Energy Efficiency Practices in Various Sectors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coromandel International Limited Annual Report 2020-21 Corporate Overview Management Reports Financial Statements

Rising with Resilience Coromandel International Limited Annual Report 2020-21 Corporate Overview Management Reports Financial Statements WHAT INSIDE RISING WITH Corporate Overview RESILIENCE Rising With Resilience | 01 We are Coromandel | 02 Performance through the years | 08 As the world encountered the unprecedented health challenges Transforming to next gen agriculture company | 10 and economic slowdown due to the COVID 19 pandemic, We, at Coromandel, displayed exceptional resilience to swiftly A Spirited Performance | 12 transform ourselves and continue our growth trajectory. It is Managing Director’s Interactive Q&A | 15 this resilient nature of ours backed by our rich legacy and strong Board of Directors | 18 commitment that has enabled us to rise in these challenging times. Faster Adoption: Smart Crop Solutions | 22 Riding the Digital Wave: Reaching Customers | 24 We were quick to embrace technology to overcome the Nurturing Communities, Changing Lives | 30 resource limitations and drive the agenda of Smart Farming. Digital became our biggest enabler as we empowered our Awards and Recognitions | 33 people, processes and stakeholders, leading to improved overall Corporate Information | 34 performance. We continued to prioritize the safety and well-being of our Management Reports employees and operated with desired caution and compliance Management Discussion and Analysis | 35 during the pandemic year. This ensured safe work environment and continuance of our operations for most part of the year, Notice of the Annual General Meeting | 53 enabled availability of agri inputs and services to the farming Board’s Report | 66 community. Corporate Governance Report | 94 We rose to support our nearby communities and Government Business Responsibility Report | 115 agencies by assisting in the areas of COVID awareness & relief, health, education and community development. -

PRSI National Awards-2020 Winners

PRSI NATIONAL AWARDS- 2020 Results Public Relations Society of India www. prsi.org.in PRSI NATIONAL AWARDS - 2020 No of S No Category Name of Organization entries 1 First Prize HP Samachar Hindustan Petroleum Corporation Ltd – Mumbai House Journal (Hindi) Second Petroleum Swar Prize Bharat Petroleum Corporation Ltd – Mumbai Third Prize Prayas Numaligarh Refinery Limited – Guwahati 2 First Prize Sail News House Journal (English) Steel Authority of India - New Delhi First Prize Varta Garden Reach Shipbuilders & Engineers Ltd. Second HP News Prize Hindustan Petroleum Corporation Ltd – Mumbai Second Kribhco News Prize Kribhco, Noida Third Prize IndianOil News Indian Oil Corporation - Marketing Division HO,Mumbai 3 Newsletter (English) First Prize Heritage Institute of Technology / Kalyan Bharti Trust, kolkata Second Ordnance Factory Board (OFB), Prize Kolkata Third Prize Aditya Birla Fashion & Retail Limited - Bengaluru, Karnataka / Mumbai 4 Third Prize Indian Oil Corporation Ltd - Barauni Newsletter (Hindi) Refinery ,Barauni 5 First Prize NTPC Ltd - New Delhi Special/Prestige Publication Second Steel Authority of India - New Delhi Prize Third Prize Indian Oil Corporation - Marketing Division (HO), Mumbai 6 Coffee Table Book First Prize Indian Oil Corporation - Marketing Division (HO) Second Garden Reach Shipbuilders & Prize Engineers Ltd. Kolkata Third Prize AIRADS Ltd. Third Prize Ordnance Factory Board (OFB) Kolkata 7 Sustainable Development Report First Prize ITC Ltd – Kolkata Second Indian Oil Corporation Ltd - Prize Corporate Office, New -

Case Study on Vidhyaonline: a Digital Learning Platform for Enhancing

CASE STUDY ON VIDHYAONLINE: A DIGITAL LEARNING PLATFORM FOR ENHANCING SALESFORCE CAPABILITIES AT COROMANDEL CASE STUDY ON VIDHYAONLINE: A DIGITAL LEARNING PLATFORM FOR ENHANCING SALESFORCE CAPABILITIES AT COROMANDEL TABLE OF CONTENTS Executive Summary 3 Introduction 5 Coromandel International Limited – Business Partner Management Development Centre (MDC) – E-Learning Partner Murugappa Group Challenges 8 For Coromandel International Limited Current Methodology Used to Educate Fresh Field-Force For Learning and Development Team For MDC Commitment 14 From MDC on Digital Knowledge Management From Coromandel Leadership L&D Initiative 16 Groundwork for Digital Contents Process Flow for E-Learnings Under VidhyaOnline Initiative Pilot Study and Initial Challenges VidhyaOnline Race: Kindling Competitive Spirit Impact 22 Field-Force Talent Transition (User Acceptance) Knowledge Transfer to Farming Ecosystem Business Impact Reflections and Lessons 28 Appendices 31 Appendix A: Cost Savings Achieved Appendix B: Users Increase and So Does Usage Appendix C: Sample of Impact: Fertilizers and CPC Growth in Last 4 Years Appendix D: Some Screenshots of the Modules The Team 37 EXECUTIVE SUMMARY CASE STUDY ON VIDHYAONLINE: A DIGITAL LEARNING PLATFORM EXECUTIVE SUMMARY 4 FOR ENHANCING SALESFORCE CAPABILITIES AT COROMANDEL Executive Summary Over the years, agricultural development has significantly improved the crop productivity of the Indian farms. However, high input and intensive farming systems have put stress on the health of the natural resources. As a leading Agricultural solutions provider, we at Coromandel are combining local knowledge with new research and technologies to deliver Integrated Crop Management (ICM) solutions to improve farming practices. ICM is a holistic approach towards sustainable farming, offering long-term solutions in agriculture. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Update Sip Stocks

UPDATE SIP STOCKS Dear Investors, We have published two reports for SIP investments in October 2018 and January 2019. From the list of stocks given for SIP investments, we recommend an exit from ASHOKLEY and INDIGO. We are expecting the sluggish performance of Auto sector so we recommend exit from ASHOKLEY while INDIGO has depicted smart upside in the last few months so we feel it is time to book profits in the stock. Nifty has rallied from the low of 10004 to the high of 11572 which is more than 15% of the swift rally. For around 21-weeks Nifty rallied which is Fibonacci number and reversal form this can be possible. The elections are around the corner which will induce further volatility in the market. The long-term view is still bullish and in such a scenario, we recommend to continue with the SIP investments in suggested stocks for 6-12 months to reap the benefits. The SIP can be done as a basket investment with 10-14 stocks with a periodicity of a month or fortnight. For your reference, we are enclosing a list of SIP stocks with their VWAP monthly average. The data is based on the SIP investment date as 10th of every month (Nearest Trading day). (* indicates: e.g. If someone has started a SIP from October-2018 the average price of ABCPITAL SIP will be around 97.3 and so as for others). Please find the enclosed links for detail report published in October 2018 and January 2019. 1. https://bit.ly/2We3SPp 2. -

Market Masala… the Flavors That Influenced the Market This Week

Go India Advisors Weekly Newsletter Market Masala… The flavors that influenced the market this week Week 24/CY20: 6th – 12th June 2020 1 Headlines this week Go India Advisors Another Day, another Deal; Powell GDP statement; Court – interest(ed) or not Weekly Newsletter Supreme Court clarified on the case of interest charged during moratorium. The issue now is limited to interest on interest deferred during moratorium. This is significant less Jio announced 7th and 8th sale of it's equity, this time 1.16% for threatening than question of interest waiver all together. Rs5683cr to Abu Dhabi Investment Authority (ADIA) and Banking sector took a sigh of relief and so did Indian additional 0.93% to Silver Lake Partners for Rs4546cr. Totalling upto 21.06% stake for Rs97885cr. More deals in offing are market. TPG(US$1.5bn), Saudi Arabia's Public Investment Fund (PIF) (US$1.5bn). And some rumours about either Google or Microsoft coming in. US Fed in it MPC on Thursday was dovish as expected. However more than expected downbeat assessment of the economy proved little bit too much for the stock markets to handle. This triggered the worst falls in stock market since 16th March. 13-06-2020 2 Global Markets – risk off Go India Advisors US Fed downbeat assessment of the economy, too hot for market to handle Weekly Newsletter Returns % Data for year 2020; except as specified 13-06-2020 3 Indian market – rally takes a breather Go India Advisors Volatility is the name of the game Weekly Newsletter Indian Markets for Week Ending 12th June 2020 For more information: Click on the image. -

Coromandel International Limited

Coromandel International Limited International Coromandel PROSPEROUS FARMER, PROGRESSIVE INDIA. Providing Holistic Agri Solutions Addressing Farmer's Needs Annual Report 2016-17 Fertilisers l Crop Protection l Specialty Nutrients l Retail Coromandel International Limited, “Coromandel House”, 1-2-10, Sardar Patel Road, Secunderabad - 500 003, India. CIN: L24120TG1961PLC000892, Email: [email protected] Tel: +91 40 2784 2034 / 2784 7212, Fax: +91 40 2784 4117, Web: www.coromandel.biz Coromandel International Limited Annual Report 2016-17 Corporate Overview | Management Reports | Financial Statements PROSPEROUS FARMER, PROGRESSIVE INDIA. Farmers are the sentinels of food security for the entire We, at Coromandel, aim towards bringing prosperity to a nation. Hence, working towards well-being of our farmers farmer’s life by being his ‘Partner for Growth’. Our farming is equivalent to strengthening foundation of India’s solutions, spread across Seed to Harvesting operations, progress. The Green Revolution in India undertaken offers sustainable value, bringing yield and quality about half a century ago, focused primarily on raising improvements in a cost effective manner. We directly agricultural output and improving food security. However, or indirectly connect close to 2 Crore farmers annually, the farm income has not grown in proportion to increase deepening our relationships with farmers by empowering in output, creating income disparity between farm and them with high quality cropping solutions. non-farm segments. As per the NSSO estimates, around a fi fth of rural households engaged in agriculture as their To secure nation’s progress and improve livelihood major occupation earn below the poverty line, putting a opportunities of half a billion masses, Indian agriculture serious challenge in achieving sustainable and inclusive needs to transform. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

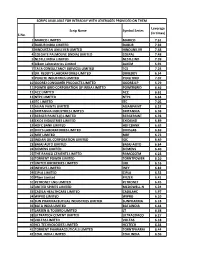

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

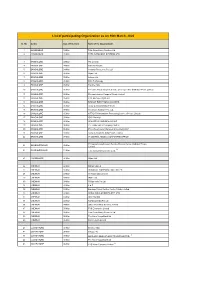

List of Participating Organization As on 16Th March, 2020

List of participating Organization as on 16th March, 2020 Sl. No Centre Date of Interview Name of the Organizations 1 AHMEDABAD 04-Mar Tata Consultancy Services Ltd. 2 AHMEDABAD 05-Mar TATA AUTOCOMP SYSTEMS LTD 3 BANGALORE 04-Mar ITC Limited 4 BANGALORE 04-Mar Bank Of Baroda 5 BANGALORE 04-Mar Vedanta Resources Pvt Ltd 6 BANGALORE 05-Mar Wipro Ltd. 7 BANGALORE 05-Mar Infosys Ltd. 8 BANGALORE 05-Mar DXC Technology 9 BANGALORE 05-Mar Deloitte India 10 BANGALORE 05-Mar PricewaterhouseCoopers Service Delivery Center (Kolkata) Private Limited 11 BANGALORE 05-Mar Pricewaterhouse Coopers Private Limited 12 BANGALORE 05-Mar Tata Advanced Systems 13 BANGALORE 05-Mar BHARAT ELECTRONICS LIMITED 14 BANGALORE 05-Mar Avery Dennison(India) Pvt Ltd 15 BANGALORE 05-Mar Accenture Solutions Pvt. Ltd. 16 BANGALORE 05-Mar NTT DATA Information Processing Services Private Limited 17 BANGALORE 05-Mar ICICI Bank ltd 18 BANGALORE 05-Mar WALKER CHANDIOK & CO LLP 19 BANGALORE 06-Mar The Indian Hotels Company Limited 20 BANGALORE 06-Mar Price Waterhouse Chartered Accountants LLP 21 BANGALORE 07-Mar Consero Solutions India Private Limited, 22 BANGALORE 07-Mar ITI LIMITED, REGD & CORPORATE OFFICE PricewaterhouseCoopers Service Delivery Center (Kolkata) Private 23 BHUBANESHWAR 30-Mar Limited 24 BHUBANESHWAR 31-Mar Tata Consultancy Services Ltd. * 25 CHANDIGARH 30-Mar Wipro Ltd. 26 CHENNAI 02-Mar ONGC Limited 27 CHENNAI 02-Mar INDIAN OIL CORPORATION LIMITED 28 CHENNAI 03-Mar Air Asia(India) Limited 29 CHENNAI 03-Mar Wipro Ltd. 30 CHENNAI 03-Mar Philips India Pvt Ltd 31 CHENNAI 03-Mar L & T 32 CHENNAI 03-Mar Barclays Global Service Centre Private Limited 33 CHENNAI 03-Mar SHELL INDIA MARKETS PVT. -

Mf Movers & Shakers

MF MOVERS & SHAKERS MARCH 2021 DART Research Tel: +91 22 40969700 E-mail: [email protected] April 12, 2021 April 12, 2021 2 Top Five Buys & Sells Top Ten MF's March 2021 3 Top Five Buys & Sells of Top MFs for the month of March 2021 No of Shares No of Shares Highest Increase in Exposure Names Bought in Highest Decrease in Exposure (by nos of shares) Bought in (by nos of shares) March 2021 March 2021 Bharat Petroleum Corporation 4,547,448 The Indian Hotels 9,826,101 Steel Authority Of India 1,995,000 Vedanta 2,988,456 Axis MF Torrent Power 1,889,278 Tata Motors 2,574,406 Suryoday Small Finance Bank 1,887,039 EPL 2,572,954 Mahindra & Mahindra Financial Services 1,644,663 Wipro 2,226,978 Bank Of Baroda 36,590,405 Vodafone Idea 21,490,000 Steel Authority Of India 9,632,297 Vedanta 7,799,200 Birla SL MF National Aluminium 7,524,001 GMR Infrastructure 4,837,500 IDFC First Bank 3,122,875 Ashok Leyland 4,252,923 State Bank Of India 2,870,884 Bharti Airtel 3,662,791 Motherson Sumi Systems 6,769,756 Vodafone Idea 8,750,000 GAIL 3,502,259 Oil & Natural Gas Corporation 8,463,632 DSP BR MF Welspun Corp 2,559,989 Vedanta 7,199,288 ITC 2,520,668 Hindalco Industries 2,468,290 Prism Johnson 2,389,002 ICICI Prudential Life Insurance 2,343,372 Max Healthcare Institute 21,422,593 Vodafone Idea 18,830,000 Indian Railway Finance Corporation 13,939,480 Siti Networks 17,967,767 HDFC MF Oil & Natural Gas Corporation 7,327,497 Power Grid Corporation Of India 13,081,255 Varroc Engineering 6,735,218 State Bank Of India 12,478,973 Bharti Airtel 5,846,094