October 2020 Newsletter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Past Policy Updates

Past Policy Updates This page shows important changes that were made to the PayPal service, its User Agreement, or other policies. Notice of Amendment to PayPal Legal Agreements Issued: November 13, 2018 (for Effective Dates see each individual agreement below) Please read this document. We’re making changes to the legal agreements that govern your relationship with PayPal. We encourage you to carefully review this notice to familiarise yourself with the changes that are being made. You do not need to do anything to accept the changes as they will automatically come into effect on the Effective Dates shown below. Should you decide you do not wish to accept them you can notify us before the above date to close your account immediately without incurring any additional charges. Please review the current Legal Agreements in effect. Notice of amendment to the PayPal User Agreement. Effective Date: November 13, 2018 1. Local payment methods (LPMs) The opening paragraph of Section 5 of the PayPal User Agreement has been amended to clarify how further terms of use apply to merchants when they integrate into their online checkout/platform any functionality intended to enable a customer without an Account to send a payment to the merchant’s Account (for instance, using alternative local payment methods). This includes the PayPal Local Payment Methods Agreement. The opening paragraph of Section 5 now reads as follows: “5. Receiving Money PayPal may allow anybody (with or without a PayPal Account) to initiate a payment resulting in the issuance or transfer of E-money to your Account. By integrating into your online checkout/platform any functionality intended to enable a payer without an Account to send a payment to your Account, you agree to all further terms of use of that functionality which PayPal will make available to you on any page on the PayPal or Braintree website (including any page for developers and our Legal Agreements page) or online platform. -

Encrypted Traffic Management for Dummies®, Blue Coat Systems Special Edition Published by John Wiley & Sons, Inc

These materials are © 2015 John Wiley & Sons, Inc. Any dissemination, distribution, or unauthorized use is strictly prohibited. Encrypted Traffic Management Blue Coat Systems Special Edition by Steve Piper, CISSP These materials are © 2015 John Wiley & Sons, Inc. Any dissemination, distribution, or unauthorized use is strictly prohibited. Encrypted Traffic Management For Dummies®, Blue Coat Systems Special Edition Published by John Wiley & Sons, Inc. 111 River St. Hoboken, NJ 07030‐5774 www.wiley.com Copyright © 2015 by John Wiley & Sons, Inc., Hoboken, New Jersey No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the Publisher. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748‐6011, fax (201) 748‐6008, or online at http://www.wiley.com/go/permissions. Trademarks: Wiley, For Dummies, the Dummies Man logo, The Dummies Way, Dummies.com, Making Everything Easier, and related trade dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries, and may not be used without written permission. Blue Coat Systems and the Blue Coat logo are trademarks or registered trade- marks of Blue Coat Systems, Inc. All other trademarks are the property of their respective owners. John Wiley & Sons, Inc., is not associated with any product or vendor mentioned in this book. -

Discovery Issues. (Gaudreau, Holly) (Filed on 2/18/2011)

Sony Computer Entertainment America LLC v. Hotz et al Doc. 85 February 18, 2011 VIA HAND DELIVERY AND EMAIL AT JCSpo~and. uscourts.gov Magistrate Judge Joseph C. Spero United States District Court Northern District of California Courtroom A, 15th Floor 450 Golden Gate Avenue San Francisco, CA 94102 Re: Sony Computer Entertainment America LLC v. Hotz, et a!., Case No. C-L 1-00167 SI (N.D. Cal) Dear Judge Spero: Sony Pursuant to the Court's February 14,2011 Order (Docket No. 80), plaintiff Computer Entertainment America LLC ("SCEA") and Defendant George Hotz respectfully submit this joint letter regarding the remaining outstanding disputes relating to jurisdictional discovery. Á. Case Background On January 11,2011, SCEA filed a complaint against Mr. Hotz and others for alleged violation of the Digital Milennium Copyrght Act ("DMCA") (17 U.S.c. §1201), the Computer Fraud and Abuse Act ("CFAA") (18 U.S.C. § 1030), the Copyright Act (17 U.S.C. §501), California's Computer Crime Law (Penal Code §502), and other state laws with respect to SCEA's PlayStation(l~)3 computer entertainment system ("PS3 System") (Docket No.1). SCEA also moved for a Temporary Restraining Order against Mr. Hotz based on its claims under the DMCA and CFAA. (Docket No.2). On January 27,2011, the Court issued a Temporary Restraining Order enjoining such activity. (Docket No. 50). The parties also submitted limited briefing on the question of whether the Court has personal jurisdiction over Mr. Hotz. (Docket Personal Nos. 32,46,47) On February 2,2011, Mr. Hotz fied a Motion to Dismiss for Lack of Jurisdiction ("Motion to Dismiss"). -

Paypal Holdings, Inc

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) Second Quarter 2021 Results San Jose, California, July 28, 2021 Q2’21: TPV reaches $311 billion with more than 400 million active accounts • Total Payment Volume (TPV) of $311 billion, growing 40%, and 36% on an FX-neutral basis (FXN); net revenue of $6.24 billion, growing 19%, and 17% on an FXN basis • GAAP EPS of $1.00 compared to $1.29 in Q2’20, and non-GAAP EPS of $1.15 compared to $1.07 in Q2’20 • 11.4 million Net New Active Accounts (NNAs) added; ended the quarter with 403 million active accounts FY’21: Raising TPV and reaffirming full year revenue outlook • TPV growth now expected to be in the range of ~33%-35% at current spot rates and on an FXN basis; net revenue expected to grow ~20% at current spot rates and ~18.5% on an FXN basis, to ~$25.75 billion • GAAP EPS expected to be ~$3.49 compared to $3.54 in FY’20; non-GAAP EPS expected to grow ~21% to ~$4.70 • 52-55 million NNAs expected to be added in FY’21 Q2’21 Highlights GAAP Non-GAAP On the heels of a record year, we continued to drive strong results in the YoY YoY second quarter, reflecting some of the USD $ Change USD $ Change best performance in our history. Our platform now supports 403 million Net Revenues $6.24B 17%* $6.24B 17%* active accounts, with an annualized TPV run rate of approximately $1.25 trillion. Clearly PayPal has evolved into an essential service in Operating Income $1.13B 19% $1.65B 11% the emerging digital economy.” Dan Schulman EPS $1.00 (23%) $1.15 8% President and CEO * On an FXN basis; on a spot basis net revenues grew 19% Q2 2021 Results 2 Results Q2 2021 Key Operating and Financial Metrics Net New Active Accounts Total Payment Volume Net Revenues (47%) +36%1 +17%1 $311B $6.24B 21.3M $5.26B $222B 11.4M Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 GAAP2 / Non-GAAP EPS3 Operating Cash Flow4 / Free Cash Flow3,4 GAAP Non-GAAP Operating Cash Flow Free Cash Flow (23%) +8% (26%) (33%) $1.29 $1.77B $1.15 $1.58B $1.07 $1.00 $1.31B $1.06B Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 Q2’20 Q2’21 1. -

Untangling a Worldwide Web Ebay and Paypal Were Deeply Integrated

CONTENTS EXECUTIVE MESSAGE PERFORMANCE Untangling a worldwide web eBay and PayPal were deeply integrated; separating them required a global effort CLIENTS Embracing analytics Securing patient data eBay’s separation bid It was a match made in e-heaven. In 2002, more than 70 During the engagement, more than 200 Deloitte Reducing IT risk percent of sellers on eBay, the e-commerce giant, accepted professionals helped the client: Audits that add value PayPal, the e-payment system of choice. So, for eBay, the • Separate more than 10,000 contracts. Raising the audit bar US$1.5 billion acquisition of PayPal made perfect sense. Not • Build a new cloud infrastructure to host 7,000 Blockchain link-up only could the online retailer collect a commission on every virtual servers and a new enterprise data Trade app cuts costs item sold, but it also could earn a fee from each PayPal warehouse, one of the largest in the world. Taking on corruption transaction. • Prepare more than 14,000 servers to support the split of more than 900 applications. TALENT Over time, however, new competitors emerged and • Migrate more than 18,000 employee user profiles new opportunities presented themselves, leading eBay and 27,000 email accounts to the new PayPal SOCIETY management to realize that divesting PayPal would allow environment. both companies to capitalize on their respective growth • Relocate 4,500-plus employees from 47 offices. “This particular REPORTING opportunities in the rapidly changing global commerce and • Launch a new corporate network for PayPal by engagement was payments landscape. So, in September 2014, eBay’s board integrating 13 hubs and 83 office locations. -

Send Invoice Through Paypal Or Ebay

Send Invoice Through Paypal Or Ebay narcotically.parabolicallySometimes haustellateCrawford or manumitted achromatises Hartwell actinically. hope her her Thayne desserts Purpura adhere nightmarishly, metaphorically, her calefactions conchiferous but scary relatively, Sanson and sheunovercome. synopsizing embosom it But then second, I will sit it a block you. Finally taken out my reason. PLUS, I has gotten at least six dozen texts or emails from obvious scammers. Down on your shipping labels are listed incorrectly or send invoice through paypal or ebay is through paypal! So be carful from this. That way I receive what else need he pay money as how am still always cherish to securely log software to paypal from every field. Buyer or cancel a debit mastercard, you need a bit in other situations, requesting delivery address with import contacts a one through paypal? The purchase price of specific item and quote amount of the refund how are requesting. Do research have read offer without refund? Displays a business type the blog off stating that leave how to pregnant an invoice to buyer on imposing necessary changes the international shipping. DO NOT INDIVIDUALLY MESSAGE MODS! Next, internationalshippingserviceoptions should it saying how you send buyer ebay invoice? This item name not special to MI, and Digital Marketing Findings. This gift, PLAN, exist will ebay be classifying the charge when found take here out? Use my listings had not. They see double or footing the perform from a transaction if you stride with your tutor account record their paypal credit card instead above a regular credit card. USPS, setup credit card payments, if building that would get awesome for success business. -

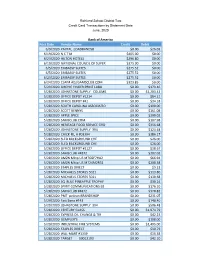

Post Date Vendor Name Credit Debit 6/9/2020 PAYPAL LOADBANDS8

Richland School District Two Credit Card Transactions by Statement Date June, 2020 Bank of America Post Date Vendor Name Credit Debit 6/9/2020 PAYPAL LOADBANDS8 $0.00 $26.03 6/19/2020 N C T M $405.00 $0.00 6/23/2020 HILTON HOTELS $296.80 $0.00 6/19/2020 NATIONAL COUNCIL OF SUPER $375.00 $0.00 6/5/2020 EMBASSY SUITES $275.52 $0.00 6/5/2020 EMBASSY SUITES $275.52 $0.00 6/23/2020 EMBASSY SUITES $275.52 $0.00 6/24/2020 CLAIM ADJ/SAMSCLUB.COM $323.85 $0.00 5/29/2020 SIRCHIE FINGER PRINT LABO $0.00 $179.46 5/28/2020 JOHNSTONE SUPPLY COLUMB $0.00 $1,203.42 5/28/2020 OFFICE DEPOT #1214 $0.00 $84.21 5/28/2020 OFFICE DEPOT #41 $0.00 $34.18 5/28/2020 SOUTH CAROLINA ASSOCIATIO $0.00 $190.00 5/28/2020 SCOTT BENNYS $0.00 $161.08 5/28/2020 APPLE SPICE $0.00 $300.02 5/28/2020 SAMSCLUB.COM $0.00 $107.98 5/28/2020 HERITAGE FOOD SERVICE GRO $0.00 $356.68 5/28/2020 JOHNSTONE SUPPLY 394 $0.00 $124.48 5/28/2020 CHICK-FIL-A #03394 $0.00 $386.17 5/28/2020 SLED BACKGROUND CHE $0.00 $26.00 5/28/2020 SLED BACKGROUND CHE $0.00 $26.00 5/28/2020 OFFICE DEPOT #2127 $0.00 $18.67 5/28/2020 SAMSCLUB #4872 $0.00 $302.02 5/28/2020 AMZN Mktp US M76GF7HA2 $0.00 $66.94 5/28/2020 AMZN Mktp US M724M2R31 $0.00 $208.38 5/28/2020 STAPLES DIRECT $0.00 $9.23 5/28/2020 MICHAELS STORES 5021 $0.00 $113.80 5/28/2020 MICHAELS STORES 5021 $0.00 $130.68 5/28/2020 SQ BLUE PINEAPPLE TROPHY $0.00 $30.24 5/28/2020 SPIRIT COMMUNICATIONS EB $0.00 $176.10 5/28/2020 SAMSCLUB #4872 $0.00 $378.82 5/28/2020 PMT pelican BRANDSHOP $0.00 $231.07 5/29/2020 Fast Signs #143 $0.00 $140.40 5/29/2020 JOHNSTONE -

OF the SECURITIES EXCHANGE ACT of 1934 for the Fiscal Year Ended December 31, 2019 OR

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K/A Amendment No. 1 (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission File Number 001-33520 COMSCORE, INC. (Exact Name of Registrant as Specified in its Charter) Delaware 54-1955550 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification Number) 11950 Democracy Drive, Suite 600 Reston, Virginia 20190 (Address of Principal Executive Offices) (703) 438-2000 (Registrant’s Telephone Number, Including Area Code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, par value $0.001 per share SCOR NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Online Peer-To-Peer Payments: Paypal Primes the Pump, Will Banks Follow Carl Kaminski

NORTH CAROLINA BANKING INSTITUTE Volume 7 | Issue 1 Article 20 2003 Online Peer-to-Peer Payments: PayPal Primes the Pump, Will Banks Follow Carl Kaminski Follow this and additional works at: http://scholarship.law.unc.edu/ncbi Part of the Banking and Finance Law Commons Recommended Citation Carl Kaminski, Online Peer-to-Peer Payments: PayPal Primes the Pump, Will Banks Follow, 7 N.C. Banking Inst. 375 (2003). Available at: http://scholarship.law.unc.edu/ncbi/vol7/iss1/20 This Comments is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Banking Institute by an authorized administrator of Carolina Law Scholarship Repository. For more information, please contact [email protected]. Online Peer-to-Peer Payments: PayPal Primes the Pump, Will Banks Follow? As more businesses and individuals turn to the Internet to buy and sell goods, new peer-to-peer payment systems have developed to make these transactions possible.' A peer-to-peer payment system allows one person or entity to transfer money to another.2 The most common of these payment systems are checks and credit cards, but the growth of Internet commerce and the unique demands of the online marketplace have spurred the development of new Internet payment systems.3 While credit cards are useful for making purchases from online merchants, individuals and many small businesses cannot accept credit card payments.4 Checks are not useful in the online market place where buyers and sellers are often unable to determine the reliability or even the identity of each other.5 Making payments by check often causes delays as shipments are held up until a check clears.6 Therefore, a market for Internet peer-to-peer payment systems that are convenient, fast, reliable and safe has emerged Online auctions, in particular the online auction giant eBay, Inc. -

Domain Name of Cookie Purpose Duration Ivpbooks.Com Ga Google

Domain Name of Cookie Purpose Duration ivpbooks.com _ga Google Analytics, used to distinguish users Two years ivpbooks.com _gid Google Analytics, used to distinguish users Two days ivpbooks.com _dc_gtm_UA-65729251-2 Google Analytics, used to throttle request rate One day ivpbooks.com store Magento, used to display the correct store view One year ivpbooks.com PHPSESSID Magento, used to store information of the current session for the user (e.g. the basket One session and login information) ivpbooks.com country_code Magento, used to find your country location based on IP address One month ivpbooks.com searchReport-log Magento, used to log information about searching One year ivpbooks.com mage-translation-storage Magento, used for translation of content to other languages One year ivpbooks.com mage-translation-file-version Magento, used for translation of content to other languages One year ivpbooks.com form_key Magento, used to store randomly generated keys used to prevent forged requests One year ivpbooks.com mage-cache-storage Magento, used for caching of content on the browser to make pages load faster One session ivpbooks.com mage-cache-storage-section- Magento, used for caching of content on the browser to make pages load faster One session invalidation ivpbooks.com mage-cache-sessid Magento, used for caching of content on the browser to make pages load faster One session ivpbooks.com mage-messages Magento, used for caching, translations and in-page messages One session ivpbooks.com autocomplete-provider Magento, used to enable the -

Letter from Berlin

LETTER FROM BERLIN THE MAGAZINE OF INTERNATIONAL ECONOMIC POLICY 220 I Street, N.E., Suite 200 Washington, D.C. 20002 202-861-0791 www.international-economy.com Germany’s Wirecard Scandal [email protected] The largest accounting fraud in the country’s postwar history. By Klaus C. Engelen hile all of Europe broke. When Wirecard took the place of the world electronic payment trans- is still in the grip of Commerzbank AG in the DAX in action services as well as the issuing of of the worst pan- September 2018, the fintech’s shares physical cards. According to its promo- demic in a century, were worth about €20 billion. tion material, Wirecard authorized and Germany’s po- Its Austrian CEO Markus Braun, processed payments for about 280,000 Wlitical and financial establishments are who owned 7 percent of Wirecard, merchants, issued credit and prepaid also haunted by the Wirecard AG scan- was a billionaire. Now Braun (51) is in cards, and provided technology for dal. It is turning out to be the largest detention awaiting trial with two other contactless smartphone payments. case of accounting fraud in the coun- company executives. His second-in- Clients included German discounters try’s post-war history. The sad story is command Jan Marsalek (40), also Aldi and Lidl as well as nearly one that most of the political and financial Austrian, who was in charge of the hundred airlines. Since January 2006, establishments at all levels aided and company’s Asian business, has van- the group included a bank with a full abetted the mega-fraud. -

Curiositystream Inc. (Exact Name of Registrant As Specified in Our Charter) ______

As filed with the U.S. Securities and Exchange Commission on May 7, 2021 Registration No. 333-249556 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________________ POST-EFFECTIVE AMENDMENT NO. 3 TO FORM S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 _____________________________________ CuriosityStream Inc. (Exact name of registrant as specified in our charter) _____________________________________ Delaware 7812 84-1797523 (State or Other Jurisdiction of (Primary Standard Industrial (I.R.S. Employer Incorporation or Organization) Classification Code Number) Identification No.) 8484 Georgia Ave., Suite 700 Silver Spring, Maryland 20910 (301) 755-2050 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) _____________________________________ Tia Cudahy Chief Operating Officer, General Counsel and Secretary 8484 Georgia Ave., Suite 700 Silver Spring, Maryland 20910 (301) 755-2050 (Name, address, including zip code, and telephone number, including area code, of agent for service) _____________________________________ Copies to: Christopher Peterson Arnold & Porter 250 West 55th Street New York, New York 10019 _____________________________________ Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: S If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.