FORM 10-Q Oaktree Capital Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Structured Finance

Financial Institutions U.S.A. Investcorp Bank B.S.C. Full Rating Report Ratings Key Rating Drivers Investcorp Bank B.S.C. Strong Gulf Franchise: The ratings of Investcorp B.S.C. (Investcorp, or the company) reflect Long-Term IDR BB Short-Term IDR B the company’s strong client franchise in the Gulf, established track record in private equity (PE) Viability Rating bb and commercial real estate investment, strong capital levels and solid funding profile. Rating constraints include sizable balance sheet co-investments and potential earnings volatility and Investcorp S.A. Investcorp Capital Ltd. placement risks presented by the business model, which could pressure interest coverage. Long-Term IDR BB Short-Term IDR B Gulf Institutional Owners Positive: The Positive Rating Outlook reflects franchise and Senior Unsecured Debt BB earnings benefits that may accrue to Investcorp from the 20% strategic equity stake sale to Support Rating Floor NF Mubadala Development Co. (Mubadala) in March 2017, a sovereign wealth fund of Abu Dhabi. This follows a 9.99% equity stake sale to another Gulf-based institution in 2015. Fitch Ratings Rating Outlook Positive views these transactions favorably, as the relationships may give Investcorp expanded access to potential new investors as well as a more stable equity base. 3i Business Diversifies AUM: The cash-funded acquisition of 3i Debt Management (3iDM) in March 2017 added $10.8 billion in AUM and is expected to be accretive for Investcorp, adding Financial Data stable management fee income. However, the acquired co-investment assets and ongoing risk Investcorp Bank B.S.C. retention requirements do increase Investcorp’s balance sheet risk exposure. -

Dear Fellow Shareholders

Dear Fellow Shareholders: At Evercore, we aspire to be the most respected independent investment banking advi- sory firm globally. Our overarching objective is to help a growing base of clients achieve superior results through trusted independent and innovative advice, provided by excep- tional professionals who bring to our clients diverse perspectives and experiences. Our clients include multinational corporations, financial sponsors, institutional investors, sov- ereign wealth funds, and wealthy individuals and family offices. Achieving this objective requires that we steadily build our team by recruiting the best, from those beginning their professional careers to veterans with decades of experience. We are deliberate in selecting and developing the members of our team, seeking to attract individuals who share our Core Values: Client Focus, Integrity, Excellence, Respect, Investment in People and Partnership. Our values are the defining elements of our culture, telling our clients and current and future generations of partners and employees what they can expect from our firm. Realizing our aspiration also requires that we deliver attractive financial results over time. Strong financial results create the opportunity to invest and grow, enabling us to serve more clients and enhance the range of services we offer. The environment for our business was generally favorable in 2017, providing both good opportunities and a few challenges: • Advisory Services: Demand for strategic corporate and capital markets advisory services remains strong. The appeal of purely independent, unconflicted advice continues to grow and the opportunities and challenges facing our clients are broad, as economic conditions, globalization, technology and regulation drive strategic change. We believe that we are well positioned here. -

Sovereign Wealth Funds As Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison

sustainability Article Sovereign Wealth Funds as Sustainability Instruments? Disclosure of Sustainability Criteria in Worldwide Comparison Stefan Wurster * and Steffen Johannes Schlosser TUM School of Governance, Technical University Munich, 80333 Munich, Germany * Correspondence: [email protected] Abstract: Sovereign wealth funds (SWFs) are state-owned investment vehicles intended to pursue national objectives. Their nature as long-term investors combined with their political mandate could make SWFs an instrument suited to promote sustainability. As an essential precondition, it is important for SWFs to commit to sustainability criteria as part of an overarching strategy. In the article, we present the sustainability disclosure index (SDI), an original new dataset for a selection of over 50 SWFs to investigate whether SWFs disclose sustainability criteria covering environmental, social, economic, and governance aspects into their mandate. In addition to an empirical measurement of the disclosure rate, we conduct multiple regressions to analyze what factors help to explain the variance between SWFs. We see that a majority of SWFs disclose at least some of the sustainability criteria. However, until today, only a small minority address a broad selection as a possible basis for a comprehensive sustainability strategy. While a high-state capacity and a young population in a country as well as a commitment to the international Santiago Principles are positively associated with a higher disclosure rate, we find no evidence for strong effects of the economic development level, the resource abundance, and the degree of democratization of a country or of the specific size and structure of a fund. Identifying favorable conditions for a higher commitment of SWFs could Citation: Wurster, S.; Schlosser, S.J. -

Sovereign Wealth Funds": Regulatory Issues, Financial Stability and Prudential Supervision

EUROPEAN ECONOMY Economic Papers 378| April 2009 The so-called "Sovereign Wealth Funds": regulatory issues, financial stability and prudential supervision Simone Mezzacapo EUROPEAN COMMISSION Economic Papers are written by the Staff of the Directorate-General for Economic and Financial Affairs, or by experts working in association with them. The Papers are intended to increase awareness of the technical work being done by staff and to seek comments and suggestions for further analysis. The views expressed are the author’s alone and do not necessarily correspond to those of the European Commission. Comments and enquiries should be addressed to: European Commission Directorate-General for Economic and Financial Affairs Publications B-1049 Brussels Belgium E-mail: [email protected] This paper exists in English only and can be downloaded from the website http://ec.europa.eu/economy_finance/publications A great deal of additional information is available on the Internet. It can be accessed through the Europa server (http://europa.eu ) KC-AI-09-378-EN-N ISSN 1725-3187 ISBN 978-92-79-11189-1 DOI 10.2765/36156 © European Communities, 2009 THE SO-CALLED "SOVEREIGN WEALTH FUNDS": REGULATORY ISSUES, FINANCIAL STABILITY, AND PRUDENTIAL SUPERVISION By Simone Mezzacapo* University of Perugia Abstract This paper aims to contribute to the debate on the regulatory and economic issues raised by the recent gain in prominence of the so-called “Sovereign Wealth Funds” (SWFs), by first trying to better identify the actual legal and economic nature of such “special purpose” government investment vehicles. SWFs are generally deemed to bring significant benefits to global capital markets. -

Alternative Perspectives on Challenges and Opportunities of Financing Development

FINANCING FOR DEVELOPMENT Alternative Perspectives on Challenges and Opportunities of Financing Development ORGANISATION OF ISLAMIC COOPERATION STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES Financing for Development Alternative Perspectives on Challenges and Opportunities of Financing Development Editors: Kenan Bağcı and Erhan Türbedar ORGANIZATION OF ISLAMIC COOPERATION THE STATISTICAL, ECONOMIC AND SOCIAL RESEARCH AND TRAINING CENTRE FOR ISLAMIC COUNTRIES (SESRIC) © May 2019 | Statistical, Economic and Social Research and Training Centre for Islamic Countries (SESRIC) Editors: Kenan Bağcı and Erhan Türbedar Kudüs Cad. No: 9, Diplomatik Site, 06450 Oran, Ankara –Turkey Telephone +90–312–468 6172 Internet www.sesric.org E-mail [email protected] The material presented in this publication is copyrighted. The authors give the permission to view, copy, download, and print the material presented provided that these materials are not going to be reused, on whatsoever condition, for commercial purposes. For permission to reproduce or reprint any part of this publication, please send a request with complete information to the Publication Department of SESRIC. All queries on rights and licenses should be addressed to the Publication Department, SESRIC, at the aforementioned address. The responsibility for the content, the views, interpretations and conditions expressed herein rests solely with the authors and can in no way be taken to reflect the views of the SESRIC or its Member States, partners, or of the OIC. The boundaries, colours and other information shown on any map in this work do not imply any judgment on the part of the SESRIC concerning the legal status of any territory or the endorsement of such boundaries. -

Sovereign Wealth Funds 2019 Managing Continuity, Embracing Change

SOVEREIGN WEALTH FUNDS 2019 MANAGING CONTINUITY, EMBRACING CHANGE SOVEREIGN WEALTH FUNDS 2019 Editor: Javier Capapé, PhD Director, Sovereign Wealth Research, IE Center for the Governance of Change Adjunct Professor, IE University 6 SOVEREIGN WEALTH FUNDS 2019. PREFACE Index 11 Executive Summary. Sovereign Wealth Funds 2019 23 Managing Continuity...Embracing Change: Sovereign Wealth Fund Direct Investments in 2018-2019 37 Technology, Venture Capital and SWFs: The Role of the Government Forging Innovation and Change 55 SWFs in a Bad Year: Challenges, Reporting, and Responses to a Low Return Environment 65 The Sustainable Development Goals and the Market for Sustainable Sovereign Investments 83 SWFs In-Depth. Mubadala: The 360-degree Sovereign Wealth Fund 97 Annex 1. Sovereign Wealth Research Ranking 2019 103 Annex 2. Sovereign Wealth Funds in Spain PREFACE 8 SOVEREIGN WEALTH FUNDS 2019. PREFACE Preface In 2019, the growth of the world economy slowed by very little margin for stimulating the economy to 2.9%, the lowest annual rate recorded since the through the fiscal and monetary policy strategies. subprime crisis. This was a year in which the ele- In any case, the developed world is undergoing its ments of uncertainty that had previously threate- tenth consecutive year of expansion, and the risks ned the stability of the cycle began to have a more of relapsing into a recessive cycle appear to have serious effect on economic expansion. Among these been allayed in view of the fact that, in spite of re- elements, there are essentially two – both of a poli- cord low interest rates, inflation and debt remain at tical nature – that stand out from the rest. -

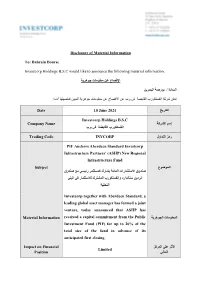

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C Would Like to Announce the Following Material In

Disclosure of Material Information To: Bahrain Bourse Investcorp Holdings B.S.C would like to announce the following material information: اﻹفصاح عن معلومات جوهرية السادة / بورصة البحرين تعلن شركة إنفستكورب القابضة ش.م.ب عن اﻹفصاح عن معلومات جوهرية المبين تفاصيلها أدناه: التاريخ Date 10 June 2021 Investcorp Holdings B.S.C إسم الشركة Company Name إنفستكورب القابضة ش.م.ب رمز التداول Trading Code INVCORP PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund الموضوع Subject صندوق اﻻستثمارات العامة يشارك كمستثمر رئيسي مع صندوق أبردين ستاندارد وإنفستكورب المشترك لﻻستثمار في البنى التحتية Investcorp together with Aberdeen Standard, a leading global asset manager has formed a joint venture, today announced that ASIIP has المعلومات الجوهرية Material Information received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. اﻷثر على المركز Impact on Financial Limited المالي Position إفصاحات سابقة ذات Previous relevant صلة )إن ُوجدت( (disclosures (if any ا ﻹسم Name Hazem Ben-Gacem المسمى الوظيفي Title Co-Chief Executive Officer of Investcorp التوقيع Signature ختم الشركة Company Seal PIF Anchors Aberdeen Standard Investcorp Infrastructure Partners’ (ASIIP) New Regional Infrastructure Fund Bahrain, 10th June 2021 – Investcorp together with Aberdeen Standard Investments, a leading global asset manager has formed a joint venture, today announced that ASIIP has received a capital commitment from the Public Investment Fund (PIF) for up to 20% of the total size of the fund in advance of its anticipated first closing. The fund has also received board approval from the Asian Infrastructure Investment Bank (AIIB) to commit US $90 million. -

Sovereign Wealth Funds Investing in Private Equity Download Data

View the full edition of Spotlight at: https://www.preqin.com/docs/newsletters/pe/Preqin-Private-Equity-Spotlight-June-2016.pdf Lead Article Sovereign Wealth Funds Investing in Private Equity Download Data Sovereign Wealth Funds Investing in Private Equity Alastair Hannah and Selina Sy provide an insight into this secretive and exclusive subset of the investor community, based on data from Preqin’s recently launched 2016 Preqin Sovereign Wealth Fund Review. Sovereign wealth funds continue to Fig. 1: Aggregate Sovereign Wealth Funds Assets under Management ($tn), capture attention as a result of their December 2008 - March 2016 ever growing assets under management (AUM) and corresponding infl uence on 7 global fi nancial markets. Despite the 6.31 6.51 decline in commodity & oil prices and the 6 global volatility seen over the past year, 5.38 Other which has reduced the capital available 4.62 to some sovereign wealth funds, AUM 5 Commodity of these investors reached $6.51tn in 3.95 Non- March 2016 (Fig. 1). This is over double 4 3.59 Commodity the AUM held in 2008 ($3.07tn), the 3.07 3.22 year Preqin launched its fi rst Sovereign 3 Hydrocarbon Wealth Fund Review. Management ($tn) 2 Relative to other institutional investors, Total Assets sovereign wealth funds typically have Aggregate SWF Assets under under a greater tolerance for the illiquidity 1 Management inherent in private equity investments, allowing many sovereign wealth funds 0 to build private equity allocations that Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Mar-15 Mar-16 may not be feasible for other investor types. -

Private Equity Giants Converge on Manufactured Homes

PRIVATE EQUITY GIANTS CONVERGE ON MANUFACTURED MASSIVE INVESTORS PILE INTO US MANUFACTURED HOME COMMUNITIES Within the last few years, some of the largest private equity firms, HOMES real estate investment firms, and institutional investors in the How private equity is manufacturing world have made investments in manufactured home communi - ties in the United States, a highly fragmented industry that has homelessness & communities are fighting back been one of the last sectors of housing in the United States that has remained affordable for residents. February 2019 In 2016, the $360 billion sovereign wealth fund for the Govern - ment of Singapore (GIC) and the $56 billion Pennsylvania Public KEY POINTS School Employees Retirement System, a pension fund for teachers and other school employees in the Pennsylvania, bought a I Within the last few years, some of the largest private equity majority stake in Yes! Communities, one of the largest owners of firms, real estate investment firms, and institutional investors manufactured home communities in the US with 44,600 home in the world have made investments in manufactured home sites. Yes! Communities has since grown to 54,000 home sites by communities in the US. buying up additional manufactured home communities. 1 I Manufactured home communities provide affordable homes for In 2017, private equity firm Apollo Global management, with $270 millions of residents and are one of the last sectors of affordable billion in overall assets, bought Inspire Communities, a manufac - housing in the United States. Across the country, they are home tured home community operator with 13,000 home sites. 2 to seniors on fixed incomes, low-income families, immigrants, Continued on page 3 people with disabilities, veterans, and others in need of low-cost housing. -

Capitalizing Economic Development Through Sovereign Investment: a “Paradox of Scarcity”?*

Capitalizing Economic Development Through Sovereign Investment: A “Paradox of Scarcity”?* Working Paper Patrick J. Schena Juergen Braunstein Asim Ali This draft: April 28, 2017 Abstract Traditionally the creation of sovereign wealth funds (SWFs) was “supply-driven”, the result of excess reserves from natural resources (e.g. Norway, Qatar, Kuwait, etc.) or non-commodity capital flows (e.g. South Korea, China, Singapore, etc.). More recently we observe many newly established or announced funds to be “demand-driven”, motivated by domestic development objectives (including infrastructure development). This transition from supply-driven to demand-driven SWF creation is most starkly manifested in SWF capitalization. This paper outlines recent developments on SWF creation – especially by countries that are neither endowed with oil wealth nor possess sizeable export surpluses to create SWFs with a development mandate. While contextualizing this study in the broader SWF literature, the aim is to provide a comprehensive overview on how funding sources impact achieving long-term financial and socio-economic development objectives. Keywords: sovereign wealth, private equity; direct investment; co-investment. JEL classification: We thank Arianne Caoili for her feedback. All errors and omissions are our own. Furthermore, we would like to thank Gayane Sargsyan, Mary Melkonyan, and Tigranuhi Grigoryan for research assistance. E-mail address: [email protected] * This draft is not for citation without permission of the authors. ! ! ! Introduction Over 25 years ago, Robert Lucas asked a simple, but profound question: “Why doesn’t capital flow from rich to poor countries?” (Lucas, 1990) Deemed the “paradox of capital”, this question remains with us and its relevance over periods has become more pronounced. -

Call for Papers for a Special Issue Ownership and Global Strategy Submission Deadline: June 15, 2022 Guest Editors: Geoffrey T

Call for Papers for a Special Issue Ownership and Global Strategy Submission deadline: June 15, 2022 Guest Editors: Geoffrey T. Wood, Western University, Canada Anna Grosman, Loughborough University London, UK Michael J. Mol, Copenhagen Business School, Denmark & University of Birmingham, UK Supervising Editor: Alvaro Cuervo-Cazurra, Northeastern University, USA Background and Purpose Who owns the firm (local or foreign shareholders, governments or private investors, concentrated or diffused shareholders, traditional or alternative investors) has long been an essential topic for research on organizations. At the same time, our conceptualization of ownership has widened over time to incorporate owners as strategists (most prominently in the case of entrepreneurial financiers), sources of capital (as in the case of large joint-stock companies), and mechanisms of control (direct or via institutional intermediaries). The linkages and tensions amongst these conceptual foundations (for instance, the tension between ownership, ownership structures, and control) have been the focus of a large literature in global strategy (Cuervo-Cazurra et al., 2019; Ferreira & Matos, 2008; Mudambi & Navarra, 2004; Shi et al., 2021). At the same time, this diversity in conceptual foundations provides numerous opportunities for advancing our understanding of the role of ownership in global strategy. This is the objective of this special issue: analyzing how ownership affects global strategy and, by extension, how strategies are employed to accommodate owners. The different conceptual foundations of ownership have received unbalanced attention in the global strategy literature. Most of that literature has studied the behavior of multinational enterprises, including work on business groups and investments by state-owned and governmental actors (Benito et al., 2016; Castaldi et al., 2019; Cuervo-Cazurra et al., 2014; Inoue et al., 2013; Wright et al., 2021). -

FY21 Press Release

Investcorp reports full year results for the fiscal year ended 30 June 2021 Firm continues to show resilience to COVID-19 impact with 17% growth in Assets Under Management (AUM) to a record high of US$ 37.6 billion Income rebounds to a net profit of US$ 125 million Bahrain, 4 August 2021 – Investcorp today announced its fiscal year results for the twelve months ended 30 June 2021 (FY21). The press release and the full set of financial statements are available on its website at www.investcorp.com. Investcorp’s FY21 results were driven by good levels of activity across the core businesses of private equity, real estate, credit management and absolute return investments. This resulted in delivering a net profit attributable to the equity holders of the parent of US$ 124 million compared to a loss of US$ 165 million in FY20 and diluted earnings per share of US$ 1.34 compared to a loss of US$ 2.57 per share in FY20. Total comprehensive income attributable to the equity holders of the parent was US$ 132 million compared to a loss of US$ 210 million in FY20. Total shareholders’ equity (excluding non-controlling interest) as of June 30, 2021, increased 46% to US$ 1,270 million (FY20: US$ 867 million) and total assets increased 13% to US$ 2,391 million (FY20: US$ 2,123 million). The FY21 recommendation for distribution of preferred and ordinary dividends is US$ 44 million in aggregate, with the proposed ordinary dividend being US$ 0.30 per share versus US$ 0.10 per share for FY20.