CNN LARRY KING LIVE Aired August 16, 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sunday Morning, March 6

SUNDAY MORNING, MARCH 6 FRO 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 COM Good Morning America (N) (cc) KATU News This Morning - Sun (cc) Paid NBA Countdown NBA Basketball Chicago Bulls at Miami Heat. (Live) (cc) 2/KATU 2 2 (Live) (cc) Paid Tails of Abbygail CBS News Sunday Morning (N) (cc) Face the Nation College Basketball Kentucky at Tennessee. (Live) (cc) College Basketball 6/KOIN 6 6 (N) (cc) Newschannel 8 at Sunrise at 6:00 Newschannel 8 at Sunrise at 7:00 AM (N) (cc) Meet the Press (N) (cc) NHL Hockey Philadelphia Flyers at New York Rangers. (Live) (cc) 8/KGW 8 8 AM (N) (cc) Betsy’s Kinder- Angelina Balle- Mister Rogers’ Curious George Thomas & Friends Bob the Builder Rick Steves’ Travels to the Nature Clash: Encounters of NOVA The Pluto Files. People’s 10/KOPB 10 10 garten rina: Next Neighborhood (TVY) (TVY) (TVY) Europe (TVG) Edge Bears and Wolves. (cc) (TVPG) opinions about Pluto. (TVPG) FOX News Sunday With Chris Wallace Good Day Oregon Sunday (N) Paid Memories of Me ★★ (‘88) Billy Crystal, Alan King. A young surgeon NASCAR Racing 12/KPTV 12 12 (cc) (TVPG) goes to L.A. to reconcile with his father. ‘PG-13’ (1:43) 5:00 Inspiration Ministry Camp- Turning Point Day of Discovery In Touch With Dr. Charles Stanley Paid Paid Paid Paid Paid Paid 22/KPXG 5 5 meeting (Cont’d) (cc) (TVG) (cc) (TVG) Spring Praise-A-Thon 24/KNMT 20 20 Paid Outlook Portland In Touch With Dr. -

Sunday Morning, May 19

SUNDAY MORNING, MAY 19 FRO 6:00 6:30 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 COM Good Morning America (N) (cc) KATU News This Morning - Sun (N) (cc) Your Voice, Your Paid This Week With George Stepha- Paid Paid 2/KATU 2 2 Vote nopoulos (N) (cc) (TVG) 5:30 Paid Paid CBS News Sunday Morning (N) (cc) Face the Nation (N) (cc) Busytown Mys- On the Money Paid Garden Time 6/KOIN 6 6 teries (TVY7) With Bartiromo NewsChannel 8 at Sunrise (N) (cc) NewsChannel 8 at Sunrise at 7:00 AM (N) (cc) Meet the Press (N) (cc) (TVG) Cycling Tour of California, Stage 8. (N) (Live) (cc) 8/KGW 8 8 Betsy’s Kinder- Angelina Balle- Mister Rogers’ Daniel Tiger’s Thomas & Friends Bob the Builder Rick Steves’ Travels to the Nature Zebra trek across the NOVA Analysis of the Neander- 10/KOPB 10 10 garten rina: Next Neighborhood Neighborhood (TVY) (TVY) Europe (TVG) Edge Makgadikgadi Pans. (TVPG) thal genome. (cc) (TVPG) FOX News Sunday With Chris Wallace Good Day Oregon Sunday (N) Paid Paid Paid Zoom ★ (‘06) Tim Allen, Courteney Cox Arquette. 12/KPTV 12 12 (cc) (TVPG) An ex-superhero mentors ragtag children. ‘PG’ Paid Paid David Jeremiah Day of Discovery In Touch With Dr. Charles Stanley Life Change Paid Paid Paid Paid Paid 22/KPXG 5 5 (cc) (TVG) (cc) (TVG) (cc) (TVG) Kingdom Con- David Jeremiah Praise W/Kenneth Winning Walk (cc) A Miracle For You Redemption (cc) Love Worth Find- In Touch (cc) PowerPoint With It Is Written (cc) Answers With Time for a 24/KNMT 20 20 nection (cc) Hagin (TVG) (cc) (TVG) ing (TVG) (TVPG) Jack Graham. -

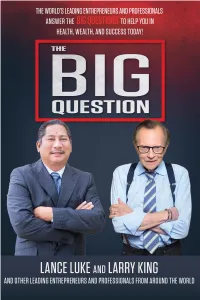

THE BIG QUESTION to Them

Copyright © 2018 CelebrityPress® LLC All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without prior written consent of the author, except as provided by the United States of America copyright law Published by CelebrityPress®, Orlando, FL. CelebrityPress® is a registered trademark. Printed in the United States of America. ISBN: 978-0-9991714-5-5 LCCN: 2018931599 This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional should be sought. The opinions expressed by the authors in this book are not endorsed by CelebrityPress® and are the sole responsibility of the author rendering the opinion. Most CelebrityPress® titles are available at special quantity discounts for bulk purchases for sales promotions, premiums, fundraising, and educational use. Special versions or book excerpts can also be created to fit specific needs. For more information, please write: CelebrityPress® 520 N. Orlando Ave, #2 Winter Park, FL 32789 or call 1.877.261.4930 Visit us online at: www.CelebrityPressPublishing.com CelebrityPress® Winter Park, Florida CONTENTS CHAPTER 1 QUESTIONS ARE MORE IMPORTANT THAN ANSWERS By Larry King .................................................................................... 13 CHAPTER 2 PUBLIC SPEAKING: HOW TO ACHIEVE MAXIMUM AUDIENCE ENGAGEMENT By Mohamed Isa .............................................................................. 23 CHAPTER 3 THE INTERVIEW THAT, SADLY, NEVER WAS By John Parks Trowbridge M.D., FACAM ..........................................31 CHAPTER 4 WHY DO THE BIG GET BIGGER? By Rebecca Crownover ...................................................................47 CHAPTER 5 THE KEYS TO SUCCESS By Patricia Delinois .......................................................................... -

Christmas Goes Global 25, 2016

T H U R S D A Y 162nd YEAR • No. 201 DECEMBER 22, 2016 CLEVELAND, TN 20 PAGES • 50¢ REMINDER County school board elections hit No. 8 CDB Sunday By CHRISTY ARMSTRONG current board Chairman Rodney Dillard, such large voting percentages. Banner Staff Writer who also won his unopposed re-election Upon learning of their wins, Lee point- edition set TOP 10 bid. ed out that all three of the new board As few things affect a school system “I look forward to a great year in the members have had ties to education in for delivery more than major changes on its board, Bradley County school system," Dillard the past. editors and staff writers of the Cleveland NEWSMAKERS said. "I'm so proud of our county schools Bryson is a retired educator best Daily Banner voted recent changes to the and believe we're going to have a great known for being a former principal of Oak on Saturday Bradley County Board of Education as year.” Grove Elementary School. Frazier also To allow our employees to the No. 8 Newsmaker for 2016. NO. 8 The three new challengers had won worked in local education, most notably Four new board members won their their seats with large margins over the serving as the superintendent of Bradley spend as much time as pos- bids for election Aug. 4, three new candi- sible with their families during incumbents. Casson won with 77.28 per- County Schools before retiring. Casson, dates and one who had been appointed to 7th District won over incumbent Charlie cent of the vote over incumbent Chris now a local business owner, has also the coming Christmas week- fill an unexpired term. -

Entertainment EXTRA! March 5 - 11, 2020 Has a New Home at the LINKS! 1361 S

$10 OFF $10 OFF WELLNESS MEMBERSHIP MICROCHIP New Clients Only All locations Must present coupon. Offers cannot be combined. Must present coupon. Offers cannot be combined. Expires 3/31/2020 Expires 3/31/2020 Free First Office Exams FREE EXAM Extended Hours Complete Physical Exam Included New Clients Only Multiple Locations Must present coupon. Offers cannot be combined. www.forevervets.com Expires 3/31/2020 4 x 2” ad Your Community Voice for 50 Years RecorPONTE VEDRA der entertainment EXTRA! March 5 - 11, 2020 has a new home at THE LINKS! 1361 S. 13th Ave., Ste. 140 Jacksonville Beach Offering: · Hydrafacials · RF Microneedling A rallies · Body Contouring · B12 Complex / around a friend and his loved ones Lipolean Injections Michael O’Neill, J. August Richards, Sarah Wayne Callies and Clive Standen (from left) Get Skinny with it! star in “Council of Dads,” premiering Tuesday on NBC. (904) 999-0977 1 x 5” ad www.SkinnyJax.com Now is a great time to It will provide your home: Kathleen Floryan List Your Home for Sale • Complimentary coverage while REALTOR® Broker Associate the home is listed • An edge in the local market LIST IT because buyers prefer to purchase a home that a seller stands behind • Reduced post-sale liability with WITH ME! ListSecure® I will provide you a FREE America’s Preferred 904-687-5146 Home Warranty for [email protected] your home when we put www.kathleenfloryan.com it on the market. 4 x 3” ad BY JAY BOBBIN NBC’s What’s Available NOW pulls together for an ill friend’s family Some friends promise to be there for for its first several weeks. -

Wesley Clark

, . __. .: ..D e = YW dm 4 Iv W -0 October 2 1, 2003 ._. .. w .. .. r Office of General Counsel Federal Election Commission 999 E Street, Northwest Washington, District of Columbia 20463 Re: Potential Federal Campaign Finance Law Violations by Presidential Candidate Wesley K. Clark, the University of Iowa, the University of Iowa College of Law, the University of Iowa Foundation, and the Richard S. Levitt Family Lecture Endowment Fund Federal Election Commission Office of General Counsel: The purpose of this letter is to report potential federal campaign finance law violations by Presidential Candidate Wesley K. Clark, the University of Iowa, the University of Iowa College of Law, the University of Iowa Foundation, and the Richard S. Levitt Family Lecture Endowment Fund regarding a paid public lecture by Presidential Candidate Clark at the University of Iowa on Friday, September 19,2003. BACKGROUND On September 17,2003, in Little Rock, Arkansas, retired United States Army General and former NATO commander Wesley K. Clark announced his candidacy for president of the United States. (See attached media stories.) Two days later, Clark delivered the University of Iowa College of Law’s 2003 Levitt Lecture (“Lecture”). (See attached University news releases.) University of Iowa College of Law Dean N. William Hines and Clark agreed in writing that the University of Iowa College of Law would pay Clark and his agent $30,000 plus travel expenses for two to deliver the Lecture. (See attached copy of contract.) Prior to announcing his candidacy, Clark served as an investment banker, a board member for several corporations, and a pundit on the cable network CNN. -

Ali Velshi on Target” a Nightly Prime-Time Show on Al Jazeera America That Spoke Truth to Power Through Debate, Interview and On-The-Ground Reporting

Ali Velshi Global Affairs & Economics Analyst Ali Velshi was most recently the host of “Ali Velshi On Target” a nightly prime-time show on Al Jazeera America that spoke truth to power through debate, interview and on-the-ground reporting. Velshi has reported from the U.S. Presidential campaign trail, as well as covering ISIL and the Syrian refugee crisis from Turkey, the days leading up to the nuclear deal from Tehran, the tensions between Russia and NATO from Eastern Europe and the High Arctic, the debt crisis in Greece, and the funeral of Nelson Mandela in South Africa. He was previously the host of “Third Rail” & “Real Money with Ali Velshi” on Al Jazeera America. Velshi joined Al Jazeera America as its first on-air hire from CNN, where he was the channel’s chief business correspondent, anchor of CNN International’s “World Business Today” and the host of CNN’s weekly business roundtable “Your Money”. Velshi also co-hosted CNN’s morning show, “American Morning” In 2010, Velshi was honored with a National Headliner Award for Business & Consumer Reporting for “How The Wheels Came Off,” a special on the near collapse of the American auto industry. Additionally, CNN was nominated for a 2010 Emmy for Velshi’s breaking news coverage of the attempted terror attack by Umar Farouq Abdulmuttalab on Northwest flight 253 into Detroit. Velshi has reported extensively on the global financial crisis; the struggles of Fannie Mae, Freddie Mac, AIG and Lehman Brothers; theU.S. government’s bailout plan; the battle over the fate of the American big three automakers; and the U.S. -

Best Betssunday

Page 6E ■ Sunday, February 16, 2014 Bismarck Tribune ■ Bismarcktribune.com SUNDAY DAYTIME FEBRUARY 16, 2014 Keke Palmer admits herself 9 AM 9:30 10 AM 10:30 11 AM 11:30 12 PM 12:30 1 PM 1:30 2 PM 2:30 KXMB (8:)S unday Face the Nation Farm Rep. Supercross AMA Basketball NCAA Wisconsin vs. Michigan (L) Golf PGA to Grey Sloan Memorial KNDX Fox News Sunday Sun. Mass Homes Paid Paid Auto Racing NASCAR Daytona 500 Site: Daytona International Speedway (L) KFYR Paid Homes Paid Paid Paid Paid Leverage Paid Paid Sochi 2014 KBMY Paid Paid Christian Worship Hour Messiah Lutheran Exploration Paid Storm Paid House Paid CATV Prophetic.. Bible Baptist Church New Song Church R. Lutheran Church Adventist Our Savior Lutheran Shepherd of Valley KBME Bali Thomas Speaks G. Gables Enertips E.Company Dragon Lead. Gen. Healthy K.Brown Lidia Cel. America TBS Get Smart ('08) Steve Carell. Drillbit Taylor ('08) Owen Wilson. Cop Out ('10) Tracy Morgan, Bruce Willis. WGN In the Heat of the Night In the Heat of the Night In the Heat of the Night In the Heat of the Night Funniest Home Videos Funniest Home Videos CW Paid Paid Animal Sci E. Stanton Live Life Hollywood Browns Browns The Good Student Sadler Colley Bakst. FAM Step Up 3 ('10) Sharni Vinson, Rick Malambri, Stick It ('06) Missy Peregrym, Jeff Bridges. A Cinderella Story ('04) Hilary Duff. CNN Fareed Zakaria GPS Reliable Sources State of the Union Fareed Zakaria GPS CNN Newsroom Your Money ESPN SportsCenter Basketball NCAA Kentucky vs. Tennessee (L) Bowling PBA ESPN2 Out. -

TV Talk Layout

ALL AMERICAN Artmywear CHINA “The New” GOLD HENNA GOLDEN FREE BUYERS TATTOOS BUFFET Restaurant & Martini Lounge Page 7 Page 12 Page 18 Amici’sPage 18 th Anniversary36 JAN.1976 JAN. 2012 A WEEKLY MAGAZINE Sept. 15-Sept. 21, 2012 Tel. 201-437-5677 Visit Us On The Web at www.TVTALKMAG.com Get $10 Worth of Dry Cleaning For 1st Time Customers See Pg. 13 For Details 1089 Ave. C (cor. of 53rd St.) Bayonne, NJ Call 201-339-7593 Story Pg. 11 Ad Pg. 13 Seven Forty Seven BAR & GRILL Kitchen is Now Open for the Season FREE APPETIZER With Any $20 Purchase • Offer Expires Sept. 30, 2012 747 Broadway (bet. 33rd & 34th Sts.) Bayonne, NJ Call 201-339-6747 ‘Boardwalk Empire’ TV blows it up for Season 3 PIPELINE By Kate O’Hare the first scene in the show. In that scene, CASHCASH FORFOR GOLD!GOLD! By Jay Bobbin On a recent Thursday night in the it’s written very well to show just how RECORD HIGH PRICES Q: I recently heard that the series “Alca- Greenpoint section of Brooklyn, N.Y., a easily that switch can just flip and how Must Bring This traz” had been canceled. Were the ratings huge fireball lit up the night sky. What- nuts this guy can be.” PAID FOR YOUR GOLD! Coupon For An that poor? — Marc Stromberg, DePere, ever else happens during Season 3 of If Cannavale is enjoying playing the Wis. HBO’s Prohibition-era drama “Board- character as written, Winter is equally YOU WILL BE AMAZED! Extra More A: Rather than defining them as “poor,” walk Empire,” which launches Sunday, enjoying putting something new on the 10% we’ll just say that they clearly weren’t up Sept. -

Dedication and Party Held at Smoky Gardens

The MIDWEEK Tuesday, June 29 Goodland Star-News 2021 1205MainAvenue,Goodland,KS67735•Phone(785)899-2338 $1 Volume 89, Number 51 8 Pages Goodland, Kansas 67735 upcoming event Peter Pan Jr. musical set for Friday A production of Peter Pan Jr. will be held at 7 p.m. Friday in Chambers Park. The musical is based on the classic Peter Pan tale. It is part of the 2021 Sum- mer Theater Festival put on by the Main Street Arts Council out of Hoxie. The festival is put on each sum- mer for area kids interested in drama performing. Other plays will be put on in Colby, Quinter, Hoxie and Atwood. Dedication and party Tickets are $15 for adults, $10 for kids ages 6-12 and free for kids 5 and under. Tickets can be purchased at http://www.mainstree- held at Smoky Gardens tartscouncil.com. It was a rainy start for the Shindig at the Smoky on Saturday, sponsored by Sher- man County Community Development, but the dedication ceremony got rolling weather with speakers including the county com- missioners, legislators and Kansas De- partment of Wildlife, Parks and Tourism report Secretary Brad Loveless. The speakers thanked everyone involved with the re- 69° cent improvements to the park and lake, 10:00 a.m. including state officials, the legislature, county workers, the former Smoky Board Monday and the Topliff family. The ceremony ended with a ribbon cutting. The weather Today improved for the party at Soldiers Memo- •Sunset,8:17p.m. rial Park, which lasted the rest of the day. -

ABSTRACT Chicken Noodle News: CNN and the Quest for Respect

ABSTRACT Chicken Noodle News: CNN and the Quest for Respect Katy McDowall Director: Sara Stone, Ph.D. This thesis, focusing on Cable News Network, studies how cable news has changed in the past 30 years. In its infancy, CNN was a pioneer. The network proved there was a place for 24-hour news and live story coverage. More than that, CNN showed that 24-hour- news could be done cheaper than most of the era’s major networks. But time has changed cable news. As a rule, it is shallower, more expensive and more political, and must adapt to changing technologies. This thesis discusses ways CNN can regain its place in the ratings against competitors like Fox News and MSNBC, while ultimately improving cable news by sticking to its original core value: the news comes first. To accomplish this, this thesis looks at CNN’s past and present, and, based upon real examples, makes projections about the network’s (and journalism’s) future. APPROVED BY DIRECTOR OF HONORS THESIS: __________________________________________ _ Dr. Sara Stone, Department of Journalism, Public Relations and New Media APPROVED BY THE HONORS PROGRAM: ___________________________________________ Dr. Andrew Wisely, Director DATE:__________________________ CHICKEN NOODLE NEWS: CNN AND THE QUEST FOR RESPECT A Thesis Submitted to the Faculty of Baylor University In Partial Fulfillment of the Requirements for the Honors Program By Katy McDowall Waco, Texas May 2012 TABLE OF CONTENTS ACKNOWLEDGEMENTS………………………………………………………………iv CHAPTER 1. INTRODUCTION………………………………………………………………...1 The Pre-CNN Television News World and the Big Three Ted Turner and His Plan The CNN Team A Television Newspaper: The Philosophies CNN Was Founded On From Now on and Forever: CNN Goes on the Air “Chicken Noodle News” Not So Chicken Noodle: CNN Stands its Ground The Big Three (Try To) Strike Back CNN at its Prime 2. -

7 Other CFP 11-6-09.Indd 1 11/6/09 12:48:11 PM

Colby Free Press Friday, November 6, 2009 Page 7 Scams a risk during Medicare open enrollment TOPEKA, — During the up- agents into your • No free lunches, either. Fed- proved Medicare plan. All ap- portant topic in today’s society, coming open-enrollment period Sandy home. Also, Medi- eral regulations prohibit offers of proved plans are available at www. consumers have to arm them- for Medicare Part D and Medicare care has no official free meals for listening to a sales medicare.gov under “Plan Finder” selves with all the information Advantage plans, I urge Kansas Praeger sales representatives. presentation or for signing up for or by calling (800) MEDICARE, they can. Being a savvy Medicare Medicare beneficiaries to be alert Beware of any sales- a particular plan. or (800) 633-4227. beneficiary or family member of to any potential scams surround- • Kansas Ins. person who says that • Do not give out personal in- • Read and understand the a beneficiary helps all of us fight ing sign-up activity. Commissioner he/she is a Medicare formation, such as Social Security plan. Be sure that the chosen plan fraudulent activities. Unfortunately, not everyone representative. numbers, bank account numbers matches the beneficiary’s needs Kansas Medicare consum- who contacts Medicare-age Kan- • Check with us or credit card numbers to anyone and that the beneficiary can con- ers can contact our department’s sans about switching to a Medi- The open-enrollment period for at the Kansas Insur- not verified as a licensed agent. tinue to see his or her current Consumer Assistance Division for care drug plan has the best inten- Medicare Prescription Drug Plan ance Department to make sure the Salespeople are not allowed to health care providers if desired.