Ivca Private Equity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

68456534758.Pdf

12th May 2021 National Stock Exchange of India Ltd, BSE Limited Exchange Plaza, Bandra Kurla Complex, P.J. Towers, Dalal Street Bandra (East), Mumbai – 400051. Mumbai - 400001. Fax No.26598237/26598238 Fax No.22722037/22723121 Name of Scrip: CIGNITITEC Scrip code: 534758 Dear Sir / Madam, Sub: Submission of Annual Report for the FY 2020-21 In compliance with Regulation 34 of SEBI (Listing Obligation and Disclosure Requirement) Regulations, 2015, we are herewith submitting the Annual report of the Company for the FY 2020-21. This is for the information and records of the Exchange, please. Thanking you. Yours Faithfully, For Cigniti Technologies Limited A.N.Vasudha Company Secretary Encl: as above WELCOMING Assuring Digital Experiences Annual Report 2020-21 Cigniti Technologies Ltd. Contents Corporate Overview Welcoming Next - Assuring Digital Experiences 01 Key Performance Indicators 07 Chairman’s Message 08 CEO’s Message 10 World of Cigniti 12 Project Cignificance, a CSR Initiative 25 Board of Directors 26 Our People 28 Corporate Information 32 Reports Notice 36 Board’s Report 44 Management Discussion and Analysis 70 Business Responsibility Report 76 Corporate Governance Report 84 Financial Statements Consolidated Statement Independent Auditors Report 114 Balance Sheet 121 Statement of Profit and Loss 122 Cash Flow Statement 124 Notes 125 Standalone Statement Independent Auditors Report 172 Balance Sheet 181 Statement of Profit and Loss 182 Cash Flow Statement 184 Notes 185 Cautionary Statement Regarding Forward-Looking Statements Certain statements in this annual report concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. -

The 58 Most Active Venture Capital Firms for Startups in India

The 58 Most Active Venture Capital Firms For Startups In India (and their investing patterns) ©2018 Inc42 All Rights Reserved Feel free to share this ebook without modification. 1 Introduction Once a startup has reached the growth stage, its most important requirement is undoubtedly the backing by reliable investors and an ample amount of funding to scale up. Though the concept of starting up has gained momentum recently, the small number of investors willing to show their trust and invest in new ventures has been a problem for startups. Many startups find it difficult to approach venture capitalists and quite a few times the investment structure of the investor is inadequate for the startup. So in this document, we bring to you the much needed list of the most active institutional investors and capital funds in India along with their investment capacity, investment structure, investment industries and some of their most notable portfolio startups. 2 Helion Venture Partners Investing in technology-powered and consumer service businesses, Helion Ventures Partners is a $605 Mn Indian- focused, an early to mid-stage venture fund participating in future rounds of financing in syndication with other venture partners. People You Should Know: Sandeep Fakun, Kanwaljit Singh. Investment Structure: Invests between $2 Mn to $10 Mn in each company with less than $10 Mn in revenues. Industries: Outsourcing, Mobile, Internet, Retail Services, Healthcare, Education and Financial Services. Startups Funded: Yepme, MakemyTrip, NetAmbit, Komli, TAXI For Sure, PubMatic. Contact Details: 8040183333, 01244615333, 3 Accel Partners Accel Partners founded in 1983 has global presence in Palo Alto, London , New York, China and India. -

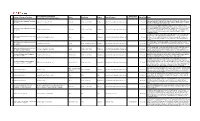

Annual Deal List

Annual Deal List 16th annual edition Contents Section Page Mergers & Acquisitions 04 1. Domestic 05 2. Inbound 15 3. Merger & Internal Restructuring 18 4. Outbound 19 Private Equity 23 QIP 67 IPO 69 Disclaimer This document captures the list of deals announced based on the information available in the public domain. Grant Thornton Bharat LLP does not take any responsibility for the information, any errors or any decision by the reader based on this information. This document should not be relied upon as a substitute for detailed advice and hence, we do not accept responsibility for any loss as a result of relying on the material contained herein. Further, our analysis of the deal values is based on publicly available information and appropriate assumptions (wherever necessary). Hence, if different assumptions were to be applied, the outcomes and results would be different. This document contains the deals announced and/or closed as of 23 December 2020. Please note that the criteria used to define Indian start-ups include a) the company should have been incorporated for five years or less than five years as at the end of that particular year and b) the company is working towards innovation, development, deployment and commercialisation of new products, processes or services driven by technology or intellectual property. Deals have been classified by sectors and by funding stages based on certain assumptions, wherever necessary. Dealtracker editorial team Pankaj Chopda and Monica Kothari Our methodology for the classification of deal type is as follows: Minority stake - 1%-25% | Strategic stake - 26%-50% | Controlling stake - 51%-75% | Majority stake - 76%-99% Maps are for graphical purposes only. -

DSP Newsletter

Social Purpose Organisations Amount US$ Funders / Resource Providers Cause Beneficiary Region Type of Support Date of Deal Notes (Non-profits and Social Enterprises) (Financial Only) ABS-CBN Lingkod Kapamilya Foundation, Inc. turned over the new 1-unit 2- ABS-CBN Lingkod Kapamilya Foundation, classroom building of Capehan Elementary School in Capihan, Libona, Bukidnon 1 Capehan Elementary School Education Children and Youths Philippines Non-Financial: Operational Management 7 Sep 2018 Inc.(ALKFI) that will benefit three hundred sixty two (362) students. Bukidnon was one of the affected areas of Typhoon Sendong in 2011. ABS-CBN Lingkod Kapamilya Operation Sagip recently turned-over 1-unit 2- classroom building in Ortega Integrated School in Libacao, Aklan. The classrooms ABS-CBN Lingkod Kapamilya Foundation, were built by 552nd Engineering Battalion of Philippine Army together with local 2 Ortega Integrated School Education Children and Youths Philippines Non-Financial: Operational Management 18-Sep-18 Inc. (ALKFI) volunteers, in coordination with the 301st Infantry Brigade, 3ID, Philippine Army. The construction of the classrooms is part of Operation Sagip’s Yolanda rehabilitation efforts. Through the donations, ALFKI's Operation Sagip, together with ABS CBN News Public Service, ABS CBN Regional and local partners, already reached 6,865 ABS-CBN Lingkod Kapamilya Foundation, 3 Benguet and Cagayan provinces Other Other Philippines Non-Financial: Operational Management 20-Sep-18 families or 34,325 individuals affected by Typhoon Ompong with relief packs in Inc. (ALKFI) Benguet and Cagayan, including more than 200 families with totally damaged houses. Seven barangays of with a total population of 3,202 will benefit from the new ABS-CBN Lingkod Kapamilya Foundation, 4 Barangay Heath Stations Health People with Medical Needs Philippines Non-Financial: Operational Management 21 Aug 2018 Barangay Heath Station equipped with a birthing facility at Brgy. -

Newsletter Q3-Q4 Web

FLASHBACK (EDITION - JANUARY 2019) 33+ 8 NIPP Konnect Sessions 189 Exclusive Pitch Curated lists Sessions at NASSCOM events 1620 98 62 Startups Curated Startups Startups Participated Participated Collaborated with DSCI, 2 Innovation Roundtables Product Council and GCC Council 2 241 for joint initiatives CXO Roundtables Startups connected for one-on-one Participation of interactions with Corporates 2 research reports with 124 Corporates in NIPP Corporate Partners - initiatives, including KPMG & Wipro NIPP Partners A TOTAL OF 1000 UNIQUE STARTUPS IMPACTED THROUGH THE ABOVE-MENTIONED ACTIVITIES! WE WELCOME OUR NEW PARTNERS (H2, 2018): WISHING YOU A HAPPY AND INNOVATIVE NEW YEAR www.nipp.tech PAGE 1 Exclusive Pitch Sessions July Chola MS, an Indian insurance firm, is a joint venture between the Cholamandalam MS Murugappa Group (an Indian conglomerate) and the Mitsui Sumitomo General Insurance Insurance Group (Japanese insurance company). The session was organised Company Ltd (Chola MS) on 14th July at the Chola MS office, as part of I And We Warehouse program. A pitch session was conducted with representatives from The RPG-Sanjiv Goenka Group on 19th July at their Kolkata office. They explored RPG – Sanjiv Goenka collaborations with startups in the Automotive space, owing to their interest across diverse business sectors such as Power & Natural Resources, Carbon Group Black, IT & Education, Infrastructure, Retail, Media, Entertainment & Sports. Startup Dabadigo were thrilled with the opportunity to showcase their product, during the session. August The leadership team of Hindustan Unilever was hosted at the Bangalore Warehouse on 8th August. The team was led by Andrew Hill – VP Hindustan Unilever Ltd. Information & Analytics, Meenakshi Burra – Director Information & (Enterprise Support Analytics and Aneesh Chaudhry – Head of Data & Analytics South Asia. -

Ivca Private Equity

KONNECT ADVOCACY IVCA PRIVATE EQUITY - RESEARCH VENTURE CAPITAL REPORT EDUCATION KONNECT NOVEMBER 2020 NEW DELHI | MUMBAI | BANGALORE CONTENTS Executive Summary 03 Private Equity Investments 04 Venture Capital Investments 07 Exits 09 Angel Investments 11 Investments involving AIFs 13 Appendix & Tables 15 160+ MEMBERS & GROWING.. Executive Summary Private Equity(1) Investments & Exits November 2020 registered 74 Private Equity (PE) investments worth about ₹20,258 Cr ($2.7 Billion). The largest PE investment was the ₹9,555 Crore ($1.3 Billion) investment from Public Investment Fund in Reliance Retail Ventures, the holding company of the retail companies of the RIL Group. Funds with AIF vehicles participated in 32 investments. Retail and IT & ITES industry topped the industry table by value and volume, respectively. Mumbai topped the chart for most investments in a city (by value). The month witnessed 20 PE exits that harvested about ₹4,425 Cr ($596 million). The largest PE Exit was the ₹1,631 Cr ($220 million) part exit by investors in publicly listed Crompton Greaves Consumer Electricals Ltd via public market sale. Venture Capital (1) Investments & Exits November 2020 registered 49 investments worth about ₹1,064 Cr ($143 million). The largest VC investment was the $15 million investment in Vegan beauty company Plum led by Faering Capital and Unilever Ventures. Funds with AIF vehicles participated in 25 investments. 25 DPIIT-registered startups raised funding during the month. IT & ITES industry topped the industry table (by volume & value). Bangalore topped the chart for highest investments (by volume) in a city. The month witnessed 12 VC exits that harvested about ₹1,142 Cr ($154 million). -

The Startup Environment and Funding Activity in India

ADBI Working Paper Series THE STARTUP ENVIRONMENT AND FUNDING ACTIVITY IN INDIA Dharish David, Sasidaran Gopalan, and Suma Ramachandran No. 1145 June 2020 Asian Development Bank Institute Dharish David is associate faculty at the Singapore Institute of Management – Global Education, Singapore. Sasidaran Gopalan is a senior research fellow at Nanyang Business School, Nanyang Technological University, Singapore. Suma Ramachandran is former head of content strategy at YourStory Media, Bengaluru, India. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. Some working papers may develop into other forms of publication. In this report, “$” refers to United States dollars. Suggested citation: David, D., S. Gopalan, and S. Ramachandran. 2020. The Startup Environment and Funding Activity in India. ADBI Working Paper 1145. Tokyo: Asian Development -

The 58 Most Active Venture Capital Firms for Startups in India

The 58 Most Active Venture Capital Firms For Startups In India (and their investing patterns) ©2018 Inc42 All Rights Reserved Feel free to share this ebook without modification. 1 Introduction Once a startup has reached the growth stage, its most important requirement is undoubtedly the backing by reliable investors and an ample amount of funding to scale up. Though the concept of starting up has gained momentum recently, the small number of investors willing to show their trust and invest in new ventures has been a problem for startups. Many startups find it difficult to approach venture capitalists and quite a few times the investment structure of the investor is inadequate for the startup. So in this document, we bring to you the much needed list of the most active institutional investors and capital funds in India along with their investment capacity, investment structure, investment industries and some of their most notable portfolio startups. 2 Helion Venture Partners Investing in technology-powered and consumer service businesses, Helion Ventures Partners is a $605 Mn Indian- focused, an early to mid-stage venture fund participating in future rounds of financing in syndication with other venture partners. People You Should Know: Sandeep Fakun, Kanwaljit Singh. Investment Structure: Invests between $2 Mn to $10 Mn in each company with less than $10 Mn in revenues. Industries: Outsourcing, Mobile, Internet, Retail Services, Healthcare, Education and Financial Services. Startups Funded: Yepme, MakemyTrip, NetAmbit, Komli, TAXI For Sure, PubMatic. Contact Details: 8040183333, 01244615333, 3 Accel Partners Accel Partners founded in 1983 has global presence in Palo Alto, London , New York, China and India. -

Fintech in India Flanders Investment & Trade Market Survey

FINTECH IN INDIA FLANDERS INVESTMENT & TRADE MARKET SURVEY Marketstudy /////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// FINTECH IN INDIA Mumbai/ 21.04.2020 //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Compiled by: Jurgen MAERSCHAND Trade and Investment Commissioner Sherlynn D’COSTA Trade Advisor Flanders Investment and Trade 7th Floor TCG Financial Centre ׀ Consulate General of Belgium ,Bandra - Kurla Complex ׀ C-53, G – Block ׀ Mumbai - 400 098 ׀ Bandra - East Phone: +91 22 68270611 Website: www.flandersinvestmentandtrade.com www.flandersinvestmentandtrade.com INHOUD 1. WHAT’S DRIVING INDIA’S FINTECH BOOM ......................................................................................................... 3 2. GEOGRAPHY OF THE INDIAN FINTECH HUBS ................................................................................................... 4 3. FINTECH DEMAND DRIVERS ........................................................................................................................................ 6 3.1 Consumers 6 3.2 Banks & financial institutions 6 3.3 Business 7 3.4 Governments 7 4. OPPORTUNITIES IN THE INDIAN FINTECH SECTORS ..................................................................................... 8 4.1 Insurtech 8 4.2 Lending 9 4.3 Payments 11 4.4 Investments 13 5. CHALLENGES & OPPORTUNITIES -

Powering Digital Transformation with Quality Engineering & Devops Automate

Powering Digital Transformation with Quality Engineering & DevOps Automate. Accelerate. Assure. Annual Report 2017-18 Contents Corporate Overview Digital Transformation 02 Quality Engineering and Quality Assurance 03 The Top 10 Digital Quality Engineering Trends of 2018 04 Role of DevOps 06 Test Automation 08 Acceleration Of Digital Transformation 10 Mitigating Risks 12 The World of Cigniti 14 Quality Engineering (QE) 24 DevOps 26 Automate 27 Accelerate 28 Assure 29 New Innovations 30 Chairman’s Message 32 CEO’s Message 34 Corporate Information 35 Board of Directors 36 Management Reports Management Discussion and Analysis 38 Notice 46 Board’s Report 58 Corporate Governance Report 83 Financial Statements Consolidated Statement Independent Auditors’ Report 106 Balance Sheet 110 Statement of Profit and Loss 111 Cash Flow Statement 113 Notes 115 Standalone Statement Independent Auditors’ Report 166 Balance Sheet 172 Statement of Profit and Loss 173 Cash Flow Statement 175 Notes 177 Cautionary Statement Regarding Forward-Looking Statement Certain statements in this annual report concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. We have tried wherever possible to identify such statements by using words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘project’, ‘intend’, ‘plan’, ‘believe’ and other words of similar substance, in connection with any discussions regarding future performance. We cannot guarantee that these forward-looking statements will be realized, although we believe that we have been prudent while making the assumptions. The achievement of results is subject to risks, uncertainties and even inaccurate assumptions. -

Ivca Private Equity

KONNECT ADVOCACY IVCA PRIVATE EQUITY - RESEARCH VENTURE CAPITAL REPORT EDUCATION KONNECT JULY 2019 NEW DELHI | MUMBAI | BANGALORE CONTENTS Executive Summary 03 Private Equity Investments 04 Venture Capital Investments 07 Exits 09 Angel Investments 10 Investments involving AIFs 12 Appendix & Tables 13 150+ MEMBERS & GROWING.. Executive Summary Private Equity(1) Investments & Exits July 2019 registered 52 Private Equity (PE) investments worth about ₹41,287 Cr ($5.9 Billion). The largest PE investment announced was the ₹25,433 Cr ($3.7 Billion) investment in Reliance’s Tower Infrastructure Trust by Brookfield. Funds with AIFs vehicles participated in 23 investments. Telecom companies topped the industry table (by value). Mumbai topped the chart for most investments in a city (by value). The month witnessed 10 PE exits that harvested about ₹13,403 Cr ($1.9 Billion). The largest exit was the ₹10,424 Cr ($1.5 Billion) exit by investors in hotels aggregator OYO via buyback. Venture Capital (1) Investments & Exits July registered 28 deals worth about ₹835 Cr ($120 million). The largest VC investment was the $18 million investment in Vymo by Emergence Capital and Sequoia Capital India. Funds with AIFs vehicles participated in 15 investments. 11 VC-funded startups were registered under DPIIT. IT companies topped the industry table (by volume & value). NCR topped the chart for highest investments (by volume) in a city. The month witnessed 3 VC exits that harvested about ₹10,543 Cr ($1517 million). Angel Investments Super Angels and Angel Networks made 20 investments (compared to 34 deals in Jul 2018). The largest angel investment involving angel investors was the $5 million (₹34.75 Cr) investment led by Sequoia India and angel investors including M V Nair, Somak Ghosh, Sandeep Tandon and Growx Ventures in Online SME Lending Startup Progcap.