINVESTMENT IV, L.P., TPG ASSOCIATES IV, L.P., TPG MANAGEMENT IV, L.P., TPG MANAGEMENT III, L.P., BONDERMAN FAMILY LIMITED PARTNERSHIP, BONDO-TPG PARTNERS III, L.P., DICK W. BOYCE, KEVIN R. BURNS, JUSTIN CHANG, JONATHAN COSLET, KELVIN DAVIS, ANDREW J. DECHET, JAMIE GATES, MARSHALL HAINES, JOHN MARREN, MICHAEL MACDOUGALL, THOMAS E. REINHART, RICHARD SCHIFTER, TODD B. SISITSKY, BRYAN M. TAYLOR, CARRIE A. WHEELER, JAMES B. WILLIAMS, JOHN VIOLA, TCW/CRESCENT MEZZANINE PARTNERS III NETHERLANDS, L.P., a/k/a TCW/CRESCENT MEZZANINE PARTNERS NETHERLANDS III, L.P., TCW/CRESCENT MEZZANINE PARTNERS III, L.P., a/k/a TCW/CRESCENT MEZZANINE FUND III, L.P., TCW/CRESCENT MEZZANINE TRUST III, TCW/CRESCENT MEZZANINE III, LLC, TCW CAPITAL INVESTMENT CORPORATION, DEUTSCHE BANK AG, and DOES 1-25, on behalf of themselves and a class of similarly situated persons and legal entities, Defendants. -

Knowledgenow: Future Foundations

KnowledgeNow: Future Foundations Apax Partners KnowledgeNow Conference October 2016 The 6th Annual Apax Partners Barcelona, KnowledgeNow Conference took place in Barcelona on October 2016 18 to 20 October 2016 What’s inside this report? Introduction Building the future for growth Putting the foundations in 02 12 20 place: case studies for success Building foundations for the future in Follow your North Star uncertain times Kyle Leahy Executive Vice President and A recipe for winning new customers Seth Brody Partner and Global Head of the General Manager of North America, Cole Haan Jon Simmons Operating Executive, Operational Excellence Practice, Apax Partners Apax Partners Mapping career paths to a strong future Greg Kayata Senior Vice President of Preparing for public markets Doug Ahrens CFO, GlobalLogic Shifting foundations in a Human Resources, Acelity 04 turbulent world The price of change Health and safety as a value driver Scott Kim CEO, Bankrate.com Cliff Dixon Vice President of Information Micro-opportunities, macro-knowledge Technology, Quality Distribution Building strength in carve-out situations Andrew Sillitoe Co-CEO and Nico Hansen Putting customers at the heart of Chief Investment Offi cer, Apax Partners Noel Goggin CEO, Aptos Matt Foster COO, Duck Creek Technologies systems planning Putting Brexit in a global context Vid Desai CIO, Vyaire Medical Sal Caruso CIO, One Call Care Management Andrew Sentance Senior Economic Nick Iozzo Operating Adviser, Apax Partners Adviser, PwC Extending your infl uence Rich Beattie Vice President, Multiply Using the Apax Portfolio Effi ciency The view from the Hill platform to get “large company” John Boehner 53rd Speaker of the United procurement States House of Representatives Edward Burgers Procurement & Facilities Manager, Exact Software Attendees The Operational Excellence team A differentiated platform for 26 28 30 value creation KnowledgeNow 2016 01 In attendance..