View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FINAL WEEK Save ^50 Htsicusswith Red Jets Firing

. Ill L . I I " ■ . ■ ■.'■'i'-','’'-■; ■ 'll . I TUESDAY, APRIL 6, 1968 The Weathw FACB 8IXTECT Averafs T h S j Net Prsaa Ron Fareeaat a# O. S. WBidlll Bar Ike Week EadeS Aptii s, issa Oeattag Sanight. law be rapraaanted would lOaa Deborah A. Bates Of 23 enter Uito an agreemeiU FOR About Town Tanner Bt. and Mias Kathleen Refuse Group Manchester, but that the bill 14,125 C. Vennart of 70 Weaver Rd. was being submitted to MtnSwr o f «he A«6tt were honored at a tea Thursday antes a district. If the NRDD Cosmetics Baieau a t CXreulndoe 0lanl«y Circle of South MeOi* at Southern Connecticut State Sets Meeting failed for lack of enabling legis College. The committee for the Church wW sponeor a rum- lation. ‘ IT'S MW niuveday at B a.m. Superior Student Progrram at Ttie four-town Northeart Ref Attembts will be made Thurs MANCHESTER, CONN., WEDNESDAY, APRIL 7, 1965 atOooper Hall. the college sponsored the tea use Disposal District (NRDD), day ulgnt to mollify hurt feel VOL. LXXXIvi NO. 169 (THIRTY-TWO PAGES—TWO SECTIONS) for 60 frsehmen who achieved ings and to patch up differences. consisting of Manchester, Ver RadMUian Seaman Appren a 3.2 point average out of a pos If they fail, thia may be the Uggeits tice Richard L. Getsewich, son sible 4.0. non, South Windsor and Bolton, last meeting fW the fcur towns. «( Mr. and Mra Richard P. Oet- wfll meet si 7:45 p.m. Thurs At The Parkadt nearich a t S7l Hartford Rd., is a His Sixth Words: 'I t la fin day in the Muidclpal Building MANCHESTER crew member of the dertroyer ished," will be the theme of the Hearing Room to decide Us fu Damages Heavy Comsat Satellite U8S Flake while undersoins re Ijenten program for senior high fresher training at Ouantanamo on Thursday at 7 a.m. -

Coca-Cola FEMSA, S.A.B. De C.V

As filed with the Securities and Exchange Commission on June 25, 2007 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 Commission file number 1-12260 Coca-Cola FEMSA, S.A.B. de C.V. (Exact name of registrant as specified in its charter) Not Applicable (Translation of registrant’s name into English) United Mexican States (Jurisdiction of incorporation or organization) Guillermo González Camarena No. 600 Centro de Ciudad Santa Fé 01210 México, D.F., México (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares, each representing 10 Series L Shares, without par value ................................................. New York Stock Exchange, Inc. Series L Shares, without par value............................................................. New York Stock Exchange, Inc. (not for trading, for listing purposes only) Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The number of outstanding shares of each class of capital or common stock as of December 31, 2006 was: 992,078,519 Series A Shares, without par value 583,545,678 Series D Shares, without par value 270,906,004 Series L Shares, without par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

The Pool Snacks

THE POOL SNACKS 1104-POOLSNACK.indd 1 29/04/19 14:20 LES SALADES SALADS Mezze en 3 variétés 25DT Triple varieties of Mezze Salade méchouia au thon 22DT Mechouia salad with tuna Salade César au poulet 25DT Ceasar salad with chicken Salade nordique 32DT Nordic salad Laitue, tomate-cerise, crevette, saumon, crabe Salmon, shrimps, crab, tomato, lettuce SUR LE POUCE SNACKS Club sandwich Au poulet ou au thon 25DT Chicken or Tuna Au saumon 32DT Salmon Panini Au poulet ou au thon 25DT Chicken or Tuna Au saumon 32DT Salmon À la tomate, mozzarella, basilic 25DT Tomato, mozzarella, basil 1104-POOLSNACK.indd 2 29/04/19 14:20 Poké Bowls Poké saumon ou thon 32DT Salmon or Tuna Poke Bowl Riz, avocat, concombre, carottes râpées, laitue, sésame, sauce Teriyaki, mayo épicée, saumon ou thon frais en cubes Rice, avocado, cucumber, carrot, lettuce, sesame, Teriyaki sauce, spicy mayo, tuna or salmon Poké Végétarien 25DT Vegetarian Poke Bowl Riz, avocat, concombre, carottes râpées, laitue, sésame, sauce Teriyaki, mayo épicée Rice, avocado, cucumber, carrot, lettuce, sesame, Teriyaki sauce, spicy mayo LES DESSERTS DESSERTS Coupe de glaces et sorbets 19DT Ice cream & Sorbets Assortissement de verrines 22DT Tiramisu, Pana cota, citron-menthe Assiette de fruits découpés 25DT Plate of fresh fruits VÉGÉTARIEN VEGETARIAN LES ALLERGÈNES ALLERGENS FRUITS LAIT ET PRODUITS GLUTEN SOJA OVOPRODUITS ARACHIDES LUPIN À COQUES LAITIERS SOY EGG PEANUTS NUTS MILK & DAIRY PRODUCTS PRODUCTS SÉSAMES MOUTARDE POISSONS CRUSTACÉS MOLLUSQUES CÉLERI SESAME MUSTARD FISH SHELLFISH MOLLUSCS -

2017 Online Commencement Program

SOUTHERN NEW HAMPSHIRE UNIVERSITY SOUTHERN NEW HAMPSHIRE UNIVERSITY COMMENCEMENT 2017 EIGHTY-FIFTH COMMENCEMENT SATURDAY, MAY 13 SUNDAY, MAY 14 2017 WELCOME TO THE SOUTHERN NEW HAMPSHIRE UNIVERSITY EIGHTY-FIFTH COMMENCEMENT SATURDAY, MAY 13 SUNDAY, MAY 14 2017 SNHU Arena Manchester, New Hampshire SATURDAY, MAY 13 AT 10:00 A.M. UNIVERSITY COLLEGE COLLEGE OF ONLINE AND CONTINUING EDUCATION UNDERGRADUATE, GRADUATE, AND DOCTORAL DEGREES ............................. 1 SATURDAY, MAY 13 AT 2:30 P.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION COLLEGE FOR AMERICA UNDERGRADUATE DEGREES AND GRADUATE DEGREES ................................ 7 SUNDAY, MAY 14 AT 10:00 A.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION UNDERGRADUATE DEGREES ....................................................................... 13 SUNDAY, MAY 14 AT 2:30 P.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION GRADUATE DEGREES .................................................................................. 19 Awards: The Loeffler Prize ...................................................................................... 25 Excellence in Teaching ............................................................................... 26 Excellence in Advising ................................................................................ 27 SNHU Honor Societies Honor Society Listing ................................................................................. 28 Presentation of Degree Candidates ARTS AND SCIENCES ................................................................................. -

Doctoral Dissertation

Doctoral Dissertation A Critical Assessment of Conflict Transformation Capacity in the Southern African Development Community (SADC): Deepening the Search for a Self-Sustainable and Effective Regional Infrastructure for Peace (RI4P) MALEBANG GABRIEL GOSIAME G. Graduate School for International Development and Cooperation Hiroshima University September 2014 A Critical Assessment of Conflict Transformation Capacity in the Southern African Development Community (SADC): Deepening the Search for a Self-Sustainable and Effective Regional Infrastructure for Peace (RI4P) D115734 MALEBANG GABRIEL GOSIAME G. A Dissertation Submitted to the Graduate School for International Development and Cooperation of Hiroshima University in Partial Fulfillment of the Requirement for the Degree of Doctor of Philosophy September 2014 DECLARATION I hereby declare that this doctoral thesis is in its original form. The ideas expressed and the research findings recorded in this doctoral thesis are my own unaided work written by me MALEBANG GABRIEL GOSIAME G. The information contained herein is adequately referenced. It was gathered from primary and secondary sources which include elite interviews, personal interviews, archival and scholarly materials, technical reports by both local and international agencies and governments. The research was conducted in compliance with the ethical standards and guidelines of the Graduate School for International Development and Cooperation (IDEC) of Hiroshima University, Japan. The consent of all respondents was obtained using the consent form as shown in Appendix 3 for the field research component of the study and for use of the respondent’s direct words as quoted therein. iii DEDICATIONS This dissertation is dedicated to the loving memory of my mother Roseline Keitumetse Malebang (1948 – 1999) and to all the people of Southern Africa. -

Haitian Creole – English Dictionary

+ + Haitian Creole – English Dictionary with Basic English – Haitian Creole Appendix Jean Targète and Raphael G. Urciolo + + + + Haitian Creole – English Dictionary with Basic English – Haitian Creole Appendix Jean Targète and Raphael G. Urciolo dp Dunwoody Press Kensington, Maryland, U.S.A. + + + + Haitian Creole – English Dictionary Copyright ©1993 by Jean Targète and Raphael G. Urciolo All rights reserved. No part of this work may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying and recording, or by any information storage and retrieval system, without the prior written permission of the Authors. All inquiries should be directed to: Dunwoody Press, P.O. Box 400, Kensington, MD, 20895 U.S.A. ISBN: 0-931745-75-6 Library of Congress Catalog Number: 93-71725 Compiled, edited, printed and bound in the United States of America Second Printing + + Introduction A variety of glossaries of Haitian Creole have been published either as appendices to descriptions of Haitian Creole or as booklets. As far as full- fledged Haitian Creole-English dictionaries are concerned, only one has been published and it is now more than ten years old. It is the compilers’ hope that this new dictionary will go a long way toward filling the vacuum existing in modern Creole lexicography. Innovations The following new features have been incorporated in this Haitian Creole- English dictionary. 1. The definite article that usually accompanies a noun is indicated. We urge the user to take note of the definite article singular ( a, la, an or lan ) which is shown for each noun. Lan has one variant: nan. -

Depot Square Garage Had Been Shot Down As Distress Sig L

iT w iL t a Average Dully Circubtfon For the Meeth of I IMW Group a of Cantar ebureh womr A oomblnad rabcanal o f Uuca TUESDAY ONLY! LIMITED QU-^TITY. tiM cluba wlU held tonight at •n. M ti Bkrl Luther League Regolnr'ftc A bou t Tow n Group 8, Mra. Kannath Bur^an^ & Bmnnuar _ . la cBurnli. 6328 OmetaUy fair and wmtlaaed eoM Ttan BMthovena will IM boaU HALE^ SELF SERVE tMlgfet aad Wedneaday, slowi|r iMdw. win haea a Member of cUe Aedit tomorrow evening at 7.80 at the the Banker’a and Colt'a cluba of Plans Program s The Oriftnil In New England! rialag temperatan Thniaday. Hartford In preparation for a Bareae of droalatlaas fM iM irrn titkaanlaa Cltl- Center CongregatloDBl church, C hen ille Bath M ats Rev. Dougins V. M a c l^ n of the combined concert to be given In Manchester— City of VUtage Chdtni ■HM chib win bold cn tmportiint Hartford on Wedneaday, February ■ M tln c c t tithuanlan ball on Gol- Wapplng Community church will “ Torchbearem” to Be AND HEALTH MARKET Smart fiofal pattama on aoUd color, grounda. Blue, orchid, zlve an addreea on ’TaleaUne. The 14, under the direction of Robert peach, green. Mack and white and d^Mmnct. crcv dvMt at eight, o’clock Knoa Chapman. (CtaaMUai Advertiatag ea Page l«> MANCHESTER, C O N N ., TURSDAY. JANUARY .10. 1040 \ (TWELVE PAGES) PRICE THREE CENTS « i gU_ > 1 1 mcmber^^are requewed hoateaem will be Mra John I^m - Present^ l»y Group VOL. -

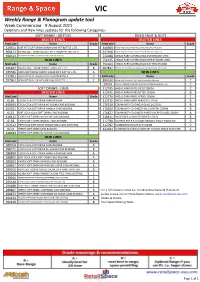

Weekly Range & Planogram Update Tool

VIC Weekly Range & Planogram update tool Week Commencing - 9 August 2021 Deletions and New lines updates for the following Categories - SOFT DRINKS - BOTTLES DRIED FRUIT & NUTS DELETED LINES DELETED LINES MetCode Name Grade MetCode Name Grade 329551 DIET RITE SOFT DRINK LEMON LIME PET BOTTLE 1.25L 346969 ANGAS PARK DRIED CRANBERRIES CRANBERRIES SNACK PACKS 6PK 968143 NEXBA SOFT DRINK SUGAR FREE LEMON PET BOTTLE 1L 347698 ANGAS PARK DRIED FRUIT C/BERRIES RAISINS B/BERRIES SNACK 6PK 948313 SCHWEPPES SOFT DRINK LEMONADE ZERO SUGAR PET BOTTLE 2L 751088 ANGAS PARK SUPERBLENDS ANTIOXIDANT 170G NEW LINES 751135 ANGAS PARK SUPERBLENDS ENERGY BOOST 200G MetCode Name Grade 751164 ANGAS PARK SUPERBLENDS GUT HEALTH 200G 636267 BISLERI SOFT DRINK CHINOTTO BOTTLE 1.25L B 907817 MURRAY RIVER SUN MUSCAT RAISINS AUSTRALIAN ORGANIC BAG 325GM 289586 KIRKS SOFT DRINK PASITO SUGAR FREE BOTTLE 1.25L A NEW LINES 313961 NEXBA SOFT DRINK CREAMING SODA SUGAR FREE BOTTLE 1L C MetCode Name Grade 297961 NEXBA SOFT DRINK LEMON SQUASH SUGAR FREE BOTTLE 1L C 894140 ANGAS PARK DRIED FRUIT FRUIT SALAD RESEALABLE BAG 500G C 50704 ANGAS PARK DRIED PRUNES AUSTRALIAN RESEALABLE BAG 1KG C SOFT DRINKS - CANS 312745 ANGUS PARK DATES DICED 200GM C DELETED LINES 313741 ANGUS PARK DATES PITTED 125GM B MetCode Name Grade 312774 ANGUS PARK DRIED APPLES 100GM C 6116 COCA-COLA SOFT DRINK CANS 8X200ML 313725 ANGUS PARK DRIED APRICOTS 125GM B 848649 COCA-COLA SOFT DRINK NO SUGAR CANS 8X200ML 176518 COMMUNITY CO GINGER GLACED 125GM B 650931 COCA-COLA SOFT DRINK VANILLA CANS 8X200ML 176699 -

Coca-Cola FEMSA, S.A.B. De C.V. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on March 14, 2013. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 Commission file number 1-12260 Coca-Cola FEMSA, S.A.B. de C.V. (Exact name of registrant as specified in its charter) Not Applicable (Translation of registrant’s name into English) United Mexican States (Jurisdiction of incorporation or organization) Calle Mario Pani No. 100, Santa Fe Cuajimalpa, 05348, México, D.F., México (Address of principal executive offices) José Castro Calle Mario Pani No. 100 Santa Fe Cuajimalpa 05348 México, D.F., México (52-55) 1519-5120/5121 [email protected] (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary shares, each representing 10 Series L New York Stock Exchange, Inc. shares, without par value Series L shares, without par value New York Stock Exchange, Inc. (not for trading, for listing purposes only) Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The number of outstanding shares of each class of capital or common stock as of December 31, 2012 was: 992,078,519 Series A shares, without par value 583,545,678 Series D shares, without par value 454,920,107 Series L shares, without par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Appendix Unilever Brands

The Diffusion and Distribution of New Consumer Packaged Foods in Emerging Markets and what it Means for Globalized versus Regional Customized Products - http://globalfoodforums.com/new-food-products-emerging- markets/ - Composed May 2005 APPENDIX I: SELECTED FOOD BRANDS (and Sub-brands) Sample of Unilever Food Brands Source: http://www.unilever.com/brands/food/ Retrieved 2/7/05 Global Food Brand Families Becel, Flora Hellmann's, Amora, Calvé, Wish-Bone Lipton Bertolli Iglo, Birds Eye, Findus Slim-Fast Blue Band, Rama, Country Crock, Doriana Knorr Unilever Foodsolutions Heart Sample of Nestles Food Brands http://www.nestle.com/Our_Brands/Our+Brands.htm and http://www.nestle.co.uk/about/brands/ - Retrieved 2/7/05 Baby Foods: Alete, Beba, Nestle Dairy Products: Nido, Nespray, La Lechera and Carnation, Gloria, Coffee-Mate, Carnation Evaporated Milk, Tip Top, Simply Double, Fussells Breakfast Cereals: Nesquik Cereal, Clusters, Fruitful, Golden Nuggets, Shreddies, Golden Grahams, Cinnamon Grahams, Frosted Shreddies, Fitnesse and Fruit, Shredded Wheat, Cheerios, Force Flake, Cookie Crisp, Fitnesse Notes: Some brands in a joint venture – Cereal Worldwide Partnership, with General Mills Ice Cream: Maxibon, Extreme Chocolate & Confectionery: Crunch, Smarties, KitKat, Caramac, Yorkie, Golden Cup, Rolo, Aero, Walnut Whip, Drifter, Smarties, Milkybar, Toffee Crisp, Willy Wonka's Xploder, Crunch, Maverick, Lion Bar, Munchies Prepared Foods, Soups: Maggi, Buitoni, Stouffer's, Build Up Nutrition Beverages: Nesquik, Milo, Nescau, Nestea, Nescafé, Nestlé's -

Case 18-33967-Bjh11 Doc 236 Filed 12/31/18 Entered 12/31/18 18:58:38 Page 1 of 795 Case 18-33967-Bjh11 Doc 236 Filed 12/31/18 Entered 12/31/18 18:58:38 Page 2 of 795

Case 18-33967-bjh11 Doc 236 Filed 12/31/18 Entered 12/31/18 18:58:38 Page 1 of 795 Case 18-33967-bjh11 Doc 236 Filed 12/31/18 Entered 12/31/18 18:58:38 Page 2 of 795 Exhibit A (Sorted Alphabetically) # Debtor Name Case No. EIN 1. Alief SCC LLC 18-33987 0523 2. Bandera SCC LLC 18-33989 0617 3. Baytown SCC LLC 18-33992 0778 4. Beltline SCC LLC 18-33996 7264 5. Booker SCC LLC 18-33999 0967 6. Bossier SCC LLC 18-34003 2017 7. Bradford SCC LLC 18-34004 9535 8. Brinker SCC LLC 18-34005 7304 9. Brownwood SCC LLC 18-33968 0677 10. Capitol SCC LLC 18-34006 1750 11. CapWest-Texas LLC 18-34008 4897 12. Cedar Bayou SCC LLC 18-34010 8889 13. Clear Brook SCC LLC 18-34012 1877 14. Colonial SCC LLC 18-34014 4385 15. Community SCC LLC 18-33969 7951 16. Corpus Christi SCC LLC 18-34016 9807 17. Crestwood SCC LLC 18-34017 7349 18. Crowley SCC LLC 18-33970 6697 19. CTLTC Real Estate, LLC 18-34018 0202 20. Fairpark SCC LLC 18-34020 7381 21. Gamble Hospice Care Central LLC 18-34022 6688 22. Gamble Hospice Care Northeast LLC 18-34025 6661 23. Gamble Hospice Care Northwest LLC 18-34027 2044 24. Gamble Hospice Care of Cenla LLC 18-34029 4510 25. Green Oaks SCC LLC 18-33971 7218 26. Harbor Lakes SCC LLC 18-33972 7299 27. Harden HUD Holdco LLC 18-34032 1502 28. Harden Non-HUD Holdco LLC 18-34035 3391 29. -

Coca-Cola FEMSA, S.A. De C.V

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2003 Commission file number 1-12260 Coca-Cola FEMSA, S.A. de C.V. (Exact name of registrant as specified in its charter) Not Applicable (Translation of registrant’s name into English) United Mexican States (Jurisdiction of incorporation or organization) Guillermo González Camarena No. 600 Centro de Ciudad Santa Fé 01210 México, D.F., México (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Name of Each Exchange Title of Each Class on Which Registered American Depositary Shares, each representing 10 Series L Shares, without par value....................................... New York Stock Exchange, Inc. Series L Shares, without par value.................................................. New York Stock Exchange, Inc. (not for trading, for listing purposes only) 8.95% Notes due November 1, 2006 .............................................. New York Stock Exchange, Inc. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The number of outstanding shares of each class of capital or common stock as of December 31, 2003 was: 844,078,519 Series A Shares, without par value 731,545,678 Series D Shares, without par value 270,750,000 Series L Shares, without par value Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.