New York Mining Club, T.O'leary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

2013 Annual Report

SURFACEBELOW THE Some statements in this report are forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those containing such words as ‘anticipate’, ‘estimates’, ‘should’, ‘will’, ‘expects’, ‘plans’ or similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual outcomes to be different from the forward-looking statements. Important factors that could cause actual results to differ from the forward looking statements include: (a) material adverse changes in global economic, alumina or aluminium industry conditions and the markets served by AWAC; (b) changes in production and development costs and production levels or to sales agreements; (c) changes in laws or regulations or policies; (d) changes in alumina and aluminium prices and currency exchange rates; and (e) the other risk factors summarised in Alumina’s Form 20-F for the year ended 31 December 2012. Unless otherwise indicated, the values in this report are presented in US dollars. CONTENTS 1 2 AT A GLANCE 4 CHAIRMAN AND CHIEF EXECUTIVE OFFICER’S REPORT 8 SUSTAINABILITY AND THE AWAC BUSINESS 10 CORPORATE GOVERNANCE STATEMENT 23 DIRECTORS’ REPORT 28 OPERATING AND FINANCIAL REVIEW 37 REMUNERATION REPORT 71 FINANCIAL REPORT 112 SHAREHOLDER INFORMATION 113 FINANCIAL HISTORY Challenging market conditions continued in 2013, stemming from a well-supplied alumina market, a sustained low international alumina pricing environment and an unfavourable foreign exchange position. Against this backdrop, Alumina Limited improved its results by recording a net profit of US$0.5 million, an increase of US$56.1 million from the previous year. -

Dow Jones Sustainability Australia Index

Effective as of 23 November 2020 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia and New Zealand Banking Group Limited Australia Banks National Australia Bank Limited Australia Banks Westpac Banking Corporation Australia Banks CIMIC Group Limited Australia Capital Goods Brambles Limited Australia Commercial & Professional Services Downer EDI Limited Australia Commercial & Professional Services Tabcorp Holdings Limited Australia Consumer Services The Star Entertainment Group Limited Australia Consumer Services Janus Henderson Group plc United Kingdom Diversified Financials Oil Search Limited Papua New Guinea Energy Woodside Petroleum Ltd Australia Energy Coles Group Limited Australia Food & Staples Retailing Fisher & Paykel Healthcare Corporation Limited New Zealand Health Care Equipment & Services Asaleo Care Limited Australia Household & Personal Products Insurance Australia Group Limited Australia Insurance QBE Insurance Group Limited Australia Insurance Suncorp Group Limited Australia Insurance Addition Amcor plc Switzerland Materials Addition BHP Group Australia Materials Boral Limited Australia Materials Evolution Mining Limited Australia Materials Fletcher Building Limited New Zealand Materials Fortescue Metals Group Limited Australia Materials IGO Limited Australia Materials Iluka Resources Limited Australia Materials Incitec Pivot Limited Australia Materials Newcrest Mining Limited Australia Materials Orocobre Limited Australia Materials Rio Tinto Ltd Australia Materials South32 Limited -

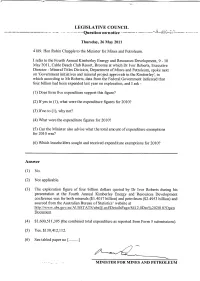

2011-08-09 Qon Exploration Expenditure

LEGISLATIVE COUNCIL C 'lff"\ 1"'.( "''1 ---------~~-~Question- on"notice ----------- ..'-?ibt;-:s::'.;"--- --_.- Thursday, 26 May 2011 4189. Hon Robin Chapple to the Minister for Mines and Petroleum. I refer to the Fourth Annual Kimberley Energy and Resources Development, 9 - 10 May 2011, Cable Beach Club Resort, Broome at which Dr Ivor Roberts, Executive Director - Mineral Titles Division, Department of Mines and Petroleum, spoke next on 'Government initiatives and mineral project approvals in the Kimberley', in which according to Mr Roberts, data from the Federal Government indicated that four billion had been expended last year on exploration, and 1 ask - (1) Does form five expenditure support this figure? (2) If yes to (1), what were the expenditure figures for 201O? (3) Ifno to (1), why not? (4) What were the expenditure figures for 2010? (5) Can the Minister also advise what the total amount of expenditure exemptions for 2010 was? (6) Which leaseholders sought and received expenditure exemptions for 2010? Answer (1) No. (2) Not applicable. (3) The exploration figure of four billion dollars quoted by Dr Ivor Roberts during his presentation at the Fourth Annual Kimberley Energy and Resources Development conference was for both minerals ($1.4017 billion) and petroleum ($2.4953 billion) and sourced from the Australian Bureau of Statistics' website at http://www.abs.gov.au/AUSST ATS/[email protected]/DetailsPage/8412.0Dec%20201 O?Open Document (4) $1,600,511,395 (the combined total expenditure as reported from Form 5 submissions). (5) Yes, $130,412,112. -

Deliver Sustainable Value

Annual Report 2020 DELIVER ABN 34 008 675 018 SUSTAINABLE VALUE ABOUT ILUKA RESOURCES lluka Resources Limited (Iluka) is an international mineral With over 3,000 direct employees, the company has sands company with expertise in exploration, project operations and projects in Australia and Sierra Leone; development, mining, processing, marketing and and a globally integrated marketing network. rehabilitation. Iluka conducts international exploration activities and The company’s objective is to deliver sustainable value. is actively engaged in the rehabilitation of previous operations in the United States, Australia and Sierra With over 60 years’ industry experience, Iluka is a Leone. leading global producer of zircon and the high grade titanium dioxide feedstocks rutile and synthetic rutile. In Listed on the Australian Securities Exchange (ASX) addition, the company has an emerging position in rare and headquartered in Perth. Iluka holds a 20% stake in earth elements (rare earths). Iluka’s products are used Deterra Royalties Limited (Deterra), the largest ASX-listed in an increasing array of applications including home, resources focussed royalty company. workplace, medical, lifestyle and industrial uses. PRODUCTS TITANIUM DIOXIDE ZIRCON TiO2 Zr Iluka is the largest producer of natural Iluka is a leading global producer of rutile and a major producer of synthetic zircon. Zircon is opaque; and heat, water, rutile, which is an upgraded, value added chemical and abrasion resistant. Primary form of ilmenite. Collectively, these uses include ceramics; refractory and products are referred to as high-grade foundry applications; and zirconium titanium dioxide feedstocks, owing to chemicals. their high titanium content. Primary uses include pigment (paints), titanium metal and welding. -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Iluka Resources Limited Macquarie WA Forum Adele Stratton, Chief Financial Officer 3 December 2019 Disclaimer and Compliance Statement 2

1 Iluka Resources Limited Macquarie WA Forum Adele Stratton, Chief Financial Officer 3 December 2019 Disclaimer and Compliance Statement 2 This presentation has been prepared by Iluka Resources Limited (Iluka). By accessing this presentation you acknowledge that you have read and understood the following statement. This document provides an indicative outlook for the Iluka business in the 2019 financial year. The information is provided to assist sophisticated investors with the modelling of the company, but should not be relied upon as a predictor of future performance. The current outlook parameters supersede all previous key physical and financial parameters. This information is based on Iluka forecasts and as such is subject to variation related to, but not restricted to, economic, market demand/supply and competitive factors. It is Iluka’s approach to modify its production settings based on market demand, and this can have a significant effect on operational parameters and associated physical and financial characteristics of the company. Forward Looking Statements This presentation contains certain statements which constitute “forward-looking statements”. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as “may”, “will”, “expect”, “plan”, “believes”, “estimate”, “anticipate”, “outlook” and “guidance”, or similar expressions, and may include, without limitation, statements regarding plans; strategies and objectives of management; anticipated production and production potential; estimates of future capital expenditure or construction commencement dates; expected costs or production outputs; estimates of future product supply, demand and consumption; statements regarding future product prices; and statements regarding the expectation of future Mineral Resources and Ore Reserves. -

Iluka Resources Full Year 2020 Results Presentation

1 Iluka Resources Limited 2020 Full Year Results Presentation Tom O’Leary, Managing Director Narngulu, Western Australia Disclaimer and Compliance Statement 2 This presentation has been prepared by Iluka Resources Limited (Iluka). By accessing this presentation you acknowledge that you have read and understood the following statement. This document provides an indicative outlook for the Iluka business in the 2021 financial year. The information is provided to assist sophisticated investors with the modelling of the company, but should not be relied upon as a predictor of future performance. The current outlook parameters supersede all previous key physical and financial parameters. This information is based on Iluka forecasts and as such is subject to variation related to, but not restricted to, economic, market demand/supply and competitive factors. It is Iluka’s approach to modify its production settings based on market demand, and this can have a significant effect on operational parameters and associated physical and financial characteristics of the company. Forward Looking Statements This presentation contains certain statements which constitute “forward-looking statements”. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as “may”, “will”, “expect”, “plan”, “believes”, “estimate”, “anticipate”, “outlook” and “guidance”, or similar expressions, and may include, without limitation, statements regarding plans; strategies and objectives of management; anticipated production and production potential; estimates of future capital expenditure or construction commencement dates; expected costs or production outputs; estimates of future product supply, demand and consumption; statements regarding future product prices; and statements regarding the expectation of future Mineral Resources and Ore Reserves. -

STOXX Australia 150 Last Updated: 02.06.2014

STOXX Australia 150 Last Updated: 02.06.2014 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 89.5 1 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 81.0 2 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 3 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 62.7 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 53.5 5 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 45.3 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 33.8 7 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 32.1 8 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 23.5 9 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 18.1 10 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 17.6 11 AU000000WDC7 B01BTX7 WDC.AX 605414 Westfield Group AU AUD Y 14.2 12 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 11.7 13 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 11.7 14 AU000000ORG5 6214861 ORG.AX 611220 Origin Energy Ltd. AU AUD Y 11.3 15 AU000000AMP6 6709958 AMP.AX 611571 AMP Ltd. AU AUD Y 10.6 16 AU000000BXB1 B1FJ0C0 BXB.AX 612000 Brambles Ltd. AU AUD Y 10.2 17 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

1 Directors and Officers' Risks, Liability and Insurance Update

quinn emanuel trial lawyers | sydney Level 15, 111 Elizabeth Street, Sydney NSW 2000, Australia | TEL +61 2 9146 3500 FAX +61 2 9146 3600 Directors and Officers' risks, liability and insurance Update - as at 2015 (December) This note provides an update on the risks and liabilities which have recently emerged for company directors and officers; as well as several other recent developments. In summary: 1. Emerging risks i. There is heightened community activism and a resulting increase in regulatory action, corruption investigations, and securities class actions; ii. cyber risks (which are emerging overseas); and iii. developments in the regulation of white collar crime (and in particular the new policy position of the US DOJ). 2. Liabilities i. We have conducted a review of major Australian D&O claims in the last 12 years (see below). This reveals the key ongoing risks and trends for Australian directors and officers; and ii. we provide below an update on two recent developments in the litigation funding sphere (the “common fund” and a case concerning ”bookbuilding” by funders). 3. Insurance i. From our experience, the leading D&O policies of insurance have responded well to the emerging risks and liabilities presently being faced by companies, as well as the continuing flow of securities and other class action claims; ii. at the same time, the confluence of substantial claims and emerging risks under D&O policies of insurance is leading to underwriters reviewing their appetite (capacity and pricing), approach, and the wording of their D&O contracts of insurance; and iii. we provide below a summary of four specific developments in the insurance law area in 2015 which may interest directors and officers.