CPY Document Title

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Syniverse Holdings, Inc. (NYSE:SVR)

Syniverse Holdings, Inc. (NYSE:SVR) McIntire Investment Institute Long Fund Memo Hideyuki Liu ([email protected]) College of Arts & Sciences Class of 2011 Table of Contents Business overview……………………………………………………………………………......3 Market misperception …………………………………………………………………………..4 Thesis points ……………………………………………………………………………………4 Catalysts / risks ………………………………………………………………………………….6 Appendix A: Value added research ……………………………………………………………7 Appendix B: Financial Ratios………………………………………………………………….10 2 Syniverse Holdings, Inc. (N YSE: SV R) Date: November 30, 2009 Price: 15.86 Analyst: Hideyuki Liu 52‐Week Market Cap Cash Total Debt P/E Gross Margin EPS Range 7.51 ‐ 19.56 1.10B 216.2M 515.6M 16.11 64.57 0.98 Business Overview Syniverse Holdings, Inc. (“Syniverse”) serves as one of the wireless industry’s only operator- neutral intermediaries and is an enabler of wireless voice and data services for telecommunications companies worldwide. Syniverse’s data clearinghouse, network and technology services solve technical and operational challenges for the industry by translating incompatible communication standards and protocols and simplifying operator interconnectivity. Syniverse’s services allow operators to deliver seamless voice, data, and next generation services to wireless subscribers including wireless voice, data roaming, short message service (SMS), multimedia messaging services (MMS), mobile instant messaging (MIM), number portability and wireless value-added services. Syniverse’s main services are as follows: . Technology Interoperability Services . Network Services . Number Portability Services . Call Processing Services . Enterprise Solutions . Off-network Database Queries The company provides its services to more than 650 operators in over 140 countries. Clients include most of the largest global wireless operators including AT&T, Sprint Nextel, Verizon Wireless, AmericaMoviles, China Telecom, KDDI, TeliaSonera, Vodafone, VimpelCom, and SK Telecom. -

Case No COMP/M.6690 - Syniverse/ MACH

EN This text is made available for information purposes only. A summary of this decision is published in all EU languages in the Official Journal of the European Union. Case No COMP/M.6690 - Syniverse/ MACH Only the English text is authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 8 (2) Date: 29/05/2013 EN EN EUROPEAN COMMISSION Brussels, 29.5.2013 C(2013) 3114 final COMMISSION DECISION of 29/05/2013 addressed to:_Syniverse Holdings, Inc. declaring a concentration to be compatible with the internal market and the EEA agreement (Case No COMP/M.6690 - Syniverse/ MACH) (Only the English text is authentic) EN 1 EN TABLE OF CONTENTS 1. INTRODUCTION AND PROCEDURE ..................................................................... 6 2. THE PARTIES AND THE PROPOSED CONCENTRATION .................................. 7 3. UNION DIMENSION ................................................................................................. 8 4. INVESTIGATION OF THE CASE ............................................................................. 8 5. MARKET DEFINITION ........................................................................................... 10 5.1. Introduction to outsourced roaming services ............................................................. 10 5.1.1. Description of Data Clearing Services ....................................................................... 10 5.1.2. Description of NRTRDE services .............................................................................. 12 5.1.3. Description of Financial -

Response to Consultation Paper on Mobile Number Portability Prepared

Response to Consultation Paper on Mobile Number Portability Prepared for: Telecom Regulatory Authority of India Submitted 29 August 2005 PROPRIETARY AND CONFIDENTIAL SYNIVERSE TECHNOLOGIES, INC. i PROPRIETARY AND CONFIDENTIAL TRAI THIS MATERIAL IS THE PROPRIETARY PROPERTY OF AND CONFIDENTIAL TO SYNIVERSE TECHNOLOGIES, INC. (SYNIVERSE). DISCLOSURE OUTSIDE OF SYNIVERSE IS PROHIBITED EXCEPT BY LICENSE AGREEMENT OR OTHER CONFIDENTIALITY AGREEMENT. THE INFORMATION CONTAINED HEREIN IS NON-BINDING AND PROVIDED FOR BUDGETARY PURPOSES ONLY. NOTWITHSTANDING ANYTHING IN THE RFP (IF APPLICABLE) TO THE CONTRARY, THE FINAL TERMS AND CONDITIONS GOVERNING THE ACTUAL SERVICES AND PRODUCTS TO BE PROVIDED, AS WELL AS THE RIGHTS AND OBLIGATIONS OF THE PARTIES, SHALL BE COVERED BY A SEPARATE AND DISTINCT AGREEMENT TO BE NEGOTIATED BY THE PARTIES. NOTHING HEREIN SHOULD BE CONSTRUED AS OBLIGATING EITHER PARTY TO THE OTHER FOR ANY PURPOSE WHATSOEVER. THE PROVISION OF ANY NETWORK ELEMENTS, COMPONENTS AND/OR SERVICES DEFINED IN THIS PROPOSAL, IS SUBJECT TO ALL APPLICABLE FEDERAL, STATE, AND LOCAL LAWS, STATUTES, RULES, AND REGULATIONS. INFORMATION CONTAINED IN THIS PROPOSAL, INCLUDING BUT NOT LIMITED TO PRICING AND EXCLUDING HARDWARE CONFIGURATION (IF APPLICABLE), IS VALID FOR NINETY (90) DAYS FROM THE DATE SET FORTH ON THE FRONT OF THIS PROPOSAL. The following are services, software products, service marks, and/or trademarks of Syniverse Technologies, Inc.: ® SM ACCESSP P inpackP P ® ® ACCESS S&EP P INPortP P ® SM ACCESSibilityP P INPositionP P ® SM BrienceP P LATALinkP P SM ® CCNSP P Phone Me Anywhere PlusP P SM ® CrossroadsP P PMA PlusP P SM ® EDTP P RoamerXchangeP P SM ® Electronic Data TransportP P SmartChallengeP P ® ® Encrypt-A-KeyP P SOLUTIONSP P SM ® Fleet-On-TrackP P Solutions Without LimitsP P ® TM FMR PlusP P S.T.A.R.S. -

Twilio-10Q-1Q21.Pdf

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________________________ FORM 10-Q _____________________________________________ ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT 1934 For the quarterly period ended March 31, 2021 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-37806 _____________________________________________ TWILIO INC. (Exact name of registrant as specified in its charter) _____________________________________________ Delaware 26-2574840 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 101 Spear Street, First Floor San Francisco, California 94105 (Address of principal executive offices) (Zip Code) (415) 390-2337 (Registrant’s telephone number, including area code) ____________________________________________ Securities registered pursuant to Section 12(b) of the act: Title of each class Trading Symbol(s) Name of each exchange on which registered Class A Common Stock, par value $0.001 per share TWLO The New York Stock Exchange As of April 30, 2021, 162,370,009 shares of the registrant’s Class A common stock and 10,325,768 shares of registrant’s Class B common stock were outstanding. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

The Wireless AMBER Alert Initiative

TheThe WirelessWireless AMBERAMBER AlertAlert InitiativeInitiative [email protected] 1 AboutAbout SyniverseSyniverse TechnologiesTechnologies • Global communications technology company specializing in innovative business and network engineering solutions that manage and interconnect voice and data systems • Telecommunications industry leader since 1987 • Global sales force in: London; Luxembourg; Rome; Beijing; Hong Kong; New Deli; Singapore; Rio de Janeiro; Belo Horizonte, Brazil; and Utrecht, The Netherlands • Nearly 300 customers in more than 30 countries throughout the Americas, Asia Pacific and Europe • Major provider of Local Number Porting Services (LNP) to the industry • New York Stock Exchange: SVR (www.Syniverse.com) [email protected] 2 Partnership:Partnership: WirelessWireless AMBERAMBER AlertAlert InitiativeInitiative • CTIA Wireless Association and Wireless Foundation – Program Sponsor and Coordinator • www.wirelessfoundation.org • National Center for Missing and Exploited Children – Interface to Law Enforcement and Clearinghouse for AMBER Alert Distribution on behalf of Dept of Justice • www.missingkids.org • Syniverse Technologies – Coordinates technology industry participation and supplies development and operational support • Wireless Carrier Community – The reach to the consumer…the feet and eyes on the street [email protected] 3 NationalNational CenterCenter forfor MissingMissing andand ExploitedExploited ChildrenChildren (NCMEC)(NCMEC) • NCMEC was established in 1984 to provide services -

Response to Public Consultation on the Review of Number Portability in Singapore

Response to Public Consultation on the Review of Number Portability in Singapore Prepared for: Info-Communication Development Authority of Singapore Submitted 3 October 2005 PROPRIETARY SYNIVERSE TECHNOLOGIES, INC. i PROPRIETARY IDA 5 OCTOBER 2005 THIS MATERIAL IS THE PROPRIETARY PROPERTY OF AND CONFIDENTIAL TO SYNIVERSE TECHNOLOGIES, INC. (SYNIVERSE). DISCLOSURE OUTSIDE OF SYNIVERSE IS PROHIBITED EXCEPT BY LICENSE AGREEMENT OR OTHER CONFIDENTIALITY AGREEMENT. THE INFORMATION CONTAINED HEREIN IS NON-BINDING AND PROVIDED FOR BUDGETARY PURPOSES ONLY. NOTWITHSTANDING ANYTHING IN THE RFP (IF APPLICABLE) TO THE CONTRARY, THE FINAL TERMS AND CONDITIONS GOVERNING THE ACTUAL SERVICES AND PRODUCTS TO BE PROVIDED, AS WELL AS THE RIGHTS AND OBLIGATIONS OF THE PARTIES, SHALL BE COVERED BY A SEPARATE AND DISTINCT AGREEMENT TO BE NEGOTIATED BY THE PARTIES. NOTHING HEREIN SHOULD BE CONSTRUED AS OBLIGATING EITHER PARTY TO THE OTHER FOR ANY PURPOSE WHATSOEVER. THE PROVISION OF ANY NETWORK ELEMENTS, COMPONENTS AND/OR SERVICES DEFINED IN THIS PROPOSAL, IS SUBJECT TO ALL APPLICABLE FEDERAL, STATE, AND LOCAL LAWS, STATUTES, RULES, AND REGULATIONS. INFORMATION CONTAINED IN THIS PROPOSAL, INCLUDING BUT NOT LIMITED TO PRICING AND EXCLUDING HARDWARE CONFIGURATION (IF APPLICABLE), IS VALID FOR NINETY (90) DAYS FROM THE DATE SET FORTH ON THE FRONT OF THIS PROPOSAL. The following are services, software products, service marks, and/or trademarks of Syniverse Technologies, Inc.: ACCESS® inpackSM ACCESS S&E® INPort® ACCESSibility® INPositionSM Brience® LATALinkSM CCNSSM Phone Me Anywhere Plus® CrossroadsSM PMA Plus® EDTSM RoamerXchange® Electronic Data TransportSM SmartChallenge® Encrypt-A-Key® SOLUTIONS® Fleet-On-TrackSM Solutions Without Limits® FMR Plus® S.T.A.R.S. STREAMLINERTM Follow Me Roaming Plus® S.T.A.R.S. -

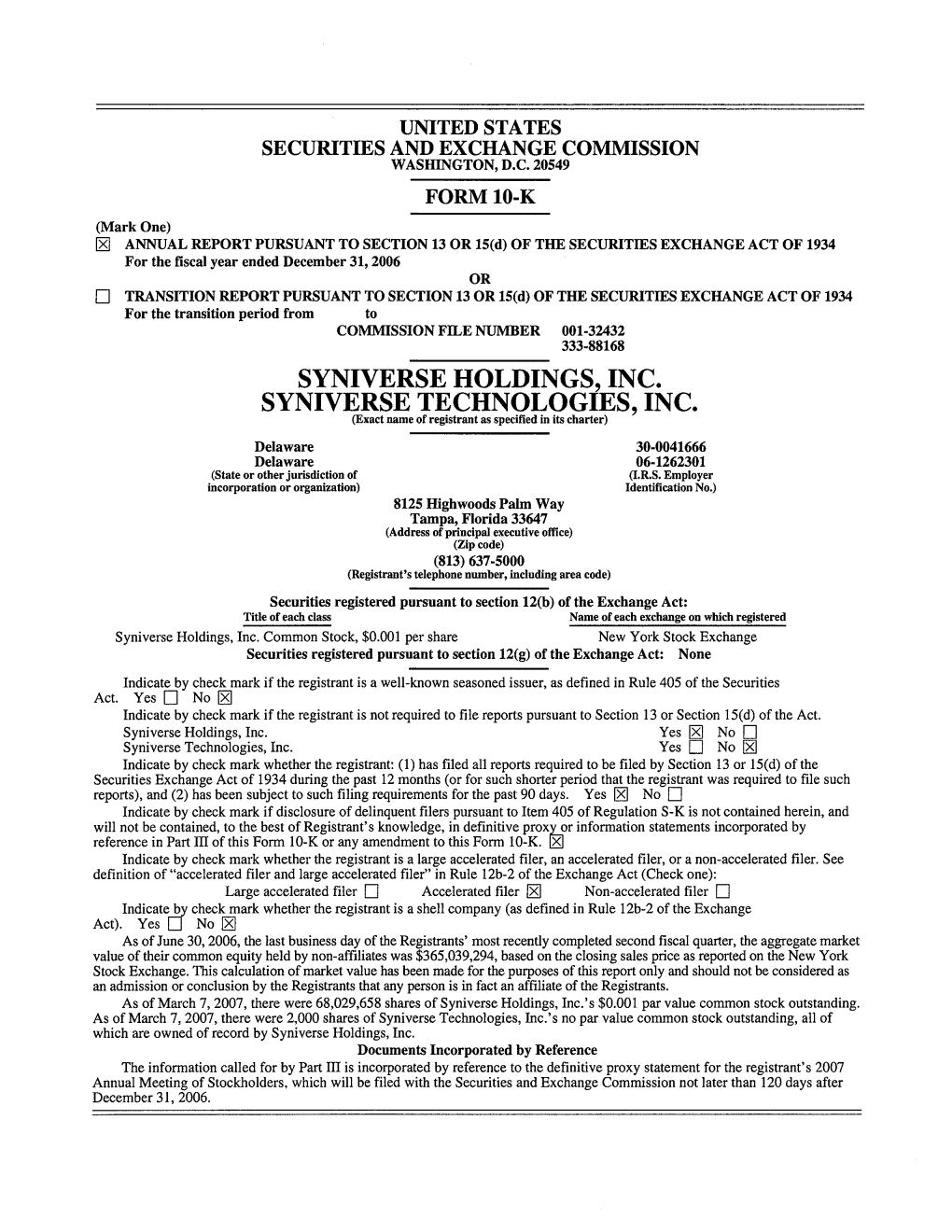

SYNIVERSE HOLDINGS, INC. SYNIVERSE TECHNOLOGIES, INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to COMMISSION FILE NUMBER 001-32432 333-88168 SYNIVERSE HOLDINGS, INC. SYNIVERSE TECHNOLOGIES, INC. (Exact name of registrant as specified in its charter) Delaware 30-0041666 Delaware 06-1262301 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 8125 Highwoods Palm Way Tampa, Florida 33647 (Address of principal executive office) (Zip code) (813) 637-5000 (Registrant’s telephone number, including area code) Securities registered pursuant to section 12(b) of the Exchange Act: Title of each class Name of each exchange on which registered Syniverse Holdings, Inc. Common Stock, $0.001 per share New York Stock Exchange Securities registered pursuant to section 12(g) of the Exchange Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Syniverse Holdings, Inc. Yes ¨ No x Syniverse Technologies, Inc. Yes x No ¨ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Engaging the Mobile Enterprise Audience – Via SMS

A Mobile Enterprise Whitepaper Engaging the Mobile Enterprise Audience – via SMS SMS TARGETS — and HiTS — THE MOBILE ENTERPRISE AUDIENCE Enterprises Pressed to Follow their Mobile Employees and Customers If there’s one monolithic feature that has dominated the enterprise IT landscape in the past few years, few would hesitate to say it’s mobility. The growth of wireless infrastructure and mobile devices has untethered employees, consumers and shareholders alike, and anyone tasked with reaching these groups has seen fixed communication channels shrink in effectiveness as mobile messaging has grown. Mail is for snails; the newspaper that lands on the driveway is read by people whose average age is 57, according to the Carnegie Corporation. Almost 25 percent of the United States population has dropped their landlines, according to the FCC. Even video has moved out of the house, and now rides on smart phones and tablets. The enterprise is now pressed to follow its employees, customers, prospects and investors wherever they go, and IT, HR, marketing and other departments have had to consider a wide range of mobility approaches. Those tasked with reaching out have found their greatest reach in a relatively simple technology: SMS. Commonly associated in the United States with inter-teenager communication, SMS and its multi-media brother, MMS, have been mushrooming in traffic volume around the world. (See Fig. 1). Over 6.9 trillion SMS messages were exchanged worldwide in 2010; total SMS traffic is expected to reach more than 11.6 trillion by the end of 2015. Person- to-person messages, let alone teenage texting, account for only part, and not the largest part, of the new traffic. -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1162 – 15.XII.2018 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 15 DECEMBER 2018) __________________________________________________________________ Geneva, 2018 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1162 of 15.XII.2018. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at http://www.itu.int/en/ITU-T/inr/forms/Pages/mnc.aspx . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website. 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities. -

Syniverse Technologies

..... ~ .-+-' .-..,co tI_ U) en c: U) ----f- -~ (I) ~- -« (l) ~ (l) w al (l) «~ --~- en CJ) -Q) .-~ ~ Q) .c:. I- About Syniverse Technologies • Global communications technology company specializing in innovative business and network engineering solutions that manage and interconnect voice and data systems • Telecommunications industry leader since 1987 • Global sales force in: London; Luxembourg; Rome; Beijing; Hong Kong; New Deli; Singapore; Rio de Janeiro; Belo Horizonte, Brazil; and Utrecht, The Netherlands • Nearly 300 customers in more than 30 countries throughout the Americas, Asia Pacific and Europe • Major provider of Local Number Porting Services (LNP) to the industry • New York Stock Exchange: SVR www.Syniverse.com ~ ~ Wireless .-:;,~. '" . AMBER ..•~~ Syn"fetse . ~ Alerts 2 Partnership: Wireless AMBER Alert Initiative • CTIA Wireless Association and Wireless Foundation - Program Sponsor and Coordinator • www.wirelessfoundation.org • National Center for Missing and Exploited Children - Interface to Law Enforcement and Clearinghouse for AMBER Alert Distribution on behalf of Dept of Justice • www.missingkids.org • Syniverse Technologies - Coordinates technology industry participation and supplies development and operational support • Wireless Carrier Community - The reach to the consumer... the feet and eyes on the street Wireless ~O ~·s." .•~.a~ AMBER •. 1\: ...lIn,.. ,_ .~~-'-;..... .. l-<n''',~ Alerts 3 National Center for Missing and Exploited C,hildren (NCMEC) • NCMEC was established in 1984 to provide services nationwide -

IPX Competitive Analysis Report Sample

IPX What customers think and wanIPXt May 2013 Competitive analysis Who offers what SAMPLE January 2014 IPX - Competitive analysis 2 About the authors Isabelle Paradis Isabelle has worked for 20 years in the telecoms industry. Her personal experience ranges from International Wholesale through to Business Strategy, Marketing and Product Management along with extensive research and consulting experience. She has worked across all continents and has lived in North America, Europe and Asia. Steve Heap Steve is a senior telecom executive with 30+ years experience leading companies from small technology start-ups to global service providers. He is a recognized expert in voice services and VoIP, Internet backbones and IP services, optical and submarine networks with significant additional experience in operations. www.hottelecom.com IPX - Competitive analysis 3 For more information contact: HOT TELECOM: t: +1 514 270 1636 f: +1 215 701 7537 e: [email protected] w: www.hottelecom.com Other reports of interest: IPX Market - Trends, Key players, Traffic http://www.hottelecom.com/reports/ipx-traffic-analysis.html International IPX Market Revenue Analysis and Forecast 2011-2015 http://www.hottelecom.com/reports/ipx-revenue-analysis.html IPX - What customers really think and want http://www.hottelecom.com/reports/ipx-customers.html DISCLAIMER: HOT TELECOM verified all information in this report to the best of its ability. The information contained herein has been obtained from sources believed to be reliable. However, as the information is based on interviews and secondary information provided by operators, regulators and other companies outside of our control, we cannot guarantee that the information provided is free of inaccuracies and/or fluctuations. -

Syniverse Response to Ofcom Consultation

Response to Ofcom Consultation Review of General Condition 18 - Number Portability Submitted 26 January 2007 PROPRIETARY THIS MATERIAL IS THE PROPRIETARY PROPERTY OF AND WHERE SO MARKED, CONFIDENTIAL TO SYNIVERSE TECHNOLOGIES, INC. (SYNIVERSE). DISCLOSURE OUTSIDE OF SYNIVERSE IS PROHIBITED EXCEPT BY LICENSE AGREEMENT OR OTHER CONFIDENTIALITY AGREEMENT. The following are services, software products, service marks, and/or trademarks of Syniverse Technologies, Inc.: ACCESS® inpackSM ACCESS S&E® INPort® ACCESSibility® INPositionSM Brience® LATALinkSM CCNSSM Phone Me Anywhere Plus® CrossroadsSM PMA Plus® EDTSM RoamerXchange® Electronic Data TransportSM SmartChallenge® Encrypt-A-Key® SOLUTIONS® Fleet-On-TrackSM Solutions Without Limits® FMR Plus® S.T.A.R.S. STREAMLINERTM Follow Me Roaming Plus® S.T.A.R.S. STREAMLINER Terminal Access Reporting System® FraudChallenger® STREAMLINER® FraudForce® SyniverseSM FraudInterceptor® Syniverse logo FraudManager® Syniverse Spark design Fraud Resource CenterSM Syniverse ConnectionsSM FraudX® UniRoamSM InForum Visibility® INLink® Whatever It Takes ® Denotes registration in the United States All other companies’ marks and names are the trademarks or service marks of the respective company. © Syniverse Technologies, Inc. All rights reserved under U.S. and international copyright laws. RESPONSE TO OFCOM CONSULTATION REVIEW OF GENERAL CONDITION 18 - NUMBER PORTABILITY INTRODUCTION As the supplier of the current Mobile Number Portability (MNP2) system, Syniverse welcomes the opportunity to respond to Ofcom regarding the future of Number Portability in the UK. Syniverse Technologies is a global communications technology company specializing in innovative business and network engineering solutions that manage and interconnect voice and data systems in more than 50 countries throughout North America, Europe, the Middle East, Central and Latin America and Asia Pacific.