Enter Rosoboronexport

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

International Exhibition of Arm in Accordance with the Decisi Armenia

Release for International Exhibition of Arms and Defence Technologies “ ArmHiTec-2020” In accordance with the decision of the Ministry of Defence of the Republic of Armenia, the Third International Exhibition of Arms and Defence Technologies “ArmHiTec- 2020" will be held in the period 26-28 March, 2020 at the Exhibition Complex "ErevanEXPO" (Yerevan, Republic of Armenia). The main objective of the International Exhibition of Arms and Defence Technologies “ArmHiTec-2020" is to develop military-economic and strategic partnership of the Republic of Armenia with its partner-countries, as well as to develop high -tech industry spheres. In 2020 the exhibition broadens its thematic sections. Along with the Ministry of Defence of the Republic of Armenia the co-organizers of the event are: - MOD of the Republic of Armenia State Military Industry Committee, being aimed at financing the military, scientific research projects, as well as end products. It allows the Committee to work closely with IT companies, carrying out the contracts in the spheres of hi- tech industries. - Ministry of Hi-Tech Industry of the Republic of Armenia, being primarily the digital sphere, military and hi-tech industries. Within the Ministry a new department, responsible for military-technical cooperation with foreign countries is currently being created. The thematic sections of the exhibition have been completed with IT tech, cyber security, engineering labs, and creative centers sections to contribute to the department’s goals realization . The Second International Exhibition of Arms and Defence Technologies “ArmHiTec - 2018” was held in a period from 29 to 31 of March on the territory of “YerevanExpo” center in the capital city of the Republic of Armenia. -

Innovations and Technologies for the Navy and Maritime Areas

Special analytical export project of the United Industrial Publishing № 04 (57), June 2021 GOOD RESULT ASSAULT BOATS IDEX / NAVDEX 2021 QATAR & SPIEF-2021 Military Technical Russian BK-10 Russia at the two Prospective mutually Cooperation in 2020 for Sub-Saharan Africa expos in Abu Dhabi beneficial partnership .12 .18 .24 .28 Innovations and technologies for the navy and maritime areas SPECIAL PARTNERSHIP CONTENTS ‘International Navy & Technology Guide‘ NEWS SHORTLY № 04 (57), June 2021 EDITORIAL Special analytical export project 2 One of the best vessels of the United Industrial Publishing 2 Industrial Internet of ‘International Navy & Technology Guide’ is the special edition of the magazine Things ‘Russian Aviation & Military Guide’ 4 Trawler Kapitan Korotich Registered in the Federal Service for Supervision of Communications, Information 4 Finance for 5G Technology and Mass Media (Roscomnadzor) 09.12.2015 PI № FS77-63977 Technology 6 The largest propeller 6 Protection From High-Precision Weapons 8 New Regional Passenger Aircraft IL-114-300 The magazine ‘Russian Aviation & Military Guide’, made by the United Industrial 8 Klimov presents design of Publishing, is a winner of National prize ‘Golden Idea 2016’ FSMTC of Russia VK-1600V engine 10 Russian Assault Rifles The best maritime General director technologies Editor-in-chief 10 ‘Smart’ Target for Trainin Valeriy STOLNIKOV 10th International Maritime Defence Show – IMDS-2021, which is held from 23 to 27 June Chief editor’s deputy 2021 in St. Petersburg under the Russian Govern- Elena SOKOLOVA MAIN TOPICS ment decree № 1906-r of 19.07.2019, is defi- Commercial director 12 Military Technical nitely unique. Show is gathering in obviously the Oleg DEINEKO best innovations for Navy and different maritime Cooperation technologies for any tasks. -

Russian Helicopters Experience and Innovation

RUSSIAN HELICOPTERS EXPERIENCE AND INNOVATION © 2013 Russian Helicopters, JSC All rights reserved RUSSIAN HELICOPTERS AT A GLANCE Russian Helicopters, JSC is the sole manufacturer of “Mil” and “Kamov” civil and military helicopters. The company’s structure incorporates design bureaus, final assembly plants, components and parts manufacturers and service providers. Russian Helicopters consolidated the entire helicopter-building industry of Russia. We offer complete helicopter lifecycle from development to disposal. Russian Helicopters was founded in 2007 as a subsidiary of Oboronprom Corporation © 2013 Russian Helicopters, JSC All rights reserved FULLY INTEGRATED STRUCTURE Oboronprom TOTAL STAFF – 41,000 EMPLOYEES Russian Helicopters (98.5%) Mil Moscow Kazan Helicopters SMPP Helicopter Service Helicopter Plant (80.22%) (59.99%) Company (72.38%) (100.0%) Kamov Rostvertol Reduktor-PM (99.79%) (92.01%) (80.84%) Moscow and region NARP (9,000 employees) Kazan (95.1%) (6,500 employees) Ulan-Ude Aviation Plant (84.82%) Perm Progress Arsenyev (1,800 employees) Aviation Company Rostov-on-Don (93.14%) (7,900 employees) Kumertau Kumertau (4,000 employees) Novosibirsk Aviation PE (500 employees) (100.0%) Arsenyev (6,000 employees) Ulan-Ude (6,000 employees) © 2013 Russian Helicopters, JSC All rights reserved RUSSIAN HELICOPTERS AROUND THE WORLD Civil Total 37,530 Military Total 22,800 9% 91% 78% Civil Military Russian-made helicopters Key regions: account for nearly 14% of the Russia, CIS, India, China, Latin global fleet and are operated America, -

Turkey's S-400 Dilemma

EDAM Foreign Policy and Security Paper Series 2017/5 Turkey’s S-400 Dilemma July, 2017 Dr. Can Kasapoglu Defense Analyst, EDAM 1 EXECUTIVE SUMMARY • This report’s core military assessment of a possible • In fact, modern air defense concepts vary between S-400 deal concludes that Ankara’s immediate aim is fighter aircraft-dominant postures, SAM-dominant to procure the system primarily for air defense missi- postures, and balanced force structures. However, if ons as a surface-to-air missile (SAM) asset, rather than Ankara is to replace its fighter aircraft-dominant con- performing ballistic missile defense (BMD) functions. cept with a SAM and aircraft mixed understanding, This priority largely stems from the Turkish Air Force’s which could be an effective alternative indeed, then currently low pilot-to-cockpit ratio (0.8:1 by open- it has to maintain utmost interoperability within its source 2016 estimates). Thus, even if the procurement principal arsenal. Key importance of interoperability is to be realized, Turkey will first and foremost operate between aircraft and integrated air and missile defense the S-400s as a stopgap measure to augment its air systems can be better understood by examining the superiority calculus over geo-strategically crucial areas. Israeli Air Force’s (IAF) recent encounter in the Syrian This is why the delivery time remains a key condition. airspace. On March 17, 2017, a Syrian S-200 (SA-5) battery fired an anti-aircraft missile to hunt down an • Although it is not a combat-tested system, not only IAF fixed-wing aircraft (probably an F-15 or F-16 Russian sources but also many Western military variant). -

![[Public Notice 10159] Guidance on Specified Persons Under Section](https://docslib.b-cdn.net/cover/6515/public-notice-10159-guidance-on-specified-persons-under-section-696515.webp)

[Public Notice 10159] Guidance on Specified Persons Under Section

This document is scheduled to be published in the Federal Register on 12/04/2017 and available online at https://federalregister.gov/d/2017-26087, and on FDsys.gov Billing Code 4710-27 DEPARTMENT OF STATE [Public Notice 10159] Guidance on Specified Persons Under Section 231 of the Countering Russian Influence in Europe and Eurasia Act of 2017 ACTION: Guidance to specify persons that are part of, or operate for or on behalf of, the defense and intelligence sectors of the Government of the Russian Federation; notice. SUMMARY: The Department of State is issuing this guidance to specify the persons that are part of, or operate for or on behalf of, the defense and intelligence sectors of the Government of the Russian Federation. This guidance, including the list specifying persons, was developed through a robust interagency process and may be updated or amended as circumstances warrant. APPLICABLE DATES: The specification of persons identified in this notice pursuant to the Act is applicable on [INSERT DATE OF PUBLICATION IN THE FEDERAL REGISTER] FOR FURTHER INFORMATION CONTACT: Philip A. Foley Director, Office of Counterproliferation Initiatives, Bureau of International Security and Nonproliferation, Department of State, Washington, DC 20520, tel.: 202-647-5193, [email protected]. BACKGROUND: Pursuant to the authority in Section 231(d) of the Countering Russian Influence in Europe and Eurasia Act of 2017 (Pub. L. 115-44), (“the Act”), the Secretary of State is issuing this guidance to specify the following as persons that are part of, or -

Russian Military Developments and Strategic Implications

i [H.A.S.C. No. 113–105] RUSSIAN MILITARY DEVELOPMENTS AND STRATEGIC IMPLICATIONS COMMITTEE ON ARMED SERVICES HOUSE OF REPRESENTATIVES ONE HUNDRED THIRTEENTH CONGRESS SECOND SESSION HEARING HELD APRIL 8, 2014 U.S. GOVERNMENT PRINTING OFFICE 88–450 WASHINGTON : 2015 For sale by the Superintendent of Documents, U.S. Government Printing Office, http://bookstore.gpo.gov. For more information, contact the GPO Customer Contact Center, U.S. Government Printing Office. Phone 202–512–1800, or 866–512–1800 (toll-free). E-mail, [email protected]. COMMITTEE ON ARMED SERVICES ONE HUNDRED THIRTEENTH CONGRESS HOWARD P. ‘‘BUCK’’ MCKEON, California, Chairman MAC THORNBERRY, Texas ADAM SMITH, Washington WALTER B. JONES, North Carolina LORETTA SANCHEZ, California J. RANDY FORBES, Virginia MIKE MCINTYRE, North Carolina JEFF MILLER, Florida ROBERT A. BRADY, Pennsylvania JOE WILSON, South Carolina SUSAN A. DAVIS, California FRANK A. LOBIONDO, New Jersey JAMES R. LANGEVIN, Rhode Island ROB BISHOP, Utah RICK LARSEN, Washington MICHAEL R. TURNER, Ohio JIM COOPER, Tennessee JOHN KLINE, Minnesota MADELEINE Z. BORDALLO, Guam MIKE ROGERS, Alabama JOE COURTNEY, Connecticut TRENT FRANKS, Arizona DAVID LOEBSACK, Iowa BILL SHUSTER, Pennsylvania NIKI TSONGAS, Massachusetts K. MICHAEL CONAWAY, Texas JOHN GARAMENDI, California DOUG LAMBORN, Colorado HENRY C. ‘‘HANK’’ JOHNSON, JR., Georgia ROBERT J. WITTMAN, Virginia COLLEEN W. HANABUSA, Hawaii DUNCAN HUNTER, California JACKIE SPEIER, California JOHN FLEMING, Louisiana RON BARBER, Arizona MIKE COFFMAN, Colorado ANDRE´ CARSON, Indiana E. SCOTT RIGELL, Virginia CAROL SHEA-PORTER, New Hampshire CHRISTOPHER P. GIBSON, New York DANIEL B. MAFFEI, New York VICKY HARTZLER, Missouri DEREK KILMER, Washington JOSEPH J. HECK, Nevada JOAQUIN CASTRO, Texas JON RUNYAN, New Jersey TAMMY DUCKWORTH, Illinois AUSTIN SCOTT, Georgia SCOTT H. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

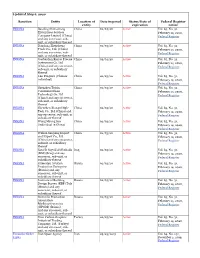

Sanction Entity Location of Date Imposed Status/Date of Federal Register Entity Expiration Notice INKSNA Baoding Shimaotong China 02/03/20 Active Vol

Updated May 6, 2020 Sanction Entity Location of Date imposed Status/Date of Federal Register entity expiration notice INKSNA Baoding Shimaotong China 02/03/20 Active Vol. 85, No. 31, Enterprises Services February 14, 2020, Company Limited (China) Federal Register and any successor, sub- unit, or subsidiary thereof INKSNA Dandong Zhensheng China 02/03/20 Active Vol. 85, No. 31, Trade Co., Ltd. (China) February 14, 2020, and any successor, sub- Federal Register unit, or subsidiary thereof INKSNA Gaobeidian Kaituo Precise China 02/03/20 Active Vol. 85, No. 31, Instrument Co. Ltd February 14, 2020, (China) and any successor, Federal Register sub-unit, or subsidiary thereof INKSNA Luo Dingwen (Chinese China 02/03/20 Active Vol. 85, No. 31, individual) February 14, 2020, Federal Register INKSNA Shenzhen Tojoin China 02/03/20 Active Vol. 85, No. 31, Communications February 14, 2020, Technology Co. Ltd Federal Register (China) and any successor, sub-unit, or subsidiary thereof INKSNA Shenzhen Xiangu High- China 02/03/20 Active Vol. 85, No. 31, Tech Co., Ltd (China) and February 14, 2020, any successor, sub-unit, or Federal Register subsidiary thereof INKSNA Wong Myong Son China 02/03/20 Active Vol. 85, No. 31, (individual in China) February 14, 2020, Federal Register INKSNA Wuhan Sanjiang Import China 02/03/20 Active Vol. 85, No. 31, and Export Co., Ltd February 14, 2020, (China) and any successor, Federal Register subunit, or subsidiary thereof INKSNA Kata’ib Sayyid al-Shuhada Iraq 02/03/20 Active Vol. 85, No. 31, (KSS) (Iraq) and any February 14, 2020, successor, sub-unit, or Federal Register subsidiary thereof INKSNA Kumertau Aviation Russia 02/03/20 Active Vol. -

Federal Register/Vol. 81, No. 193/Wednesday, October 5, 2016

69190 Federal Register / Vol. 81, No. 193 / Wednesday, October 5, 2016 / Notices system. The MTSNAC will consider congestion and increase mobility Authority: 49 CFR part 1.93(a); 5 U.S.C. new bylaws, form subcommittees and throughout the domestic transportation 552b; 41 CFR parts 102–3; 5 U.S.C. app. working groups, and develop work system; Sections 1–16 plans and recommendations. e. actions designed to strengthen By Order of the Maritime Administrator. DATES: The meeting will be held on maritime capabilities essential to Dated: September 29, 2016. Tuesday, October 18, 2016 from 8:00 economic and national security; T. Mitchell Hudson, Jr., f. ways to modernize the maritime a.m. to 5:00 p.m. and Wednesday, Secretary, Maritime Administration. October 19, 2016 from 8:00 a.m. to 12:00 workforce and inspire and educate the next generation of mariners; [FR Doc. 2016–23989 Filed 10–4–16; 8:45 am] p.m. Eastern Daylight Saving Time BILLING CODE 4910–81–P (EDT). g. actions designed to encourage the continued development of maritime ADDRESSES: The meeting will be held at innovation and; the St. Louis City Center Hotel, 400 h. any other actions MARAD could South 14th Street, St. Louis, MO 63103. take to meet its mission to foster, DEPARTMENT OF THE TREASURY FOR FURTHER INFORMATION CONTACT: Eric promote, and develop the maritime Office of Foreign Assets Control Shen, Co-Designated Federal Officer at: industry of the United States. (202) 308–8968, or Capt. Jeffrey Public Participation Sanctions Actions Pursuant to Flumignan, Co-Designated Federal Executive Orders 13660, 13661, 13662, The meeting will be open to the Official at (212) 668–2064 or via email: and 13685 [email protected] or visit the MTSNAC public. -

OFFICE of FOREIGN ASSETS CONTROL CHANGES to the Sectoral Sanctions Identifications List

OFFICE OF FOREIGN ASSETS CONTROL CHANGES TO THE Sectoral Sanctions Identifications List SINCE JANUARY 1, 2015 This publication of Treasury's Office of Foreign center/sanctions/Programs/Pages/ukraine.aspx# Order 13662 Directive Determination - Subject to Assets Control ("OFAC") is a reference tool directives. [UKRAINE-EO13662] (Linked To: Directive 2; alt. Executive Order 13662 Directive providing actual notice of actions by OFAC with OPEN JOINT-STOCK COMPANY ROSNEFT Determination - Subject to Directive 4; For more respect to persons that are identified pursuant to OIL COMPANY). information on directives, please visit the Executive Order 13662 and are listed on the AKTSIONERNOE OBSHCHESTVO following link: http://www.treasury.gov/resource- Sectoral Sanctions I dentifications List (SSI List). KOMMERCHESKI BANK GLOBEKS (f.k.a. center/sanctions/Programs/Pages/ukraine.aspx# The latest changes may appear here prior to their CJSC GLOBEXBANK; a.k.a. GLOBEKSBANK, directives. [UKRAINE-EO13662] (Linked To: publication in the Federal Register, and it is AO; a.k.a. GLOBEX COMMERCIAL BANK, OPEN JOINT-STOCK COMPANY ROSNEFT intended that users rely on changes indicated in JOINT STOCK COMPANY; a.k.a. OIL COMPANY). this document. Such changes reflect official GLOBEXBANK; f.k.a. ZAKRYTOE BANK BELVEB OJSC (a.k.a. actions of OFAC, and will be ref lected as soon as AKTSIONERNOE OBSHCHESTVO BELVESHECONOMBANK OAO; a.k.a. practicable in the Federal Register under the KOMMERCHESKI BANK GLOBEKS), d. 59 str. BELVNESHECONOMBANK OPEN JOINT index heading "Foreign Assets Control." New 2 ul. Zemlyanoi Val, Moscow 109004, Russia; STOCK COMPANY), 29 Pobeditelei ave., Minsk Federal Register notices with regard to SWIFT/BIC GLOB RU MM; Website 220004, Belarus; SWIFT/BIC BELB BY 2X; identifications made under Executive Order 13662 globexbank.ru; Executive Order 13662 Directive Website bveb.by; Executive Order 13662 may be published at any time. -

FINAL DIVESTMENT LIST—SUDAN Compiled As of August 30, 2020

FINAL DIVESTMENT LIST—SUDAN Compiled as of August 30, 2020 Pursuant to N.C. Gen. Stat. § 147-86.43, the State Treasurer has determined that the companies listed below appear to be engaged in “restricted business operations,” as that term is defined in the amended Sudan (Darfur) Divestment Act of 2007 (the “Act”), based on federal sanctions lists and other publicly available, credible information. This updated List may be found at the State Treasurer’s website: https://www.nctreasurer.com. The State Treasurer and North Carolina Retirement Systems may not invest funds, and must divest any existing investment, with the restricted companies listed below. N.C. Gen. Stat. § 147-86.44. “Company” is defined by the Act to include not only restricted companies listed as a result of their own apparent restricted business operations in Sudan but also any “wholly-owned subsidiaries, majority-owned subsidiaries, parent companies, or affiliates of such entities.” N.C. Gen. Stat. § 147-86.42(3). The Department of State Treasurer is not responsible for compliance with the Act by other agencies or State political subdivisions. The Department’s responsibilities are solely focused on implementing N.C. Gen. Stat. § 147-86.44, which relates to the Department’s investments, and implementing the Act as it relates to the identification of companies that appear to be engaged in restricted business operations in Sudan (and their affiliates). Restricted Company Restricted Company ASEC Company for Mining ASCOM, S.A.E Oil India Ltd. AviChina Industry & Technology Company Limited Orca Gold Inc. Bharat Heavy Electricals Ltd. PetroChina Co., Ltd. China Petroleum & Chemical Corp. -

Russian Helicopters Streamlines Rostvertol Management Structure

Russian Helicopters streamlines Rostvertol management structure Moscow / 10 June 2014 Russian Helicopters, a subsidiary of Oboronprom, part of State Corporation Rostec, announces that Pyotr Motrenko has been appointed Managing Director of its Rostvertol subsidiary by Rostvertol’s Board of Directors at a meeting held in Rostov-on-Don on 7 June. Outgoing General Director Boris Slusar has been elected Chairman of the Board of Directors of Rostvertol, with Oboronprom CEO Dmitry Lelikov appointed Deputy Chairman. Rostvertol’s Annual General Meeting of shareholders (AGM), also held in Rostov-on-Don on 7 June, approved the transfer to Russian Helicopters of the functions of Rostvertol’s sole executive body, previously carried out by Boris Slusar. Before his new appointment Pyotr Motrenko served as Deputy General Director for Finance, Commercial Issues and Reconstruction. The appointments form part of Russian Helicopters’ continuing drive to streamline operational and management structures across the company, and to improve interaction between Russian Helicopters subsidiaries to increase the speed of decision-making and reduce delays. “After completing the consolidation of Russia’s helicopter industry into Russian Helicopters, the process of reorganisation has entered a new phase,” Russian Helicopters CEO Alexander Mikheev said. “We will continue to build the new image of the sector by creating centres of excellence, modernising our production capacities, investing to create manufacturing and R&D clusters, and streamlining management structures and asset-management systems.” “Rostvertol is one of Russian Helicopters’ key production assets,” Rostvertol Chairman Boris Slusar said. “The plant produces the latest Mi-28N(E) Night Hunter helicopter, the legendary Mi- 35M gunship, and the world’s heaviest-lift transport helicopter – the Mi-26(T).