Alaska Air Group, Inc.; Rule 14A-8 No-Action Letter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Congressional Committees Roster

HOUSE AND SENATE COMMITTEE MEMBERSHIP Provided below are House and Senate Committee membership rosters with jurisdiction over health programs as of Friday, November 17, 2006. At the time of this printing, only the Senate Democrats have released their Committee assignments. Assignments for the House Committees will not take place until December when Congress reconvenes in the lame-duck session. However, most Members of Congress who were on the Committees before the election will continue to serve. Members whose names are crossed out will not be returning in the 110th Congress. Members whose names are underlined, indicates that they have been added to the Committee. Senate Appropriations Committee Majority Minority Robert C. Byrd, WV - Chair Thad Cochran, MS - Rnk. Mbr. Daniel K. Inouye, HI Ted Stevens, AK Patrick J. Leahy, VT Arlen Specter, PA Tom Harkin, IA Pete V. Domenici, NM Barbara A. Mikulski, MD Christopher S. Bond, MO Harry Reid, NV Mitch McConnell, KY Herbert H. Kohl, WI Conrad Burns, MT Patty Murray, WA Richard C. Shelby, AL Byron L. Dorgan, ND Judd Gregg, NH Dianne Feinstein, CA Robert F. Bennett, UT Richard J. Durbin, IL Larry Craig, ID Tim P. Johnson, SD Kay Bailey Hutchison, TX Mary L. Landrieu, LA Mike DeWine, OH Jack Reed, RI Sam Brownback, KS Frank Lautenberg NJ Wayne A. Allard, CO Ben Nelson, NE Senate Budget Committee Majority Minority Kent Conrad, ND - Chair Judd Gregg, NH - Rnk. Mbr. Paul S. Sarbanes, MD Pete V. Domenici, NM Patty Murray, WA Charles E. Grassley, IA Ron Wyden, OR Wayne A. Allard, CO Russ Feingold, WI Michael B. -

Congressional Record—House H1917

April 27, 2006 CONGRESSIONAL RECORD — HOUSE H1917 ADDITIONAL SPONSORS H.R. 3949: Mr. KLINE and Mr. ABERCROMBIE. H.R. 5015: Mr. UDALL of Colorado and Mr. H.R. 3964: Mr. FRANK of Massachusetts, Mr. GRIJALVA. Under clause 7 of rule XII, sponsors CASE, and Mr. HONDA. H.R. 5022: Ms. DEGETTE, Mrs. CAPPS, Mr. were added to public bills and resolu- H.R. 4005: Mr. STRICKLAND and Mr. UDALL EMANUEL, Mr. LARSEN of Washington, and tions as follows: of Colorado. Mr. AL GREEN of Texas. H.R. 34: Mr. OXLEY. H.R. 4033: Mr. CHABOT and Mr. H.R. 5037: Mr. CAMPBELL of California, Mr. H.R. 65: Mr. OXLEY, Mr. GERLACH, Mr. BLUMENAUER. PETERSON of Pennsylvania, Mr. GARY G. MIL- WOLF, and Mr. TAYLOR of North Carolina. H.R. 4082: Mr. HOLT. LER of California, Mr. TAYLOR of North Caro- H.R. 161: Mr. REYES and Mr. RANGEL. H.R. 4121: Mr. CARTER. lina, Mr. BACHUS, Mr. FOLEY, Mr. BACHUS, H.R. 226: Mr. WALSH. H.R. 4156: Mr. BECERRA. Mr. FOLEY, and Mr. OXLEY. H.R. 503: Mr. INGLIS of South Carolina and H.R. 4157: Miss MCMORRIS, Mr. CAMPBELL H.R. 5056: Mr. COLE of Oklahoma. Mr. BARRETT of South Carolina. of California, Mr. LUCAS, and Mr. COLE of H.R. 5058: Ms. SCHAKOWSKY and Mr. CON- H.R. 550: Ms. HARMAN. Oklahoma. YERS. H.R. 691: Mr. LEWIS of Kentucky. H.R. 4197: Mr. BERMAN. H.R. 5072: Mr. KING of Iowa, Mr. LATHAM, H.R. 699: Mr. MILLER of North Carolina, H.R. 4217: Mr. -

Congress of the United States Washington, DC 20515

Congress of the United States Washington, DC 20515 August 10, 2021 The Honorable Nancy Pelosi Speaker of the House U.S. House of Representatives Washington, D.C. 20515 Dear Speaker Pelosi: We applaud the work of the bipartisan group of Senators and the Biden Administration for reaching a final agreement on a Bipartisan Infrastructure Framework. This agreement, which is consistent with our proposal, has the support of the bipartisan Problem Solvers Caucus — 29 Democrats and 29 Republicans. It proves that Congress can work together, across the aisle in both chambers, to address our nation’s most pressing needs. As soon as the Senate completes its work, we must bring this bipartisan infrastructure bill to the House floor for a standalone vote. This once-in-a-century investment deserves its own consideration, without regard to other legislation. After years of waiting, we cannot afford unnecessary delays to finally deliver on a physical infrastructure package. It will create millions of good-paying jobs and boost economic growth, address lead in children’s drinking water, repair our crumbling bridges, tunnels, and railways, make investments in electric vehicles, and upgrade the nation’s power infrastructure to help deliver clean energy and resiliency. As we continue to recover from the pandemic, the American people are counting on us to drive real results for them in every single Congressional district. Separately, as we begin the reconciliation process, we have concerns about the specific components of that potential package. Before the House adopts a budget resolution, Members of Congress should be able to review a detailed scope of spending levels and revenue raisers. -

(Ftongresa Qf Lift Mmteii BC 20515

(ftongresa Qf lift Mmteii BC 20515 December 7,2006 The Honorable Sheila Bair Chairman Federal Deposit Insurance Corporation 550 17th Street, NW Washington, DC 20429 Dear Chairman Bair: We urge you to extend for at least an additional six months, the moratorium on deposit insurance applications for new industrial loan companies (ILCs) and on changes in control of ILCs by commercial firms, which is scheduled to expire on January 31, 2007. This extension is necessary to allow the 110th Congress, which will take office on January 3, 2007, an opportunity to act on this important public policy issue. An extension of the moratorium on applications by commercial firms will allow Congress to provide the FDIC with direction on the extent to which commercial firms should be allowed to enter the banking business through ownership of ELCs. Since it is applications for deposit insurance by commercial firms that raise the issue of the mixing of banking and commerce we urge that the moratorium be extended for those pending and future applications. Applications that involve ownership by financial firms do not raise these issues and we do not object to lifting the moratorium on those applications. As you know, Rep. Gillmor and Rep. Frank have introduced legislation this Congress, H.R. 5746, to address the issues raised by the rapid expansion of the ILC charter. We expect that similar legislation will be introduced early in the next Congress, and that it may be considered early in the session, but clearly there will not be time for the Congress to act before the current FDIC moratorium expires. -

2020: Alaska Air Group PAC Contributions

2020: Alaska Air Group PAC Contributions State District Candidate Committee or PAC Office Party Amount Airlines for America PAC $ 5,000 New Democrat Coalition D $ 1,500 AK Lisa Murkowski Denali PAC Federal Leadership PAC R $ 2,500 AK At-Large Don Young Alaskans for Don Young U.S. House R $ 7,000 AK Dan Sullivan Alaskans for Dan Sullivan U.S. Senate R $ 5,000 CA 3 John Garamendi Garamendi for Congress U.S. House D $ 1,000 CA 11 Mark DeSaulnier Mark DeSaulnier for Congress U.S. House D $ 1,000 CA 12 Nancy Pelosi Nancy Pelosi for Congress U.S. House D $ 2,500 CA 35 Norma Torres Norma Torres for Congress U.S. House D $ 1,000 CA 42 Ken Calvert Ken Calvert for Congress U.S. House R $ 1,000 CA 46 Lou Correa Lou Correa for Congress U.S. House D $ 1,000 HI 1 Ed Case Ed Case for Congress U.S. House D $ 1,000 ID Jim Risch Jim Risch for US Senate U.S. Senate R $ 2,000 ID Mike Simpson Simpson for Congress U.S. House R $ 1,000 KS 3 Sharice Davids Sharice for Congress U.S. House D $ 1,000 ME Susan Collins Collins for Senator U.S. Senate R $ 1,000 MO 6 Sam Graves Graves for Congress U.S. House R $ 3,500 MT Steve Daines Steve Daines for Montana U.S. Senate R $ 1,000 OR Ron Wyden Wyden for Senate U.S. Senate D $ 1,000 OR 1 Suzanne Bonamici Bonamici for Congress U.S. -

GUIDE to the 117Th CONGRESS

GUIDE TO THE 117th CONGRESS Table of Contents Health Professionals Serving in the 117th Congress ................................................................ 2 Congressional Schedule ......................................................................................................... 3 Office of Personnel Management (OPM) 2021 Federal Holidays ............................................. 4 Senate Balance of Power ....................................................................................................... 5 Senate Leadership ................................................................................................................. 6 Senate Committee Leadership ............................................................................................... 7 Senate Health-Related Committee Rosters ............................................................................. 8 House Balance of Power ...................................................................................................... 11 House Committee Leadership .............................................................................................. 12 House Leadership ................................................................................................................ 13 House Health-Related Committee Rosters ............................................................................ 14 Caucus Leadership and Membership .................................................................................... 18 New Members of the 117th -

United States Senate

F ORMER S TATE L EGISLATORS IN THE 11 7 TH C ONGRESS as of December 30, 2020 UNITED STATES SENATE Nebraska UNITED STATES HOUSE Connecticut Steve Scalise (R) Grace Meng (D) Tennessee Deb Fischer (R) OF REPRESENTATIVES Joe Courtney (D) Joe Morrelle (D) Tim Burchett (R) 45 Total John Larson (D) Maine Jerrold Nadler (D) Steve Cohen (D) New Hampshire 193 Total Jared Golden (D) Paul Tonko (D) Mark Green (R) 22 Republicans Jeanne Shaheen (D) Florida Chellie Pingree (D) Lee Zeldin (R) Margaret Wood Hassan (D) 95 Democrats Gus Bilirakis (R) Andrew Garbarino (R) Texas Charlie Crist (D) Maryland Kevin Brady (R) 23 Democrats (Includes one Delegate) Nicole Malliotakis (R) New Jersey Ted Deutch (D) Anthony Brown (D) Joaquin Castro (D) Robert Menendez (D) Mario Diaz-Balart (R) Andy Harris (R) Henry Cuellar (D) 96 Republicans Northern Mariana Islands Lois Frankel (D) Steny Hoyer (D) Lloyd Doggett (D) Alabama New York Matt Gaetz (R) Jamie Raskin (D) Gregorio C. Sablan (I) Sylvia Garcia (D) Richard Shelby (R) 1 Independent (Delegate) Charles Schumer (D) Al Lawson (D) Lance Gooden (R) William Posey (R) Massachusetts North Carolina Van Taylor (R) Alaska 1 New Progressive Party Deborah Ross (D) North Carolina (Resident Commissioner from Darren Soto (D) Katherine Clark (D) Marc Veasey (D) Lisa Murkowski (R) Thom Tillis (R) Debbie Wasserman-Schultz (D) Bill Keating (D) Dan Bishop (R) Randy Weber (R) Puerto Rico) Alma Adams (D) Greg Steube (R) Stephen Lynch (D) Pat Fallon (R) Arizona Ohio Daniel Webster (R) Virginia Foxx (R) Patrick McHenry (R) Krysten Sinema -

GUIDE to the 116Th CONGRESS

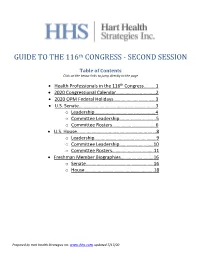

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

<!Tongre5'5' of Tbe Wntteb Tate5'

ED CASE COMMITTEE ON APPROPRIATIONS 1 ST DISTRICT, HAWArl SUBCOMMITTEES: MILITARY CONSTRUCTION, VETERANS AFFAIRS AND RELATED AGENCIES 2210 RAYBURN HOUSE OFFICE BUILDING WASHINGTON, DC 20515 COMMERCE, JUSTICE, SCIENCE AND TELEPHONE: 202-225-2726 <!tongre5'5'of tbe Wntteb �tate5' RELATED AGENCIES FAX: 202-225-0688 LEGISLATIVE 8AANCH 1003 BISHOP STREET, SUITE 1110 J!}ouseof l\epresentahbes COMMITTEE ON NATURAL RESOURCES HONOLULU, HI 96813 TELEPHONE: 808-650-6688 �a�btngton, ]B� SUBCOMMITTEES: FAX: 808-533-0133 20515-1101 NATIONAL PARKS, FORESTS AND PUBLIC LANDS WATER, OCEANS AND WILDLIFE WEBSITE: CASE.HOUSE.GOV INDIGENOUS PEOPLES OF THE UNITED STATES April 22, 2021 The Honorable Rosa DeLauro The Honorable Kay Granger Chair Ranking Member Committee on Appropriations Committee on Appropriations U.S. House of Representatives U.S. House of Representatives Washington, DC 20515 Washington, DC 20515 Dear Chair DeLauro and Ranking Member Granger: I am requesting fundingfor the Moku o Lo'e Marine Laboratory Refuge Eco-Friendly Sea Wall Research project in Fiscal Year 2022. The entity to receive funding forthis project is the Hawai'i Institute of Marine Biology located at 46-007 Lilipuna Road, Kane'ohe, HI 96744. Moku o Lo'e Marine Laboratory Refuge, home of the Hawai'i Institute of Marine Biology, is sufferingfr om major seawall failure throughout Moku o Lo'e (Coconut Island). The sea wall is over 80 years old and protects millions of dollars in infrastructure supporting cutting edge research focused on marine conservation. The fundingwo uld be used forthe design of a pilot investigation that examines the capacity of innovative blue-green design approaches to enhance native coral habitat and provide protection to critical coastal infrastructurein Hawai'i. -

State Delegations

STATE DELEGATIONS Number before names designates Congressional district. Senate Republicans in roman; Senate Democrats in italic; Senate Independents in SMALL CAPS; House Democrats in roman; House Republicans in italic; House Libertarians in SMALL CAPS; Resident Commissioner and Delegates in boldface. ALABAMA SENATORS 3. Mike Rogers Richard C. Shelby 4. Robert B. Aderholt Doug Jones 5. Mo Brooks REPRESENTATIVES 6. Gary J. Palmer [Democrat 1, Republicans 6] 7. Terri A. Sewell 1. Bradley Byrne 2. Martha Roby ALASKA SENATORS REPRESENTATIVE Lisa Murkowski [Republican 1] Dan Sullivan At Large – Don Young ARIZONA SENATORS 3. Rau´l M. Grijalva Kyrsten Sinema 4. Paul A. Gosar Martha McSally 5. Andy Biggs REPRESENTATIVES 6. David Schweikert [Democrats 5, Republicans 4] 7. Ruben Gallego 1. Tom O’Halleran 8. Debbie Lesko 2. Ann Kirkpatrick 9. Greg Stanton ARKANSAS SENATORS REPRESENTATIVES John Boozman [Republicans 4] Tom Cotton 1. Eric A. ‘‘Rick’’ Crawford 2. J. French Hill 3. Steve Womack 4. Bruce Westerman CALIFORNIA SENATORS 1. Doug LaMalfa Dianne Feinstein 2. Jared Huffman Kamala D. Harris 3. John Garamendi 4. Tom McClintock REPRESENTATIVES 5. Mike Thompson [Democrats 45, Republicans 7, 6. Doris O. Matsui Vacant 1] 7. Ami Bera 309 310 Congressional Directory 8. Paul Cook 31. Pete Aguilar 9. Jerry McNerney 32. Grace F. Napolitano 10. Josh Harder 33. Ted Lieu 11. Mark DeSaulnier 34. Jimmy Gomez 12. Nancy Pelosi 35. Norma J. Torres 13. Barbara Lee 36. Raul Ruiz 14. Jackie Speier 37. Karen Bass 15. Eric Swalwell 38. Linda T. Sa´nchez 16. Jim Costa 39. Gilbert Ray Cisneros, Jr. 17. Ro Khanna 40. Lucille Roybal-Allard 18. -

State Senator Kaiali'i Kahele Receives Endorsement From

FOR IMMEDIATE RELEASE Contact: Alan Tang, Olomana Loomis June 1, 2020 Mobile: (808) 261-8412 Email: [email protected] State Senator Kaiali‘i Kahele Receives Endorsement from Hawai‘i U.S. Senator Mazie Hirono for Congressional District 2 [HONOLULU] – State Senator Kaiali‘i Kahele today received the endorsement of Hawai‘i U.S. Senator Mazie Hirono in his bid to represent Congressional District 2. U.S. Senator Mazie Hirono said, “I support Democrat Kai Kahele for Congressional District 2. With his service in the Hawai‘i Air National Guard and the Hawai‘i State Legislature, Kai will bring with him a perspective and understanding of the critical needs of those who have served our country and of the priorities for our state. I look forward to working with him in Congress on education, health care and other critical issues as we face unprecedented challenges and look for ways to move our nation and our state forward.” Other prominent leaders who have also endorsed Kahele include: Hawai‘i senior U.S. Senator Brian Schatz; Hawai‘i U.S. Congressman Ed Case; former Hawaiʻi Governors John Waiheʻe, Ben Cayetano and Neil Abercrombie, who serve as Honorary Co-Chairs of the Kahele for Congress Campaign Committee; Hawai‘i State Senate President Ronald Kouchi; Hawai‘i State Senate Vice President Michelle Kidani; and former Lieutenant Governor and former Hawai‘i State Senate President Shan Tsutsui. Kahele currently serves as Majority Floor Leader and Chairman of the Committee on Water and Land in the Hawaiʻi State Senate, where he represents his hometown of Hilo. He announced his candidacy on Martin Luther King Jr. -

May 11, 2020 the Honorable Nancy Pelosi the Honorable Kevin

May 11, 2020 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker Minority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader McCarthy, We are writing in support of the calls for a $49.95 billion infusion of federal funding to state departments of Transportation (DOTs) in the next COVID-19 response legislation. Our transportation system is essential to America’s economic recovery, but it is facing an immediate need as the COVID-19 pandemic significantly impacts states’ transportation revenues. With negotiations for the next COVID-19 relief package underway, we write to convey our strong support that future legislation includes a provision to address the needs of highway and bridge projects. With millions of Americans following “stay-at-home” orders, many state governments are facing losses in revenues across the board. These State DOTs are not exempt from these losses but operate with unique funding circumstances by having their own revenue shortfalls. Projections are showing decreases in state motor fuel tax and toll receipts as vehicle traffic declines by 50 percent in most parts of the country due to work and travel restrictions. An estimated 30 percent average decline in state DOTs’ revenue is forecasted over the next 18 months. Some state DOTs could experience losses as high as 45 percent. Due to these grim realities, some states are unable to make contract commitments for basic operations such as salt and sand purchases for winter operations. Both short-term and long-term transportation projects that were previously set to move forward are being delayed, putting construction jobs at risk.