In Part Two of This Deep Dive, We Provide an Overview of the Warehouse-Club Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shaping the World

Shaping the World Dean’s State of the School Address Jack H. Knott C. Erwin and Ione L. Piper Dean and Professor USC Price School of Public Policy University of Southern California May 15, 2012 USC PRICE SCHOOL OF PUBLIC POLICY Our naming gift was just the beginning of our Campaign for Excellence, and a future of extraordinary Impact. As Jim Collins states in his book, From Good to Great in the Social Sectors, “No matter how much you have achieved, you will always be merely good relative to what you can become. Greatness is an inherently dynamic process, not an end point.” ~ Dean Jack H. Knott Dean’s State of the School Address May 15, 2012 USC Price School of Public Policy University of Southern California Introduction A Growing Academic Reputation Thank you everyone for coming today. Before we announced our naming gift, ballots among peer institutions were due in to U.S. News and World Report for their It is wonderful to see so many members of our Athenian Society triennial ranking of public affairs schools nationwide. When and other special friends and donors here to celebrate with us the results were released, we moved up to No. 6, from No. 7, this morning. I thank every one of you in this room, including the among 266 schools. This was our fifth consecutive top-10 Price School faculty and staff, for your unsurpassed dedication national ranking, and our highest to-date. and hard work. We retained equally high rankings in all subcategories, and I take such great pride in our school, and in our extraordinary rose to 4th in health policy and management, alongside accomplishments and milestones we’ve achieved this past year. -

Costco Introduction Location History

Costco Introduction Costco Wholesale Corporation is the seventh largest retailer in the world. As of July 2012 it was the fifth largest retailer in the United States, and the largest membership warehouse club chain in the United States. As of October 2007, Costco is the largest retailer of wine in the world. Location Costco is headquartered in Issaquah, Washington, United States and was founded in 1983 in Kirkland, Washington with its first warehouse in nearby Seattle. Today Costco has locations in the United Kingdom, Canada, Australia, Mexico, Taiwan, South Korea, Japan, and the United States. History Founded by James (Jim) Sinegal and Jeffrey H. Brotman, Costco opened its first warehouse in Seattle, Washington, on September 15, 1983.Sinegal had started in wholesale distribution by working for Sol Price at both FedMart and Price Club. Brotman, an attorney from an old Seattle retailing family, had also been involved in retail distribution from an early age.Wal-Mart founder Sam Walton had plans to merge Sam's Club with Price Club.[10] In 1993, however, Costco merged with Price Club (called Club Price in the Canadian province of Quebec). Costco's business model and size were similar to those of Price Club, which was founded by Sol and Robert Price in 1976 in San Diego, California. Thus, the combined company, PriceCostco, was effectively double the size of each of its parents. Just after the merger, PriceCostco had 206 locations generating $16 billion in annual sales PriceCostco was initially led by executives from both companies, but then Sol and his son Robert Price founded Price Enterprises and left Costco in December 1994.The first Price Club location was opened in 1976 in an old airplane hangar, previously owned by Howard Hughes, and is still in operation today (Warehouse No. -

What Is a Warehouse Club?

What is a Warehouse Club? The principle operators in the warehouse club industry are BJ’s Wholesale, Cost-U-Less, Costco Wholesale, PriceSmart and Sam’s Club. These five companies follow the basic warehouse club principles developed by Sol and Robert Price, who founded the warehouse club industry when they opened the first Price Club in San Diego, California in 1976. However, the five warehouse club operators have adapted those basic concepts to today’s retail environment. This chapter provides an explanation of the key characteristics of a warehouse club in 2010. Overall Description A warehouse club offers its paid members low prices on a limited selection of nationally branded and private label merchandise within a wide range of product categories (see picture on the right of Mott’s sliced apples at BJ’s). Rapid inventory turnover, high sales volume and reduced operating costs enable warehouse clubs to operate at lower gross margins (8% to 14%) than discount chains, supermarkets and supercenters, which operate on gross margins of 20% to 40%. BJ’s – Mott’s Sliced Apples Overall Operating Philosophy When it comes to buying and merchandising, the warehouse clubs follow the same simple and straightforward six-point philosophy that was originated by Sol Price: 1. Purchase quality merchandise. 2. Purchase the right merchandise at the right time. 3. Sell products at the lowest possible retail price. 4. Merchandise items in a clean, undamaged condition. 5. Merchandise products in the right location. 6. Stock items with the correct amount of inventory, making sure that supply is not excessive. In 1983, Joseph Ellis, an analyst at Goldman Sachs, summarized the warehouse club operating philosophy in a meaningful and relevant way. -

Final Debriefing About Case N. 16 Amazon (State N. and Name of the Selected Company) Analyzed by Alfonso - Name –Navarro Miralles- Surname

Final debriefing about case n. 16 Amazon (state n. and name of the selected company) Analyzed by Alfonso - name –Navarro Miralles- surname Scientific articles/papers State at least n.1 scientific article/paper you selected to support your analysis and recommendations N. Title Author Journal Year, Link number 1. 17/06/2017 https://www.elconfidencial.com/tecnologia/2017-06-17/amazon-whole-foods-supermercados-amazon-go_1400807/ 2. 2/06/2020 https://r.search.yahoo.com/_ylt=AwrP4o3VEdleYUMAKhxU04lQ;_ylu=X3oDMTByZmVxM3N0BGNvbG8DaXIyBHBvcwMxBHZ0aWQDBHNlYwNzYw- -/RV=2/RE=1591312982/RO=10/RU=https%3a%2f%2flahora.gt%2famazon-coloca-sus-bonos-al-interes-mas-bajo-jamas-pagado-por-una-empresa-en-ee- uu%2f/RK=2/RS=Zx5.zD_yM_46ddGLB3MWurVI_Yw- 3. 2/04/2019 https://r.search.yahoo.com/_ylt=AwrJS5g3EtleXmwAKj9U04lQ;_ylu=X3oDMTByaW11dnNvBGNvbG8DaXIyBHBvcwMxBHZ0aWQDBHNlYwNzcg-- /RV=2/RE=1591313079/RO=10/RU=https%3a%2f%2fwww.merca20.com%2famazon-lanzo-una-agresiva-estrategia-de-mercadotecnia-en-whole- foods%2f/RK=2/RS=iypqQZFlpG12X9jM7BsXb1VPVx8- Describe the company’s strategic profile and its industry Applying the tools of analysis covered in the whole textbook, identify and evaluate the company’s strategic profile, strategic issues/problems that merit attention (and then propose, in the following section, action recommendations to resolve these issues/problems). Jeff Bezos founded the electronic commerce company Amazon in 1995, a name chosen for his taste for the Amazon River. Their service was somewhat novel to netizens, resulting in the increase in visits fastly. Only in the first month of operation, and to Bezos' own happiness, had books been sold in all corners of the United States. Months later it reached 2,000 daily visitors, a figure that would multiply abysmally in the next year. -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

'Always Low Prices': a Comparison of Costco to Wal-Mart's Sam's Club

26 Academy of Management Perspectives August Decency Means More than “Always Low Prices”: A Comparison of Costco to Wal-Mart’s Sam’s Club Wayne F. Cascio* Executive Overview Wal-Mart’s emphasis on “Always low prices. Always” has made it the largest retail operation in history. However, this unrelenting mission has also created a way of doing business that draws substantial criticism regarding the company’s employment practices, relationships with suppliers, and the company’s impact on local economies. This paper focuses on a company that delivers low prices to consumers, but in a fundamentally different way than its competitor, Wal-Mart. That company is warehouse-retailer Costco. In the following sections we will begin by providing some background on the company, including its history, its business model, its ethical principles, core beliefs, and values. Then we will consider some typical Wall Street analysts’ assessments of this approach, followed by a systematic comparison of the financial performance of Costco with that of Sam’s Club, a warehouse retailer that is part of Wal-Mart. o be sure, Wal-Mart wields its awesome power source of unrelenting criticism. As Fishman for just one purpose: to bring the lowest possi- (2006) notes, the company’s core values seem to Tble prices to its customers. Sam Walton, affec- have become inverted, for they now sometimes tionately known as “Mr. Sam” by Wal-Mart asso- drive behavior that is not only exploitive, but in ciates, embodied a number of admirable values some cases, illegal as well. Consider the pressure that he instilled in the company he founded: hard on store managers to control labor costs. -

Trader Joe's Vs. Whole Foods Market

MIT Students Trader Joe’s vs. Whole Foods Market: A Comparison of Operational Management 15.768 Management of Services: Concepts, Design, and Delivery 1 Grocery shopping is more diversified and evolved than ever before. Individuals across the nation have access to everything from exotic products to unique delivery services. Often, specialty stores have limited locations whereas specialty services have a limited reach. However, two retailers have expanded to hundreds of locations while adhering to unexpected market positioning for previously untargeted market segments. Whole Foods Market and Trader Joe’s have become household names while also innovating beyond regional and national traditional chains. Despite comparable size in terms of locations, each store’s growth has operated using a very different model. This document will address the various facets for both Whole Foods Market and Trader Joe’s in order to understand how each business model has won a piece of the market pie and share of wallet. Whole Foods Market Background and History In 1978, John Mackey had a vision to build a store that would meet his desire for whole, natural foods as part of the movement away from artificial, processed foods. Mackey was a college dropout, but against all odds he was able to borrow $45,000 in capital financing and open his first store for what would become Whole Foods in Austin, Texas.1 By all accounts it has been an incredible success and the most recent annual report (2009) reveals that there are 284 stores across most of the United States with a handful in Canada and Great Britain.2 2009 2008 2007 2006 Sales (000s) $8,031,620 $7,953,912 $6,591,773 $5,607,376 1 http://www.wholefoodsmarket.com/company/history.php 2 Whole Foods Market Annual Report (2009), pg. -

Whole Foods Market Unacceptable Ingredients for Food (As of March 15, 2019)

Whole Foods Market Unacceptable Ingredients for Food (as of March 15, 2019) 2,4,5-trihydroxybutyrophenone (THBP) benzoyl peroxide acesulfame-K benzyl alcohol acetoin (synthetic) beta-cyclodextrin acetone peroxides BHA (butylated hydroxyanisole) acetylated esters of mono- and diglycerides BHT (butylated hydroxytoluene) activated charcoal bleached flour advantame bromated flour aluminum ammonium sulfate brominated vegetable oil aluminum potassium sulfate burnt alum aluminum starch octenylsuccinate butylparaben aluminum sulfate caffeine (extended release) ammonium alum calcium benzoate ammonium chloride calcium bromate ammonium saccharin calcium disodium EDTA ammonium sulfate calcium peroxide apricot kernel/extract calcium propionate artificial sweeteners calcium saccharin aspartame calcium sorbate azo dyes calcium stearoyl-2-lactylate azodicarbonamide canthaxanthin bacillus subtilis DE111 caprocaprylobehenin bacteriophage preparation carmine bentonite CBD/cannabidiol benzoates certified colors benzoic acid charcoal powder benzophenone Citrus Red No. 2 Page 1 of 4 cochineal foie gras DATEM gardenia blue diacetyl (synthetic) GMP dimethyl Silicone gold/gold leaf dimethylpolysiloxane heptylparaben dioctyl sodium sulfosuccinate (DSS) hexa-, hepta- and octa-esters of sucrose disodium 5'-ribonucleotides high-fructose corn syrup/HFCS disodium calcium EDTA hjijiki disodium dihydrogen EDTA hydrogenated oils disodium EDTA inosine monophosphate disodium guanylate insect Flour disodium inosinate iron oxide dodecyl gallate kava/kava kava EDTA lactic acid esters of monoglycerides erythrosine lactylated esters of mono- and diglycerides ethoxyquin ma huang ethyl acrylate (synthetic) methyl silicon ethyl vanillin (synthetic) methylparaben ethylene glycol microparticularized whey protein derived fat substitute ethylene oxide monoammonium glutamate eugenyl methyl ether (synthetic) monopotassium glutamate FD&C Blue No. 1 monosodium glutamate FD&C Blue No. 2 myrcene (synthetic) FD&C Colors natamycin (okay in cheese-rind wax) FD&C Green No. -

The Us Grocery Industry in the 2020S

Global Journal of Business Disciplines Volume 3, Number 1, 2019 THE U.S. GROCERY INDUSTRY IN THE 2020S: WHO WILL COME OUT ON TOP? Maamoun Ahmed, University of Minnesota Duluth ABSTRACT The world of grocery retail is constantly shifting. Competition continues to intensify driven by two main players: Amazon and Walmart. The two American giants are dominating the brick- and-mortar and online realms. However, they are being challenged by a German underdog, Aldi. Aldi’s business model is built around slashing cost without compromising quality. A typical Aldi store is 12,000 square feet, and carries a limited selection of mostly inexpensive private brands (1,000 SKUs). Merchandise is often stacked in the aisles and sold straight from the cardboard box it was shipped in. Basically, Aldi is a grocery store that's the size of a convenience store. Consequently, the deep-discount grocer has been able to appeal to a growing price-sensitive segment and continues to win over American consumers. Aldi U.S. has grown from one store in 1976 to almost 2,000 stores in 36 states in 2019, and has plans to expand to 2,500 stores by the end of 2022. There is no doubt the nimble “underdog” has disrupted the $700 billion grocery industry, and giants like Amazon, Kroger, and Walmart have no choice but to up their game. The retail behemoths are aggressively lowering prices and continuously refining online ordering and home delivery programs to respond to the threat Aldi poses. Selling groceries in America has never been harder. Can U.S. -

Update on How Whole Foods Market Is Responding to COVID-19 March 13, 2020

Update on How Whole Foods Market Is Responding to COVID-19 March 13, 2020 LEADERSHIP MESSAGE The following message was posted on behalf of the E-Team. Dear Team Members, As we continue to closely monitor the COVID-19 situation and respond in real-time, we wanted to call your attention to the communication below, which has also been posted on our website for customers and external stakeholders. We are pleased to share an update on funding for Team Members who may be impacted by COVID- 19 and in need of additional support. Our parent company, Amazon, has matched Team Members’ generous contributions to the Team Member Emergency Fund (TMEF) with an additional $1.617M. In support of our Shared Fate Leadership Principle, these funds will help ease the burden on Team Members who need critical support for themselves and their families. For more information or assistance in applying, please reach out to your Team Member Services Executive Leader or point of contact. Thank you for your continued dedication and hard work during these challenging times. Your health and wellbeing remain our top priority, and we will continue to provide updates via Innerview about the additional steps and measures we implement as the situation continues to unfold. Thank you, The E-Team X March 13, 2020 How Whole Foods Market is Responding to COVID-19 To our Whole Foods Market community and customers: We want to make sure you know what to expect when visiting our stores in the coming weeks, as well as how we’re responding to the evolving coronavirus (COVID-19) situation, both as a retailer and employer. -

Kroger: Value Trap Or Value Investment - a Deep Due Diligence Dive

Kroger: Value Trap Or Value Investment - A Deep Due Diligence Dive seekingalpha.com /article/4115509-kroger-value-trap-value-investment-deep-due-diligence-dive Chuck 10/23/2017 Walston The acquisition of Whole Foods Market, announced by Amazon ( AMZN) last June sent shockwaves through the grocery industry. 1/20 When the deal was finalized in August, Amazon announced plans to lower the prices of certain products by as much as a third. The company also hinted at additional price reductions in the future. Amazon Prime members will be given special savings and other in-store benefits once the online retail giant integrates its point of sale system into Whole Foods stories. 2/20 Analysts immediately predicted a future of widespread margin cuts across the industry. Well before Amazon's entry into stick and brick groceries, Kroger ( KR) experienced deterioration in comparable store sales. 3/20 (Source: Kroger Investor Presentation slideshow) (Source: SEC Filings via SA contributor Quad 7 Capital) Additionally, Kroger's recent results reflect gross margin compression. 4/20 (Source: SEC Filings via SA contributor Quad 7 Capital) After the takeover, Whole Foods initiated a price war. According to Reuters, prices at a Los Angeles Whole Foods store are lower on some products than comparable goods sold in a nearby Ralph's store owned by Kroger. The Threat From Amazon Research conducted by Foursquare Labs Inc. indicates the publicity surrounding Amazon's recent acquisition of Whole Foods, combined with the announcement of deep price cuts, resulted in a 25% surge in customer traffic. Not content to attack conventional grocers with their panoply of online food services and margin cuts, Amazon registered a trademark application for a meal-kit service. -

Store Name Address Zip Code

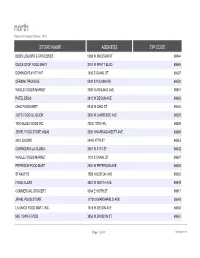

north Based on Grocery Stores - 2013 STORE NAME ADDRESS ZIP CODE BOB'S LIQUORS & GROCERIES 5069 W MADISON ST 60644 QUICK STOP FOOD MART 2751 W PRATT BLVD 60645 DOMINICK'S #147/1147 1340 S CANAL ST 60607 CERMAK PRODUCE 5220 S PULASKI RD 60632 WHOLE FOODS MARKET 3300 N ASHLAND AVE 60657 PATEL BROS 2610 W DEVON AVE 60659 OHIO FOOD MART 5345 W OHIO ST 60644 JOE'S FOOD & LIQUOR 3626 W LAWRENCE AVE 60625 TWO BLUE FOODS INC 702 E 100TH PL 60628 JEWEL FOOD STORE #3349 2520 N NARRAGANSETT AVE 60639 200 LIQUORS 204 E 47TH ST 60653 CARNICERIA LA GLORIA 2551 W 51ST ST 60632 WHOLE FOODS MARKET 1101 S CANAL ST 60607 PETERSON FOOD MART 2534 W PETERSON AVE 60659 STANLEY'S 1558 N ELSTON AVE 60622 FOOD 4 LESS 4821 W NORTH AVE 60639 COMMERCIAL GROCERY 3004 E 100TH ST 60617 JEWEL FOOD STORE 11730 S MARSHFIELD AVE 60643 LA UNICA FOOD MART, INC. 1515 W DEVON AVE 60660 MID TOWN FOODS 3855 W DIVISION ST 60651 Page 1 of 50 09/26/2021 north Based on Grocery Stores - 2013 WARD 28 50 2 23 44 50 37 39 8 36 3 14 2 50 32 37 10 34 40 27 Page 2 of 50 09/26/2021 north Based on Grocery Stores - 2013 7400 S HALSTED FOOD AND LIQUORS, INC. 7400 S HALSTED ST 60621 THREE BROTHER 900 N FRANCISCO AVE 60622 CUENCA'S BAKERY & GROCERIES 4229 W MONTROSE AVE 60641 JEWEL FOOD STORES #3262 4660 W IRVING PARK RD 60641 ROMAN BROS 1 INC 6978 N CLARK ST 60626 TAI NAM CORPORATION 4925 N BROADWAY 60640 LA JALISCIENCE 3239 W 26TH ST 60623 HOLLYWOOD TOWER MKT 5701 N SHERIDAN RD 60660 A & R FOOD MART 5952 W GRAND AVE 60639 S.