DISCLAIMER This PDF Is an Exact Copy of the Annual Report And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNEX Stock Indices Meeting the Requirements of Article 344 Of

DRAFT ITS ON DIVERSIFIED INDICES UNDER ARTICLE 344(4) OF REGULATION (EU) 575/2013 ANNEX Stock indices meeting the requirements of Article 344 of Regulation (EU) No 575/2013 Index Country\Area 1. STOXX Asia/Pacific 600 Asia/Pacific 2. ASX100 Australia 3. ASX200 Australia 4. S&P All Ords Australia 5. ATX Austria 6. ATX Prime Austria 7. BEL20 Belgium 8. SaoPaulo - Bovespa Brazil 9. TSX60 Canada 10. CETOP20 Index Central Europe 11. CSI 100 Index China 12. CSI 300 Index China 13. FTSE China A50 Index China 14. Hang Seng Mainland 100 China China 15. PX Global Prague Czech Republic 16. OMX Copenhagen 20 CAP Denmark 17. OMX Copenhagen 25 Denmark 18. OMX Copenhagen Benchmark Denmark 19. FTSE RAFI Developed 1000 Developed Markets 20. CECE Composite Index EUR Eastern Europe 21. FTSE RAFI Emerging Markets Emerging Markets 22. MSCI Emerging Markets 50 Emerging Markets 23. Bloomberg European 500 Europe 24. DJ Euro STOXX 50 Europe 25. FTSE Euro 100 Europe 26. FTSE Eurofirst 100 Europe 27. FTSE Eurofirst 300 Europe 28. FTSE Eurofirst 80 Europe 29. FTSE EuroMid Europe 30. FTSE Eurotop 100 Europe 31. MSCI Euro Europe 32. MSCI Europe Europe 33. MSCI Pan-Euro Europe 34. NTX New Europe Blue Chip Europe 35. S&P Euro Europe 36. S&P Europe 350 Europe 1 DRAFT ITS ON DIVERSIFIED INDICES UNDER ARTICLE 344(4) OF REGULATION (EU) 575/2013 37. STOXX All Europe 100 Europe 38. STOXX All Europe 800 Europe 39. STOXX Europe 50 Europe 40. STOXX Europe 600 Europe 41. STOXX Europe 600 Equal Weight Europe 42. -

COMPARISON of the EUROPEAN and the U.S. UNREGULATED STOCK MARKETS DESIGNED for SMES Imanou Akala, Sakarya University

The International Journal of Business and Finance Research Vol. 13, No. 1, 2019, pp. 85-102 ISSN: 1931-0269 (print) www.theIBFR.com ISSN: 2157-0698 (online) COMPARISON OF THE EUROPEAN AND THE U.S. UNREGULATED STOCK MARKETS DESIGNED FOR SMES Imanou Akala, Sakarya University ABSTRACT This paper examines the state of small and medium enterprises (SMEs) in European and U.S. unregulated stock markets. The analysis compares the performance of both markets, using the weekly adjusted closing index prices of Euronext all share index, NYSE AMEX Composite Index, and the OTCM ADR Index for the 2013-2017 period. ADF, EGARCH, and ARCH tests were performed on the collected time series data, to measure and forecast index price volatility, risk and return. The results show a high level of price volatility in some periods; but a permanent effect of shocks was not observed in the long term for all the analyzed indexes. Negative shocks cause more volatility than positive shocks. However, an overall result shows that, the Euronext all share index, despite slight declines, displays an upward trend and relatively higher returns with less risk, than the NYSE AMEX Composite Index, and the OTCM ADR Index. This results reflects the better performance of the European unregulated market, compare to its U.S. counterparts. JEL: M130, G1, C120, C220 KEYWORDS: Small and Medium Enterprises, Stock Markets, Initial Public Offering, Index Prices, Financial Risk and Return INTRODUCTION lthough a significant amount of reports and studies have been conducted regarding SMEs in the American, the Asian, the European unregulated stock markets and elsewhere (Hall, 2007; OICV AIOSCO 2015; Bremus, 2015; Kiškis, Limba and Gulevičiūtė, 2016; Kentaro, 2016 and others); studies comparing SMEs’ unregulated stock markets performance to each other, locally or internationally are scarce. -

Monatsemta-Gzamkvlevi.Pdf

მონაცემთა გზამკვლევი გლობალური განვითარების რაკურსში სტატისტიკა ინდექსები რეიტინგები თბილისი 2020 წელი შ ი ნ ა ა რ ს ი ს ტ ა ტ ი ს ტ ი კ ა ..............................................................................................................................................................................11 გაეროს სტატისტიკა / UNITED NATIONS STATISTICS ................................................................................................................11 მსოფლიო ბანკის მონაცემები/ THE WORLD BANK DATA .......................................................................................................11 საერთაშორისო სავალუტო ფონდის სტატისტიკა / IMF - INTERNATIONAL MONETARY FUND STATISTICS .............................11 შრომის საერთაშორისო ორგანიზაციის სტატისტიკა და მონაცემთა ბაზები / ILO - INTERNATIONAL LABOUR ORGANIZATION STATISTICS AND DATABASES ....................................................................................................................................11 მსოფლიო სავაჭრო ორგანიზაციის სტატისტიკა / WTO - WORLD TRADE ORGANIZATION STATISTICS ...................................11 გაეროს ვაჭრობისა და განვითარების კონფერენციის სტატისტიკა / UNCTAD STAT - UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT STATISTICS .................................................................................................................12 გაეროს სამრეწველო განვითარების ორგანიზაციის სტატისტიკა / UNIDO - UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION STATISTICS .......................................................................................................................................12 -

AIM Journal General News Flexible Essensys Centralnic

JUNE 2019 THE ONLINE MONTHLY FOR THE ALTERNATIVE INVESTMENT MARKET JOURNAL In this issue Impax enters AIM 50 index GENERAL NEWS Impax Asset Management Group has been Petroleum. Gaming machine platforms Flexible Essensys promoted to the FTSE AIM UK 50 index in supplier Quixant has been hit by uncertain 02 the second quarterly review of 2019. The levels of demand for its products and cleantech-focused investment manager the share price has fallen, even though is replacing recruitment and training directors have bought shares. ADVISERS company Staffline, which has been beset by The reserve list still includes wealth AFH growth accounting and trading problems. manager Mattioli Woods, finance provider 03 accelerates Impax reported a 15% increase in assets Morses Club, gold producer Pan African under management to £13.3bn in the Resources, lawyer Knights Group and rail quarter to March 2019. The reserve list optimisation software supplier Tracsis. The NEWS includes fashion brand Joules, which was new companies added are IMImobile, San Telford strategy on the list last time, as well as Ceres Power, Leon Energy, Bioventix, Judges Scientific 04 switch Brooks Macdonald, Horizon Discovery and and Telit Communications, where the share Premier Asset Management. price has recovered in the past quarter Ceres Power has been promoted to following the sale of its automotive division. NEWS the FTSE AIM 100 index, along with Formerly AIM-quoted PPHEHotel litigation funder Manolete Partners and Group has been promoted to the FTSE Audioboom income 06 growth Jadestone Energy Inc, which is also quoted 250, while business parks investment on the TSX Venture Exchange. -

The Essential AIM Stock Market Guide

The Essential AIM Stock Market Guide A guide for companies considering floating on AIM The essential AIM Stock Market guide Contents 1. Introduction 2. The AIM Stock Market 3. The benefits of AIM 4. The drawbacks of AIM 5. Raising funding on AIM 6. Making acquisitions using AIM 7. Joining AIM 8. Methods of floating on Aim 9. The AIM Stock Market flotation process 10. AIM Advisors 11. AIM Investors 12. AIM Stock Market rules 13. The costs of joining AIM 14. Life as an AIM company 15. Non UK AIM companies 16. Frequently asked AIM questions 17. Glossary of AIM Stock Market terms 1. Introduction Since its launch in 1995, over 3,000 companies have joined the AIM Stock Market, raising over £70 billion of investment capital to fund their growth. AIM has been designed with an appropriate level of regulation which helps privately owned companies to become public companies with the minimum about of unnecessary red tape. Companies choose to join AIM for a variety of reasons, including; A platform to raise funding in the short term to expand the business A mechanism to undertake further fundraisings in the future to enable continued business growth The opportunity to enhance the value of the company A way in which a company can take advantage of opportunities to acquire other businesses The opportunity to raise the profile and credibility of the company to new and existing customers A strategic exit route for existing investors The AIM Stock Market is now firmly established and can boast, that it is the only major growth market that has survived and flourished through two complete economic cycles. -

Which Market?

www.pwc.ru/capital-markets Which market? An overview of London, New York and Hong Kong stock exchanges Capital Markets The process of selecting the most appropriate exchange for your business to list its shares is challenging and complex. Understanding the differences among global exchanges and determining the exchange that best fits the unique needs of your business are key aspects of a successful listing Overview of key regulatory requirements Having decided that a public offering is the next step in your company’s development, choosing ‘where’ to list is one of the next most important decisions to consider, whether you plan an initial public offering (IPO) or a secondary listing. As markets and businesses become increasingly global, the decision of choosing the most appropriate exchange becomes more challenging. A number of factors must be considered in determining the best option, and planning early can help your company comply with listing and regulatory requirements. To help you determine which option is best for your company, we have highlighted some of the factors to consider and explained some of the high-level differences among the largest stock exchanges located in London, New York and Hong Kong. Some factors to consider include: • This criteria may be difficult to achieve as the pre-listing regulatory review requirements vary Admission / eligibility criteria by market. • Costs of listing vary in each market. • Certain industries and types of companies may achieve favorable valuations in certain markets, Valuation due to competitors and other recent listings of peer companies. • The company’s core business locations may affect the appetite for its equity, often driving a domestic listing. -

FTSE AIM Index Series Rules

Ground Rules FTSE AIM Index Series v3.8 ftserussell.com An LSEG Business August 2021 Contents 1.0 Introduction .................................................................... 3 2.0 Management Responsibilities ....................................... 4 3.0 FTSE Russell Index Policies ......................................... 6 4.0 Eligible Securities .......................................................... 8 5.0 Index Qualification Criteria ......................................... 11 6.0 Periodic Review of Constituent Companies .............. 12 7.0 Additions Outside of a Review ................................... 14 8.0 Corporate Actions and Events .................................... 15 9.0 Industry Classification Benchmark (ICB)................... 17 10.0 Algorithm and Calculation Method ............................. 18 Appendix A: Index Opening and Closing Hours ................. 19 Appendix B: Status of Indices .............................................. 20 Appendix C: Further Information ......................................... 21 FTSE Russell An LSEG Business | FTSE AIM Index Series, v3.8, August 2021 2 of 21 Section 1 Introduction 1.0 Introduction 1.1 This document sets out the Ground Rules for the construction and management of the FTSE AIM Index Series. Copies of these Ground Rules are available from FTSE International Limited (FTSE). 1.2 The FTSE AIM Index Series is designed to represent the performance of companies quoted on the AIM Market (AIM) of the London Stock Exchange. The Index Series includes the following Indices: FTSE AIM 100 Index (Real Time Index) FTSE AIM UK 50 Index (Real Time Index) FTSE AIM All-Share Index (Real Time Index) FTSE AIM All-Share Supersector Indices (End of Day Indices) 1.3 The FTSE AIM Index Series does not take account of ESG factors in its index design. 1.4 FTSE Russell FTSE Russell is a trading name of FTSE International Limited, Frank Russell Company, FTSE Global Debt Capital Markets Limited (and its subsidiaries FTSE Global Debt Capital Markets Inc. -

Financial Markets and International Stock Exchanges Mercados

Financial Markets and International Stock Exchanges Mercados Financieros y Bolsas de Acciones Internacionales AUTORES: Cabrera Duran, Rafael David Rodríguez Guillermo, Adrián Grado de Contabilidad y Finanzas Curso 2019/2020 Convocatoria: junio de 2020 Fecha de presentación: 12/06/2020 Tutor: Javier Giner Rubio ÍNDICE DE CONTENIDO RESUMEN ..................................................................................................................................... 4 INTRODUCCIÓN ........................................................................................................................... 5 1. RANKING MUNDIAL POR CAPITALIZACIÓN BURSÁTIL ...................................................... 6 1.1. TOP 10 GLOBAL. .............................................................................................................. 6 1.2. TOP 3 POR CONTINENTES. ............................................................................................. 7 1.2.1. Continente europeo ................................................................................................... 7 1.2.1.1. Euronext .............................................................................................................. 7 1.2.1.2. La Bolsa de Londres ........................................................................................... 8 1.2.1.3. La Bolsa de Frankfurt ....................................................................................... 10 1.2.1.4. La Bolsa de Valores de Madrid ....................................................................... -

Internationalization Vs. Regionalization of Volatility Spillover in the Asian Countries Stock Markets”

“Internationalization Vs. Regionalization of Volatility Spillover in the Asian Countries Stock Markets” By Maheen Butt MASTER OF SCIENCE IN MANAGEMENT SCIENCES (Finance) DEPARTMENT OF MANAGEMENT SCIENCES CAPITAL UNIVERSITY OF SCIENCE & TECHNOLOGY ISLAMABAD November 2016 Internationalization Vs. Regionalization of Volatility Spillover in the Asian Countries Stock Markets By Maheen Butt -MMS143055 SUPERVISOR Dr. Arshad Hassan A research thesis submitted to the Department of Management Sciences, Capital University of Science & Technology, Islamabad in partial fulfilment of the requirements for the degree of MASTER OF SCIENCE IN MANAGEMENT SCIENCES (FINANCE) DEPARTMENT OF MANAGEMENT SCIENCES CAPITAL UNIVERSITY OF SCIENCE & TECHNOLOGY ISLAMABAD November 2016 CAPITAL UNIVERSITY OF SCIENCE & TECHNOLOGY ISLAMABAD CERTIFICATE OF APPROVAL Internationalization vs. Regionalization of Volatility Spillover in the Asian Countries Stock Markets By Maheen Butt MMS143055 THESIS EXAMINING COMMITTEE S No Examiner Name Organization (a) External Examiner Dr.Iftikhar Hussain Adil NUST, Islamabad (b) Internal Examiner Mr. Nasir Rasool CUST, Islamabad (c) Supervisor Dr. Arshad Hassan CUST, Islamabad ________________________________ Dr. Arshad Hassan Thesis Supervisor November 2016 ______________________________ ___________________________ Dr.Sajid Bashir Dr. Arshad Hassan Head Dean Department of Management and Social Faculty of Management and Social Sciences Sciences Dated : November 2016 Dated : November, 2016 Dedication This thesis is dedicated to my mother Sumaira Butt &my father Mr. Zafar Iqbal Butt (late). Although he is no longer of this world, his memories continue to regulate my life. I won’t forget you. I am also dedicated this work to my uncle Mr. Ghulam Farooq Dogar, brother Zeeshan Ali, sister Dr. Madiha Butt, nephew Muhammad Abdullah and supervisor Dr. Arshad Hassan whose categorical encouragement and prop up made it possible for me to finish the work. -

"Assessing the Quality of Stock Market Indices: Requirements for Asset

An EDHEC Risk & Asset Management Research Centre Publication Assessing the Quality of Stock Market Indices: Requirements for Asset Allocation and Performance Measurement Commissioned by: Sponsored by: September 2006 EDHEC is one of the top five business schools in France and was ranked 12th in the Financial Times Masters in Management Rankings 2005 owing to the high quality of its academic staff (over 100 permanent lecturers from France and abroad) and its privileged relationship with professionals that the school has been developing since it was established in 1906. EDHEC Business School has decided to draw on its extensive knowledge of the professional environment and has therefore concentrated its research on themes that satisfy the needs of professionals. EDHEC pursues an active research policy in the field of finance. Its “Risk and Asset Management Research Centre” carries out numerous research programmes in the areas of asset allocation and risk management in both the traditional and alternative investment universes. Copyright © 2006 EDHEC ASSESSING THE QUALITY OF STOCK MARKET INDICES: REQUIREMENTS FOR ASSET ALLOCATION AND PERFORMANCE MEASUREMENT Table of Contents About the Authors 2 Foreword 3 Executive Summary 6 Résumé 11 Zusammenfassung 17 Introduction 24 1. Problem Outline 26 1.1. Indices in the Finance Literature 26 1.2. Indices in the Asset Management Industry 44 1.3. Conclusion 53 1.4. References 54 2. Lack of Stability 59 2.1. The Data 59 2.2. Style Composition 60 2.3. Sector Stability 68 2.4. Implicit Views 75 3. Lack of Efficiency 80 3.1. Efficiency: Conceptual remarks 80 3.2. Data 81 3.3. -

Traders' Guide 2016

Traders’ Guide 2016 Kepler Cheuvreux is the leading independent European financial services company specialising in advisory services and intermediation for the investment management industry. We have four business lines: Equities, Debt & Credit, Investment Solutions, and Corporate Finance. Headquartered in Paris, the company employees over 550 professionals and has offices in Amsterdam, Boston, Frankfurt, Geneva, London, Madrid, Milan, New York, San Francisco, Stockholm, Vienna, and Zurich. We are a unique multi-local European broker. Kepler Cheuvreux has the most extensive research coverage in Europe and the largest distribution platform with a team of over 100 involved in sales, trading and execution. In terms of market share, we are a Top 10 broker in European equities, combined with global execution capability. Our main purpose is to provide our clients with “unconflicted” execution. As an agency broker, we offer execution in Equities, Equity/debt Derivatives, ETFs and Fixed Income. We cover the US, European and Asian markets. Our client base is made up of asset managers, hedge funds, investment banks, insurance companies, family offices, sovereign wealth funds, retail clients, ECM partners and corporates. It is important to note that the foundation of the business is our Research Products, leveraged across all four business lines. We cover 650 stocks in Europe, and this breadth is complimented by our Asian research distribution, agreement with CIMB, which covers 750 Asian stocks. Our sector and country traders are in constant contact with our analysts to ensure all breaking and corporate news as well as rating changes are taken into account. Our firm has one of the highest cash block crossing rates in the industry: 13% in Large Caps, 22% in Mid Caps and 27% in Small Caps year-to-July 2017. -

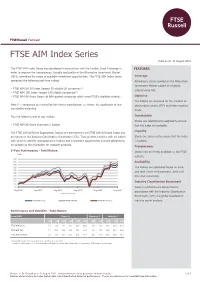

FTSE AIM Index Series

FTSE Russell Factsheet FTSE AIM Index Series Data as at: 31 August 2021 bmkTitle1 The FTSE AIM Index Series was developed in conjunction with the London Stock Exchange in FEATURES order to improve the transparency, liquidity and profile of the Alternative Investment Market (AIM), extending the range of available investment opportunities. The FTSE AIM Index Series Coverage comprises the following real-time indices: All ordinary shares quoted on the Alternative Investment Market subject to eligibility – FTSE AIM UK 50 Index (largest 50 eligible UK companies*) criteria being met. – FTSE AIM 100 Index (largest 100 eligible companies*) – FTSE AIM All-Share Index (all AIM quoted companies which meet FTSE's eligibility criteria) Objective The indices are designed for the creation of Note (*): companies are ranked by full market capitalisation i.e. before the application of any structured products, ETFs and index tracking investibility weighting. funds. Plus the following end-of-day indices: Investability Stocks are selected and weighted to ensure – FTSE AIM All-Share Supersector Indices that the index is investable. Liquidity The FTSE AIM All-Share Supersector Indices are derived from the FTSE AIM All-Share Index and are based on the Industry Classification Benchmark (ICB). They provide investors with 19 indices Stocks are screened to ensure that the index with which to identify macroeconomic trading and investment opportunities and are designed to is tradable. be suitable as the foundation for tradable products. Transparency 5-Year Performance - Total Return Index rules are freely available on the FTSE (GBP) website. 190 180 Availability 170 160 The indices are calculated based on price 150 and total return methodologies, both real 140 130 time and end-of-day.