RBI FUNCTIONS HISTORY of RBI • 1926- Hilton Young Commission Given Recommendation for RBI

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Government Mint Alipore, Kolkata, West Bengal

India Government Mint Alipore, Kolkata, West Bengal - 700053 India Ph 91-033-24010132/2401 4938 ; Fax 033-24010553 email: [email protected] EXPRESSION OF INTEREST NOTICE NO. 1 for 2019-2020 Web- https://igmkolkata.spmcil.com / e-mail- [email protected] INVITING EXPRESSION OF INTEREST (EOI) FOR APPOINTMENT OF EXPERIENCED AND REGISTERED DESIGNING FIRMS FOR PLANNING, DESIGN AND PRODUCTION WORK OF INDIA GOVERNMENT MINT MUSEUM AT KOLKATA (WEST BENGAL) General Manager, India Government Mint, Kolkata, West Bengal, invites Expression of Interest (EOI) for Appointment of experienced & registered Architect/Designing firm for Museum Interior designing, detail drawing and production work of India Government Mint, Kolkata, West Bengal and taking the approval for the following work at Alipore, Kolkata Sr. Name of Project Approximate Cost of Statutory Authority for No. interiors area project Sanction of Plans 1. Museum Interiors designing & 366 sq mts 4.4 cr India Government Mint, Work execution of India Kolkata, Government Mint West Bengal Eligibility, Qualification and Experience Criteria for Architectural Firm:- 1. The applicant should be an Architect/Designer/Design firm/Consortium of Companies. Appropriate documents supporting their status must be submitted. 2. The applicant should have an Architect, registered with the Council of Architecture with at least 5 years of experience of national & international repute. (to be supported by attested copy of registration) 3. Applicant with national/international competition projects and awarded jury member will be given preference. 4. The Applicant should have been mainly engaged in similar works, and should have worked on at least 2 projects of a similar nature in the last 4 years. -

India Government Mint Alipore, Kolkata, a Unit of Spmcil (A Wholly Owned Corporation of Government of India, Ministry of Finance)

INDIA GOVERNMENT MINT ALIPORE, KOLKATA, A UNIT OF SPMCIL (A WHOLLY OWNED CORPORATION OF GOVERNMENT OF INDIA, MINISTRY OF FINANCE) INVITES INDIA TEL – (033) 24014132 TO 4135 FAX – (033) 24010553 Invitation to Paper Tender for Supply of 3,00,000 Pcs. Of D.W. TARPAULINE JUTE BAGS Contents Section - I = Notice of open tender Section - II = Covering letter Section - III = Submission of tender Section - IV = Instructions to tenderers Section - V = Terms and conditions Section - VI = Technical specifications Annexure Table - 1 Summary of Price Schedule -3- India Government Mint Alipore, Kolkata-700053 India Tel – (033) 24014132 to 4135 Fax – (033) 24010553 No.54/PT-405(09-10)/ Date: 08-12-2009 TENDER NOTICE Sealed Tenders in two parts (Part-1 : Techno-commercial Bid and Part-II : Price Bid) in separate sealed covers are invited by the General Manager, India Government Mint, Alipore, Kolkata – 700 053 on behalf of the President of India for the supply of following item :– Quantity Description D.W. TARPAULINE JUTE BAGS as per IS: 3344-1965 with amendment 3 3,00,000 Pcs. (Reaffirmed 2000) Size: 47 cms X 35 cms. Note: The quantity mentioned above may either be increased or decreased. a) Earnest Money Deposit : Rs.90,000/- in the form of Demand Draft or Bankers Cheque in favor of the “General Manager, India Government Mint, Alipore, Kolkata” is to be furnished along with Technical Bid without which tender will not be considered. Sales Tax Registration Number, I.T. Clearance Certificate, PAN etc. are also required to be furnished. No interest will be paid on EMD/Security deposit. -

RTI Handbook

PREFACE The Right to Information Act 2005 is a historic legislation in the annals of democracy in India. One of the major objective of this Act is to promote transparency and accountability in the working of every public authority by enabling citizens to access information held by or under the control of public authorities. In pursuance of this Act, the RTI Cell of National Archives of India had brought out the first version of the Handbook in 2006 with a view to provide information about the National Archives of India on the basis of the guidelines issued by DOPT. The revised version of the handbook comprehensively explains the legal provisions and functioning of National Archives of India. I feel happy to present before you the revised and updated version of the handbook as done very meticulously by the RTI Cell. I am thankful to Dr.Meena Gautam, Deputy Director of Archives & Central Public Information Officer and S/Shri Ashok Kaushik, Archivist and Shri Uday Shankar, Assistant Archivist of RTI Cell for assisting in updating the present edition. I trust this updated publication will familiarize the public with the mandate, structure and functioning of the NAI. LOV VERMA JOINT SECRETARY & DGA Dated: 2008 Place: New Delhi Table of Contents S.No. Particulars Page No. ============================================================= 1 . Introduction 1-3 2. Particulars of Organization, Functions & Duties 4-11 3. Powers and Duties of Officers and Employees 12-21 4. Rules, Regulations, Instructions, 22-27 Manual and Records for discharging Functions 5. Particulars of any arrangement that exist for 28-29 consultation with or representation by the members of the Public in relation to the formulation of its policy or implementation thereof 6. -

Beekar-The-Numismatist About This BLOG

Beekar-the-numismatist About this BLOG 1.) THE QUICKEST CIRCULATING COIN OF INDIA 2.) METAMORPHOSIS OF 1 RUPEE COINS OF INDIA, 1835 TO 2011 3.) REGULAR ANNA/ PICE SERIES COINS OF REPUBLIC OF INDIA 4.) DECIMAL 1, 2, 3, 5, 10, 20, 25, 50 PAISE REGULAR COINS 5.) DECIMAL 1, 2, 5, 10 RUPEES REGULAR 6.) REGULAR CROSS COINS, ISSUED IN INDIA 7.) 5, 10, 20, 25 PAISE COMMEMORATIVE COINS OF INDIA | 8.) 50 PAISE COMMEMORATIVE COINS OF INDIA 9.) 1 RUPEE COMMEMORATIVE COINS OF INDIA 10.) 2 RUPEES CIRCULATING COMMEMORATIVE COINS OF INDIA 11.) 5 RUPEES CIRCULATING COMMEMORATIVE COINS OF INDIA 12.) 10 RUPEES CIRCULATING COMMEMORATIVE COINS OF INDIA 13.) MINT ERROR COINS OF INDIA 14.) THE MULE COINS OF REPUBLIC INDIA 15.) THE FAKE COINS OF INDIA 16.) AN INTERESTING 100 RUPEES NOTE About This Blog Dear Friend, Thank you for visiting my blog. I have been collecting coins of India from my child hood days. At that time, no internet was there, what to speak of internet, even no reference books on coin collection, were available with me. I simply collected coins from circulation, choosing only by different designs. After buying a reference book on coins, “Nineteenth & Twentieth Century Coins of India”, written by Mr. D Chakravarty of Kolkata, I gained a good knowledge about the science of coin collection. After getting a broad- band connection, I had the privilege of accessing the Internet and got a chance to visit many sites on coin collection and learnt many facts about coins. As I am a teacher by profession, I wished to share my knowledge about coins with my fellow collectors and I presume that I have achieved my aim to some extent by starting this blog. -

![(1980): Primary Aluminium Ingots for Remelting for Aircraft Purposes [MTD 7: Light Metals and Their Alloys]](https://docslib.b-cdn.net/cover/1307/1980-primary-aluminium-ingots-for-remelting-for-aircraft-purposes-mtd-7-light-metals-and-their-alloys-2811307.webp)

(1980): Primary Aluminium Ingots for Remelting for Aircraft Purposes [MTD 7: Light Metals and Their Alloys]

इंटरनेट मानक Disclosure to Promote the Right To Information Whereas the Parliament of India has set out to provide a practical regime of right to information for citizens to secure access to information under the control of public authorities, in order to promote transparency and accountability in the working of every public authority, and whereas the attached publication of the Bureau of Indian Standards is of particular interest to the public, particularly disadvantaged communities and those engaged in the pursuit of education and knowledge, the attached public safety standard is made available to promote the timely dissemination of this information in an accurate manner to the public. “जान का अधकार, जी का अधकार” “परा को छोड न 5 तरफ” Mazdoor Kisan Shakti Sangathan Jawaharlal Nehru “The Right to Information, The Right to Live” “Step Out From the Old to the New” IS 23 (1980): Primary Aluminium Ingots for Remelting for Aircraft Purposes [MTD 7: Light Metals and their Alloys] “ान $ एक न भारत का नमण” Satyanarayan Gangaram Pitroda “Invent a New India Using Knowledge” “ान एक ऐसा खजाना > जो कभी चराया नह जा सकताह ै”ै Bhartṛhari—Nītiśatakam “Knowledge is such a treasure which cannot be stolen” IS : -23-1980 Indian Standard SPECIFICATION FOR PRIMARY ALUMINlUM INGOTS FOR REMELTING FOR AIRCRAFT PURPOSES ( Third Revision ) Light Metals and Their Alloys Sectional Committee, SMDC 10 Chairman Representing SHRI B. K. MURTHY Indian Aluminium Co Ltd, Calcutta Members SHRI V. D. AGARWAL Aluminium Corporation of India Ltd, Calcutta SHRI V. K. AGRAWAL Hindustan Aluminium Corporation Ltd, Renukoot, Dist Mirzapur SHRI K. -

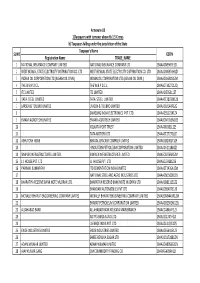

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

View Document

mRifÙk ,lih,elhvkbZ,y rduhdh :i ls ,d ubZ laLFkk gS ftldk izfrHkwfr eqnz.k rFkk flDdksa dh <+ykbZ esa 'krkfCn;ksa iqjkuk vuqHko gSA lHkh ukS mRiknu bdkb;ksa dk izca/ku] fu;a=.k] j[k&j[kko rFkk izpkyu djsalh ,oa Dokbu fMohtu] vkfFkZd dk;Z foHkkx] foRr ea=ky;] Hkkjr ljdkj ds v/khu Fkk ftls ,lih,elhvkbZ,y dks 10 Qjojh] 2006 dks LFkkukarfjr fd;k x;kA foÙk ea=ky; cksMZ funs’kdksa ds ek/;e ls ,lih,elhvkbZ,y ij iz’kklfud fu;a=.k j[krk gSA ukS mRiknu bdkb;ksa esa pkj Hkkjr ljdkj Vdlkysa] nks pykFkZ i= eqnz.kky;] nks izfrHkwfr eqnz.kky; rFkk ,d izfrHkwfr dkxt dkj[kkuk gSA oha lnh dksydkrk Vdlky esa flDdksa dh <ykbZ izkjaHk 18 th Century Hkkjr ljdkj Vdlky] eqEcbZ Hkkjr ljdkj Vdlky] gSnjkckn Hkkjr izfrHkwfr eqnz.kky;] ukfld esa mRiknu izkjaHk esa flDdksa dh <+ykbZ izkjaHk dh LFkkiuk izfrHkwfr dkxt dkj[kkuk] gks’kaxkckn Hkkjr izfrHkwfr eqnz.kky;] ukfld dksydkrk dh orZeku Vdlky esa mPp xq.kork ds izfrHkwfr dkxt esa djsalh eqnz.k izkjaHk dk vk/kqfudhdj.k dk mRiknu izkjaHk cSad uksV eqnz.kky;] nsokl esa izfrHkwfr eqnz.kky;] gSnjkckn esa Hkkjr ljdkj Vdlky] uks,Mk esa djsalh eqnz.k izkjaHk mRiknu izkjaHk flDdksa dh <+ykbZ izkjaHk Manufacturer of Instruments of Faith SPMCIL 2 Annual Report 2017-18 Manufacturer of Instruments of Faith SPMCIL CONTENTS Vision and Mission 4 Leadership at SPMCIL 5 Letter to Shareholders 7 Performance at a Glance 11 About SPMCIL 15 Directors’ Profile 23 Directors' Report 28 Financial Statement 94-221 (a) Standalone 94-159 (i) Independent Auditor's Report 95 (ii) Balance Sheet 124 (iii) Statement of Profit and Loss 125 (iv) Cash Flow Statement 126 (v) Notes to Financial Statement 128 (b) Consolidated 160-221 (i) Independent Auditor's Report 161 (ii) Balance Sheet 176 (iii) Statement of Profit and Loss 177 (iv) Cash Flow Statement 178 (v) Notes to Financial Statement 180 Glossary 222 Notice of AGM 223 Annual Report 2017-18 3 Manufacturer of Instruments of Faith SPMCIL VISION To be leader in manufacturing of currency, coins and security products through process excellence and innovation. -

Alipore, Kolkata – 700 053 (W.B.) India

INDIA GOVERNMENT MINT, ALIPORE, KOLKATA – 700 053 (W.B.) (A Unit of SPMCIL, Wholly owned by Govt. of India) Tel.: (033) 2401-4938, Fax : (033) 2401-0553, e-mail : [email protected] | CIN : U22213DL2006GOI144763 Sealed tenders from eligible and qualified bidders are invited by the undersigned for procurement of below mentioned items: Tender No. 54/T-45(21-22)/6000016448 NOTICE INVITING TENDER (NATIONAL COMPETITIVE BIDDING) Earnest Money Deposit Last Date & Time for Item Description (EMD) Tender Submission BIDDER HAS TO SUBMIT 20/07/2021 till 15:00 hrs. HIRING OF SERVICE FOR BID SECURITY HANDLING TAXATION FOR 1 YEAR ONE DECLARATION Tender OpeninG : TAX ASSISTANT(CA INTER/CMA INTER) (ENCLOSED AS ANNEXURE 20/07/2021 at 15:30 hrs. III). For further details, please visit our website http://iGmkolkata.spmcil.com Please note that any amendment/CorriGendum will be published on our website only. Sd- The Chief General Manager India Government Mint, Alipur, Kolkata Pin- 700053 India Ph. No: 91-33-24014132-35, 24014821 Fax No: 033-24010553 CIN: U22213DL2006GOI144763 E-Mail: [email protected] Web: www.igmkolkata.spmcil.com GSTIN : 19AAJCS6111J2Z4 IEC Code:506051536 PAN No: AAJCS6111J PR Number PR Date Indenter Department 11009126 15.06.2021 Finance FINANCE Not Transferable Security Classification: TENDER DOCUMENT FOR HIRING OF: HIRING OF SERVICE FOR HANDLING TAXATION FOR 1 YEAR ONE TAX ASSISTANT(CA INTER/ CMA INTER) Tender Number: 6000016448/FINANCE, Dated: 28.06.2021 This Tender Document Contains__________Pages. Details of Contact person in SPMCIL regarding this tender: Name: Nayan Nikhil Sarkar Designation: Dy.General Manager (T.O) Address: IGMK (India Government Mint, Kolkata) India Regd. -

PRESS INFORMATION BUREAU GOVERNMENT of INDIA ****** Hon’Ble Union Minister of Finance Sh

PRESS INFORMATION BUREAU GOVERNMENT OF INDIA ****** Hon’ble Union Minister of Finance Sh. Arun Jaitley gives away awards for excellence at the 11th Foundation Day celebrations of Security Printing and Minting Corporation of India Ltd. (SPMCIL) SPMCIL contributed to the world’s biggest exercise of demonetisation SPMCIL is among the few government companies to have become debt free New Delhi, February 17, 2017 Magha 28, 1938 Hon’ble Union Minister of Finance Sh. Arun Jaitley gave away awards for excellence at the 11th Foundation Day celebrations of Security Printing and Minting Corporation of India Ltd. (SPMCIL) at the National Media Centre, New Delhi. He said that SPMCIL played an important role in the world’s biggest exercise of demonetisation. The event was also attended by Secretary Economic Affairs, Sh Shaktikanta Das and higher officials from SPMCIL. The awards were given away to 26 employees of SPMCIL for their excellence in various fields during the year 2015-16. Besides, different units of SPMCIL were also awarded for their work in areas of 1) Productivity – India Government Mint, Mumbai, 2) Energy Conservation – India Security Press, Nashik, 3) Environment & Safety – India Government Mint, Noida, 4) Training and Development – Security Paper Mill, Hoshangabad, 5) Vigilance – Bank Note Press, Dewas, and 6) Official Language (Shri Shankar Dayal Singh Shield) – Currency Note Press, Nashik. The CMD Cup was awarded to the India Security Press, Nashik. The awards were received by the GM/ AGM of the respective units. While addressing the gathering, the Hon’ble Minister of Finance congratulated SPMCIL for becoming debt free and said that SPMCIL not only mints money but also makes money for the government. -

Exchange Coinage & Currency

CHAPTER 40 EXCHANGE, COINAGE AND CURRENCY Exchange: Foreign exchange reserves are an important component of the Balance of Payment (BoP) and an essential element in the analysis of an economy’s external position. India’s foreign exchange reserves comprise foreign currency assets (FCA), gold, special drawing rights (SDRs) and reserve tranche position (RTP) in the International Monetary Fund (IMF). Special Drawing Rights (SDRs): SDRs are international foreign exchange reserve assets. Allocated to nations by the International Monetary Fund (IMF), a SDR represents a claim to foreign currencies for which it may be exchanged in times of need. Although denominated in US dollars, the nominal value of an SDR is derived from a basket of currencies; in this case a fixed amount of Japanese Yen, US Dollars, British Pounds and Euros. SDRs are the IMF's unit of account and are denoted with the ISO 4217 currency code XDR. Reserve Tranche Position (RTP): The primary means of financing the IMF is through members' quotas. Each member of the IMF is assigned a quota, part of which is payable in SDRs or specified usable currencies ("reserve assets"), and part in the member's own currency. The difference between a member's quota and the IMF's holdings of its currency is a country's Reserve Tranche Position (RTP). Foreign currency assets: Foreign currency assets include foreign exchange reserves less gold holdings, special drawing rights and India's reserve position in the IMF. Foreign exchange reserves are accumulated when there is absorption of the excess foreign exchange flows by the RBI through intervention in the foreign exchange market, aid receipts, interest receipts, and funding from the International Bank for Reconstruction and Development (IBRD), Asian Development Bank (ADB), International Development Association (IDA), etc. -

Supplementary

SUPPLEMENTARY Table of Contents 1. POLITY AND CONSTITUTION __________ 4 3.7. Swift Norms ______________________ 12 1.1. NONE OF THE ABOVE (NOTA) _________ 4 3.8. Branch Authorisation Policy _________ 13 1.2. Party Symbol Allocation _____________ 4 3.9. Legal Entity Identifier ______________ 13 1.3. Tribal Sub Plan _____________________ 4 3.10. PAiSA Portal _____________________ 13 1.4. National Green Tribunal _____________ 5 3.11. Petroleum, Chemicals and Petrochemical Investment Region ____________________ 14 1.5. Review of the Contempt of Courts Act, 1971 ________________________________ 5 3.12. UNNATI Project __________________ 14 1.6. Central Civil Services (Conduct) Rules, 1964 3.13. Central Road and Infrastructure Fund 14 ____________________________________ 6 3.14. SFOORTI App ____________________ 14 2. INTERNATONAL RELATIONS __________ 7 3.15. Intelligent Transportation Systems __ 14 2.1. MFN Status _______________________ 7 3.16. International Road Transports (TIR) 2.2. European Bank for Reconstruction and Convention __________________________ 15 Development (EBRD) ___________________ 7 3.17. SUNREF Housing Project ___________ 15 2.3. SAARC Development Fund (SDF) ______ 7 3.18. E-Shakti Initiative of NABARD _______ 15 2.4. Asia-Europe Meeting________________ 8 3.19. World Food Program ______________ 15 2.5. Indian Ocean Conference ____________ 8 3.20. International Rice Research Institute _ 15 2.6. Asia-Africa Growth Corridor __________ 8 3.21. Asian Tea Alliance ________________ 16 2.7. India-Pacific Islands Sustainable 3.22. Ensure Portal ____________________ 16 Development Conference _______________ 8 3.23. Re-Weave.in ____________________ 16 2.8. Asia Reassurance Initiative Act (ARIA) __ 9 3.24. Indian Labour Conference (ILC) ______ 16 2.9. -

India Government Mint, Mumbai a Unit of Security

SECURITY PRINTING AND MINTING CORPORATION OF INDIA LIMITED INDIA GOVERNMENT MINT, MUMBAI A UNIT OF SECURITY PRINTING AND MINTING CORPORATION OF INDIA LIMITED (SPMCIL) (WHOLLY OWNED BY GOVERNMENT OF INDIA) SHAHID BHAGATSINGH ROAD, FORT, MUMBAI 400 001 INDIA TEL NO : 022-22703184/85 EXT.110/131 FAX NO : 022-22661450 E-Mail : [email protected] WEBSITE : igmmumbai.spmcil.com http://www.eprocure.gov.in NATIONAL COMPETITIVE BIDDING NO. 6000016132 DATED: 23.03.2021 PROCUREMENT OF PURE SILVER BLANKS – 11,000 NOS (WG.40 GM. EACH) Closing date and time for receipt of Tender - 23.04.2021 AT 02.30 P.M. Place of receipt of Tender - INDIA GOVT. MINT, MUMBAI Date and time of opening of Tender - 23.04.2021 AT 03.00 P.M. Place of opening of Tender - INDIA GOVT. MINT, MUMBAI 1 SECURITY PRINTING AND MINTING CORPORATION OF INDIA LIMITED SECTION I: NOTICE INVITING NATIONAL COMPETITIVE BIDDING PROCUREMENT OF PURE SILVER BLANKS NCB No.: 6000016132 Date.: 23.03.2021 1. India Government Mint, Mumbai (A unit of SPMCIL), Shahid Bhagat Singh Road, Fort, Mumbai - 400001, invites sealed tenders from eligible and qualified tenderers for below mentioned: Earnest Schedule Due date & time for Delivery Brief description of goods/services Money No. Deposit (Rs.) opening of tender Period 1. PROCUREMENT OF PURE SILVER NIL Techno Please Commercial refer BLANKS – 6,0000 NOS. Bid will be Section VI- opened on (List of 23.04.2021 Require 2. PROCUREMENT OF PURE SILVER at 03.00 P.M. ments) of BLANKS – 5,0000 NOS. NIL the tender document. (For full details please see the technical specification as mentioned in Section VII of the tender document.) Type of Tender National Competitive Bidding in Two Bid system viz.