ISLE of MAN SPECIAL: Navigating the Conduct of Business Code Click Here Or Press Enter for the Accessibility Optimised Version

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Gd 2020/0058

GD 2020/0058 2020/21 1 Programme for Government October 2020 – July 2021 Introduction The Council of Ministers is pleased to bring its revised Programme for Government to Tynwald. The Programme for Government was agreed in Tynwald in January 2017, stating our strategic objectives for the term of our administration and the outcomes we hoped to achieve through it. As we enter the final year of this parliament, the world finds itself in the grip of the COVID-19 pandemic. This and other external factors, such as the prospect of a trade agreement between the UK and the EU, will undoubtedly continue to influence the work of Government in the coming months and years. What the Isle of Man has achieved over the past six months, in the face of COVID-19, has been truly remarkable, especially when compared to our nearest neighbours. The collective response of the people of our Island speaks volumes of the strength of our community and has served to remind us of the qualities that make our Island so special. At the beginning of the pandemic the Council of Ministers suspended the Programme for Government, and any work within it, to bring to bear the complete resources of the public service in the fight against coronavirus as we worked to keep our island and its people safe. Through the pandemic we have seen behaviour changes in society and in Government, and unprecedented times seem to have brought unprecedented ways of working. It is important for the future that we learn from the experiences of COVID and carry forward the positive elements of both what was achieved, and how Government worked together to achieve it. -

PP No 2020/0212

PP 2020/0212 ECONOMIC POLICY REVIEW COMMITTEE FIRST REPORT FOR THE SESSION 2020-21 VISITOR ACCOMMODATION ECONOMIC POLICY REVIEW COMMITTEE FIRST REPORT FOR THE SESSION 2020-21 VISITOR ACCOMMODATION There shall be three Policy Review Committees which shall be Standing Committees of the Court. Subject to Standing Order 5.6(3) they may scrutinise the established (but not emergent) policies, as deemed necessary by each Committee, of the Departments and Offices indicated in this paragraph together with the associated Statutory Boards and other bodies: Economic Committee: Treasury; the Department for Enterprise; and the Cabinet Office (including constitutional matters). Each Policy Review Committee shall in addition be entitled to take evidence from witnesses, whether representing a Department, Office, Statutory Board or other organisation within its remit or not, in cases where the subject matter cuts across different areas of responsibility of different Departments, Offices, Statutory Boards or other organisations. The Policy Review Committees may also hold joint sittings for deliberative purposes or to take evidence. The Chairmen of the Policy Review Committees shall agree on the scope of a Policy Review Committee’s inquiry where the subject cuts across the respective boundaries of the Policy Review Committees’ remits. Each Policy Review Committee shall have – (a) a Chairman elected by Tynwald, (b) two other Members. Members of Tynwald shall not be eligible for membership of the Committee, if, for the time being, they hold any of the following offices: President of Tynwald, member of the Council of Ministers, member of the Treasury Department referred to in section 1(2)(b) of the Government Departments Act 1987. -

Laurence Skelly – Rushen Political Questions

Laurence Skelly – Rushen Political Questions (2016) Why do you want to be a member of the Continue the work started. Challenging House of Keys? last 5 years but even more so next 5 years. Believe my proactive approach and contribution has been positive and experienced gained will be beneficial for next administration. If you were elected, what would your Maintain a diversified growing economy priorities be on a national level? that supports our high level social welfare including health, education and balanced society. Promote culture of national pride in all that we do and help make our Island great place to live, work, visit and invest. If you were elected, what would your Develop a National Marine Centre priorities be on a constituency level? celebrating UNESCO accreditation, wider use of Southlands old and new for health and social care services in our community, realise sports and recreational facilities at Ballakilley, revisit Marina options, encourage more jobs and businesses and relaunch Queenie Festival. How well do you think the present Worth pointing out this has been most administration has handled the major challenging for decades. Difficult and challenges of the past five years? unwelcome decisions have been made in order to rebalance revenue budget but kept a positive growing economy with low unemployment - so overall the performance has been satisfactory. What are the main political and social Fall out of Brexit, positioning the IOM issues facing the Isle of Man in the next economy, maintaining balanced society five years? and planning for ageing demographic. How would you deal with the challenges Brexit will take time to unfold and fully referred to in the previous answer? understand implications but we must comprehensively review all options and be ready to adapt what is in best interests of IOM. -

MINUTES of the MEETING of MAUGHOLD PARISH COMMISSIONERS HELD on MONDAY April 7 Th 2014, 7.30 PM at DHOON CHURCH HALL

MINUTES OF THE MEETING OF MAUGHOLD PARISH COMMISSIONERS HELD ON MONDAY April 7 th 2014, 7.30 PM AT DHOON CHURCH HALL 7.30 pm Meeting of Maughold Parish Commissioners Present: Mrs M Fargher Mr M. Cowley, Mr R Moughtin, Mrs C Perks, Mr J Quayle. 14.28 Apologies: All Members present. 14.29. Declarations of any Interests in the business of the Agenda. None declared besides those discussed at 14.31 below. 14.30. Consideration of the accuracy of the Minutes of the Meeting of the 3rd March 2014. These were agreed to be a correct record. Proposed Mr Moughtin , seconded Mr Cowley . Resolved . 14.31. Matters Arising from the Minutes of the 3rd of March 2014. Daffodil Competition. Mrs Fargher reported that she had attended on the day of the judging of the daffodil competition with the clerk. The Captain of the Parish, Mrs Lace had judged the competition. Mrs Fargher advised that the standard of entries had been extremely high. Mrs Fargher asked if a letter could be forwarded to Mrs Lace CP thanking her for undertaking judgement of the competition. Agreed . 14.32. Matters for Discussion . a. Feedback on Garff Authority Meeting, and to discuss further investigation of a single Garff local authority (Rates Equalisation Information CF). Mr Moughtin indicated that the meeting in Maughold had gone extremely well, with unanimous support for the investigation of the formation of a single Garff Local authority. The attendance at the public meeting had been less than in previous years, but it was noted that the poorer turnout was perhaps due to the error made by Lonan Commissioners with the content of the letter. -

ISLE of MAN SPECIAL: Navigating the Conduct of Business Code CONTENTS: News • Analysis • Video • Features Contents

Click here for the accessibility optimised version ISLE OF MAN SPECIAL: navigating the conduct of business code CONTENTS: News • Analysis • Video • Features Contents INTRODUCTION UK NEWS AN ISLAND’S FINANCE ISLE OF Bringing the Isle of Man’s Round-up of the latest news from MANIFESTO MAN impressive history up-to-date the UK, its Crown Dependencies and Overseas Territories An overview of the Isle of Man The Isle of Man Government’s today, its regulatory environment Simon Pickering explains the and international partners factors underpinning the island’s ongoing success Contents Contacts Publisher/Editor: Christopher Copper-Ind Tel +44 (0) 20 3727 9937 Head of Video & Ezines: Gary Robinson Tel +44 (0) 20 3727 9938 Editorial Director: Jonathan Boyd Tel +44 (0) 20 3727 9922 Correspondent: Pedro Gonçalves Tel: +44 (0) 20 3727 9937 Head of sales: Eliot Morton Tel +44 (0) 20 3727 9945 Head of marketing: Vanessa Forde Tel +44 (0) 20 3727 9924 CRACKING THE IN THE HOT SEAT PROFESSIONAL Office manager & accounts: Maria Margariti CONDUCT OF VIDEO: Zurich International CEO SERVICES Tel +44 (0) 20 3727 9925 Peter Huber is the latest addition to Managing Director: Louise Hanna BUSINESS CODE our exclusive Big Interview series Some of the biggest players in Tel +44 (0) 20 3727 9939 offshore financial services Chairman: Nicholas Rapley The island’s biggest names give Tel +44 (0) 20 3727 9939 their views in words and video Imagery: iStockPhoto.com, Shutterstock.com INTRODUCTION Bringing the Isle of Man’s impressive history up-to-date An unrivalled democratic history Welcome to International Investment’s 23rd special report. -

National Telecommunications Strategy October 2018

NATIONAL TELECOMMUNICATIONS STRATEGY OCTOBER 2018 GD 2018/0062 CONTENTS Foreword 04 Hon. Howard Quayle MHK – Chief Minister Hon. Laurence Skelly MHK – Minister for Enterprise Executive Summary 06 Our Telecommunications Vision 07 The six key strategic themes 08 Why we need a Telecommunications Strategy 09 Theme 1: Making it Happen 10 Theme 2: Regulation and Legislation 12 Theme 3: National Broadband Plan 15 Theme 4: Subsea Cables 22 Theme 5: Planning and Wayleaves 24 Theme 6: Government Operations 26 Summary 28 Conclusion 30 Glossary 31 3 FOREWORD HON. HOWARD QUAYLE, MHK CHIEF MINISTER The Isle of Man Government is determined to support the development of a telecoms infrastructure which meets the needs of both business and the public, now and into the future. We must have this if we are to be an Island of enterprise and opportunity, a special place to live and work. This strategy will support growth supports the economy as a whole. It The Isle of Man can be recognised and productivity and give everyone sends a clear message that the Island once more as being at the forefront the opportunity to engage in a is forward-looking in its approach of telecoms innovation. A fully modern connected world. The and is actively looking to grow digital connected Island with access to need for high speed broadband is a related industries such as Fintech and choice, value and a sustainable question being addressed by every Digital Health. telecommunications infrastructure. developed and many developing countries around the world. It The Island, as an internationally My Government fully supports has been shown that high quality, respected and trusted Crown this strategy and I am determined high speed communications are Dependency, has a long to see it deliver real benefits for essential for economic growth and history of reliable and stable all those who live and work on social inclusion. -

Mission to Isle of Man 22-23 November 2018

Special Committee on Tax Crimes, Tax Evasion and Tax Avoidance (TAX3) Mission to Isle of Man 22-23 November 2018 PRELIMINARY DRAFT PROGRAMME Thursday, 22 ARRIVAL TO ISLE OF MAN of Members foreseen for November 2018 Thursday afternoon at 15.00 local time (departure from Brussels in the morning). Thursday, 22 November 2018 Time Institution/Host Address/Tel Subject Scenic tour of the Island with a short stop at Tynwald Hill established by the Vikings where the Island’s Parliament, which Pick up from the 15.15 - 16.45 is 1,000 years old, airport annually promulgates the Island’s laws at the Island’s National Day every 5th July. Arrival to hotel for the first meeting Fight against Meeting with money laundering Taxwatch, informal Fight against Isle of Man-based corporate and discussion group on individual tax 17.00 - 18.00 Hotel the topics of tax evasion avoidance and the Transparency of offshore finance beneficial industry ownership VAT Time Institution/Host Address/Tel Subject Fight against money laundering, tax evasion and 18.10 - 19.10 Meeting with Appelby Hotel tax avoidance Transparency of beneficial ownership Checking in at the hotel and transfer to the venue of the dinner (walking distance) Working dinner with Hon Howard Quayle MHK, Chief Minister Hon Alfred Cannan MHK, Minister for the Treasury Hon Laurence Skelly MHK, Minister for Fight against Enterprise money laundering Fight against Mr Will Greenhow, Organised by the corporate and Chief Secretary IoM Government individual tax 20.00 - 22.00 evasion Mr John Quinn, HM Venue -

Standing Committee of Tynwald on Public Accounts Emergency

PP 2020/0107(2) STANDING COMMITTEE OF TYNWALD ON PUBLIC ACCOUNTS EMERGENCY SCRUTINY THIRD REPORT FOR THE SESSION 2019-20 MACRO ECONOMIC EFFECT OF THE EMERGENCY AND FINANCIAL SUPPORT SCHEMES Volume 2 of 2 STANDING COMMITTEE OF TYNWALD ON PUBLIC ACCOUNTS EMERGENCY SCRUTINY THIRD REPORT FOR THE SESSION 2019-20 MACRO ECONOMIC EFFECT OF THE EMERGENCY AND FINANCIAL SUPPORT SCHEMES 3.1 There shall be a Standing Committee of the Court on Public Accounts. 3.2 Subject to paragraph 3.6, the Committee shall have – (a) a Chairman elected by Tynwald, (b) a Vice-Chairman elected by Tynwald, (c) four other Members, who shall be Chairman of each of the Policy Review Committees (ex officio) and the Chairman of the Committee on Constitutional and Legal Affairs and Justice; and a quorum of three. 3.3 Members of Tynwald shall not be eligible for membership of the Committee, if, for the time being, they hold any of the following offices: President of Tynwald, member of the Council of Ministers, member of the Treasury Department referred to in section 1(2)(b) of the Government Departments Act 1987. 3.4 The Committee shall – (a) (i) consider any papers on public expenditure and estimates presented to Tynwald as may seem fit to the Committee; (ii) examine the form of any papers on public expenditure and estimates presented to Tynwald as may seem fit to the Committee; (iii) consider any financial matter relating to a Government Department or statutory body as may seem fit to the Committee; (iv) consider such matters as the Committee may think fit in order to scrutinise the efficiency and effectiveness of the implementation of Government policy; and (v) lay an Annual Report before Tynwald at each October sitting and any other reports as the Committee may think fit. -

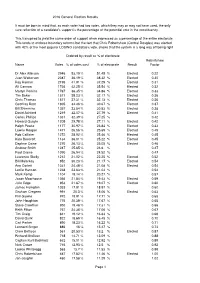

2016 General Election Statistics Summary

2016 General Election Results It must be born in mind that, as each voter had two votes, which they may or may not have used, the only sure reflection of a candidate's support is the percentage of the potential vote in the constituency. This transpired to yield the same order of support when expressed as a percentage of the entire electorate This tends to endorse boundary reforms but the fact that Chris Robertshaw (Central Douglas) was elected with 42% of the most popular LOSING candidate's vote, shows that the system is a long way off being right Ordered by result as % of electorate Robertshaw Name Votes % of votes cast % of electorate Result Factor Dr Alex Allinson 2946 53.19 % 51.45 % Elected 0.22 Juan Watterson 2087 36.19 % 38.32 % Elected 0.30 Ray Harmer 2195 41.91 % 37.29 % Elected 0.31 Alf Cannan 1736 42.25 % 35.54 % Elected 0.32 Martyn Perkins 1767 36.35 % 34.86 % Elected 0.33 Tim Baker 1571 38.23 % 32.17 % Elected 0.36 Chris Thomas 1571 37.31 % 32.13 % Elected 0.36 Geoffrey Boot 1805 34.46 % 30.67 % Elected 0.37 Bill Shimmins 1357 33.54 % 30.53 % Elected 0.38 David Ashford 1219 32.07 % 27.79 % Elected 0.41 Carlos Phillips 1331 32.39 % 27.25 % 0.42 Howard Quayle 1205 29.78 % 27.11 % Elected 0.42 Ralph Peake 1177 30.97 % 26.84 % Elected 0.43 Lawrie Hooper 1471 26.56 % 25.69 % Elected 0.45 Rob Callister 1272 28.92 % 25.46 % Elected 0.45 Kate Beecroft 1134 36.01 % 25.22 % Elected 0.45 Daphne Caine 1270 26.13 % 25.05 % Elected 0.46 Andrew Smith 1247 25.65 % 24.6 % 0.47 Paul Craine 1090 26.94 % 24.52 % 0.47 Laurence Skelly 1212 21.02 -

Department of Economic Development

Department of Economic Development Isle of Man Rheynn Lhiasaghey Tarmaynagh Hon. Laurence Skelly MHK Government Minister for Economic Development Department of Economic Development Refityi. Vrinoliri 1st Floor, St George's Court Upper Church Street Douglas, Isle of Man IM1 1EX Direct Dial No: (01624) 686401 Fax: (01624) 686454 Website: www.gov.im/ded Email: [email protected] 26 June 2015 To: Mr Speaker and Members of the House Of Keys Dear Mr Speaker and Members of the House of Keys Re: House of Keys Sitting 23 June 2015 — Oral Question 5 At this week's sitting of the House of Keys, I responded to the question on Local Regeneration Committees from the Honourable Member for Onchan, Mr Quirk. As part of my response I committed to provide to the Honourable Members details of the wider remit for the Local Regeneration Committees, and details of the assistance to areas outside of Douglas available under the Financial Assistance Scheme. The information is attached in the Annex to this letter. In addition, I have included the full current terms of reference of the Local Regeneration Committees and current membership. Yours sincerely Hon Laurence Skelly MHK Minister for Economic Development Enc. Annex Annex Wider remit of the Local Regeneration Committees The wider remit of the Committees could include matters such as: • Supporting the delivery of Vision 2020 and the Government's economic growth agenda. • Compiling, in conjunction with Government, a baseline of local economic information which includes, employment sectors, employment numbers, unemployment, housing numbers and types, retail information, number of new businesses established, the businesses benefitting from grants, footfall figures and vacant shop unit data. -

Candidate Information Pack 01-03-18

Executive Agencies Candidate Information Pack 01-03-18 01-03-18 1 Message to Candidates for Posts of Chair and Chief Executives Department for Enterprise - Executive Agencies Dear Candidate, Thank you for your interest in playing a key role within one of our Executive Agencies. We welcome business leaders to be part of this exciting public-private sector approach to economic development. You may already have some idea about the Department for Enterprise but we would like to use this document to give you a richer picture of the Executive Agency structure we have established and the Department in which it operates. We have spent a significant amount of time determining the appropriate corporate governance framework and we have benefited from the wealth of experience and insights from external stakeholders. We have addressed the Agency board composition and working arrangements within the Terms of Reference attached to each Agency. This is a stand-alone document, available as a link from the job advertisement. If you believe you have the experience and qualities to join us, we very much look forward to hearing from you. Kind Regards, Laurence Skelly MHK Minister for Enterprise 01-03-18 2 Summary of Executive Agency Board Vacancies Agency Agency Board Term of Recruitment Panel vacancies appointment 1 Chair 2 years (+2 years by Minister, Political Member & Open recruitment mutual agreement) Chief Executive DfE Minimum of 6 external 3 years (+ 3 years if Chair, Political Member, Chief voluntary Board members re-nominated) Executive By nomination/discussion -

Im-Esummit-Report-2014.Pdf

Kindly sponsored by © 2014-2015 KPMG LLC, an Isle of Man limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative 1 (“KPMG International”), a Swiss entity. All rights reserved. Introduction Since becoming the world’s first Following a wake-up breakfast kindly Paul Leyland of Regulus Partners jurisdiction to introduce legislation provided by sponsors Manx Telecom, followed with an erudite and specific to eGaming in 2001, the Isle the Summit proper opened with a penetrating analysis of point of of Man has secured its place as a welcome address by Minister for the consumption licensing and the dot world leading jurisdiction which is Department of Economic com model before KPMG’s Head of home to the industry’s most Development, Laurence Skelly, MHK. VAT, Sandra Skuszka, delivered a celebrated licensed brands and most Minister Skelly provided a brief particularly pertinent presentation on comprehensive suite of ancillary overview of the success of the Island’s forthcoming changes to place of service providers. Today, the Isle of eGaming sector, which now accounts supply VAT rules for January 2015. Man stands for constancy in for 13% of the Island’s GDP, before Representatives of the International technological innovation and introducing the day’s first speaker Masters of Gaming Law returned to regulatory progress even as it faces Quirino Mancini of SCM Lawyers. provide the final presentation of the changes to its white list status, its Drawing upon a series of examples day in a spirited debate concerning the nearest onshore neighbour moving from his home jurisdiction Italy, Mr US regulatory scheme and emerging to a place of consumption Mancini tackled the perennial problem market issues.