Comparative Analysis of Public and Private Sector Banks in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

111Th SLBC Meeting

राज्य स्तरीय बℂक셍स 셍मिती,गोवा राज्य State Level Bankers’ Committee, Goa State Agenda & Background Papers of __________________________________ 111th SLBC Meeting WEB MEETING THROUGH MICROSOFT TEAMS th Date : 24 NOVEMBER 2020 Time : 11.30 AM 셍ंयोजकConvener भारतीयस्टेटबℂक State Bank of India िागसदर्शी बℂक मवभाग, SLBC Department थानीय प्रधान कायासलय, Local Head Office, बांद्रा-कुलास 셍ंकुल, Bandra Kurla Complex, िुंबई – ४०००५१, Mumbai – 400051, INDEX Agenda Particulars Page No. Point No. 1 Confirmation of Minutes of 110th SLBC Meeting dated 21.09.2020 2 - 7 2 Position in respect of Action Points of last meeting 8 Review of Financial Inclusion Initiatives, expansion of banking network and 3 Financial Literacy a. Banking scenario of the State 9 b. Details of Business Correspondents / Customer Service Point (BC/CSP) 9 c. List of Unbanked villages 10 d. Review of Financial literacy initiatives by banks (particularly digital 11 financial literacy). e. Status of Financial Inclusion (PMJDY). 11-12 f. Govt Security Schemes (PMSBY PMJJBY and APY) 13-14 4. Expanding and Deepening of Digital Payments Ecosystem 15-17 Review of Credit disbursement by banks 5 a. Review of Performance under ACP 18-23 b. Review of Priority Sector Lending. 24-27 6 Launching of ACP for the year 2021 -22 28 7 Pradhan Mantri MUDRA Yojana (PMMY) 29 a. Progress in Lending for last four quarters b. Position of NPA in Mudra Accounts as on 30.09.2020 8. Doubling farmers’ income by 2022 a. Measures 30 b. Present Position of Lending to Farmers 31 Government Sponsored Schemes 9 a) Review of Government Sponsored Schemes as on 30.09.2020 32 b) Schematic lending, Certificate Cases and Recovery of NPAs 10 The quarterly meetings of Steering Sub Group of SLBC Goa for Sept 2020 33 11 Timely submission of data by Bank, adhering to the schedule of SLBC meeting. -

INDIAN BANKING SECTOR – a PARADIGM SHIFT Original

IF : 4.547 | IC Value 80.26 VolumeVOLUME-6, : 3 | Issue ISSUE-6, : 11 | November JUNE-2017 2014 • ISSN • ISSN No No 2277 2277 - -8160 8179 Original Research Paper Commerce INDIAN BANKING SECTOR – A PARADIGM SHIFT Snehal Kotak Research Scholar, Dept of Commerce, Nims University Associate Professor, Humanities, Social Sciences and Commerce, NIMS University Dr. Mukesh Kumar Co-Author ABSTRACT With the potential to become the fth largest banking industry in the world by 2020 and third largest by 2025 according to KPMG-CII report, India's banking and nancial sector is expanding rapidly. The Indian Banking industry is currently worth Rs. 81 trillion (US $ 1.31 trillion) and banks are now utilizing the latest technologies like internet and mobile devices to carry out transactions and communicate with the masses. The Indian banking sector consists of 26 public sector banks, 20 private sector banks and 43 foreign banks along with 61 regional rural banks (RRBs) and more than 90,000 credit cooperatives. This paper explains the changing banking scenario, the impact of economic reforms and analyses the challenges and opportunities of national and commercial banks. KEYWORDS : Introduction: Progress Made- Analysysis the various challenges & opportunities Today Indian Banking is at the crossroads of an invisible revolution. that stand in front of the Indian Banking Industry. The sector has undergone signicant developments and investments in the recent past. Most of banks provide various The Banking Regulation Act: services such as Mobile banking, SMS Banking, Net banking and The Banking Act 1949 was a special legislation, applicable ATMs to their clients. According to the Reserve Bank of India (RBI), exclusively to the banking companies. -

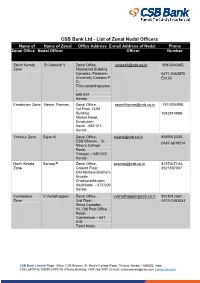

CSB Bank Ltd - List of Zonal Nodal Officers Name of Name of Zonal Office Address E-Mail Address of Nodal Phone Zonal Office Nodal Officer Officer Number

CSB Bank Ltd - List of Zonal Nodal Officers Name of Name of Zonal Office Address E-mail Address of Nodal Phone Zonal Office Nodal Officer Officer Number South Kerala Sri Aneesh V Zonal Office, [email protected] 8943344365, Zone Malankara Building Complex, Palayam, 0471-2463570 University Campus P Ext.33 O, Thiruvananthapuram - 695 034 Kerala Ernakulam Zone Newin Thomas Zonal Office, [email protected] 7510304998, 1st Floor, DJM Building, 7042814998 Market Road, Ernakulam, Kochi - 682 011 Kerala Thrissur Zone Sajan K Zonal Office, [email protected] 8589072330, CSB Bhavan, St 0487-6619214 Mary’s College Road, Thrissur – 680 020 Kerala North Kerala Sanooj P Zonal Office, [email protected] 8157047144, Zone Ground Floor, 8921897007 CM Mathew Brothers Arcade, Chakkorathkulam, Kozhikode – 673 006 Kerala Coimbatore V Varadhappan Zonal Office, [email protected] 9578012367, Zone 2nd Floor, 0422-2383053 Shiva Complex, 54, Old Post Office Road, Coimbatore – 641 018 Tamil Nadu CSB Bank Limited Regd. Office: CSB Bhavan, St. Mary's College Road, Thrissur, Kerala – 680020, India. CIN: L65191KL1920PLC000175 | Phone Banking :1800 266 9090 | E-mail: [email protected] | www.csb.co.in Chennai Zone Saranya R Zonal Office, [email protected] 9942063813 603, Rani Seethai Hall, 044-28294078 Anna Salai, Extn: 22 Chennai – 600 006 Tamil Nadu Western Zone Shoby John Zonal Office, [email protected] 9222104047, Jolly Maker Chambers - 022-22821636 II, 4th Floor, Vinay K Shah Marg, Nariman Point, Mumbai - 400 021 Maharashtra Northern Zone Jagdeep Sharma Zonal Office, [email protected] 9871892299, G- 36, Mezzanine Floor, 011-23733543 Connaught Place, New Delhi -110 001 Deccan Zone Namitha Ponnanna CSB Bank Ltd., Zonal [email protected] 8277093654 Office Unit No. -

Current Affairs Quiz – August, September & October for IBPS Exams

Current Affairs Quiz – August, September & October for IBPS Exams August - Current Affairs Quiz: Q.1) The Rajya Sabha passed the Constitution Q.8) Who came up with a spirited effort to beat _____ Bill, 2017 with amendments for setting up Florian Kaczur of Hungary and finish second in of a National Commission for Backward Classes, the Czech International Open Chess tournament was passed after dropping Clause 3. at Pardubidze in Czech Republic? a) 121st b) 122nd c) 123rd a) Humpy Koneru b) Abhijeet Gupta d) 124th e) 125th c) Vishwanathan Anand d) Harika Dronavalli Q.2) From which month of next year onwards e) Tania Sachdev government has ordered state-run oil companies Q.9) Which country will host 2024 summer to raise subsidised cooking gas, LPG, prices by Olympics? four rupees per cylinder every month to eliminate a) Japan b) Australia c) India all the subsidies? d) France e) USA a) January b) February c) March Q.10) Who beats Ryan Harrison to claim fourth d) April e) May ATP Atlanta Open title, he has reached the final in Q.3) Who will inaugurate the two-day Conclave of seven of eight editions of the tournament, added Tax Officers ―Rajaswa Gyansangam‖ scheduled to a fourth title to those he won in 2013, 2014 and be held on 1st and 2nd September, 2017 in New 2015? Delhi? a) Roger Federer b) Nick Kyrgios a) Arun Jaitley b) Narendra Modi c) Andy Murray d) John Isner c) Rajnath Singh d) Nitin Gadkari e) Kevin Anderson e) Narendra Singh Tomar Q.11) Who was the youngest of the famous seven Q.4) The Executive Committee of National Mission ‗Dagar Bandhus‘ and had dedicated his life to for Clean Ganga (4th meeting) approved seven keeping the Dhrupad tradition alive, died projects worth Rs _____ crore in the sector of recently. -

Consolidation Among Public Sector Banks

R Gandhi: Consolidation among public sector banks Speech by Mr R Gandhi, Deputy Governor of the Reserve Bank of India, at the MINT South Banking Enclave, Bangalore, 22 April 2016. * * * Assistance provided by Shri Santosh Pandey is gratefully acknowledged. 1. At present banking system in India is evolving with a mixture of bank types serving different segments of the economy. In the last few years, the system has seen entry of new banks and emergence of new bank types targeted to serve niche segments of the society. However, banking system continues to be dominated by Public Sector Banks (PSBs) which still have more than 70 per cent market share of the banking system assets. At present there are 27 PSBs with varying sizes. State Bank of India, the largest bank, has balance sheet size which is roughly 17 times the size of smallest public sector bank. Most PSBs follow roughly similar business models and many of them are also competing with each other in most market segments they are active in. Further, PSBs have broadly similar organisational structure and human resource policies. It has been argued that India has too many PSBs with similar characteristics and a consolidation among PSBs can result in reaping rich benefits of economies of scale and scope. 2. The suggestion of consolidation among PSBs has quite old history. Narasimham Committee Report in 1991 (NC-I), recommended a three tier banking structure in India through establishment of three large banks with international presence, eight to ten national banks and a large number of regional and local banks. -

Souvenir Lazer.Pmd

IDRBT AWARD Dr. Y.V. Reddy, RBI Governor Presents IDRBT Award. 100 per cent Core Banking Mr. N.R. Narayana Moorthy, Chief Mentor, Infosys Technologies declares SIB as 100 per cent CBS enabled 500th Branch Ms. Sheila Dikshit, Chief Minister of Delhi inaugurating 500th Branch Dear Patrons & Well Wishers, Someone once said “If you add a little to a little and do this often, soon the little will become great”. South Indian Bank as it ushers in its 80th year of service to the community is the very epitome of this quotation. From its humble beginnings in 1929, the bank has grown from strength to strength in delivering outstanding value to its customers and creating a name for itself in the banking arena. With an initial paid up capital of Rs 22000, the bank has now grown into an organization with a business of Rs 27000 crores, presence in 23 states and 520 branches, truly making it a force to reckon with amongst the banks in the country. “ ... little will become great ” The journey over the last 80 years has not been without its fair share of difficulties, but our bank has always endeavoured to ensure that the basic epithet of customer service was never compromised. Our achievements are a glowing testimonial of the confidence and the trust which we enjoy with our customers. We have been pioneers right from being the first private sector bank to open a NRI branch as well as being the first to start an Industrial Finance branch in 1993. We have been ahead of the curve in taking cognisance of the importance of technology and achieved 100% implementation of the Core Banking Solution in 2007. -

Do Bank Mergers, a Panacea for Indian Banking Ailment - an Empirical Study of World’S Experience

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 21, Issue 10. Series. V (October. 2019), PP 01-08 www.iosrjournals.org Do Bank Mergers, A Panacea For Indian Banking Ailment - An Empirical Study Of World’s Experience G.V.L.Narasamamba Corresponding Author: G.V.L.Narasamamba ABSTRACT: In the changed scenario of world, with globalization, the need for strong financial systems in different countries, to compete with their global partners successfully, has become the need of the hour. It’s not an exception for India also. A strong financial system is possible for a country with its strong banking system only. But unfortunately the banking systems of many emerging economies are fragmented in terms of the number and size of institutions, ownership patterns, competitiveness, use of modern technology, and other structural features. Most of the Asian Banks are family owned whereas in Latin America and Central Europe, banks were historically owned by the government. Some commercial banks in emerging economies are at the cutting edge of technology and financial innovation, but many are struggling with management of credit and liquidity risks. Banking crises in many countries have weakened the financial systems. In this context, the natural alternative emerged was to improve the structure and efficiency of the banking industry through consolidation and mergers among other financial sector reforms. In India improvement of operational and distribution efficiency of commercial banks has always been an issue for discussion for the Indian policy makers. Government of India in consultation with RBI has, over the years, appointed several committees to suggest structural changes towards this objective. -

Banks Doing Salary Transactions Through Wage

BANKS DOING SALARY TRANSACTIONS THROUGH WAGE PROTECTION SYSTEM Sl No Name of Bank Rating . 1 For WPS Queries Related to State Bank of India : 8921303221 (Jithin),9496096832(Anju Mohan) 2 For WPS Queries Related to Union Bank Pls Contact : 9495590075 (Nidhin) 3 For WPS Queries Related to Federal Bank: 0484-2412125,9746094636(Sita S) 4 For WPS Queries Related to South Indian Bank Pls Contact : 8547389016 (Deepthi),9446373267(Premjith) 5 For WPS Queries Related to ICICI Bank: 9846339935 (Renjith Das) 6 For WPS Queries Related to Canara Bank Pls Contact :8281991598,0471-2471222(Shini) 7 For WPS Queries Related to Dhanlaxmi Bank: 09539003879 ,0487 6617207/211 (Gireesh Nair P) 8 For WPS Queries Related to IDBI Bank: 9047080044,0471-2321168,69 (Manoj A) 8 For WPS Queries Related to Punjab National Bank: 8882345254, 0484-2384625 (Anish) 10 For WPS Queries Related to Andhra Bank: 9912659777(Ashish), 9700835875(Rakesh) 11 For WPS Queries Related to AXIS Bank: 8589008686(Dhanya R); 9847998098(Vivek Sarathy) 12 For WPS Queries Related to CSB Bank: 9620237305,0487-6619283 (Sanilkumar) 13 For WPS Queries Related to HDFC Bank Pls Contact : 9388 302 673 (Sandeepkumar) 14 For WPS Queries Related to Indian Bank Pls Contact : 9446534258 (Ramesh) 15 For WPS Queries Related to Central Bank of India: 4712471294 16 For WPS Queries Related to Bank of India Pls Contact : 8891003310 (Gayathri.J.) 17 For WPS Queries Related to UCO Bank Pls Contact : 0484 2788608 (Unnikrishnan, Manager) 18 For WPS Queries Related to Corporation Bank Pls Contact : 0471-2338260,9446451958(Juny Sam) 19 20 For WPS Queries Related to Indian Overseas Bank Pls Contact : 0471-2461397(Nithin) 21 For WPS Queries Related to IndusInd Bank Pls Contact :9840871992(Mathavan C) 22 23 Note:- *Support Person details of some banks are not included in this document as that are not provided by the bank. -

Some Aspects of the Indian Stock Market in the Post-Liberalisation Period

SOME ASPECTS OF THE INDIAN STOCK MARKET IN THE POST-LIBERALISATION PERIOD K.S. Chalapati Rao, M.R. Murthy and K.V.K. Ranganathan As a part of the process of economic liberalisation, the stock market has been assigned an important place in financing the Indian corporate sector. Besides enabling mobilising resources for investment, directly from the investors, providing liquidity for the investors and monitoring and disciplining company management company managements are the principal functions of the stock markets. This paper examines the developments in the Indian stock market during the `nineties in terms of these three roles. Share price indices have been constructed for the years 1994 to 1999 at select company category and industry levels to bring out the investor preferences and their implications for the resources mobilising capacity of different segments of the corporate sector. Introduction process got deepened and widened in 1991 Under the structural adjustment programme as development of capital markets was made an many developing countries made substantial integral part of the restructuring strategy. After policy changes to pull down the administrative 1991, as a part of the de-regulation measures, barriers to free flow of foreign capital and the Capital Issues Control Act, 1947 that international trade. In the same vein, required all corporate proposals for going public restrictions and regulations on new investments to be examined and approved by the in reserved areas for public sector witnessed Government, was dispensed with [Narasimham radical change. Strengthening of capital markets Committee Report, 1991, p. 120].2 The was advocated for successful implementation of Securities and Exchange Board of India (SEBI) the privatisation programmes and attracting which was set up in early 1988 was given external capital flows [World Bank, 1996, p. -

INDIAN BANKING Current Challenges & Alternatives for the Future

E C O N O M I C R E S E A R C H FOUNDATION INDIAN BANKING Current Challenges & Alternatives for the future C. P. Chandrasekhar Jayati Ghosh C. P. Chandrasekhar, is Professor at the Centre for Economic Studies and Planning,School of Social Sciences, Jawaharlal Nehru University, New Delhi. Besides being engaged in teaching and research for more than three decades at JNU, he has served as Visiting Senior Lecturer, School of Oriental and African Studies, University of London and Executive Editor of Deccan Herald Group of Publications in Bangalore. He was a member of the Independent Commission on Banking and Financial Policies constituted by AIBOC in 2004 and released in 2006. He has published widely in academic journals and his most recent book titled "Karl Marx's Capital and the Present" was published in 2017. He has also co-authored many books, including, “India in an Era of Liberalization”; “Crisis as Conquest: Learning from East Asia”; “The Market that failed: A decade of Neo-Liberal economic Reforms in India”; and “Promoting ICT for Human Development in Asia: India”. He is a regular columnist for Frontline and Business Line brought out by The Hindu group of newspapers and a contributor to the H.T. Parekh Finance Column in the Economic and Political Weekly. Jayati Ghosh is Professor of Economics at the Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi. She has authored and edited a dozen books and more than 180 scholarly articles. Recent books include Demonetisation Decoded: A critique of India’s monetary experiment (with CP Chandrasekhar and Prabhat Patnaik, Routledge 2017), the Elgar Handbook of Alternative Theories of Economic Development (co-edited with Erik Reinert and Rainer Kattel, Edward Elgar 2016) and the edited volume India and the International Economy, (Oxford University Press 2015). -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

Deposit Insurance and Credit Guarantee Corporation “When Learning Is Purposeful, Creativity Blossoms

A monthly publication from South Indian Bank www.southindianbank.com To kindle interest in economic affairs... Student’s corner To empower the student community... [email protected] 29th Year of Publication STUDENTS’ ECONOMIC FORUM Experience Next Generation Banking MARCH 2020 The South Indian Bank Ltd., H.O. : 'S.I.B. House', Thrissur, Kerala Theme No: 340: Deposit Insurance and Credit Guarantee Corporation “When learning is purposeful, creativity blossoms. When creativity blossoms, thinking emanates. When thinking emanates, knowledge is fully lit. When knowledge is lit, economy flourishes.” - DR. A.P.J. ABDUL KALAM The “SIB Students’ Economic forum” is designed to kindle interest in the minds of younger generation. We highlight one theme in every monthly publication. Topic of discussion for this month is “D.I.C.G.C”. Introduction DICGC, Deposit Insurance and Credit Guarantee Corporation is a statutory body established on 15th July 1978. But it was introduced in India in 1962. India was the 2nd country to introduce this Scheme. The first country which introduced DICGC was USA in 1933. The prime purpose of DICGC is to provide insurance for the money deposited in all banks. The functions of the DICGC are governed by the provisions of ‘The Deposit Insurance and Credit Guarantee Corporation Act, 1961 (DICGC Act) and ‘The Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961 framed by the Reserve Bank of India. Background ¾ Bank failure was a common phenomenon in the 19th & 20th century. Such instances triggered the need for banks to safe guard the money deposited by their customers. ¾ Post establishment of RBI in 1935, the failure of Travancore National Bank & Quilon Bank highlighted this issue.