Press Release Nayara Energy Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

APEG Summer Internship

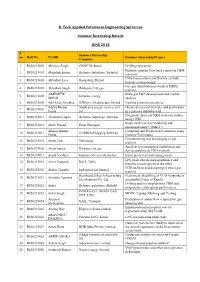

B. Tech Applied Petroleum Engineering Spl in Gas Summer Internship Details JUNE 2018 S Summer Internship no Roll No. NAME Summer Internship Project Company . 1 R820215002 Abhijeet Singh ONGC Mehsana Drillling operations Hydrulic propant flow back control in CBM 2 R820215003 Abhishek kumar Reliance Industries, Shahdol reservoir LNG transportaton and flexible custody 3 R820215005 Abhishek Leve Kongsberg Digital transfer system design City gas distribution network of MDPE 4 R820215007 Abhishek Singh Rudrapur City gas pipeline ABHISHEK Shale gas E&P development and market 5 R820215008 Infraline energy SINGH analysis 6 R820215009 Adil Khan Khokhar Offshore infrastructure limited Pipeline protection practices Aditya Kumar South asia energy services pvt. Chemical removal of scales and perforation 7 R820215010 Gupta ltd. in a pressure depleted well Diagnostic plots for CBM reservoir studies 8 R820215011 Akanksha Gupta Reliance Industries, Mumbai using OFM Single well reservoir modeling and 9 R820215012 Akriti Prasad Essar Durgapur simulation using COMET 3 Akshay Kumar Formation and Production Evaluation using 10 R820215013 Halliburton logging Services Gupta Logging Techniques Commisioning and discharging in gas 11 R820215015 Aman Jain Siti energy pipeline Analysis of transmission distribution and 12 R820215016 Aman kumar Haryana city gas service pipeline in CGD network 13 R820215017 Aman Vaidhya Institute of reservoir studies Concepts of reservoir management LPG plant design and maintenance and 14 R820215018 Amrit Pratyush IOCL, Delhi pipeline system design in the plant. CGD analysis and designing of sweet gas 15 R820215020 Aniket Tripathi Indrapasta gas limited pipeline Jharkhand Urban Infrastructure Planning & Modelling of CGD Networks in 16 R820215021 Anindya Apoorva Development Co. Ltd geographical area of Ranchi Drilling and its completion in CBM and 17 R820215022 Ankit Reliance industries, Shahdol progressive cavity pump performance INDIAN-OIL ADANI GAS 18 R820215023 Ankit Singh MDPE- Laying, Flushing and Testing. -

Nayara Energy Ltd Jmn5

CRZ Compliance Report Reference: Govt of India letter No: 16011/22/2000-IA-III, Dt. 03.11.2000 Period: March’18 to August’18 Compliance Status Report of CRZ Clearance for the period March 2018 to August 2018 Sr. No. Conditions Compliance Status Specific Conditions : 1. All the conditions stipulated by Forests and All conditions stipulated by the Department of Forests & Environment, GoG in their Environment department, GoG as contained in their letter no. FCA-1096-1663-K dated 16.10.1997 are complied with. Please refer detail letter No.ENV-1096-GOI-1421-PI dated.5.7.2000 while report in Annexure 1. according CRZ clearance and letter no. FCA-1096- Compliance Status w.r.t. Forest & Env department (GOG) letter no ENV-1096-GOI- 1663-K dated 16.10.1997 while granting permission 1421-PI dated 05.07.2000 is attached as Annexure 2. for Right of Way through Marine National Park (MNP) / Marine Sanctuary (MS) shall be effectively implemented. 2. All the conditions stipulated by the Forestry Wing of All conditions stipulated by the Forestry Wing of the Ministry of Environment & the Ministry of Environment & Forests while according Forests vide their letter no. 8C/12/385/96-FCW dated 8.12.1999 have been forestry clearance vide their letter no. 8C/12/385/96- implemented. Please refer Annexure 3. FCW dated 8.12.1999 shall be effectively implemented. 3. The project will be implemented in such a manner that The project was implemented under the advice of NIO to prevent damage to corals. there is minimum damage to corals. -

Nayara Energy Annual Report 2017-18

Nayara Energy Limited (Formerly known as Essar Oil Limited) Contents Corporate Overview Ushering in a New Era 01 We are Nayara Energy 02 Nayara Energy: The Brand 04 Year in Review 06 Message from the Chairman 08 From the CEO’s Desk 10 Corporate Information 13 Board of Directors 14 Management Committee 16 Reports Directors’ Report 17 Financial Statement Standalone Independent Auditor’s Report 49 Balance Sheet 56 Statement of Profit and Loss 57 Cash Flow Statement 58 Statement of Changes in Equity 60 Notes 62 Consolidated Independent Auditor’s Report 116 Balance Sheet 120 Statement of Profit and Loss 122 Cash Flow Statement 124 Statement of Changes in Equity 126 Notes 129 Form AOC-1 195 Notice AGM Notice 197 2 Annual Report 2017-18 Corporate Overview Reports Financial Statements Ushering in a New Era The world needs energy and more of it. As economies grow, the demand for energy keeps increasing at a rapid pace. At Nayara Energy, our pursuit of excellence continues as we usher in a new era with a new brand identity and vigour. In FY 2017-18, the Refinery processed crude higher than rated capacity with our SPM registering highest ever crude intake. Our High Speed Diesel (HSD) production surpassed our previous best. This has helped us enrich our product portfolio. We have also expanded the retail network further with over 1000 new outlets opened during the year. As we continue ushering into a new era, we have re-emphasised our focus on Health, Environment, and Safety (HSE) while looking at planning for fresh investments in new assets and good governance. -

India's Energy Future in a World of Change

India’s Energy Future in a World of Change 26-28 October 2020 India Energy Forum in Review Inaugural Address Inaugural Address and Ministerial Dialogue Hon. Shri Narendra Modi, Prime Minister, India H.R.H. Prince Abdulaziz bin Salman, Minister of Energy, Kingdom of Saudi Arabia Inaugural Address and Closing Remarks Inaugural Address and Ministerial Dialogue Hon. Shri Dharmendra Pradhan, Minister of Petroleum & Natural Gas Hon. Dan Brouillette, Secretary of Energy, and Minister of Steel, Government of India United States Department of Energy 1 Indian Ministerial Dialogue Indian Ministerial Dialogue Hon. Smt. Nirmala Sitharaman, Minister of Finance and Minister of Hon. Shri Piyush Goyal, Minister of Railways and Minister of Commerce & Corporate Affairs, Government of India Industry, Government of India Ministerial Dialogue New Map of Energy for India The Hydrogen Economy and Closing Remarks Shri Tarun Kapoor, Secretary, H.E. Mohammad Sanusi Barkindo, Secretary Dr. Rajiv Kumar, Vice Chairman, NITI Aayog, Ministry of Petroleum & Natural Gas, General, OPEC Government of India Government of India 2 Leadership Dialogue Leadership Dialogue Tengku Muhammad Taufik, President & Group Chief Executive, Bernard Looney, Group Chief Executive, bp p.l.c. PETRONAS Leadership Dialogue Future of Refining & Petrochemicals in a World of Surplus Patrick Pouyanné, Chairman & Chief Executive Officer, TOTAL S.A. S.M. Vaidya, Chairman, Indian Oil Corporation Ltd. 3 Technologies to Optimize Costs, Recovery & Emissions in the Upstream Judson Jacobs, Executive Shashi Shanker, Chairman & Director, Upstream Technology, Sunil Duggal, Group Chief Managing Director, Oil and Natural Lorenzo Simonelli, Chairman & IHS Markit Executive Officer, Vedanta Gas Corporation Ltd. (ONGC) CEO, Baker Hughes Growing Share of Gas in India’s Energy Mix: What is realistic? Ernie Thrasher, Chief Executive Michael Stoppard, Chief Meg Gentle, President & Chief Manoj Jain, Chairman & Officer & Chief Marketing Officer, Strategist, Global Gas, IHS Markit Executive Officer, Tellurian Inc. -

NAYARA ENERGY LIMITED Corporate Presentation

NAYARA ENERGY LIMITED Corporate Presentation September 2018 1 Legal Disclaimer NOT FOR PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES This presentation and the information contained herein are not an offer of the securities for sale in the United States and are not for publication or distribution to persons in the United States. The presentation is being made to you on the basis that you have confirmed you are not located or resident in the United States. No securities have been, nor will they be, registered under the US Securities Act of 1933 (the “US Securities Act”) or the securities laws of any state or other jurisdiction of the United States. No securities may be offered or sold in the United States unless those securities have been registered under the US Securities Act or are offered or sold pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the US Securities Act and applicable state securities laws. There will be no public offer of securities in the United States. THIS PRESENTATION DOES NOT CONSTITUTE OR FORM PART OF AN OFFER OR SOLICITATION OF AN OFFER TO PURCHASE OR SUBSCRIBE FOR ANY SECURITIES AND SHALL NOT FORM THE BASIS OF OR BE RELIED ON IN CONNECTION WITH ANY CONTRACT OR BINDING COMMITMENT WHATSOEVER. This presentation is confidential and has been prepared by Nayara Energy Limited (the “Company”) solely for information purposes. This presentation is the sole responsibility of the Company and has been prepared by the Company based on information and data which the Company considers reliable. -

Press Release Nayara Energy Limited

Press Release Nayara Energy Limited August 11, 2020 Ratings Facilities Amount Rating1 Rating Action (Rs. crore) Long term Bank Facilities – 12,956.14 CARE AA; Stable Term Loans/ECB/EPBG (Double A; Reaffirmed Long term Bank Facilities – 2,000.00 Outlook: Stable) Fund-based limits Short-term Bank Facilities – 2,250.00 Bill Discounting CARE A1+ Reaffirmed Short-term Bank Facilities – (A One Plus) 12,200.00 Non-fund based limits 29,406.14 (Rs. Twenty Nine thousand Four Total Facilities hundred Six crore and Fourteen lakh only) Provisional 267.00 CARE AA; Stable Non-Convertible Debentures (Rs. Two hundred and Sixty Seven crore Assigned (Provisional Double A; only) Outlook: Stable) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The rating assigned to the proposed NCD of Rs.267 crore is provisional and will be converted into a final rating post completion of merger of Vadinar Oil Terminal Limited (VOTL; rated CARE AA; Stable) with Nayara Energy Limited and receipt of documents related to the same. These NCDs will be issued to minority shareholders of VOTL as a consideration. The ratings assigned to the bank facilities and long-term debt instruments of Nayara Energy Limited (Nayara, formerly known as Essar Oil Limited) derives strengths from strong market position of its shareholders i.e. Rosneft Singapore Pte Limited, a subsidiary of Rosneft Oil Company and Kesani Enterprises Company Limited, a consortium comprising Trafigura and United Capital Partners (UCP) investment group, together having 49.13% shareholding -

Nayara Energy Annual Report 2016-17

Essar Oil Limited Annual Report 2016-17 Essar Oil Limited Contents Corporate Overview Reports Financial Statement Scaling New Heights 01 Directors’ Report 11 Standalone The World of Essar Oil 02 Independent Auditor’s Report 44 Snapshot of FY 2016-17 04 Balance Sheet 50 Message from the Former Chairman 06 Statement of Profit and Loss 51 Message from the Former Managing Cash Flow Statement 52 Director & CEO 08 Notes 55 Corporate Information 10 Consolidated Independent Auditor’s Report 123 Balance Sheet 128 Statement of Profit and Loss 129 Cash Flow Statement 130 Notes 133 Form AOC-1 206 Notice AGM Notice 208 2 Annual Report 2016-17 | Scaling New Heights Corporate Overview Reports Financial Statements Scaling New Heights Crude and product storage facility at the Refinery Keeping up with its tradition of setting new records, Essar Oil Given the Company’s commitment to superior performance, continued its streak of stellar performance for yet another year we have been regularly investing in the process and technology in FY 2016-17. The Company clocked its highest-ever crude improvement. Through a slew of proactive strategies, we have throughput of 20.94 MMT in FY 2016-17, while production of been able to achieve three-fold increase in sales of petcoke to HSD and MS also stood at its best 10,053 kT and 3,498 kT, small-scale customers. As a result of these efforts, our petcoke respectively. Essar Oil’s crude receipt through SPM also hit its sales grew by 11% in FY 2016-17 while sulphur sales grew by peak at 18.8 MMT for the first time in the Company’s history. -

Nayara Energy Limited

NAYARA ENERGY LIMITED Corporate Identity Number: U11100GJ1989PLC032116 Phone: 91 2833 661444, Fax: 91 2833 662929 Email: [email protected] NOTICE FOR THE 27 TH ANNUAL GENERAL MEETING NOTICE is hereby given that Twenty Seventh Annual General Meeting of the members of ESSAR OIL LIMITED will be held at the Registered 305, Gujarat on Thursday, September 28, 2017 at 11.00 a.m., to transact, the following business: ORDINARY BUSINESS “RESOLVED THAT pursuant to the provisions of Sections 149, 152, 161 and other applicable provisions of the Companies Act, 1. 2013 and the Rules framed thereunder (including any statutory together with the reports of Board of Directors and Auditors force) (“Act”), Mr. Chin Hwee Tan (DIN: 07703660), who was thereon. appointed by the Board of Directors as an Additional Director 2. To receive, consider and adopt the audited consolidated of the Company with e ect from August 19, 2017 pursuant to ended March 31, 2017 together with the report of Auditors the next Annual General Meeting and in respect of whom the thereon. Company has received a notice in writing from a member under 3. of Director, be and is hereby appointed as a Director of the Company liable to retire by rotation.” an Ordinary Resolution: 5. Appointment of Mr. Jonathan Kollek as Director of the “RESOLVED THAT pursuant to the provisions of Sections 139, Company 142 and other applicable provisions of the Companies Act, 2013 and Rules framed thereunder (including any statutory as an Ordinary Resolution: in force), and pursuant to the recommendations of the Audit “RESOLVED THAT pursuant to the provisions of Sections 149, Committee and the Board of Directors of the Company, M/s S. -

Registered Sulgas Delegate List

S. No. Name Designation Company City Country 1 Nitin Jain General Manager Adage Automation Pvt Ltd Goa IND 2 Nilesh Mistry Regional Manager - Sales Airoil Flaregas Pvt Ltd Mumbai IND 3 Christopher Sandall Manager Airoil Flaregas Pvt Ltd Mumbai IND 4 Anantha Kukkuvada National Sales & Service Manager Ametek Instruments India Pvt Ltd Bengaluru IND 5 Jochen Geiger Director Sales &Service EMEA - India Ametek Process Instruments Pittsburg USA 6 Ravindra Patil Deputy Manager Technical Amines & Plasticizers Limited Navi Mumbai IND 7 Michael Ku Application Engineer Applied Analytics Inc. Burlington USA 8 Amardeep Puri Deputy Country Sales Manager Axens India New Delhi IND 9 Sushant Aggarwal Senior Manager - Marketing and Sales BASF India Limited Navi Mumbai IND 10 Pallavi Panchal Sales Manager BASF India Limited Navi Mumbai IND 11 Manish Mehta Technology Manager BASF Middle East Dubai UAE 12 Anand Narayanan Head Marketing Batliboi Environmental Private Limited Mumbai IND 13 Marlene Vaz Marketing Manager BC Insight Ltd. London IND 14 Swapan Mitra Global Sales Manager Beltran Technologies Inc. New York USA 15 Rajesh Nandanwar Senior Manager (Tech Services) Bharat Oman Refineries Limited Bina IND 16 Sudeep Mukherjee Assistant Manager Bharat Oman Refineries Limited Bina IND 17 Abhishek Srivastava Manager Technical Services SRU Bharat Oman Refineries Limited Bina IND 18 Praveen Bisht Deputy Manager Operations SRU Bharat Oman Refineries Limited Bina IND 19 Vivek Sawant Chief Manager Ops (DHDS/DHT) Bharat Petroleum Corporation Ltd Mumbai IND 20 Sanjay -

Nayara Energy Joins Hands with INS Valsura for the Jamnagar Navy Half Marathon

Nayara Energy Joins Hands with INS Valsura for the Jamnagar Navy Half Marathon Participation from over 4000 people in various race categories December, 2nd 2019, Jamnagar: Nayara Energy, a leading integrated downstream company, has joined hands with INS Valsura as the Title Sponsors for the Jamnagar Navy Half Marathon to be held on Sunday, 8th December 2019. Over 4000+ enthusiastic participants are expected to participate in the races at the half marathon. There are 4 categories of races – Half Marathon, 10Km, 5Km and the 5Km fun run. Nayara Energy continues to engage with local communities in areas of health sanitation, education and environment sustainability. Considering Jamnagar is at the epicentre of Nayara Energy’s existence, the Jamnagar Navy Half Marathon is a great opportunity for the company to engage with the local communities as well as the navy who play a crucial role in guarding the coastal belt of the region. To participate in the Nayara Energy Jamnagar Navy Half Marathon, register online on https://www.jamnagarnavyhalfmarathon.com/ oooo About Nayara Energy: Nayara Energy is a new-age downstream company of international scale with strong presence across the hydrocarbon value chain from refining to retail. In August 2017, the company was acquired by international investors, Rosneft and an investment consortium comprising of global commodity trading firm, Trafigura and UCP Investment Group. The company owns and operates India’s second largest single site refinery at Vadinar, Gujarat with a current capacity of 20MMTPA. The refinery is one of the world’s most modern and complex refineries with a complexity of 11.8, which is amongst the highest globally. -

NAYARA ENERGY LIMITED Registered Office: Khambhalia, Post Box No

NAYARA ENERGY LIMITED Registered Office: Khambhalia, Post Box No. 24, District Devbhumi Dwarka, Gujarat 361305 Corporate Identity No. (CIN): U11100GJ1989PLC032116 Tel. No.: +91 2833 661444; Fax No.: +91 2833 662929 Email: [email protected]; Website: www.nayaraenergy.com POSTAL BALLOT NOTICE PURSUANT TO SECTION 110 OF THE COMPANIES ACT, 2013 READ WITH RULE 22 OF THE COMPANIES (MANAGEMENT AND ADMINISTRATION) RULES, 2014 To The Shareholder(s), NOTICE is hereby given to the shareholders (the “Shareholders/Members”) of Nayara Energy Limited (the “Company”), pursuant to Section 110 and other applicable provisions, if any, of the Companies Act, 2013 read with Rule 22 and other provisions of the Companies (Management and Administration) Rules, 2014 (the “Companies Act”) including any statutory modification(s) or re-enactment(s) thereof for the time being in force, that the resolutions appended below are proposed to be passed by way of Postal Ballot /remote e-voting process. The proposed resolutions, the explanatory statement thereto setting out the material facts and reasons thereof as required under Section 102 of the Companies Act, 2013 along with a Postal Ballot form and a self-addressed postage pre-paid envelope (if posted within India) are enclosed for your consideration. 1. Re-appointment of Mr. Charles Anthony Fountain as Executive Chairman of the Company To consider and, if thought fit, to pass the following resolution as a Special Resolution: “RESOLVED THAT pursuant to the provisions of Sections 196, 197, 198, 203, Schedule -

Press Release Nayara Energy Limited (Formerly Known As Essar Oil Limited)

Press Release Nayara Energy Limited (formerly known as Essar Oil Limited) July 25, 2018 Ratings Amount Facilities Rating1 Remarks (Rs. Crore) CARE AA; Stable Proposed Non-Convertible Debentures 3,000 Assigned (Double A; Outlook: Stable) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The rating assigned to NCD issue of Nayara Energy Limited (Nayara Energy, formerly known as Essar Oil Ltd) derives strengths from change in ownership of the company and strong market position of its shareholders i.e. PJSC Rosneft Oil Company (holding 49.13%) and investment consortium of Trafigura and United Capital Partners (UCP; combined holding 49.13%), in the industry and Nayara Energy’s strong operational profile being India’s second largest single location refinery, relatively higher Gross Refining Margins (GRM’s) than peers in the industry, continuous 100% refinery throughput and strategic location of its refinery along with captive port terminal and power plant albeit a single asset facility. The rating also positively factors in realization of funds given to erstwhile Essar group companies and subsequent settlement of past dues as per agreed payment schedule with NIOC and successful completion of refinancing process as per planned structure. The ratings also factors in adequate debt coverage metrics. However, the aforementioned rating strengths are partially tempered by its exposure to volatility of crude prices, crack spreads and foreign exchange rates, competitive industry scenario and government regulation risk in the Indian Oil & Gas segment. Any large debt funded capital expenditure adversely impacting financial risk profile and/or any substantial drop in GRM or PBILDT margin adversely impacting operational risk profile is the key rating sensitivity.