MI Chelverton UK Equity Growth Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

ES River and Mercantile UK Recovery Fund

ES River and Mercantile UK Recovery Fund Quarterly Report to 30 September 2020 UK Equity Unconstrained Fund I Monthly Report Month 2008 UK Recovery For unitholders only0 ES R&M UK Recovery Fund Quarter 3, 2020 Fund Objective The investment objective of the Fund is to grow the value of your investment (known as “capital growth”) in excess of the MSCI United Kingdom Investable Market Index (IMI) Net Total Return (the “Benchmark”) over a rolling 5 year period, after the deduction of fees. Performance (net of fees) B share class Benchmark Difference 3 Months -1.4% -3.6% 2.2% 1 Year -17.1% -18.5% 1.4% 3 Years p.a. -5.9% -4.1% -1.8% 5 Years p.a. 3.8% 3.0% 0.8% 10 Years p.a. 7.8% 4.6% 3.1% Since Inception p.a. 12.6% 7.9% 4.7% 20% 10% 0% -10% -20% -30% 3 Months 1 Year 3 Years 5 Years 10 Years Since Inception p.a. p.a. p.a. p.a. ES R&M UK Recovery Fund B Shares MSCI UK IM Index Performance (gross of fees) Z class Z share class Benchmark Difference 3 Months -1.2% -3.6% 2.4% 1 Year -16.2% -18.5% 2.3% 3 Years p.a. -5.0% -4.1% -0.9% 5 Years p.a. 4.8% 3.0% 1.9% 10 Years p.a. 8.9% 4.6% 4.2% Source: River and Mercantile Asset Management LLP. Benchmark is the MSCI UK Investable Market index, net GBP. -

Annual Report and Audited Financial Statements

Annual report and audited financial statements BlackRock Charities Funds • BlackRock Armed Forces Charities Growth & Income Fund • BlackRock Catholic Charities Growth & Income Fund • BlackRock Charities Growth & Income Fund • BlackRock Charities UK Bond Fund • BlackRock Charities UK Equity ESG Fund • BlackRock Charities UK Equity Fund • BlackRock Charities UK Equity Index Fund For the financial period ended 30 June 2020 Contents General Information 2 About the Trust 3 Charity Authorised Investment Fund 4 Charity Trustees’ Investment Responsibilities 4 Fund Manager 4 Significant Events 4 Investment Report 5 Report on Remuneration 15 Accounting and Distribution Policies 21 Financial Instruments and Risks 24 BlackRock Armed Forces Charities Growth & Income Fund 37 BlackRock Catholic Charities Growth & Income Fund 56 BlackRock Charities Growth & Income Fund 74 BlackRock Charities UK Bond Fund 95 BlackRock Charities UK Equity ESG Fund 111 BlackRock Charities UK Equity Fund 125 BlackRock Charities UK Equity Index Fund 138 Statement of Manager’s and Trustee’s Responsibilities 162 Independent Auditor’s Report 165 Supplementary Information 169 1 General Information Advisory Committee Members - BlackRock manager of the Funds, each of which is an alternative Armed Forces Charities Growth & Income investment fund for the purpose of the Alternative Fund: Investment Fund Managers Directive. Mr Michael Baines (Chairman) Mr Guy Davies Directors of the Manager Major General A Lyons CBE G D Bamping* Major General Ashley Truluck CB, CBE M B Cook Colonel -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Herbert Smith Freehills Boosts London Corporate Capability with Ecm Partner Hire

HERBERT SMITH FREEHILLS BOOSTS LONDON CORPORATE CAPABILITY WITH ECM PARTNER HIRE 23 June 2020 | London Firm news Leading global law firm Herbert Smith Freehills has hired Michael Jacobs to join its market leading Global Corporate practice as an Equity Capital Markets partner in London. Michael joins the firm from Allen & Overy where he was a partner. He returns to London from Hong Kong, where he has spent the last three years. Michael is an equity capital markets specialist and has represented listed companies, underwriters and investors on initial public offerings, secondary offerings and other strategic equity transactions. He also regularly advises listed corporates on the equity capital markets implications of public and private M&A transactions and restructurings. Prior to relocating to Hong Kong, Michael acted on the initial public offerings of Worldpay, Virgin Money, Hastings Insurance, Neinor Homes and The Gym Group and secondary capital raises by companies including Great Portland Estates, Sirius Minerals, Ophir Energy, Capitec Bank, GKN, Vedanta Energy and the recapitalisation and consensual bail in of the Co- operative Bank. Michael is recommended by Legal 500 for equity capital markets transactions. Michael also has considerable experience across mainstream corporate finance transactions, including public and private M&A, board-level corporate advisory work, restructurings and regulatory advice for clients including advising on cross-border deals which span a wide range of sectors, including financial institutions, fintech and growth capital. His M&A experience includes advising on Banco de Sabadell’s takeover of TSB Banking Group and the acquisition of Northern Rock by Virgin Money, as well as on transactions for Ping An, Go-Jek, Discovery Capital and Roivant Sciences during his time in Hong Kong. -

Annual Report 2019

Synthomer plc Annual Report 2019 BUILDING GLOBAL DIFFERENTIATION Synthomer plc We continue to make good progress towards our strategic objectives despite challenging market conditions in 2019. The acquisition of the highly complementary OMNOVA Solutions Inc will extend our geographic reach, expand our global platform and allow us to further differentiate our business. Our successful capital investment expansion programme in 2018/2019 positions us well to capture higher-than-market growth and extend our leadership positions in our core markets. Who we are Industrial Specialities is focused on our speciality Synthomer is a speciality chemicals company and chemical additives and non-water-based one of the world’s leading suppliers of water-based chemistry for a broad range of applications from polymers. With strong geographic and end market polymer additives and monomers to emerging diversity combined with product differentiation, materials and technologies. Synthomer holds leadership positions in a wide Our culture range of markets including coatings, construction, Synthomer is fully committed to building a textiles, paper and healthcare. business where the people, purpose, culture Our purpose and values of the Group are fully aligned. Revenue As a global leader in water-based polymer Synthomer is a diverse global company with an 43% chemistry, our purpose is to continually innovate inclusive culture which embodies meritocracy, 42% 15% to meet the needs of our customers and society openness, fairness and transparency. in a sustainable way. 3 Our values What we do Synthomer has five core values. At the heart We operate through three global businesses – of our business is SHE (Safety, Health and 1 Performance Elastomers (PE); Environmental) – we always have time to work Functional Solutions (FS); and safely. -

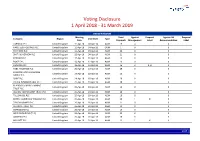

Global Voting Activity Report to March 2019

Voting Disclosure 1 April 2018 - 31 March 2019 UNITED KINGDOM Meeting Total Against Proposal Against ISS Proposal Company Region Vote Date Type Date Proposals Management Label Recommendation Label CARNIVAL PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 19 0 0 HANSTEEN HOLDINGS PLC United Kingdom 11-Apr-18 04-Apr-18 OGM 1 0 0 RIO TINTO PLC United Kingdom 11-Apr-18 04-Apr-18 AGM 22 0 0 SMITH & NEPHEW PLC United Kingdom 12-Apr-18 04-Apr-18 AGM 21 0 0 PORVAIR PLC United Kingdom 17-Apr-18 10-Apr-18 AGM 15 0 0 BUNZL PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 19 0 0 HUNTING PLC United Kingdom 18-Apr-18 12-Apr-18 AGM 16 2 3, 8 0 HSBC HOLDINGS PLC United Kingdom 20-Apr-18 13-Apr-18 AGM 29 0 0 LONDON STOCK EXCHANGE United Kingdom 24-Apr-18 18-Apr-18 AGM 26 0 0 GROUP PLC SHIRE PLC United Kingdom 24-Apr-18 18-Apr-18 AGM 20 0 0 CRODA INTERNATIONAL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 18 0 0 BLACKROCK WORLD MINING United Kingdom 25-Apr-18 19-Apr-18 AGM 15 0 0 TRUST PLC ALLIANZ TECHNOLOGY TRUST PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 10 0 0 TULLOW OIL PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 16 0 0 BRITISH AMERICAN TOBACCO PLC United Kingdom 25-Apr-18 19-Apr-18 AGM 20 1 8 0 TAYLOR WIMPEY PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 21 0 0 ALLIANCE TRUST PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 13 0 0 SCHRODERS PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 19 0 0 WEIR GROUP PLC (THE) United Kingdom 26-Apr-18 20-Apr-18 AGM 23 0 0 AGGREKO PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 20 0 0 MEGGITT PLC United Kingdom 26-Apr-18 20-Apr-18 AGM 22 1 4 0 1/47 -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Q2 Sustainable Investment Report US.Indd

Sustainable Investment Report Q2 2017 For Financial Intermediary, Institutional and Consultant use only. Not for redistribution under any circumstances. Contents 1 6 Introduction INfl uence With great power comes great responsibility: shareholders have a vital role to play Unaoil case study: managing the changing risk 2 INsight 8 Managing corporate controversies: the role of ESG ratings Second quarter 2017 We’ll always have Paris: our view of climate Total company engagement change remains unchanged Engagement in numbers ESG and Sovereign Bonds: our new framework for ESG integration Shareholder voting Engagement progress In an ideal world, our work on sustainability and Environmental, Social and Governance (ESG) integration combined with our focus on active fund management would mean that we are never exposed to controversies. The reality of managing $500 billion of assets is more complex. Jessica Ground Global Head of Stewardship, Schroders This quarter we explore corporate controversies. Meanwhile, despite policymakers around the world We have analysed third party ESG scores and concluded stressing the importance of corporate governance, that they are of little help in identifying companies that engaged asset managers and asset owners, and new will face them. We have always viewed such ratings as Stewardship Codes being introduced almost monthly, a starting point, rather than the defi nitive view on a we are seeing more companies fl oat with fewer company, and this work confi rms that our proprietorial shareholder rights. In recent consultations with index approach is correct. We also highlight the engagement providers and exchanges, we have emphasised the work that we did with our holdings following revelations need to preserve existing governance standards. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

GCN UK) Is a Company Limited by Guarantee Registered in England and Wales (08567552)

Global Compact Network UK – Register of Members Global Compact Network UK (GCN UK) is a company limited by guarantee registered in England and Wales (08567552). This is a widely used legal structure for not-for profit organisations. You can learn more about companies limited by guarantee here: https://www.companylawclub.co.uk/companies-limited-by-guarantee A company limited by guarantee has members rather than shareholders. Members of the company, while not owners, have control over the Network. Only company members can: Vote at the Network’s annual general meeting on any significant changes to the company and its purpose; Vote for Trustees; Be members of the Network Board and Network Advisory Group. The rules within which we must operate (Companies Act 2006) make a distinction between being a member of the Network and a member of the company. The only cost of being a member of the company is that in the unlikely event that the company is wound up, members may be asked to contribute a token amount of £1 towards any outstanding debts. Below you can find an extract from the GCN UK Register of Members. To access the full Register or become a member of the company, please contact us at [email protected] Extract from the GCN UK Register of Members (as of 25 February 2021) 1 A.T. Kearney 26 Belron 2 Abcam plc 27 Bettercoal 3 Accenture 28 Bioregional Development Group 4 Achilles Group Ltd 29 BP plc 5 Adam Smith International Ltd 30 Bradbury's Global Risk Group 6 Adare International 31 Brave Bison Limited 7 ADM (Group) Limited 32 BT 8 Affinity Private Wealth 33 Burberry 9 Agulhas Applied Knowledge 34 Burges Salmon LLP 10 AIK Energy Ltd 35 Cameron Hume 11 Alpha: r² 36 Cameron Hume Limited 12 Anglo American plc 37 Canon Europe 13 Anthesis (UK) Limited 38 Capco 14 Arabesque 39 Centrica 15 ARM Holdings Ltd 40 Chaucer 16 Article 13 Ltd 41 CIMA 17 ASOS plc 42 Clifford Chance LLP 18 Aston Martin Lagonda 43 Clyde & Co. -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM