SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Maxtor External Hdd Software

Maxtor external hdd software This software contains the MacOS 9 driver for the Maxtor OneTouch external hard This software contains Retrospect Express HD for use with original Maxtor. Software & App Support Windows AutoRun icons for the Maxtor Basics Portable external drive. Identifying and troubleshooting hard drive noise issues. Get information about Seagate Software & Apps. Samsung Drive Manager · Sdrive · Media Sync software for Windows · Media Sync software for Mac OS. Windows Autorun icons for the Maxtor Basics Portable external drive. Serial Specific Identifying and troubleshooting hard drive noise issues · How to use Disk. Maxtor Hard Disk Drive Free Driver Download | Free Download Seagate Drive Drivers Download Removable Drive · Maxtor USB Drivers Download USB. Editors' Note: Clicking on the Download Now (Visit Site) button above will open a connection to a third-party site. cannot completely ensure the. Seagate Maxtor OneTouch III USB drivers are tiny programs that enable your External Hard Drive hardware to communicate with your operating system. Download the latest Seagate External Hard Drive device drivers (Official and Certified). Seagate External Hard Drive drivers updated daily. Download ad Size: MB. This hard disk recovery tool restores data from corrupted, formatted and inaccessible Note - If you want to get back files from Maxtor external hard drive, then. If your external hard drive is not working properly nor recognized in Windows 10 but was fine in the previous OS, then it's most likely because. Free data recovery software for Maxtor external hard disk drive data recovery after quick format. The Maxtor Manager software enables advanced features, such as backing up and Power on your Maxtor external hard drive and connect it to your computer. -

Proxy Notice

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF BROOKS AUTOMATION, INC. TO BE HELD ON JANUARY 18, 2011 The 2011 Annual Meeting of Stockholders of Brooks Automation, Inc. (“Brooks” or the “Company”) will be held on January 18, 2011 at 10:00 a.m., local time, at 15 Elizabeth Drive, Chelmsford, Massachusetts 01824 for the following purposes: 1. To elect nine directors to serve for the ensuing year and until their successors are duly elected. 2. To ratify the selection of PricewaterhouseCoopers LLP as our independent registered accounting firm for the 2011 fiscal year. 3. To transact any other matters which may properly come before the Annual Meeting or any adjourned session thereof. The Board of Directors has fixed November 30, 2010 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. All stockholders are cordially invited to attend the Annual Meeting. To ensure your representation at the Annual Meeting we urge you to complete a proxy telephonically, electronically or by mail, if you requested a proxy statement be mailed to you as described in the proxy statement. This year we will again take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders over the Internet. This so-called e-proxy process is becoming familiar to many investors and it can serve to expedite stockholders’ receipt of proxy materials, lower costs and diminish the environmental impact of our annual meeting. Stockholders who choose to receive e-proxy materials have been sent a notice with instructions as to how to access our proxy statement and annual report, as well as how to vote. -

D2 Blu-Ray 12X User Manual

LaCie d2 Blu-ray Drive Table of Contents User Manual page 1 Table of Contents 1. Introduction................................................................................................................. 4 1.1. Box Content ................................................................................................................................. 5 1.2. Minimum System Requirements ...................................................................................................... 6 1.2.1. For Burning/Mastering ...................................................................................................... 6 1.2.2. For HD Video* Playback .................................................................................................... 6 1.3. Views of the Drive ......................................................................................................................... 7 1.3.1. Front View ....................................................................................................................... 7 1.3.2. Rear View ........................................................................................................................ 7 1.4. 1.4. Cables and Connections ........................................................................................................ 8 1.4.1. Hi-Speed USB 2.0 ............................................................................................................ 8 1.4.2. FireWire 400................................................................................................................... -

How to Use This Manual Icons Used in This Manual

LaCie Big Disk USB 2.0 How To Use This Manual User’s Manual How To Use This Manual In the toolbar: Previous Page / Next Page Go to Previous View / Go to Next View Go to Contents Page / Go to Precautions Page On the page: Click on the text within the Contents page to jump to information on that topic. Printing: While optimized for onscreen viewing, the pages of this manual are formatted for printing on 8 1/2” x 11” and A4 sized paper, giving you the option to print the entire manual or just a specific page or section. To Exit: From the Menu bar at the top of your screen, select: File > Quit. Icons Used In This Manual Italicized paragraphs feature an icon describing the type of information being given. Important Info: This icon refers to an important step that must be followed. Tech Note: This icon refers to tips to help maximize performance. Caution! This icon indicates a potential hazard, and gives tips on how to avoid them. LaCie Big Disk USB 2.0 Table of Contents User’s Manual Table of Contents Foreword 4 Precautions 6 1. Introduction 7 1.1. What Your LaCie Drive Can Do 7 2. Your LaCie Drive 8 2.1. Minimum System Requirements 8 2.2. Package Contents And Views Of The Drive 9 2.2.1. Package Contents 9 2.2.2. Views Of The Drive 10 2.3. USB 12 3. Installing Your LaCie Drive 13 3.1. Connecting The Power Supply 14 3.2. Connecting The Interface Cable 15 3.2.1. -

Lacie D2 Thunderbolt 3 USB-C User Manual

LaCie d2 Thunderbolt 3 USB-C User Manual Model: Click here to access an up-to-date online version of this document. You will also find the most recent content as well as expandable illustrations, easier navigation, and search capability. Contents 1 .R .e .g .u . l.a .t o. r. y. .C . o. m. p. l.i a. n. c. e. .4 . .F .C .C . .D . e. c.l a. r. a. t.i o. .n . o. f. .C .o . n. f.o . r.m . .a .n .c .e . 4. .F .C .C . .C . l.a .s s. .A . .I n. f.o . r.m . .a .t i.o . n. 4. .F .C .C . .C . a. u. t.i o. .n . 4. .I m. .p . o. r. t.a .n .t . N. .o .t e. :. F. C. .C . R. .a .d .i a. t.i o. n. E. x. p. o. .s u. .r e. .S .t .a .t e. m. .e .n .t . 4. .I n. d. u. s. t.r .y . C. .a .n .a .d .a . .5 . .I m. .p . o. r. t.a .n .t . N. .o .t e. .f o. .r .m . .o .b . i.l e. d. e. v. i.c .e .u . s.e . .5 . .N . o. t.e . I.m . .p .o .r .t a. n. .t e. .p .o .u . r. l.' u. .t i.l i.s .a .t i.o .n . .d .e .d .i s. p. o. .s i.t .i f.s . m. .o . b. i.l e. -

Seagate Technology Plc

SEAGATE TECHNOLOGY PLC FORM 10-K (Annual Report) Filed 08/03/18 for the Period Ending 06/29/18 Telephone (353) (1) 234-3136 CIK 0001137789 Symbol STX SIC Code 3572 - Computer Storage Devices Industry Computer Hardware Sector Technology Fiscal Year 06/30 http://www.edgar-online.com © Copyright 2018, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 29, 2018 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-31560 SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY (Exact name of registrant as specified in its charter) Ireland 98-0648577 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 38/39 Fitzwilliam Square Dublin 2, Ireland (Address of principal executive offices) Registrant’s telephone number, including area code: (353) (1) 234-3136 Securities registered pursuant to Section 12 (b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Ordinary Shares, par value $0.00001 per share The NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Production Networks in Asia: a Case Study from the Hard Disk Drive

ADBI Working Paper Series Production Networks in Asia: A Case Study from the Hard Disk Drive Industry Daisuke Hiratsuka No. 301 July 2011 Asian Development Bank Institute Daisuke Hiratsuka is director-general of the Institute of Developing Economies, Japan External Trade Organization. This paper is the revised version of the paper presented at the ADBI-WIIW Conference, "Comparative Analysis of Production Networks in Asia and Europe", held in Vienna on 15–16 July 2010. The author would like to thank Dr. Nippon Poapongsakorn, president of the Thailand Development Research Institute, for his helpful comments on the previous version. The views expressed in this paper are the views of the authors and do not necessarily reflect the views or policies of ADBI, the Asian Development Bank (ADB), its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. ADBI encourages readers to post their comments on the main page for each working paper (given in the citation below). Some working papers may develop into other forms of publication. Suggested citation: Hiratsuka, D. 2011. Production Networks in Asia: A Case Study from the Hard Disk Drive Industry. ADBI Working Paper 301. -

Lacie Mobile Drive User Manual

LaCie Mobile Drive User Manual © 2019 Seagate Technology LLC. All rights reserved. Seagate, Seagate Technology, the Spiral logo, and LaCie logo are trademarks or registered trademarks of Seagate Technology LLC or one of its affiliated companies in the United States and/or other countries. All other trademarks or registered trademarks are the property of their respectiCvleic ko whenre tros .a Wccehses nan r eufpe-tror-indagt eto o ndlrinivee v ecraspioancity, one gigabyte, or GB, equals of this document. You will also find the most recent content as well as expandable illustrations, easier one billinoanvi gbatyiotne, san adn sdea rochn eca ptaebrilaitby.yte, or TB, equals one thousand billion bytes. Your computer’s operating system may use a different standard of measurement and report a lower capacity. In addition, some of the listed capacity is used for formatting and other functions and will not be available for data storage. Quantitative usage examples for various applications are for illustrative purposes. Actual quantities will vary based on various factors, including file size, file format, features, and application software. The export or re-export of hardware or software containing encryption may be regulated by the U.S. Department of Commerce, Bureau of Industry and Security (for more information, visit www.bis.doc.gov) and controlled for import and use outside of the U.S. Actual data rates may vary depending on operating environment and other factors. Complying with all applicable copyright laws is the responsibility of the user. All coded instruction and program statements contained herein is, and remains copyrighted works and confidential proprietary information of Seagate Technology LLC or its affiliates. -

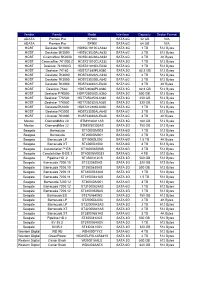

Vendor Family Model Interface Capacity Sector Format

Vendor Family Model Interface Capacity Sector Format ADATA Premier Pro SP600 SATA 6G 32 GB N/A ADATA Premier Pro SP900 SATA 6G 64 GB N/A HGST Deskstar 5K1000 HDS5C1010CLA382 SATA 3G 1 TB 512 Bytes HGST Deskstar 5K3000 HDS5C3020ALA632 SATA 6G 2 TB 512 Bytes HGST CinemaStar 5K2000 HCS5C2020ALA632 SATA 6G 2 TB 4K Bytes HGST CinemaStar 7K1000.C HCS721010CLA332 SATA 3G 1 TB 512 Bytes HGST Deskstar 7k1000.D HDS721010DLE630 SATA 6G 1 TB 512 Bytes HGST Deskstar 7K160 HDS721680PLA380 SATA 3G 82.3 GB 512 Bytes HGST Deskstar 7K2000 HDS722020ALA330 SATA 3G 2 TB 512 Bytes HGST Deskstar 7K3000 HDS723020BLA642 SATA 6G 2 TB 512 Bytes HGST Deskstar 7K4000 HDS724040ALE640 SATA 6G 4 TB 4K Bytes HGST Deskstar 7K80 HDS728080PLA380 SATA 3G 82.3 GB 512 Bytes HGST Deskstar P7K500 HDP725050GLA360 SATA 3G 500 GB 512 Bytes HGST Deskstar T7K500 HDT725025VLA380 SATA 3G 250 GB 512 Bytes HGST Deskstar T7K500 HDT725032VLA360 SATA 3G 320 GB 512 Bytes HGST Deskstar7K1000 HDS721010KLA330 SATA 3G 1 TB 512 Bytes HGST Deskstar7K3000 HDS723030ALA640 SATA 6G 3 TB 512 Bytes HGST Ultrastar 7K4000 HUS724040ALE640 SATA 6G 4 TB 4K Bytes Maxtor DiamondMax 20 STM3160811AS SATA 3G 160 GB 512 Bytes Maxtor DiamondMax 22 STM3750330AS SATA 3G 750 GB 512 Bytes Seagate Barracuda ST1000DM003 SATA 6G 1 TB 512 Bytes Seagate Barracuda ST2000DM001 SATA 6G 2 TB 512 Bytes Seagate Barracuda LP ST1500DL003 SATA 6G 1.5 TB 4K Bytes Seagate Barracuda XT ST4000DX000 SATA 6G 4 TB 512 Bytes Seagate Constellation™ ES ST33000650NS SATA 6G 3 TB 512 Bytes Seagate Constellation ® ES.3 ST4000NM0033 SATA 6G 4 -

EN362000 Zip SCSI Manual

Portable SCSI Drive Owner’s Manual • Installation Guide (Quick Start instructions in blue & bold) • User’s Guide (Includes Iomega software information) • Troubleshooting • How to Get Help http://www.iomega.com Table of Contents Installation Guide Installation on a Mac or Mac-Compatible ................................... 4 Installation on a PC ..................................................................... 12 User’s Guide Operating Your Zip® Drive .......................................................... 22 Zip® Tips ........................................................................................ 25 Iomega Software ......................................................................... 26 Using Zip® Disks ............................................................................ 29 Using Zip® Disks Cross-Platform .................................................. 32 Connecting Your Zip® Drive in a SCSI Chain .............................. 33 Troubleshooting Green activity light does not come on or disk won’t insert .... 35 Zip® drive not recognized (PC and Mac systems) ...................... 35 Computer does not start properly after installing Zip® drive .. 36 Zip® drive is assigned multiple drive letters .............................. 37 You want to use Windows 95/98 DOS mode with Zip® drive ... 37 You want to change the drive letter assigned to Zip® drive .... 38 Zip® drive transfer speed seems slow ......................................... 38 Data transfer problems or drive operation is erratic ............... 39 -

Lacie D2 Thunderbolt 2 | Usb 3.0 User Manual

LACIE D2 THUNDERBOLT 2 | USB 3.0 USER MANUAL Click here to access an up-to-date online version of this document. You will find the latest content as well as expandable illustrations, easier navigation, and search capability. LaCie d2 Thunderbolt 2 | USB 3.0 User Manual 1 INTRODUCTION Welcome to the User Manual for the LaCie d2 Thunderbolt™ 2. LaCie's Thunderbolt 2 storage enclosures feature transfer rates with the potential to reach up to 20Gb/s bi-directional. Connect the LaCie d2 to a computer that supports Thunderbolt 2 technology for the ultimate in performance with 4K video and graphics. The LaCie d2 is ideal for professional editors, photographers, and graphic artists that demand extraordinary performance both in the office and the field. The LaCie d2 also features a USB 3.0 port. Transfer rates can reach up to 5Gb/s when connected to a computer with a USB 3.0 port. Since it is backwards compatible, USB 3.0 gives you universal connectivity to any computer with a USB 2.0 port. This manual will guide you through the process of connecting your LaCie d2 and explain its features. For questions on installation or use, consult the Getting Help page. BOX CONTENT ■ LaCie d2 ■ Thunderbolt cable ■ USB 3.0 cable (USB 2.0 compatible) ■ External power supply ■ Quick Install Guide Important info: Save your packaging. In the event that the hard drive should need to be repaired or serviced, it must be returned in its original packaging. LaCie d2 Thunderbolt 2 | USB 3.0 User Manual 2 Software suite During installation, you have the option to install the following software utilities: ■ Intego® Backup Assistant (Mac®) ■ LaCie Genie® Timeline (Windows®) ■ LaCie Private-Public (protect data with AES 256-bit encryption) MINIMUM SYSTEM REQUIREMENTS Your system must meet certain requirements in order for your LaCie product to function properly. -

Printmgr File

August 31, 2020 Dear Fellow Shareholder: You are cordially invited to attend the 2020 Annual General Meeting of Shareholders of Seagate Technology plc, which will be held at 5:00 p.m. Irish Standard Time on Thursday, October 22, 2020, at 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. Due to public health concerns and continuing uncertainty in connection with COVID-19, this year we also are offering you the opportunity to virtually join the Annual General Meeting via live webcast over the Internet at 5:00 p.m. Irish Standard Time (12:00 p.m. Eastern Daylight Time). You may virtually join the Annual General Meeting and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/STX2020. In accordance with Irish law, we are required to have a principal meeting place, which is a physical location, where shareholders may attend the Annual General Meeting in person and vote. However, in light of public health concerns and travel recommendations and restrictions, we strongly advise shareholders not to attend in person at the principal meeting place, and ask that shareholders join the Annual General Meeting virtually instead. Shareholders joining virtually will not be able to vote at the meeting. Your vote is important. We encourage shareholders to cast their votes in advance of the Annual General Meeting, whether they plan to attend in person or join virtually. We continue to monitor COVID-19 developments and other circumstances. Should we determine that alternate Annual General Meeting arrangements may be advisable or required, such as changing the date, time or location of the Annual General Meeting, we will announce our decision by press release, post additional information at investors.seagate.com, and make a public filing with the U.S.