Financial Services Compensation Scheme – Information Sheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Friends of Halesworth County Library Minutes of Meeting of the Trustees

Friends of Halesworth County Library Minutes of meeting of the Trustees held on 29th October 2019 Present: Alison Britton (Chair), David Borer, Natalie Evans, Sheila Freeman, Nigel Frostick, Julie Gulliver, Evelyn Lindqvist, Irene Thomas Actions 1. Welcome & Apologies: Yvonne Sandison. Apologies 2. Minutes • Minutes of meeting held 17th September were read and approved. 3. Matters arising • Transportation – A response from Emma Healey is still awaited. Alison AB and not elsewhere attended the Halesworth Volunteer Centre AGM on 17th October but did not on agenda have a chance to speak with Emma. But co-operation with the Library was mentioned in the HVC future plans! • Alison will ask David Hopkins to investigate a new screen and projector as he AB has knowledge of the previous one. • Christmas Raffle Prizes – it was agreed that Trustees would contribute to the AB purchase of two “One4all” gift cards – one for £100 and one for £50. 4. Updates David Borer reported: Treasurer’s report • Receipts: Donations £439.79 inc. a £100 from the Woolnoughs which Alison has acknowledged. £422.05 Antique Street Market; Income from donated items £144.10; £15.26 interest on savings account. Total receipts: £1,333.01 • Outgoing Payments: £1,828.64 shelving; EPS Banner £75; ReadySpex re-stock £139.92; petty cash £71.99. Total £2,115.95 • Balances: Petty cash £164.84 Current account £9,080.80 Savings account £30,275.31 Current Total: £39,520.95 5. Sorting Friends Bank account signatories for the • It was decided that the treasurer is to be the HSBC main account holder. bank accounts Alison Britton to remain a signatory and two new signatories to be added: Julie Gulliver and Evelyn Lindqvist. -

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Retail Monitoring Survey 2015

Retail Monitoring Survey 2015 1 Retail Monitoring Survey 2015 Retail Monitoring Survey 2015 As part of the Council’s ongoing monitoring work, a Retail Monitoring Survey is undertaken. The survey covers retailing within town centres (AP56) and district centres (AP59) identified as such within the 2001 Local Plan policy1. Town Centre reports – May 2015 Aldeburgh Felixstowe Framlingham Leiston Saxmundham Woodbridge District Centre reports – May 2015 Cavendish Park, Felixstowe 1 Grange Farm, Kesgrave The Square, Martlesham Heath Walton High Street Wickham Market This information helps monitor the viability and vitality of existing retail centres and has helped inform changes to town and district centre boundaries. Additional data concerning retailing in the district can be found in the annually updated Authority Monitoring Report (AMR). 1 Sycamore Drive, Rendlesham not monitored. Retail Monitoring Survey 2015 TOWN CENTRES FELIXSTOWE TOWN CENTRE SHOPPING USES - May 2015 ADDRESS NO. NAME AREA (sq USE FORMER USE IF CHANGED WITHIN YEAR or IS VACANT m) CLASS HAMILTON Rd,East 2 Vacant 95 A1 Coes Menswear 4 Taxi office no sign on door or anything 18 SG Coastal Taxis 6 The Card Centre 67 A1 8 San Moi Oriental – Noodle Bar & Restaurant 104 A3 China Garden – chinese restaurant 10 Tony`s Star Nails – nail bar 88 A1 Vacant 12 The Thrifty Thistle 44 A1 Vacant 14 Hair Artistry 84 A1 Vogue Hair Company 16 Café on the Corner 126 A3 Vacant 18-20 Barclays bank 480 A2 2 22 Trinity Methodist Church 555 D1 24 Vacant 72 A2 Ashton K C J - solicitors 26 Madison -

IBS Annual Review 2018.Pdf

Established 1849 Includes summary financial statement for year ended 30 November 2018 growing closer One of the most significant events of the year was the introduction of the General Data Protection Regulation, a complex project which we worked efficiently and diligently to comply with. Membership and branches Chairman’s summary 4 As a mutual we place great importance on the 170 Years of “The Old Freehold” 5 satisfaction and support of our members and work All In 6 to meet their needs. Community matters 8 The demand for our face-to-face services saw us Savings & Mortgages 10 open new premises at a time when other financial Introducing our Board 12 service providers have closed branches. We are Summary Financial Statement 14 facing increasing demand for complementary Directors’ Remuneration Report 18 online services and are making good progress with this project which will remain a focus in the coming year. Supporting home ownership Looking back By employing an expert, manual approach to underwriting we understand the personal at 2018 circumstances behind each mortgage A welcome from Richard Norrington, application enabling us to be innovative with Chief Executive our mortgage lending. We introduced new products specifically designed With a backdrop of continuing economic for borrowers aged 50 plus, offering no maximum uncertainty, we began our financial year positively age restriction at the end of the mortgage deal. with a commitment to our face-to-face services, Borrowing in later life brings with it a set of unique opening two new premises in the existing branch needs as well as changing sources of income towns of Ipswich and Woodbridge. -

ANNUAL REPORT Year Ended 30 November 2020 Year Ended 30 November 2020

ANNUAL REPORT Year ended 30 November 2020 Year ended 30 November 2020 2 www.ibs.co.uk Contents 4 Chairman’s Report 6 Chief Executive’s Report 9 Directors’ Report 16 Corporate Governance Report 24 Directors’ Remuneration Report 26 Statement of Directors’ Responsibilities 27 Independent Auditor’s Report 32 Statement of Comprehensive Income 33 Statement of Financial Position 34 Statement of Changes in Members’ Interests 35 Statement of Cash Flows 36 Notes to the Accounts 68 Annual Business Statement 69 Information Relating to Directors 2020 3 Year ended 30 November 2020 Chairman’s Report Despite the impact of COVID-19 on all UK businesses Ipswich Against this backdrop the overall results of the business Building Society has remained firmly open for business. We also demonstrate our strengthened resilience. Highlights of the have seen continued growth in mortgages and improved our year were: capital position, whilst continuing to deliver exceptional service to • Strong targeted mortgage completions of £123m (2019: members thanks to outstanding levels of colleague engagement £115m). Our targeted approach delivered a strong net interest and maintaining our ongoing support to our communities. margin of 1.8% (2019: 1.8%) on a total book of £568m at year The year has clearly been dominated by the COVID-19 pandemic end (2019: £523m). which has brought concerns about health and wellbeing for many • Savings balances increased by £21m taking overall deposits to of our members as well as having a significant economic impact. a pleasing £624m (2019: £603m). The efforts to control the pandemic have been considerable and I would like to thank all key workers in the UK for everything they • Despite the pressures of the pandemic we recorded continued have done for us during this time; their spirit and hard work has supportive feedback from members, with the Society’s overall Net been inspirational. -

Finding the Sweet Spot: How Building Societies Need to Strike a Balance

BUILDING SOCIETIES RESEARCH REPORT FINDING THE SWEET SPOT: HOW BUILDING SOCIETIES NEED TO STRIKE A BALANCE. For professional use only 2 BUILDING SOCIETIES RESEARCH REPORT BUILDING SOCIETIES RESEARCH REPORT 3 EXECUTIVE SUMMARY For building societies, the rise of a week, and 84% use their building society’s website the digital banking environment Building societies remain “Building societies are at the heart at least once a month. heavily dependent on branches changes not just their strategy of their communities, but the way for product purchases. Most rate these services highly, with three quarters but also their fundamental their customers want to interact giving them a score of eight out of ten or more. going forward will change. Whilst nature. How do organisations Half (50%) of customers They’re also going to be increasingly important traditionally rooted in – opened their savings account branches have been at the core of revenue generators. and owned by – their local in branch against only 37% distribution, customers are telling using the building society’s us more and more that they want Insurance, among the most commoditized of financial communities fulfill their vision website. to buy their products and services services products, has long been the bread and butter in a society dominated by the online as well as through the of price comparison sites, for example. Yet at the Internet? 45% bought their mortgage in moment the branch is still the most common sales branch, against 19% online. branches.” channel for holders of life (47%), home (43%), critical Politicians, regulators, product Mark Holweger, Managing Director, illness (38%) and income protection (33%) insurance. -

IPSWICH SIPP CASH DEPOSIT Terms & Conditions

IPSWICH SIPP CASH DEPOSIT Terms & Conditions Summary Box When is interest paid? Key Product Information for our Savings Account Annual interest is payable on the 5 April and can be added to the account or paid to the main SIPP bank account. Interest is calculated on a daily basis from Account Name Ipswich SIPP Cash Deposit the date of investment up to the day before withdrawal. • Variable tiered interest rates (correct as at 20 February 2013) How do I close the account? Requests to close the account must be made in writing and in conjunction with £1,000 - £24,999 1.75% Gross/AER the rules of the scheme. Your funds will be sent by CHAPS to the main SIPP £25,000 - £49,999 2.15% Gross/AER bank account. The Society will not send your funds to any other account. Interest Rates (AER) £50,000 - £99,999 2.40% Gross/AER £100,000 - £249,999 2.55% Gross/AER Death of the scheme member £250,000 - £500,000 2.75% Gross/AER Following receipt of the appropriate proof of death, funds plus accrued interest will be sent by CHAPS to the main SIPP bank account. The Society will not • Interest is calculated on a daily basis send funds to any other account. No penalty is charged if the closure relates to • Annual interest on 5 April death of the scheme member. Tax Status Automatically eligible to receive gross interest Cancellation rights Conditions for Not applicable You have a 14 day period in which to reconsider your decision to invest into Bonus Payments this account. -

Review of the Year 2019 Including Summary Financial Statement for Year Ended 30 November 2019

Review of the Year 2019 Including summary financial statement for year ended 30 November 2019 1849 Ipswich and Suffolk Permanent Benefit Building Society and Ipswich and Suffolk Freehold Land Society established 1969 ‘Permanent Benefit’ cut from the name, resulting in Ipswich & Suffolk Building Society Took in Ipswich & District Building Society, resulting 1975 in Ipswich Building Society 2020 Turn to page 8 Suffolk Buildingto find Society? out more Savings and branches To satisfy the demand for our online service we have continued to work on this channel, which remains one of our primary focus areas for the coming year. Our bolstered IT team continues to ensure that our digital infrastructure is safe and secure and it is right that From the Chairman 4 we take the time to deliver the project correctly and Membership 5 thoroughly. Community Matters 6 We are increasingly aware of the importance of our Suffolk Building Society 8 physical branches not just to our members but to the Summary Financial Statement 10 wider communities we serve – in both Halesworth and Directors’ Remuneration Report 14 Aldeburgh we are now the last remaining financial services provider on the high street. Our Hadleigh branch, first opened in 1979, has been treated to a makeover fit for the 21st century and returned to its Looking back original ‘Suffolk Pink’ colouring. at 2019 To celebrate Suffolk Day this year, we launched a duo of savings accounts in support of the Rural Coffee A welcome from Richard Norrington, Chief Caravan, a local charity which focuses on tackling rural Executive isolation across our county. -

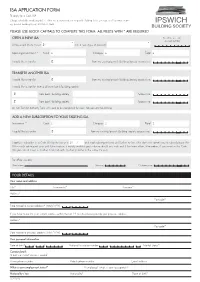

ISA APPLICATION FORM to Apply for a Cash ISA

ISA APPLICATION FORM To apply for a Cash ISA. Cheques should be made payable to either the account holder or to Ipswich Building Society in respect of ‘customer’s name’ eg: Ipswich Building Society IRO Mr. R. Smith. PLEASE USE BLOCK CAPITALS TO COMPLETE THIS FORM. ALL FIELDS WITH * ARE REQUIRED OPEN A NEW ISA For office use only: account number * * I/We would like to invest £ into a new (type of account) Opening investment * Cash £ Cheques £ Total £ I would like to transfer £ from my existing Ipswich Building Society account no. TRANSFER ANOTHER ISA I would like to transfer £ from my existing Ipswich Building Society account no. I would like to transfer from a different bank/building society £ from bank/building society Account no. £ from bank/building society Account no. An ISA Transfer Authority Form will need to be completed for each ISA you are transferring. ADD A NEW SUBSCRIPTION TO YOUR EXISTING ISA Investment * Cash £ Cheques £ Total £ I would like to transfer £ from my existing Ipswich Building Society account no: I apply to subscribe to a Cash ISA for the tax year 20 / and each subsequent year until further notice. (This does not commit you to subscribing to this ISA in each subsequent year until further notice; it merely enables you to do so should you wish and if the terms allow.) Remember, if you invest in this Cash ISA you cannot invest in another Cash ISA with another provider in the same tax year. For office use only: User name User no. Customer no. YOUR DETAILS Your name and address Title* Forename(s)* Surname* Address* -

Rpt MFI-EU Hard Copy Annual Publication

MFI ID NAME ADDRESS POSTAL CITY HEAD OFFICE RES* UNITED KINGDOM Central Banks GB0425 Bank of England Threadneedle Street EC2R 8AH London No Total number of Central Banks : 1 Credit Institutions GB0005 3i Group plc 91 Waterloo Road SE1 8XP London No GB0015 Abbey National plc Abbey National House, 2 Triton NW1 3AN London No Square, Regents Place GB0020 Abbey National Treasury Services plc Abbey National House, 2 Triton NW1 3AN London No Square, Regents Place GB0025 ABC International Bank 1-5 Moorgate EC2R 6AB London No GB0030 ABN Amro Bank NV 10th Floor, 250 Bishopsgate EC2M 4AA London NL ABN AMRO Bank N.V. No GB0032 ABN AMRO Mellon Global Securities Services Princess House, 1 Suffolk Lane EC4R 0AN London No BV GB0035 ABSA Bank Ltd 75 King William Street EC4N 7AB London No GB0040 Adam & Company plc 22 Charlotte Square EH2 4DF Edinburgh No GB2620 Ahli United Bank (UK) Ltd 7 Baker Street W1M 1AB London No GB0050 Airdrie Savings Bank 56 Stirling Street ML6 OAW Airdrie No GB1260 Alliance & Leicester Commercial Bank plc Building One, Narborough LE9 5XX Leicester No GB0060 Alliance and Leicester plc Building One, Floor 2, Carlton Park, LE10 0AL Leicester No Narborough GB0065 Alliance Trust Savings Ltd Meadow House, 64 Reform Street DD1 1TJ Dundee No GB0075 Allied Bank Philippines (UK) plc 114 Rochester Row SW1P 1JQ London No GB0087 Allied Irish Bank (GB) / First Trust Bank - AIB 51 Belmont Road, Uxbridge UB8 1SA Middlesex No Group (UK) plc GB0080 Allied Irish Banks plc 12 Old Jewry EC2R 8DP London IE Allied Irish Banks plc No GB0095 Alpha Bank AE 66 Cannon Street EC4N 6AE London GR Alpha Bank, S.A. -

Direct Debit Mandate

DD form A4_Layout 1 12/01/2011 08:19 Page 1 Instruction to your Bank or Building Society Originators Identification to pay Direct Debits 800176 Please fill in the relevant sections of this form and return completed to: Ipswich Building Society PO Box 547 Ipswich IP3 9WZ Name(s) of account holder(s) Reference Number (Ipswich Building Society main mortgage account number) For Ipswich Building Society Office Use Only Bank or Building Society account number Branch sort code Instruction to your Bank or Building Society Please pay Ipswich Building Society Direct Debits from the account detailed on this instruction subject to the safeguards assured by The Direct Debit Guarantee. Name and full postal address of your Bank I understand that this instruction may remain with Ipswich Building Society and, or Building Society Branch if so, details will be passed electronically to my Bank/Building Society. To: The Manager __________________________ Bank or Building Society Signature(s) Address _________________________________________________________ 1 ________________________________________________________ _________________________________________________________________ _________________________________________________________________ 2 ________________________________________________________ ________________________________ Postcode ________________________ Date Banks and Building Societies may not accept Direct Debit Instructions for some types of account STANDING ORDER CANCELLATION Name and full postal address of your Bank or Building Society Branch -

Saxmundham Town Council , Minutes of the Meeting of the Planning & Development Control Committee 6.00 PM 2Nd June 2021 in the Market Hall

Saxmundham Town Council , Minutes of the Meeting of the Planning & Development Control Committee 6.00 PM 2nd June 2021 in the Market Hall Councillors: Cllr. J. Fisher (Chair) Cllr. C. Hawkins Cllr. N. Hiley Also Present: J. Morcom (Assistant Town Clerk (ATC)) 22/21PD Apologies for absence None have been received. 23/21PD Pecuniary/Non-Pecuniary Interests Cllr Fisher and Cllr Hiley both declared a non-pecuniary interest in Item 5 as they are members of Ipswich Building Society. 24/21PD Minutes of the Previous Meeting held 19th May 2021 Amendments were made by hand to the title date on the minutes which was changed from 28th April 2021 to 19th May 2021, and to Item 20/21PD, DC/21/1722/LBC, in which ‘pain’ was amended to ‘paint’. It was then unanimously RESOLVED to approve the minutes of the meeting held on 19th May 2021. The minutes were signed. 25/21PD Open Forum No members of the public had joined the meeting. 26/21PD Planning Applications DC/21/2258/FUL: 84 Fairfield Road. Single storey flat roof extension to rear of property. It was unanimously RESOLVED that the Town Council had no objections to the application. DC/21/2491/LBC: Ipswich Building Society, 10 high St. Proposed replacement of brand signage to shop front and replacement of existing hanging sign and new branding. It was unanimously RESOLVED that the Town Council had no objections to the application. 27/21PD Recent Planning Decisions. – none to report. The next meeting of the Planning and Development Control Committee will be at 6pm on Wednesday 16th June 2021.