PRELIMINARY OFFICIAL STATEMENT DATED JULY 21,2014 Counsel Delivery of of Assuming on Or Able for Delivery on Or About August 13, 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE VILLAGE at FALLSWAY MULTIFAMILY DEVELOPMENT in an OPPORTUNITY ZONE BALTIMORE, MARYLAND the Village at Fallsway

THE VILLAGE AT FALLSWAY MULTIFAMILY DEVELOPMENT IN AN OPPORTUNITY ZONE BALTIMORE, MARYLAND The Village at Fallsway THIS CONFIDENTIAL OFFERING MEMORANDUM (“Offering Memorandum”) is being furnished to the recipient (the “Recipient”) solely for the Recipient’s own limited use in considering whether to provide financing for The Village at Fallsway located at 300-320 North Front Street, 300-312 North High Street, and 300 Fallsway, Baltimore, MD (the “Property”), on behalf of Airo Capital Management (the “Sponsor”). This confidential information does not purport to be all-inclusive nor does it purport to contain all the information that a prospective investor may desire. Neither Avison Young, the Sponsor nor any of their respective partners, managers, officers, employees or agents makes any representation, guarantee or warranty, expressed or implied, as to the accuracy or completeness of this Offering Memorandum or any of its contents and no legal liability is assumed or shall be implied with respect thereto. The Recipient agrees that: (a) the Offering Memorandum and its contents are confidential information, except for such information contained in the Offering Memorandum that is a matter of public record; (b) the Recipient and the Recipient’s employees, agents, and consultants (collectively, the “need to know parties”) will hold and treat the Offering Memorandum in the strictest of confidence, and the Recipient and the need to know parties will not, directly or indirectly, disclose or permit anyone else to disclose its contents to any other person, firm, or entity without the prior written authorization of the Sponsor; and, (c) the Recipient and the need to know parties will not use, or permit to be used, this Offering Memorandum or its contents in any fashion or manner detrimental to the interest of the Sponsor or for any purpose other than use in considering whether to invest into the Property. -

7522 · 00NGREBSIONAL Redoril-SENATE

7522 · 00NGREBSIONAL REDORil-SENATE. :UAY 24 ' ' 5738. Also .resolutions adopted by the Texa Chamberof Com PETITIONS AND MEMORIALS. merce, relative to section. 28· of tlie .Tones shipping bill·1 to the Committee on the Merchant Marine and· Fisheries.. Mr. LADD presented a resolution adopted' at the annual 57o9. By-Mr.. CULLEN: Resolution1adopted.by the American meeting of the Pennsylvania Branch, Women's International' Marine_ Association of· New- York City; indorsing Sooate bill, League for P-eace-·and Freedom, at Philadelphia; Pa., favo1·ing the prompt declaration of La _general amnesty · by the President 321.7 . a~d House bill 10644 and-urging their early passag~; to tb.e: of the United States, which· was referred· to the Committee on Committee on1the. Merchant Marine and1Fish&ies. the Judiciary; 5740J By· l\1~ CURRY: Resolution of thee-Henry w;: Lawton: Camn, United Spanish War- Veterans,. at. their; nineteenth. anT Mr. SHORTRIDGE' presented a memorial of•sundry citizens nual encampment, favoring the retention1a.nd developmentiof tbe of Oakland, Calif., remonstrating against the enactment' of leg M.ar.e Island Navy Yard; to the Committee on Naval Atfairs. islation providing for compulsory Sunday observance- in the 574-L By !lilr: KIESS :-Petition of: residents of, Millpe.rt, Pa:,, District of Columbia-,, which was· referred to the Committee on protesting against the passage of House,bills-.9753 and14388 and' the District· or COiumbia. ' He also presented resolutions· adopted by. the Santa Rosa Senate bi11 1 l948~ to the:Committoo on the District•. ot Columbia. 5742.. By;• Mr~ KISSEL: Petition of Naval1,Militia. New Y-.ork Chamber of Commerce, of Santa Rosa, Calif.,· protesting against City, N. -

Federal Register/Vol. 72, No. 174/Monday, September

51658 Federal Register / Vol. 72, No. 174 / Monday, September 10, 2007 / Notices would be constructed off-site and 1979 MPS) 940–1145 Center St.; 2–9th Ct. South Carolina W.; 4–10th Ave. N.; 2–4 10th Ct. N.; 16– convenient to the park and St. Charleston County Augustine’s Spanish Quarter. The 24 11th Ave. N.; 1–2 11th Ct. N., Birmingham, 07001027 Seashore Farmers’ Lodge No. 767, NE. corner authority for publishing this notice is 42 Jct. of Sol Legare & Old Sol Legare Rds., U.S.C. 4332(2)(C). Arkansas James Island, 07001043 DATES: The ROD was signed by the Washington County Marlboro County Regional Director, NPS, Southeast West Dickdon Street Commercial Historic Region, on June 11, 2007. Appin (Boundary Increase), US 15/401 W, District, Dickson St. between Arkansas approx. 1 mi. SW. of Bennettsville, ADDRESSES: Copies of the ROD are Ave. & St. Charles Ave. & West Ave. Bennettsville, 07001044 available from the Superintendent, between Dickson St. & Lafayette St., Castillo de San Marcos National Fayetteville, 07001028 Newberry County Monument, 1 South Castillo Drive, St. Florida Hope Rosenwald School, 1971 Hope Station Augustine, Florida 32084; telephone: Rd., Pomaria, 07001045 Duval County 904–829–6506. Tennessee Hutchinson—Suddath Building, (Downtown FOR FURTHER INFORMATION CONTACT: The Jacksonville MPS) 315–319 E. Bay St., Meigs County Superintendent, Castillo de San Marcos Jacksonville, 07001029 National Monument, at the address and Blythe Ferry (Boundary Increase), (Meigs Indiana County, Tennessee MRA) TN 60 at telephone number shown above or Tennessee R., Birchwood, 07001046 David Libman at 404–562–3124, Posey County Wisconsin extension 685. -

Jonestown Vision Plan November 2015

JONESTOWN VISION PLAN NOVEMBER 2015 JONESTOWN VISION PLAN BALTIMORE, MARYLAND NOVEMBER 24, 2015 Prepared for: Historic Jonestown, Inc. Jewish Museum of Maryland Prepared By: Mahan Rykiel Associates Arnett Muldrow Associates Table of Contents ix | Executive Summary 1 | Introduction 5 | Neighborhood Assessment 25 | Recommendations 81 | Implementation Plan Acknowledgements The McKim Center Patisserie Poupon Funding Provided By Jewish Museum of Maryland Councilwoman Rikki Spector Abell Foundation Councilman Carl Stokes France Merrick Foundation Delegate Peter A. Hammen Delegate Brooke Lierman Participant Organizations Baltimore Housing Jewish Museum of Maryland Housing Authority of Baltimore City (HABC) Historic Jonestown, Inc. Housing and Community Development (HCD) Jonestown Planning Council Baltimore City Department of Recreation and Parks Johns Hopkins University, Carey School of Business, (BCRP) CityLab Baltimore Development Corporation (BDC) Albermarle Square Tenant’s Association Department of Transportation (DOT) Albermarle Square Homeowner’s Association Parking Authority of Baltimore City (PABC) B’nai Israel Baltimore City Police Department (BCPD) Reginald F. Lewis Museum of Maryland African American History & Culture Ofce of Mayor Stephanie Rawlings-Blake Star-Spangled Banner House Baltimore City Department of Planning (DOP) Carroll Museums, Inc. Carrollton Inn/1840’s Ballroom St. Vincent De Paul Church Fairfeld Inn & Suites Helping Up Mission Commercial Development Group Lenny’s Deli Baltimore Heritage Attman’s Deli Baltimore National -

Baltimore Maryland

6 m; n GENERAL INDEX SANBORN MAPS BALTIMORE MARYLAND VOLUMES 1 TO 5, 5A AND 6 TO 11 INCLUSIVE PUBLISHED BY SANBORN MAP COMPANY NEW YORK 1945 VOLUME I Sheets 1 to 97 Inclusive VOLUME II Sheets 113 to 220 Inclusive VOLUME III Sheets 221 to 316 Inclusive VOLUME IV Sheets 317 to 418 Inclusive VOLUME V Sheets 501 to 584 Inclusive VOLUME VA Sheets 501A to 553A Inclusive VOLUME VI Sheets 601 to 699c Inclusive VOLUME VII Sheets 701 to 799G Inclusive WIT TTiv/np VTTT / 800 Series VOLUME VIII 11200 Serieg vnT TTMir TY / 9^0 Series VOLUME IX 11300 geries VOLUME X go Series VOLUME XI {1100 The intervening numbers between the various volumes are reserved for additional sheets that may be added from time to time. INCLUDED TOWNS, &c. VOL. VOL. BROOKLYN 5A MORRELL PARK 1 CANTON 5 MT. WASHINGTON 10 CURTIS BAY 5 & 5A MT. WINANS 1 EAST BROOKLYN 5 & 5A ORANGEVILLE 5 FAIRFIELD 5 & 5A RASPEBURG 11 GARDENVILLE 11 ROLAND PARK 10 HAMILTON 11 ST. HELENA 5 HIGHLANDTOWN 5 TEN HILLS 8 IRVINGTON 8 VIOLETVILLE 8 LAKELAND 1 WEST ARLINGTON 9 LAURAVILLE 11 WESTPORT 1 MASONVILLE 5 & 5A STREETS VOL. SHEET A Abbott, 1600-1661 3 266 " Court, 800-949 3 263 " _, 1000-1131 3 263A Abbottston, 1500-1575 7 719 1600-1779 7 715 Abell Ave., 3000-3246 6 *653 " 3001-3247 6 *654 « " 3300-3314 6 *655 « " 3301-3315 6 *656 Abington Ave., N., 1-60 8 1241 " S., 1-50 8 1241 Abraham, 3 263 Academy Alley, 500-617 2 127 Ave., 4100-4211 9 1386 Ackworth, „ 8 1204 8 1212 Acme Ave., 9 970 Ada Ave., - 7 724 Adam, Bee Adams. -

RPN Spring12

ROLAND PARK NEWS Tuxedo Pharmacy at 76: Prescription for Spring 2012 Neighborhood Pharmacy Has Not Expired Volume By Kathy Hudson “It cost $2,500, and I can tell you Dad Neighborhood pharmacies didn’t have it,” says Harold, the second Forty-Five once dotted the greater Davidov son. In 1942, Louis Davidov Roland Park area. University bought the pharmacy building, a shingled Parkway Pharmacy operated home with two apartments upstairs above This Issue’s at 100 West University the store. Highlights Parkway, where One World In a cloth-bound ledger that still sits on Café is today. Wagner & an office shelf, a normal day in those early Wagner operated on Cold years shows 13 prescriptions filled, each KidsView Spring Lane, inside the for about $1.50. double doors of today’s Page 6 Roland Park Bagel shop. “This was how you were supposed to make a living,” laughs Harold, who today Acorn Hill at Morgan & Millard’s Roland Park Pharmacy occupied the Robert E corner of the Roland Park Lee Park Shopping Center, where Page 10 Petit Louis is today. Tuxedo Pharmacy sat between the Word of Mouth Hat Rack and Graul’s (yes, Graul’s) in the Tuxedo Page 12 Park shopping center on Tour the Roland Avenue. Brothers Harold and Arnold Thanks to the Davidov Davidov have spent their Footpaths of lives at Tuxedo Pharmacy. family, dedicated owners Roland Park Photo: Ann Stuzin of Tuxedo Pharmacy for 76 Page 18 years, the prescription for a neighborhood drugstore has not expired. While Home Sales others are no longer, Tuxedo Pharmacy thrives Page 22 where it has always been on Roland Avenue. -

THE LENORE 114 East Lexington Street Baltimore, MD 21202

THE LENORE 114 East Lexington Street Baltimore, MD 21202 is a historic building in downtown Baltimore, originally designed in 1926 in the Second Renaissance Revival Style. The building was originally the Federal Reserve Bank of Richmond’s branch in Baltimore. The exterior features a rustic limestone facing, with carvings and arched windows on the first floor. The building contains 102 luxury apartments in addition to first-floor and lower retail spaces. OVER 6,00O JURORS are onsite every month, at the courthouse directly across the street. Circuit court, offers in tandem with area businesses, a juror lunch program,as well as discounts for parking, (ie. starbucks, quizno’s, b’more bistro, arrow parking & others) DOWNTOWN PARTNERSHIP Station North ontonUpton MAJOR MARKET anageent RATE APARTMENT torit PROJECTS: ondaries DowntownDOWNTOWN Baltimore BY & Adjacent THE NUMBERS Neighborhoods Bolton 11. 500 Park Ave Hill Visit GoDowntownBaltimore.com/work for a complete list of our data-driven publications including the 500 Park Avenue MAJOR MARKET-RATE 153 units, 2017 completion Economic Impact Report, Downtown Development Report, State of Downtown, and Housing Study. 12. Appraiser’s Building StAPARTMENTate PROJECTS 103 S. Gay Street Center 137 units, 2017 completion Johnston OVER 50 UNITSSquare 13. Banner Hill 611 S. Charles Street TENTH 349 units, 2018 completion TH $ Mount Vernon 10 LARGEST 14. 1305 Dock BILLION Heritage 2 Crossing 1305 Dock StreetNotable Residential Openings 103 Units, 2016 Completion DOWNTOWN 1.17retail spending 15. 414 Light Street IN THE Calvert St Old Town Seton 414 Light Street Project Name Address Project Type Housing Type # of Units Hill 11 394 units, 2018 completion COUNTRY 7 28 26 Preston Gardens Stadium Square/ 101 W. -

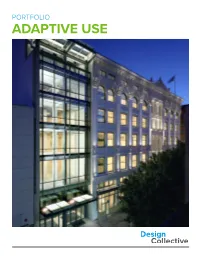

Adaptive Use Years40+ of Offering Innovative & Comprehensive Design Solutions

PORTFOLIO ADAPTIVE USE YEARS40+ OF OFFERING INNOVATIVE & COMPREHENSIVE DESIGN SOLUTIONS Founded in 1978, Design Collective is an OFFICE LOCATIONS 85+ person multi-disciplinary design firm Baltimore located in Baltimore, Maryland and Chicago, 601 East Pratt Street, Suite 300 Baltimore, Maryland 21202 Illinois. The firm’s diverse national practice 410.685.6655 includes a broad range of project types and design commissions in over 30 states, and Chicago international projects in Europe, Asia, South 9 W. Washington Street, 4th Floor America and Africa. Chicago, Ill 60602 312.625.4747 Design Collective offers expertise, leadership, and design innovation in the disciplines of WEBSITE planning, architecture, interiors, landscape www.designcollective.com architecture, and environmental graphics and SERVICES signage. For many of our clients, these design • Architecture disciplines coalesce to create imaginative, • Interiors realistic and seamlessly-integrated mixed- • Urban Design & Planning use planning and design solutions. Our more • Landscape Architecture than 350 awards for planning and design • Environmental Signage & Graphics excellence are a testament to our approach and the quality of our work. CORE COMPETENCIES • Mixed-Use Multi-Family • Higher Education Facilities • Student Housing & Student Life Facilities • Urban Design & Infill Development 85+ • Life Sciences & Research Facilities EMPLOYEES • Commercial Office & Workplace Environments 100% 50 EMPLOYEE OWNED LEED BUILDINGS 350+ REGISTERED IN DESIGN AWARDS 28 STATES 2 | | 3 RELEVANT PROJECTS GUINNESS OPEN GATE BREWERY 2019 ULI WAVEMAKER & BARREL HOUSE AWARD 2019 BALTIMORE DIAGEO - GUINNESS BUSINESS JOURNAL REAL ESTATE AWARDS, BEST RELAY, MARYLAND IN SHOW Design Collective was selected to work in tandem with Diageo, Guinness and their partners to design the new 60,000 SF Open Gate Brewery for Guinness in Relay, Maryland. -

View the Vertical File List

Maryland Historical Trust Library Vertical Files The vertical file collection at the Maryland Historical Trust library contain a wealth of information related to historic buildings and properties from across the state. These files include material which complements reports completed for the Maryland Inventory of Historic Properties and National Register of Historic Places, including architectural drawings, newspaper clippings from national, state, and local newspapers, photographs, notes, and ephemera. The vertical files can be viewed in the library, Tuesday through Thursday, by appointment. To schedule an appointment, researchers should contact Lara Westwood, librarian, at [email protected] or 410-697-9546. Please note that this list is incomplete and will be updated. For more information, please contact the librarian or visit the website. Annapolis – Anne Arundel County AA- Annapolis (Anne Arundel County) Development Impacts Annapolis, Md. AA- Annapolis (Anne Arundel County) Maps Annapolis, Md. AA-2046 Annapolis (Anne Arundel County) Annapolis Historic District Annapolis, Md. AA-2046 Annapolis (Anne Arundel County) Annapolis Historic District – Research Notes Annapolis, Md. AA- Annapolis (Anne Arundel County) Annapolis Emergency Hospital Association Annapolis, Md. AA-360 Annapolis (Anne Arundel County) Acton 1 Acton Place, Annapolis, Md. AA- Annapolis (Anne Arundel County) Acton Notes Annapolis, Md. AA- Annapolis (Anne Arundel County) Acton Place Spring House 11 Acton Place, Annapolis, Md. AA-393 Annapolis (Anne Arundel County) Adams-Kilty House 131 Charles Street, Annapolis, Md. AA- Annapolis (Anne Arundel County) Alleys Annapolis, Md. AA- Annapolis (Anne Arundel County) Annapolis Dock & Market Space Annapolis, Md. AA-1288 Annapolis (Anne Arundel County) Annapolis Elementary School 180 Green Street, Annapolis, Md. -

East Street School National Register Nomination, 5LA

United States Department of the Interior NATIONAL PARK SERVICE 2280 National Register of Historic Places 1201 "I" (Eye) Street, NW Washin gton D.C. 20005 The Director of the National Park Service is pleased to announce actions on the following properties for the National Register of Historic Places. For further information contact Edson Beall at (202) 354-2255 or E-mail: [email protected] Visit our web site at http://www.cr.nps.gov/nr WEEKLY LIST OF ACTIONS TAKEN ON PROPERTIES: 12/17/07 THROUGH 12/21/07 KEY: State, County, Property Name, Address/Boundary, City, Vicinity, Reference Number, NHL, Action, Date, Multiple Name CALIFORNIA, LOS ANGELES COUNTY Pisgah Home Historic District, 6026-6044 Echo St. & 6051 A-D Hayes St., Los Angeles, 07001304, LISTED, 12/19/07 COLORADO, LAS ANIMAS COUNTY East Street School, 206 East St., Trinidad, 07001277, LISTED, 12/19/07 INDIANA, ELKHART COUNTY Conn, Charles Gerard, Mansion, 723 Strong Ave., Elkhart, 07001278, LISTED, 12/19/07 INDIANA, HENDRICKS COUNTY Smith Farm, 2698 S Cty. Rd. 900 E., Plainfield vicinity, 07001279, LISTED, 12/19/07 INDIANA, JACKSON COUNTY Cavanaugh Bridge, .6 mi S of Cty. Rd. 700 S on Cty. Rd. 550 W over Muscatatuck R., Brownstown vicinity, 07001280, LISTED, 12/19/07 INDIANA, PORTER COUNTY Wolf, Josephus, House, 453 W 700 N., Valparaiso vicinity, 07001281, LISTED, 12/19/07 INDIANA, PULASKI COUNTY Pulaski County Courthouse, 112 E Main St., Winamac, 07001282, LISTED, 12/19/07 INDIANA, VERMILLION COUNTY Vermillion County Courthouse, 255 S Main St., Newport, 07001283, LISTED, 12/19/07 MARYLAND, BALTIMORE INDEPENDENT CITY Grief, L. -

Southeast Strategic Transportation Vision

Southeast Strategic Transportation Vision Southeast Strategic Transportation Vision Table of Contents I. EXECUTIVE SUMMARY .......................................................................................................................... 3 II. Study Area ............................................................................................................................................. 5 III. Previous Studies and Improvements ................................................................................................ 8 IV. 2007-2015 Infrastructure Investments ............................................................................................. 8 V. Economic Development Activity/ Land Use Forecasts (2015-2020) ..................................................... 9 VI. Existing Transportation Network .................................................................................................... 12 A. Walking and Biking Network ........................................................................................................... 12 B. Transit ............................................................................................................................................. 12 C. Roadway Network (Passenger Cars and Trucks) ................................................................................. 16 VII. Future Traffic Forecasts .................................................................................................................. 20 A. Trip Generation .............................................................................................................................. -

Federal Register/Vol. 72, No. 174/Monday

51658 Federal Register / Vol. 72, No. 174 / Monday, September 10, 2007 / Notices would be constructed off-site and 1979 MPS) 940–1145 Center St.; 2–9th Ct. South Carolina W.; 4–10th Ave. N.; 2–4 10th Ct. N.; 16– convenient to the park and St. Charleston County Augustine’s Spanish Quarter. The 24 11th Ave. N.; 1–2 11th Ct. N., Birmingham, 07001027 Seashore Farmers’ Lodge No. 767, NE. corner authority for publishing this notice is 42 Jct. of Sol Legare & Old Sol Legare Rds., U.S.C. 4332(2)(C). Arkansas James Island, 07001043 DATES: The ROD was signed by the Washington County Marlboro County Regional Director, NPS, Southeast West Dickdon Street Commercial Historic Region, on June 11, 2007. Appin (Boundary Increase), US 15/401 W, District, Dickson St. between Arkansas approx. 1 mi. SW. of Bennettsville, ADDRESSES: Copies of the ROD are Ave. & St. Charles Ave. & West Ave. Bennettsville, 07001044 available from the Superintendent, between Dickson St. & Lafayette St., Castillo de San Marcos National Fayetteville, 07001028 Newberry County Monument, 1 South Castillo Drive, St. Florida Hope Rosenwald School, 1971 Hope Station Augustine, Florida 32084; telephone: Rd., Pomaria, 07001045 Duval County 904–829–6506. Tennessee Hutchinson—Suddath Building, (Downtown FOR FURTHER INFORMATION CONTACT: The Jacksonville MPS) 315–319 E. Bay St., Meigs County Superintendent, Castillo de San Marcos Jacksonville, 07001029 National Monument, at the address and Blythe Ferry (Boundary Increase), (Meigs Indiana County, Tennessee MRA) TN 60 at telephone number shown above or Tennessee R., Birchwood, 07001046 David Libman at 404–562–3124, Posey County Wisconsin extension 685.