Legislation to Further Reduce Impediments to Capital Formation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qtnugrrss Uf Tir Unitcb Iatr% Maalpugtrnz, 3Qt Fl515

Qtnugrrss uf tIr Unitcb Iatr% maalpugtrnz, 3Qt fl515 October 14, 2020 Mike Pompeo Alex Azar II Secretary of State Secretary of Health and Human Services Department of State Department of Health and Human Services 2201 C Street NW 301 7th St. SE Washington, D.C. 20520 Washington, D.C. 20229 Dear Secretary Pompeo and Secretary Azar: We write to express our serious concern over the Trump administration’s reckless approach to U.S.—international health cooperation that reversed long-standing successful policies advocated on a bipartisan basis by previous administrations. Your actions limited American cooperation with the European Union and removed American experts from the ground in China, where the outbreak began. This impeded the ability of American public health officials to receive timely and accurate information about the pandemic, delaying our response and likely costing American lives. We urge you to immediately reestablish common-sense cooperation with the global community and to explore additional measures that could further strengthen our domestic and international capacity to control the virus and save lives. The initial response to the COVID-19 outbreak by the Chinese government was demonstrably flawed and seriously problematic. However, prior to this outbreak, your Department of Health and Human Services (HHS) dramatically downsized the U.S.’ global epidemic prevention activities. This led to both the Centers for Disease Control (CDC) and the National Institutes of Health reducing U.S. personnel in China as well as the closure of the National Science Foundation office there. This deprived the U.S. of early and accurate information on the novel coronavirus outbreak and impeded our ability to prepare and respond. -

Did Spillovers from Europe Indeed Contribute to the 2010 U.S. Flash Crash?

No. 622 / January 2019 Did Spillovers From Europe Indeed Contribute to the 2010 U.S. Flash Crash? David-Jan Jansen Did Spillovers From Europe Indeed Contribute to the 2010 U.S. Flash Crash? David-Jan Jansen * * Views expressed are those of the authors and do not necessarily reflect official positions of De Nederlandsche Bank. De Nederlandsche Bank NV Working Paper No. 622 P.O. Box 98 1000 AB AMSTERDAM January 2019 The Netherlands Did Spillovers From Europe Indeed Contribute to the 2010 U.S. Flash Crash?* David-Jan Jansen a a De Nederlandsche Bank, Amsterdam, The Netherlands This version: January 2019 Abstract Using intraday data, we study spillovers from European stock markets to the U.S. in the hours before the flash crash on 6 May 2010. Many commentators have pointed to negative market sentiment and high volatility during the European trading session before the Flash Crash. However, based on a range of vector autoregressive models, we find no robust evidence that spillovers increased at that time. On the contrary, spillovers on 6 May were mostly smaller than in the preceding days, during which there was great uncertainty surrounding the Greek sovereign debt crisis. The absence of evidence for spillovers underscores the difficulties in understanding the nature of flash events in financial markets. Keywords: flash crash, spillovers, financial stability, connectedness. JEL classifications: G15, N22, N24. * This paper benefitted from discussions with Sweder van Wijnbergen as well as from research assistance by Jack Bekooij. Any errors and omissions remain my responsibility. Views expressed in the paper do not necessarily coincide with those of de Nederlandsche Bank or the Eurosystem. -

Cracks in the Pipeline 2

MEDIA CONTACT: Lauren Strayer | [email protected] 212-389-1413 FINANCIAL PIPELINE .o rg Series CRACKS IN THE PIPELINE 2 HIGH FREQUENCY TRADING by: Wallace C. Turbeville his is the second of a series of articles, that increase the inefficiency of Capital Intermediation and entitled “The Financial Pipeline Series”, its cost. The increased volumes in the traded markets are examining the underlying validity of the largely a result of high-speed, computer driven trading assertion that regulation of the financial by large banks and smaller specialized firms. This article markets reduces their efficiency. These illustrates how this type of trading (along with other activ- articles assert that the value of the finan- ities discussed in subsequent articles) extracts value from cial markets is often mis-measured. The the Capital Intermediation process rendering it less efficient. efficiency of the market in intermediat- It also describes how the value extracted is a driver of even ing flows between capital investors and more increased volume creating a dangerous and powerful capital users (like manufacturing and service businesses, feedback loop. individuals and governments) is the proper measure. Unreg- Tying increased trading volume to inefficiencies runs ulated markets are found to be chronically inefficient using counter to a fundamental tenet of industry opponents to Tthis standard. This costs the economy enormous amounts financial reform. They assert that burdens on trading will each year. In addition, the inefficiencies create stresses to the reduce volumes and thereby impair the efficient functioning system that make systemic crises inevitable. Only prudent of the markets. regulation that moderates trading behavior can reduce these The industry’s position that increased volume reduces inefficiencies. -

The Future of Computer Trading in Financial Markets an International Perspective

The Future of Computer Trading in Financial Markets An International Perspective FINAL PROJECT REPORT This Report should be cited as: Foresight: The Future of Computer Trading in Financial Markets (2012) Final Project Report The Government Office for Science, London The Future of Computer Trading in Financial Markets An International Perspective This Report is intended for: Policy makers, legislators, regulators and a wide range of professionals and researchers whose interest relate to computer trading within financial markets. This Report focuses on computer trading from an international perspective, and is not limited to one particular market. Foreword Well functioning financial markets are vital for everyone. They support businesses and growth across the world. They provide important services for investors, from large pension funds to the smallest investors. And they can even affect the long-term security of entire countries. Financial markets are evolving ever faster through interacting forces such as globalisation, changes in geopolitics, competition, evolving regulation and demographic shifts. However, the development of new technology is arguably driving the fastest changes. Technological developments are undoubtedly fuelling many new products and services, and are contributing to the dynamism of financial markets. In particular, high frequency computer-based trading (HFT) has grown in recent years to represent about 30% of equity trading in the UK and possible over 60% in the USA. HFT has many proponents. Its roll-out is contributing to fundamental shifts in market structures being seen across the world and, in turn, these are significantly affecting the fortunes of many market participants. But the relentless rise of HFT and algorithmic trading (AT) has also attracted considerable controversy and opposition. -

Ai: Understanding and Harnessing the Potential Wireless & Digital Services Ai: Understanding and Harnessing the Potential White Paper

AI: UNDERSTANDING AND HARNESSING THE POTENTIAL WIRELESS & DIGITAL SERVICES AI: UNDERSTANDING AND HARNESSING THE POTENTIAL WHITE PAPER CONTENTS INTRODUCTION ..............................................................................................................................................................................02 1. THE PRODUCTIVITY CONUNDRUM: WILL AI HELP US BREAK INTO A NEW CYCLE? ...........................................................05 1.1 Global productivity growth is faltering ...................................................................................................... 05 1.2 AI has the potential to drive productivity improvements and hence economic growth .................................... 06 2. AI FUTURES ........................................................................................................................................................................11 2.1 Replacing the smartphone with a ubiquitous voice assistant ....................................................................... 11 2.2 Your AI powered personal digital assistant ............................................................................................... 12 2.3 Is AI the missing piece for a truly smart city? ........................................................................................... 14 2.4 City of the future ................................................................................................................................... 16 2.5 Giving medics more time to care ............................................................................................................ -

Circuit Breakers and New Market Structure Realities

Circuit Breakers and New Market Structure Realities China’s dramatic and short-lived But there are questions about whether regulators have been able to keep up with today’s high-speed markets, with one experience with market circuit trader likening them to police on bicycles trying to catch breakers at the start of the New Year Ferraris.1 Regulators themselves have admitted as much. Testifying before the US Senate Committee on Banking after has revived debate about whether the Flash Crash of 2010, former SEC Chairwoman Mary such market interventions do more Schapiro said: “One of the challenges that we face in recreating the events of May 6 is the reality that the technologies used for harm than good, as regulators and market oversight and surveillance have not kept pace with the market participants around the world technology and trading patterns of the rapidly evolving and expanding securities markets.”2 continue to grapple with new market In response, a growing number of equity and equity-related structure realities and the law of markets (e.g., futures and listed options) around the world have introduced circuit breakers in the form of stock-specific and unintended consequences. market-wide trading halts as well as price limit bands in order to stabilize markets when, as the SEC has said, “severe market While many developments in modern equity markets have price declines reach levels that may exhaust market liquidity.”3 benefited investors in the form of greater efficiency and lower The 10 largest (by value traded) equity markets around the costs, they have also led to highly complex and fragmented world have already implemented or are planning to introduce markets. -

August 10, 2021 the Honorable Nancy Pelosi the Honorable Steny

August 10, 2021 The Honorable Nancy Pelosi The Honorable Steny Hoyer Speaker Majority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader Hoyer, As we advance legislation to rebuild and renew America’s infrastructure, we encourage you to continue your commitment to combating the climate crisis by including critical clean energy, energy efficiency, and clean transportation tax incentives in the upcoming infrastructure package. These incentives will play a critical role in America’s economic recovery, alleviate some of the pollution impacts that have been borne by disadvantaged communities, and help the country build back better and cleaner. The clean energy sector was projected to add 175,000 jobs in 2020 but the COVID-19 pandemic upended the industry and roughly 300,000 clean energy workers were still out of work in the beginning of 2021.1 Clean energy, energy efficiency, and clean transportation tax incentives are an important part of bringing these workers back. It is critical that these policies support strong labor standards and domestic manufacturing. The importance of clean energy tax policy is made even more apparent and urgent with record- high temperatures in the Pacific Northwest, unprecedented drought across the West, and the impacts of tropical storms felt up and down the East Coast. We ask that the infrastructure package prioritize inclusion of a stable, predictable, and long-term tax platform that: Provides long-term extensions and expansions to the Production Tax Credit and Investment Tax Credit to meet President Biden’s goal of a carbon pollution-free power sector by 2035; Extends and modernizes tax incentives for commercial and residential energy efficiency improvements and residential electrification; Extends and modifies incentives for clean transportation options and alternative fuel infrastructure; and Supports domestic clean energy, energy efficiency, and clean transportation manufacturing. -

Potential Committee Vacancies in the 117Th Congress Last Updated November 25, 2020

Potential Committee Vacancies in the 117th Congress Last updated November 25, 2020 Congressional committees are a critical part of the legislative process. Committees serve as gatekeepers for legislation, considering and amending bills before they reach the floor. Hearings and investigations shape policy debates and provide critical oversight. At the beginning of each Congress, Members receive their committee assignments. Members pursue membership on committees that align with their interests and priorities, and their assignments are determined by the Democratic Caucus and the Republican Conference - with heavy influence from party leadership and steering committees.1 When determining committee assignments, the parties weigh member preferences along with seniority, regional balance, and balance among ideological and identity caucuses.2 Committee vacancies present opportunities for returning members to gain spots on new committees and for incoming freshmen to get their initial assignments. Vacancies for committee chairs and ranking members can have major policy implications because those leaders shape committees’ priorities. Committee vacancies may occur due to a preexisting vacancy or because a previous member retired, ran for another office, or lost reelection. On the Democratic side, Members can receive waivers that allow them to serve on additional committees beyond the caps in Democratic Caucus rules.3 While returning members usually have the option to remain on their previous committees (except for committees with term limits4), a returning Democratic committee member using a waiver is not guaranteed the option to keep the committee slot. The Democratic Caucus uses waivers to distribute remaining committee slots after all members, including incoming freshmen, have hit their caps. The actual number of vacancies going into the 117th Congress depends on the final partisan composition of the House, which is reflected in the committee ratios negotiated by Democratic and Republican leaders. -

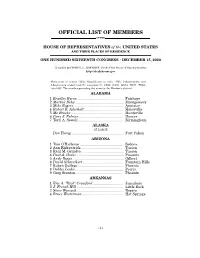

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

March 20, 2020 the Honorable Maxine Waters Chairwoman

March 20, 2020 The Honorable Maxine Waters The Honorable Al Green Chairwoman Chairman Committee on Financial Services Subcommittee on Oversight and Investigations United States House of Representatives Committee on Financial Services Washington, DC 20515 United States House of Representatives Washington, DC 20515 The Honorable Brad Sherman Chairman The Honorable Joyce Beatty Subcommittee on Investor Protection, Chairwoman Entrepreneurship, and Capital Markets Subcommittee on Diversity and Inclusion Committee on Financial Services Committee on Financial Services United States House of Representatives United States House of Representatives Washington, DC 20515 Washington, DC 20515 The Honorable Gregory W. Meeks The Honorable Bill Foster Chairman Chairman Subcommittee on Consumer Protection and Task Force on Artificial Intelligence Financial Institutions Committee on Financial Services Committee on Financial Services United States House of Representatives United States House of Representatives Washington, DC 20515 Washington, DC 20515 The Honorable Stephen Lynch The Honorable Wm. Lacy Clay Chairman Chairman Task Force on Financial Technology Subcommittee on Housing, Community Committee on Financial Services Development and Insurance United States House of Representatives Committee on Financial Services Washington, DC 20515 United States House of Representatives Washington, DC 20515 The Honorable Emanuel Cleaver Chairman Subcommittee on National Security, International Development and Monetary Policy Committee on Financial Services United -

CONGRESSIONAL RECORD— Extensions of Remarks E2185 HON. BRAD SHERMAN HON. BARBARA LEE HON. MAX SANDLIN HON. SCOTT Mcinnis

October 26, 1999 CONGRESSIONAL RECORD — Extensions of Remarks E2185 CIVITAS PROGRAM RESTORING IN MEMORY OF PRESIDENT My proposal could save the government bil- HOPE IN BOSNIA AND JULIUS NYERERE lions of dollars. Giving up the 3.4 percent pay HERZEGOVINA raise and cutting away earmarked proposals HON. BARBARA LEE would eliminate the need for indiscriminate OF CALIFORNIA spending cuts which would devastate already HON. BRAD SHERMAN IN THE HOUSE OF REPRESENTATIVES under-funded programs. Mr. Speaker, the time to act is now. We OF CALIFORNIA Tuesday, October 26, 1999 have to make the tough choices that the IN THE HOUSE OF REPRESENTATIVES Ms. LEE. Mr. Speaker, as a student, active American people sent us here to make. For us in the African liberation movement, President to meet our obligations and protect Social Se- Tuesday, October 26, 1999 Julius Nyerere was a source of inspiration to curity, we will have to make sacrifices. We will me. As a supporter, educator and celebrator Mr. SHERMAN. Mr. Speaker, in recent have to do the right thing. of indigenous African cultures, Nyerere was a I am hopeful that the House leadership will weeks a delegation of educators and edu- President who left an indelible mark not only make the right choice at this critical moment in cation officials from Bosnia and Herzegovina on Africans of all countries, but of people of all the budget debate. It will take courage. It will traveled to my district to continue their work nations. require us to make tough choices. And that’s with the Center for Civic Education in imple- It is fitting at this time to pay the utmost re- our job. -

Circuit Breakers, Volatility, and the US Equity Markets

Circuit Breakers, Trading Collars, and Volatility Transmission Across Markets: Evidence from NYSE Rule 80A Michael A. Goldstein* Babson College Current version: April 7, 2015 * Donald P. Babson Professor of Finance, Babson College, Finance Department, 231 Forest Street, Babson Park, MA 02457-0310; Phone: (781) 239-4402; Fax: (781) 239-5004; E-mail: [email protected] The author would like to thank Mark Ventimiglia, formerly of the International and Research Division of the New York Stock Exchange, for providing the data for this study and Alejandro Latorre, formerly of the Capital Markets Function of the Federal Reserve Bank of New York for excellent research assistance. Additional thanks go to Robert Van Ness (the editor), Joan Evans, James Mahoney, and participants at the Second Joint Central Bank Research Conference on Risk Measurement and Systematic Risk in Tokyo, Japan. Much of this analysis was completed when the author was the Visiting Economist at the New York Stock Exchange. The views expressed in this paper do not necessarily reflect those of the New York Stock Exchange. An early version of this paper was entitled “Circuit Breakers, Volatility, and the U.S. Equity Markets: Evidence from NYSE Rule 80A.” Circuit Breakers, Trading Collars, and Volatility Transmission Across Markets: Evidence from NYSE Rule 80A Abstract The New York Stock Exchange’s Rule 80A attempted to de-link the futures and equity markets by limiting index arbitrage trades in the same direction as the last trade to reduce stock market volatility. Rule 80A leads to a small but statistically significant decline in intraday U.S. equity market volatility.