Ivca Private Equity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Asia Pacific Private Equity & Venture Capital Web Meeting

The Asia Pacific Private Equity & Venture Capital Web Meeting ZOOM & SLACK September 28th, 29th & 30th 2020 Singapore Standard Time LIVE ONLY, RECORDING IS PROHIBITED BUSINESS CASUAL ATTIRE The Asia Pacific Private Equity & Venture Capital Web Meeting ZOOM & SLACK– September 28th, 29th & 30th 2020 Dear Colleague, It is with great pleasure that I invite you to The Asia Pacific Private Equity & Venture Capital Web Meeting. The aim of this Web Meeting is to connect private equity & venture capital funds, family offices, institutional investors, and other industry professionals across Asia Pacific Region and the world. Our online meeting brings together over 300 c-level executives that will join us to virtually network and discuss investment opportunities, allocations, and the current performance of all private equity & venture capital related asset classes. Panel discussions to be covered include topic on institutional investor, family office, private equity, and venture capital perspectives. This is a live event and closed to the media. Video and audio recording of this event is strictly prohibited. We look forward to hosting you digitally! Best, Roy Carmo Salsinha President, CEO Carmo Companies Agenda Outline MONDAY, SEPTEMBER 28TH – DAY 1 8:00 am SGT Welcoming Address President, CEO, Carmo Companies (New York) 8:05 am SGT Best-Practices for Earning Returns in Venture Capital While Reducing Risk During COVID-19 Every crisis creates opportunity. The dot-com bubble burst gave rise to Amazon, EBay, and many others. During the 2008 financial crisis, Pinterest, Slack, and Stripe were created. If you were not investing in the market at that time, you would have lost-out on those opportunities. -

Structured Finance

Financial Institutions U.S.A. Investcorp Bank B.S.C. Full Rating Report Ratings Key Rating Drivers Investcorp Bank B.S.C. Strong Gulf Franchise: The ratings of Investcorp B.S.C. (Investcorp, or the company) reflect Long-Term IDR BB Short-Term IDR B the company’s strong client franchise in the Gulf, established track record in private equity (PE) Viability Rating bb and commercial real estate investment, strong capital levels and solid funding profile. Rating constraints include sizable balance sheet co-investments and potential earnings volatility and Investcorp S.A. Investcorp Capital Ltd. placement risks presented by the business model, which could pressure interest coverage. Long-Term IDR BB Short-Term IDR B Gulf Institutional Owners Positive: The Positive Rating Outlook reflects franchise and Senior Unsecured Debt BB earnings benefits that may accrue to Investcorp from the 20% strategic equity stake sale to Support Rating Floor NF Mubadala Development Co. (Mubadala) in March 2017, a sovereign wealth fund of Abu Dhabi. This follows a 9.99% equity stake sale to another Gulf-based institution in 2015. Fitch Ratings Rating Outlook Positive views these transactions favorably, as the relationships may give Investcorp expanded access to potential new investors as well as a more stable equity base. 3i Business Diversifies AUM: The cash-funded acquisition of 3i Debt Management (3iDM) in March 2017 added $10.8 billion in AUM and is expected to be accretive for Investcorp, adding Financial Data stable management fee income. However, the acquired co-investment assets and ongoing risk Investcorp Bank B.S.C. retention requirements do increase Investcorp’s balance sheet risk exposure. -

Dear Fellow Shareholders

Dear Fellow Shareholders: At Evercore, we aspire to be the most respected independent investment banking advi- sory firm globally. Our overarching objective is to help a growing base of clients achieve superior results through trusted independent and innovative advice, provided by excep- tional professionals who bring to our clients diverse perspectives and experiences. Our clients include multinational corporations, financial sponsors, institutional investors, sov- ereign wealth funds, and wealthy individuals and family offices. Achieving this objective requires that we steadily build our team by recruiting the best, from those beginning their professional careers to veterans with decades of experience. We are deliberate in selecting and developing the members of our team, seeking to attract individuals who share our Core Values: Client Focus, Integrity, Excellence, Respect, Investment in People and Partnership. Our values are the defining elements of our culture, telling our clients and current and future generations of partners and employees what they can expect from our firm. Realizing our aspiration also requires that we deliver attractive financial results over time. Strong financial results create the opportunity to invest and grow, enabling us to serve more clients and enhance the range of services we offer. The environment for our business was generally favorable in 2017, providing both good opportunities and a few challenges: • Advisory Services: Demand for strategic corporate and capital markets advisory services remains strong. The appeal of purely independent, unconflicted advice continues to grow and the opportunities and challenges facing our clients are broad, as economic conditions, globalization, technology and regulation drive strategic change. We believe that we are well positioned here. -

Sovereign Wealth Funds As Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison

sustainability Article Sovereign Wealth Funds as Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison Stefan Wurster * and Steffen Johannes Schlosser TUM School of Governance, Technical University Munich, 80333 Munich, Germany * Correspondence: [email protected] Abstract: Sovereign wealth funds (SWFs) are state-owned investment vehicles intended to pursue national objectives. Their nature as long-term investors combined with their political mandate could make SWFs an instrument suited to promote sustainability. As an essential precondition, it is important for SWFs to commit to sustainability criteria as part of an overarching strategy. In the article, we present the sustainability disclosure index (SDI), an original new dataset for a selection of over 50 SWFs to investigate whether SWFs disclose sustainability criteria covering environmental, social, economic, and governance aspects into their mandate. In addition to an empirical measurement of the disclosure rate, we conduct multiple regressions to analyze what factors help to explain the variance between SWFs. We see that a majority of SWFs disclose at least some of the sustainability criteria. However, until today, only a small minority address a broad selection as a possible basis for a comprehensive sustainability strategy. While a high-state capacity and a young population in a country as well as a commitment to the international Santiago Principles are positively associated with a higher disclosure rate, we find no evidence for strong effects of the economic development level, the resource abundance, and the degree of democratization of a country or of the specific size and structure of a fund. Identifying favorable conditions for a higher commitment of SWFs could Citation: Wurster, S.; Schlosser, S.J. -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Sovereign Wealth Funds": Regulatory Issues, Financial Stability and Prudential Supervision

EUROPEAN ECONOMY Economic Papers 378| April 2009 The so-called "Sovereign Wealth Funds": regulatory issues, financial stability and prudential supervision Simone Mezzacapo EUROPEAN COMMISSION Economic Papers are written by the Staff of the Directorate-General for Economic and Financial Affairs, or by experts working in association with them. The Papers are intended to increase awareness of the technical work being done by staff and to seek comments and suggestions for further analysis. The views expressed are the author’s alone and do not necessarily correspond to those of the European Commission. Comments and enquiries should be addressed to: European Commission Directorate-General for Economic and Financial Affairs Publications B-1049 Brussels Belgium E-mail: [email protected] This paper exists in English only and can be downloaded from the website http://ec.europa.eu/economy_finance/publications A great deal of additional information is available on the Internet. It can be accessed through the Europa server (http://europa.eu ) KC-AI-09-378-EN-N ISSN 1725-3187 ISBN 978-92-79-11189-1 DOI 10.2765/36156 © European Communities, 2009 THE SO-CALLED "SOVEREIGN WEALTH FUNDS": REGULATORY ISSUES, FINANCIAL STABILITY, AND PRUDENTIAL SUPERVISION By Simone Mezzacapo* University of Perugia Abstract This paper aims to contribute to the debate on the regulatory and economic issues raised by the recent gain in prominence of the so-called “Sovereign Wealth Funds” (SWFs), by first trying to better identify the actual legal and economic nature of such “special purpose” government investment vehicles. SWFs are generally deemed to bring significant benefits to global capital markets. -

Alternative Perspectives on Challenges and Opportunities of Financing Development

FINANCING FOR DEVELOPMENT Alternative Perspectives on Challenges and Opportunities of Financing Development ORGANISATION OF ISLAMIC COOPERATION STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES Financing for Development Alternative Perspectives on Challenges and Opportunities of Financing Development Editors: Kenan Bağcı and Erhan Türbedar ORGANIZATION OF ISLAMIC COOPERATION THE STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES (SESRIC) © May 2019 | Statistical, Economic and Social Research and Training Centre for Islamic Countries (SESRIC) Editors: Kenan Bağcı and Erhan Türbedar Kudüs Cad. No: 9, Diplomatik Site, 06450 Oran, Ankara –Turkey Telephone +90–312–468 6172 Internet www.sesric.org E-mail [email protected] The material presented in this publication is copyrighted. The authors give the permission to view, copy, download, and print the material presented provided that these materials are not going to be reused, on whatsoever condition, for commercial purposes. For permission to reproduce or reprint any part of this publication, please send a request with complete information to the Publication Department of SESRIC. All queries on rights and licenses should be addressed to the Publication Department, SESRIC, at the aforementioned address. The responsibility for the content, the views, interpretations and conditions expressed herein rests solely with the authors and can in no way be taken to reflect the views of the SESRIC or its Member States, partners, or of the OIC. The boundaries, colours and other information shown on any map in this work do not imply any judgment on the part of the SESRIC concerning the legal status of any territory or the endorsement of such boundaries. -

68456534758.Pdf

12th May 2021 National Stock Exchange of India Ltd, BSE Limited Exchange Plaza, Bandra Kurla Complex, P.J. Towers, Dalal Street Bandra (East), Mumbai – 400051. Mumbai - 400001. Fax No.26598237/26598238 Fax No.22722037/22723121 Name of Scrip: CIGNITITEC Scrip code: 534758 Dear Sir / Madam, Sub: Submission of Annual Report for the FY 2020-21 In compliance with Regulation 34 of SEBI (Listing Obligation and Disclosure Requirement) Regulations, 2015, we are herewith submitting the Annual report of the Company for the FY 2020-21. This is for the information and records of the Exchange, please. Thanking you. Yours Faithfully, For Cigniti Technologies Limited A.N.Vasudha Company Secretary Encl: as above WELCOMING Assuring Digital Experiences Annual Report 2020-21 Cigniti Technologies Ltd. Contents Corporate Overview Welcoming Next - Assuring Digital Experiences 01 Key Performance Indicators 07 Chairman’s Message 08 CEO’s Message 10 World of Cigniti 12 Project Cignificance, a CSR Initiative 25 Board of Directors 26 Our People 28 Corporate Information 32 Reports Notice 36 Board’s Report 44 Management Discussion and Analysis 70 Business Responsibility Report 76 Corporate Governance Report 84 Financial Statements Consolidated Statement Independent Auditors Report 114 Balance Sheet 121 Statement of Profit and Loss 122 Cash Flow Statement 124 Notes 125 Standalone Statement Independent Auditors Report 172 Balance Sheet 181 Statement of Profit and Loss 182 Cash Flow Statement 184 Notes 185 Cautionary Statement Regarding Forward-Looking Statements Certain statements in this annual report concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. -

Sovereign Wealth Funds 2019 Managing Continuity, Embracing Change

SOVEREIGN WEALTH FUNDS 2019 MANAGING CONTINUITY, EMBRACING CHANGE SOVEREIGN WEALTH FUNDS 2019 Editor: Javier Capapé, PhD Director, Sovereign Wealth Research, IE Center for the Governance of Change Adjunct Professor, IE University 6 SOVEREIGN WEALTH FUNDS 2019. PREFACE Index 11 Executive Summary. Sovereign Wealth Funds 2019 23 Managing Continuity...Embracing Change: Sovereign Wealth Fund Direct Investments in 2018-2019 37 Technology, Venture Capital and SWFs: The Role of the Government Forging Innovation and Change 55 SWFs in a Bad Year: Challenges, Reporting, and Responses to a Low Return Environment 65 The Sustainable Development Goals and the Market for Sustainable Sovereign Investments 83 SWFs In-Depth. Mubadala: The 360-degree Sovereign Wealth Fund 97 Annex 1. Sovereign Wealth Research Ranking 2019 103 Annex 2. Sovereign Wealth Funds in Spain PREFACE 8 SOVEREIGN WEALTH FUNDS 2019. PREFACE Preface In 2019, the growth of the world economy slowed by very little margin for stimulating the economy to 2.9%, the lowest annual rate recorded since the through the fiscal and monetary policy strategies. subprime crisis. This was a year in which the ele- In any case, the developed world is undergoing its ments of uncertainty that had previously threate- tenth consecutive year of expansion, and the risks ned the stability of the cycle began to have a more of relapsing into a recessive cycle appear to have serious effect on economic expansion. Among these been allayed in view of the fact that, in spite of re- elements, there are essentially two – both of a poli- cord low interest rates, inflation and debt remain at tical nature – that stand out from the rest. -

Shared Economy – India Story February 2020

Maple Capital Advisors ® Engaging to Create Value Shared Economy – India Story February 2020 1 Content Preface 3 The Shared Economy – Sector Highlights 5 Overview 5 Drivers of the Shared economy in India 8 Sector Snapshots- Co-working space 10 Industry Overview 10 Co-working Economics 11 Other drivers for co-working 11 Private Equity in Co-working-India 12 Mergers and Acquisitions in Co-working -India 12 Investment drivers in co-working space 13 Regulations in Co-Working 13 Co-working space- Way ahead 14 Sector Snapshots- Co-living Space 15 Industry Overview 15 Co-Living vs. other accommodation options available 16 Other factors driving co living 16 Factors driving co-living 16 Investment drivers in co-living space 18 Regulations in Co-Living 18 Co-living space- Way Ahead 19 Sector Snapshots- Shared Mobility 20 Industry Overview 20 Why share? 23 Other Factors driving the Shared Mobility sector: 24 Investment drivers in Shared Mobility 24 Regulations in Shared Mobility 27 Shared Mobility: Way Ahead 28 Sector Snapshots – Furniture Rental 29 Industry Overview 29 Renting v/s owing furniture 30 Other factors driving furniture rental 31 Investment drivers in furniture rental sector 32 Regulations in Furniture Rental 32 Furniture rental: Way Ahead 33 Investment Summary & Conclusion 34 2 Preface Pankaj Karna Founder and MD - Maple Capital Advisors Shared Economy, establishing as a solid theme for the next decade…. We are in interesting times, as the preferences on asset ownership are changing rapidly and systematically. Coming from an era where asset ownership was dharma and anything else looked down upon, the world has rapidly espoused the opposite today. -

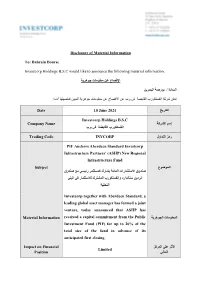

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C Would Like to Announce the Following Material In

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C would like to announce the following material information: اﻹفصاح عن معلومات جوهرية السادة / بورصة البحرين تعلن شركة إنفستكورب القابضة ش.م.ب عن اﻹفصاح عن معلومات جوهرية المبين تفاصيلها أدناه: التاريخ Date 10 June 2021 Investcorp Holdings B.S.C إسم الشركة Company Name إنفستكورب القابضة ش.م.ب رمز التداول Trading Code INVCORP PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund الموضوع Subject صندوق اﻻستثمارات العامة يشارك كمستثمر رئيسي مع صندوق أبردين ستاندارد وإنفستكورب المشترك لﻻستثمار في البنى التحتية Investcorp together with Aberdeen Standard, a leading global asset manager has formed a joint venture, today announced that ASIIP has المعلومات الجوهرية Material Information received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. اﻷثر على المركز Impact on Financial Limited المالي Position إفصاحات سابقة ذات Previous relevant صلة )إن ُوجدت( (disclosures (if any ا ﻹسم Name Hazem Ben-Gacem المسمى الوظيفي Title Co-Chief Executive Officer of Investcorp التوقيع Signature ختم الشركة Company Seal PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund Bahrain, 10th June 2021 – Investcorp together with Aberdeen Standard Investments, a leading global asset manager has formed a joint venture, today announced that ASIIP has received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. The fund has also received board approval from the Asian Infrastructure Investment Bank (AIIB) to commit US $90 million. -

Sovereign Wealth Funds Investing in Private Equity Download Data

View the full edition of Spotlight at: https://www.preqin.com/docs/newsletters/pe/Preqin-Private-Equity-Spotlight-June-2016.pdf Lead Article Sovereign Wealth Funds Investing in Private Equity Download Data Sovereign Wealth Funds Investing in Private Equity Alastair Hannah and Selina Sy provide an insight into this secretive and exclusive subset of the investor community, based on data from Preqin’s recently launched 2016 Preqin Sovereign Wealth Fund Review. Sovereign wealth funds continue to Fig. 1: Aggregate Sovereign Wealth Funds Assets under Management ($tn), capture attention as a result of their December 2008 - March 2016 ever growing assets under management (AUM) and corresponding infl uence on 7 global fi nancial markets. Despite the 6.31 6.51 decline in commodity & oil prices and the 6 global volatility seen over the past year, 5.38 Other which has reduced the capital available 4.62 to some sovereign wealth funds, AUM 5 Commodity of these investors reached $6.51tn in 3.95 Non- March 2016 (Fig. 1). This is over double 4 3.59 Commodity the AUM held in 2008 ($3.07tn), the 3.07 3.22 year Preqin launched its fi rst Sovereign 3 Hydrocarbon Wealth Fund Review. Management ($tn) 2 Relative to other institutional investors, Total Assets sovereign wealth funds typically have Aggregate SWF Assets under under a greater tolerance for the illiquidity 1 Management inherent in private equity investments, allowing many sovereign wealth funds 0 to build private equity allocations that Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Mar-15 Mar-16 may not be feasible for other investor types.