A Complete Guide to Health Insurance Coverage for Older New Yorkers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Statutory Accounting Principles (E) Working Group Materials

Statutory Accounting Principles Working Group Additional Handouts June 13, 2009 1. Comment letter from Interested parties 2. Separate Account Subgroup Update and Referral 3. Principles Based Reserving Update 4. Ref # 2009-11 Accounting Practices and Procedures Manual Content Changes Additional Handout 1 - IP Comment Letter D. Keith Bell, CPA Rose Albrizio, CPA Senior Vice President Vice President Accounting Policy Accounting Practices Corporate Finance AXA Financial, Inc. The Travelers Companies, Inc. 212-314-5630; FAX 212-314-5662 860-277-0537; FAX 860-954-3708 Email: [email protected] Email: [email protected] June 10, 2009 Mr. Joe Fritsch, Chairman Statutory Accounting Principles Working Group National Association of Insurance Commissioners 2301 McGee Street, Suite 800 Kansas City, MO 64108-2604 RE: Comments on Other Than Temporary Impairments of Loan-backed and Structured Securities Dear Mr. Fritsch, We offer the following comments on Other Than Temporary Impairments of Loan- backed and Structured Securities, which represent the views of the interested parties included in the attached sign on list. Many companies (primarily property/casualty companies or P&C companies) prefer to make no change to statutory accounting. These differing views result from the current differences in statutory accounting rules for life companies eligible for IMR and AVR reporting, HMO, stand-alone health and P&C companies not eligible for AVR and IMR reporting as well P&C companies’ concerns about the added complexity involved in bifurcating credit and non credit losses. Background SSAP No. 43 Prior to the adoption of SSAP No. 98, the statutory accounting rules for other than temporary impairment (OTTI) of loan-backed and structured securities were governed by SSAP No. -

Employee Benefits Guide Document Is Available in a Larger Font

Employee Benefits Guide For Employees Who Are Members of the Seattle Police Officers’ Guild* 2021 *City Employees Covered by a Union Contract with Seattle Police Officers’ Guild Updated June 11, 2021 For assistance understanding the information in this document • Need to speak with someone in a language other than English? Call the Benefits Unit at 206-615-1340 and we will help you access Language Line Services. You will have access to an interpreter and a Benefits Unit staff member to answer your questions. • Hearing impaired? If you use a TDD, the City provides interpretation services. Call 7-1-1 or 1-800-833-6384 on your TDD. You will be connected with the Washington Relay Service. Give them the number of the party you want to call. They will call the person for you, then interpret information from your TDD to the person you are calling. • Visually impaired? This Employee Benefits Guide document is available in a larger font. To request an electronic copy, contact the Benefits Unit at 206-615-1340. • Would rather hear the information than read it? If your understanding is improved by having someone read or paraphrase information for you, you are invited to attend a benefits orientation. Orientations cover all City benefits and provide ample time for questions. You can meet with the presenter after the session if you have additional questions or questions you would like to ask confidentially. Orientations are held every other week. Orientations are held every other week – enroll on Employee Self-Service, Training section. If additional help is needed or you would prefer to speak to someone confidentially, please call the Benefits Unit at 206-615-1340. -

Kentucky Health Cooperative Guide to Using Your Health Insurance Plan

KENTUCKY HEALTH COOPERATIVE, INC. THE WAIT IS OVER! I HAVE HEALTH INSURANCE. NOW WHAT? A Guide to Using Your Health Insurance Plan Brought to You By Kentucky Health Cooperative, Inc. 1-855-687-5942 #KYHC #GetHealthyKy www.mykyhc.org CONGRATULATIONS ON YOUR HEALTH PLAN DECISION! This booklet may provide new information about your health insurance plan. Or, it may serve as a refresher. Either way, we hope you fi nd it helpful. Note: Examples in this guide do not refl ect specifi c plans. If you are a Kentucky Health Cooperative plan member, please contact your agent with questions. Or, you may call Member Services at 1-855-687-5942 for details about costs and features of plans. NOTES ABOUT MY PLAN Year: _______________________________________________________________ Effective Date: ______________________________________________________ Premium Due Date: __________________________________________________ Name/Phone Number, Email Address of Insurance Agent, kynector, or Other Person Who Helped Me: ________________________________________ ____________________________________________________________________ The Name of My Plan Is: _____________________________________________ My Member ID: _____________________________________________________ My Primary Care Provider Is: _________________________________________ Phone number: ______________________________________________________ My Provider’s Website URL: __________________________________________ My Specialists: ______________________________________________________ ____________________________________________________________________ -

Module 15: Other Sources of Health Insurance and Prescription Drug Coverage

OTHER SOURCES OF HEALTH INSURANCE AND PRESCRIPTION DRUG COVERAGE MODULE 15: OTHER SOURCES OF HEALTH INSURANCE AND PRESCRIPTION DRUG COVERAGE Objectives HIICAP counselors will learn about employer retiree plans and how they work with Medicare. Additionally, counselors will learn about COBRA, New York State of Health, Veterans Administration Health Benefits, and TRICARE for Life, and be provided with resources on other available services that may be useful to uninsured or underinsured clients. What kind of health plans do employers offer to retirees? ▪ Some employers offer a Health Maintenance Organization (HMO) as an alternative to their fee- for-service health plans. ▪ Some employers provide retiree plans that pay Medicare deductibles and coinsurance when employees become eligible at age 65. ▪ Other employers may offer a basic Medigap plan to their retirees. What is COBRA? COBRA is a federal program that allows former employees to keep their employer-sponsored group health plans under most circumstances. What is New York State of Health: The Official Health Plan Marketplace? ▪ New York State of Health (NYSOH) is a statewide online marketplace for state residents to receive information about health insurance options. Through NYSOH, consumers can enroll in subsidized or unsubsidized Qualified Health Plans (QHPs) as well as public insurance programs like Medicaid, Child Health Plus, and Essential Plans (EPs). ▪ Most Medicare enrollees are not eligible to purchase QHPs or EPs. Medicare enrollees can be eligible for Medicaid but will need to enroll through their Local Department of Social Services (LDSS). Current Medicaid beneficiaries insured through NYSOH who become eligible for Medicare will need to have their Medicaid cases transferred to the LDSS. -

Cost-Sharing Mechanisms in Health Insurance Schemes: a Systematic Review

Cost-sharing mechanisms in health insurance schemes: A systematic review Submitted to The Alliance for Health Policy and Systems Research, WHO From Meng Qingyue, Jia Liying, Yuan Beibei Center for Health Management and Policy, Shandong University October, 2011 TABLE OF CONTENTS AbAbAb stract .............................................................................................................................................. 3 1 Background ..................................................................................................................................... 6 2 Objectives and definitions ............................................................................................................... 7 3 Criteria for inclusion of studies........................................................................................................ 7 4. Methods ........................................................................................................................................ 8 4.1 Searched databases and websites ........................................................................................... 8 4.2 Search strategy ........................................................................................................................ 8 4.3 Review method ...................................................................................................................... 10 5 Results ......................................................................................................................................... -

Guide to Japan's National Health Insurance (NHI) System

Guide to Japan’s National Health Insurance (NHI) System Contents How Japan’s National Health Insurance System (NHI) Works······················ 1 NHI Members ······················································································ 2 Joining and Leaving the NHI System ·················································· 3 Under such circumstances, report within 14 days······························· 4 NHI Tax (Premium) Contributions Supporting NHI ······························ 5 Pay Your NHI Tax (Premium) on Time·················································· 7 NHI Benefits ························································································ 8 Hospital Meal Costs ········································································ 10 Hospital Living Costs······································································· 11 Major Medical Costs········································································ 12 Injuries from Traffic Accident and Other Incidents ······························· 16 Long-Term Care Insurance System····················································· 17 Combined Copayments System for Major Medical and Long-Term Care Costs···· 18 Retiree Medical System······································································· 19 Long Life Medical Care System··························································· 19 Disability Welfare Services ·································································· 20 How Japan’s National Health Insurance (NHI) System -

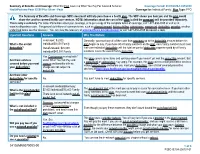

Summary of Benefits and Coverage Completed Example

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2022 – 12/31/2022 Insurance Company 1: Plan Option 1 Coverage for: Family | Plan Type: PPO The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, [insert contact information]. For definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You can view the Glossary at www.[insert].com or call 1-800-[insert] to request a copy. Important Questions Answers Why This Matters Generally, you must pay all of the costs from providers up to the deductible amount before this What is the overall plan begins to pay. If you have other family members on the plan, each family member must $500/Individual or $1,000/family deductible? meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible. This plan covers some items and services even if you haven’t yet met the deductible amount. Are there services Yes. Preventive care and primary But a copayment or coinsurance may apply. For example, this plan covers certain preventive covered before you meet care services are covered before services without cost-sharing and before you meet your deductible. -

Veteran's Health Insurance and Copays at VA

Veteran’s Health Insurance and Copayments at VA YOUR HEALTH INSURANCE AND VA Why VA Bills Your Health Insurance VA is required by law to bill any health insurance carrier that provides coverage for you, including policies held by your spouse. Only Veterans treated for non service-connected conditions should see their insurance company billed for their treatment. Veterans who are treated for service-connected conditions should not have their insurance company billed for treatment. VA does not bill Medicare or Medicaid. Please note: VA may bill High Deductible Health Plans (HDHPs) for medical care and services provided to Veterans for non service-connected conditions. (HDHPs are usually linked to a Health Savings Account that can be used to pay VA copayments.) VA may also accept reimbursement from Health Reimbursement Arrangements (HRAs) for care provided for non service-connected conditions. Where the Money Goes Money collected from health insurance reimbursements is returned directly to the medical centers and used to enhance the health care services provided to Veterans. For this to happen, information must be obtained regarding your health insurance coverage. VA staff may call you at home to obtain this information or they may ask you for it when you check in for an appointment at the medical center. Always bring your insurance card with you when you come to VA. This will provide the facility with your current insurance information. IB 10-77 July 2019 Page 1 of 2 Insurance Coverage and Eligibility for VA Health Care Your insurance coverage or lack of insurance coverage does not determine your eligibility for treatment at a VA health care facility. -

Trends in Cost Sharing for Medical Services, 2013–2018 Employee Benefit Research Institute 901 D Street, SW, Suite 802 Washington, D.C

Trends in Cost Sharing for Medical Services, 2013–2018 Employee Benefit Research Institute 901 D Street, SW, Suite 802 Washington, D.C. 20024 Phone: (202) 659-0670 Fax: (202) 775-6312 Center for Research on Health Benefits Innovation This study was conducted through the EBRI Center for Research on Health Benefits Innovation (EBRI CRHBI). Launched in 2010, the CRHBI focuses on helping employers assess the impact that plan design, with the goal of increasing consumer engagement, has on cost, quality, and access to health care. Why Become a Partner? Become a Partner! • Ongoing and focused networking with EBRI and other experts, including those with other Research Center The Center focuses on three broad areas of partners. research: • Your organization is publicly recognized as a Research • Behavioral economics Center or Initiative partner and a highly respected leader within the employee benefits community—a positive • Incentives reflection on your brand. • Consumer-driven health benefits • Help ensure the continued in-depth, fact-based examination of key current and emerging issues. Current Research Topics: • Engage with EBRI to define and analyze key research and assess implications and insights. • Disenrollment from HSA-eligible health plans • Provide professional development opportunities for your • HSA Balances and Use of Health Care Services organization’s researchers and experts, who can work with • Use of Low Valued Health Care Services and Deductibles EBRI researchers. • Workplace Wellness Programs • Provide feedback on research and analyses before they’re published. • Accountable Care Organizations (ACOs) To become a partner, contact Paul Fronstin at [email protected] or EBRI Member Relations at [email protected]. -

International Profiles of Health Care Systems

EDITED BY Elias Mossialos and Ana Djordjevic London School of Economics and Political Science MAY 2017 MAY Robin Osborn and Dana Sarnak The Commonwealth Fund International Profiles of Health Care Systems Australia, Canada, China, Denmark, England, France, Germany, India, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Singapore, Sweden, Switzerland, Taiwan, and the United States THE COMMONWEALTH FUND is a private foundation that promotes a high performance health care system providing better access, improved quality, and greater efficiency. The Fund’s work focuses particularly on society’s most vulnerable, including low-income people, the uninsured, minority Americans, young children, and elderly adults. The Fund carries out this mandate by supporting independent research on health care issues and making grants to improve health care practice and policy. An international program in health policy is designed to stimulate innovative policies and practices in the United States and other industrialized countries. MAY 2017 International Profiles of Health Care Systems Australia EDITED BY Canada Elias Mossialos and Ana Djordjevic London School of Economics and Political Science China Denmark Robin Osborn and Dana Sarnak The Commonwealth Fund England France To learn more about new publications when they become available, Germany visit the Fund’s website and register to receive email alerts. India Israel Italy Japan The Netherlands New Zealand Norway Singapore Sweden Switzerland Taiwan United States CONTENTS Table 1. Health Care System Financing and Coverage in 19 Countries . 6 Table 2. Selected Health Care System Indicators for 18 Countries . 7 Table 3. Selected Health System Performance Indicators for 17 Countries. 8 Table 4. Provider Organization and Payment in 19 Countries . -

Summary of Benefits and Coverage

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2020-12/31/2020 HealthPartners:Peak $3000 Plus Silver - Peak Coverage for: Individual/Family | Plan Type: PPO The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, call 1-877-838-4949 or visit us at www.healthpartners.com. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-877-838-4949 to request a copy. Important Questions Answers Why This Matters: In-network: $3,000 Generally, you must pay all of the costs from providers up to the deductible amount before this What is the overall Individual/$6,000 Family plan begins to pay. If you have other family members on the plan, each family member must meet deductible? Out-of-network: $20,000 their own individual deductible until the total amount of deductible expenses paid by all family Individual/$40,000 Family members meets the overall family deductible. Yes. Coinsurance marked with * This plan covers some items and services even if you haven’t yet met the deductible amount. -

Definitions of Health Insurance Terms

DEFINITIONS OF HEALTH INSURANCE TERMS In February 2002, the Federal Government’s Interdepartmental Committee on Employment-based Health Insurance Surveys approved the following set of definitions for use in Federal surveys collecting employer-based health insurance data. The BLS National Compensation Survey currently uses these definitions in its data collection procedures and publications. These definitions will be periodically reviewed and updated by the Committee. ASO (Administrative Services Only) – An arrangement in which an employer hires a third party to deliver administrative services to the employer such as claims processing and billing; the employer bears the risk for claims. ♦ This is common in self-insured health care plans. Coinsurance - A form of medical cost sharing in a health insurance plan that requires an insured person to pay a stated percentage of medical expenses after the deductible amount, if any, was paid. ♦ Once any deductible amount and coinsurance are paid, the insurer is responsible for the rest of the reimbursement for covered benefits up to allowed charges: the individual could also be responsible for any charges in excess of what the insurer determines to be “usual, customary and reasonable”. ♦ Coinsurance rates may differ if services are received from an approved provider (i.e., a provider with whom the insurer has a contract or an agreement specifying payment levels and other contract requirements) or if received by providers not on the approved list. ♦ In addition to overall coinsurance rates, rates may also differ for different types of services. Copayment - A form of medical cost sharing in a health insurance plan that requires an insured person to pay a fixed dollar amount when a medical service is received.