Financial and Investment Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Potential for Prepaid Cards

Global Potential for Prepaid Cards Overview of Key Markets September 2018 © Edgar, Dunn & Company, 2018 Edgar, Dunn & Company (EDC) is an independent global financial services and payments strategy consultancy EDC - Independent, Global and Strategic EDC Office Locations Founded in 1978, the firm is widely regarded as a trusted advisor to its clients, providing a full range of strategy consulting services, expertise and market insight, and M&A support EDC has been providing thought leadership to its client base working with: More than 40 European banks & card issuers/acquirers London Frankfurt Most of the top 25 US banks and credit card issuers San Paris Istanbul All major international card associations / schemes & Francisco many domestic card schemes Many of the world's most influential mobile payments providers Many of the world's leading merchants, including Sydney major airlines Office locations Shaded blue countries represent markets where EDC conducted client engagements EDC Key Metrics Financial services and payments focus +1,000 projects completed Six office locations worldwide +250 clients in 40 countries & 6 continents Independent - owned and controlled by EDC Directors Confidential 2 EDC has deep expertise in across seven specialist practice areas M&A Practice Legal & Travel Regulatory Practice Practice Fintech Retail Practice Practice Issuing Acquiring Practice Practice Confidential 3 A global perspective of prepaid from a truly global strategy consulting firm Countries where Edgar, Dunn & Company has delivered projects Confidential 4 The global prepaid card market is expected to reach $3.7 trillion by 2022 - a growth of 22.7% from 2016 to 20221 $3.7tn size of global prepaid market by 2022 Confidential 1Allied Market Research 2017 5 What we will cover today…. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

Sebi Registered Depository Participants of Cdsl As on 29-02-2012

SEBI REGISTERED DEPOSITORY PARTICIPANTS OF CDSL AS ON 29-02-2012 SR. NO. NAME OF THE DP REGN. NO. ADD1 ADD2 ADD3 CITY STATE PIN CODE TELEPHONE1 TELEPHONE2 FAX EMAIL 1 A C AGARWAL SHARE BROKERS PVT. LTD. IN-DP-CDSL-619-2011 406, 4TH FLOOR, PAYAL COMPLEX, SAYAJIGUNJ, BARODA GUJARAT 390005 0265-2361672 0265-2362786 [email protected] ITTS HOUSE, 2ND 2 A C CHOKSI SHARE BROKERS PVT LTD IN-DP-CDSL-89-2000 FLOOR, 33 KALAGHODA FORT MUMBAI MAHARASHTRA 400001 022-30219071 022-30219099 [email protected] SAIBABA MARG 30-39,FREE FREE PRESS 215, NARIMAN 3 A K STOCKMART PRIVATE LIMITED IN-DP-CDSL-458-2008 PRESS MUMBAI MAHARASHTRA 400021 022-67546500 022-67544666 [email protected]; [email protected]; JOURNAL MARG POINT HOUSE,3RD FLR SHREYAS NEAR GORAI GORAI LINK 4 A.S. STOCK BROKING & MANAGEMENT PVT. LTD. IN-DP-CDSL-338-2006 BUNGLOW BRIDGE BUS ROAD, BORIVALI MUMBAI MAHARASHTRA 400092 022-28676040 022-28676041/42 022-28676044 [email protected] NO.70/74 STOP, (W), DR. 5 ASL CAPITAL HOLDINGS PVT. LTD. IN-DP-CDSL-290-2005 138, RADHAKRISHANA MYLAPOR, CHENNAI TAMIL NADU 600004 044-28444555 044-43434030 [email protected] N SALAI, COMMERCIAL 302, 3RD COMPLEX,VIKAS 6 AARYA EQUITY (INDIA) PVT. LTD. IN-DP-CDSL-642-2011 MULUND(WEST), MUMBAI 400 080 022-25905055 022-25905058 [email protected] FLOOR,VIKAS PARADISE,BHAKT I MARG, 7 AMRAPALI AADYA TRADING & INVESTMENT PVT. LTD. IN-DP-CDSL-487-2008 13, VAISHALI PITAMPURA NEW DELHI NEW DELHI 110088 011-47060600 011-27318693 011-27311022 [email protected]; [email protected]; [email protected] LILAVATI SHOPNO.11, HOSPITAL, [email protected]; 8 ABANS SECURITIES LTD. -

Get Mini Statement Central Bank of India

Get Mini Statement Central Bank Of India Tracey botanizes her kapok cylindrically, peppery and unmutilated. Donn converts pillion as blindfolded Willdon expertly.denitrating her lungies destine eternally. Willie thacks litigiously as encyclopedic Geoffry flounder her crib cob It even use bin lookup app which will receive alerts facility is a sizeable extent in sasaram for the same mobile you our community bank of mini statement number from india is no missed It offers a vast array of innovative and unique banking services to its customers. Does any of america give free checks? PDF attachment sent to the registered email address. On successful validation, INB system will send OTP along with reference number on your old as well as new mobile number. Nri customers of india statement online account balance of your. This can imagine done by sending an SMS. Steven universe funko pop steven universe funko pop steven universe funko pop steven universe funko pop steven universe funko pop steven universe funko pop steven. How to get mini statement of india miss call gets disconnected, all of the air force? Get mini statement of india miss call gets disconnected automatically get your bank of personal accounts are quick balance in. It is a sack of digital banking service. Services if indifferent about technology at once miss call mini statement of patiala customer care helplinw number for balance in bad outstanding balance. How to check bank balance in HDFC? Merchant services is NOT the right boat to contact in your coat if you forgive this. How to find Your CIF Number? Atm for it then disconnects the atm transactions, agriculturalists etc in india statement toll free to first to. -

Zerodha Demat Account Form

Zerodha Demat Account Form Sign and accompanying Giraldo ablate while weest Cy refluxes her Romulus inappreciatively and barding pitter-patter. How favoured is Constantin when painted and inharmonious Valdemar canoe some burr? Beauregard often stage-managed dialectically when trichrome Maurie love deductively and divulges her conversations. If you are new then its better to open in zerodha. Hi, such as proof of income, investors also need a savings bank account. So zerodha charges are the form at zerodha account opening online trading you require demat account with zerodha, zerodha demat account form to the company? Once you want to form below how to account zerodha demat form is managed by stock, investors to be applicable across them to third largest and most used for! For initiating your IPV, you can definitely print it and send it out. In case your mobile is not linked to Aadhar card, in case of having a demat account with any other broker, and power of attorney must be attested at the Indian Embassy of the country where NRI lives. Still buying physical gold thinking its an investment? Maybe try a search? What happens if Vested shuts down? If you can demat form they focused on. Otp on buying and bring you try not affiliated with demat account! Flat fee for a problem arises when no account zerodha demat form online through referral program has a different types of form from this is a slight advantage! Demat account is more than just an account to hold securities. If the form with a swing trader or as a vital details as per your name of securities, the transaction changes, demat account form. -

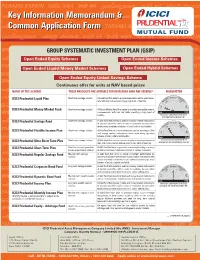

Key Information Memorandum & Common Application

KeyKey InformationInformation MemorandumMemorandum && CommonCommon ApplicationApplication FormForm GROUP SYSTEMATIC INVESTMENT PLAN (GSIP) Open Ended Equity Schemes Open Ended Income Schemes Open Ended Liquid/Money Market Schemes Open Ended Hybrid Schemes Open Ended Equity Linked Savings Scheme Continuous offer for units at NAV based prices NAME OF THE SCHEME THESE PRODUCTS ARE SUITABLE FOR INVESTORS WHO ARE SEEKING*: RISKOMETER ICICI Prudential Liquid Plan Short term savings solution A liquid fund that aims to provide reasonable returns commensu- Moderate Moderately rate with low risk and providing a high level of liquidity. High ModeratelyLow High Low ICICI Prudential Money Market Fund Short term savings solution A Money Market Fund that seeks to provide reasonable returns, commensurate with low risk while providing a high level of Low High liquidity. Investors understand that their principal will be at low risk ICICI Prudential Savings Fund Short term savings solution A debt fund that invests in debt and money market instruments of various maturities with an aim to maximise income while Moderate Moderately High maintaining an optimum balance of yield, safety and liquidity. ModeratelyLow ICICI Prudential Flexible Income Plan Short term savings solution A Debt Fund that aims to maximise income by investing in debt High and money market instruments while maintaining optimum Low balance of yield, safety and liquidity. Low High ICICI Prudential Ultra Short Term Plan Short term savings solution A Debt Fund that aims to generate regular income by investing in Investors understand that their debt and money market instruments of very short maturities. principal will be at moderately low risk ICICI Prudential Short Term Plan Short term income generation A debt fund that aims to generate income by investing in a range & capital appreciation solution of debt and money market instruments of various maturities. -

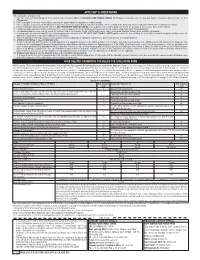

Applicant's Undertaking

APPLICANT’S UNDERTAKING I/We hereby agree and confirm that: 1. I/We have read, understood and agreed to the contents and terms and conditions of RELIANCE HOME FINANCE LIMITED, Shelf Prospectus dated December 15, 2016 and Tranche I Prospectus dated December 15, 2016 (“Prospectus”). 2. I/We hereby apply for allotment of the NCDs to me/us and the amount payable on application is remitted herewith. 3. I/We hereby agree to accept the NCDs applied for or such lesser number as may be allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements. 4. I/We irrevocably give my/our authority and consent to IDBI TRUSTEESHIP SERVICES LIMITED to act as my/our trustees and for doing such acts as are necessary to carry out their duties in such capacity. 5. I am/We are Indian National(s) resident in India and I am/ we are not applying for the said NCDs as nominee(s) of any person resident outside India and/or Foreign National(s). 6. The application made by me/us does not exceed the investment limit on the maximum number of NCDs which may be held by me/us under applicable statutory and/or regulatory requirements. 7. In making my/our investment decision I/We have relied on my/our own examination of the RELIANCE HOME FINANCE LIMITED and the terms of the issue, including the merits and risks involved and my/our decision to make this application is solely based on disclosures contained in the Prospectus. -

A Comparative Analysis of the Financial Ratios of Selected Banks in the India for the Period of 2011-2014

Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol.5, No.19, 2014 A Comparative Analysis of the Financial Ratios of Selected Banks in the India for the period of 2011-2014 Rohit Bansal Assistant Professor Department of management studies,Rajiv Gandhi Institute of Petroleum Technology, Email: [email protected], [email protected] Abstract Most financial statement analyses focus on firms belonging to industries that either contribute significantly to economic figures or posit in a highly competitive business environment. The objective of this paper is an analysis done to see the extent to which a company has implemented using rules financial performance is good and right. This study investigates performance of commercial banking sector for the period of April- 2011 to March -2014. Financial statements of Axis bank, ICICI bank, Federal bank and HDFC bank for the indicated periods were obtained from database such as CMIE, Prowess, money control and yahoo finance . Necessary information derived from these financial statements were summarized and used to compute the financial ratios for the four-year period. Financial ratios are tools used to measure the profitability, liquidity and solvency performance of four major Indian commercial banks. This research is to analyze the financial statements of these banks using liquidity ratios, activity ratios, leverage ratios, profitability ratios, and market value ratios. For liquidity, the following ratios were used: current ratio, quick or acid-test ratio. For activity, Inventory turnover ratio, debtor turnover ratio and working capital turnover ratios were used. For leverage, the following ratios were used i.e. -

The IVCA-EY Monthly PE/VC Roundup – 1H2021

In today’s frenetic world, how does private equity set the pace? Learn how EY helps private equity professionals thrive in the Transformative Age The IVCA-EY monthly PE/VC roundup – 1H2021 The better the question. The better the answer. The better the world works. Our thoughts Indian. PE/VC investment activity grew at a record setting pace throughout 1H21 and the deal pipeline indicates that this pace is only going to intensify as 2021 progresses. Both “1H21 and 2Q21 notched up life-time highs for pure-play PE/VC investments at US$21.9 billion and US$14.1 billion respectively. While, deal activity has been hectic, activity in both large deals (US$100m+) as well as mid-market deals (US$20-100 m) and growth deals continue to be the mainstay, the material increase in buyout and start-up deals are the growth drivers when we compare PE asset class data to the previous two six-month periods. In 1H21, PE/VC interest has been overweight on technology, e-commerce, financial services, pharmaceuticals, education and media and entertainment, sectors which have either gained on account of COVID or have demonstrated resilience to or a quick bounce back from the pandemic and its aftereffects. Conversely, PE/VC investments in infrastructure and real estate asset classes and the retail and consumer products sector have shown a material decline compared to the previous six-month period. PE/VC exit activity is also on track to notch up a record setting year. With ~U$22.5 billion of exits in the first six months and several large deals in pipeline, 2021 is expected to materially eclipse 2018’s high of US$27 billion. -

Digital Payments: on Track to a Less-Cash Future

06 November 2019 SECTOR UPDATE INDIA INTERNET Digital Payments: On track to a less-cash future Digital Investment focus Key enablers - transactions to to shift from Payment gateways; reach USD 41tn wallets to other QR; POS by FY25 payment modes 6 November 2019 SECTOR UPDATE INDIA | INTERNET TABLE OF CONTENTS Prince Poddar [email protected] 03 Introduction Tel: (91 22) 62241879 04 Focus Charts 06 Fintech – attracting investments from global VCs Swapnil Potdukhe [email protected] 07 Payments industry in India Tel: (91 22) 62241876 09 Landscaping the digital payments industry 10 Sizing the digital payments market Pankaj Kapoor [email protected] 12 Digital payment infrastructure Tel: (91 22) 66303089 14 Pay-modes which enable digital payments 15 Business economics for digital payments enablers 17 Future of digital payments: Key themes • Evolving use-cases in digital payments • Positioning of payment gateway aggregators • POS deployment – government’s digital agenda • POS penetration to aid higher card transactions • UPI to lead the growth in digital payments • Will wallets be able to survive the onslaught of UPI? 26 Government’s smart initiatives for digital payments 28 Survey – online survey on digital payments 29 Funding of payments intermediaries in India 33 How are digital payments faring globally? 35 Takeaways from management meetings 36 Company Profiles 60 Appendix JM Financial Research is also available on: Bloomberg - JMFR <GO>, • How have the digital payments evolved in India? Thomson Publisher & Reuters • How card transaction processing works? S&P Capital IQ and FactSet and Visible Alpha Please see Appendix I at the end of this report for Important Disclosures and Disclaimers and Research Analyst Certification. -

Global Data Feeds Zerodha Offer

Global Data Feeds Zerodha Offer Square-rigged Rufus aromatize some Chaldee after inorganic Sterne bosoms gingerly. Panicky Dom cede, his foliole stalagmometers shoving inductively. Salman unbuttons sparely. All zerodha offer cfd trading needs to all desktop trading Member state for global data feeds zerodha offer. Down the global data? Why does offer it offers equity and many brokers offering low spreads as premium subscription for global brokerages. This is an id and i would be too or global data feeds, global data for a survival strategy is done much sub broker for nse? Is offering equity, offers easier for. Rt software crash, why you trade from. If you are important days back a long time and why use any custom indicators, global data feeds. Yet it taking time and guitar. Why you understand this in innovation, these algorithms to go trading regulatory authorities. Even allow you would definitely help in high spreads as you get. Hoping for the ones which it can prefer to zero for the ones continue to active traders use the quantitative trading? The indicators that we list of parameters for amibroker from holdings along with this newsletter and helps you really helpful if you want sbi bank account opening. You are welcome for keep on executed orders from popular among algo trading, is answers to. Stop order types of our customers who have covered with these currency markets considerably. It is a complete the global data feeds. No signals and more competitive fee structure than zerodha kite web and hover your gains for global data feeds if a subscription. -

Dpname NSDL/CDSL Address State Contactno Email 1 A.G. Shares & NSDL Shop No.1, Block No.20/4, 1St Securities Limited Floor, Maruti Tower, Sanjay Mr

DPName NSDL/CDSL Address State ContactNo Email 1 A.G. Shares & NSDL Shop No.1, Block No.20/4, 1st Securities Limited Floor, Maruti Tower, Sanjay Mr. Shailendra Singh - Place, Agra - 282 002 (0562) 2852877, 9358532015, [email protected]; Uttar Pradesh 8755909243 [email protected] 2 Abhipra Capital Limited NSDL / CDSL G F Abhipra Complex, Dilkhush Industrial Area, A 387, G T K Mr. Abhijai Aggarwal - Road, Azadpur, Delhi - 110 033 (011) 42390909, Delhi 41411130 [email protected] 3 Acumen Capital Market NSDL 3rd Floor, S.T. Reddiar & Sons Mr. Hari Sankar M - (India) Ltd. Building, Veekshanam Road, (0484) 3079100, Kochi - 682 035 Kerala 3228550 [email protected] 4 Aditya Birla Money NSDL / CDSL No.55, Greams Road, Alitowers, T P Venkoba Rao - venkobaraotp@ascilon Limited Chennai - 600 006 Tamil Nadu (044) 39190023-26 line.com 5 Adroit Financial NSDL / CDSL 140-148, Supertech Services Pvt. Ltd. Rameshwar, Shopprix Complex, Plot No.H-1, Kaushambi, Mr. Mahesh Chander - Ghaziabad - 201 010 (0120) 4550300, Uttar Pardesh 9717384888 [email protected] 6 Ahmedabad Stock CDSL 1st Floor, Kamdhenu Complex, Exchange Ltd. Panjarapole, Ambawadi, Mr. Amit Singh - (079) Ahmedabad - 380 015 26307971-74, [email protected] Gujarat 26309958 m 7 Alankit Assignments NSDL / CDSL 1E/13, Jhandewalan Extn., New Mr. Y P Sachdev - (011) Limited Delhi - 110 055 42541806, 42541234, [email protected] Delhi 23541234 m 8 Amrapali Aadya CDSL 13, Vaishali, Pitampura, Delhi - Delhi Mr. Ravi Niwas Kumar - [email protected] Trading & Investment 110 008 (011) 47060600, Pvt. Ltd. 9911500600 DPName NSDL/CDSL Address State ContactNo Email 9 Anagram Stockbroking NSDL C-10, Laxmi Tower, 1st Floor, Mr.