2004 Q4 6 0 5 4 -2 3 -4 2 1 Agriculture Manufacturing Services 2004 Q3 0 2003 Q3 GDP - Growth Foreign Exchange Reserves % USD Billion 14 7

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

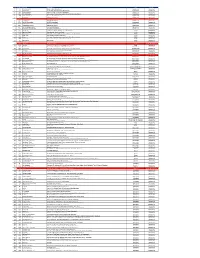

S# BRANCH CODE BRANCH NAME CITY ADDRESS 1 24 Abbottabad

BRANCH S# BRANCH NAME CITY ADDRESS CODE 1 24 Abbottabad Abbottabad Mansera Road Abbottabad 2 312 Sarwar Mall Abbottabad Sarwar Mall, Mansehra Road Abbottabad 3 345 Jinnahabad Abbottabad PMA Link Road, Jinnahabad Abbottabad 4 131 Kamra Attock Cantonment Board Mini Plaza G. T. Road Kamra. 5 197 Attock City Branch Attock Ahmad Plaza Opposite Railway Park Pleader Lane Attock City 6 25 Bahawalpur Bahawalpur 1 - Noor Mahal Road Bahawalpur 7 261 Bahawalpur Cantt Bahawalpur Al-Mohafiz Shopping Complex, Pelican Road, Opposite CMH, Bahawalpur Cantt 8 251 Bhakkar Bhakkar Al-Qaim Plaza, Chisti Chowk, Jhang Road, Bhakkar 9 161 D.G Khan Dera Ghazi Khan Jampur Road Dera Ghazi Khan 10 69 D.I.Khan Dera Ismail Khan Kaif Gulbahar Building A. Q. Khan. Chowk Circular Road D. I. Khan 11 9 Faisalabad Main Faisalabad Mezan Executive Tower 4 Liaqat Road Faisalabad 12 50 Peoples Colony Faisalabad Peoples Colony Faisalabad 13 142 Satyana Road Faisalabad 585-I Block B People's Colony #1 Satayana Road Faisalabad 14 244 Susan Road Faisalabad Plot # 291, East Susan Road, Faisalabad 15 241 Ghari Habibullah Ghari Habibullah Kashmir Road, Ghari Habibullah, Tehsil Balakot, District Mansehra 16 12 G.T. Road Gujranwala Opposite General Bus Stand G.T. Road Gujranwala 17 172 Gujranwala Cantt Gujranwala Kent Plaza Quide-e-Azam Avenue Gujranwala Cantt. 18 123 Kharian Gujrat Raza Building Main G.T. Road Kharian 19 125 Haripur Haripur G. T. Road Shahrah-e-Hazara Haripur 20 344 Hassan abdal Hassan Abdal Near Lari Adda, Hassanabdal, District Attock 21 216 Hattar Hattar -

Volume VI, Issue-X, October 2016

Volume VI, Issue-X, October 2016 October in History Fast-Rising Pakistan Whitewash West Indies Pakistan and West Indies series October 28, 1964: was played in UAE. Pakistan's hockey team won Silver Medal in Tokyo Olympic games. The series started with the first October 26, 1968: T20 September 23, 2016. The Pakistan became Olympic Hockey third test match is yet to be Champion, by winning over Australia 2-1. played. Pakistan played their first ever Day and Night test October 24, 1971: game in this series. Pink ball Pakistan won World Hockey Cup was finally seen in the hands of defeating Spain 1-0 at Barcelona. the Pakistani bowlers. October 28, 1972: In the first T20 Pakistan won by President Bhutto inaugurated Karachi night international at Sharjah on men after scoring 127 in Pak - Nuclear Power Plant (KANUPP). nine-wickets after restricting West Indies to 115 in Twenty20 Sunday . Pakistan once again istan's 133-run victory against October 15, 1979: Internationals at Dubai posted a big total of 337-5 in West Indies in Abu Dhabi. This Dr. Abdus Salam, eminent Pakistani International Stadium, Dubai their 50 overs on October 2, is Younis' highest ranking since scientist, was awarded Physics Nobel on September 23, 016. 2016. he was No. 1 in March 2009 and Prize. No. 2 in July that year; he In third ODI, Pakistan contin - October 21, 1987: currently trails Steven Smith by Pakistan held West Indies to ued their domination over West Jan Sher Khan won World Open Squash 144-9 to win the second T20 at 46 points and leads Joe Root at Championship for the first time. -

Punjab Tourism for Economic Growth Final Report Consortium for Development Policy Research

Punjab Tourism for Economic Growth Final Report Consortium for Development Policy Research ABSTRACT This report documents the technical support provided by the Design Team, deployed by CDPR, and covers the recommendations for institutional and regulatory reforms as well as a proposed private sector participation framework for tourism sector in Punjab, in the context of religious tourism, to stimulate investment and economic growth. Pakistan: Cultural and Heritage Tourism Project ---------------------- (Back of the title page) ---------------------- This page is intentionally left blank. 2 Consortium for Development Policy Research Pakistan: Cultural and Heritage Tourism Project TABLE OF CONTENTS LIST OF ACRONYMS & ABBREVIATIONS 56 LIST OF FIGURES 78 LIST OF TABLES 89 LIST OF BOXES 910 ACKNOWLEDGMENTS 1011 EXECUTIVE SUMMARY 1112 1 BACKGROUND AND CONTEXT 1819 1.1 INTRODUCTION 1819 1.2 PAKISTAN’S TOURISM SECTOR 1819 1.3 TRAVEL AND TOURISM COMPETITIVENESS 2324 1.4 ECONOMIC POTENTIAL OF TOURISM SECTOR 2526 1.4.1 INTERNATIONAL TOURISM 2526 1.4.2 DOMESTIC TOURISM 2627 1.5 ECONOMIC POTENTIAL HERITAGE / RELIGIOUS TOURISM 2728 1.5.1 SIKH TOURISM - A CASE STUDY 2930 1.5.2 BUDDHIST TOURISM - A CASE STUDY 3536 1.6 DEVELOPING TOURISM - KEY ISSUES & CHALLENGES 3738 1.6.1 CHALLENGES FACED BY TOURISM SECTOR IN PUNJAB 3738 1.6.2 CHALLENGES SPECIFIC TO HERITAGE TOURISM 3940 2 EXISTING INSTITUTIONAL ARRANGEMENTS & REGULATORY FRAMEWORK FOR TOURISM SECTOR 4344 2.1 CURRENT INSTITUTIONAL ARRANGEMENTS 4344 2.1.1 YOUTH AFFAIRS, SPORTS, ARCHAEOLOGY AND TOURISM -

33422717.Pdf

1 Contents 1. PREFACE ........................................................................................................................................... 4 2. OVERVIEW OF THE CULTURAL ASSETS OF THE COMMUNITIES OF DISTRICTS MULTAN AND BAHAWALPUR ................................................................... 9 3. THE CAPITAL CITY OF BAHAWALPUR AND ITS ARCHITECTURE ............................ 45 4. THE DECORATIVE BUILDING ARTS ....................................................................................... 95 5. THE ODES OF CHOLISTAN DESERT ....................................................................................... 145 6. THE VIBRANT HERITAGE OF THE TRADITIONAL TEXTILE CRAFTS ..................... 165 7. NARRATIVES ................................................................................................................................... 193 8. AnnEX .............................................................................................................................................. 206 9. GlossARY OF TERMS ................................................................................................................ 226 10. BIBLIOGRAPHY ............................................................................................................................. 234 11. REPORTS .......................................................................................................................................... 237 12 CONTRibutoRS ............................................................................................................................ -

Private Sector Affiliated Institutions with Allocation of Seats (2020-21) Regular Categories Additional Categories Radio- Sr

Private Sector Affiliated Institutions with Allocation of Seats (2020-21) Regular Categories Additional Categories Radio- Sr. Operation graphy Public Anes- Name of Institute Dental Medical Ophth. Physio Dialysis Total No. Dispenser Theater & Health thesia Tech. Lab Tech. Tech. Tech. Tech. Tech. Imaging Tech. Tech. Tech. Fatima Memorial Hospital, 1 40 75 40 x 25 x 75 x 5 x Shadman, Lahore 260 Sharif Institute of Allied Health Sciences Sharif Medical & Dental 2 25 25 25 25 25 10 10 x 25 x College, Jati Umra, Raiwind Road, Lahore 170 Mansoorah Institute of Paramedical Sciences, Mansoorah 3 25 25 25 25 25 x x x 10 x Hospital, Near Multan Chungi, Multan Road, Lahore 135 Muhafazat Institute of Allied Health Medical Sciences, Lahore 4 (Amina Inayat Medical College), Faizpur Interchange, M-2, 25 25 50 25 25 x x x x x Motorway, Lahore 150 Ittefaq Paramedical Institute, Ittefaq Hospital (Trust), Model 5 x x 25 25 25 x x x 10 x Town, Lahore 85 Arif Memorial Paramedical College, 35 KM, Ferozpur Road, 6 50 x 25 25 x x x x x x Lahore 100 Central Park Medical College, Central Park Housing Scheme, 7 40 x 50 50 40 x 40 x x 10 Kahna, 31 KM Ferozpur Road, Lahore 230 Pakistan Society for the Rehabilitation of the Disabled, 111 - 8 x x 20 20 x x 20 x x x Ferozpur Road, Lahore 60 Surayya Azeem Institute of Allied Health Sciences, 5-Bahawalpur 9 75 x 25 25 25 x x x x x Road, Chowk Chouburji, Lahore 150 Abdul Waheed College of Allied Health Sciences, 10 25 25 25 25 25 10 25 x 10 x Bedian Road, Phase IX, DHA, Lahore 170 Lahore Institute of Technical Education (LITE), Near Dubai 11 75 x x x x x x x x x Chowk, Shalamar Link Road, Saddar, Lahore Cantt. -

Unit-1 Global Tourist Traffic Trends and Receipts Patterns Over the Years

International Tourism BTTM-203 UNIT-1 GLOBAL TOURIST TRAFFIC TRENDS AND RECEIPTS PATTERNS OVER THE YEARS Structure: 1.1 Objectives. 1.2 Introduction. 1.3 Tourist traffic trends over the years 1.3.1 Present Scenario 1.3.2 Regional Highlights 1.4 Tourism receipts over the years. 1.4.1 Present Scenario 1.5 Let Us Sum Up 1.6 Clues to Answers 1.7 References 1.1 OBJECTIVES: After reading this Unit you will be able to: • To understand the tourist arrivals patterns in past few years, • To know about the trends of tourist receipts in international tourism, • To understand the pattern of tourist arrivals all over the world • To know about the most visited countries. • To know about the top tourism receipts earners. 1.2 INTRODUCTION: Tourism has become a popular global leisure activity. In 2010, there were over 940 million international tourist arrivals, with a growth of 6.6% as compared to 2009. International tourism receipts grew to US$ 919 billion (euro 693 billion) in 2010, corresponding to an increase in real terms of 4.7% .The massive movement of tourists world over and the economic transformation that is taking place because of tourism are known features of tourism. However, the unimaginable growth of international tourism has also brought about rapid changes in terms of economic growth as well as decline. 1 International Tourism BTTM-203 In this Unit, we attempt to give an overview of the issues involved in tourism at a global level and the economic impacts that have been generated or felt as a result of it. -

Ayub Medical Complex Abbotabd Prof. Dr. Adil Nasir Khan Clinic

City Address Opp: WCH ZARBAT PLAZA GAMI ADDA, ABBATTABAD Aamir Plaza Opp: Ayub Medical Complex Abbotabd Abbattabad Prof. Dr. Adil Nasir Khan Clinic, Opp: Inor, Ayub Medical Complex Abbottabad Opp Shafiq Medical Plaza Near Mid City CNG Mandian Abbottabad Ahemdpur Aziz Plaza Opp. THQ, Ahemdpur Alipur Opp Govt Boys High School Multan Road Alipur. Arif Wala College Stop Qaboola Road Arif Wala. Shop No. 10 New Kashmir Market Near CMH Rawalakot, Azad Jammu and Kashmir Azad Jammu and Kashmir Farrukh Dental & Trauma Center, Bhimer Road, Azad Jammu Kashmir Super Shaheen Chemist Pharmacy Opp: DHQ Hospital, Kotli City, Azad Jammu Kashmir Bangla Road Haroonabad District Bahawalnagar Baldia Road City Chowk, Bahawalnagar Bahawalnagar Setlite Town Commercial Area Bahawalpur OPP: DHQ.Hospital DCO Office Road Bahawalnagar Opp: Bahawal Victoria Hospital, Circular Road, Bahawalpur Opp: Bahawal Victoria Hospital, Circular Road, Bahawalpur Club Road Allama Iqbal Park Chowk Hasilpur Bahawalpur Hospital Road, Opp: Main Gate Sheikh Zayad Hospital, Rahim Yar Khan OPP. CIVAL HOSPITAL BAHAWAL PUR. Sohail Infertility Treatment Center, Noor Mahal Road, Bahawalpur Bhakkar Opp: Ali Hospital, Near Piyala Chowk, Bhakkar Burewala Near T.H.Q Hospital Stadium Raod Bur-e-Wala Chakwal Opposite Degree College, Near Pakistan Carpet, Pindi Road, Chakwa Charsadda Opp: DHQ Hospital, Charsadda, KPK Chichawatni Block# 14, Girls College Road, Chichawatni Chiniot Jhang Road Near Cash and Cary Chiniot City. chishtian Bahawalnagar Road Opp: THQ Hospital Chishtian Dadu Noorani Chowk Near Passport Office Dadu Daska Civil Chowk, Opp: Emergency Gate Civil Hospital Daska Depalpur Syed Plaza Kasur Road, Depalpur District Okara Dera Ghazi Khan Shop No. 03 House No. 113, Block No. -

Appendix VII Bank Wise ATMS' Location

Appendix VII Bank Wise ATMS’ Location ABN Amro Bank NV (17) -Cavalary Ground Commercial Area -DHA L.C.C.H.S. -Kashmir Road Islamabad Main Branch -Opp FG College (2) -Liberty Market -Model Town Link Road Karachi (9) -PAF Base -Main Branch Abdulla Haroon Road (2) -Upper Mall -Shaheed-e-Millat -Wahdat Road -Gulshan-e-Iqbal University Road (2) -Park Towers Clifton (Off Site) (2) -National Stadium (Off Site) (2) Multan (2) -Cantt Aziz Road. Lahore (6) -Chowk Rasheed Abad -Main Branch Sharah-e-Quaid-e-Azam (2) -Cavalry Ground Branch Cantt. Nowshera Cavalry Road -Defence Branch -Gulberg Boulevard (Off Site) (2) Peshawar (2) -Hayatabad P.D.A Commercial Complex Allied Bank of Pakistan (45) -University Town Abbottabad Supply Bazar Quetta (2) -Jinnah Road Faisalabad (2) -Shahbaz Town -Peoples Colony-I -Sitara Tower -Bilal Chowk Rawalpindi (2) -Kashmir Road Gujranwala (2) -Satellite Town -Peoples Colony -Wapda Town Sialkot Cantt Wah Cantt Hyderabad Latifabad No.07 Askari Commercial Bank Ltd. (43) Islamabad (5) -Al-Babar Centre F-8 Abbottabad Lala Rukh Plaza -Blue Area Bahawalpur Noor Mahal Road -Civic Centre Melody Market -PAF Complex-E-9 Faisalabad (2) -Zaki Centre I-8 -Peoples Colony F.M. Plaza -University Road Karachi (13) -Bath Island (Off Site) Gujranwala G.T.Road -Buffer Zone Gujrat Hassan Plaza -DHA Khayaban-e-Badar -DHA Zamzama Islamabad (7) -Gulshan-e-Hadeed Phase-I -Al-Shifa International (Offsite) -Gulshan-e-Iqbal Regency Apartment -F-10 Markaz (2) -Hassan Chamber Clifton -F-7 Markaz -Khalid Bin Waleed -I-9 Industrial Area -M.A.H. Society Commercial Area -Islamabad Club -North Nazimabad Haidry Market -Jinnah Avenue Raseed Plaza -Shahrah-e-Faisal Amber Tower -Site Metrovile Jhelum Cantt Kohinoor Plaza -University Road Gulshan-e-Iqbal Lahore (10) Karachi (8) -Bahadarabad Branch -Allama Iqbal Town -DHA. -

Of 8 S# Branch Code Branch Name Branch Adress City/Town 71 165 Gilgit Branch Main Bazar Airport Road Gilgit Gilgit 72 731 Ranai Road, Chillas Shop No

S# Branch Code Branch Name Branch Adress City/Town 1 24 Abbottabad Branch Mansera Road Abbottabad Abbottabad 2 312 Sarwarabad, Abbottabad Sarwar Mall, Mansehra Road Abbottabad Abbottabad 3 345 Jinnahabad, Abbotabad PMA Link Road, Jinnahabad Abbottabad Abbottabad 4 721 Mansehra Road, Abbotabad Lodhi Golden Tower Supply Bazar Mansehra Road Abbottabad Abbottabad 5 721A PMA Kakul Abbottabad IJ-97, Near IJ Check Post, PMA Kakul, Abbottabad. Abbottabad 6 351 Ali Pur Chatha Near Madina Chowk, Ali Pur Chattha Ali Pur Chattha 7 266 Arifwala Plot # 48, A-Block, Outside Grain Market, Arifwala Arifwala 8 197 Attock City Branch Ahmad Plaza Opposite Railway Park Pleader Lane Attock City Attock 9 318 Khorwah, District Badin survey No 307 Main Road Khurwah District Badin Badin 10 383 Badyana Pasrur Road Badyana, District Sialkot. Badyana 11 298 Bagh, AJ&K Kashmir Palaza Hadari Chowk BAGH, Azad Kashmir BAGH AJK 12 201 Bahawalnagar Branch Grain Market Minchanabad Road Bahawalnagar Bahawalnagar 13 305 Haroonabad Plot No 41-C Ghalla Mandi, Haroonabad District Bahawalnagar Bahawalnagar 14 390 Grain Market, Model Town-B, Bahawalpur Plot No. 112/113-B, Model Town-B, Bahawalpur Bahawalpur 15 134 Channi Goth Bahawalpur Uch Road Channi Goth Tehsil Ahmed Pur East Bahawalpur 16 269 UCH Sharif, District Bahawalpur Building # 68-B, Ahmed Pur East Road, Uch Sharif, Distric Bahawalpur Bahawalpur 17 25 Noor Mahal Bahawalpur 1 - Noor Mahal Road Bahawalpur Bahawalpur 18 261 Bahawalpur Cantt Al-Mohafiz Shopping Complex, Pelican Road, Opposite CMH, Bahawalpur Cantt Bahawalpur 19 750 IBB Circular Rd Bhawalpur Khewat No 38 Ground & First floor Aziz House Rafique Sabir Building Circular Road Bahawalpur Bahawalpur 20 258A Bannu Cantt Shop No. -

Atms (Operational/Closed)

S. No. ATM ID Location ATM Address City Status 1 24 Abt Abbottabad Mansera Road Abbottabad Abbottabad Operational 2 312 Sarwar Mall Sarwar Mall, Mansehra Road Abbottabad Abbottabad Operational 3 345 Abt Jinnahabad PMA Link Road, Jinnahabad Abbottabad Abbottabad Operational 4 721 Ibb Abbottabad Lodhi Golden Tower Supply Bazar Mansehra Road Abbottabad Abbottabad Operational 5 1024 CMH Abbottabad Mansera Road Abbottabad Abbottabad Operational 6 1721 Abt Kakool 1 Abbottabad Kakool 1 Abbottabad Operational 7 2024 Amc Abbottabad Mansera Road Abbottabad Abbottabad Under Maintenance 8 2721 Abt Kakool 2 Abbottabad Kakool 2 Abbottabad Operational 9 3721 Ibb BRC Abbottabad Ibb BRC Abbottabad Abbottabad Operational 10 4721 Abt Kakool 3 Abbottabad Kakool 3 Abbottabad Operational 11 5721 Abbottabad Kakool 4 Abbottabad Kakool 4 Abbottabad Operational 12 6721 CSD SHOP PMA KAKUL CSD SHOP PMA KAKUL Abbottabad Operational 13 3024 FF CENTRE ABBOTTABAD FF CENTRE ABBOTTABAD Abbottabad Operational 14 131 Kam Kamra Cantonment Board Mini Plaza G. T. Road Kamra. Attock Operational 15 149 Pgh Pindi Ghaib Main Katcheri Road Pindi Gheb Attock Operational 16 197 Attock City Ahmad Plaza Opposite Railway Park Pleader Lane Attock City Attock Operational 17 252 Fateh Jang Main Rawalpindi Road, Fateh Jang Attock Operational 18 333 Khour POL Khour Company,Khour,Tehsil Pindi Gheb, District Attock Attock Operational 19 344 Hassanabdal Near Lari Adda, Hassanabdal, District Attock Attock Operational 20 1131 Kam Hazroo Kam Hazroo Attock Operational 21 1737 Ibb Hassan Abdal Ibb -

ICI PAKISTAN LIMITED Interim Dividend 78 (50%) List of Shareholders Whose CNIC Not Available with Company for the Year Ending June 30, 2015

ICI PAKISTAN LIMITED Interim Dividend 78 (50%) List of Shareholders whose CNIC not available with company for the year ending June 30, 2015 S.NO. FOLIO NAME ADDRESS Net Amount 1 47525 MS ARAMITA PRECY D'SOUZA C/O AFONSO CARVALHO 427 E MYRTLE CANTON ILL UNITED STATE OF AMERICA 61520 USA 1,648 2 53621 MR MAJID GANI 98, MITCHAM ROAD, LONDON SW 17 9NS, UNITED KINGDOM 3,107 3 87080 CITIBANK N.A. HONG KONG A/C THE PAKISTAN FUND C/O CITIBANK N.A.I I CHUNDRIGAR RD STATE LIFE BLDG NO. 1, P O BOX 4889 KARACHI 773 4 87092 W I CARR (FAR EAST) LTD C/O CITIBANK N.A. STATE LIFE BUILDING NO.1 P O BOX 4889, I I CHUNDRIGAR ROAD KARACHI 310 5 87147 BANKERS TRUST CO C/O STANDARD CHARTERED BANK P O BOX 4896 I I CHUNDRIGAR ROAD KARACHI 153 6 10 MR MOHAMMAD ABBAS C/O M/S GULNOOR TRADING CORPORATION SAIFEE MANZIL ALTAF HUSAIN ROAD KARACHI 64 7 13 SAHIBZADI GHULAM SADIQUAH ABBASI FLAT NO.F-1-G/1 BLOCK-3 THE MARINE BLESSINGS KHAYABAN-E-SAADI CLIFTON KARACHI 2,979 8 14 SAHIBZADI SHAFIQUAH ABBASI C/O BEGUM KHALIQUAH JATOI HOUSE NO.17, 18TH STREET KHAYABAN-E-JANBAZ, PHASE V DEFENCE OFFICERS HOUSING AUTHO KARACHI 892 9 19 MR ABDUL GHAFFAR ABDULLAH 20/4 BEHAR COLONY 2ND FLOOR ROOM NO 5 H ROAD AYESHA BAI MANZIL KARACHI 21 10 21 MR ABDUL RAZAK ABDULLA C/O MUHAMMAD HAJI GANI (PVT) LTD 20/13 NEWNAHM ROAD KARACHI 234 11 30 MR SUBHAN ABDULLA 82 OVERSEAS HOUSING SOCIETY BLOCK NO.7 & 8 KARACHI 183 12 50 MR MOHAMED ABUBAKER IQBAL MANZIL FLAT NO 9 CAMPBELL ROAD KARACHI 3,808 13 52 MST HANIFA HAJEE ADAM PLOT NO 10 IST FLOOR MEGHRAJ DUWARKADAS BUILDING OUTRAM ROAD NEAR PAKISTAN -

Role of Libraries & Information Centers in Promoting Culture and Architecture in Cholistan Desert, South Punjab Pakistan

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Library Philosophy and Practice (e-journal) Libraries at University of Nebraska-Lincoln October 2013 Role of Libraries & Information Centers in Promoting Culture and Architecture in Cholistan Desert, South Punjab Pakistan Rubina Bhatti Islamia University of Bahawalpur, [email protected] Mazhar Hayat Librarian, Govt. Post Graduate College for Women, TEVTA, Bahawalpur, [email protected] Sarwat Mukhtar Lecturer: Deptt. Library & Information Science, The Islamia University of Bahawalpur, [email protected] Follow this and additional works at: https://digitalcommons.unl.edu/libphilprac Part of the Library and Information Science Commons Bhatti, Rubina; Hayat, Mazhar; and Mukhtar, Sarwat, "Role of Libraries & Information Centers in Promoting Culture and Architecture in Cholistan Desert, South Punjab Pakistan" (2013). Library Philosophy and Practice (e-journal). 1002. https://digitalcommons.unl.edu/libphilprac/1002 Role of Libraries & Information Centers in Promoting Culture and Architecture in Cholistan Desert, South Punjab Pakistan Mazhar Hayat Dr. Rubina Bhatti Sarwat Mukhtar Abstract This study was conducted with purpose to explore the elapsed and hidden treasures of Cholistan dessert in South Punjab, Pakistan. It discusses the role of university libraries of South Punjab, museums, Pakistan National library, Pakistan Library Association and HEC, digitization centers and documentation centers. It suggests that grant must be provided for research activities in different aspects of Cholistani Culture including Tribal Folks, Art, Culture, loriyan and old songs. HEC and Punjab government should provide special funds to libraries to support endangered art and culture like Chunri, khusa, paintings, weaving, the famous puppet show of Cholistan, folk songs of Darawar and cultural theatre.