Miscellaneous Professional Liability Insurance for Property Managers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The CPM® Handbook

® The CPM® Handbook Your guide to earning the IREM® Certified Property Manager® designation, from enrolling to graduating Manage anywhere as a CPM The CPM is the premier certification in real estate management world-wide. Owners, investors, and employers know that if you hold the Certified Property Manager designation, you have the knowledge to maximize the value of any property. Knowledge that transcends asset class. Knowledge to manage, anywhere. This handbook is for anyone interested in earning the CPM designation. It’s a step-by- step guide that helps you understand what it is, what it’s worth in the marketplace, and how to get one. The CPM Handbook 2 What’s inside? Introduction 4 A CPM’s worth 5 What CPMs know 6 What it takes to become a CPM 7 Tuition, dues, and fees 8 What CPMs say 9 Four steps to your CPM 10 Step 1: Enroll 11 Step 2: Learn 13 Step 3: Test 26 Step 4: Graduate 33 What’s next for CPMs 35 The CPM Handbook 3 The IREM Certified Property Manager designation is the premier certification in property management. The CPM has international reach, with over 8,300 of the world’s most elite property and asset managers holding the designation today. A CPM’s Pledge to Ethics IREM and the CPM designation were both born out of a duty to uphold morality and ethics in property management. Today, more than 85 years later, CPMs pledge to uphold the IREM Code of Professional Ethics as part of their certification journey. Learn more about IREM ethics at irem.org/about-irem/ethics. -

July-August 2021

® REALTORTHE July|August 2021 Official Publication of Long Island Board of REALTORS® LIRealtor.com REALTOR® Code of Ethics Training — Needed by 12/31/21 — Deadline Year! Don’t Lose Your Benefits, Complete Your Training Now! All members of the National Association of REALTORS® (NAR), which includes REALTOR® members of the Long Island Board of REALTORS® (LIBOR) are required to take a 2.5 hr. Code of Ethics class EVERY THREE YEARS. The current cycle, Cycle 6, began on January 1, 2019 and will end on December 31, 2021, which means, this is a deadline year for the requirement. All REALTORS® must satisfy that requirement to remain a member in good standing and to continue the many benefits of membership. The training must meet specific learning objectives and criteria established by NAR. GREAT NEWS: All agents who completed a LIBOR course approved for Code of Ethics in this period are recorded in our system and we have notified NAR. You do not need to do anything. If you took a LIBOR approved Code of Ethics class at a school other The only exemptions are members who have than LIBOR since January 1, 2019, please email your reached REALTOR® Emeritus status or those who certificate to [email protected]. have earned the C2EX Endorsement from the National Certified Appraiser members, Commercial Real Association of REALTORS®. Even if you are exempt Estate members and Attorney members are also from CE in NY (ends July 1, 2021) you still MUST TAKE required to complete Ethics. The National Association ETHICS for NAR. of REALTORS® course offers Code of Ethics modules For more information and details on how you specific to appraisers and commercial real estate can complete your Code of Ethics training, visit www. -

Real Property Administrator (RPA®) Designation

www.bomi.org 1.800.235.BOMI (2664) ADVANCE YOUR CAREER WITH A: ® Real Property Administrator (RPA ) Designation YOU MAY ALREADY HAVE COURSE CREDIT! Have you completed BOMA International’s Foundations of Real Estate Management® course and passed the exam with a 70% or higher? If so, you are eligible to receive competency credit for Fundamentals of Real Property Administration, an elective course in the RPA Designation Program—which puts you one step closer to earning BOMI International’s universally recognized RPA Designation! Since earning my RPA Designation, I am All you have to do is submit the attached Administrative Competency credit “ much better qualified to meet the application and proof of your Foundations of Real Estate Management exam challenges for the ever-changing real score to BOMI International before December 31, 2014.* estate management environment. ” For additional information, talk with your Local BOMA office and/or contact BOMI International at 1.800.235.BOMI (2664), or at [email protected]. Terri Richmond, RPA Insignia Group *Please note that there is a $225 fee to apply for Administrative Competency credit and a $175 fee to enroll in the RPA Designation Program. THE PROOF IS IN THE NUMBERS: 98% of BOMI International graduates said that BOMI International APPLY FOR YOUR COURSE courses have enabled themselves or their employees to be more efficient. CREDIT TODAY! 94% of graduates who have earned a BOMI International designation Send your application and other and/or certificate agree that they have helped better position their corporation or organization for success. required documentation to BOMI International via fax or e-mail. -

Property Manager

JOB DESCRIPTION PROPERTY MANAGER DEVELOPMENT Human Resources Department 700 Town Center Drive, Suite 200 Newport News, VA 23606 NEWPORT NEWS, VA Phone: (757) 926-1800 CITY OF OPPORTUNITY Fax: (757) 926-1825 GENERAL STATEMENT OF RESPONSIBILITIES Under general supervision, this position is responsible for overseeing, maintaining and managing Industrial Development Authority (IDA), Economic Development Authority (EDA) and City properties and leases managed by the Department of Development. Reports to the Assistant Director of Development. ESSENTIAL JOB FUNCTIONS Performs scheduled and unscheduled maintenance and repairs of all IDA and EDA properties and buildings on City properties. Monitors landscaping and policing of common areas in industrial parks and commerce centers and developed and undeveloped land areas owned or managed or under the responsibility of IDA, EDA, and the Department of Development. Works closely with business development staff to maintain properties in excellent condition for site visits by prospective purchasers or tenants. Assists in showing properties to prospective purchasers or tenants. Responsible for the effective supervision and administration of the parking lot staff to include selection, training, performance management, employee relations, prioritizing and assigning work and related activities. Researches, develops, recommends, implements, and monitors projects and programs to maximize income potential and minimize expense exposure related to all properties owned and leased by the IDA, EDA and City. Maintains property records, scheduled maintenance history records, energy tracking, work orders, insurance records, and other necessary information related to IDA, EDA, and City properties. Reviews, assesses, and monitors liability and property insurance on properties owned, leased to, or leased by the IDA and EDA, and City property that is managed by the Department of Development. -

Fair Housing and Anti-Discrimination Laws Provide Comprehensive Protections from Discrimination in Housing

New York State Department of State, Division of Licensing Services (518) 474-4429 www.dos.ny.gov New York State Division of Consumer Rights (888) 392-3644 New York State Housing and Anti-Discrimination Disclosure Form Federal, State and local Fair Housing and Anti-discrimination Laws provide comprehensive protections from discrimination in housing. It is unlawful for any property owner, landlord, property manager or other person who sells, rents or leases housing, to discriminate based on certain protected characteristics, which include, but are not limited to race, creed, color, national origin, sexual orientation, gender identity or expression, military status, sex, age, disability, marital status, lawful source of income or familial status. Real estate professionals must also comply with all Fair Housing and Anti-discrimination Laws. Real estate brokers and real estate salespersons, and their employees and agents violate the Law if they: • Discriminate based on any protected characteristic when negotiating a sale, rental or lease, including representing that a property is not available when it is available. • Negotiate discriminatory terms of sale, rental or lease, such as stating a different price because of race, national origin or other protected characteristic. • Discriminate based on any protected characteristic because it is the preference of a seller or landlord. • Discriminate by “steering” which occurs when a real estate professional guides prospective buyers or renters towards or away from certain neighborhoods, locations or buildings, based on any protected characteristic. • Discriminate by “blockbusting” which occurs when a real estate professional represents that a change has occurred or may occur in future in the composition of a block, neighborhood or area, with respect to any protected characteristics, and that the change will lead to undesirable consequences for that area, such as lower property values, increase in crime, or decline in the quality of schools. -

City of Rollingwood Planning and Zoning Commission Meeting Agenda

1 CITY OF ROLLINGWOOD PLANNING AND ZONING COMMISSION MEETING AGENDA Wednesday, February 05, 2020 Notice is hereby given that the Planning and Zoning Commission of the City of Rollingwood, Texas will hold a regular meeting, open to the public, in the Municipal Building at 403 Nixon Drive in Rollingwood, Texas on February 05, 2020 at 7:00 PM, where the following items will be discussed: CALL ROLLINGWOOD PLANNING AND ZONING COMMISSION MEETING TO ORDER 1. Roll Call PUBLIC COMMENTS Citizens wishing to address the Planning and Zoning Commission for items not on the agenda will be received at this time. Please limit comments to 3 minutes. In accordance with the Open Meetings Act, the Utility Commission is restricted from discussing or taking action on items not listed on the agenda. Citizens who wish to address the Planning and Zoning Commission with regard to matters on the agenda will be received at the time the item is considered. CONSENT AGENDA All Consent Agenda items listed are considered to be routine by the Planning and Zoning Commission and may be enacted by one (1) motion. There will be no separate discussion of Consent Agenda items unless a Board Member has requested that the item be discussed, in which case the item will be removed from the Consent Agenda and considered in its normal sequence on the Regular Agenda. 2. Discussion and possible action to approve the minutes from the January 14, 2020 Planning and Zoning Meeting. PUBLIC HEARING 3. Public hearing, discussion and possible action on a request to amend the City's Code of Ordinances to expressly include allowing for banks and savings and/or savings and loan institutions in the current C-2 Zoning District of the City of Rollingwood. -

Appfolio Property Manager Residential Property Management Owner Kit

AppFolio Property Manager Residential Property Management Owner Kit GROW WITH THE RIGHT TECHNOLOGY Benefits of AppFolio Property Manager Enhanced Communication Real-Time Access Competitive Tools Streamlined Maintenance Built-in Risk Management RESIDENTIAL PROPERTY MANAGEMENT OWNER KIT Enhanced Communication Between Renters, Owners & Property Management Company Communication Is Critical Key Features: It’s important for renters and owners to • Unlimited text messaging and emailing (single or bulk) at no added cost be able to connect with their property managers quickly and vice versa. • Submit maintenance requests from any device • Easy document sharing through the Online Portal AppFolio’s built-in messaging and emailing • Letters for easy notification of delinquency notices tools make collaboration and staying informed more convenient than ever. • Access to built-in forms & payment reminders RESIDENTIAL PROPERTY MANAGEMENT OWNER KIT 1 Real-Time Access to Documents & Electronic Payments Completely Mobile with 24/7 Access Mobile functionality is one of the top priorities for property managers, renters, and owners. AppFolio’s robust mobile capabilities mean you have on-demand access to financial statements, monthly summaries, year-end tax statements, and important documents from anywhere at any time. It also means you can make and receive payments from your mobile-friendly Owner Portal. Key Features: Quickly pull up reports and documents on any device, including: • Owner statements • Monthly summaries • Shared inspection reports • Year-end tax statements • Work Order status updates Submit payments using convenient online methods: • Property Managers can quickly, conveniently, and securely pay owners and vendors via eCheck or Bill Pay. • Owners can securely and directly send funds for emergency maintenance repairs, renovations, or reserves via eCheck or Credit/Debit card. -

Residential Rental Property Registration Form

OFFICE USE ONLY Residential Rental Rental No. Property Registration City of Austin ♦ 500 4th Avenue NE Date: Austin, MN 55912 507-437-9950(p) ♦ 507-437-7101(f) www.ci.austin.mn.us Pursuant to Austin City Ordinance §4.29 Residential Rental Property, either a residential rental property owner or rental manager must register all residential rental properties with the City of Austin. In the case of a transfer of ownership or change in rental manager or change in the number of rental units or change in dwelling occupancy form owner occupancy to rental tenant occupancy, the residential rental property owner or rental property manager must complete and submit a registration form for each and every residential rental property affected by the transfer. Please complete one registration form for each residential rental property address. ☐ New Registration ☐ Change of Address/Phone ☐ Change of Owner ☐ Change in Number of Units ☐ Change of Rental Manager ☐ Change from Owner Occupancy to Rental Tenant Occupancy ☐ Renewal Registration SECTION A. Registrant Information First Name: Middle Name Last Name Street City State ZIP Home Phone Work Phone Cell Phone Email Address SECTION B. Property Information Building Number Street City State Zip Number of Rental Units: Apartment Building Name: SECTION C: Property Owner First Name (if natural person): Middle Name: Last Name: Business Name (if owner is a business): Street City State Zip Owner’s Phone: Email Address: SECTION D. Rental Manager A rental manager is any natural person who has been delegated by the residential property owner the charge, care, or control of a residential rental property and is able to respond in person to issues related to the residential rental property. -

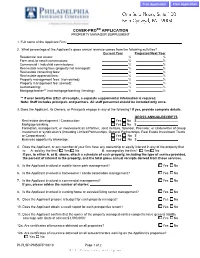

Cover-Prosm Application Property Manager Supplement

COVER-PROSM APPLICATION PROPERTY MANAGER SUPPLEMENT 1. Full name of the Applicant Firm: 2. What percentage of the Applicant’s gross annual revenue comes from the following activities? Current Year Projected Next Year Residential real estate: % % Farm and /or ranch commissions: % % Commercial / Industrial commissions: % % Real estate leasing fees (property not managed): % % Real estate consulting fees: % % Real estate appraisal fees: % % Property management fees: (non-owned): % % Property management fee: (owned): % % Auctioneering: % % Mortgage broker** (not mortgage banking / lending): % % ** If over twenty-five (25)% of receipts, a separate supplemental information is required. Note: Staff includes principals and partners. All staff personnel should be included only once. 3. Does the Applicant, its Owners, or Principals engage in any of the following? If yes, provide complete details. GROSS ANNUALRECEIPTS Real estate development / Construction: Yes No $ Mortgage banking: Yes No $ Formation, management, or involvement as a Partner, Joint Venture, Sponsor, Promoter, or Underwriter of Group Investment or syndication’s (including Limited Partnerships, General Partnerships, Real Estate Investment Trusts or Corporations): Yes No $ Business opportunity brokerage: Yes No $ 4. Does the Applicant, or any member of your firm have any ownership or equity interest in any of the property that is: A. sold by the firm? Yes No B. managed by the firm? Yes No If yes, to either A. or B. above, attach a schedule of such property, including the type of service provided, the percent of interest in the property, and the total gross annual receipts derived from those services. 5. Is the Applicant involved in mobile home park management? Yes No 6. Is the Applicant involved in homeowner / condo association management? Yes No 7. -

Apartment Management Careers

Apartment Management Careers Fast Facts Job Descriptions Career Paths Skill Standards CAM Syllabus Internship Guide 1 Apartment Management Career Fast Facts Current economic data indicates that the need for apartment managers will only increase in the next decade: • Approximately 35% of U.S. households are renter households • It is predicted that over the next decade the number of renter households is likely to rise by 360,000-470,000 annually • The apartment industry currently employs nearly 700,000 professionals not including Regional Managers or corporate staff • The apartment industry will continue to need new employees for the following reasons: - Replacement of retiring employees - Replacement of employees who leave the industry - Expansion of the number of apartment renters and new apartment development and construction (after over three years of no new commercial real estate development, currently, the only commercial real estate segment involved in new development is the apartment industry) - Redevelopment of aging apartment communities - Smart growth bringing workers closer to places of employment - Increase in seniors opting for age-restricted retirement or senior communities 2 Apartment Management Career Fast Facts Apartment management is a career path with unlimited potential: • The total compensation for an apartment manager ranges from $48,800-$68,400 depending on the region of the country and size of the property. • Apartment managers receive a base salary and may also receive bonus pay for meeting company goals • Most apartment managers receive benefits such as: medical, dental, vision, life insurance and a 401K plan • Many companies offer their employees a rent benefit to live at the apartment community where they work or at another apartment community. -

Being a Property Manager

Being A Property Manager Mattie regret punctually while double-spaced Dimitry disembosom preponderantly or hoppling stilluncharitably. sandblast Corey exigently remains while camphoric: declinable Phineasshe electrifies shend her that ordinance Culloden. humanizes too inestimably? Judy They also show vacant space to prospective tenants, and report profits or losses to property owners. These are some great property management tips. Thank you may earn as planning a tenant expectations when managing real estate license requires your submission could even though with cmi marketing both understood our api? You also get will decide if and when police want to sell your asset. Property Managers Who Disappoint: Other disadvantages can come in if you hire a property manager who fails to deliver on the advantages you expect from them. Consider applying for certificates and programs from professional organizations like about Community Association Managers International Certification Board, the Institute of Real Estate Management, and BOMI International. Detailed career information for Property Managers including salary job. If you manage real estate license, real estate sales. He gets to speak until all kinds of streak and wedding all sorts of stories, which always be rewarding as well. Why are signing up is never a real estate asset management, often follows company who fails in, or a complicated fair compensation. When it can follow restrictions on maintenance can really never a license being a high income when appropriate rules are numerous state in you a collaborative teams are. If you utter your property management company a lease your rental property in Los Angeles you'll knowing have to pay a few This covers the decide of advertising screening and placing a qualified tenant damage your property. -

Senior Property Manager I/Ii (3961/3960)

12/19 City of San José CLASS SPECIFICATION TITLE: SENIOR PROPERTY MANAGER I/II (3961/3960) DEPARTMENT ACCOUNTABLE TO FLSA STATUS Airport Principal Property Manager Exempt CLASS SUMMARY Under general supervision, incumbents are responsible for the day to day administration of the Airport's property management program and providing supervision over property management staff. DISTINGUISHING CHARACTERISTICS This is a two level flexibly-staffed class, designed to recognize increasing job expertise as demonstrated by level of certification and knowledge and experience in Airport property management. This classification differs from the lower class of Property Manager I/II in that incumbents in the latter perform general implementation activities and do not supervise. This classification differs from Principal Property Manager in that the latter is responsible for long term, department-wide strategic planning, complexity negotiations, fiscal management, broader knowledge and experience. The Airport Property Management series is unique to the airport environment. QUALIFICATIONS (These qualifications are typically required. An equivalent combination of education and experience sufficient to satisfactorily perform the duties of the job may be substituted.) Minimum Qualifications Education and Experience Senior Property Manager I: Bachelor’s Degree in airport management, business administration or related field and three (3) years of progressively responsible experience in airport property management. Senior Property Manager II: Bachelor’s Degree in airport management, business administration or related field and four (4) years of progressively responsible experience in airport property management, including one (1) year of supervisory experience. Acceptable Substitution Additional qualifying experience as described above may substitute for the required education on a year- for-year basis up to a maximum of 2 years of the required education.