Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

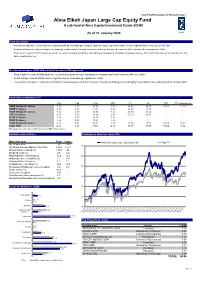

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 January 2020 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 25-30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares -0.29 4.47 12.94 -0.29 24.54 26.44 86.03 11.36 I GBP C shares -0.58 2.63 4.95 -0.58 23.80 24.93 - - I EUR Hedged C shares -0.43 4.29 12.94 -0.43 23.69 23.44 - - I JPY C shares -0.35 4.53 13.85 -0.35 25.10 26.48 - - I EUR C shares 1.36 5.60 14.74 1.36 - - - - I EUR D shares 1.36 5.58 14.67 1.36 - - - - I USD Hedged C shares -0.20 5.06 14.81 -0.20 27.84 33.92 94.05 12.47 Topix (TR) -2.14 1.21 8.88 -2.14 10.17 18.46 53.20 7.86 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

United Japan Growth Fund

United Japan Growth Fund Semi Annual Report for the half year ended 30 June 2021 United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) MANAGER UOB Asset Management Ltd Registered Address: 80 Raffles Place UOB Plaza Singapore 048624 Company Registration No. : 198600120Z Tel: 1800 22 22 228 DIRECTORS OF UOB ASSET MANAGEMENT LTD Lee Wai Fai Eric Tham Kah Jin PehKianHeng Thio Boon Kiat TRUSTEE State Street Trust (SG) Limited 168 Robinson Road #33-01, Capital Tower Singapore 068912 CUSTODIAN / ADMINISTRATOR / REGISTRAR State Street Bank and Trust Company, acting through its Singapore Branch 168 Robinson Road #33-01, Capital Tower Singapore 068912 AUDITOR PricewaterhouseCoopers LLP 7 Straits View, Marina One East Tower, Level 12 Singapore 018936 SUB-MANAGER Fukoku Capital Management, Inc. 1-3-1 Uchisaiwaicho Chiyoda-Ku Saiwai Building 3rd Floor Tokyo 100-0011, Japan -1- United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) A) Fund Performance Since Inception 18 August 3yr 5yr 10 yr 1995 3mth 6mth 1yr Ann Ann Ann Ann Fund Performance/ % % % Comp Comp Comp Comp Benchmark Returns Growth Growth Growth Ret Ret Ret Ret United Japan Growth Fund -2.42 -2.27 16.23 3.68 5.17 4.75 2.57 Benchmark -0.24 3.01 20.29 6.73 10.16 8.13 0.60 Source: Morningstar. Note: The performance returns of the Fund are in Singapore Dollar based on a NAV-to-NAV basis with dividends and distributions reinvested, if any. The benchmark of the Fund: Aug 95 – Dec 04: Nikkei 225 Stock Average; Jan 05 – Dec 10: Topix; Jan 11 to Present: MSCI Japan Index. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

The Demonstra#On of Smart City and Expansion to the Urban Disaster

1 The demonstraon of smart city and expansion to the urban disaster recovery promo-on area in Japan Toshiba corporaon Community Solu-on Div. Yoshimasa Kudo 2 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 3 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 4 Roadmap of smart city project 2009 2010 2011 2012 2013 2014 2015 - Miyako island smart grid project Energy stabilization Demand response project Effects & evaluaon of large PV/ many PV Distribution network system of next generations Energy management of Realiza<on of electric and thermal control smart city Energy conservaon project (BEMS/HEMS) Demonstration Smart EV project of basic technology (EV charging) New Mexico smart grid project (Overseas project) & others Demonstration The four-location smart city operational experiments (Japanese project) & others of smart city Business model project Earthquake (DR, Aggregator) 5 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 6 Miyako island smart grid system 7 Major smart city project in Japan 4 areas were selected as the smart city of first pilot -

Real Estate Sector 4 August 2015 Japan

Deutsche Bank Group Markets Research Industry Date Real estate sector 4 August 2015 Japan Real Estate Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] F.I.T.T. for investors Last dance Bubbles always come in different forms With the big cliff of April 2017 in sight, enjoy the last party like a driver careening to the cliff's brink. Japan is now painted in a completely optimistic light, with the pessimism which permeated Japan after the Great East Japan Earthquake in 2011 forgotten and expectations for the 2020 Tokyo Olympics riding high. The bank lending balance to the real estate sector is at a record high, and we expect bubble-like conditions in the real estate market to heighten due to increased investment in real estate to save on inheritance taxes. History repeats itself, but always in a slightly different form. We have no choice but to dance while the dance music continues to play. ________________________________________________________________________________________________________________ Deutsche Securities Inc. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 124/04/2015. Deutsche Bank Group Markets Research Japan Industry Date 4 August 2015 Real Estate Real estate sector FITT Research Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst Last dance (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] Bubbles always come in different forms Top picks With the big cliff of April 2017 in sight, enjoy the last party like a driver Mitsui Fudosan (8801.T),¥3,464 Buy careening to the cliff's brink. -

NOTICE of the CONVOCATION of the 148Th ORDINARY GENERAL MEETING of SHAREHOLDERS

This document has partly been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Securities Code: 4021 May 31, 2018 To Those Shareholders with Voting Rights Kojiro Kinoshita Representative Director, President & CEO Nissan Chemical Industries, Ltd. 7-1, Kanda Nishiki-cho 3-chome, Chiyoda-ku, Tokyo, JAPAN NOTICE OF THE CONVOCATION OF THE 148th ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 148th Ordinary General Meeting of Shareholders of Nissan Chemical Industries, Ltd. (the “Company”). The meeting will be held as described below. If you are unable to attend the meeting, you can exercise your voting rights by either of the following means. Please review the Reference Documents for the General Meeting of Shareholders, and exercise your voting rights. Exercise of Voting Rights in Writing Please indicate your votes for or against the proposals on the enclosed Voting Rights Exercise Form and return it to the Company, ensuring that the form reaches us by 5:40 p.m., Tuesday, June 26, 2018. Exercise of Voting Rights via the Internet, etc. Please access the website for exercising voting rights as indicated in the enclosed Voting Rights Exercise Form and exercise your voting rights by 5:40 p.m., Tuesday, June 26, 2018 (please refer to page 2 hereof). 1. Date and Time: Wednesday, June 27, 2018 at 10:00 a.m. -

Mitsui Fudosan and LINK-J to Participate in the BRAVE

Press Release December 7, 2016 Beyond Next Ventures Life Science Innovation Network Japan, Inc. (LINK-J) Mitsui Fudosan Co. Ltd. Mitsui Fudosan and LINK-J to Participate in the BRAVE Acceleration Program as Partners to Support Business Startups of University-originated Technology Business Ventures Life Sciences Award established at the Final Examination to invite the winner to a U.S. event organized by Biocom, with approximately 800 members around the world Tokyo, Japan, December 7, 2016 - Life Science Innovation Network Japan Inc. (LINK-J), an incorporated association founded by Mitsui Fudosan Co., Ltd. (Mitsui Fudosan) and a group of volunteers from academia, and Mitsui Fudosan are pleased to announce that they will take part in the BRAVE Acceleration Program operated by Beyond Next Ventures Inc. (Beyond Next Ventures), a company making incubation investments in university-originated technology business ventures, as corporate partners. Beyond Next Ventures is a venture capital firm with strength in incubation investments in university-originated technology business ventures at the seed level in the fields of medical and health care, robots, artificial intelligence (AI), Internet of Things (IoT), big data and other advanced technologies. In November 2016, it moved its head office from Chiyoda-ku to Nihonbashi in Chuo-ku in Tokyo, where life sciences firms are clustered. Its president and representative director Tsuyoshi Ito serves as a LINK-J Supporter*. Outline of the BRAVE Acceleration Program The BRAVE Acceleration Program is a platform that helps researchers and entrepreneurs in universities and research institutes and those aiming for commercialization to launch business based on innovative technologies. It is intended to offer knowledge, expertise and a network for achieving commercialization. -

Stoxx® Japan 600 Esg-X Index

STOXX® JAPAN 600 ESG-X INDEX Components1 Company Supersector Country Weight (%) Toyota Motor Corp. Automobiles & Parts Japan 3.87 Sony Corp. Consumer Products & Services Japan 2.55 Softbank Group Corp. Telecommunications Japan 2.44 Keyence Corp. Industrial Goods & Services Japan 1.77 RECRUIT HOLDINGS Industrial Goods & Services Japan 1.54 Mitsubishi UFJ Financial Group Banks Japan 1.48 Shin-Etsu Chemical Co. Ltd. Chemicals Japan 1.36 Nippon Telegraph & Telephone C Telecommunications Japan 1.36 Nintendo Co. Ltd. Consumer Products & Services Japan 1.30 Nidec Corp. Technology Japan 1.30 Fast Retailing Co. Ltd. Retail Japan 1.25 Daikin Industries Ltd. Construction & Materials Japan 1.19 Takeda Pharmaceutical Co. Ltd. Health Care Japan 1.18 Tokyo Electron Ltd. Technology Japan 1.16 Honda Motor Co. Ltd. Automobiles & Parts Japan 1.10 Daiichi Sankyo Co. Ltd. Health Care Japan 1.08 Sumitomo Mitsui Financial Grou Banks Japan 1.04 Murata Manufacturing Co. Ltd. Technology Japan 1.03 KDDI Corp. Telecommunications Japan 1.02 Hitachi Ltd. Industrial Goods & Services Japan 0.92 Itochu Corp. Industrial Goods & Services Japan 0.92 Fanuc Ltd. Industrial Goods & Services Japan 0.90 Hoya Corp. Health Care Japan 0.84 Mitsubishi Corp. Industrial Goods & Services Japan 0.83 Mizuho Financial Group Inc. Banks Japan 0.76 SOFTBANK Telecommunications Japan 0.75 Denso Corp. Automobiles & Parts Japan 0.72 Mitsui & Co. Ltd. Industrial Goods & Services Japan 0.71 Tokio Marine Holdings Inc. Insurance Japan 0.70 Oriental Land Co. Ltd. Travel & Leisure Japan 0.68 SMC Corp. Industrial Goods & Services Japan 0.68 Mitsubishi Electric Corp. Industrial Goods & Services Japan 0.67 Seven & I Holdings Co. -

Rothschild & Co Risk-Based Japan Index

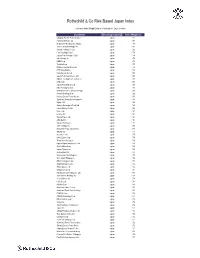

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

List:The 2019 Competitive IT Strategy Companies

Selection of Companies for 2019 Competitive IT Strategy Company Stock Selection and and Noteworthy IT Strategy Companies Programs Announced - METI and the TSE selected outstanding listed companies implementing a Competitive IT Strategy to enhance corporate value - The Ministry of Economy, Trade and Industry (METI) and the Tokyo Stock Exchange (TSE) have jointly been conducting a selection of outstanding companies for their efforts for IT utilization under the Competitive IT Strategy Company Stock Selection program. METI hereby announces that METI and the TSE have selected 29 companies under the 2019 Competitive IT Strategy Company Stock Selection program and 20 companies under the 2019 Noteworthy IT Strategy Companies program. These programs were held five times this year. 1. Outline of the Competitive IT Strategy Company Stock Selection program The program targets TSE-listed companies proactively engaging in efforts for IT utilization to improve management innovations, earnings and productivity in terms of improving mid- to long-term corporate value and fortifying competitiveness. METI and the TSE select such companies among all TSE-listed companies as Competitive IT Strategy Company Stocks by sector and introduce them to the public. In the 2019 program, METI and the TSE assessed companies that have been engaging in promotion of efforts for digital transformation (DX)* in accordance with the DX Promotion Guidelines and whose management has strongly been committed to such efforts. To assess companies’ current efforts for IT utilization, METI conducted a survey titled “2019 Survey of Competitive IT Strategies,” targeting all TSE-listed companies. In screening candidate companies, METI assigned scores to the responses concerning the following five areas and financial situation, and finally selected 29 companies screened by the final examination of the examination committee. -

Directors Auditors

Management Team (As of June 26, 2019) 5 Shinichi Hayashi 6 Motoya Aizawa Director and Managing Officer External Director In charge of Real Estate Solutions Department Apr. 1984 Joined Heiwa Real Estate Co., Ltd. (the Company) Apr. 1965 Joined Nippon Kangyo Securities Co., Ltd. (currently Mizuho Securities Co., Ltd.) Apr. 2007 Manager of Nagoya Branch of the Company Nov. 1973 Managing Director of Aizawa Securities Co., Ltd. Jun. 2010 General Manager, Group Leader of Building Sales Group, Leasing Headquarters of the Company Dec. 1979 President and CEO of Aizawa Securities Co., Ltd. 5 Jun. 2011 General Manager, Group Leader of Building Sales Group, Leasing Headquarters of the Company Jun. 1998 Chairman of Aizawa Securities Co., Ltd. Jun. 2012 Managing Officer (current position) in charge of the Redevelopment of the Nihonbashi Kabutocho Jun. 2008 Chairman and President of Aizawa Securities Co., Ltd. 4 3 2 District, and Group Leader of Building Sales Group, Leasing Headquarters of the Company Jun. 2010 External Director of Heiwa Real Estate Co., Ltd. (current position) 11 Jun. 2013 In charge of the Headquarters of Redevelopment of the Nihonbashi Kabutocho District Jun. 2011 President and CEO of Aizawa Securities Co., Ltd. May 2015 General Manager of Real Estate Marketing Department and in charge of Real Estate Jul. 2018 Chairman of Aizawa Securities Co., Ltd. 10 Marketing Department of the Company Oct. 2018 Chairman and CEO of Aizawa Securities Co., Ltd. Jun. 2015 In charge of Property Management Department of the Company Jun. 2019 Senior Advisor of Aizawa Securities Co., Ltd. (current position) Jul. 2016 Manager of Sapporo Branch of the Company 8 Jun. -

Mitsui Fudosan Co., Ltd. Notice of the 109Th Ordinary General

[Translation for Reference and Convenience Purposes Only] Please note that the following is an unofficial English translation of the original Japanese text of the Notice of the 109th Ordinary General Shareholders’ Meeting of Mitsui Fudosan Co., Ltd. The Company provides this translation for reference and convenience purposes only and without any warranty as to its accuracy or otherwise. In the event of any discrepancy between this translation and the original Japanese, the latter shall prevail. Securities Code: 8801 June 7, 2021 To the Shareholders of Mitsui Fudosan Co., Ltd. Masanobu Komoda President and Chief Executive Officer Mitsui Fudosan Co., Ltd. 1-1, Nihonbashi Muromachi 2-chome Chuo-ku, Tokyo, Japan Notice of the 109th Ordinary General Shareholders’ Meeting Mitsui Fudosan Co., Ltd. (hereinafter referred to as the “Company”) announces that the 109th Ordinary General Shareholders’ Meeting (hereinafter referred to as the “Meeting”) will be held, as given below. Instead of attending the Meeting, you can exercise your voting rights in writing or via the Internet as provided below. Please take the time to review the attached Reference Materials for the Meeting, and exercise your voting rights by no later than 5:30 p.m. on Monday, June 28, 2021 (Tokyo Time). Exercise of voting rights You may exercise your voting rights by one of the following three methods. Please review the attached Reference Materials (on pages 4 to 17) for the Meeting, and exercise your voting rights. Recommended 1. Exercise of voting rights in writing Please indicate your approval or disapproval of each proposed item on the attached Exercise of Voting Rights form, and return the form to the Company.